Global B2B Electronic Commerce Market Size, Share, Statistics Analysis Report By Product type (Consumer Electronics (Smartphones, Laptops and Tablets, Smartwatches, Headphones and Earphones, Others), Computing Equipment (Servers and Data Centers, Networking Equipment (Routers, Switches, Hubs), Storage Devices (HDDs, SSDs, NAS), Others), Electronic Components (Resistors, Capacitors, and Transistors, Integrated Circuits (ICs), Connectors and Cable Assemblies, Printed Circuit Boards (PCBs), Others), Consumer Appliances (Air Conditioners, Refrigerators, Washing Machines, Coffee Machines, Others), Others), By End user (Offline retailers, Distributers, Specialty store, Hypermarket/Supermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148514

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

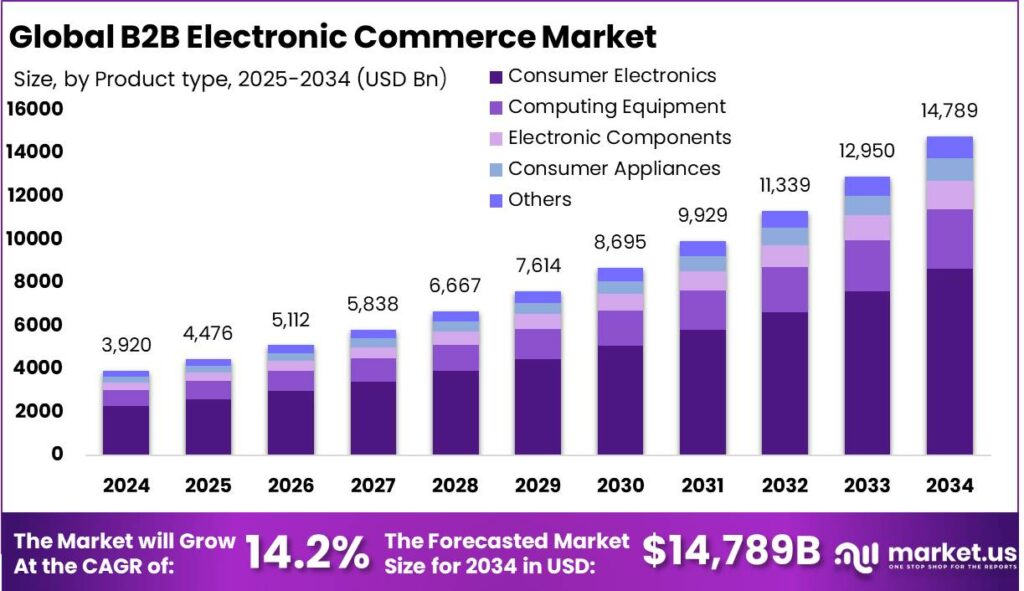

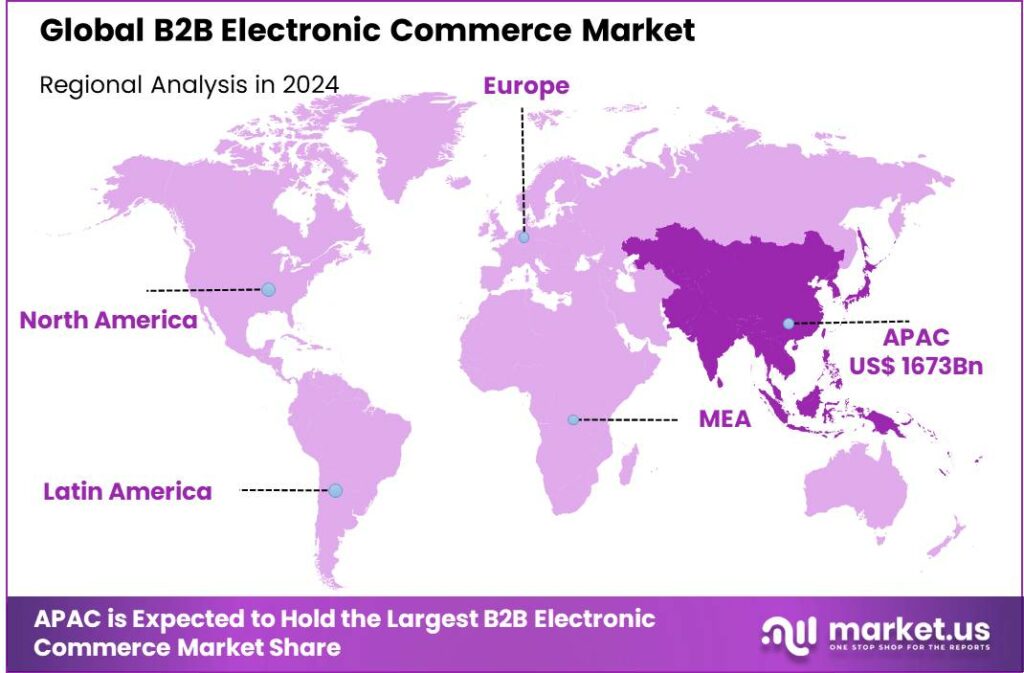

The Global B2B Electronic Commerce Market size is expected to be worth around USD 14,789 Billion By 2034, from USD 3,919.8 Billion in 2024, growing at a CAGR of 14.20% during the forecast period from 2025 to 2034. The Asia-Pacific region was the dominant player in the global B2B Electronic Commerce market in 2024, holding over 42.7% of the market share and generating approximately USD 1,673 billion in revenue.

B2B Electronic Commerce (B2B E-Commerce) refers to the exchange of goods, services, or information between businesses through digital platforms. Unlike B2C commerce, B2B transactions involve larger volumes, longer sales cycles, and negotiated pricing, such as manufacturers ordering raw materials or wholesalers buying inventory.

B2B e-commerce platforms streamline procurement, automate workflows, and provide real-time inventory management. Digital solutions like cloud-based marketplaces, e-procurement software, and API integrations are transforming supply chains, boosting efficiency and visibility. The sector is shifting toward digital-first procurement strategies and self-service portals for buyer transactions without human interaction.

Demand for B2B e-commerce platforms is rising as businesses seek to simplify procurement, cut costs, and reduce errors. As digital literacy rises and demand for real-time visibility grows, businesses are shifting away from offline channels. Global disruptions like the pandemic and geopolitical changes have highlighted inefficiencies in manual procurement, prompting investments in agile digital infrastructures.

The increasing adoption of technologies such as Artificial Intelligence (AI), Machine Learning (ML), and data analytics is transforming the B2B e-commerce landscape. These technologies enable predictive analytics for demand forecasting, personalized marketing strategies, and enhanced customer service through chatbots and virtual assistants.

As per the latest insights from Capital One Shopping, the U.S. B2B e-commerce market is valued at approximately USD 4.2 trillion in 2024, with forecasts suggesting a rise to nearly USD 7.54 trillion by 2029. This growth reflects a major shift in how businesses buy and sell, with the average B2B company now generating 82% of its revenue through remote, non-in-person sales.

Amazon Business continues to dominate as the largest B2B marketplace, having reached USD 35 billion in sales in 2023. Notably, U.S. B2B e-commerce sales have climbed by 12.1% in 2024, representing 13.3% of the global B2B e-commerce market share. Within the U.S., a strong 74.6% of total e-commerce activity is B2B, while only 25.4% is attributed to B2C or retail e-commerce.

Supporting this trend, a study by commercebuild highlights that 80% of B2B buyers prefer to make purchases via online channels, reflecting the growing need for digital-first selling strategies. It is projected that U.S. B2B e-commerce will surpass USD 4,600 billion by 2025. Moreover, two-thirds of B2B buyers are comfortable placing orders of USD 50,000 or more without speaking to a sales representative, indicating trust in digital platforms.

Additionally, 80% of B2B buyers use mobile devices to research and buy products, and 42.9% of all e-commerce transactions are expected to be conducted via mobile by the end of 2024. The sector offers opportunities in untapped verticals like industrial machinery, agriculture tech, and medical devices. Growing demand for niche B2B marketplaces and innovations like AI-driven personalization, predictive ordering, and real-time logistics are creating new revenue streams.

Key Takeaways

- The Global B2B Electronic Commerce Market size is projected to reach approximately USD 14,789 Billion by 2034, growing from USD 3919.8 Billion in 2024, reflecting a CAGR of 14.20% from 2025 to 2034.

- In 2024, the Consumer Electronics segment held a dominant market position, accounting for more than 58.7% of the market share.

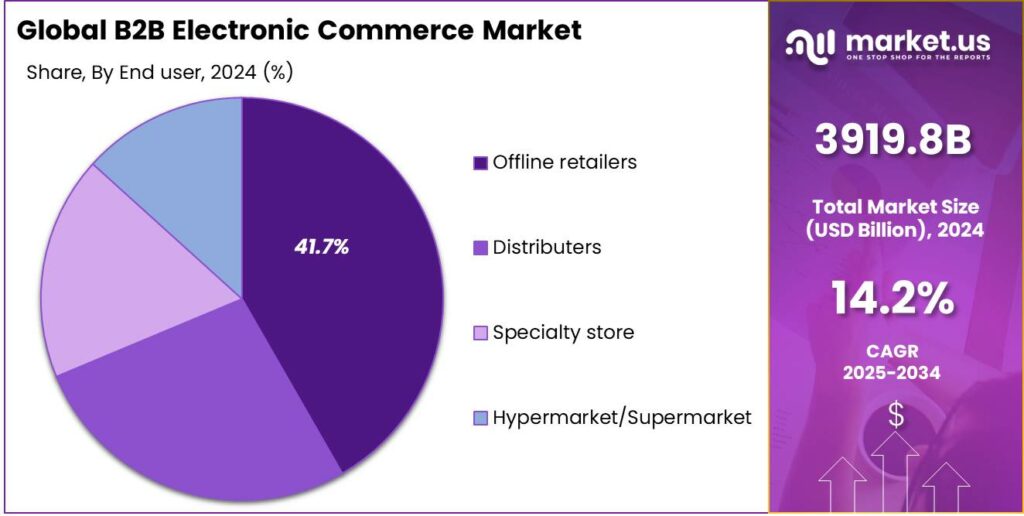

- The Offline Retailers segment also captured a significant market share, representing more than 41.7% of the global B2B Electronic Commerce market in 2024.

- The Asia-Pacific region was the dominant player in the global B2B Electronic Commerce market in 2024, holding over 42.7% of the market share and generating approximately USD 1,673 billion in revenue.

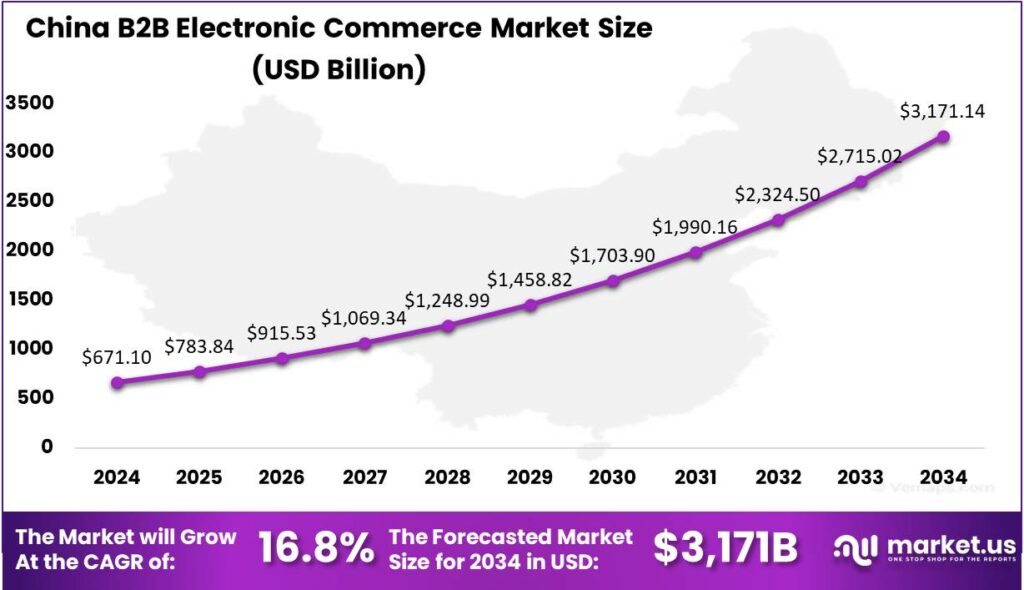

- In 2024, China was a key contributor to the market, with the B2B Electronic Commerce market valued at around USD 671.1 billion, establishing the country as one of the most influential players in the global B2B digital trade landscape.

Analyst’s Viewpoint

Investment opportunities in the B2B e-commerce sector are abundant, given the market’s rapid growth and technological advancements. Investors are particularly interested in platforms that offer innovative solutions, such as AI-driven analytics, blockchain for secure transactions, and cloud-based services for scalability.

The recent achievement of unicorn status by JSW One Platforms, following a funding round of Rs 340 crore, exemplifies the sector’s attractiveness to investors. Businesses are adopting these technologies to achieve scalability, improve decision-making, and enhance customer engagement. Scalability allows businesses to handle increased transaction volumes without compromising performance.

The regulatory environment for B2B e-commerce is evolving to address issues related to data privacy, cybersecurity, and fair trade practices. Regulations such as the Digital Markets Act in the European Union aim to ensure fair competition and protect business users’ rights on digital platforms. Compliance with these regulations is essential for businesses to operate legally and maintain trust with partners and customers.

China Market Analysis

In 2024, the B2B Electronic Commerce market in China was valued at approximately USD 671.1 billion, positioning the country as one of the most dominant players in the global B2B digital trade landscape. This robust valuation reflects China’s deep integration of digital tools across procurement, supply chain, and wholesale operations.

The growth momentum in this sector is being further accelerated by government support for digital trade, increased demand for cross-border procurement, and digital transformation initiatives among traditional industries. Major B2B platforms such as Alibaba.com, Made-in-China, and JD Business have become critical engines for trade, offering scalable solutions, intelligent matchmaking, and automation in logistics and payments.

Driven by these dynamic developments, the China B2B e-commerce market is projected to expand at a compound annual growth rate (CAGR) of 16.8% over the forecast period. This high growth rate indicates strong market optimism, underpinned by evolving trade models, rising cross-border demand, and increasing reliance on digital procurement solutions.

In 2024, Asia-Pacific held a dominant market position, capturing more than a 42.7% share of the global B2B Electronic Commerce market and generating approximately USD 1,673 billion in revenue. This regional leadership is driven by rapid industrialization, advanced digital infrastructure, and high manufacturing and export activities in China, Japan, South Korea, and India.

The dominance of Asia-Pacific can also be attributed to the region’s robust government initiatives supporting digital trade, automation, and cross-border commerce. Additionally, the growing preference among Asian manufacturers for direct, digital distribution channels over traditional intermediaries is enhancing cost efficiency and improving global buyer access.

Another critical factor reinforcing the region’s lead is the increasing use of AI, blockchain, and cloud technologies to enable real-time inventory tracking, secure transactions, and predictive analytics in procurement. Businesses across the Asia-Pacific region are quickly modernizing their procurement and supply chain operations to remain competitive and agile.

The Asia-Pacific region is poised to maintain its leadership in B2B e-commerce, driven by ongoing innovations in digital supply networks and the development of inclusive digital trade ecosystems. With its integration of smart logistics, mobile-first platforms, and favorable regulatory environments, the region is setting a global standard for B2B digital transformation.

Product type Analysis

In 2024, Consumer Electronics segment held a dominant market position, capturing more than a 58.7% share, driven by the continuous rise in bulk procurement of devices such as smartphones, laptops, tablets, and wearables by businesses.

Enterprises are increasingly digitizing their operations and employee infrastructure, which has fueled demand for high-performance mobile and computing devices. Companies involved in education, healthcare, logistics, and finance are especially purchasing consumer electronics at scale for both internal operations and customer engagement, making this segment a major contributor to B2B electronic commerce growth.

The rising work-from-home and hybrid work culture has also added to the bulk ordering of laptops, tablets, and accessories. B2B platforms are witnessing a surge in contracts for outfitting remote workforces, particularly among IT service providers, consulting firms, and startups. These transactions are usually high volume and often recurring, giving consumer electronics a long-term demand pipeline.

Smart devices such as wearables, smartwatches, and IoT-enabled tools have also entered the B2B ecosystem, especially in industries focused on health monitoring, delivery tracking, and field service management. Organizations are now integrating these products into their digital operations for real-time data gathering and workforce efficiency.

End user Analysis

In 2024, Offline retailers segment held a dominant market position, capturing more than a 41.7% share of the global B2B Electronic Commerce market. This leadership is primarily attributed to the large network of brick-and-mortar retail outlets that continue to rely on digital procurement systems to manage inventory, streamline order cycles, and source products directly from manufacturers or wholesalers.

The surge in B2B digital tools among offline retailers is also being driven by the increasing digitization of supply chains and the integration of real-time order management systems. Physical retail stores, particularly in developing regions across Asia and Latin America, are using mobile-based ordering platforms to connect with suppliers and access wider catalogs.

Another key driver behind the dominance of this segment is the ability of B2B platforms to help offline retailers overcome traditional procurement challenges such as fragmented supplier networks, inconsistent pricing, and long lead times. With digital dashboards, data-driven reordering systems, and dynamic pricing modules, retailers can now optimize their buying cycles more efficiently.

Offline retailers continue to lead with rapid digital integration, efficient restocking, and real-time data for smarter procurement. As online and offline retail competition grows, traditional stores will increasingly incorporate B2B commerce to stay relevant, agile, and cost-effective in the evolving retail landscape.

Key Market Segments

By Product type

- Consumer Electronics

- Smartphones

- Laptops and Tablets

- Smartwatches

- Headphones and Earphones

- Others

- Computing Equipment

- Servers and Data Centers

- Networking Equipment (Routers, Switches, Hubs)

- Storage Devices (HDDs, SSDs, NAS)

- Others

- Electronic Components

- Resistors, Capacitors, and Transistors

- Integrated Circuits (ICs)

- Connectors and Cable Assemblies

- Printed Circuit Boards (PCBs)

- Others

- Consumer Appliances

- Air Conditioners

- Refrigerators

- Washing Machines

- Coffee Machines

- Others

- Others

By End user

- Offline retailers

- Distributers

- Specialty store

- Hypermarket/Supermarket

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Digital Transformation in B2B E-Commerce

The progression of digital transformation stands as a pivotal driver in the evolution of B2B e-commerce. Enterprises are increasingly adopting digital tools to streamline operations, enhance customer experiences, and remain competitive in a rapidly changing market.

Digital transformation enhances B2B operations by automating processes, improving data analytics, and offering personalized services, leading to increased efficiency and customer satisfaction. Technologies like AI, machine learning, and cloud computing enable real-time decision-making and predictive analytics.

Restraint

Complexity of Technological Integration

A key challenge in B2B e-commerce adoption is integrating new technologies with legacy systems. Many organizations face issues with data synchronization, process alignment, and system interoperability due to incompatibilities between old systems and modern e-commerce platforms.

Integrating new technologies into B2B e-commerce requires significant time, resources, and expertise. Businesses must ensure their CRM, ERP, and supply chain systems communicate smoothly with e-commerce platforms to avoid data silos and inefficiencies. Additionally, the fast pace of technological change means integration solutions must be adaptable, increasing the complexity and cost of ongoing updates and maintenance.

Opportunity

Expansion into Emerging Markets

Emerging markets present a substantial opportunity for the growth of B2B e-commerce. These regions often have underserved business sectors that can benefit from the efficiencies and reach offered by digital commerce platforms. The increasing internet penetration, mobile device usage, and digital literacy in these markets create a conducive environment for e-commerce adoption.

B2B e-commerce platforms provide businesses in emerging economies with access to a broader customer base, streamlined procurement, and reduced transaction costs. They also enable local suppliers and manufacturers to connect with international buyers, boosting global trade and economic growth.

Industry insights show that B2B e-commerce start-ups are helping small retailers order more affordably and reach wider markets. The growth of e-commerce in these regions presents both opportunities and challenges for companies seeking global expansion.

Challenge

Supply Chain Integration

Integrating supply chain operations with e-commerce platforms remains a significant challenge in B2B commerce. The complexity of B2B transactions, which often involve bulk orders, customized products, and negotiated pricing, necessitates robust supply chain management systems that can handle intricate order processes and provide seamless integration with inventory management.

Real-time visibility into inventory, order statuses, and delivery timelines is vital for meeting customer expectations and ensuring operational efficiency. However, many businesses face challenges due to outdated systems, lack of standardization, and poor data integration, resulting in delays and higher costs.

Industry analyses stress the importance of integrating ERP systems with e-commerce software to tackle these issues. This integration helps B2B companies optimize supply chain management, capture leads, build relationships, and drive sales growth.

Key Growth Factors

- Digital Transformation of Procurement: Businesses are increasingly moving their purchasing processes online. This shift allows companies to manage orders more efficiently, access real-time data, and integrate with existing systems like ERP and CRM.

- Rise of Online Marketplaces: Online B2B marketplaces are becoming central hubs where buyers and sellers connect. These platforms offer a wide range of products, competitive pricing, and convenience, making it easier for businesses to find what they need and expand their reach.

- Integration of Advanced Technologies: Technologies like artificial intelligence (AI) and automation are being adopted to enhance the B2B e-commerce experience. AI helps in predicting customer preferences, optimizing pricing, and improving inventory management, leading to more personalized and efficient services.

- Changing Buyer Expectations: Modern B2B buyers expect the same ease and personalization they experience in B2C shopping. They prefer self-service options, mobile accessibility, and tailored recommendations, prompting businesses to upgrade their digital platforms to meet these expectations.

- Global Market Expansion: B2B e-commerce enables companies to reach international markets without the need for a physical presence. This global reach opens up new opportunities for growth, allowing businesses to serve a broader customer base and diversify their market presence.

Emerging Trends

B2B electronic commerce is undergoing significant transformation, driven by technological advancements and evolving buyer expectations. One prominent trend is the shift towards digital-first purchasing behaviors. Buyers now prefer seamless online experiences, prompting businesses to enhance their digital platforms to meet these expectations.

Artificial Intelligence (AI) is playing a crucial role in this evolution. AI-powered tools are enabling personalized product recommendations, predictive analytics, and automated customer service, thereby improving the overall buying experience.

Another significant trend is the adoption of headless commerce architectures. This approach decouples the front-end and back-end systems, allowing for greater flexibility and faster implementation of new features, which is essential for businesses aiming to stay competitive .

Business Benefits

B2B e-commerce platforms help businesses reach a global audience, boosting sales and brand recognition through search engines and targeted marketing. They also offer customers the convenience of ordering and account management, enhancing satisfaction with features like self-service portals and personalized recommendations.

By automating processes such as order processing, inventory management, and invoicing, B2B e-commerce reduces the need for manual labor and physical storefronts. This leads to significant cost savings in operations and overhead expenses.

B2B e-commerce platforms provide businesses with valuable data on customer behavior, sales trends, and inventory, helping them make better decisions and improve performance. These platforms are also available 24/7, allowing customers to place orders and make inquiries at their convenience, no matter the time zone.

Key Player Analysis

B2B (business-to-business) electronic commerce is rapidly growing as companies increasingly shift their operations to digital platforms.

Amazon.com, Inc., is one of the most well-known players in e-commerce, not just in B2C (business-to-consumer) but also in B2B. Amazon Business, the company’s dedicated B2B platform, provides a wide range of products and services to businesses worldwide. Amazon’s vast product catalog, competitive pricing, and reliable delivery systems give it a significant advantage in attracting business buyers.

Alibaba.com has a global reputation as a dominant force in B2B electronic commerce. Headquartered in China, Alibaba.com connects suppliers, manufacturers, and wholesalers with buyers around the world. Its vast network of sellers and buyers allows businesses to source products at competitive prices. The platform’s accessibility, scalability, and advanced tools have helped businesses of all sizes expand their global reach.

eBay Inc. has traditionally been known for consumer auctions, but it has also carved a niche for B2B commerce. eBay’s business marketplace allows companies to buy and sell a wide variety of goods, including industrial equipment, electronics, and office supplies. eBay’s focus on auctions and fixed-price listings gives it a unique edge in the B2B space, offering flexibility for businesses to negotiate deals.

Top Key Players in the Market

- Amazon.com, Inc.

- Alibaba.com

- eBay Inc.

- Costco Wholesale Corporation

- Dangdang

- Flipkart.com

- JD.com

- Shopify

- Shopee

- Walmart

- Wayfair LLC

- Others

Top Opportunities for Players

The B2B e-commerce sector is undergoing significant transformation, presenting several opportunities for industry players.

- Expansion of B2B Marketplaces: Global B2B marketplaces, such as Alibaba and Amazon Business, are rapidly growing and becoming central hubs for procurement. These platforms provide businesses with efficient access to a wide range of products and services, reshaping traditional supply chains and unlocking new market entry opportunities through digital platforms.

- Adoption of Self-Service Portals: A significant shift towards self-service in B2B transactions is underway, with buyers increasingly preferring platforms that allow independent purchase management, minimizing the need for direct sales interactions. This trend is driving companies to create user-friendly interfaces that streamline transactions, boosting customer satisfaction and loyalty.

- Integration of Artificial Intelligence: Artificial Intelligence (AI) is increasingly being integrated into B2B e-commerce platforms to enhance customer experiences and operational efficiency. AI applications, such as personalized recommendations and chatbots, are helping businesses to better understand customer needs and streamline the purchasing process.

- Growth in Cross-Border Trade: The digitization of supply chains is facilitating cross-border trade, enabling businesses to expand their reach into new markets. Improved logistics and digital platforms are reducing barriers to international commerce, allowing companies to tap into emerging markets and diversify their customer base.

- Emphasis on Customer Experience: Despite the growth in B2B e-commerce, customer satisfaction remains a challenge, with many buyers reporting subpar online experiences. This gap presents an opportunity for businesses to differentiate themselves by prioritizing user experience, ensuring that their platforms are intuitive, responsive, and tailored to customer needs.

Recent Developments

- In October 2024, ClearCourse, a software and payments company, acquired GOb2b, a B2B e-commerce platform. This deal aims to offer better integrated solutions for small and mid-sized businesses in the UK, especially in food, health, and manufacturing.

- In November 2024, Alibaba consolidated its domestic and international e-commerce platforms into a single business unit to enhance operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 3,919.8 Bn Forecast Revenue (2034) USD 14,789 Bn CAGR (2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product type (Consumer Electronics (Smartphones, Laptops and Tablets, Smartwatches, Headphones and Earphones, Others), Computing Equipment (Servers and Data Centers, Networking Equipment (Routers, Switches, Hubs), Storage Devices (HDDs, SSDs, NAS), Others), Electronic Components (Resistors, Capacitors, and Transistors, Integrated Circuits (ICs), Connectors and Cable Assemblies, Printed Circuit Boards (PCBs), Others), Consumer Appliances (Air Conditioners, Refrigerators, Washing Machines, Coffee Machines, Others), Others), By End user (Offline retailers, Distributers, Specialty store, Hypermarket/Supermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc, Alibaba.com, eBay Inc., Costco Wholesale Corporation, Dangdang, Flipkart.com, JD.com, Shopify, Shopee, Walmart, Wayfair LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  B2B Electronic Commerce MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

B2B Electronic Commerce MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon.com, Inc.

- Alibaba.com

- eBay Inc.

- Costco Wholesale Corporation

- Dangdang

- Flipkart.com

- JD.com

- Shopify

- Shopee

- Walmart

- Wayfair LLC

- Others