Global Autonomous Underwater Vehicle Market Size, Share, Growth Analysis By Type (Shallow, Medium, Large), By Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-Hull Vehicle), By System (Payload & Sensor System, Collision Avoidance, Communication & Networking, Navigation & Guidance, Propulsion & Mobility, Chassis, Power & Energy System, Others), By Speed (5 Knots), By Propulsion (Electric, Mechanical, Hybrid), By Application (Military & Defense, Oil & Gas, Environment Protection & Monitoring, Oceanography, Archaeology & Exploration, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169691

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

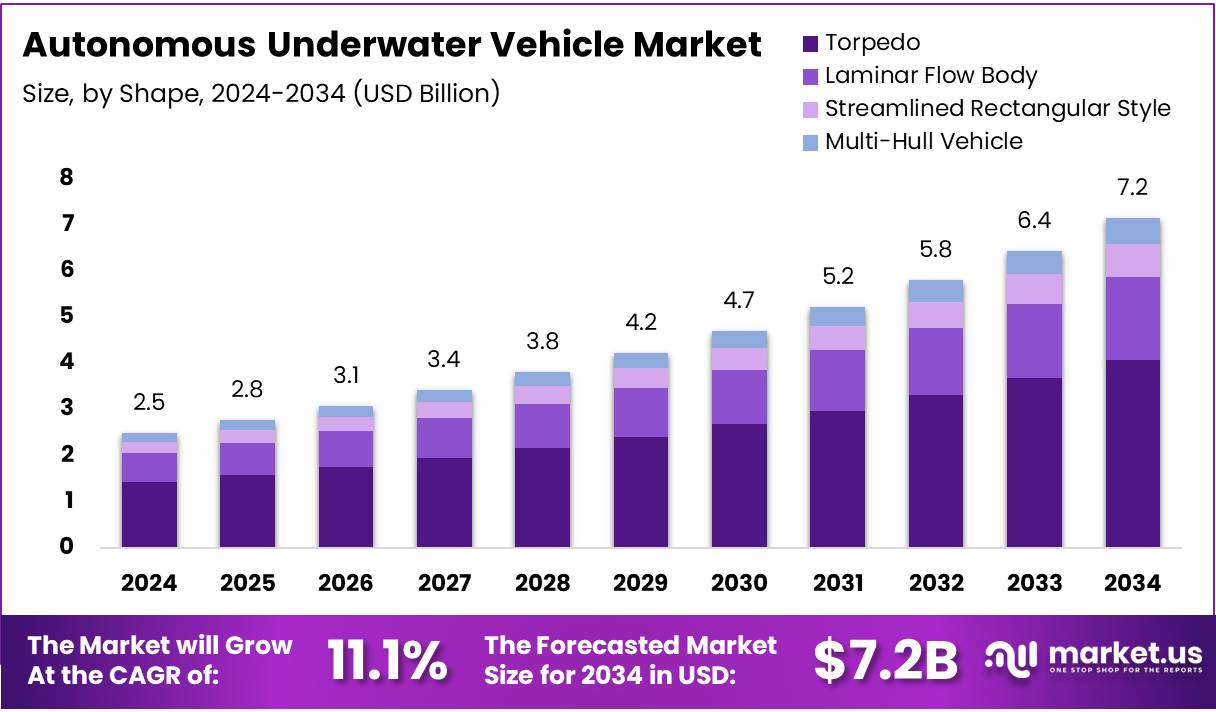

The Global Autonomous Underwater Vehicle Market size is expected to be worth around USD 7.2 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 11.1% during the forecast period from 2025 to 2034.

The Autonomous Underwater Vehicle (AUV) Market is experiencing significant growth, driven by rising demand for ocean exploration, defense applications, and environmental monitoring. These vehicles operate independently without tethering, providing critical data for scientific research and commercial operations. Consequently, investments in AUV technologies continue to expand globally, highlighting emerging opportunities for stakeholders and innovators.

Moreover, government initiatives and funding in marine research have accelerated the adoption of AUVs. Policies promoting oceanographic studies and subsea surveillance support technological development, allowing companies to deploy advanced sensors and sonar systems. As a result, AUVs are increasingly integrated into national maritime strategies, creating a favorable regulatory environment that encourages innovation and long-term market stability.

In addition, AUVs are crucial in marine geoscience applications, often moving at speeds of up to 1.5–2.0 m/s. This mobility enables rapid data collection across large subsea areas, enhancing the efficiency of mapping ocean floors and monitoring underwater ecosystems. Consequently, organizations increasingly rely on AUVs for detailed surveys, reducing the need for human-operated missions in deepwater conditions.

Energy efficiency also drives market growth, with approximately 40% of an AUV’s interior devoted to energy storage systems. This focus ensures longer operational periods and reliability for extended missions. Moreover, typical AUV missions last up to 24 hours, which is determined by onboard sensor and sonar power consumption, supporting continuous exploration without frequent interruptions.

Recharge time and operational depth are additional considerations influencing market expansion. Existing scientific AUVs can operate in water depths up to 6000 m, while recharge cycles typically require 4–8 hours, ensuring readiness for subsequent missions. These technical capabilities open opportunities in offshore research, resource exploration, and environmental monitoring sectors, driving higher adoption rates.

Key Takeaways

- The Global Autonomous Underwater Vehicle Market is projected to reach USD 7.2 Billion by 2034 from USD 2.5 Billion in 2024, growing at a CAGR of 11.1%.

- In the By Type segment, Shallow AUVs dominate with a 46.8% share.

- In the By Shape segment, Torpedo-shaped AUVs lead with a 57.9% share.

- In the By System segment, Payload & Sensor Systems hold a 24.5% share.

- In the By Speed segment, Low-speed (<5 Knots) AUVs dominate with a 67.3% share.

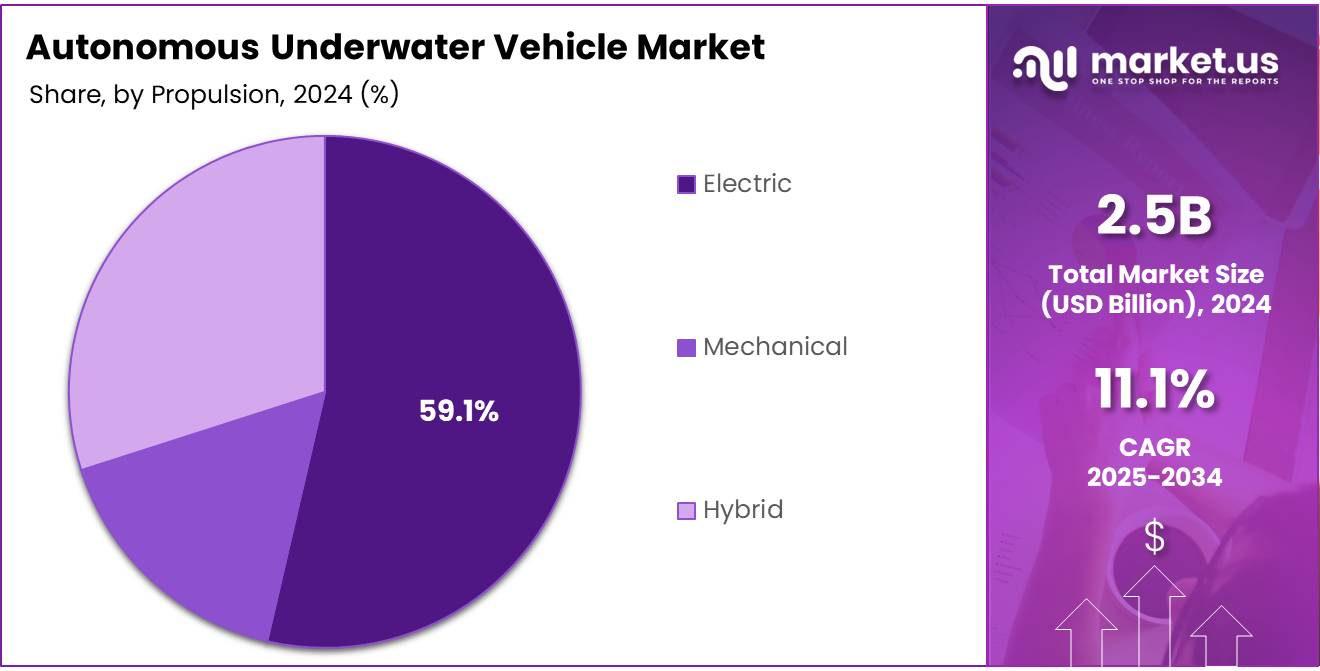

- In the By Propulsion segment, Electric AUVs lead with a 59.1% share.

- In the By Application segment, Military & Defense applications dominate with a 47.2% share.

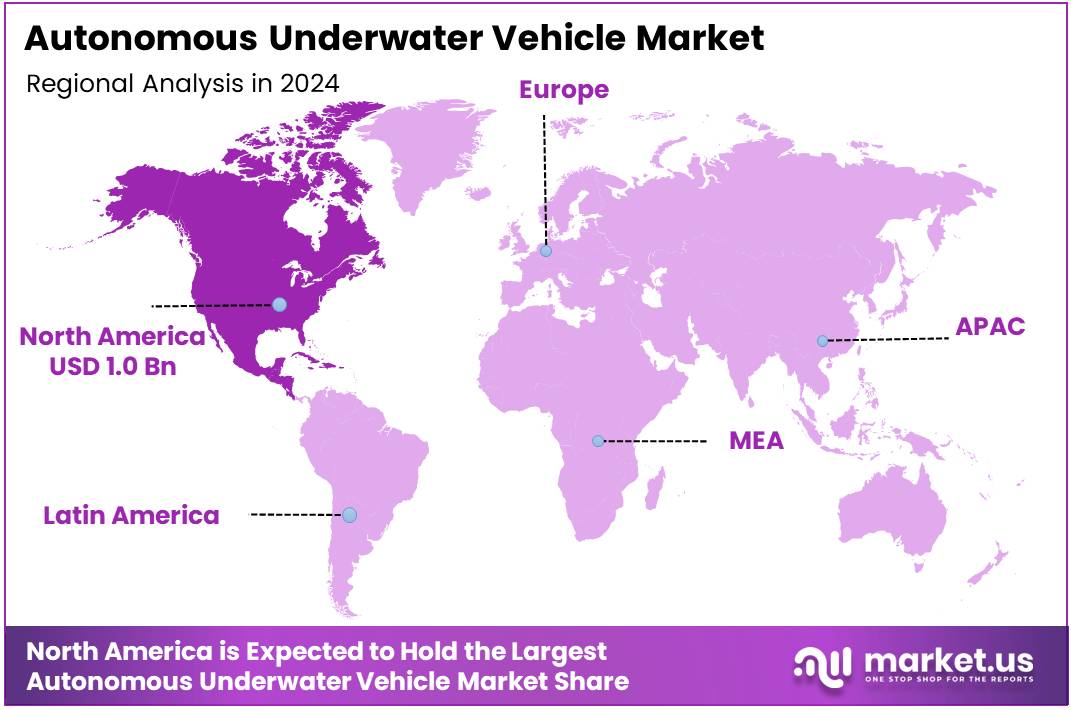

- North America is the leading region with a 43.9% market share, valued at USD 1.0 Billion.

Type Analysis

Shallow AUVs dominate with 46.8% due to their versatility and operational efficiency in coastal waters.

In 2024, Shallow held a dominant market position in the By Type Analysis segment of Autonomous Underwater Vehicle Market, with a 46.8% share. These vehicles operate effectively in depths up to 1000 meters, making them ideal for coastal surveillance, harbor security, and nearshore scientific research. Their compact design and lower operational costs attract commercial and research institutions seeking cost-effective underwater solutions.

Medium AUVs serve mid-depth operations ranging from 1000 to 3000 meters, catering to offshore oil and gas exploration activities. These vehicles balance operational depth capability with payload capacity, enabling extended missions in continental shelf regions. Their robust construction supports diverse sensor configurations for geological surveys and infrastructure inspection tasks.

Large AUVs provide deep-sea exploration capabilities exceeding 3000 meters, targeting specialized applications in oceanographic research and deep-water mineral exploration. These sophisticated systems incorporate advanced navigation technologies and extended endurance capabilities. Their deployment supports critical missions in unexplored oceanic territories and extreme underwater environments.

Shape Analysis

Torpedo-shaped AUVs dominate with 57.9% due to their superior hydrodynamic efficiency and speed capabilities.

In 2024, Torpedo held a dominant market position in the By Shape Analysis segment of Autonomous Underwater Vehicle Market, with a 57.9% share. This cylindrical configuration minimizes drag resistance, enabling faster transit speeds and enhanced fuel efficiency during long-distance missions. Military applications particularly favor this design for stealth reconnaissance and rapid deployment scenarios requiring minimal detection profiles.

Laminar Flow Body designs optimize underwater movement through smooth surface contours that reduce turbulence formation. These vehicles achieve exceptional energy efficiency in extended survey missions, particularly benefiting scientific research operations. Their specialized hull geometry supports stable sensor platform performance in varied current conditions.

Streamlined Rectangular Style AUVs offer increased internal volume for payload accommodation while maintaining reasonable hydrodynamic performance. This configuration facilitates modular sensor integration and equipment reconfiguration between missions. Commercial operators value this flexibility for multi-purpose deployment strategies.

Multi-Hull Vehicle designs provide enhanced stability and payload distribution across multiple connected bodies. These innovative platforms support specialized applications requiring simultaneous multi-sensor operations or increased buoyancy control. Their unique architecture enables novel approaches to complex underwater survey tasks.

System Analysis

Payload & Sensor Systems dominate with 24.5% due to their critical role in data collection and mission functionality.

In 2024, Payload & Sensor System held a dominant market position in the By System Analysis segment of Autonomous Underwater Vehicle Market, with a 24.5% share. These integrated components include sonar arrays, cameras, environmental sensors, and sampling equipment that define vehicle mission capabilities. Advanced sensor fusion technologies enable comprehensive underwater mapping and detection operations across various application domains.

Collision Avoidance systems incorporate acoustic vector sensors and real-time processing algorithms to prevent underwater obstacles and terrain impacts. These safety-critical components protect valuable equipment during autonomous navigation through complex underwater environments. Their reliability directly influences operational confidence in unmanned missions.

Communication & Networking technologies facilitate data transmission and remote command execution through acoustic modems and satellite links. These systems enable real-time mission monitoring and adaptive operational control from surface vessels or shore stations. Emerging underwater internet protocols expand collaborative multi-vehicle operations.

Navigation & Guidance systems integrate inertial sensors, Doppler velocity logs, and GPS surface positioning for precise underwater trajectory control. These components ensure accurate waypoint following and mission area coverage in GPS-denied underwater environments. Advanced algorithms compensate for current drift and positioning uncertainty.

Propulsion & Mobility systems deliver thrust generation and maneuvering control through thrusters, control surfaces, and buoyancy mechanisms. These components determine vehicle speed, endurance, and operational envelope characteristics. Efficient propulsion designs directly impact mission duration and range capabilities.

Chassis structures provide pressure-resistant housings and mechanical frameworks protecting internal systems from underwater pressure and environmental conditions. Material selection balances strength requirements with weight constraints and corrosion resistance. Modular chassis designs facilitate maintenance and component upgrades.

Power & Energy System components include batteries, fuel cells, and power management electronics sustaining extended autonomous operations. Energy storage capacity fundamentally limits mission duration and operational range. Emerging technologies focus on increasing energy density and recharge capabilities.

Others encompass specialized subsystems including data storage, thermal management, and auxiliary equipment supporting specific mission requirements. These components enhance vehicle capabilities for niche applications and extreme environmental conditions. Integration flexibility accommodates evolving operational demands.

Speed Analysis

Low-speed AUVs dominate with 67.3% due to their superior energy efficiency and detailed survey capabilities.

In 2024, <5 Knots held a dominant market position in the By Speed Analysis segment of Autonomous Underwater Vehicle Market, with a 67.3% share. These slower-moving vehicles excel in high-resolution mapping, environmental monitoring, and scientific data collection requiring precise sensor positioning. Their reduced speed enables extended mission durations through efficient energy consumption, particularly benefiting long-endurance survey operations and detailed inspection tasks.

>5 Knots AUVs provide rapid transit capabilities for time-sensitive missions and large-area coverage requirements. These faster vehicles support military reconnaissance, emergency response operations, and expedited survey campaigns. Their enhanced speed reduces deployment time between operational areas, though at the cost of increased energy consumption and reduced endurance compared to slower alternatives.

Propulsion Analysis

Electric propulsion dominates with 59.1% due to its operational simplicity and environmental compliance.

In 2024, Electric held a dominant market position in the By Propulsion Analysis segment of Autonomous Underwater Vehicle Market, with a 59.1% share. Battery-powered electric motors provide clean, quiet operation with minimal maintenance requirements and precise speed control. These systems eliminate fuel handling complexities and reduce acoustic signatures, making them ideal for scientific research and covert military operations requiring stealth characteristics.

Mechanical propulsion systems utilize traditional combustion engines or closed-cycle power generation for extended range capabilities. These configurations support long-duration missions requiring greater energy capacity than current battery technology provides. Their mechanical complexity demands specialized maintenance but delivers superior endurance for deep-ocean exploration.

Hybrid propulsion combines electric and mechanical systems, optimizing performance across varied mission profiles through adaptive power source selection. These versatile platforms switch between quiet electric operation for sensitive tasks and mechanical power for extended transit phases. Hybrid architectures represent emerging solutions balancing endurance, stealth, and operational flexibility requirements.

Application Analysis

Military & Defense applications dominate with 47.2% due to strategic importance and substantial government investment.

In 2024, Military & Defense held a dominant market position in the By Application Analysis segment of Autonomous Underwater Vehicle Market, with a 47.2% share. Naval forces deploy AUVs for mine countermeasures, intelligence gathering, submarine detection, and harbor protection operations. These strategic applications drive significant research funding and technological advancement, establishing military requirements as primary market drivers influencing vehicle capabilities and performance standards.

Oil & Gas operations utilize AUVs for pipeline inspection, subsea infrastructure monitoring, and offshore facility surveys. These commercial applications reduce inspection costs and operational risks compared to manned alternatives. AUVs enable continuous asset monitoring in deep-water installations, supporting preventive maintenance strategies and regulatory compliance verification.

Environment Protection & Monitoring deployments track marine ecosystem health, pollution assessment, and climate change research. Environmental agencies and research institutions employ AUVs for repetitive survey missions documenting temporal changes in underwater habitats. Their non-invasive observation capabilities support conservation efforts and environmental impact assessments.

Oceanography research leverages AUVs for seafloor mapping, water column profiling, and marine geology investigations. Scientific missions explore oceanic processes, underwater volcanic activity, and deep-sea ecosystems. AUVs extend research capabilities into previously inaccessible regions, advancing fundamental understanding of marine environments.

Archaeology & Exploration applications discover shipwrecks, submerged cultural sites, and historical artifacts through non-destructive survey techniques. These specialized missions combine high-resolution imaging with precise positioning for documentation and preservation planning. AUVs accelerate underwater archaeological surveys across extensive search areas.

Others include aquaculture monitoring, underwater construction support, and cable laying operations. These emerging applications demonstrate expanding commercial adoption beyond traditional sectors. Niche markets continue developing as AUV technology becomes more accessible and cost-effective for diverse industries.

Key Market Segments

By Type

- Shallow

- Medium

- Large

By Shape

- Torpedo

- Laminar Flow Body

- Streamlined Rectangular Style

- Multi-Hull Vehicle

By System

- Payload & Sensor System

- Collision Avoidance

- Communication & Networking

- Navigation & Guidance

- Propulsion & Mobility

- Chassis

- Power & Energy System

- Others

By Speed

- <5 Knots

- >5 Knots

By Propulsion

- Electric

- Mechanical

- Hybrid

By Application

- Military & Defense

- Oil & Gas

- Environment Protection & Monitoring

- Oceanography

- Archaeology & Exploration

- Others

Drivers

Rising Global Investments in Oceanographic Research and Marine Surveillance Drives Market Growth

The Autonomous Underwater Vehicle (AUV) market is benefiting from growing global investments in oceanographic research. Governments and private organizations are funding deep-sea exploration and marine data collection, increasing the need for efficient unmanned underwater solutions. This investment accelerates the adoption of AUVs in research projects.

There is a rising demand for advanced alternatives to manned submersibles. AUVs provide safer, cost-effective, and longer-duration underwater operations. Researchers and defense agencies prefer unmanned vehicles to reduce human risk in deep-sea missions, making AUVs a preferred choice for complex underwater tasks.

Technological advancements in battery life and propulsion systems are enhancing AUV performance. Longer endurance, improved maneuverability, and efficient power management allow AUVs to cover greater distances and conduct extended missions. These improvements make AUVs more reliable and attractive for commercial, research, and military applications.

The expansion of environmental monitoring and climate change studies also fuels market growth. AUVs are increasingly used to track ocean health, monitor marine biodiversity, and collect climate-related data. Their ability to operate in harsh conditions and provide precise measurements supports global initiatives for sustainable ocean management and environmental conservation.

Restraints

Regulatory and Skilled Workforce Challenges Restraining the Autonomous Underwater Vehicle Market

The Autonomous Underwater Vehicle (AUV) market faces challenges due to stringent regulatory and environmental compliance requirements. Governments and environmental bodies impose strict guidelines for underwater operations. These regulations often slow down project approvals and increase operational costs, making it harder for companies to expand quickly.

Compliance with environmental standards is critical, as underwater operations can impact marine ecosystems. Companies must invest in monitoring, reporting, and safety measures, which can reduce overall profitability. These regulatory hurdles can also limit the deployment of advanced AUV technologies in certain regions.

Another major restraint is the limited availability of skilled professionals for AUV operation and maintenance. Operating these vehicles requires specialized technical knowledge in navigation, sensors, propulsion, and data analysis. The shortage of trained personnel slows down adoption rates and increases dependency on costly training programs.

Maintenance and troubleshooting of AUVs are equally challenging. Without enough experts, companies face higher downtime and operational inefficiencies. This gap in workforce availability restricts the market’s growth potential, especially in emerging regions where technical training is limited.

Growth Factors

Integration of Advanced AI and Machine Learning Drives Market Growth

The adoption of advanced AI and machine learning in Autonomous Underwater Vehicles (AUVs) is creating significant growth opportunities. These technologies improve navigation accuracy, enabling AUVs to operate in complex underwater environments without human intervention. AI also enhances data analysis, allowing faster and more precise interpretation of collected information.

Rising demand for deep-sea exploration is another key driver. Industries like oil, gas, and minerals are increasingly relying on AUVs for underwater surveys. These vehicles provide safer, cost-effective, and efficient solutions for detecting resources in deep ocean areas, which were previously difficult to access.

Global interest in underwater archaeology and marine research is also contributing to market growth. Governments and research organizations are expanding programs to study ocean biodiversity, historical shipwrecks, and underwater ecosystems. AUVs are ideal for these tasks, as they can collect detailed data without disturbing fragile environments.

The development of hybrid AUV systems offers further opportunities. These vehicles combine multiple propulsion and energy systems, allowing extended mission durations and improved operational flexibility. This innovation is particularly valuable for long-term monitoring and complex underwater missions, increasing the appeal of AUVs across scientific and industrial applications.

Emerging Trends

Increasing Adoption of Advanced Technologies Drives Autonomous Underwater Vehicle Market

The growing use of swarm technology is a key trend in the AUV market. This technology allows multiple AUVs to work together on coordinated missions, improving efficiency and coverage for tasks like underwater surveys and inspections. Swarm operations are particularly valuable in complex and deep-sea environments.

Another emerging factor is the adoption of real-time data transmission. Cloud-connected AUVs enable instant data sharing and analysis, reducing delays in decision-making. This trend supports industries such as oil and gas, environmental monitoring, and defense by providing actionable insights faster and more reliably.

The market is also seeing a shift toward modular and customizable AUV platforms. Manufacturers are designing vehicles that can be easily reconfigured with different payloads and sensors, allowing operators to tailor missions to specific requirements. This flexibility lowers costs and enhances operational efficiency.

Collaboration between defense agencies and commercial AUV manufacturers is further boosting market trends. Partnerships focus on developing advanced technologies, improving mission capabilities, and sharing expertise. Such collaborations are accelerating innovation and expanding the adoption of AUVs across both military and commercial sectors.

Regional Analysis

North America Dominates the Autonomous Underwater Vehicle Market with a Market Share of 43.9%, Valued at USD 1.0 Billion

North America holds a leading position in the Autonomous Underwater Vehicle (AUV) market, accounting for a dominant share of 43.9% with a market value of USD 1.0 Billion. Growth in the region is driven by rising defense spending, extensive marine research initiatives, and strong adoption of advanced AUV technologies for oceanography and surveillance. The presence of well-established infrastructure and research facilities further supports market expansion.

Europe Autonomous Underwater Vehicle Market Trends

Europe is witnessing steady growth in the AUV market, fueled by increased environmental monitoring and climate research programs. Rising government investments in defense and maritime technology also contribute to the adoption of AUVs. Technological collaborations between research institutes and industry players are enhancing AUV capabilities, supporting market growth across the region.

Asia Pacific Autonomous Underwater Vehicle Market Trends

The Asia Pacific region shows promising growth potential for the AUV market, driven by offshore oil and gas exploration, deep-sea mining, and growing investments in marine research. Rapid technological adoption and government initiatives in countries like China, Japan, and India are accelerating market development. Emerging defense programs also provide additional opportunities.

Middle East and Africa Autonomous Underwater Vehicle Market Trends

The Middle East and Africa region is gradually adopting AUV technology, primarily for offshore energy exploration and maritime security operations. Investments in modernizing naval capabilities and environmental monitoring projects are expected to support steady growth in the AUV market in the coming years.

Latin America Autonomous Underwater Vehicle Market Trends

Latin America is observing moderate growth in the AUV market, mainly driven by offshore oil and gas operations and marine research activities. Increasing collaborations between regional research centers and technology providers are expected to support market development, although adoption remains slower compared to North America and Europe.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Autonomous Underwater Vehicle Company Insights

By 2024, the market is expected to witness significant growth, with technological innovation, operational reliability, and integration capabilities emerging as decisive factors for success. Key players in the industry are leveraging their engineering expertise and strategic partnerships to meet the diverse needs of defense, commercial, and research segments.

Lockheed Martin leverages its long-standing defense systems expertise to deliver highly robust and mission-ready AUVs. Their platforms focus on extended endurance, sophisticated navigation, and seamless integration with naval command networks, making them a preferred choice for government and defense agencies. The company’s ability to blend advanced technology with operational reliability continues to strengthen its leadership in the military AUV segment.

ThyssenKrupp brings decades of maritime engineering experience to the AUV market, with industrial-grade solutions tailored for offshore infrastructure inspection and maintenance. Their vehicles are engineered for durability and high-performance in challenging underwater conditions, offering significant value to energy, subsea construction, and industrial monitoring operations.

General Dynamics emphasizes modularity and system integration, providing versatile AUV platforms suitable for a range of applications—from mine detection to deep-sea surveillance. Their focus on flexible architecture, reliability, and mission customization enhances their appeal across defense, commercial, and research markets, supporting multi-purpose underwater operations.

L3 Ocean Server Saab develops compact, cost-efficient, and agile AUVs designed for scientific research, coastal surveillance, and mapping. Their vehicles enable rapid deployment and reduced operational costs, making them suitable for academic, environmental, and commercial survey clients seeking efficient underwater solutions.

Top Key Players in the Market

- Lockheed Martin

- ThyssenKrupp

- General Dynamics

- L3 Ocean Server Saab

- Kongsberg Gruppen ASA

- FUGRO NV-CVA

- International Submarine Engineering Ltd.

- Boston Engineering

- Mitsubishi Heavy Industries

Recent Developments

- In November 2025: The DRDO developed lightweight autonomous underwater vehicles (AUVs) designed for enhanced mobility. These AUVs are equipped with advanced sonar units and high-resolution cameras for precise underwater operations.

- In March 2025: Destinus acquired Aerialtronics, strengthening its presence in the Dutch advanced UAV technology sector. This acquisition enhances capabilities in drone innovation and aerial technology solutions.

- In March 2025: Teledyne Technologies Incorporated agreed to acquire Valeport Holdings Limited, a leading underwater sensor manufacturer. This move expands Teledyne’s portfolio in oceanographic and subsea measurement technologies.

- In November 2024: Vatn Systems raised $13 million in a seed funding round to advance autonomous underwater vehicles for US defense. The funding aims to accelerate R&D and enhance AUV deployment for defense operations.

- In September 2024: Beam deployed the world’s first AI-driven autonomous underwater vehicle. This innovation integrates artificial intelligence for smarter, autonomous underwater exploration and operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 7.2 Billion CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Shallow, Medium, Large), By Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-Hull Vehicle), By System (Payload & Sensor System, Collision Avoidance, Communication & Networking, Navigation & Guidance, Propulsion & Mobility, Chassis, Power & Energy System, Others), By Speed (<5 Knots, >5 Knots), By Propulsion (Electric, Mechanical, Hybrid), By Application (Military & Defense, Oil & Gas, Environment Protection & Monitoring, Oceanography, Archaeology & Exploration, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lockheed Martin, ThyssenKrupp, General Dynamics, L3 Ocean Server Saab, Kongsberg Gruppen ASA, FUGRO NV-CVA, International Submarine Engineering Ltd., Boston Engineering, Mitsubishi Heavy Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Underwater Vehicle MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Underwater Vehicle MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lockheed Martin

- ThyssenKrupp

- General Dynamics

- L3 Ocean Server Saab

- Kongsberg Gruppen ASA

- FUGRO NV-CVA

- International Submarine Engineering Ltd.

- Boston Engineering

- Mitsubishi Heavy Industries