Global Autonomous Pods Market Size, Share, Growth Analysis By Vehicle Type (Passenger Pods, Cargo Pods, Campus Pods, Airport Pods, Urban Pods), By Power Source (Electric Pods, Hybrid Pods, Alternative Fuel Pods), By Autonomy Level (Level 4, Level 5), By Application (Smart Cities, Airports, Campuses, Logistics, Public Transport, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174881

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

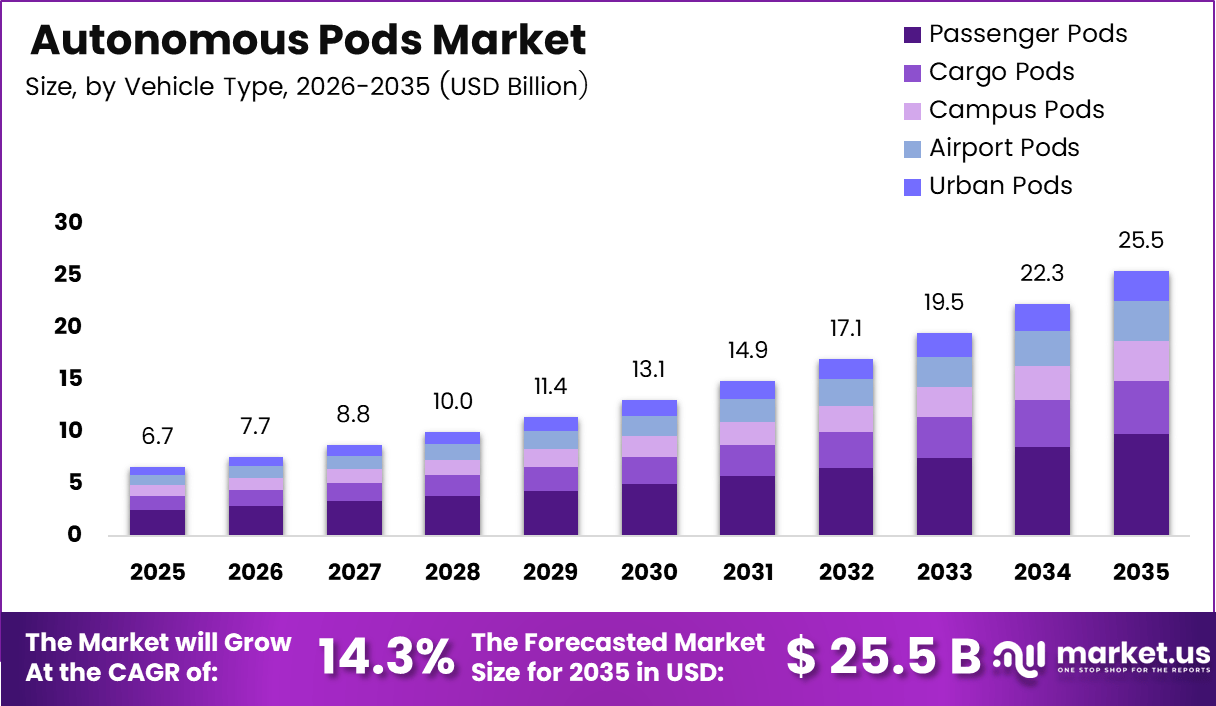

The Global Autonomous Pods Market size is expected to be worth around USD 25.5 billion by 2035, from USD 6.7 billion in 2025, growing at a CAGR of 14.3% during the forecast period from 2026 to 2035.

The Autonomous Pods market refers to compact, self driving, electric mobility units designed for short distance passenger transport within controlled environments. These systems commonly operate in airports, smart cities, campuses, and business districts. As part of autonomous mobility solutions, the market combines automation, shared mobility, and sustainable urban transport models.

Market growth is increasingly influenced by urban congestion challenges and rising demand for efficient last mile connectivity. Consequently, city planners focus on low speed autonomous vehicles that improve traffic flow and reduce emissions. Moreover, continuous progress in AI navigation, sensors, and vehicle intelligence strengthens commercial readiness.

Government investment plays a critical role in accelerating adoption across regions. Therefore, regulators are shaping frameworks that support geofenced autonomous transport and electric mobility initiatives. In parallel, public infrastructure funding and sustainability mandates improve long term confidence, while pilot programs help normalize autonomous passenger services in daily commuting environments.

Growth opportunities continue emerging in airport transit, smart campuses, and mixed use developments. As a result, autonomous pods increasingly replace traditional shuttle systems with predictable operating costs and continuous availability. Additionally, integration with digital mobility platforms enables scheduling, access control, and real time fleet optimization, supporting both informational and transactional mobility use cases.

Operational performance data validates long term market potential. According to Heathrow Airport authorities, the Personal Rapid Transit system has operated with 98.5% reliability and remains active today. The city expects around 40 pods in service, designed to function similarly to driverless taxi solutions within controlled transport corridors.

Furthermore, Heathrow’s system currently runs 21 four passenger vehicles along a 2.4 mile route connecting Terminal 5 to business parking zones. Terminal 5 accommodates nearly 35 million passengers annually, while pods travel at speeds up to 25 miles per hour, ensuring efficient passenger throughput.

In the Middle East, according to Masdar City authorities in the United Arab Emirates, autonomous pod transport operates using 100% fossil fuel free methods. The podcars seat 4 or 6 passengers and have collectively transported over 1,000,000 people since 2010, reinforcing scalability and regulatory acceptance.

Key Takeaways

- The Global Autonomous Pods Market is projected to expand from USD 6.7 billion in 2025 to USD 25.5 billion by 2035, registering a CAGR of 14.3% over the forecast period.

- Passenger Pods represent the leading vehicle type segment with a 38.5% share in 2025, driven by urban commuting, shared mobility, and last mile transport demand.

- Electric Pods dominate the power source segment, accounting for 67.2% of the market in 2025, supported by sustainability mandates and lower operating costs.

- Level 4 autonomy leads the autonomy level segment with an 83.9% share in 2025, reflecting suitability for controlled environments such as campuses and airports.

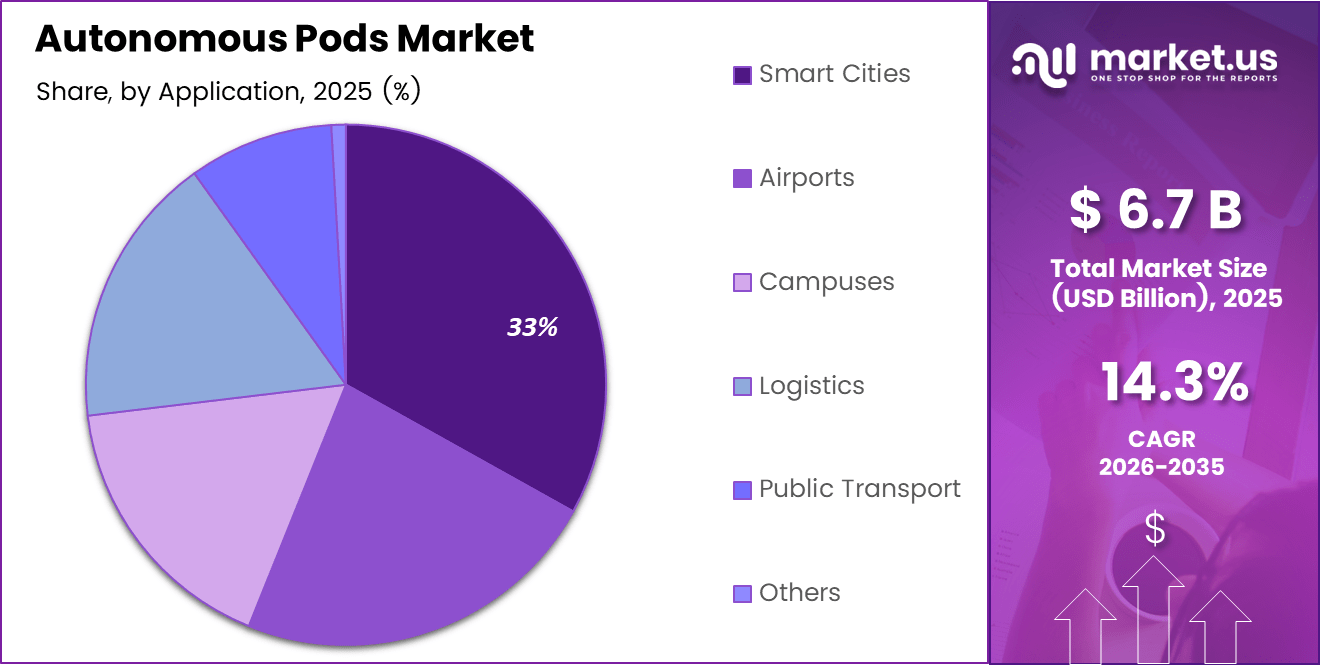

- Smart Cities emerge as the largest application segment, holding 33.2% of the market in 2025 due to government backed intelligent mobility initiatives.

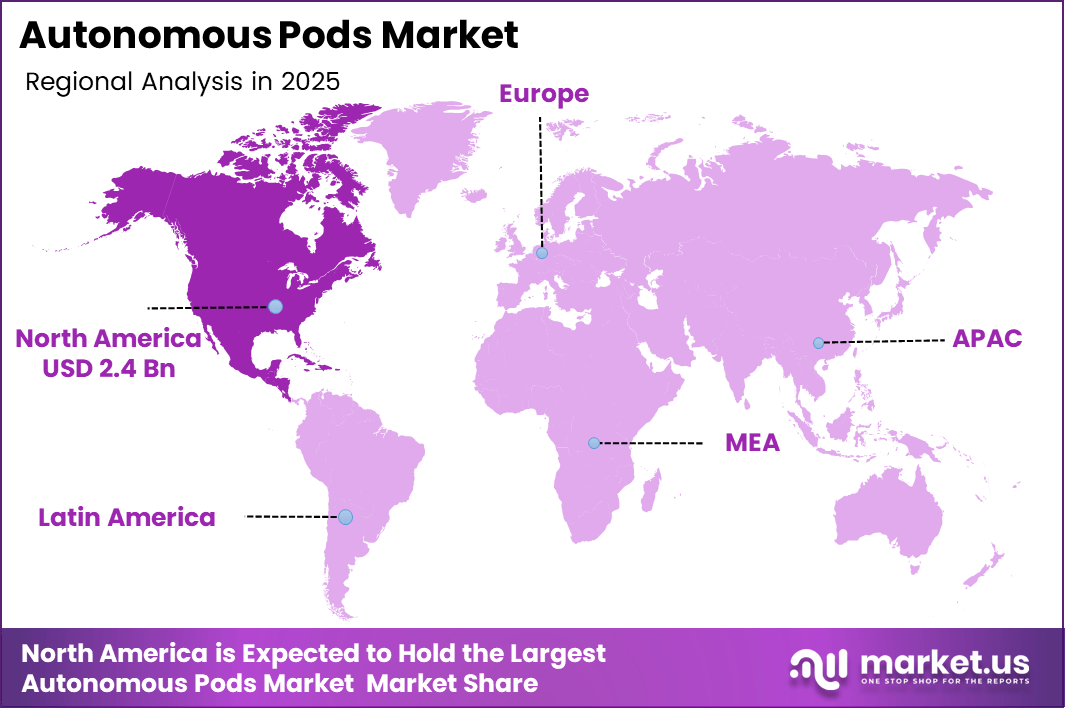

- North America dominates the regional landscape with a 37.2% market share in 2025, valued at USD 2.4 billion, supported by early adoption and pilot scale deployments.

By Vehicle Type Analysis

Passenger Pods dominate with 38.5% due to their strong alignment with shared mobility, last mile transport, and urban commuting needs.

In 2025, Passenger Pods held a dominant market position in the By Main Segment Analysis segment of Autonomous Pods Market, with a 38.5% share. These pods support safe, efficient, and contactless mobility. Moreover, cities increasingly favor them for reducing congestion, improving accessibility, and supporting sustainable transport initiatives.

Cargo Pods focus on autonomous goods movement within controlled and semi urban environments. They improve delivery efficiency while lowering labor dependency. As e commerce expands, logistics operators increasingly integrate cargo pods to streamline short distance transport and ensure predictable delivery performance.

Campus Pods serve universities, corporate parks, and industrial campuses by enabling smooth internal mobility. They enhance connectivity across large campuses while minimizing operational costs. Consequently, organizations deploy these pods to improve employee and student movement within secure zones.

Airport Pods enhance passenger movement between terminals, parking zones, and transit hubs. They reduce walking distances and improve traveler experience. Airports adopt them to optimize flow management and provide seamless, automated transportation.

Urban Pods operate in dense city environments for short distance trips. They support smart mobility goals and reduce reliance on conventional vehicles. Municipal authorities increasingly pilot these pods to modernize public transport ecosystems.

By Power Source Analysis

Electric Pods dominate with 67.2% driven by sustainability goals, lower operating costs, and compatibility with smart infrastructure.

In 2025, Electric Pods held a dominant market position in the By Main Segment Analysis segment of Autonomous Pods Market, with a 67.2% share. These pods benefit from zero tailpipe emissions and quiet operation. Moreover, expanding charging infrastructure accelerates their deployment across urban and campus environments.

Hybrid Pods combine electric and conventional systems to extend operational range. They serve regions where charging infrastructure remains limited. As a result, operators adopt hybrid solutions to ensure flexibility while gradually transitioning toward cleaner mobility solutions.

Alternative Fuel Pods explore options such as hydrogen or biofuels. They support long term decarbonization strategies. Although adoption remains selective, these pods attract interest from regions aiming to diversify energy sources and reduce dependency on traditional fuels.

By Autonomy Level Analysis

Level 4 autonomy dominates with 83.9% due to proven safety performance and suitability for controlled environments.

In 2025, Level 4 held a dominant market position in the By Main Segment Analysis segment of Autonomous Pods Market, with a 83.9% share. These systems operate without human intervention in defined areas. Consequently, they align well with campuses, airports, and smart city pilots.

Level 5 autonomy represents fully autonomous operation across all environments. Although development continues, deployment remains limited. Stakeholders continue testing this level as technology maturity, regulations, and public acceptance gradually evolve.

By Application Analysis

Smart Cities dominate with 33.2% as governments prioritize intelligent, automated, and sustainable mobility solutions.

Smart Cities held a dominant market position in the By Main Segment Analysis of the Autonomous Pods Market in 2025, accounting for a 33.2% share. These environments integrate autonomous pods with connected digital infrastructure, including traffic management systems, sensors, and urban data platforms. As a result, cities improve traffic efficiency, enhance road safety, and optimize energy consumption while supporting sustainable urban mobility goals.

Airports increasingly deploy autonomous pods to improve passenger flow and overall operational efficiency across terminals. These systems help reduce congestion in high traffic zones while enabling seamless, contactless movement for travelers and staff. With global passenger volumes steadily rising, airports rely more on automation to manage internal mobility and enhance traveler experience.

Campuses adopt autonomous pods to strengthen internal transportation within controlled and predictable environments. Pods support productivity by minimizing travel time between buildings and facilities for students, employees, and visitors. Educational institutions and corporate campuses favor these systems due to their safety features, defined routes, and ease of integration.

Logistics applications utilize autonomous pods for short distance freight movement within urban and semi controlled environments. These systems help optimize supply chains by reducing delivery delays and labor dependency. As demand for urban delivery and micro logistics grows, operators continue expanding pod deployment for efficient last mile operations.

Public transport systems integrate autonomous pods as feeder solutions that connect users to major transit hubs. These pods improve first and last mile connectivity, addressing gaps in traditional transport networks. Transit authorities increasingly view autonomous pods as complementary assets that enhance accessibility and network efficiency.

Other applications include healthcare facilities and industrial sites where controlled environments support reliable automation. In hospitals, pods assist with internal transport of staff, patients, and supplies, while industrial sites use them for operational movement. Adoption continues to grow as organizations prioritize efficiency, safety, and cost optimization through autonomous mobility solutions.

Key Market Segments

By Vehicle Type

- Passenger Pods

- Cargo Pods

- Campus Pods

- Airport Pods

- Urban Pods

By Power Source

- Electric Pods

- Hybrid Pods

- Alternative Fuel Pods

By Autonomy Level

- Level 4

- Level 5

By Application

- Smart Cities

- Airports

- Campuses

- Logistics

- Public Transport

- Others

Drivers

Urban Congestion Reduction Through Compact Self Driving Mobility Units Drives Market Growth

Urban areas face daily pressure from traffic crowding and limited road space. Autonomous pods address this issue by using compact designs that move people efficiently over short distances. As an analyst viewpoint, these pods reduce the number of private vehicles on roads and improve traffic flow in dense city zones.

City governments increasingly invest in autonomous mobility pilots to test safer and smarter transport models. These projects help authorities study real world usage, safety, and public acceptance. Over time, pilot success builds confidence and supports wider adoption across urban transport networks.

Demand for low cost last mile and short distance travel also supports market growth. Autonomous pods offer affordable point to point movement for daily commuters, elderly users, and tourists. Their lower operating costs compared to traditional vehicles make them attractive for cities and operators.

Technology progress strengthens this growth path. Improvements in sensor fusion and AI based navigation systems help pods detect obstacles, plan routes, and operate smoothly. These systems raise safety levels and reliability, encouraging broader use in public environments.

Restraints

Regulatory Uncertainty Around Fully Driverless Public Deployment Restrains Market Expansion

One major restraint comes from unclear rules for fully driverless operations. Many regions still test autonomous mobility under strict supervision. This slows commercial deployment and limits how quickly operators can scale services across cities.

As an analyst view, policymakers move carefully due to safety, liability, and public trust concerns. Without clear standards, manufacturers and operators face delays in approvals. This uncertainty affects investment planning and long term rollout strategies.

High upfront costs also restrict market growth. Autonomous pods require advanced sensors, software, charging systems, and communication infrastructure. Cities and private operators must invest heavily before seeing returns.

Smaller municipalities often struggle to justify these costs. Even when long term savings exist, budget limits slow adoption. Until infrastructure costs fall and regulations stabilize, market expansion remains gradual.

Growth Factors

Integration of Autonomous Pods Within Smart City Transport Ecosystems Creates Strong Opportunities

Smart city development opens major opportunities for autonomous pods. Cities aim to connect transport systems through data driven platforms. Pods can link with traffic systems, public transit, and energy networks to improve overall mobility efficiency.

Campuses, airports, and industrial parks also offer growth potential. These controlled environments suit autonomous operation due to fixed routes and predictable traffic. As an analyst, these zones act as stepping stones toward wider urban deployment.

Sustainability goals further support opportunity growth. Autonomous pods often use electric power, lowering emissions and noise. Shared usage models reduce vehicle ownership and align with green mobility targets.

Partnerships between OEMs and transit operators strengthen this outlook. Collaboration helps combine vehicle technology with operational expertise, accelerating deployment and improving service quality.

Emerging Trends

Deployment of Autonomous Pods for First and Last Mile Connectivity Shapes Market Trends

First and last mile connectivity remains a key trend. Autonomous pods bridge gaps between transit hubs and final destinations. This improves convenience and increases public transport usage across cities.

Digital twins and AI powered simulation tools also gain attention. These technologies allow operators to test routes, traffic patterns, and demand before deployment. As an analyst, this reduces risk and improves service planning.

Subscription based autonomous mobility services continue to rise. Users prefer predictable costs and easy access without ownership. This model supports recurring revenue and wider adoption.

Design trends also evolve. Lightweight and modular pod designs improve energy efficiency and flexibility. Modular layouts allow operators to adjust seating or cargo space based on demand, enhancing operational value.

Regional Analysis

North America Dominates the Autonomous Pods Market with a Market Share of 37.2%, Valued at USD 2.4 Billion

The North America Autonomous Pods Market holds a dominant position due to early adoption of autonomous mobility solutions and strong pilot scale deployments in urban environments. The region accounted for a 37.2% share, valued at USD 2.4 billion, supported by smart city investments and favorable testing frameworks. High demand for last mile connectivity and aging population mobility solutions continues strengthening regional uptake. Advanced digital infrastructure further supports smooth integration of autonomous pods into existing transport systems.

Europe Autonomous Pods Market Trends

Europe shows steady growth driven by sustainability focused transport policies and congestion reduction initiatives. Cities emphasize shared electric mobility to meet emission targets and reduce urban traffic density. Public acceptance of autonomous public transport pilots remains high, supporting gradual scaling. Integration with multimodal transport networks improves usability and long term adoption.

Asia Pacific Autonomous Pods Market Trends

Asia Pacific represents a high growth region due to rapid urbanization and dense metropolitan populations. Governments actively test autonomous pods to solve short distance transit challenges in megacities. Smart city programs and digital transport platforms accelerate deployment. Cost sensitive mobility demand also supports shared autonomous pod usage.

Middle East and Africa Autonomous Pods Market Trends

The Middle East and Africa region shows emerging adoption, led by smart infrastructure investments and futuristic urban development projects. Autonomous pods align with goals to modernize public transport systems and reduce private vehicle dependency. Controlled environments such as planned cities and tourism zones drive early use cases. Long term growth depends on regulatory clarity and infrastructure expansion.

Latin America Autonomous Pods Market Trends

Latin America demonstrates gradual adoption supported by urban mobility reforms and congestion management needs. Cities explore autonomous pods for feeder routes connecting mass transit hubs. Budget constraints influence phased deployment strategies. Growing focus on affordable shared mobility solutions supports future market expansion.

U.S. Autonomous Pods Market Trends

The U.S. Autonomous Pods Market benefits from strong innovation ecosystems and extensive real world testing programs. Municipal authorities explore pods for campus mobility, airports, and urban downtowns. Demand for accessible transport solutions for elderly and disabled populations supports adoption. Data driven traffic management systems enhance operational efficiency and service reliability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Autonomous Pods Company Insights

Waymo continues to anchor its strategy around fully autonomous ride services, leveraging years of real world driving data and mature sensor fusion stacks. The company’s focus on safety validation, geofenced operations, and scalable fleet management positions it as a benchmark for reliability within autonomous pod ecosystems. Its steady expansion across controlled urban environments supports gradual market confidence and regulatory alignment.

Tesla approaches autonomous pods from a software first and hardware optimized perspective, emphasizing vision based autonomy and over the air updates. The company’s vertical integration model allows rapid iteration of autonomous features, while its large installed vehicle base creates long term potential for shared autonomous mobility concepts aligned with pod style use cases.

BMW AG positions itself through collaborative development and premium urban mobility concepts, combining advanced driver assistance systems with intelligent vehicle architectures. Its approach emphasizes human centric design, modular pod interiors, and seamless integration with smart city infrastructure, supporting differentiated autonomous pod offerings for premium and mixed use environments.

Daimler AG leverages its engineering depth and commercial vehicle expertise to advance autonomous pod solutions for both passenger and logistics applications. The company’s strength lies in system redundancy, safety engineering, and regulatory readiness, enabling deployment of autonomous pods in controlled transport corridors and enterprise focused mobility networks.

Collectively, these players are shaping the Autonomous Pods Market through disciplined technology scaling, ecosystem partnerships, and a strong emphasis on safety, software intelligence, and urban mobility integration.

Top Key Players in the Market

- Waymo

- Tesla

- BMW AG

- Daimler AG

- Ford Motor Company

- General Motors

- Groupe SA

- Tesla Inc.

- Toyota Motor Corporation

Recent Developments

- In October 2024, NEXT confirmed that its 2025-generation modular autonomous passenger pod is production-ready, with manufacturing scheduled to begin in 2025 at Tecnobus factories near Rome, supported by an active industrial partnership and a collaboration with van-pooling startup Wayla (powered by ioki) to conduct real-world vehicle testing in Milan during 2025.

- In November 2025, Revealed its autonomous pod-style concept vehicle “Mobi” at the Japan Mobility Show 2025, showcasing a fully self-driving electric bubble pod designed for children as part of its Mobility for All initiative, highlighting low-speed autonomous pod mobility for controlled environments without onboard adult supervision.

Report Scope

Report Features Description Market Value (2025) USD 6.7 billion Forecast Revenue (2035) USD 25.5 billion CAGR (2026-2035) 14.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Pods, Cargo Pods, Campus Pods, Airport Pods, Urban Pods), By Power Source (Electric Pods, Hybrid Pods, Alternative Fuel Pods), By Autonomy Level (Level 4, Level 5), By Application (Smart Cities, Airports, Campuses, Logistics, Public Transport, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Waymo, Tesla, BMW AG, Daimler AG, Ford Motor Company, General Motors, Groupe SA, Tesla Inc., Toyota Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Waymo

- Tesla

- BMW AG

- Daimler AG

- Ford Motor Company

- General Motors

- Groupe SA

- Tesla Inc.

- Toyota Motor Corporation