Global Autonomous Finance Platform Market By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Autonomous Accounting & Bookkeeping, Intelligent Cash Flow Management), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177113

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Driver Impact Analysis

- Restraints Impact Analysis

- Emerging Trends

- Growth Factors

- Technology Enablement Analysis

- By Deployment Mode

- By Organization Size

- By Application

- By End User Industry

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

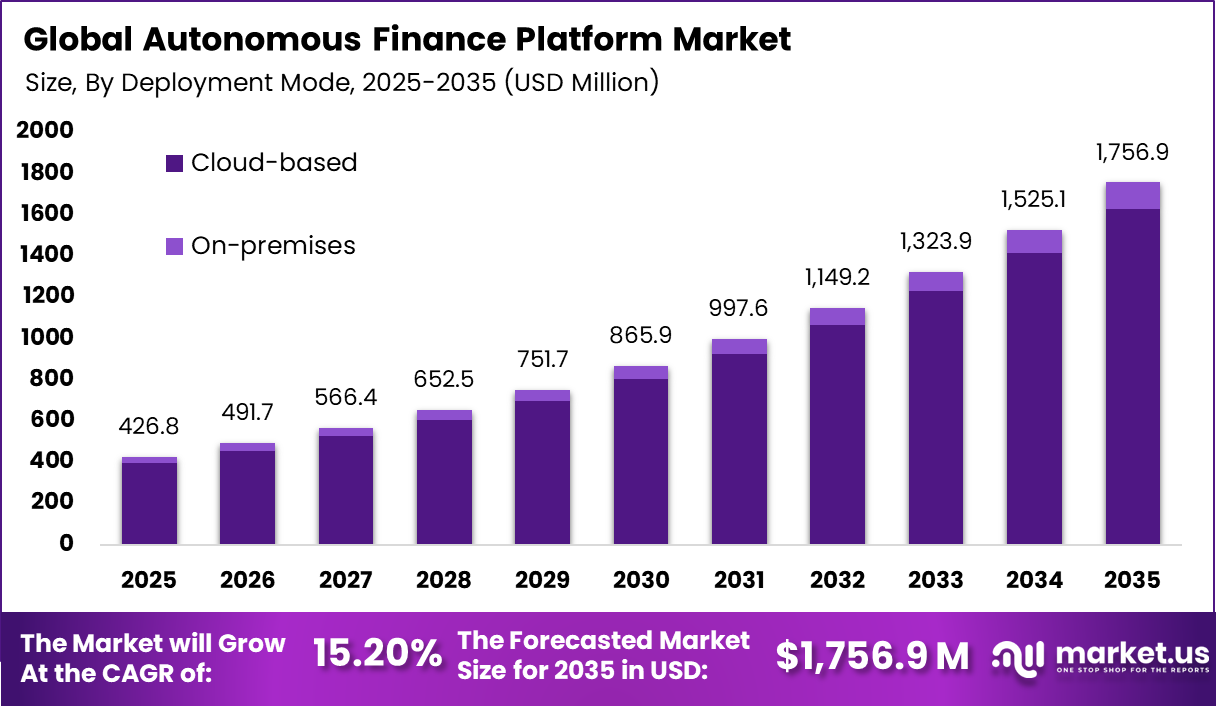

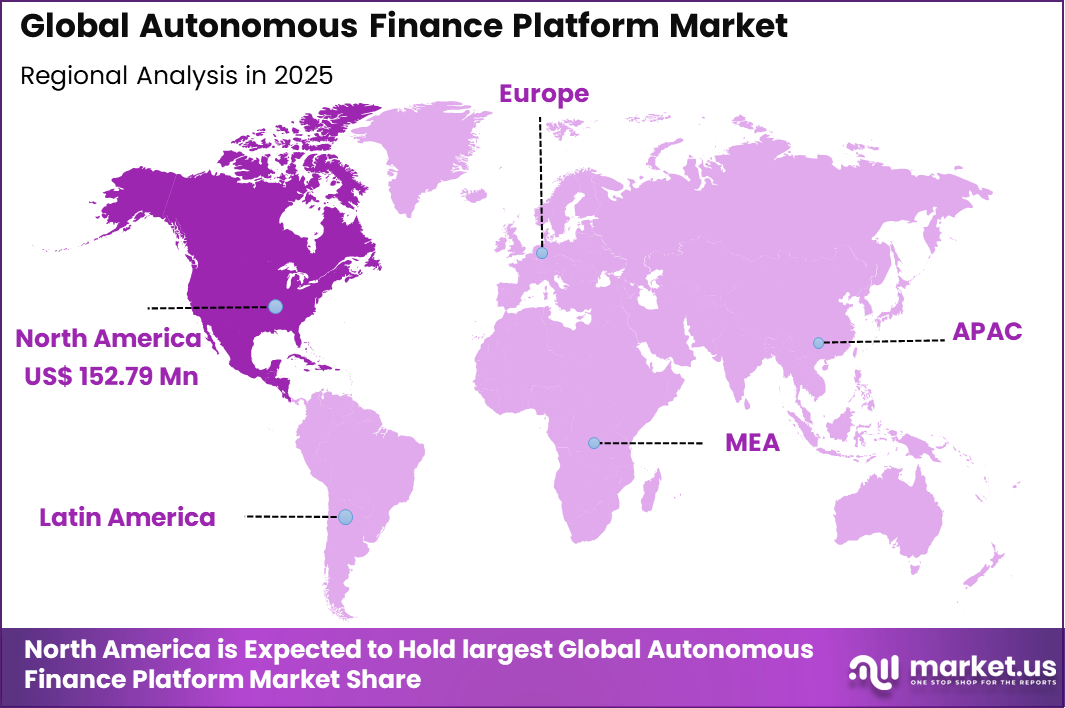

The Global Autonomous Finance Platform Market generated USD 426.8 million in 2025 and is predicted to register growth from USD 491.7 million in 2026 to about USD 1,756.9 million by 2035, recording a CAGR of 15.20% throughout the forecast span. In 2025, North America held a dominant market position, capturing more than a 35.8% share, holding USD 152.79 Million revenue.

The Autonomous Finance Platform Market refers to software platforms that automate financial decision making, execution, and monitoring with minimal human intervention. These platforms are designed to manage activities such as budgeting, forecasting, cash flow optimization, risk controls, reconciliation, and financial operations across enterprises. Autonomous finance moves beyond basic automation by enabling systems to act on insights rather than only reporting them.

The market is emerging as finance functions shift from manual processing to continuous, system driven decision support. Autonomous finance platforms are typically built on cloud infrastructure and integrate with core finance systems. They rely on data ingestion from multiple sources to operate in near real time. Industry observations indicate that more than 65% of finance leaders are prioritizing automation initiatives to reduce dependency on manual processes.

One of the primary drivers of the market is the growing complexity of financial operations. Organizations manage large volumes of transactions, multiple currencies, and distributed business units. Manual oversight is no longer scalable or timely. Autonomous platforms help finance teams maintain control while operating at higher speed and scale.

Demand for autonomous finance platforms is increasing among large enterprises with complex financial structures. These organizations face frequent forecasting errors and delayed close cycles. Internal studies show that finance teams spend nearly 50% of their time on data preparation and reconciliation tasks. Autonomous platforms reduce this burden and improve decision timeliness.

Top Market Takeaways

- By deployment mode, cloud-based platforms account for 92.8% of the market, enabling AI-driven automation, real-time data processing, and seamless scalability across global operations.

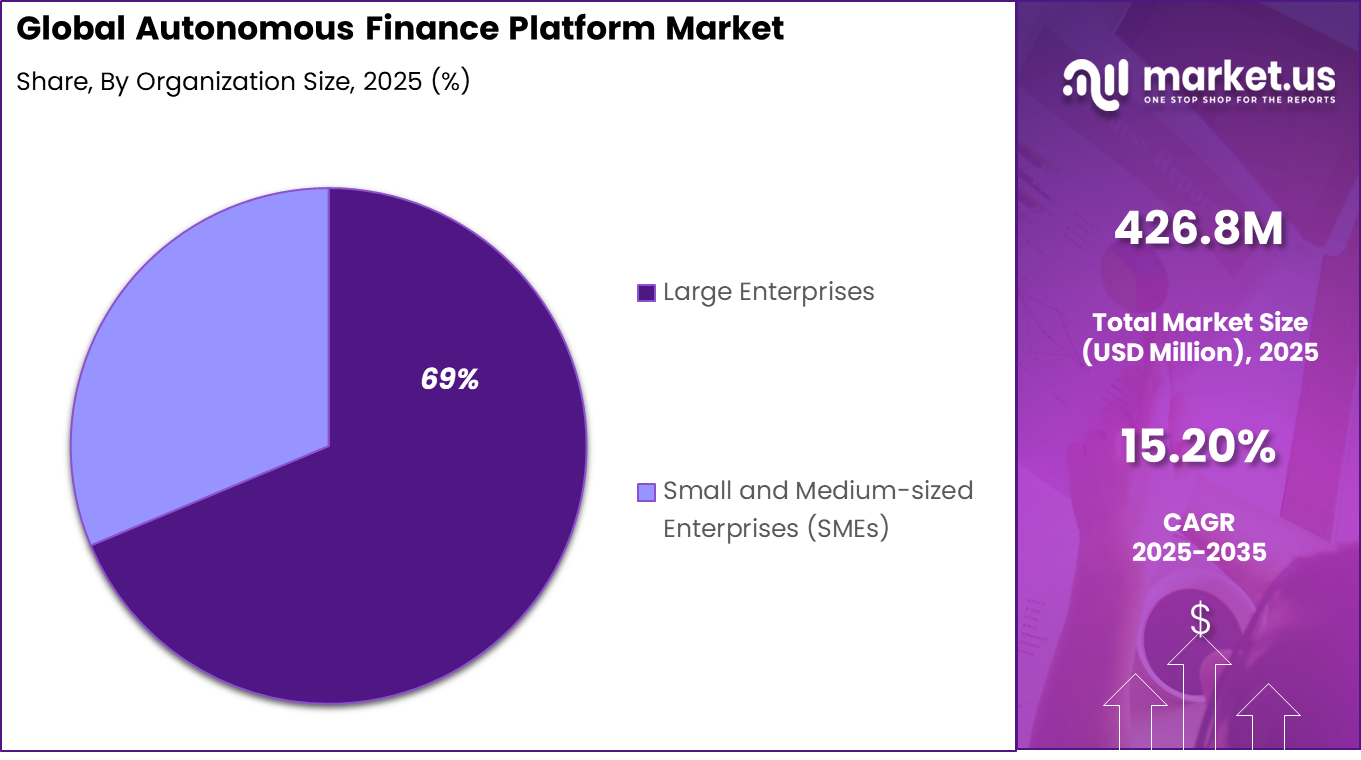

- By organization size, large enterprises represent 68.7%, adopting these platforms for complex financial workflows, compliance automation, and integration with ERP systems.

- By application, autonomous accounting & bookkeeping captures 41.5%, automating invoice processing, reconciliations, ledger updates, and anomaly detection with minimal human input.

- By end-user industry, BFSI holds 58.3% share, leveraging autonomy for transaction monitoring, regulatory reporting, and risk management amid rising digital volumes.

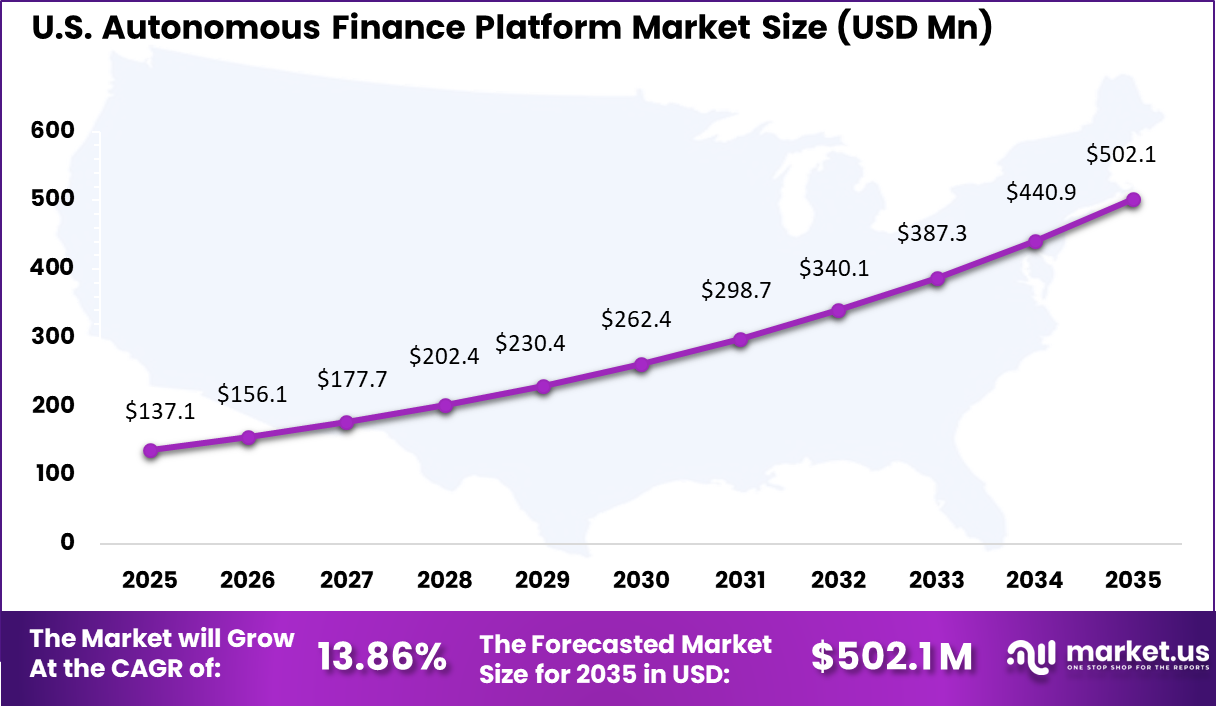

- By region, North America leads with 35.8% of the global market, where the U.S. is valued at USD 137.1 million with a projected CAGR of 13.86%, driven by AI adoption and regulatory tech demands.

Driver Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising demand for automation in finance operations and decision-making +4.1% North America, Europe Short to medium term Growing adoption of AI-driven forecasting, budgeting, and reconciliation +3.5% Global Medium term Increasing pressure to reduce manual errors and operational costs +3.0% Global Medium term Expansion of real-time data integration across financial systems +2.6% North America, Asia Pacific Medium term Shift toward self-optimizing finance and continuous close models +2.0% North America, Europe Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High implementation complexity and change management effort -3.1% Global Short to medium term Limited trust in fully autonomous financial decision systems -2.6% Global Medium term Data quality and system integration challenges -2.2% Global Medium term Regulatory concerns around automated financial controls -1.8% Europe, North America Medium term Skills gap in AI-driven finance transformation -1.5% Asia Pacific, Latin America Medium to long term Emerging Trends

In the Autonomous Finance Platform market, a key trend is the expansion of self-learning systems that can manage financial routines with minimal human input. Platforms are increasingly designed to analyse spending patterns, forecast cash needs, and automate routine decisions such as payment scheduling and savings adjustments.

This trend reflects a shift from static rule-based automation toward adaptive engines that refine their decisions as they process more data. Another emerging pattern is the embedding of intelligent alerts and suggestions that guide users through financial choices in clear, actionable language, making advanced finance management feel natural rather than technical for small business owners and individual users.

Growth Factors

A principal growth factor is the increasing demand for simplified financial decision support among users who may lack deep treasury or finance expertise. Autonomous finance platforms help relieve operational burden by converting complex data into recommendations that can be executed with confidence, reducing anxiety around cash flow timing or debt management.

Another important driver is the drive for operational efficiency across finance functions, where routine tasks such as reconciliation, balance forecasting, and liquidity optimisation consume significant time and attention. By automating these functions, organisations free staff to focus on strategic tasks, while also strengthening accuracy and consistency in routine financial processes.

Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline AI-driven financial planning and decision engines +4.2% Autonomous forecasting and optimization Global Short to medium term Machine learning-based anomaly detection and controls +3.6% Error and risk reduction North America, Europe Medium term Cloud-native finance automation platforms +3.1% Scalability and agility Global Medium term Integration with ERP, treasury, and accounting systems +2.7% End-to-end finance orchestration Global Medium to long term Continuous close and real-time reporting frameworks +2.2% Faster financial visibility Europe, North America Long term By Deployment Mode

Cloud based deployment accounts for 92.8% of adoption in the autonomous finance platform market, as these platforms rely on continuous data processing and real time automation. Cloud environments support high computational needs required for autonomous decision making across financial workflows. This deployment model also enables rapid updates as financial rules and data inputs evolve.

Organizations prefer cloud based platforms due to easier integration with existing financial systems. Centralized access improves visibility across departments and geographies. These advantages continue to reinforce cloud dominance in autonomous finance deployments.

By Organization Size

Large enterprises represent 69% of adoption, driven by the complexity of their financial operations. These organizations manage high transaction volumes across multiple business units. Autonomous finance platforms help reduce manual intervention while maintaining control over financial accuracy.

Large enterprises also face stricter governance and reporting requirements. Automation improves consistency in financial records and audit readiness. This operational need sustains strong adoption among large scale organizations.

By Application

Autonomous accounting and bookkeeping account for 41.5% of application usage, as organizations seek to automate routine financial tasks. These platforms handle invoice processing, ledger updates, and reconciliation with minimal human input. This improves efficiency and reduces processing errors.

Automation also allows finance teams to focus on strategic analysis rather than manual data entry. Continuous learning systems adapt to transaction patterns over time. This makes autonomous accounting a core use case within autonomous finance platforms.

By End User Industry

The BFSI sector holds 58.3% of end user adoption, as financial institutions manage complex and high volume financial data. Autonomous finance platforms support faster processing and improved accuracy in internal finance operations.

This is critical in environments with tight regulatory oversight. BFSI organizations also prioritize operational resilience and cost control. Automation reduces dependency on manual processes while maintaining compliance. This continues to drive adoption across the sector.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Autonomous Accounting & Bookkeeping

- Intelligent Cash Flow Management

- Automated Financial Planning & Analysis (FP&A)

- Self-Optimizing Treasury & Investments

- Proactive Fraud Detection & Risk Management

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Retail & E-commerce

- Manufacturing

- Healthcare

- Others

Regional Analysis

North America accounts for 35.8% of the autonomous finance platform market, supported by advanced digital banking adoption and strong use of automation in financial operations. Financial institutions and enterprises in the region are adopting autonomous platforms to automate forecasting, payments, reconciliations, and decision support. Demand is driven by the need to reduce manual intervention, improve accuracy, and manage financial operations at scale in complex business environments.

The United States market is valued at USD 137.1 Mn and is growing at a CAGR of 13.86%, reflecting increasing reliance on AI-driven financial decision systems. Adoption is influenced by rising transaction complexity, real-time financial monitoring needs, and pressure to improve operational efficiency. Growth is further supported by wider acceptance of automation in treasury, accounting, and financial planning functions across enterprises and financial institutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Large enterprise software providers such as Oracle Corporation, SAP SE, and Workday, Inc. lead the autonomous finance platform market through integrated ERP and financial management suites. Their platforms use AI to automate close processes, forecasting, and compliance reporting. Strong data integration and scalability support adoption among large enterprises. Sage Group plc and Intuit, Inc. extend autonomous finance capabilities to mid-sized and small businesses.

Specialized financial automation and performance management vendors such as BlackLine, Inc., HighRadius Corporation, and OneStream Software, LLC focus on record-to-report, order-to-cash, and planning automation. Planful, Inc. and Vena Solutions strengthen forecasting and budgeting use cases. These platforms help finance teams improve cash flow visibility and decision speed.

Emerging and AI-native providers such as Pegasystems, Inc., Trullion, Inc., and Botkeeper, Inc. emphasize real-time automation and continuous accounting. Xero, Ltd. supports autonomous finance for SMEs through API-driven ecosystems. Aible, Inc. adds predictive insights for finance teams. Other vendors expand innovation and regional reach, supporting steady growth of autonomous finance platforms.

Top Key Players in the Market

- Pegasystems, Inc.

- HighRadius Corporation

- OneStream Software, LLC

- BlackLine, Inc.

- Workday, Inc.

- Sage Group plc

- Oracle Corporation

- SAP SE

- Xero, Ltd.

- Intuit, Inc.

- Planful, Inc.

- Vena Solutions

- Trullion, Inc.

- Botkeeper, Inc.

- Aible, Inc.

- Others

Future Outlook

The future outlook for the Autonomous Finance Platform Market is positive as businesses and financial institutions increasingly adopt systems that automate financial decision making. Demand for autonomous finance platforms is expected to rise because these solutions use artificial intelligence and machine learning to manage tasks such as budgeting, forecasting, and cash flow optimization without constant human input.

Adoption of real-time data processing and predictive analytics will support more accurate insights and faster decisions. Growth can be attributed to the need for operational efficiency, improved financial visibility, and reduced manual effort. Overall, the market is expected to expand as organizations seek advanced tools for smarter financial management.

Recent Developments

- In May 2025, BlackLine announced an expansion of its AI capabilities, embedding intelligent agents across principal financial workflows. This step marked a shift from rule-based automation toward AI-driven decision support and anomaly detection for record-to-report and invoice-to-cash cycles

Report Scope

Report Features Description Market Value (2025) USD 426.8 Million Forecast Revenue (2035) USD 1,756.9 Million CAGR(2025-2035) 15.20% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Autonomous Accounting & Bookkeeping, Intelligent Cash Flow Management), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pegasystems, Inc., HighRadius Corporation, OneStream Software, LLC, BlackLine, Inc., Workday, Inc., Sage Group plc, Oracle Corporation, SAP SE, Xero, Ltd., Intuit, Inc., Planful, Inc., Vena Solutions, Trullion, Inc., Botkeeper, Inc., Aible, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Finance Platform MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Autonomous Finance Platform MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Pegasystems, Inc.

- HighRadius Corporation

- OneStream Software, LLC

- BlackLine, Inc.

- Workday, Inc.

- Sage Group plc

- Oracle Corporation

- SAP SE

- Xero, Ltd.

- Intuit, Inc.

- Planful, Inc.

- Vena Solutions

- Trullion, Inc.

- Botkeeper, Inc.

- Aible, Inc.

- Others