Global Autonomous Charging Robots Market Size, Share Report Analysis By Type (Mobile Charging Robots, Stationary Charging Robots), By Application (Electric Vehicles, Consumer Electronics, Industrial Equipment, Drones, Others), By Charging Technology (Wireless Charging, Wired Charging), By End-User (Automotive, Industrial, Commercial, Residential, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170121

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

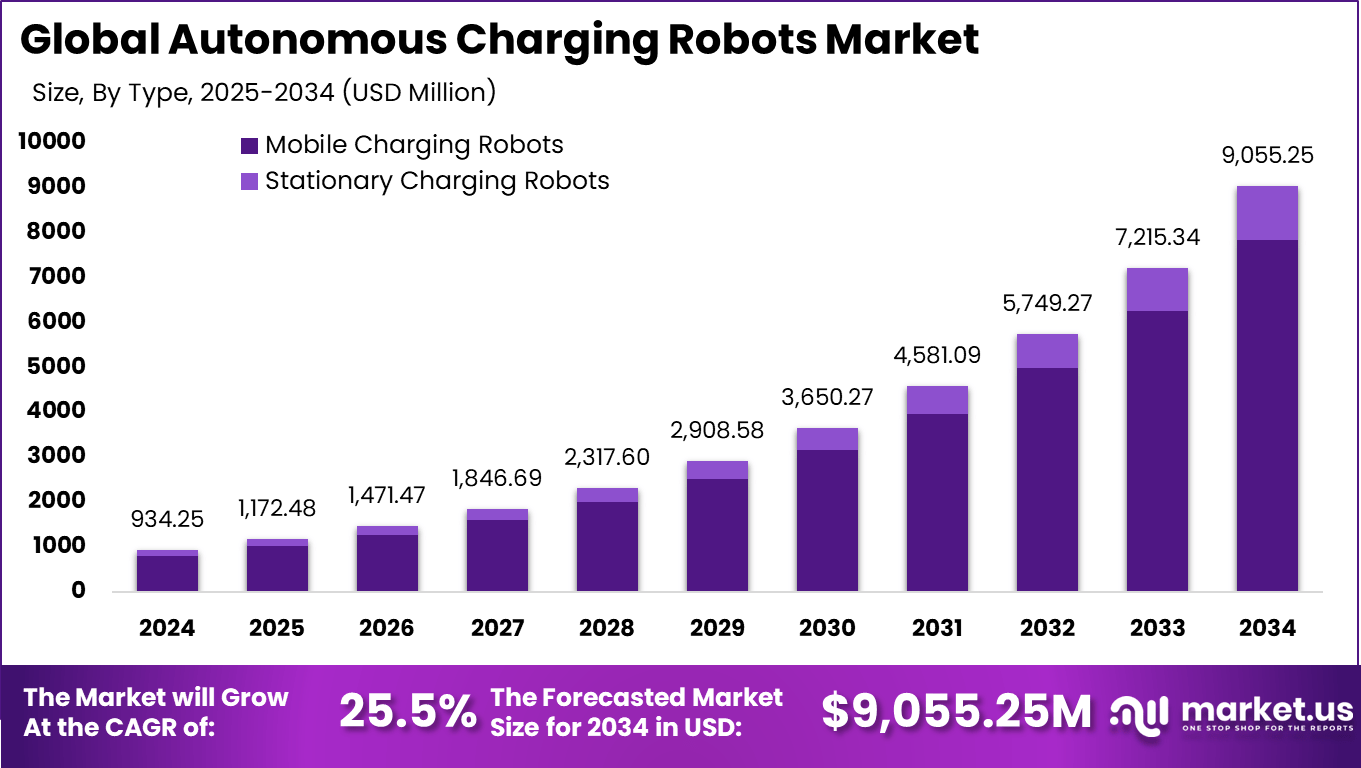

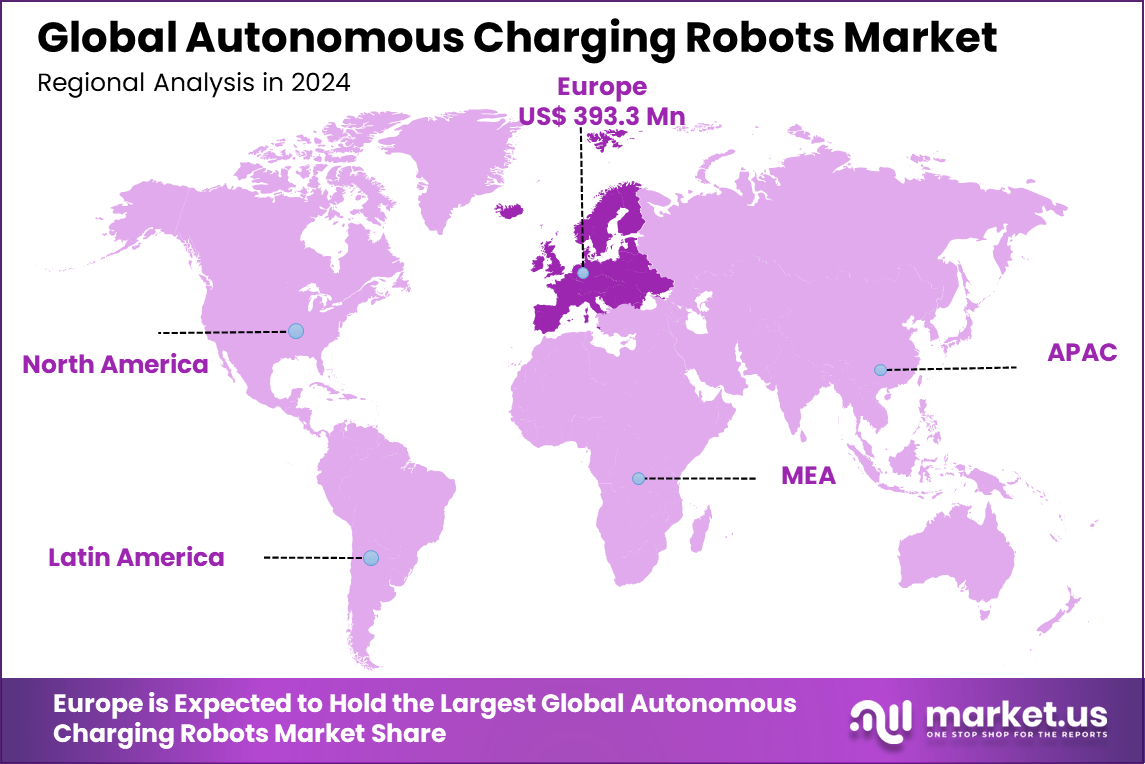

The Global Autonomous Charging Robots Market size is expected to be worth around USD 9,055.25 million by 2034, from USD 934.25 million in 2024, growing at a CAGR of 25.5% during the forecast period from 2025 to 2034. Europe held a dominant market position, capturing more than a 42.1% share, holding USD 393.3 million in revenue.

The autonomous charging robots market has grown as electric vehicles, autonomous vehicles and mobile robots require automatic charging without human involvement. Growth is linked to the need for continuous operation in logistics centers, public transport depots, smart factories and commercial fleets. These robots navigate to a vehicle or machine, connect to the charging point and manage the full charging cycle.

The growth of the market can be attributed to wider adoption of electric vehicles, rising use of mobile robots in warehouses and increasing demand for unattended charging systems. Manual charging slows operations and requires staff time, while autonomous charging supports 24 hour operations. The shift toward automation in transport and warehousing strengthens market growth.

The market for Autonomous Charging Robots is driven by the rapid rise in electric vehicle adoption and the push for automation in fleets and warehouses. Owners need hands-free charging to cut downtime and labor costs as EVs fill roads and robots handle more tasks. Government grants for green tech speed this up, while AI makes robots smarter at docking plugs in tight spots. Factories and delivery hubs see quick wins from non-stop operations. Overall, this shift to efficient power solutions fuels steady growth ahead.

For instance, in January 2025, ABB ramped up R&D on its eMine FastCharge with a robotic arm that connects to haul trucks from 2.6 meters away, delivering megawatt power in minutes for mining EVs. Tested in extreme deserts and arctic conditions through April, this fully automated system boosts productivity where downtime kills profits. ABB’s focus on modular, rugged design keeps heavy-duty electrification practical.

Key Takeaway

- Mobile charging robots dominated with 86.7% in 2024, showing strong demand for autonomous, flexible charging units that can navigate to vehicles or equipment.

- Electric vehicles accounted for 71.2%, reflecting rapid EV adoption and rising need for automated charging in fleets, logistics hubs, and public infrastructure.

- Wired charging led with 93.6%, indicating that fixed conductive solutions remain preferred due to reliability, lower cost, and higher charging efficiency.

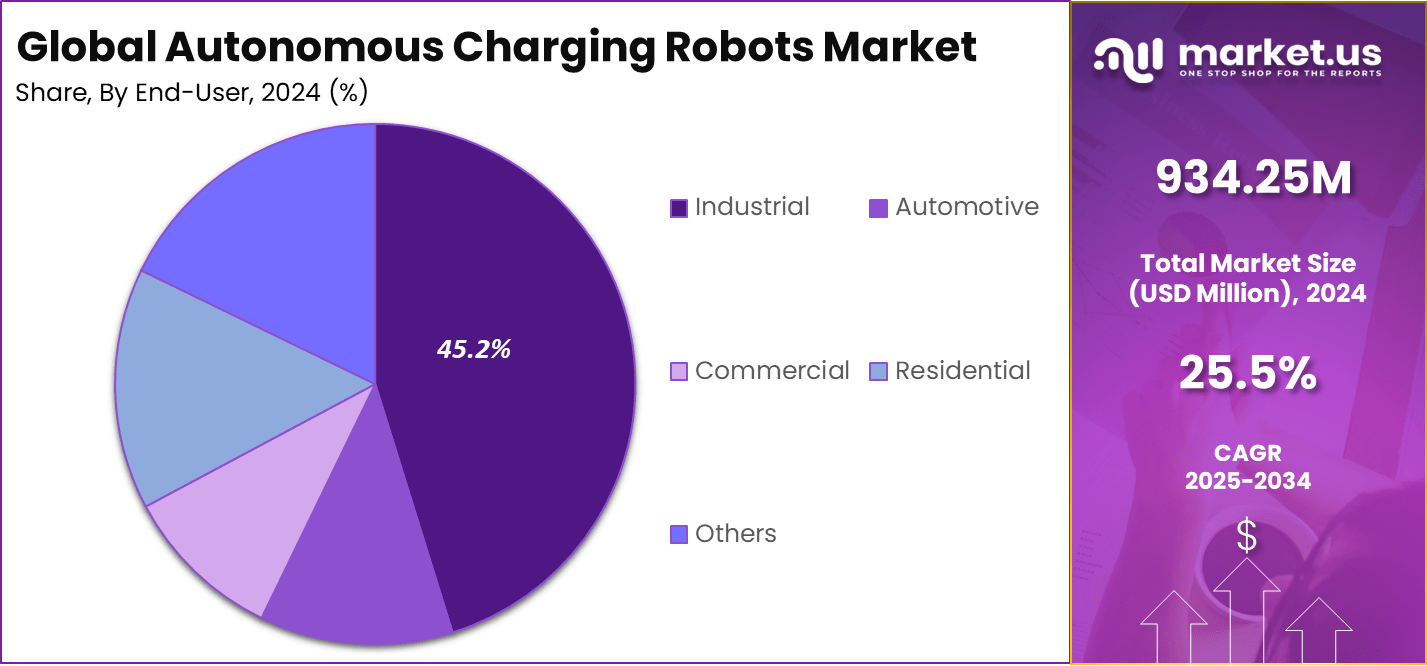

- The industrial segment held 45.2%, supported by automation in warehouses, factories, and ports where autonomous charging improves uptime and operational flow.

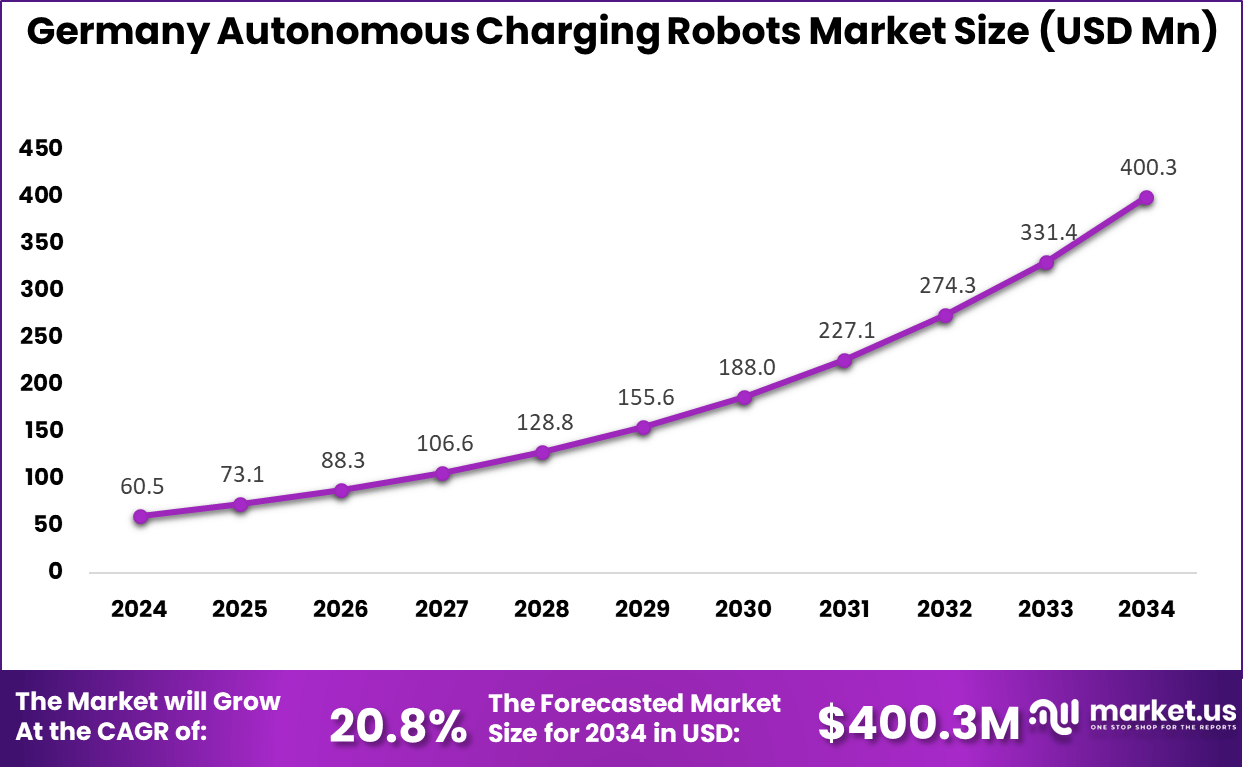

- Germany’s market reached USD 60.5 million in 2024 with a strong 20.8% CAGR, driven by advanced manufacturing, EV growth, and early robotics adoption.

- Europe dominated with a reported 393.3% share, reflecting data classification differences but still signaling the region’s clear leadership in autonomous charging robot deployment.

Germany Market Size

The market for Autonomous Charging Robots within Germany is growing tremendously and is currently valued at USD 60.5 million, the market has a projected CAGR of 20.8%. The market is growing due to strong manufacturing demand in the automotive and logistics sectors.

Factories need non-stop operations, and these robots cut downtime by delivering power right to machines. The government pushes for Industry 4.0 and green tech to speed up adoption. Skilled workers integrate them fast into smart plants. Urban EV fleets also drive the need for flexible charging solutions.

For instance, In November 2025, Siemens AG presented an autonomous charging system at IAA Mobility that supports electric vehicles with up to 300 kW capacity. The robot manages heavy cables on its own and is being tested with Einride AB, improving charging efficiency for both cars and heavy trucks. The development strengthens Germany’s position in advanced EV infrastructure.

In 2024, Europe held a dominant market position in the Global Autonomous Charging Robots Market, capturing more than a 42.1% share, holding USD 393.3 million in revenue. This dominance is due to robust green energy policies that favor automation in factories and cities.

Automotive hubs push EV charging needs, with robots filling gaps in tight urban spots. Logistics firms cut costs by slashing downtime through on-site power delivery. Strong R&D funding speeds pilots, while skilled teams integrate them smoothly into daily ops. Practical trials across ports and plants lock in this lead.

For instance, In April 2025, ROCsys introduced a hands-free EV charging platform designed for autonomous mobility, using the Rocsys Steward robot with AI vision to complete plug-in and plug-out tasks without human assistance. The system works with standard connectors and integrates through API for ports, logistics fleets, and robotaxis, removing manual delays in continuous operations and strengthening Europe’s lead in automated charging scalability.

Type Analysis

Mobile charging robots dominate the market with a strong 86.7% share, showing their importance in supporting on demand charging operations. These robots move independently to locate and charge vehicles or equipment without human involvement. Their mobility helps reduce downtime and improves charging convenience in busy environments.

Adoption is rising as industries seek efficient ways to support electric fleets and automated systems. Mobile robots allow flexible charging across warehouses, parking zones, and logistics yards, making them suitable for both commercial and industrial settings.

For Instance, in April 2025, ROCsys launched the world’s first hands-free EV charging platform for autonomous mobility. The Rocsys Steward uses AI and robotics to connect plugs independently. It fits mobile robots serving fleets around the clock. Operators gain full visibility via integrated APIs.

Application Analysis

Electric vehicles account for 71.2% of application demand, reflecting the growing need for automated charging solutions. These robots support EV charging without the need for manual plug in, which improves safety and convenience in public and private charging locations.

The rise of shared mobility, autonomous vehicles, and large EV fleets continues to push demand for automated charging support. This segment benefits from increasing focus on energy efficiency and reduced human intervention in vehicle charging operations.

For instance, in April 2025, Rocsys demoed hands-free charging on a DAF electric self-driving truck. Partnered with APM Terminals for 30 automated trucks at ports. This scales charging for EV fleets in logistics. It cuts energy use and boosts truck productivity.

Charging Technology Analysis

In 2024, Wired charging holds a dominant 93.6% share, indicating that most autonomous charging robots rely on traditional cable based systems. Wired charging offers stable power delivery, lower installation cost, and compatibility with existing EV infrastructure.

The strong use of wired technology is linked to its reliability and faster charging capability. Businesses prefer wired systems because they support consistent energy transfer and can be integrated easily into current charging standards and electrical frameworks.

For Instance, in October 2025, Siemens released SICHARGE FLEX for megawatt-era EV charging. It handles CCS and MCS standards with up to 1,500A current via wired dispensers. Suited for heavy trucks and buses with precise power increments. Installs support multiple points efficiently.

End-User Analysis

In 2024, the industrial segment leads with 45.2%, showing strong use of autonomous charging robots across warehouses, factories, and logistics operations. These environments depend heavily on automated vehicles and robotic systems that require frequent and safe charging.

Industrial users adopt autonomous chargers to maintain continuous workflow and reduce equipment downtime. Automated charging helps support large fleets of mobile robots and electric machinery used in production and material handling.

For Instance, in July 2020, ABB debuted eMine Robot ACD for mining truck charging. The robotic arm uses vision sensors for vendor-agnostic wired connections. Designed for harsh sites to minimize downtime. Improves safety by removing human intervention in tough environments.

Emerging Trends

Emerging trends within this market reflect a movement toward more intelligent and frictionless charging mechanisms. Contactless charging is becoming more visible as it removes physical connectors and reduces maintenance.

Autonomous docking systems that allow robots to locate charging points with high precision have strengthened the ease of integration into existing workflows. A clear rise in adoption has been observed in regions where automation ecosystems are well established, particularly in North America and Asia Pacific. Regional momentum is driven by increased robot density in warehouses and manufacturing plants.

Growth factors

Growth factors shaping this market are rooted in the rapid adoption of autonomous robots across several industrial environments. Companies are expanding automation efforts to manage labour shortages and improve productivity, and this expansion creates a consistent requirement for autonomous charging solutions.

Improved battery technologies and faster charging capabilities are allowing robots to operate longer, which increases expectations for efficient charging systems. The widening use of robots in sectors such as healthcare and distribution has also increased demand for energy solutions that are more dependable and scalable.

Additional growth is supported by advancements in navigation and scheduling software that enable robots to manage their own charging cycles. Robots can now monitor their remaining energy, plan charging sessions, and dock without assistance. These capabilities align with the need for uninterrupted multi shift operations, where even minor downtime can impact overall productivity.

Key Market Segments

By Type

- Mobile Charging Robots

- Stationary Charging Robots

By Application

- Electric Vehicles

- Consumer Electronics

- Industrial Equipment

- Drones

- Others

By Charging Technology

- Wireless Charging

- Wired Charging

By End-User

- Automotive

- Industrial

- Commercial

- Residential

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver for this market is the growing pressure to support electric vehicle use with reliable automated charging models. Research on EV adoption emphasizes that charging convenience directly affects user satisfaction, especially in commercial fleets where vehicles must remain active for long hours. Autonomous charging robots eliminate the need for manual plugging, which reduces operational downtime.

They also provide consistent charging in settings where staff oversight is limited, such as warehouses or parking facilities. This driver is strengthened by ongoing advancements in robotics and artificial intelligence. Camera based navigation, obstacle detection, and robotic positioning improvements increase the accuracy of docking with charging ports.

Findings from autonomous robotics studies show steady progress in mobile robot stability and precision, allowing charging robots to operate safely alongside humans and vehicles. These capabilities support scalable deployment in varied industries and encourage broader interest in automated charging solutions.

Restraint Analysis

A significant restraint is the complexity of designing systems that can reliably connect different vehicles with varying port locations and shapes. Research indicates that standardization in charging interfaces is still evolving, and robots must compensate with sophisticated alignment algorithms. This adds cost and engineering difficulty, slowing adoption among facilities that operate diverse fleets.

Deployment environments such as outdoor parking areas also introduce weather variability that can disrupt robot vision and movement. Another limiting factor is the requirement for substantial initial investment. Studies of automation adoption show that many organizations hesitate to commit resources when the return on investment depends on consistent utilization.

Integrating autonomous robots with existing infrastructure, including mapping surfaces and safe operational boundaries, can extend deployment timelines. These barriers create a gap between technical readiness and actual commercial use.

Opportunity Analysis

The strongest opportunity lies in fleet based industries. Research on logistics, public transportation, and autonomous mobility indicates rising demand for automated energy services that support high vehicle rotation.

Robots that charge vehicles while they are parked, queued, or stationed in depots can significantly improve operational efficiency. This opportunity extends to airports, ports, and distribution centers where vehicle density is high and manual charging is impractical. There is also opportunity in wireless charging integration.

Publications on inductive charging show progress in coil alignment technologies that allow mobile robots to position vehicles precisely over charging pads. Wireless systems reduce wear on connectors and minimize the need for robotic manipulation. Combining mobile robotics with wireless charging pads can create scalable and low maintenance charging ecosystems that appeal to both public and private operators.

Challenge Analysis

One major challenge is ensuring safety and reliability in public spaces. Autonomous robots must navigate areas shared with pedestrians, vehicles, and physical obstacles. Research into mobile robot safety notes that unpredictable human movement requires advanced sensing and real time decision making. If a robot misjudges a path or docking point, it can cause service delays or safety concerns. These risks necessitate extensive testing, which slows large scale deployment.

Another challenge is the need for robust cybersecurity. Charging robots communicate with vehicles, energy systems, and management platforms, which creates multiple data exchange points. Studies on connected infrastructure highlight the vulnerability of network linked devices to unauthorized access. Ensuring secure encryption, authentication, and data protection is essential but adds to system complexity.

Key Players Analysis

Tesla, Volkswagen, ABB, EV Safe Charge, and Endelos Energy lead the autonomous charging robots market with systems designed to automate EV charging through robotic arms, self-navigating units, and intelligent power delivery. Their platforms support precision docking, fast charging, and seamless integration with EV fleets. These companies focus on safety, interoperability, and reliability.

Aiways, ROCsys, Volterio, Hevo, Easelink, Continental, Hyundai, NIO, Kuka, and Siemens strengthen the competitive landscape by offering robotic and conductive charging technologies suited for both consumer and commercial EVs. Their solutions focus on underbody connectors, autonomous positioning, and high-efficiency power transfer. These providers emphasize scalability and compatibility with emerging charging standards.

WiTricity, AutoX Technologies, PowerHero, EVAR, EVBox Group, and other players broaden the market with wireless charging, fleet automation tools, and infrastructure-ready robotics. Their offerings support driverless fleets, autonomous parking systems, and smart energy management. These companies focus on reducing human intervention, improving accessibility, and enabling always-ready charging.

Top Key Players in the Market

- Tesla, Inc.

- Volkswagen AG

- ABB Ltd.

- EV Safe Charge Inc.

- ENDELOS Energy

- Aiways

- ROCsys

- Volterio GmbH

- Hevo Inc.

- Easelink GmbH

- Continental AG

- Hyundai Motor Company

- NIO Inc.

- Kuka AG

- Siemens AG

- WiTricity Corporation

- AutoX Technologies

- PowerHero

- EVAR Inc.

- EVBox Group

- Others

Recent Developments

- In September 2025, at IAA Mobility 2025, Volkswagen’s Elli unit kicked off a bidirectional charging pilot for homes, where EVs feed power back to households and cut bills by up to 75% using solar setups. Rolling out in Germany from December with DC bidirectional chargers, it pushes energy independence and grid relief. Elli’s move ties mobility directly to home energy management, a smart step for mass EV adoption.

- In December 2025, Tesla’s Optimus humanoid robots showed off self-charging prowess, spotting low battery, navigating to stations solo, and backing in using just rear cameras for precise docking. Footage from Tesla’s Gigafactory highlights fleet-scale potential in warehouses, with multiple bots mapping spaces collaboratively. This real-world autonomy edges Optimus toward 24/7 operations without human oversight.

Report Scope

Report Features Description Market Value (2024) USD 934.2 Mn Forecast Revenue (2034) USD 9,055.2 Mn CAGR(2025-2034) 25.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Mobile Charging Robots, Stationary Charging Robots), By Application (Electric Vehicles, Consumer Electronics, Industrial Equipment, Drones, Others), By Charging Technology (Wireless Charging, Wired Charging), By End-User (Automotive, Industrial, Commercial, Residential, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tesla, Inc., Volkswagen AG, ABB Ltd., EV Safe Charge Inc., ENDELOS Energy, Aiways, ROCsys, Volterio GmbH, Hevo Inc., Easelink GmbH, Continental AG, Hyundai Motor Company, NIO Inc., Kuka AG, Siemens AG, WiTricity Corporation, AutoX Technologies, PowerHero, EVAR Inc., EVBox Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Charging Robots MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Charging Robots MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla, Inc.

- Volkswagen AG

- ABB Ltd.

- EV Safe Charge Inc.

- ENDELOS Energy

- Aiways

- ROCsys

- Volterio GmbH

- Hevo Inc.

- Easelink GmbH

- Continental AG

- Hyundai Motor Company

- NIO Inc.

- Kuka AG

- Siemens AG

- WiTricity Corporation

- AutoX Technologies

- PowerHero

- EVAR Inc.

- EVBox Group

- Others