Global Automotive Transparent Antenna Market Size, Share and Report Analysis By Frequency Range (High frequency, Very-high frequency, and Ultra-high frequency), By Vehicle Propulsion (Internal Combustion Engines and Electric Vehicles), By Application (Sunroof, Windshield, and Windows), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Sales Channel (OEM and Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178448

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

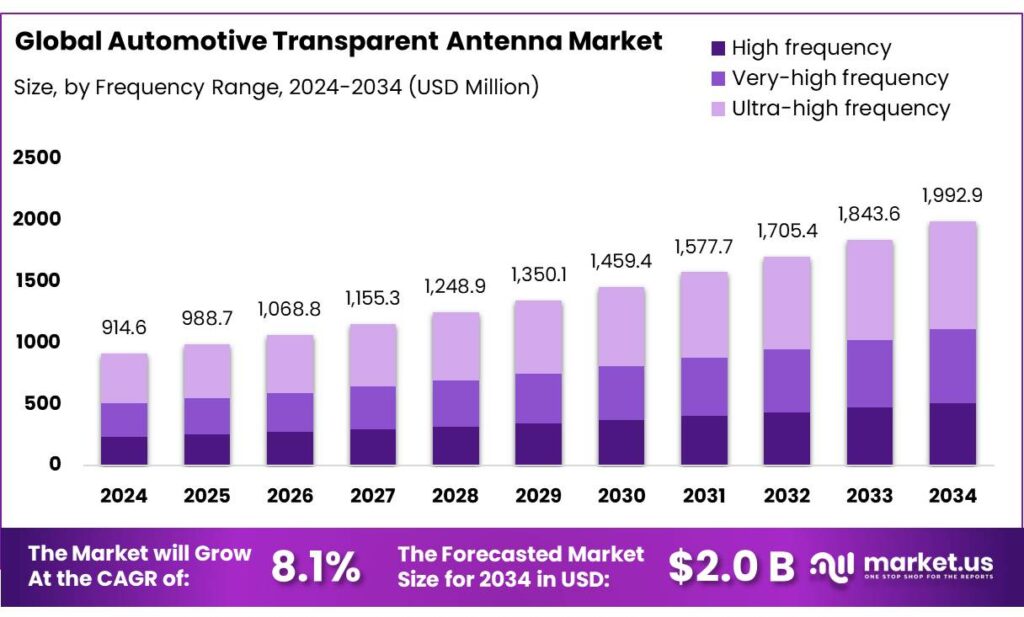

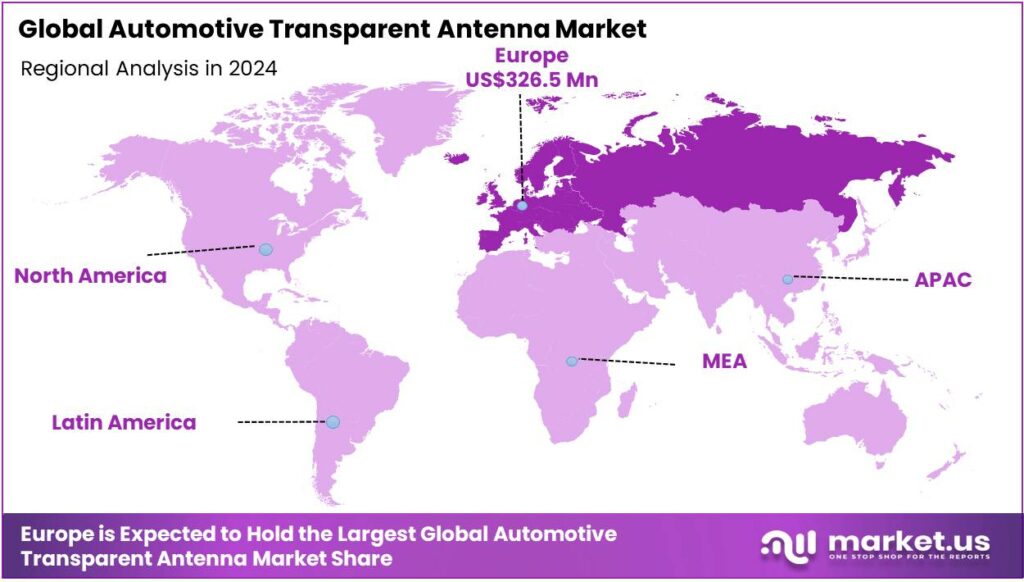

The Global Automotive Transparent Antenna Market is expected to be worth around USD 1992.9 Million by 2034, up from USD 914.6 Million in 2024, and is projected to grow at a CAGR of 8.1%, from 2025 to 2034. Europe accounted for 35.7%, reaching USD 326.5 Mn.

Automotive transparent antennas are optically clear communication devices designed to be integrated directly into a vehicle’s glass surfaces, such as windshields, sunroofs, and side windows. By using specialized conductive materials that allow visible light to pass through, these antennas provide high-performance connectivity for 5G, GPS, and Wi-Fi without the need for traditional external whips or shark fins.

- The 2024 C-NCAP (China New Car Assessment Program) officially incorporates C-V2X (Cellular Vehicle-to-Everything) functionality into its active safety scoring, with up to 12.5% of crash prevention points tied to these systems.

The market is driven by the growing demand for advanced communication technologies, particularly in the context of connected and autonomous vehicles. These antennas are integral for supporting high-speed data transfer, such as V2X communication systems, which are essential for real-time vehicle-to-vehicle and vehicle-to-infrastructure interactions.

- Antennas utilizing Transparent Conductive Films (TCFs) typically achieve efficiencies below 40% at transparency levels exceeding 70%.

The market faces challenges such as high production costs, the need for advanced materials, and technical limitations related to signal performance. Additionally, Europe leads in this market, with its emphasis on regulatory frameworks and innovative automotive designs. Transparent antennas are increasingly favored for their ability to blend seamlessly into vehicle exteriors, particularly on windshields, offering aesthetic and functional advantages.

- Euro NCAP integrated vehicle-to-everything communication into its safety scoring, with significant scoring impacts beginning in 2026. Failure to implement direct communication (sidelink/PC5) may result in penalties, while V2X implementation is expected to add up to 0.5 points to the overall safety score by 2026.

Most antennas are sold to OEMs, where integration during manufacturing ensures optimal performance and design compatibility. While transparent antennas are more commonly used in passenger vehicles due to their design focus, the adoption in commercial vehicles remains limited. Moreover, geopolitical tensions and regulatory hurdles further impact the supply chain, particularly for critical materials.

Key Takeaways

- The global automotive transparent antenna market was valued at USD 914.6 million in 2024.

- The global automotive transparent antenna market is projected to grow at a CAGR of 8.1% and is estimated to reach US$1992.9 Million by 2034.

- On the basis of the frequency range of antennas, ultra-high frequency antennas dominated the market, constituting 44.2% of the total market share.

- Based on the vehicle propulsion, internal combustion engines dominated the automotive transparent antenna market, with a substantial market share of around 65.5%.

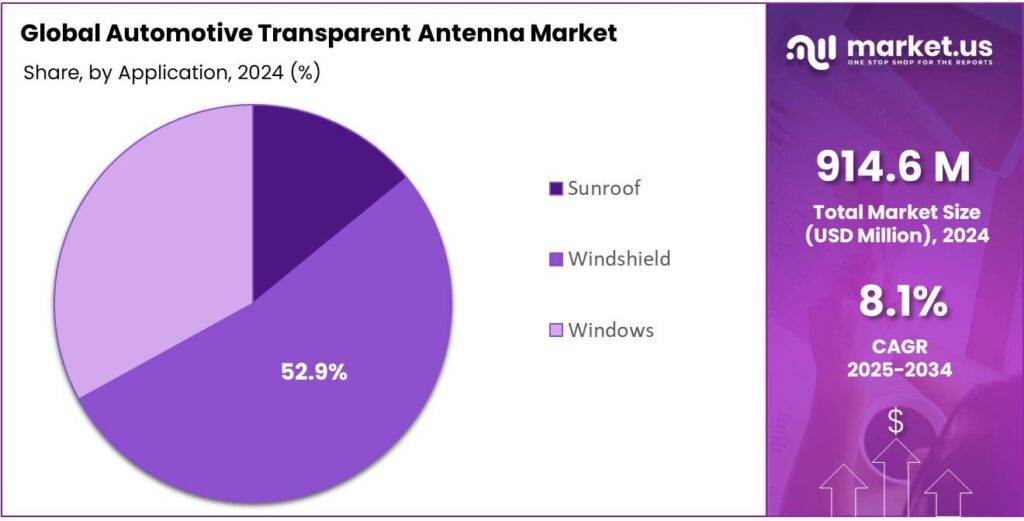

- Based on the applications of antennas, the automotive transparent antenna on the windshield led the market, comprising 52.9% of the total market.

- Among the types of vehicles, passenger cars held a major share in the automotive transparent antenna market, 78.6% of the market share.

- Among the sales channels of the automotive transparent antenna, OEMs are the most considerable channel for the product, accounting for around 86.1% of the revenue.

- In 2024, Europe was the most dominant region in the automotive transparent antenna market, accounting for 35.7% of the total global consumption.

Frequency Range Analysis

Ultra-high Frequency is a Prominent Frequency Range in the Market.

The market is segmented based on frequency ranges of automotive transparent antenna into high frequency (HF), very-high frequency (VHF), and ultra-high frequency (UHF). The ultra-high frequency antennas led the market, comprising 44.2% of the market share, due to their superior performance in modern automotive communication systems. UHF bands offer higher bandwidth, enabling faster data transfer, which is critical for supporting applications such as 5G, vehicle-to-vehicle (V2V), and vehicle-to-infrastructure (V2I) communications.

In addition, UHF antennas provide a balance between range and data rate, making them more suitable for automotive environments compared to HF or VHF antennas, which can be more susceptible to interference and have less efficient data throughput. Furthermore, UHF antennas are more compact and easier to integrate into vehicle designs without compromising on aesthetics, aligning well with the automotive industry’s focus on sleek, unobtrusive designs.

Vehicle Propulsion Analysis

Internal Combustion Engine Vehicles Dominated the Automotive Transparent Antenna Market.

On the basis of vehicle propulsion, the automotive transparent antenna market is segmented into internal combustion engines and electric vehicles. The internal combustion engine vehicles dominated the automotive transparent antenna market, comprising 65.5% of the market share, primarily due to differences in vehicle design and infrastructure needs. ICE vehicles typically rely on traditional internal systems, such as radio and GPS, that require robust antenna solutions, often integrated into the vehicle’s exterior or structure.

Additionally, these vehicles tend to have more space and fewer limitations regarding electrical interference, making the integration of antennas simpler. In contrast, EVs, which prioritize energy efficiency and compact designs, often feature more streamlined, tech-focused communication systems, such as wireless charging and advanced telemetry. The integration of transparent antennas into EVs may be less critical in the early adoption phases since EVs frequently leverage alternative communication methods.

Application Analysis

Automotive Transparent Antennas Are Most Widely Projected on Windshields.

The automotive transparent antennas are most widely projected on windshields, with a notable market share of 52.9%, due to the windshield’s optimal position and size for communication functionality. The windshield offers a large, unobstructed surface area, allowing for better signal reception and transmission without interference from surrounding structures or vehicle components.

In addition, windshields are typically closer to key electronic systems, such as the vehicle’s central communication modules, ensuring minimal signal degradation. In contrast, sunroofs and side windows are often subject to more environmental factors, such as reflections and exposure to sunlight, which can reduce antenna performance. Furthermore, placing antennas on the windshield ensures they are less likely to be obscured or damaged, preserving their functionality while maintaining the vehicle’s aesthetic appeal.

Vehicle Type Analysis

Passenger Cars Held a Major Share of the Automotive Transparent Antenna Market.

Based on types of vehicles, the automotive transparent antenna market is segmented into passenger cars and commercial vehicles. Among the vehicle types, 78.6% of the automotive transparent antennas consumed globally are for passenger cars, primarily due to the different design priorities and technology requirements of these vehicle types. Passenger cars typically focus on aesthetics, connectivity, and advanced communication systems, such as infotainment, GPS, and 5G. Transparent antennas, which blend seamlessly into the vehicle’s design, align with these preferences for a sleek and modern appearance while supporting high-performance connectivity.

In contrast, commercial vehicles, such as trucks and buses, prioritize durability, utility, and cost-effectiveness over aesthetics. Their communication systems tend to be more utilitarian and robust, often employing external or more traditional antenna designs. Additionally, commercial vehicles operate in environments where functionality and range, rather than design integration, are the primary considerations, leading to less emphasis on the use of transparent antennas.

Sales Channel Analysis

Automotive Transparent Antenna Products Are Mostly Sold to OEMs.

Among the sales channels of the automotive transparent antenna, 86.1% of the total global consumption of automotive transparent antennas is sold to OEMs, as they have greater control over vehicle design and production, allowing for seamless integration of antennas during the manufacturing process. OEMs can optimize the antenna placement and ensure it meets performance and aesthetic requirements from the outset.

Additionally, vehicle manufacturers typically require high volumes of antennas to meet the needs of mass production, making it more efficient for antenna suppliers to engage with OEMs. In contrast, aftermarket installations often face challenges such as compatibility with existing vehicle designs, varying customer needs, and the complexity of integrating transparent antennas into vehicles that were not originally designed for them. Consequently, the aftermarket demand for such antennas remains lower compared to the OEM market.

Key Market Segments

By Frequency Range

- High frequency

- Very-high frequency

- Ultra-high frequency

By Vehicle Propulsion

- Internal Combustion Engines

- Electric Vehicles

By Application

- Sunroof

- Windshield

- Windows

By Vehicle Type

- Passenger Cars

- Hatchback

- Sedan

- SUV

- Others

- Commercial Vehicles

- Light Duty

- Heavy Duty

By Sales Channel

- OEM

- Aftermarket

Drivers

Demand for Connected and Autonomous Vehicles (CAVs) Drives the Automotive Transparent Antenna Market.

The demand for connected and autonomous vehicles (CAVs) is a key driver for the automotive transparent antenna market, largely due to the increased reliance on advanced communication technologies. Autonomous vehicles require high-speed data transmission for real-time vehicle-to-vehicle and vehicle-to-infrastructure communications. Transparent antennas, which offer seamless integration into vehicle surfaces without compromising aesthetics, are essential for enabling these systems.

Additionally, regulatory bodies are pushing for V2X adoption. For instance, in August 2024, the United States Department of Transportation (USDOT) announced the “Saving Lives with Connectivity” plan aimed to accelerate the deployment of vehicle-to-everything (V2X) technologies, which rely on high-performance antenna systems for connectivity, to enhance road safety, mobility, and efficiency.

Furthermore, the initiative supports a zero-fatality goal and includes nearly US$60 million in grants for V2X technology deployment, ensuring secure, interoperable communication across devices and platforms. Similarly, several companies are exploring the opportunities in autonomous vehicles. For instance, Waymo’s ride-hailing service has driven over 71 million miles on public roads without a human driver and billions more in simulation. Similarly, in 2025, they launched a partnership with Toyota to develop a next-generation personal-use vehicle. These advancements propel the automotive transparent antenna market.

Restraints

Technical Limitations Pose Significant Challenges to the Automotive Transparent Antenna Market.

Technical limitations present significant challenges in the automotive transparent antenna market. The integration of transparent antennas into vehicle designs necessitates balancing performance, aesthetics, and manufacturing feasibility. For instance, as noted by the European Commission in its Automotive Electronics 2030 publication, achieving high signal integrity and minimal interference while maintaining transparency in materials requires advanced engineering, which can increase production complexity and cost.

Similarly, technical limitations mostly arise from a contradictory relationship between conductivity and transparency. Optically transparent antennas (OTAs) using transparent conductive films (TCFs) such as indium tin oxide (ITO) often exhibit high sheet resistance, leading to significant Ohmic losses. While metal mesh antennas offer higher conductivity, they are often inferior in transparency performance compared to TCFs. At 90% transparency, meshed antennas can reach efficiencies above 50%, yet their performance decreases at higher frequencies due to signal leakage through the mesh.

Moreover, while transparent antennas must support a variety of communication standards, ensuring that these systems meet automotive safety standards, such as those outlined by the International Automotive Task Force (IATF) 16949 certification, adds further complexity. Additionally, the use of specialized materials such as conductive polymers or advanced composites to achieve transparency while maintaining durability and performance can increase manufacturing costs, limiting widespread adoption without significant cost control measures.

Opportunity

Focus on 5G/6G and Advanced Infotainment Systems Creates Opportunities in the Automotive Transparent Antenna Market.

The increasing focus on 5G/6G and advanced infotainment systems presents a notable opportunity for the automotive transparent antenna market. According to the U.S. Federal Communications Commission (FCC), the rollout of 5G networks is driving the need for high-performance antennas capable of handling high-bandwidth, low-latency communications, which are essential for next-generation infotainment and vehicle connectivity.

Similarly, the European Commission’s connected and automated driving framework emphasizes the importance of robust communication systems for real-time data sharing and navigation, making transparent antennas crucial for advanced infotainment systems that rely on continuous, high-capacity connectivity.

Leveraging the trend, several companies are exploring the opportunities in the market. For instance, at CES 2024, LG unveiled its transparent antenna for automobiles designed in collaboration with renowned French glass manufacturer Saint-Gobain Sekurit. LG’s transparent telematics solutions support 5G, Wi-Fi 6E (6 GHz band), and GNSS, featuring over 80 patented innovations.

Moreover, the International Telecommunication Union (ITU) highlights 6G’s potential in supporting ultra-high-definition media, further reinforcing the need for advanced antenna solutions in automotive systems to ensure seamless communication and entertainment experiences for passengers. These developments encourage greater adoption of transparent antenna solutions, driven by the demand for integrated, high-performance connectivity.

Trends

Adoption of Nanotechnology and Specialized Materials.

Adoption of nanotechnology and specialized materials is a primary trend enabling high-performance automotive transparent antennas by resolving the trade-off between optical clarity and signal efficiency, aimed at enhancing performance while maintaining aesthetic appeal. Modern implementations shift from traditional transparent conductive oxides (TCOs) toward nanostructured metal meshes and hybrid nanomaterials.

Nanomaterials, such as conductive nanocomposites, offer improvements in electrical conductivity and strength, crucial for antennas that must withstand the automotive environment. Nanotechnology advances the functionality of automotive components, including antennas, by enabling materials that are both lightweight and efficient.

For instance, nanoscale metal meshes, such as Meta Materials’ NANOWEB, utilize sub-micron line widths of 0.15 to 1 micron to remain invisible to the human eye while maintaining the conductivity of bulk metals. These nanostructured films achieve up to 99% optical transmission and extremely low sheet resistance (1–20 Ω/sq.), significantly outperforming standard indium tin oxide (ITO). Similarly, solutions such as CHASM’s AgeNT utilize a CNT/copper hybrid technology to provide over 90% optical transparency with performance parity to low-loss, ceramic PCB-based antennas.

Specialized materials such as transparent conductive films (TCFs), used in combination with nanotechnology, are increasingly utilized to meet the performance demands of modern communication systems such as 5G and V2X. These materials facilitate the development of transparent antennas that support high-speed data transfer while maintaining vehicle aesthetics.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Increased Prices of Automotive Transparent Antenna.

The geopolitical tensions are affecting the automotive transparent antenna market by disrupting global supply chains, creating material shortages, and intensifying regulatory scrutiny. The ongoing trade disputes between major economies, such as the U.S. and China, have led to tariffs and restrictions on key materials used in antenna production, including rare earth metals.

Transparent antennas rely heavily on Indium, primarily for Indium Tin Oxide (ITO) films. According to the U.S. Geological Survey (USGS) 2024 Mineral Commodity Summaries, China accounted for approximately 59% of global refined indium production in 2023. Export controls on gallium and germanium, often processed alongside indium, highlight the risk of supply disruptions.

Similarly, according to the U.S. Department of Commerce, the U.S.-China trade war has resulted in delays and higher costs for the procurement of components critical to electronic systems in automotive applications, including antennas.

Geopolitical instability in key manufacturing regions, particularly in East Asia, further threatens the stability of the supply chain. There are concerns over the volatility of supply chains for high-tech automotive components, including antennas, which are sensitive to international political dynamics, affecting timely deliveries and market stability.

Regional Analysis

Europe Held the Largest Share of the Global Automotive Transparent Antenna Market.

In 2024, Europe dominated the global automotive transparent antenna market, holding about 35.7% of the total global consumption, driven by the region’s strong focus on advanced automotive technologies and stringent regulatory frameworks. The European Commission’s Connected and Automated Driving initiative emphasizes the importance of in-vehicle communication systems, boosting demand for efficient antenna solutions. In particular, the EU’s push toward 5G and V2X communication technologies necessitates high-performance antennas integrated into vehicle designs.

Additionally, European manufacturers such as BMW Group and Volkswagen Group have disclosed partnerships for hidden antenna glass. The EU’s regulatory push for environmental sustainability encourages the use of transparent antennas made from eco-friendly materials, contributing to Europe’s leadership in the automotive transparent antenna market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of automotive transparent antennas focus on several strategic activities, such as investing in research and development (R&D) to improve antenna performance, particularly in the areas of signal clarity, efficiency, and multi-band capabilities, which are crucial for 5G and V2X applications. Additionally, they prioritize the integration of advanced materials, such as nanocomposites and transparent conductive films, to achieve optimal performance while maintaining vehicle aesthetics.

Similarly, collaborations with automakers and tech firms are another critical focus, enabling manufacturers to tailor antenna designs to specific vehicle models and communication systems. Additionally, manufacturers are increasingly addressing sustainability concerns by incorporating eco-friendly materials and meeting regulatory standards.

The Major Players in The Industry

- Meta Materials Inc.

- VENTI Group

- AGC

- Quectel

- CHASM Advanced Materials, Inc.

- Shenzhen VLG Wireless Technology Co., Ltd.

- VVDN Technologies

- LG Electronics

- In2tec Technology

- Harada Industry Co., Ltd.

- Other Key Players

Key Development

- In March 2025, Quectel Wireless Solutions, a leading global provider of IoT solutions, announced the introduction of its YFCX001WWAH 5G transparent antenna, which is designed to enhance connectivity while ensuring a smooth and uninterrupted device design.

Report Scope

Report Features Description Market Value (2024) US$914.6 Mn Forecast Revenue (2034) US$ 1992.9 Mn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Frequency Range (High frequency, Very-high frequency, and Ultra-high frequency), By Vehicle Propulsion (Internal Combustion Engines and Electric Vehicles), By Application (Sunroof, Windshield, and Windows), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Sales Channel (OEM and Aftermarket) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Meta Materials Inc., VENTI Group, AGC, Quectel, CHASM Advanced Materials, Inc., Shenzhen VLG Wireless Technology Co., Ltd., VVDN Technologies, LG Electronics, In2tec Technology, Harada Industry Co., Ltd., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Automotive Transparent Antenna MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Transparent Antenna MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Meta Materials Inc.

- VENTI Group

- AGC

- Quectel

- CHASM Advanced Materials, Inc.

- Shenzhen VLG Wireless Technology Co., Ltd.

- VVDN Technologies

- LG Electronics

- In2tec Technology

- Harada Industry Co., Ltd.

- Other Key Players