Global Automotive Terminals Market Size, Share, Growth Analysis By Current Rating (41-100 ampere, Below 40 ampere, Above 100 ampere), By Terminals (Blade Terminals, Pin Terminals, Socket Terminals, Ring Terminals, Spade Terminals, Others), By Vehicle (Passenger Cars, Commercial Vehicles), Application (Power Distribution, Engine Control Units (ECUs), Battery Connections, Lighting System, Infotainment System, Advanced Driver-assistance Systems (ADAS), Sensors, Others), By Sales Channel (OEM, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176447

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

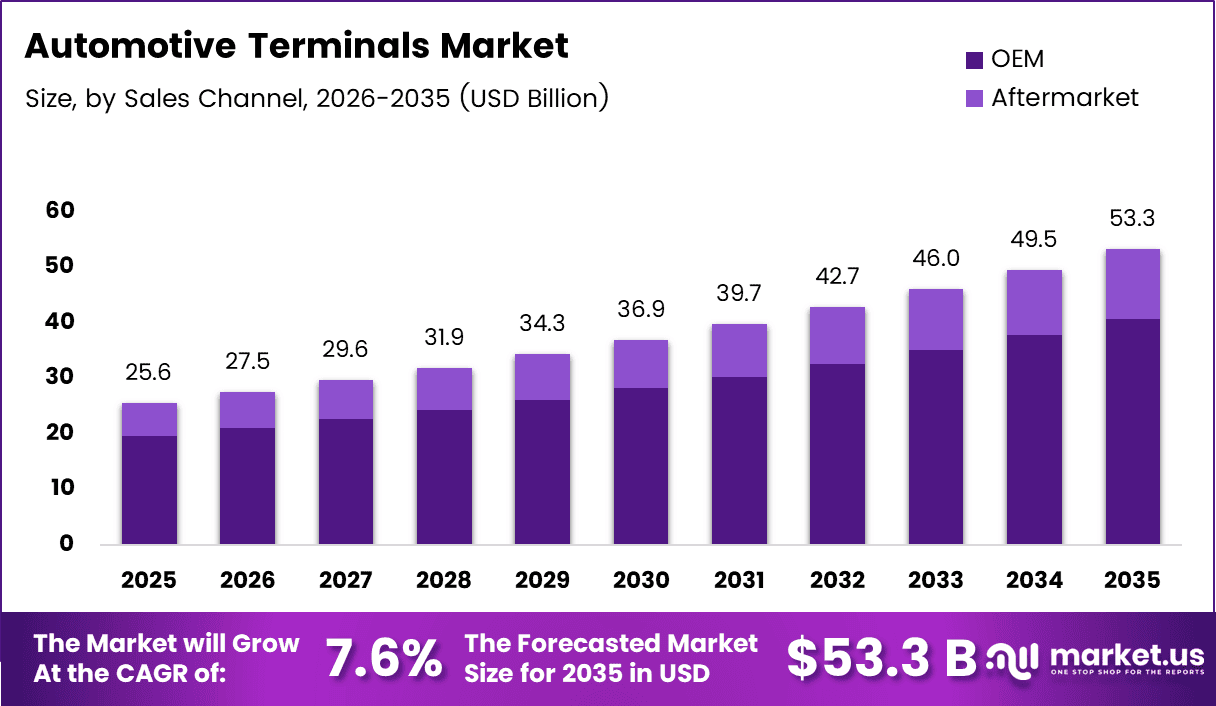

Global Automotive Terminals Market size is expected to be worth around USD 53.3 Billion by 2035 from USD 25.6 Billion in 2025, growing at a CAGR of 7.6% during the forecast period 2026 to 2035.

Automotive terminals are critical electrical connectors that facilitate power distribution and signal transmission across vehicle systems. These precision-engineered components ensure reliable connections between wire harnesses, electronic control units, sensors, and various electrical assemblies. Their robust design enables efficient current flow while maintaining durability under harsh automotive conditions.

The market experiences substantial growth driven by advancing vehicle electrification and sophisticated electronics integration. Moreover, rising consumer demand for enhanced safety features and connected mobility solutions accelerates terminal adoption. Consequently, manufacturers invest heavily in developing high-performance terminals capable of supporting complex automotive architectures with superior reliability and longevity.

Government regulations worldwide mandate stringent automotive safety and performance standards, compelling automakers to upgrade electrical systems. Additionally, environmental policies promoting electric vehicle adoption create opportunities for high-voltage terminal applications. Therefore, regulatory frameworks significantly influence market dynamics by establishing quality benchmarks and encouraging technological innovation across the automotive terminals industry.

Electric and hybrid vehicle proliferation presents substantial growth opportunities for specialized terminal manufacturers. Furthermore, the shift toward autonomous driving technologies requires dense wiring networks with enhanced signal integrity. These developments necessitate advanced terminal solutions that deliver exceptional performance in demanding electrical environments while supporting miniaturization trends.

According to Scandinavian Auto Logistics, their auto terminal features a storage area of 150,000 square meters purpose-built for efficient vehicle handling. According to Xindemarinenews, at Shanghai’s Haitong International Automotive Terminal, more than 5,000 vehicles are loaded daily on average since early this year. China-manufactured new-energy vehicles now possibly constitute approximately 30 percent of terminal exports this year.

Investment in automated manufacturing technologies and material innovations strengthens production capabilities across the industry. However, manufacturers must navigate commodity price fluctuations and increasing design complexity. Therefore, strategic partnerships and operational efficiency improvements remain essential for sustained competitive advantage in this evolving market landscape.

Key Takeaways

- Global Automotive Terminals Market valued at USD 25.6 Billion in 2025, projected to reach USD 53.3 Billion by 2035

- Market growing at CAGR of 7.6% during forecast period 2026-2035

- Blade Terminals segment dominates with 28.4% market share in 2025

- 41-100 ampere current rating segment leads with 47.8% share

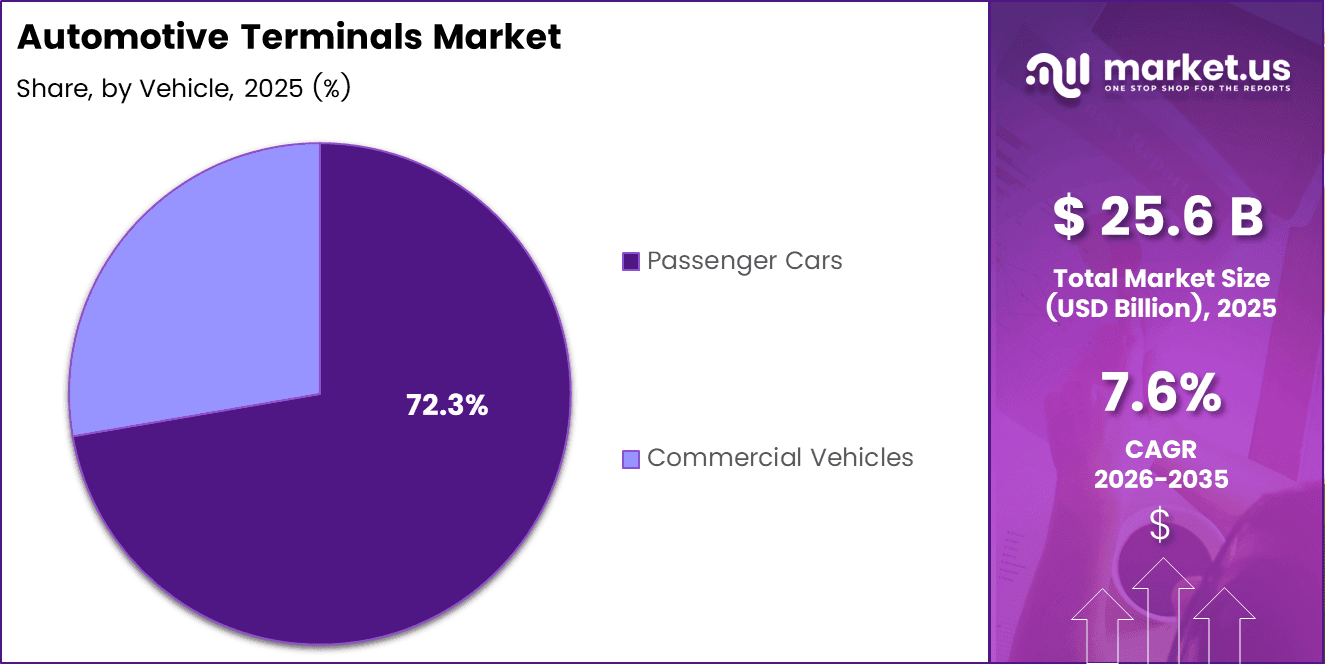

- Passenger Cars segment commands 72.3% market share

- Power Distribution application holds 24.9% share

- OEM sales channel accounts for 76.2% of market

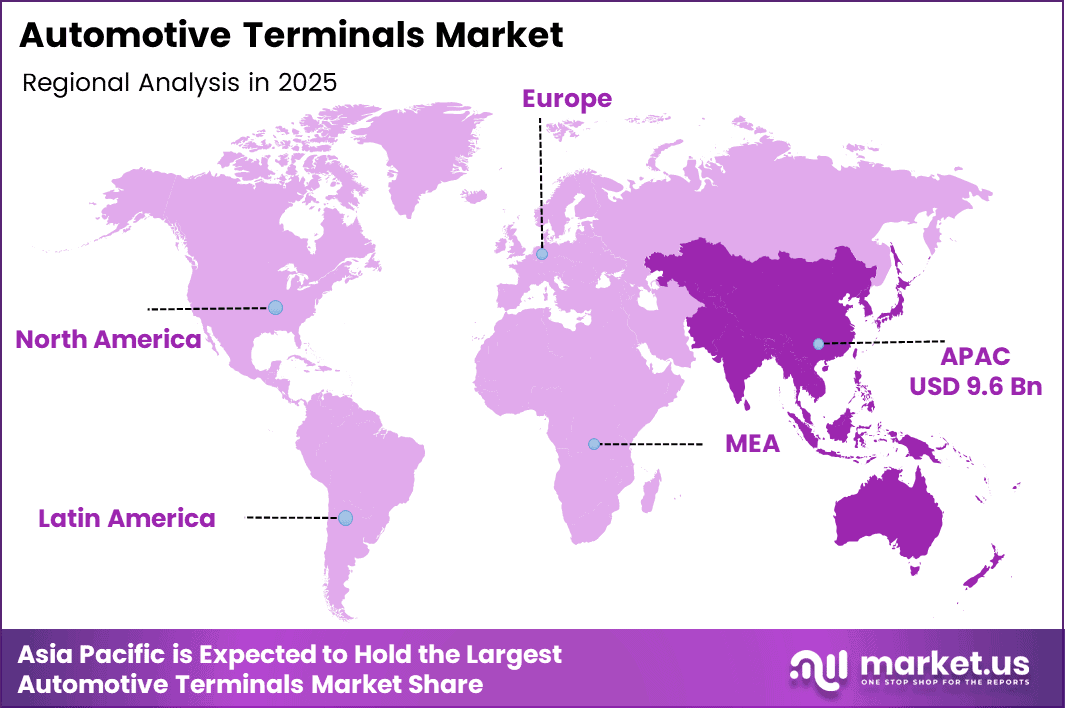

- Asia Pacific region dominates with 37.5% share, valued at USD 9.6 Billion

Current Rating Analysis

41-100 ampere dominates with 47.8% due to optimal balance between power handling and compact design.

In 2025, ‘41-100 ampere‘ held a dominant market position in the ‘Current Rating’ segment of Automotive Terminals Market, with a 47.8% share. This range offers versatility across multiple automotive applications including power distribution, lighting systems, and moderate-load electrical components. Consequently, automakers prefer this rating for balancing performance requirements with cost-effectiveness.

Below 40 ampere terminals serve low-power applications such as sensors, infotainment interfaces, and control signal transmission. These terminals dominate in signal-intensive architectures where precision matters more than high current capacity. Moreover, their compact footprint enables dense packaging in space-constrained automotive environments. Therefore, they remain essential for modern vehicle electronics.

Above 100 ampere terminals address high-power requirements in electric vehicles, battery management systems, and starter motor circuits. Rising electrification drives demand for robust high-current solutions capable of handling extreme loads. Additionally, thermal management capabilities distinguish premium terminals in this category. However, their specialized applications limit market share compared to mid-range alternatives.

Terminals Analysis

Blade Terminals dominate with 28.4% due to ease of installation and reliable electrical connections.

In 2025, ‘Blade Terminals‘ held a dominant market position in the ‘Terminals’ segment of Automotive Terminals Market, with a 28.4% share. These flat, tab-shaped connectors provide quick-disconnect functionality and secure electrical contact in various automotive systems. Their standardized design facilitates mass production while ensuring consistent performance. Consequently, blade terminals remain industry favorites for fuse boxes and power distribution applications.

Pin Terminals excel in multi-pin connector assemblies requiring precise alignment and signal integrity. Their cylindrical design ensures stable contact pressure and minimal signal degradation across automotive communication networks. Moreover, pin terminals accommodate high mating cycle requirements in diagnostic ports and sensor connections. Therefore, they prove indispensable for electronic control units and advanced driver assistance systems.

Socket Terminals complement pin terminals by providing receptacle counterparts in connector systems. These terminals feature spring-loaded contacts that maintain consistent pressure throughout vehicle operational lifecycles. Additionally, their design accommodates thermal expansion without compromising electrical continuity. However, their supporting role limits independent market presence compared to primary terminal types.

Ring Terminals offer permanent mounting solutions for critical electrical connections requiring mechanical stability. Their circular eye design enables secure bolt-fastening to chassis grounds and battery posts. Furthermore, ring terminals withstand vibration and mechanical stress in harsh automotive environments. Nevertheless, installation complexity restricts their application scope primarily to essential grounding and power connections.

Spade Terminals provide versatile quick-connect solutions for moderate-current applications throughout vehicle electrical systems. Their fork-shaped design allows tool-free installation while maintaining adequate contact pressure. Moreover, spade terminals facilitate rapid assembly in manufacturing environments and simplified maintenance procedures. Therefore, they find widespread use in lighting circuits and auxiliary power distribution networks.

Others category encompasses specialized terminal designs including bullet connectors, flag terminals, and custom automotive solutions. These variants address unique application requirements beyond standard terminal configurations. Additionally, emerging technologies drive innovation in proprietary terminal designs optimized for specific vehicle platforms. However, their niche applications result in limited collective market share.

Vehicle Analysis

Passenger Cars dominate with 72.3% due to high production volumes and extensive electrical systems.

In 2025, ‘Passenger Cars‘ held a dominant market position in the ‘Vehicle’ segment of Automotive Terminals Market, with a 72.3% share. Passenger vehicles incorporate increasingly sophisticated electrical architectures supporting infotainment, safety systems, and comfort features. Moreover, rising consumer expectations for connected mobility and advanced driver assistance drive terminal content per vehicle. Consequently, this segment represents the largest consumption base for automotive terminals globally.

Commercial Vehicles require robust terminal solutions capable of withstanding demanding operational conditions and extended duty cycles. Heavy-duty trucks, buses, and delivery vehicles utilize specialized terminals engineered for higher vibration resistance and environmental exposure. Additionally, commercial electrification trends introduce high-voltage terminal requirements for electric drivetrains and auxiliary systems. Therefore, this segment exhibits strong growth potential despite smaller overall market share.

Application Analysis

Power Distribution dominates with 24.9% due to fundamental role in vehicle electrical architecture.

In 2025, ‘Power Distribution‘ held a dominant market position in the ‘Application’ segment of Automotive Terminals Market, with a 24.9% share. Power distribution networks serve as the electrical backbone connecting battery sources to all vehicle systems and components. These critical pathways require high-reliability terminals capable of managing substantial current loads while minimizing voltage drops. Consequently, power distribution remains the primary terminal application across all vehicle types.

Engine Control Units (ECUs) utilize specialized terminals ensuring precise signal transmission for engine management and performance optimization. These terminals must deliver exceptional signal integrity while withstanding engine compartment heat and vibration. Moreover, increasing ECU complexity in modern powertrains demands higher-density connector solutions with enhanced durability. Therefore, this application segment drives innovation in miniaturized high-performance terminal technologies.

Battery Connections represent critical high-current terminal applications requiring exceptional conductivity and mechanical robustness. Electric vehicle proliferation significantly expands battery terminal requirements for both main traction batteries and auxiliary power systems. Additionally, thermal management capabilities prove essential in high-power battery applications. However, this specialized focus limits market share compared to broader distribution applications.

Lighting Systems employ terminals across exterior and interior illumination circuits requiring reliable long-term performance. LED technology adoption reduces current requirements while increasing circuit complexity and terminal count per vehicle. Furthermore, adaptive lighting systems introduce additional control requirements for dynamic beam patterns. Nevertheless, standardization limits growth potential compared to emerging electronic applications.

Infotainment Systems demand terminals supporting complex data transmission alongside power delivery for displays, audio equipment, and connectivity modules. Rising consumer expectations for seamless digital experiences drive infotainment content growth in modern vehicles. Moreover, integration with smartphone ecosystems requires terminals ensuring signal quality across multiple communication protocols. Therefore, this segment exhibits robust expansion aligned with digital transformation trends.

Advanced Driver-assistance Systems (ADAS) require high-reliability terminals ensuring uninterrupted operation of safety-critical sensors, cameras, and processing units. These applications demand terminals with superior signal integrity and environmental sealing against moisture and contaminants. Additionally, autonomous driving evolution increases ADAS complexity and terminal requirements exponentially. Consequently, this application represents significant growth opportunity for specialized terminal manufacturers.

Sensors utilize terminals across numerous automotive monitoring and control functions including temperature, pressure, position, and environmental detection systems. Miniaturization trends drive demand for compact terminals accommodating dense sensor networks throughout vehicles. Furthermore, sensor proliferation in electrified and autonomous vehicles creates sustained growth. However, low individual terminal value limits overall market impact despite high unit volumes.

Others category encompasses diverse applications including climate control, power windows, seat adjustments, and emerging technologies. These varied uses collectively represent significant terminal consumption across vehicle electrical systems. Additionally, innovation in vehicle features continuously generates new terminal application opportunities. Nevertheless, fragmentation across multiple systems results in modest individual application shares.

Sales Channel Analysis

OEM dominates with 76.2% due to direct integration during vehicle manufacturing processes.

In 2025, ‘OEM‘ held a dominant market position in the ‘Sales Channel’ segment of Automotive Terminals Market, with a 76.2% share. Original equipment manufacturers purchase terminals in bulk quantities for integration into new vehicle production lines worldwide. This channel benefits from long-term supply agreements and standardized specifications ensuring consistent quality and performance. Consequently, OEM relationships represent the primary revenue stream for automotive terminal manufacturers globally.

Aftermarket channels serve replacement and repair requirements throughout vehicle operational lifecycles after initial sale. This segment addresses terminal failures, electrical system upgrades, and maintenance needs across aging vehicle populations. Moreover, aftermarket demand remains stable due to continuous vehicle servicing requirements independent of new production cycles. Therefore, this channel provides valuable revenue diversification despite smaller overall market share.

Key Market Segments

By Current Rating

- 41-100 ampere

- Below 40 ampere

- Above 100 ampere

By Terminals

- Blade Terminals

- Pin Terminals

- Socket Terminals

- Ring Terminals

- Spade Terminals

- Others

By Vehicle

- Passenger Cars

- Commercial Vehicles

By Application

- Power Distribution

- Engine Control Units (ECUs)

- Battery Connections

- Lighting System

- Infotainment System

- Advanced Driver-assistance Systems (ADAS)

- Sensors

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Vehicle Electrification Increasing Demand for High-Reliability Electrical Terminals

Electric and hybrid vehicle adoption accelerates globally, driven by environmental regulations and consumer preferences for sustainable mobility solutions. These advanced powertrains require sophisticated electrical architectures with specialized terminals capable of managing high voltages and currents safely. Consequently, automotive manufacturers prioritize terminal reliability to ensure safety and performance throughout vehicle lifecycles.

Vehicle electrification introduces complex battery management systems, power electronics, and charging infrastructure requiring robust electrical connections. Moreover, high-voltage applications demand terminals engineered with superior insulation properties and enhanced safety features. Therefore, electrification trends fundamentally reshape terminal specifications and drive substantial market growth through increased content per vehicle.

Growing integration of advanced driver assistance systems requires dense wiring networks supporting multiple sensors, cameras, and processing units simultaneously. These sophisticated safety technologies depend on reliable signal transmission through high-quality terminals ensuring uninterrupted operation. Additionally, autonomous driving evolution exponentially increases electrical complexity and terminal count requirements throughout vehicles.

Restraints

Volatility in Copper and Specialty Alloy Prices Impacting Terminal Manufacturing Costs

Copper serves as the primary conductive material in automotive terminals, making manufacturers vulnerable to commodity price fluctuations. Global supply-demand dynamics, geopolitical tensions, and economic conditions create significant cost uncertainty for terminal production. Consequently, manufacturers struggle to maintain stable pricing while managing unpredictable raw material expenses that directly impact profitability.

Specialty alloys used in high-performance terminals experience similar price volatility affecting production economics. Moreover, terminal manufacturers often cannot immediately pass cost increases to automotive customers due to long-term supply agreements. Therefore, raw material price instability creates margin pressure and financial planning challenges throughout the terminal supply chain.

Increasing design complexity in modern automotive electrical systems leads to higher engineering, testing, and validation expenses for terminal manufacturers. Advanced applications require extensive reliability testing under extreme conditions including temperature cycling, vibration exposure, and corrosion resistance. Additionally, stringent automotive quality standards demand comprehensive validation processes before production approval, extending development timelines and costs significantly.

Growth Factors

Rapid Adoption of Electric and Hybrid Vehicles Expanding High-Voltage Terminal Applications

Electric vehicle market penetration accelerates worldwide as governments implement supportive policies and charging infrastructure expands. These vehicles require specialized high-voltage terminals for battery connections, power distribution, and charging systems beyond traditional automotive requirements. Consequently, electrification creates substantial new demand for advanced terminal solutions engineered for elevated voltage and current specifications.

Growing demand for lightweight and miniaturized terminals supports vehicle efficiency objectives and enables dense packaging in modern automotive architectures. Manufacturers develop innovative materials and designs reducing terminal weight while maintaining performance and reliability standards. Moreover, miniaturization facilitates increased functionality within constrained spaces supporting evolving vehicle electronics. Therefore, lightweight terminal technologies represent significant growth opportunities.

Localization of automotive component manufacturing in emerging economies reduces costs and improves supply chain resilience for global automakers. Regional production expansion creates opportunities for terminal manufacturers establishing local operations serving growing automotive markets. Additionally, government incentives and favorable trade policies encourage investment in domestic automotive supply chains. However, quality standardization remains essential for successful market penetration.

Emerging Trends

Shift Toward High-Voltage and High-Current Terminals for EV Powertrain Systems

Electric vehicle powertrain electrification drives demand for specialized terminals handling voltages exceeding traditional automotive electrical systems significantly. These high-voltage applications require enhanced insulation, safety features, and robust construction ensuring reliable operation under extreme electrical conditions. Consequently, manufacturers invest heavily in developing next-generation terminal technologies specifically engineered for electric mobility applications.

Adoption of automated crimping and assembly technologies improves terminal manufacturing efficiency while enhancing quality consistency and reducing labor costs. Advanced automation enables precise crimp force control and real-time quality monitoring ensuring optimal electrical and mechanical performance. Moreover, automated systems increase production speeds supporting growing market demand. Therefore, manufacturing technology advancement represents critical competitive differentiation.

Rising use of corrosion-resistant and high-temperature terminal materials extends operational reliability in harsh automotive environments. Advanced material engineering develops alloys and platings withstanding extreme temperature fluctuations, chemical exposure, and environmental contamination. Additionally, standardization of modular connector and terminal platforms across vehicle models reduces complexity and improves economies of scale throughout automotive supply chains.

Regional Analysis

Asia Pacific Dominates the Automotive Terminals Market with a Market Share of 37.5%, Valued at USD 9.6 Billion

Asia Pacific commands the largest market share at 37.5%, valued at USD 9.6 Billion, driven by massive automotive production volumes in China, Japan, South Korea, and India. The region hosts major global automakers and extensive supply chain networks supporting both domestic consumption and export markets. Moreover, rapid electric vehicle adoption and government electrification mandates accelerate terminal demand growth throughout Asia Pacific.

North America Automotive Terminals Market Trends

North America demonstrates strong market performance supported by advanced automotive technologies and premium vehicle segment growth. The region prioritizes safety innovations and autonomous driving development requiring sophisticated electrical architectures with high-reliability terminals. Additionally, electric vehicle investment by major automakers creates substantial opportunities for specialized terminal suppliers serving North American production facilities.

Europe Automotive Terminals Market Trends

Europe leads in stringent automotive regulations and environmental standards driving terminal quality requirements and technological innovation. The region’s commitment to vehicle electrification and carbon neutrality goals accelerates demand for advanced high-voltage terminal solutions. Furthermore, European automotive manufacturers maintain strong relationships with local terminal suppliers ensuring technical collaboration and rapid innovation cycles.

Latin America Automotive Terminals Market Trends

Latin America experiences moderate growth driven by expanding automotive production in Brazil and Mexico serving regional and export markets. Economic development and rising middle-class populations increase vehicle ownership rates supporting terminal demand growth. However, economic volatility and currency fluctuations create market uncertainty affecting investment decisions throughout the automotive supply chain.

Middle East & Africa Automotive Terminals Market Trends

Middle East and Africa represent emerging markets with growing automotive assembly operations and aftermarket service requirements. Government initiatives promoting local manufacturing and economic diversification create opportunities for terminal suppliers establishing regional presence. Additionally, harsh climate conditions require specialized terminals engineered for extreme temperature and environmental challenges unique to these regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

TE Connectivity Ltd. maintains a leading position through comprehensive terminal product portfolios serving diverse automotive applications globally. The company invests significantly in research and development, creating innovative solutions for electric vehicle high-voltage systems and advanced driver assistance technologies. Moreover, TE Connectivity leverages extensive manufacturing capabilities and global distribution networks ensuring reliable supply to major automakers worldwide. Their technical expertise and quality reputation establish strong competitive advantages.

Yazaki Corporation specializes in automotive wiring harnesses and terminal solutions supporting major vehicle manufacturers across multiple continents. The company emphasizes integrated electrical distribution systems combining terminals, connectors, and wire assemblies for optimized performance. Additionally, Yazaki focuses on lightweight designs and environmentally sustainable manufacturing processes aligned with automotive industry trends. Their long-standing customer relationships and engineering capabilities drive continued market success.

Amphenol Corporation offers diversified interconnect solutions including specialized automotive terminals for demanding applications requiring exceptional reliability. The company serves premium vehicle segments and emerging electric mobility markets with advanced terminal technologies. Furthermore, Amphenol pursues strategic acquisitions expanding capabilities and market reach, including recent connectivity business acquisitions. Their innovation focus and market diversification strategy strengthen competitive positioning significantly.

Molex LLC delivers comprehensive terminal and connector systems supporting automotive electrical architecture evolution toward increased electrification and automation. The company develops miniaturized high-density terminals enabling complex electronic integrations within constrained vehicle spaces. Moreover, Molex collaborates closely with automotive customers on custom solutions addressing specific application requirements. Their engineering expertise and manufacturing excellence establish strong industry presence and customer loyalty.

Key Players

- 3M Company

- Amphenol Corporation

- AVX Corporation

- Delphi Technologies

- Molex LLC

- Nexans S.A.

- Robert Bosch GmbH

- Sumitomo Electric Industries

- TE Connectivity Ltd.

- Yazaki Corporation

Recent Developments

- August 2025 – Amphenol Corporation announced acquisition of Connectivity and Cable Solutions Business from CommScope, expanding its automotive terminal capabilities and market presence. This strategic transaction strengthens Amphenol’s position in high-performance connectivity solutions serving electrified vehicle platforms and advanced automotive applications requiring enhanced signal integrity and power handling capabilities.

- April 2025 – The Australian Competition and Consumer Commission approved Qube Holdings Limited’s acquisition of Melbourne International RoRo & Auto Terminal Pty Ltd following court-enforceable undertaking. This regulatory clearance enables expanded automotive logistics infrastructure supporting efficient vehicle distribution and terminal operations throughout the region with enhanced capacity for handling growing automotive exports.

Report Scope

Report Features Description Market Value (2025) USD 25.6 Billion Forecast Revenue (2035) USD 53.3 Billion CAGR (2026-2035) 7.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Current Rating (41-100 ampere, Below 40 ampere, Above 100 ampere), ByTerminals (Blade Terminals, Pin Terminals, Socket Terminals, Ring Terminals, Spade Terminals, Others), By Vehicle (Passenger Cars, Commercial Vehicles), Application (Power Distribution, Engine Control Units (ECUs), Battery Connections, By Lighting System, Infotainment System, Advanced Driver-assistance Systems (ADAS), Sensors, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M Company, Amphenol Corporation, AVX Corporation, Delphi Technologies, Molex LLC, Nexans S.A., Robert Bosch GmbH, Sumitomo Electric Industries, TE Connectivity Ltd., Yazaki Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Terminals MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Terminals MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Amphenol Corporation

- AVX Corporation

- Delphi Technologies

- Molex LLC

- Nexans S.A.

- Robert Bosch GmbH

- Sumitomo Electric Industries

- TE Connectivity Ltd.

- Yazaki Corporation