Global Automotive Piston Engine System Market Size, Share, Growth Analysis By Raw Material Type (Cast Iron, Aluminum Alloy, Others), By Component Type (Piston, Piston Ring, Piston Pin), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Cars, Commercial Vehicles), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177362

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

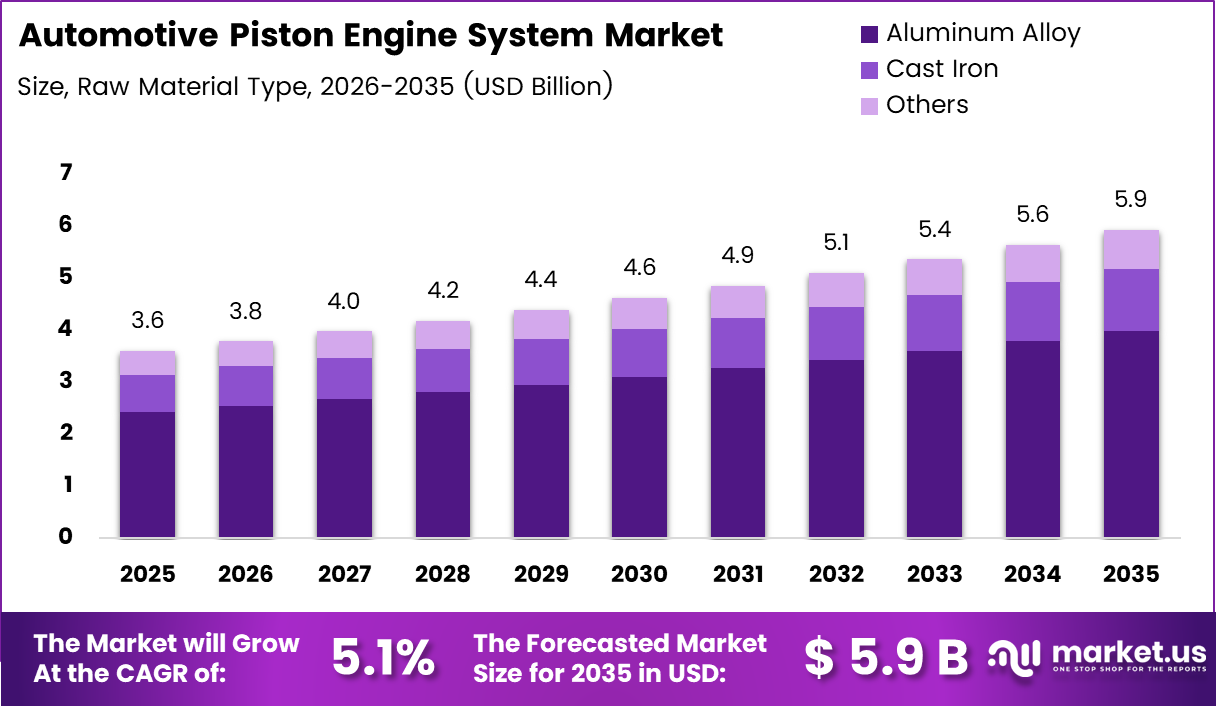

Global Automotive Piston Engine System Market size is expected to be worth around USD 5.9 Billion by 2035 from USD 3.6 Billion in 2025, growing at a CAGR of 5.1% during the forecast period 2026 to 2035.

The automotive piston engine system comprises critical components including pistons, piston rings, and piston pins that convert fuel combustion into mechanical energy. These systems operate across extreme temperature ranges from -30°C to 400°C while maintaining structural integrity. Moreover, modern pistons feature oval designs with diameter variations of 0.3-0.8% between pin axis and skirt for optimal performance.

Piston engines remain fundamental to global automotive propulsion despite emerging electric vehicle trends. These systems must balance lightweight construction for high-speed operation with durability requirements across diverse operating conditions. Additionally, advanced materials and engineering innovations continue enhancing thermal efficiency and emissions performance in contemporary applications.

The market experiences sustained growth driven by fuel efficiency mandates and emerging market vehicle demand. However, manufacturers face pressure from stringent emission regulations requiring continuous technological advancement. Consequently, industry investment focuses on optimized combustion chamber designs and alternative fuel compatibility to extend piston engine relevance.

Technological innovations including variable compression ratios and cylinder deactivation systems boost market expansion opportunities. Furthermore, integration of artificial intelligence for predictive maintenance creates new value propositions for commercial applications. Therefore, the market demonstrates resilience through adaptation to evolving regulatory and performance requirements.

Hybrid vehicle architectures incorporating advanced piston engines with electric motors represent significant growth segments. Additionally, sustainable aviation fuel applications and hydrogen-fueled systems expand market boundaries beyond traditional automotive uses. These diversification strategies position piston engine technology for continued industrial relevance across transportation sectors.

Peak combustion pressures in diesel engines reach 150-160 bar, requiring robust component engineering and thermal management solutions. The piston skirt evacuates approximately 25% of thermal energy, with remaining heat transferred through connecting components and lubrication systems. Moreover, material science advancements enable weight reduction while maintaining structural performance under extreme operational stresses.

Iron alloys designated as steels contain carbon levels below 2%, providing strength characteristics essential for demanding engine applications. Aluminum-silicon alloys and carbon fiber composites increasingly replace traditional materials for enhanced efficiency. Consequently, material selection directly influences engine performance, longevity, and environmental impact across vehicle platforms.

Key Takeaways

- Global Automotive Piston Engine System Market projected to reach USD 5.9 Billion by 2035 from USD 3.6 Billion in 2025 at 5.1% CAGR.

- Aluminum Alloy segment dominates raw material type with 67.3% market share in 2025.

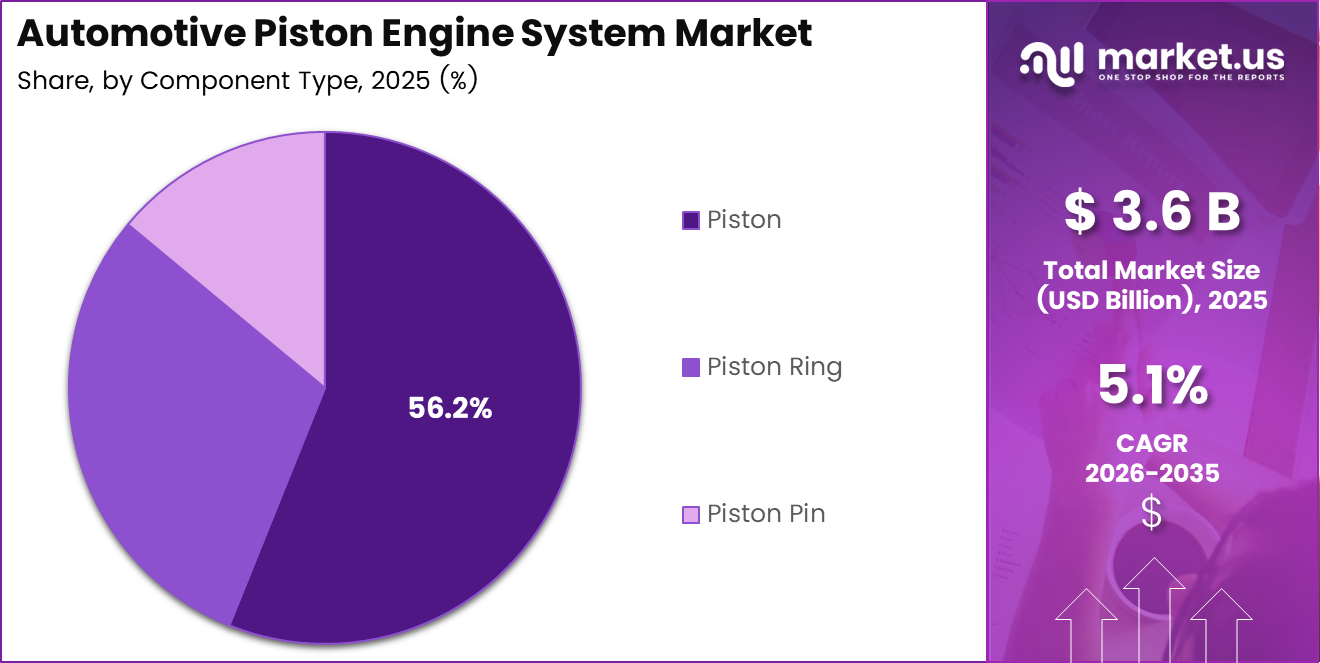

- Piston component type leads with 56.2% share driven by replacement and performance upgrade demand.

- Gasoline fuel type accounts for 72.9% of market due to widespread passenger vehicle adoption.

- Passenger Cars segment holds 78.1% share reflecting global automotive production volumes.

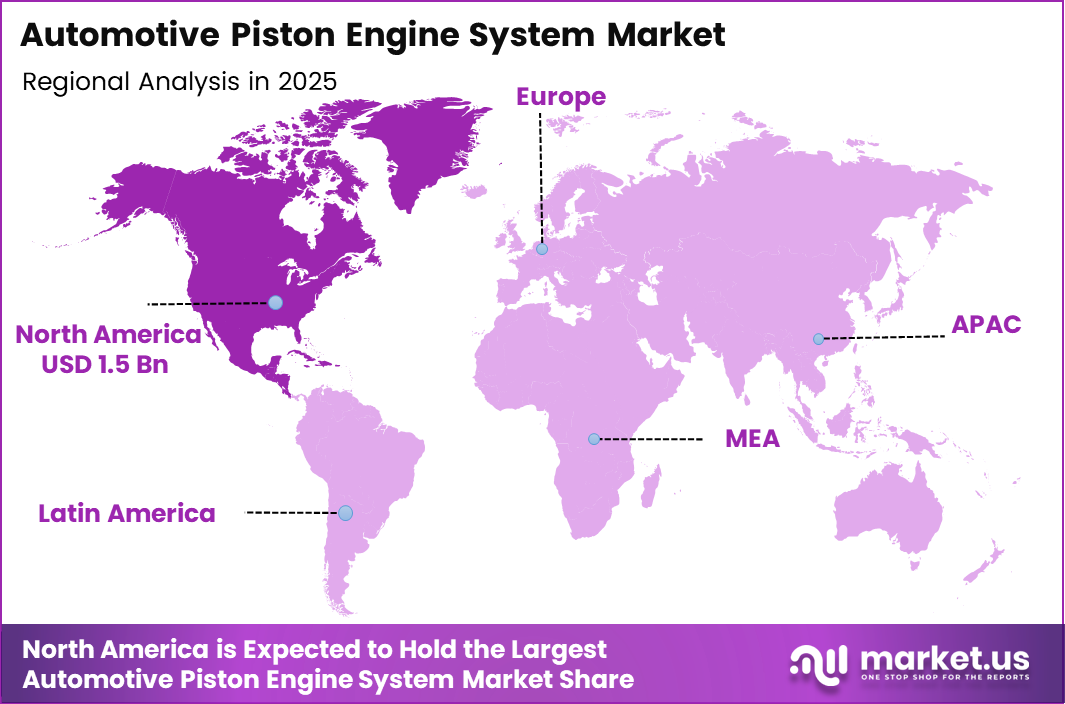

- North America dominates regional market with 43.70% share valued at USD 1.5 Billion.

- Variable compression ratio and cylinder deactivation technologies drive efficiency improvements.

- Hydrogen-fueled piston engines and sustainable aviation applications present emerging growth opportunities.

Raw Material Type Analysis

Aluminum Alloy dominates with 67.3% due to superior weight-to-strength ratio and thermal conductivity.

In 2025, Aluminum Alloy held a dominant market position in the Raw Material Type segment of Automotive Piston Engine System Market, with a 67.3% share. Aluminum alloys offer exceptional lightweight properties enabling higher engine speeds and improved fuel efficiency. Moreover, superior thermal conductivity facilitates effective heat dissipation crucial for modern high-performance engines. Therefore, automotive manufacturers increasingly specify aluminum-based pistons for passenger and commercial applications.

Cast Iron maintains relevance in heavy-duty diesel applications requiring extreme durability and cost-effectiveness. Cast iron pistons deliver superior wear resistance and dimensional stability under high combustion pressures exceeding 150 bar. Additionally, established manufacturing processes and lower material costs support continued adoption in commercial vehicle segments. However, weight disadvantages limit applications in fuel-efficiency-focused designs.

Others category includes advanced composites and specialty alloys targeting niche high-performance applications. Carbon fiber reinforced materials and ceramic matrix composites offer extreme temperature resistance for racing applications. Furthermore, experimental materials incorporating graphene and nano-coatings promise enhanced tribological properties. Consequently, innovation in alternative materials continues despite limited current market penetration.

Component Type Analysis

Piston dominates with 56.2% due to critical functional role and frequent replacement requirements.

In 2025, Piston held a dominant market position in the Component Type segment of Automotive Piston Engine System Market, with a 56.2% share. Pistons constitute the primary conversion mechanism transforming combustion pressure into reciprocating motion within cylinder assemblies. Moreover, exposure to extreme thermal and mechanical stresses necessitates periodic replacement throughout vehicle lifecycle. Therefore, aftermarket demand significantly supplements original equipment manufacturer volumes across global markets.

Piston Ring components provide essential sealing between piston and cylinder wall while controlling oil consumption and heat transfer. Multiple ring configurations including compression and oil control variants require precise engineering tolerances. Additionally, advanced coatings enhance wear resistance and reduce friction losses for improved efficiency. Consequently, piston ring technology directly influences engine performance and emissions characteristics.

Piston Pin elements serve as articulation points connecting pistons to connecting rods enabling rotational motion transfer. These components endure significant bearing loads and require high-strength steel or titanium alloys. Furthermore, hollow pin designs reduce reciprocating mass while maintaining structural integrity. Thus, piston pin optimization contributes meaningfully to overall engine refinement and durability.

Fuel Type Analysis

Gasoline dominates with 72.9% due to widespread passenger vehicle adoption and infrastructure availability.

In 2025, Gasoline held a dominant market position in the Fuel Type segment of Automotive Piston Engine System Market, with a 72.9% share. Gasoline engines dominate global passenger vehicle production with established refueling infrastructure supporting consumer convenience. Moreover, advanced direct injection and turbocharging technologies enhance gasoline engine efficiency approaching diesel performance levels. Therefore, manufacturers continue investing in gasoline piston engine refinement despite electrification trends.

Diesel fuel type maintains strong presence in commercial vehicle and heavy-duty applications requiring superior torque characteristics. Diesel combustion produces peak pressures reaching 160 bar demanding robust piston construction and thermal management solutions. Additionally, compression ignition efficiency advantages support diesel adoption in long-haul transportation and industrial equipment. However, stringent particulate emission regulations challenge diesel market growth in passenger segments.

Vehicle Type Analysis

Passenger Cars dominate with 78.1% due to high production volumes and diverse powertrain configurations.

In 2025, Passenger Cars held a dominant market position in the Vehicle Type segment of Automotive Piston Engine System Market, with a 78.1% share. Passenger vehicle production exceeds 60 million units annually worldwide creating substantial original equipment and aftermarket piston system demand. Moreover, diverse engine displacement ranges from compact three-cylinder to performance V8 configurations require varied piston specifications. Therefore, passenger car segment represents primary revenue source for piston system manufacturers globally.

Commercial Vehicles segment encompasses trucks, buses, and utility vehicles demanding enhanced durability for intensive operational cycles. Commercial applications often utilize larger displacement diesel engines with reinforced piston assemblies withstanding extended service intervals. Additionally, fleet maintenance requirements generate consistent aftermarket replacement demand supporting stable revenue streams. Consequently, commercial vehicle segment offers attractive margins despite lower production volumes compared to passenger applications.

Key Market Segments

By Raw Material Type

- Cast Iron

- Aluminum Alloy

- Others

By Component Type

- Piston

- Piston Ring

- Piston Pin

By Fuel Type

- Gasoline

- Diesel

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Drivers

Increasing Demand for Fuel-Efficient Engines Drives Market Growth

Global automotive markets demonstrate sustained demand for fuel-efficient internal combustion engines particularly across emerging economies experiencing rapid motorization. Manufacturers respond by developing advanced piston technologies incorporating reduced friction coatings and optimized combustion chamber geometries. Moreover, turbocharged downsized engines deliver enhanced power density while meeting stringent efficiency standards. Therefore, piston system innovation directly supports automotive industry fuel economy objectives.

Stringent emission regulations mandate continuous development of advanced piston engine technologies reducing particulate matter and nitrogen oxide emissions. Regulatory frameworks including Euro 7 and China VI standards impose challenging compliance requirements driving substantial engineering investment. Additionally, manufacturers implement sophisticated thermal management and combustion control strategies requiring precision-engineered piston components. Consequently, regulatory pressure accelerates technological advancement throughout the piston system supply chain.

Rising adoption of hybrid powertrains integrating optimized piston engines with electric motors creates new market opportunities. Hybrid architectures leverage piston engine efficiency at steady-state conditions while electric assistance optimizes transient performance. Furthermore, dedicated hybrid engine calibrations enable Atkinson cycle operation maximizing thermal efficiency. Thus, hybrid vehicle proliferation extends piston engine market relevance amid electrification trends.

Restraints

Electric Vehicle Transition Threatens Long-Term Market Viability

Accelerating consumer and regulatory shift toward battery electric vehicles fundamentally challenges piston engine market growth trajectories. Major automotive manufacturers announce aggressive electrification strategies with several targeting complete internal combustion phase-out by 2035. Moreover, expanding charging infrastructure and improving battery economics enhance electric vehicle competitiveness against conventional powertrains. Therefore, long-term piston system demand faces structural headwinds from transportation electrification.

High research and development costs associated with meeting complex emission compliance requirements strain manufacturer profitability and investment capacity. Advanced piston technologies require extensive simulation, prototyping, and validation processes consuming significant engineering resources. Additionally, specialized manufacturing equipment and quality control systems demand substantial capital expenditure. Consequently, smaller suppliers face barriers maintaining technological competitiveness amid escalating development costs.

Investment uncertainty arising from unclear regulatory timelines and market transition paths complicates strategic planning for piston system manufacturers. Companies must balance continued internal combustion innovation against diversification into electric powertrain components and alternative technologies. Furthermore, potential stranded assets from premature technology transitions create financial risks throughout the supply chain. Thus, industry participants navigate complex strategic decisions amid evolving automotive landscape.

Growth Factors

Emerging Applications and Technologies Accelerate Market Expansion

Expansion of sustainable aviation fuel-compatible piston engines for general aviation and unmanned aerial vehicles creates new market segments. Aviation applications demand exceptional reliability and power-to-weight ratios driving specialized piston system development. Moreover, drone proliferation across commercial and military sectors generates incremental demand for compact efficient engines. Therefore, aerospace diversification offers growth opportunities beyond traditional automotive applications.

Development of hydrogen-fueled piston engine systems for commercial vehicle applications represents significant innovation frontier with environmental benefits. Hydrogen combustion produces zero carbon emissions while leveraging existing piston engine manufacturing infrastructure and expertise. Additionally, hydrogen engines offer advantages over fuel cells including lower costs and superior cold-weather performance. Consequently, hydrogen piston technology attracts substantial research investment from commercial vehicle manufacturers.

Integration of artificial intelligence and IoT sensors for predictive maintenance and performance optimization enhances piston system value propositions. Connected engine systems enable real-time monitoring of piston wear, thermal conditions, and combustion quality supporting proactive maintenance scheduling. Furthermore, data analytics identify optimization opportunities improving fuel efficiency and reducing operational costs. Thus, digitalization transforms piston engines from mechanical components into intelligent connected systems.

Emerging Trends

Advanced Technologies Reshape Market Landscape

Implementation of variable compression ratio technology maximizes thermal efficiency across diverse operating conditions from low-load cruising to high-output acceleration. Variable compression systems adjust combustion chamber geometry dynamically optimizing thermodynamic cycles for instantaneous power requirements. Moreover, these technologies enable significant efficiency gains exceeding 15% compared to fixed compression engines. Therefore, premium automotive manufacturers increasingly adopt variable compression as competitive differentiator.

Adoption of advanced materials including aluminum-silicon alloys and carbon fiber composites enables substantial weight reduction improving vehicle efficiency. Material science innovations deliver pistons with 30% lower mass while maintaining structural integrity under extreme combustion pressures. Additionally, advanced coatings reduce friction losses and enhance thermal barrier properties extending component longevity. Consequently, materials technology constitutes critical enabler for next-generation piston system performance.

Integration of cylinder deactivation and skip-fire technologies improves fuel economy in multi-cylinder engines during partial load operation. These systems selectively disable cylinders when full power is unnecessary reducing pumping losses and friction. Furthermore, sophisticated engine management algorithms ensure seamless transitions maintaining driver comfort and emissions compliance. Thus, cylinder management technologies represent cost-effective efficiency enhancement complementing broader electrification strategies.

Regional Analysis

North America Dominates the Automotive Piston Engine System Market with a Market Share of 43.70%, Valued at USD 1.5 Billion

North America leads global automotive piston engine system market with 43.70% share valued at USD 1.5 Billion driven by extensive light truck and SUV production. The region’s preference for larger displacement engines and robust aftermarket infrastructure supports sustained piston system demand. Moreover, advanced manufacturing capabilities and proximity to major automotive OEMs strengthen North American supplier competitiveness globally.

Europe Automotive Piston Engine System Market Trends

Europe demonstrates strong piston engine innovation focused on downsized turbocharged configurations meeting stringent emission standards. European manufacturers pioneer advanced diesel technologies and premium gasoline engines incorporating sophisticated piston designs. Additionally, robust commercial vehicle production across Germany, France, and Italy generates substantial heavy-duty piston demand. However, aggressive electrification policies create uncertainty regarding long-term market trajectories.

Asia Pacific Automotive Piston Engine System Market Trends

Asia Pacific represents fastest-growing regional market driven by expanding automotive production in China, India, and Southeast Asian nations. Rising middle-class incomes stimulate passenger vehicle demand while commercial vehicle growth supports infrastructure development. Moreover, local manufacturers increasingly develop indigenous piston technologies reducing import dependence. Therefore, Asia Pacific offers substantial growth opportunities despite intensifying competition.

Latin America Automotive Piston Engine System Market Trends

Latin America maintains steady piston system demand supported by established automotive manufacturing presence in Brazil and Mexico. The region favors flex-fuel engine configurations compatible with ethanol blends requiring specialized piston materials and coatings. Additionally, cost-sensitive markets prioritize durability and serviceability over advanced efficiency technologies. Consequently, Latin America represents stable market with moderate growth potential.

Middle East & Africa Automotive Piston Engine System Market Trends

Middle East and Africa demonstrate growing automotive piston demand driven by infrastructure investments and increasing vehicle ownership rates. Harsh operating environments including extreme temperatures and poor fuel quality necessitate robust piston designs with enhanced wear resistance. Moreover, commercial vehicle growth supporting construction and logistics sectors generates incremental market opportunities. Therefore, the region presents emerging growth potential despite current limited market size.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Aisin Seiki maintains leadership position through comprehensive powertrain component portfolio and deep integration with Toyota manufacturing systems. The company leverages advanced metallurgy expertise and precision manufacturing capabilities delivering high-performance piston systems across passenger and commercial segments. Moreover, Aisin invests substantially in hybrid powertrain technologies positioning for evolving market requirements. Therefore, the company demonstrates balanced approach supporting both traditional and electrified vehicle architectures.

Mahle GmbH operates as premier global supplier specializing in engine systems and components with particular strength in piston technology innovation. The company pioneered numerous advanced piston designs including gallery-cooled configurations and lightweight aluminum constructions. Additionally, Mahle develops sophisticated thermal management solutions optimizing piston cooling and reducing friction losses. Consequently, the company maintains technological leadership driving industry performance benchmarks.

Federal Mogul Holding LLC delivers extensive aftermarket presence complementing original equipment manufacturing capabilities across diverse vehicle applications. The company’s broad product portfolio spans economy to premium performance pistons serving global replacement demand. Furthermore, Federal Mogul operates comprehensive distribution networks ensuring parts availability supporting vehicle longevity. Thus, the company capitalizes on substantial aftermarket opportunities generated by global vehicle parc.

Tenneco Inc provides integrated powertrain solutions combining piston systems with emission control and ride performance technologies. The company emphasizes clean air products addressing stringent regulatory requirements while maintaining combustion efficiency. Moreover, Tenneco pursues strategic acquisitions expanding technological capabilities and market reach. Therefore, the company positions as comprehensive supplier addressing complex automotive system integration challenges.

Key Players

- Aisin Seiki

- Capricorn Automotive

- Federal Mogul Holding LLC

- Mahle GmbH

- Rheinmetall

- Hitachi Automotive Systems

- Shriram Pistons & Rings Ltd

- Magna International

- Tenneco Inc

- Riken Corporation

- PT Astra Otoparts Tbk

Recent Developments

- January 2025– American Axle and Manufacturing agreed to acquire GKN Automotiv e owner Dowlais in cash-and-stock transaction valuing the London-listed firm at approximately USD 1.44 billion. This strategic acquisition expands American Axle’s drivetrain capabilities and global manufacturing footprint across key automotive markets.

- December 2024 – Saudi Aramco completed acquisition of 10 percent stake in Horse Powertrain, the Renault-Geely joint internal-combustion venture, at valuation of EUR 7.4 billion. This investment demonstrates continued confidence in advanced internal combustion engine development supporting energy transition strategies.

Report Scope

Report Features Description Market Value (2025) USD 3.6 Billion Forecast Revenue (2035) USD 5.9 Billion CAGR (2026-2035) 5.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material Type (Cast Iron, Aluminum Alloy, Others), By Component Type (Piston, Piston Ring, Piston Pin), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Cars, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aisin Seiki, Capricorn Automotive, Federal Mogul Holding LLC, Mahle GmbH, Rheinmetall, Hitachi Automotive Systems, Shriram Pistons & Rings Ltd, Magna International, Tenneco Inc, Riken Corporation, PT Astra Otoparts Tbk Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Piston Engine System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Piston Engine System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Aisin Seiki

- Capricorn Automotive

- Federal Mogul Holding LLC

- Mahle GmbH

- Rheinmetall

- Hitachi Automotive Systems

- Shriram Pistons & Rings Ltd

- Magna International

- Tenneco Inc

- Riken Corporation

- PT Astra Otoparts Tbk