Global Automotive Biometric Market Size, Share, Growth Analysis By Offering (Hardware, Software, Service), By Technology (Fingerprint Recognition, Facial Recognition, Voice Recognition, Iris Recognition), By Application (Vehicle Access Control, Driver Identification & Personalization, Driver Monitoring Systems (DMS), Infotainment & HMI Control, In-Car Payment Authentication), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168822

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

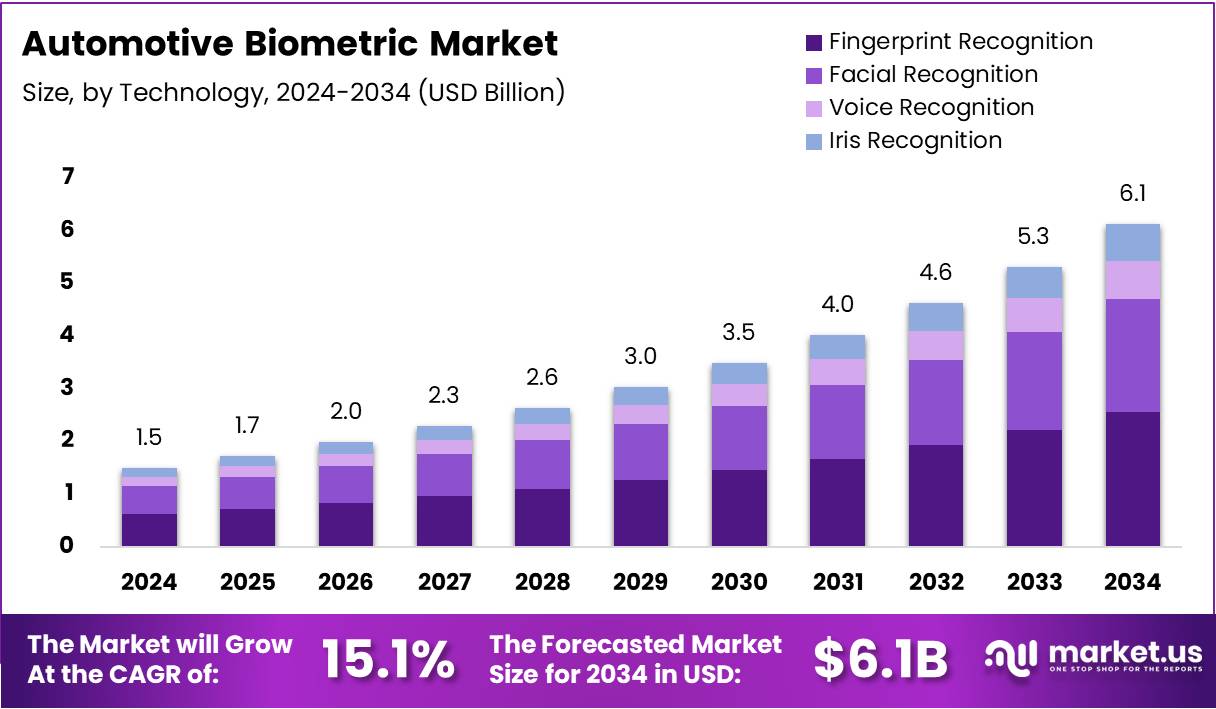

The Global Automotive Biometric Market size is expected to be worth around USD 6.1 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 15.1% during the forecast period from 2025 to 2034.

The automotive biometric market covers technologies enabling identity verification and driver authentication inside vehicles securely. It involves fingerprint sensors, facial recognition, voice analysis, eye-scan or hand-geometry systems enabling seamless driver identification and personalization features. These solutions support secure vehicle access, personalized settings and driver verification while integrating convenience and trust into modern mobility experiences.

In recent years demand has surged due to rising security concerns and digital transformation across the auto industry. OEMs increasingly integrate in-vehicle biometrics for safer access and theft prevention. Consequently automotive-biometric adoption accelerates and market forecasts expect robust growth driven by consumer demand for secure and personalized vehicle experiences.

Moreover these systems offer expanded opportunities in fleet management, driver identity verification and shared mobility services. Biometric access control enables contactless entry and startup authorisation for car-sharing services. Additionally driver monitoring via facial or eye recognition supports fatigue detection and improves overall safety. Therefore biometric solutions align with mobility and security trends across urban transportation networks.

Simultaneously governments worldwide encourage adoption by updating safety guidelines and data-protection regulations. Regulatory frameworks now require secure personal data handling for biometric storage and usage throughout automotive systems. Incentives and grants support research in driver-authentication technologies and related privacy controls. Consequently public policies nurture biometric compliance and help build industry confidence.

Furthermore consumer acceptance appears strong. According to research, 74.8 % indicated comfort with fingerprint use, while 66.2 % accepted voice samples. Additionally 63 % accepted hand-geometry, 61.1 % accepted facial imaging and 60.6 % accepted eye scans. These figures reflect growing public trust and readiness for biometric adoption inside vehicles.

According to industry research, more than 2,000,000 cars currently operate with advanced driver-monitoring biometric systems globally. This demonstrates substantial real-world implementation and validates market potential. Therefore the automotive biometric market holds significant opportunity, with wider deployment promising enhanced security, improved user convenience and stronger regulatory compliance across future mobility ecosystems.

Key Takeaways

- Global Automotive Biometric Market expected to reach USD 6.1 Billion by 2034 from USD 1.5 Billion in 2024, growing at a 15.1% CAGR.

- By Offering, Hardware dominates with a 56.9% share in 2024.

- By Technology, Fingerprint Recognition leads with a 37.4% market share in 2024.

- By Application, Vehicle Access Control holds the largest share at 39.6% in 2024.

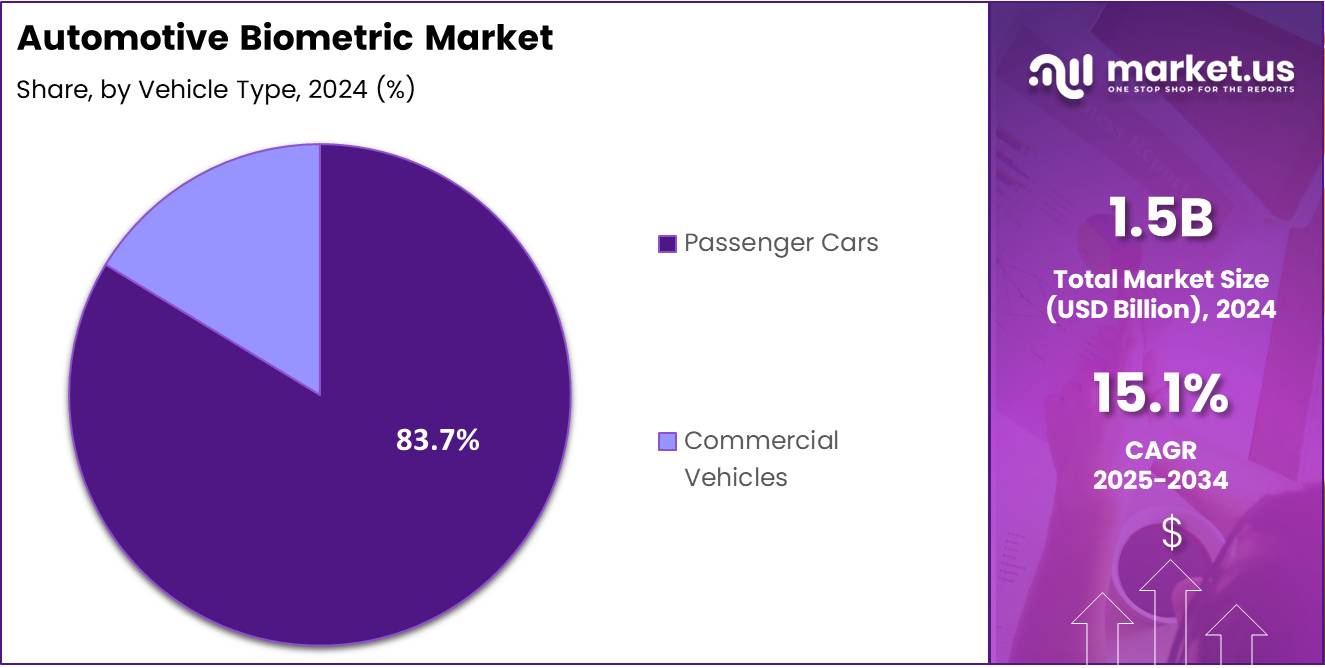

- By Vehicle Type, Passenger Cars dominate with a 83.7% share in 2024.

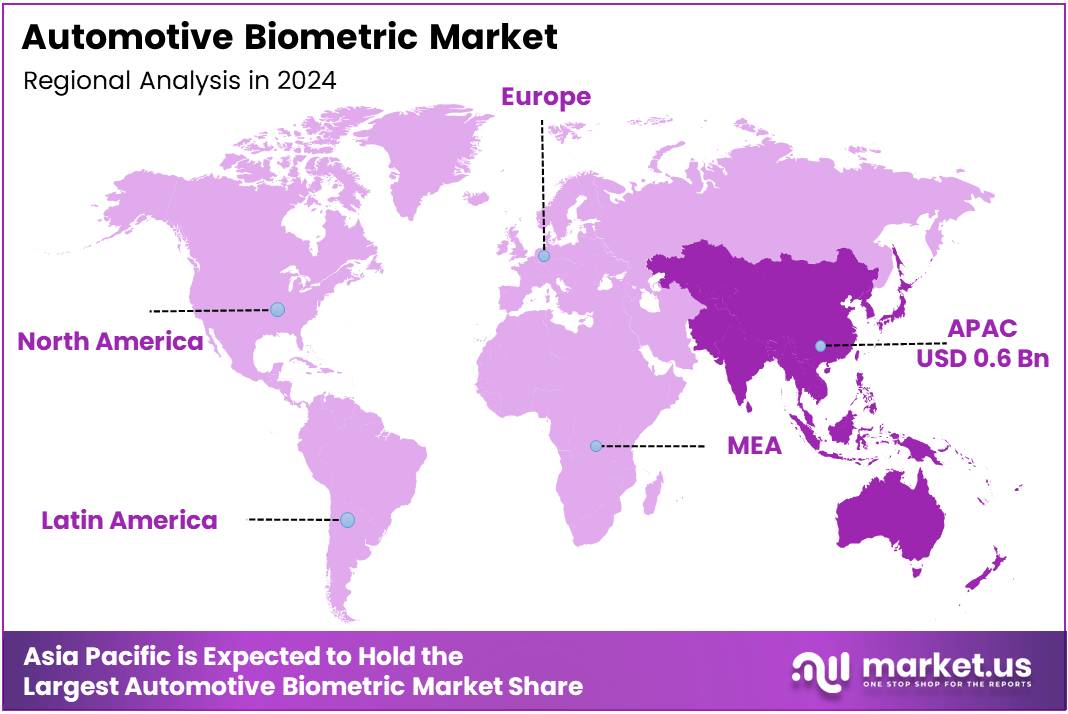

- Asia Pacific is the leading region with 42.8% market share, valued at USD 0.6 Billion in 2024.

By Offering Analysis

Hardware dominates with 56.9% owing to its strong integration across modern vehicles.

In 2024, Hardware held a dominant market position in the By Offering segment of the Automotive Biometric Market, with a 56.9% share. It accelerated adoption as OEMs increasingly embedded biometric modules such as sensors and scanners to enhance secure access, in-car personalization, and real-time authentication.

Software continued gaining traction within the By Offering segment. It advanced biometric capabilities by enabling faster processing, multimodal recognition, and cloud-linked identity management. Automakers used software layers to improve accuracy and reduce false matches, thereby strengthening vehicle-level safety outcomes and user experience.

Service steadily expanded across the By Offering segment. It supported long-term system maintenance, calibration, and upgrades of biometric-enabled vehicles. Increasing dealership-level support, remote diagnostics, and subscription-based authentication services contributed to recurring revenues and fostered trust among end users adopting advanced in-car biometrics.

By Technology Analysis

Fingerprint Recognition dominates with 37.4% due to its reliability and cost-efficiency.

In 2024, Fingerprint Recognition held a dominant market position in the By Technology segment, securing a 37.4% share. It gained momentum as automakers favored compact, low-cost fingerprint sensors for secure vehicle entry, ignition authorization, and user-specific settings without requiring additional external hardware.

Facial Recognition advanced within the By Technology segment. It enhanced hands-free authentication by utilizing cabin cameras for seamless driver verification. Automakers adopted this technology to improve safety, reduce theft, and personalize cabin experiences through real-time detection and adaptive comfort settings.

Voice Recognition steadily progressed in the By Technology segment. It offered convenient, touch-free command execution while supporting biometric authentication. As connected infotainment systems grew, voice-based identity verification gained importance for in-car payments, personalized profiles, and secure access to digital vehicle functions.

Iris Recognition gained attention within the By Technology segment. It delivered high-precision authentication ideal for premium vehicles. Although adoption remained niche, its accuracy and spoof-resistance positioned it as an emerging solution for future advanced driver verification and secure cockpit environments.

By Application Analysis

Vehicle Access Control dominates with 39.6% due to rising demand for secure authentication.

In 2024, Vehicle Access Control held a dominant market position in the By Application segment, capturing a 39.6% share. It expanded rapidly as consumers preferred biometric-based entry and start systems that eliminate key dependency and strengthen theft prevention while ensuring fast and secure access.

Driver Identification & Personalization advanced within the By Application segment. It enabled automated adjustment of mirrors, seating, climate, and infotainment preferences. OEMs deployed personalized biometric profiles to enhance comfort and streamline user experiences for multi-driver households and shared mobility fleets.

Driver Monitoring Systems (DMS) grew significantly in the By Application segment. It leveraged biometric cues to detect drowsiness, distraction, and cognitive patterns. With regulatory focus on road safety, DMS adoption accelerated across passenger and commercial vehicles to reduce accidents and improve vigilance.

Infotainment & HMI Control gained momentum in the By Application segment. It introduced biometric-based user commands for seamless interaction with navigation, media, and vehicle settings. The shift toward multimodal interfaces strengthened its role in enhancing convenience and supporting secure in-car digital operations.

By Vehicle Type Analysis

Passenger Cars dominate with 83.7% driven by widespread OEM integration.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment, with a remarkable 83.7% share. It benefitted from strong consumer demand for advanced safety, personalization, and secure access features. Automakers increasingly embedded biometrics into mid-range and premium models.

Commercial Vehicles steadily expanded within the By Vehicle Type segment. Fleet operators adopted biometrics to verify authorized drivers, monitor fatigue, and manage vehicle usage. As safety regulations tightened, biometric-enabled commercial fleets improved compliance, operational efficiency, and secure access management across diverse transportation environments.

Key Market Segments

By Offering

- Hardware

- Software

- Service

By Technology

- Fingerprint Recognition

- Facial Recognition

- Voice Recognition

- Iris Recognition

By Application

- Vehicle Access Control

- Driver Identification & Personalization

- Driver Monitoring Systems (DMS)

- Infotainment & HMI Control

- In-Car Payment Authentication

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Drivers

Strong Push for Enhanced Vehicle Anti-Theft and Identity Verification Systems Drives Market Growth

The automotive biometric market is gaining strong momentum as car manufacturers and technology providers focus on building safer and more secure vehicles. One of the key drivers is the growing need for advanced anti-theft solutions. With vehicle theft becoming more sophisticated, automakers are adopting fingerprint, facial, and voice-based authentication to ensure only authorized users can access and operate the vehicle. This shift not only improves security but also builds consumer trust in modern mobility systems.

Another major driver is the increasing adoption of biometric technologies to comply with emerging safety and driver monitoring regulations. Governments and regulatory bodies are encouraging or mandating systems that can detect driver fatigue, distraction, or impairment. Biometric sensors play an essential role here by analyzing eye movement, facial expressions, or heart rate, helping prevent accidents and supporting safer driving environments.

Additionally, the rapid expansion of connected and autonomous vehicles is accelerating the use of biometrics. As vehicles become more digital and personalized, biometrics enable seamless interaction between the driver and in-car systems. Features such as personalized settings, secure digital payments, and real-time identity verification enhance overall user experience. Together, these factors create a strong foundation for sustained growth in the automotive biometric market.

Restraints

Low Consumer Trust Due to Data Privacy and Identity Misuse Concerns

Growing data privacy concerns are becoming a major restraint for the automotive biometric market. Many customers still hesitate to share their biometric information, such as fingerprints or facial data, due to fear of misuse. This lack of trust slows adoption, even when the technology offers strong security benefits. As vehicles become more connected, consumers worry about how their personal data is stored, who manages it, and whether it can be accessed by unauthorized parties. This uncertainty makes buyers cautious and limits the pace at which automakers can roll out biometric solutions.

Another key restraint is the limited interoperability between biometric systems offered by different automotive brands. Since each manufacturer uses its own hardware and software standards, these systems do not work seamlessly across brands or platforms. This creates a fragmented ecosystem, where biometric authentication cannot be easily transferred or recognized from one vehicle to another. As a result, drivers do not get a unified experience, and automakers face higher integration costs.

Growth Factors

Integration of Voice and Emotion Recognition Enhances Market Potential

The automotive biometric market offers strong growth opportunities as carmakers begin to integrate advanced voice and emotion recognition systems into vehicles. These technologies allow cars to understand driver mood, stress levels, and preferences, enabling a more personalized and safer in-car experience. As consumers increasingly expect comfort-driven digital features, automakers are shifting toward intelligent cabins that adapt automatically, creating space for rapid expansion in biometric innovation.

Another major opportunity lies in the development of biometric-based payment and in-vehicle transaction platforms. These systems use fingerprint, facial, or voice authentication to enable secure fuel payments, toll payments, and subscription services directly from the dashboard. As connected car ecosystems expand, secure biometric payments are expected to become a standard feature, offering convenience while reducing fraud risks.

The rise of contactless access solutions also presents a promising growth avenue, especially for electric vehicle (EV) charging and smart parking. Biometric authentication can simplify how drivers unlock charging points, authorize charging sessions, or access parking facilities without cards, apps, or physical keys. With more cities adopting smart mobility infrastructure, such solutions can significantly enhance user experience and operational efficiency across EV and urban mobility networks.

Emerging Trends

Rising Use of Biometric Cabin Monitoring Drives Market Trends

The automotive biometric market is seeing a strong shift toward driver well-being, with more vehicles using biometric cabin monitoring systems. These systems track vital signs and stress levels, helping detect fatigue or health issues in real time. This trend supports safer driving and personalized in-car experiences, making vehicles more responsive to occupants’ needs.

Luxury car segments are increasingly adopting multimodal biometric authentication. By combining fingerprint, facial, and voice recognition, these systems provide enhanced security and convenience. Consumers in this segment value seamless access and tailored vehicle settings, which encourages manufacturers to integrate multiple biometric technologies into a single platform.

Another key trend is the move toward on-device processing. Instead of sending data to the cloud, biometric information is processed locally within the vehicle. This approach ensures faster authentication and higher data security, addressing consumer concerns over privacy and reducing reliance on network connectivity.

Regional Analysis

Asia Pacific Dominates the Automotive Biometric Market with a Market Share of 42.8%, Valued at USD 0.6 Billion

In 2024, Asia Pacific held a dominant position in the automotive biometric market, accounting for a 42.8% share and valued at USD 0.6 Billion. The growth is driven by rapid adoption of connected vehicles, rising consumer awareness about vehicle security, and government initiatives promoting smart mobility solutions. Increasing production of luxury and electric vehicles in the region further supports the demand for in-car biometric systems.

North America Automotive Biometric Market Trends

North America is witnessing steady growth in automotive biometrics, fueled by high vehicle safety standards and stringent regulatory requirements. Adoption of advanced driver monitoring systems and biometric-based authentication for connected cars is accelerating market expansion. The region also benefits from early adoption of innovative technologies and strong consumer acceptance of biometric features.

Europe Automotive Biometric Market Trends

Europe shows consistent market development driven by the focus on vehicle safety, anti-theft measures, and compliance with EU driver monitoring regulations. Premium vehicle segments are increasingly integrating multimodal biometric solutions, enhancing both convenience and security for drivers. Growth is also supported by rising awareness around data privacy and secure access systems.

Middle East and Africa Automotive Biometric Market Trends

The Middle East and Africa region is gradually adopting automotive biometrics, with growth supported by luxury vehicle sales and investments in smart city initiatives. Rising security concerns and demand for premium in-car experiences are driving adoption of fingerprint, facial, and voice recognition systems in vehicles.

Latin America Automotive Biometric Market Trends

Latin America is experiencing emerging interest in automotive biometrics, mainly in high-end vehicles and fleet management. Government focus on vehicle security and growing awareness of biometric technologies among consumers is gradually expanding the market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Biometric Company Insights

The global automotive biometric market in 2024 continues to mature as automakers look beyond traditional keyless entry and driver identification systems, increasingly incorporating fingerprint, facial, and behavioral biometric authentication to enhance vehicle security and personalize user experience. Market momentum is driven by growing concerns over vehicle theft, increasing demand for shared mobility, and rising passenger expectations for seamless, secure access. Against this backdrop, several technology leaders stand out for their strategic positioning and product development efforts.

Fujitsu Limited remains a prominent player, leveraging its strong background in biometric authentication and large-scale enterprise security solutions to adapt to in‑vehicle applications. Its ability to integrate fingerprint and facial recognition with secure backend services positions it well for OEM partnerships seeking scalable biometric implementations.

Synaptics Incorporated builds on its strengths in sensor development and human‑machine interface technologies to provide compact fingerprint modules ideal for modern vehicle interiors. Its sensor‑based solutions offer reliability and cost‑efficiency, making them a favorite for automakers aiming to integrate biometrics into entry and ignition systems without compromising design.

Continental AG benefits from its deep automotive heritage and understanding of in‑vehicle networks, allowing it to integrate biometric systems with legacy electronic control units and vehicle security frameworks. Its holistic automotive systems approach makes biometric authentication part of a broader vehicle safety and access control strategy, an advantage for OEMs seeking turnkey solutions.

Fingerprint Cards AB brings specialized biometric expertise with a focus on fingerprint sensor technology optimized for mobility environments. Its compact, low‑power sensors are well suited for inclusion in steering wheels, door handles, or center consoles — supporting seamless biometric authentication without requiring overt hardware redesign.

Top Key Players in the Market

- Fujitsu Limited

- Synaptics Incorporated

- Continental AG

- Fingerprint Cards AB

- Hitachi Ltd.

- Methode Electronics Inc.

- VOXX International Corporation

- Safran S.A.

- HID Global Corporation

- BioEnable Technologies Pvt. Ltd.

Recent Developments

- In Nov 2025: Gentex Corporation announced that it has acquired Toronto-based BioConnect, a leading company in biometric authentication solutions. This move is expected to strengthen Gentex’s capabilities in secure automotive identity verification and user experience.

- In April 2025: FORVIA and Smart Eye unveiled a new in-car system leveraging existing Driver Monitoring System (DMS) cameras for iris and facial biometric authentication. The system aims to enhance driver safety and enable seamless personalization features in vehicles.

- In November 2024: The Continental and trinamiX introduced the Invisible Biometrics Sensing Display, a cutting-edge automotive safety and comfort technology. This innovation focuses on contactless biometric sensing to improve both security and user convenience in cars.

- In Oct 2025: Ping Identity acquired the UK-based biometrics firm Keyless, expanding its global footprint in secure digital identity and authentication solutions. The acquisition will support enhanced biometric capabilities across automotive and enterprise applications.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 6.1 Billion CAGR (2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Service), By Technology (Fingerprint Recognition, Facial Recognition, Voice Recognition, Iris Recognition), By Application (Vehicle Access Control, Driver Identification & Personalization, Driver Monitoring Systems (DMS), Infotainment & HMI Control, In-Car Payment Authentication), By Vehicle Type (Passenger Cars, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fujitsu Limited, Synaptics Incorporated, Continental AG, Fingerprint Cards AB, Hitachi Ltd., Methode Electronics Inc., VOXX International Corporation, Safran S.A., HID Global Corporation, BioEnable Technologies Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Biometric MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Biometric MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fujitsu Limited

- Synaptics Incorporated

- Continental AG

- Fingerprint Cards AB

- Hitachi Ltd.

- Methode Electronics Inc.

- VOXX International Corporation

- Safran S.A.

- HID Global Corporation

- BioEnable Technologies Pvt. Ltd.