Global Automatic Liquid Filling Machine Market Size, Share, Growth Analysis By Automation Level (Fully Automatic Liquid Filling Machines, Manual Liquid Filling Machines, Semi-Automatic Liquid Filling Machines), By Filling Technology (Piston-Based Filling, Gravity Filling, Pressure Filling, Vacuum Filling, Pump-Based Filling, Others), By Filling Application (Bottles, Jars, Vials & Ampoules, Pouches, Aseptic Cartons, Cans & Jerry Cans, Drums & Barrels, Others), By End Use Industry (Food & Beverage, Healthcare & Pharmaceuticals, Cosmetic & Personal Care, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175815

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

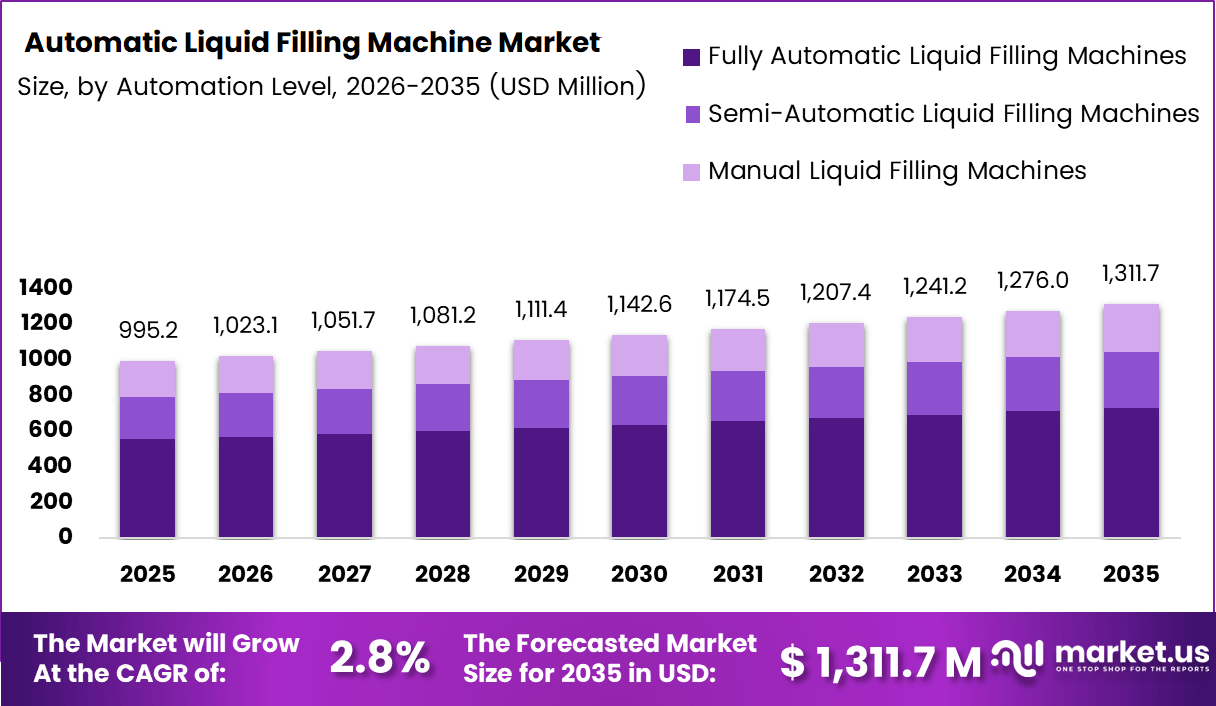

Global Automatic Liquid Filling Machine Market size is expected to be worth around USD 1,311.7 Million by 2035 from USD 995.2 Million in 2025, growing at a CAGR of 2.8% during the forecast period 2026 to 2035.

The automatic liquid filling machine market encompasses advanced packaging equipment designed to dispense precise liquid volumes into containers. These machines serve industries requiring high-speed, accurate filling operations. Moreover, they reduce manual labor while improving production efficiency and product consistency across manufacturing facilities.

Automation technology enables manufacturers to achieve faster throughput rates and minimize product wastage. Consequently, businesses can meet increasing consumer demand while maintaining strict quality standards. These systems integrate seamlessly with existing production lines, enhancing overall operational productivity and reducing human error significantly.

Market growth stems from expanding food and beverage production alongside pharmaceutical manufacturing requirements. Additionally, cosmetics and personal care sectors increasingly adopt automated solutions. Therefore, manufacturers invest in scalable filling technologies to support rising production volumes and maintain competitive advantages in global markets.

Government regulations emphasizing hygiene standards and product safety drive technology upgrades. Furthermore, initiatives supporting industrial automation and manufacturing modernization accelerate market expansion. However, compliance requirements vary across regions, influencing technology adoption rates and investment decisions among manufacturers seeking regulatory adherence.

Investment opportunities emerge as small and medium enterprises embrace automation technologies. Additionally, emerging economies experience rapid industrialization, creating demand for efficient packaging solutions. Consequently, market players develop cost-effective, modular systems tailored to diverse manufacturing requirements and budget constraints across different industry segments.

According to Kinex Cappers, automatic filling machines achieve speeds up to 100 bottles per minute with accuracy of +/- 0.5%, making them ideal for low to medium viscosity fluids with fill ranges from 0.5ml to 1 gallon. This precision capability supports manufacturers in minimizing product loss while maximizing throughput efficiency.

According to Adinath Pharma, modern systems feature all contact parts made of SS316 material with easy removal systems for auto-claving, sterilization, and cleaning, while machine construction utilizes SS304 material. These design specifications ensure compliance with stringent hygiene requirements across pharmaceutical and food processing applications worldwide.

Key Takeaways

- Global Automatic Liquid Filling Machine Market valued at USD 995.2 Million in 2025, projected to reach USD 1,311.7 Million by 2035

- Market growing at a CAGR of 2.8% during the forecast period 2026-2035

- Fully Automatic Liquid Filling Machines segment dominates with 55.8% market share in 2025

- Piston-Based Filling technology holds 45.4% share among filling technology segments

- Bottles application segment leads with 55.7% market share in filling applications

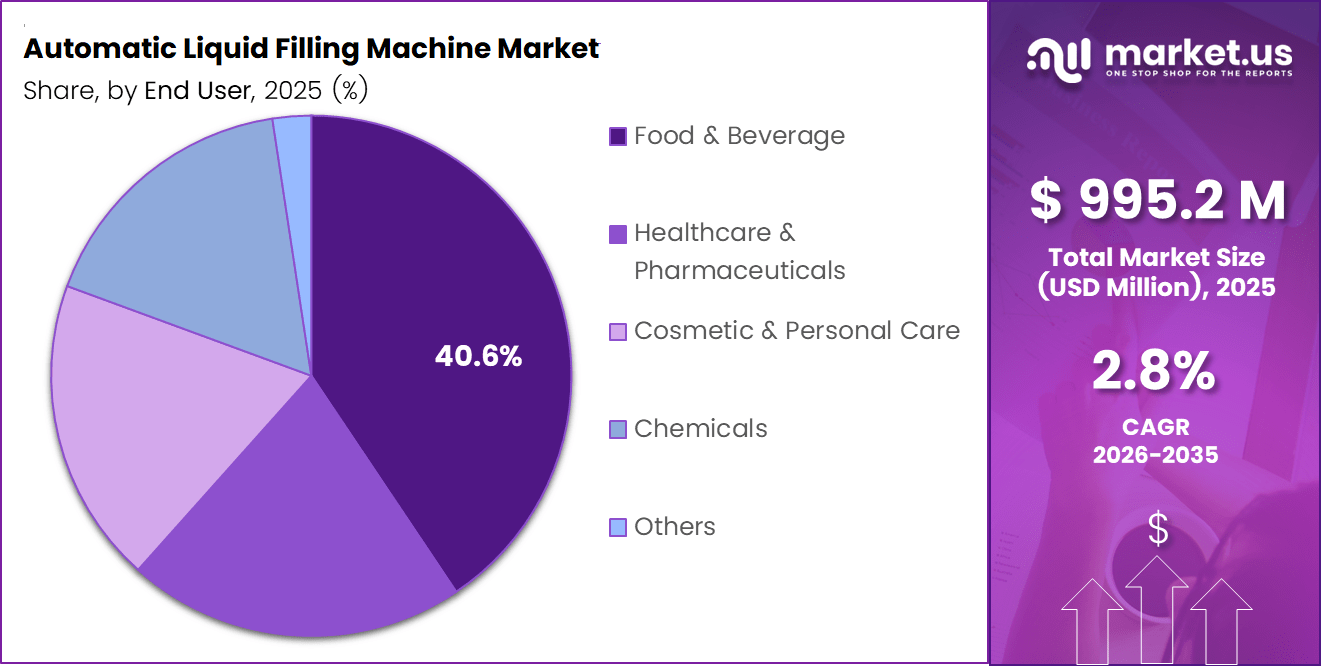

- Food & Beverage industry represents 40.6% of end-use market demand

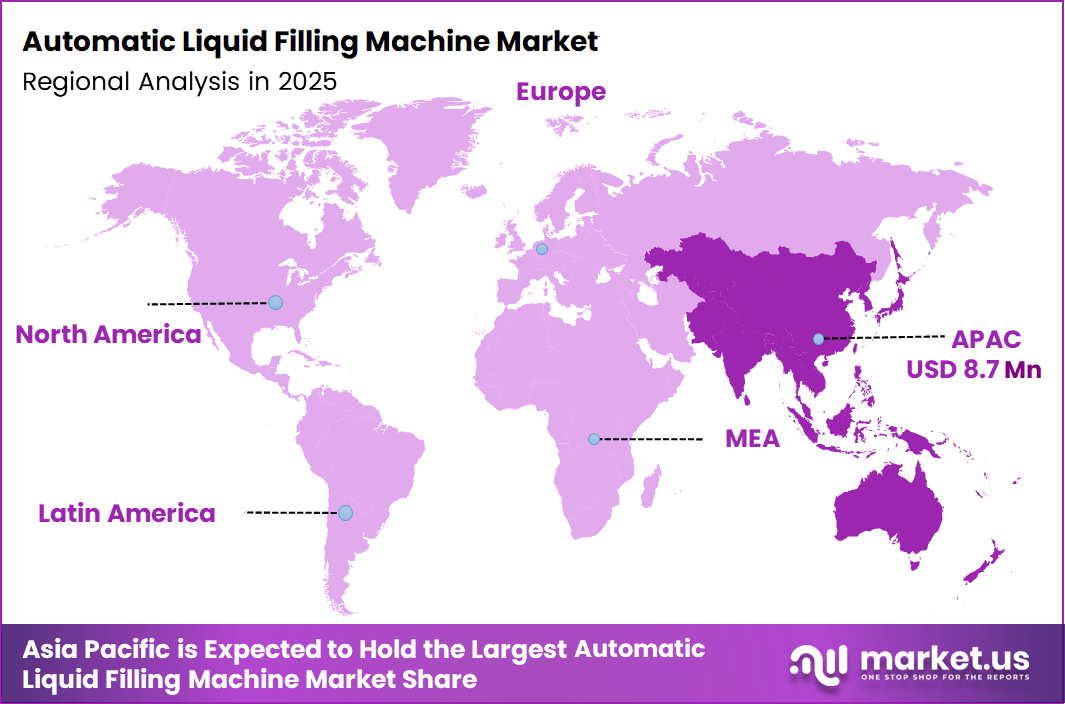

- Asia Pacific dominates regional market with 34.5% share, valued at USD 8.7 Million

Automation Level Analysis

Fully Automatic Liquid Filling Machines dominate with 55.8% due to superior efficiency and reduced labor dependency.

In 2025, Fully Automatic Liquid Filling Machines held a dominant market position in the By Automation Level segment of Automatic Liquid Filling Machine Market, with a 55.8% share. These systems deliver maximum throughput while eliminating manual intervention requirements. Consequently, manufacturers achieve consistent filling accuracy and reduced operational costs across high-volume production environments.

Manual Liquid Filling Machines serve niche applications requiring flexibility and lower capital investment. These systems appeal to small-scale operations and specialty product manufacturers. However, they involve higher labor costs and slower production speeds. Therefore, adoption remains limited to specific use cases where automation benefits don’t justify investment requirements.

Semi-Automatic Liquid Filling Machines offer balanced solutions combining operator control with mechanical assistance. These systems suit medium-scale operations requiring moderate production volumes. Moreover, they provide cost-effective automation without fully automated system complexity. Additionally, they enable manufacturers to gradually transition toward complete automation while maintaining operational flexibility.

Filling Technology Analysis

Piston-Based Filling dominates with 45.4% due to versatility across viscosity ranges and precise volumetric control.

In 2025, Piston-Based Filling held a dominant market position in the By Filling Technology segment of Automatic Liquid Filling Machine Market, with a 45.4% share. This technology handles diverse product viscosities effectively. Furthermore, it delivers accurate dosing for both thin and thick liquids. Consequently, manufacturers prefer piston systems for applications requiring consistent volume control.

Gravity Filling technology relies on liquid weight for container filling operations. This method suits low-viscosity products and simple applications. Moreover, it requires minimal maintenance and offers cost-effective solutions. However, filling accuracy depends on liquid properties and environmental conditions affecting flow rates during production processes.

Pressure Filling utilizes compressed air or gas to force liquid into containers rapidly. This technology enables high-speed filling operations for carbonated beverages. Additionally, it maintains product integrity by controlling pressure levels. Therefore, beverage manufacturers widely adopt this method for consistent filling performance across production lines.

Vacuum Filling creates negative pressure to draw liquid into containers precisely. This technology prevents foaming and maintains product quality during filling. Moreover, it suits applications requiring gentle handling of sensitive liquids. Consequently, pharmaceutical and cosmetic industries prefer vacuum systems for premium product packaging.

Pump-Based Filling employs mechanical pumps to dispense liquids accurately. These systems handle various viscosities with adjustable flow rates. Additionally, they offer flexibility for different container sizes. However, pump selection depends on product characteristics and required filling speeds for specific manufacturing applications.

Others category includes specialized filling technologies serving unique application requirements. These systems address niche market demands with customized solutions. Moreover, they incorporate innovative approaches for challenging liquid products. Therefore, manufacturers develop proprietary technologies to differentiate their offerings in competitive markets.

Filling Application Analysis

Bottles dominate with 55.7% due to widespread use across beverage, pharmaceutical, and personal care industries.

In 2025, Bottles held a dominant market position in the By Filling Application segment of Automatic Liquid Filling Machine Market, with a 55.7% share. Bottle packaging offers consumer convenience and product protection effectively. Furthermore, automated filling systems handle diverse bottle shapes and sizes efficiently. Consequently, manufacturers invest heavily in bottle-specific filling technologies supporting high-volume production requirements.

Jars serve food products, cosmetics, and pharmaceutical preparations requiring wider openings. These containers accommodate thicker products and facilitate consumer usage. Moreover, automated jar filling systems ensure precise dosing while minimizing spillage. Additionally, jar packaging appeals to premium product segments where presentation influences purchasing decisions significantly.

Vials & Ampoules cater to pharmaceutical and medical applications demanding sterile filling processes. These small containers require high-precision dosing and contamination-free handling. Consequently, aseptic filling technologies dominate this segment. Therefore, pharmaceutical manufacturers invest in specialized equipment ensuring compliance with stringent regulatory standards.

Pouches represent growing packaging format offering lightweight, flexible solutions. These containers reduce material costs and storage space requirements. Moreover, pouch filling technology advances enable liquid product packaging efficiently. Additionally, sustainability trends drive pouch adoption across food and beverage categories seeking eco-friendly alternatives.

Aseptic Cartons provide shelf-stable packaging for beverages and liquid foods without refrigeration. This format extends product shelf life significantly through sterile filling processes. Furthermore, it reduces distribution costs and environmental impact. Consequently, dairy and juice manufacturers increasingly adopt aseptic carton filling technologies.

Cans & Jerry Cans serve industrial liquids, lubricants, and bulk beverages requiring durable packaging. These containers withstand transportation stress and offer long-term storage stability. Moreover, automated filling systems handle various can sizes efficiently. Therefore, chemical and automotive industries rely on can filling equipment.

Drums & Barrels accommodate large-volume liquid products for industrial and commercial applications. These containers require specialized filling equipment handling substantial quantities accurately. Additionally, drum filling systems incorporate safety features managing hazardous materials. Consequently, chemical manufacturers invest in robust filling solutions ensuring worker safety.

Others category encompasses specialized containers serving unique industry requirements. These applications include tubes, sachets, and custom packaging formats. Moreover, manufacturers develop flexible filling systems adapting to evolving packaging trends. Therefore, innovation continues addressing emerging market demands across diverse product categories.

End Use Industry Analysis

Food & Beverage dominates with 40.6% due to massive production volumes and diverse liquid product portfolios.

In 2025, Food & Beverage held a dominant market position in the By End Use Industry segment of Automatic Liquid Filling Machine Market, with a 40.6% share. This industry demands high-speed filling equipment supporting enormous production capacities. Furthermore, product variety requires versatile filling technologies handling different viscosities. Consequently, food and beverage manufacturers represent the largest customer segment driving market growth.

Healthcare & Pharmaceuticals require precision filling equipment ensuring dosage accuracy and sterile conditions. These industries prioritize compliance with stringent regulatory standards and quality protocols. Moreover, pharmaceutical filling systems incorporate advanced aseptic technologies preventing contamination. Additionally, growing healthcare demand globally drives investment in automated pharmaceutical packaging solutions.

Cosmetic & Personal Care sector emphasizes aesthetic packaging and precise product dispensing. These manufacturers seek filling equipment delivering consistent quality across premium product lines. Furthermore, automation reduces production costs while maintaining brand standards. Consequently, cosmetic companies invest in flexible filling systems accommodating diverse product formulations.

Chemicals industry handles hazardous and industrial liquids requiring specialized filling equipment. These applications demand robust systems ensuring worker safety and environmental protection. Moreover, chemical filling machines withstand corrosive materials and harsh operating conditions. Therefore, manufacturers develop durable equipment meeting industry-specific safety requirements.

Others category includes industries like automotive lubricants, household cleaners, and agricultural chemicals. These sectors require customized filling solutions addressing unique product characteristics. Additionally, emerging applications create new market opportunities for specialized equipment. Consequently, manufacturers diversify offerings to capture niche industry segments.

Key Market Segments

By Automation Level

- Fully Automatic Liquid Filling Machines

- Manual Liquid Filling Machines

- Semi-Automatic Liquid Filling Machines

By Filling Technology

- Piston-Based Filling

- Gravity Filling

- Pressure Filling

- Vacuum Filling

- Pump-Based Filling

- Others

By Filling Application

- Bottles

- Jars

- Vials & Ampoules

- Pouches

- Aseptic Cartons

- Cans & Jerry Cans

- Drums & Barrels

- Others

By End Use Industry

- Food & Beverage

- Healthcare & Pharmaceuticals

- Cosmetic & Personal Care

- Chemicals

- Others

Drivers

Rising Demand for High-Speed Packaging Drives Automatic Filling Machine Adoption

Food, beverage, and pharmaceutical industries require rapid production capabilities meeting growing consumer demand. Consequently, manufacturers invest in high-speed automatic filling systems achieving superior throughput rates. Moreover, these technologies reduce production time while maintaining consistent quality standards. Therefore, automation becomes essential for competitive advantage in fast-paced markets.

Reducing labor dependency represents critical priority as workforce costs increase globally. Additionally, human error risks product quality and safety in sensitive applications. Consequently, automated filling systems eliminate inconsistencies while improving operational reliability. Furthermore, manufacturers achieve better resource allocation by deploying workers to value-added tasks rather than repetitive filling operations.

Precision filling minimizes product wastage and spillage, directly impacting profitability margins. Moreover, accurate dosing ensures regulatory compliance and customer satisfaction across industries. Therefore, businesses prioritize automated systems delivering consistent volumetric control. Additionally, reduced wastage supports sustainability initiatives while lowering raw material costs significantly across manufacturing operations.

Restraints

High Capital Investment Requirements Limit Market Accessibility

Advanced automatic filling systems require substantial initial capital expenditure for procurement and installation. Consequently, small and medium enterprises face financial barriers adopting sophisticated automation technologies. Moreover, customization costs increase when adapting equipment to specific production requirements. Therefore, budget constraints limit market penetration among cost-sensitive manufacturers seeking automation benefits.

Automated machinery involves complex maintenance protocols requiring specialized technical expertise and spare parts inventory. Additionally, unexpected downtime disrupts production schedules and reduces operational efficiency significantly. Consequently, manufacturers must invest in preventive maintenance programs and technical training. Furthermore, maintenance costs accumulate over equipment lifecycle, impacting total ownership expenses.

System failures create production bottlenecks affecting delivery commitments and customer relationships. Moreover, repair times extend when specialized components require replacement or technical support. Therefore, manufacturers weigh automation benefits against downtime risks when making investment decisions. Additionally, backup systems and redundancy measures increase overall capital requirements for reliable operations.

Growth Factors

Industrial Expansion in Emerging Markets Accelerates Demand

Emerging economies experience rapid manufacturing sector growth driving packaging equipment demand. Consequently, regions like Asia Pacific, Latin America, and Africa invest heavily in production infrastructure. Moreover, rising middle-class populations increase consumer product consumption requiring automated filling solutions. Therefore, equipment manufacturers target these high-growth markets with tailored offerings.

Manufacturers increasingly require flexible filling systems handling multiple product formats and container types. Additionally, customization capabilities enable quick changeovers supporting diverse product portfolios. Consequently, equipment suppliers develop modular designs accommodating varying production requirements. Furthermore, multi-format solutions reduce capital expenditure by eliminating need for dedicated filling lines.

Small and medium enterprises recognize automation benefits for scaling operations and improving competitiveness. Moreover, equipment manufacturers introduce affordable, compact systems targeting this segment. Consequently, SME adoption accelerates market growth beyond traditional large-scale manufacturers. Additionally, government initiatives supporting SME modernization further drive automation technology accessibility.

Emerging Trends

Smart Technology Integration Transforms Filling Operations

IoT sensors and connectivity enable real-time monitoring of filling operations and equipment performance. Consequently, manufacturers gain data insights optimizing production efficiency and predictive maintenance scheduling. Moreover, smart systems detect anomalies early, preventing quality issues and costly downtime. Therefore, digital transformation becomes critical competitive differentiator in modern manufacturing environments.

Servo-driven systems deliver superior precision, speed control, and energy efficiency compared to traditional technologies. Additionally, fully automatic configurations minimize operator intervention while maximizing production consistency. Consequently, manufacturers transition toward advanced servo systems supporting Industry 4.0 initiatives. Furthermore, these technologies reduce mechanical wear and maintenance requirements significantly.

Pharmaceutical and food industries demand aseptic filling technologies preventing contamination in sensitive liquid products. Moreover, hygienic design standards ensure compliance with stringent regulatory requirements across global markets. Consequently, equipment suppliers prioritize cleanroom-compatible systems with sterilization capabilities. Additionally, aseptic technology adoption expands beyond traditional applications into premium consumer products.

Regional Analysis

Asia Pacific Dominates the Automatic Liquid Filling Machine Market with a Market Share of 34.5%, Valued at USD 8.7 Million

Asia Pacific leads the global market driven by extensive manufacturing activities and industrial expansion. The region hosts major food, beverage, and pharmaceutical production facilities requiring high-volume filling equipment. Moreover, countries like China, India, and Japan invest heavily in automation technologies supporting economic growth. Consequently, Asia Pacific maintains its dominant position with 34.5% market share valued at USD 8.7 Million.

North America Automatic Liquid Filling Machine Market Trends

North America demonstrates strong demand driven by advanced manufacturing capabilities and stringent quality standards. The region emphasizes technological innovation and automation adoption across pharmaceutical and food industries. Moreover, established infrastructure and favorable regulatory frameworks support market growth. Therefore, North American manufacturers continuously upgrade filling equipment to maintain competitive advantages globally.

Europe Automatic Liquid Filling Machine Market Trends

Europe prioritizes sustainable manufacturing practices and compliance with strict environmental regulations. The region’s pharmaceutical and cosmetic industries drive demand for precision filling technologies. Additionally, Industry 4.0 initiatives accelerate smart manufacturing adoption across European production facilities. Consequently, equipment suppliers focus on energy-efficient, digitally integrated filling solutions meeting European market requirements.

Latin America Automatic Liquid Filling Machine Market Trends

Latin America experiences growing industrialization and expanding consumer markets driving packaging equipment demand. Countries like Brazil and Mexico invest in food processing and beverage production infrastructure. Moreover, regional manufacturers increasingly adopt automation technologies improving operational efficiency. Therefore, Latin America represents emerging opportunity for filling equipment suppliers targeting growth markets.

Middle East & Africa Automatic Liquid Filling Machine Market Trends

Middle East and Africa witness industrial diversification beyond traditional sectors into manufacturing and processing. The region’s pharmaceutical and food industries expand to meet rising domestic consumption. Additionally, government initiatives supporting local production capabilities drive equipment investments. Consequently, filling machine demand grows as manufacturers establish modern production facilities across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Filling Equipment Co. Inc. specializes in precision liquid filling technologies serving diverse industries globally. The company offers extensive nozzle configurations and custom solutions for rotary and straight-line filling applications. Moreover, their engineering expertise spans over six decades of innovation in packaging automation. Consequently, Filling Equipment maintains strong market presence through technical excellence and customer-focused solutions supporting various production requirements.

APACKS delivers comprehensive packaging solutions including liquid filling, capping, and labeling equipment. The company focuses on affordable automation technologies accessible to small and medium enterprises. Additionally, APACKS provides application-specific machines supporting diverse product viscosities and container formats. Therefore, they enable businesses to scale operations efficiently while maintaining quality standards across production processes.

Accutek Packaging Company, Inc. manufactures versatile filling equipment handling products from thin liquids to thick pastes. Their systems incorporate advanced technologies ensuring accurate dosing and minimal product wastage. Moreover, Accutek emphasizes customization capabilities addressing unique customer requirements across industries. Consequently, the company serves food, beverage, pharmaceutical, and cosmetic manufacturers requiring reliable, efficient filling solutions.

OPTIMA packaging group GmbH provides sophisticated packaging machinery combining filling, closing, and quality inspection technologies. The company specializes in pharmaceutical and life sciences applications demanding aseptic processing capabilities. Additionally, OPTIMA integrates smart technologies enabling data-driven production optimization and regulatory compliance. Therefore, they support manufacturers achieving highest quality standards in sensitive product packaging operations.

Key players

- Filling Equipment Co. Inc.

- APACKS

- Accutek Packaging Company, Inc.

- OPTIMA packaging group GmbH

- CDA USA

- Ronchi Mario S.p.A.

- Karmelle Ltd.

- Neostarpack Co., Ltd.

- Metalnova S.p.a.

- Adelphi Group of Companies

- KHS GmbH

- Krones AG

- ProMach Inc.

- Syntegon (Bosch)

- Mitsubishi Heavy Industries Ltd.

- Other Key Players

Recent Developments

- September 2024 – Acasi Machinery acquired Filling Equipment Co. Inc., adding over 60 years of engineering innovation to their portfolio. The acquisition expands Acasi’s product line with established customer base and extraordinary range of filling nozzles for both rotary and straight-line filling machines supporting diverse applications.

- January 2026 – Automated Industrial Robotics Inc. (AIR) announced acquisition of KAON Automation, an Ireland-based industrial automation company. The transaction expands AIR’s presence in medical and life sciences markets while enhancing capabilities across precision assembly, aseptic high-speed filling, and end-of-line automation technologies.

Report Scope

Report Features Description Market Value (2025) USD 995.2 Million Forecast Revenue (2035) USD 1,311.7 Million CAGR (2026-2035) 2.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Automation Level (Fully Automatic Liquid Filling Machines, Manual Liquid Filling Machines, Semi-Automatic Liquid Filling Machines), By Filling Technology (Piston-Based Filling, Gravity Filling, Pressure Filling, Vacuum Filling, Pump-Based Filling, Others), By Filling Application (Bottles, Jars, Vials & Ampoules, Pouches, Aseptic Cartons, Cans & Jerry Cans, Drums & Barrels, Others), By End Use Industry (Food & Beverage, Healthcare & Pharmaceuticals, Cosmetic & Personal Care, Chemicals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Filling Equipment Co. Inc., APACKS, Accutek Packaging Company Inc., OPTIMA packaging group GmbH, CDA USA, Ronchi Mario S.p.A., Karmelle Ltd., Neostarpack Co. Ltd., Metalnova S.p.a., Adelphi Group of Companies, KHS GmbH, Krones AG, ProMach Inc., Syntegon (Bosch), Mitsubishi Heavy Industries Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automatic Liquid Filling Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automatic Liquid Filling Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Filling Equipment Co. Inc.

- APACKS

- Accutek Packaging Company, Inc.

- OPTIMA packaging group GmbH

- CDA USA

- Ronchi Mario S.p.A.

- Karmelle Ltd.

- Neostarpack Co., Ltd.

- Metalnova S.p.a.

- Adelphi Group of Companies

- KHS GmbH

- Krones AG

- ProMach Inc.

- Syntegon (Bosch)

- Mitsubishi Heavy Industries Ltd.

- Other Key Players