Global Auto Repair Shop Insurance Market Size, Share and Analysis Report By Coverage Type (Garage Liability Insurance, Garagekeepers Liability Insurance, Commercial Property Insurance, Business Interruption Insurance, Workers' Compensation Insurance, Commercial Auto Insurance), By Shop Type (General Auto Repair Shops, Collision & Body Shops, Specialty Repair Shops (Transmission, Brakes, etc.), Franchise/Dealership Service Centers), By Shop Size (Small Independent Shops, Medium-Sized Shops, Large/Multi-Bay Operations), By Policy Duration (Annual Policies, Monthly Payment Plans), By Sales Channel (Independent Insurance Agents/Brokers, Direct/Online Carriers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175357

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Coverage Type Analysis

- Shop Type Analysis

- Shop Size Analysis

- Policy Duration Analysis

- Sales Channel Analysis

- U.S. Market Size

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

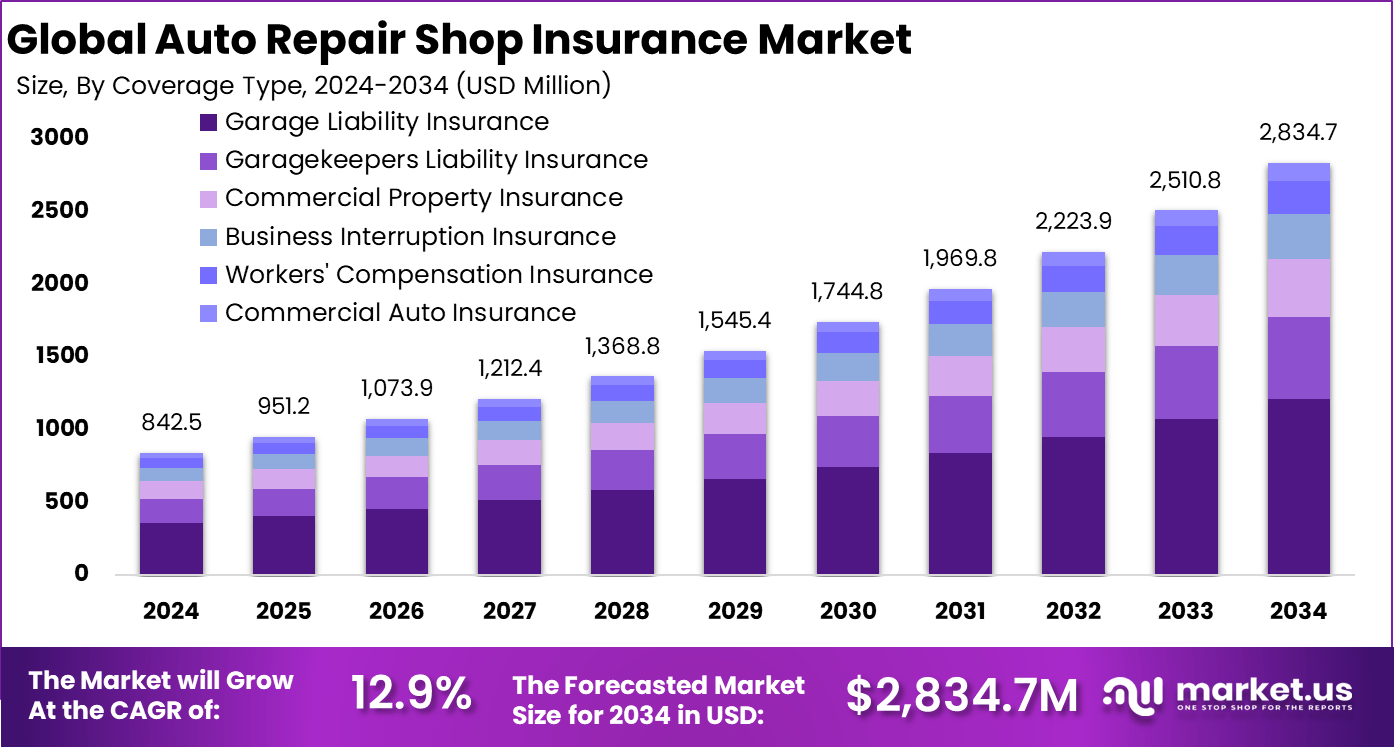

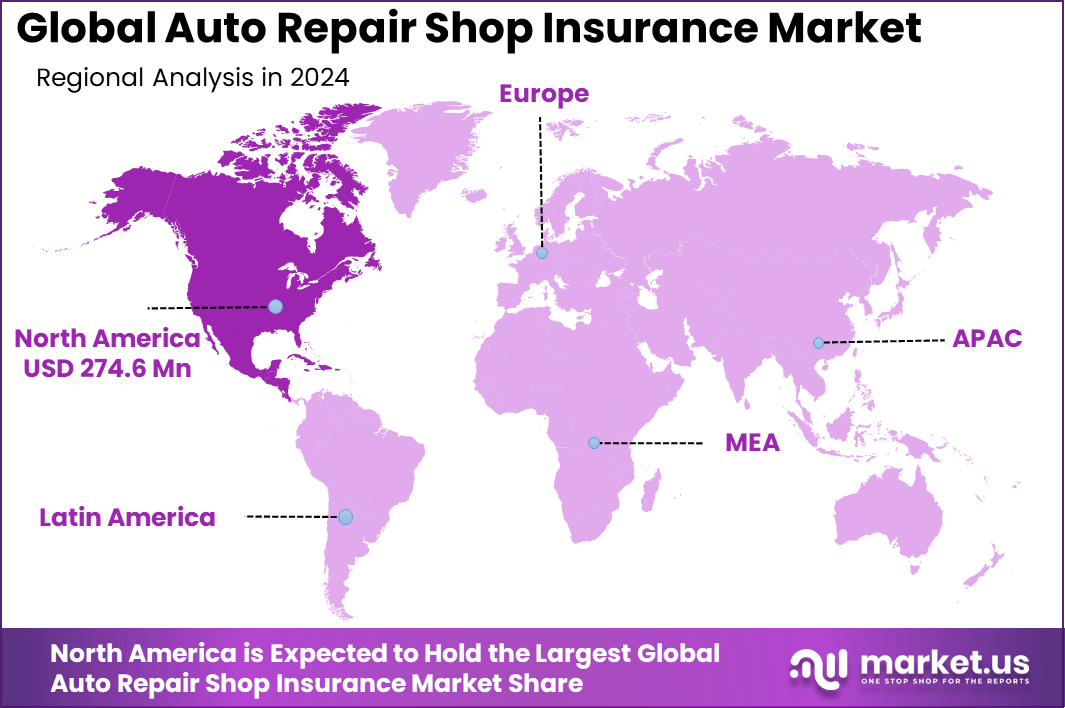

The Global Auto Repair Shop Insurance Market size is expected to be worth around USD 2,834.7 million by 2034, from USD 842.5 million in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 32.6% share, holding USD 274.6 million in revenue.

Auto Repair Shop Insurance Market refers to insurance solutions designed to protect businesses that provide vehicle maintenance, repair, and servicing activities from financial and operational risks. These policies typically cover liabilities related to customer vehicles, workplace injuries, property damage, and legal claims arising from daily repair operations. Auto repair shops operate in environments with heavy machinery, hazardous materials, and customer assets, which increases exposure to loss events.

Insurance serves as a financial safeguard that enables these businesses to operate with stability and confidence. The market exists to address the unique risk profile of automotive service providers. Repair shops differ from general businesses due to their direct responsibility for customer vehicles and employee safety. As repair activities become more complex, insurance coverage has shifted from basic protection to more structured and comprehensive risk management solutions.

Top Driving Factors include increasing regulatory oversight and heightened awareness of liability risks within the automotive repair sector. Authorities require repair businesses to meet safety and employment standards, which often mandate specific insurance coverage. Failure to comply can result in fines, legal exposure, or business suspension. These regulatory pressures drive consistent demand for insurance solutions.

For instance, in November 2025, Farmers Insurance resumed new commercial multi-peril policies for auto service and repair shops after market improvements. This opens doors for more coverage in key areas. It reflects the agility of American carriers responding to shop demands in a tough environment.

Demand Analysis indicates steady demand from small independent workshops as well as larger multi-location repair networks. Smaller shops often seek essential coverage to protect limited capital and ensure business continuity. Larger operations typically require broader protection due to higher transaction volumes and workforce size. Demand is sustained across different shop formats due to the universal nature of operational risk.

Key Takeaway

- In 2024, the Garage Liability Insurance segment dominated the Global Auto Repair Shop Insurance Market, capturing a 42.8% share.

- In 2024, the General Auto Repair Shops segment held a dominant position with 54.3% of the market share.

- In 2024, the Small Independent Shops segment captured 63.7% of the market share.

- Annual Policies led the market with an 88.2% share in 2024.

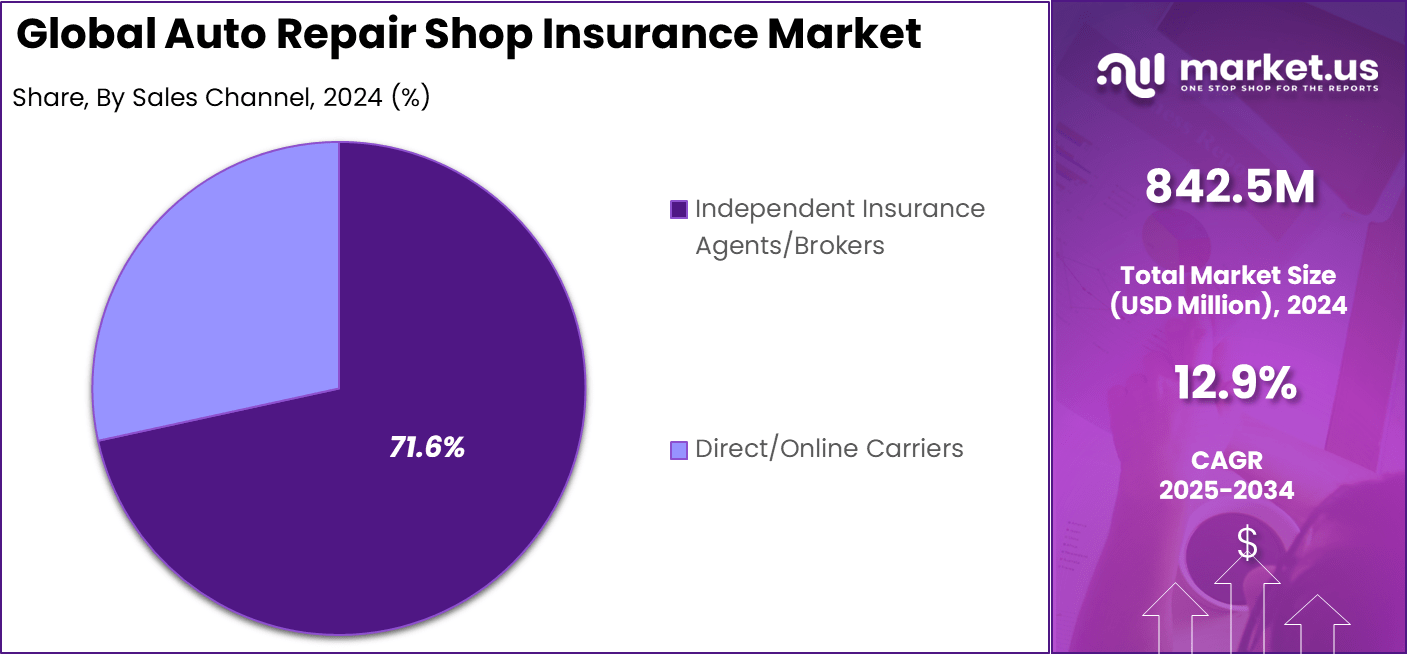

- Independent Insurance Agents/Brokers held a dominant market share of 71.6% in 2024.

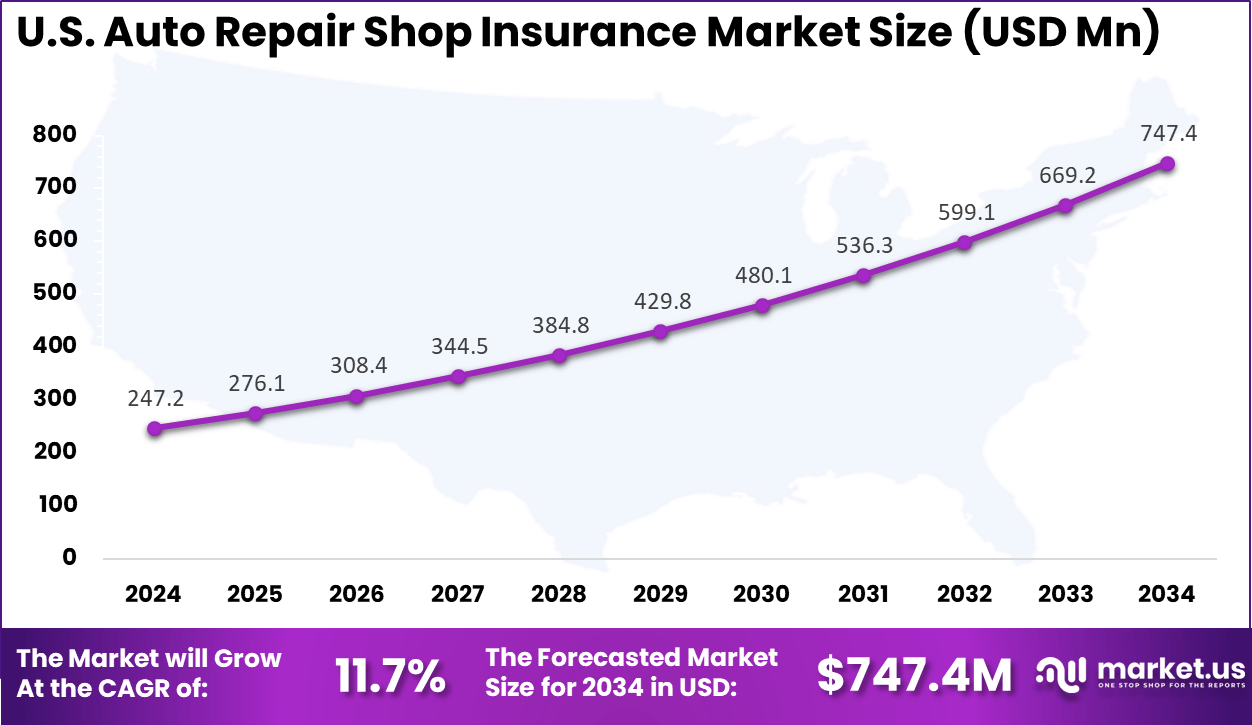

- The U.S. Auto Repair Shop Insurance Market was valued at USD 247.2 Million in 2024, with a robust CAGR of 11.7%.

- North America held 32.6% of the Global Auto Repair Shop Insurance Market share in 2024.

Coverage Type Analysis

In 2024, The Garage Liability Insurance segment held a dominant market position, capturing a 42.8% share of the Global Auto Repair Shop Insurance Market. Shop owners rely on it heavily because it shields them from claims tied to customer injuries or vehicle damage right in the garage. Daily operations bring these risks close, like slips on oily floors or fender benders during test drives. This coverage stands out as the go-to choice for handling those everyday headaches that keep owners up at night.

While other options, like garage keepers, handle stored cars, garage liability covers the broader scene. It fits the fast-paced world of auto repairs where multiple vehicles roll in and out. Owners value how it pairs with basic policies to build full protection without overcomplicating things. In the end, it meets the real needs of shops grinding through busy days.

For Instance, in January 2025, The Hartford reported strong first-quarter results with property and casualty premiums up 9%, highlighting growth in business insurance lines like garage liability. This reflects their focus on tailored coverage for auto shops facing daily risks such as customer slips or vehicle mishaps during repairs. Shop owners appreciate the reliable claims handling that keeps operations running smoothly.

Shop Type Analysis

In 2024, the General Auto Repair Shops segment held a dominant market position, capturing a 54.3% share of the Global Auto Repair Shop Insurance Market. They tackle a wide range of fixes, from brakes to transmissions, facing all sorts of risks along the way. These shops serve everyday drivers with routine work, which drives steady insurance demand. Owners here know broad coverage keeps their doors open no matter what comes through the bay.

Specialty shops focus on niches like tires or alignments, but general ones dominate volume. Their mix of services means higher exposure to varied claims, pushing them toward comprehensive plans. This setup reflects how most local mechanics operate, balancing multiple jobs without deep specialization. It keeps the segment strong and growing.

For instance, in October 2025, Travelers emphasized customizable garage policies for general repair shops in recent industry updates, covering broad services from brakes to engines. Their competitive rates and strong customer service help these high-volume shops manage varied claims efficiently. This approach supports the segment’s dominance in everyday auto fixes.

Shop Size Analysis

In 2024, The Small Independent Shops segment held a dominant market position, capturing a 63.7% share of the Global Auto Repair Shop Insurance Market. These family-run spots handle oil changes and tune-ups on tight margins, making affordable insurance key to survival. Without corporate safety nets, owners prioritize basics that cover tools, liability, and quick fixes. They form the backbone of local repair services everywhere.

Larger shops spread risks across teams and locations, taking a smaller slice overall. Small ones buy more policies relative to their numbers because every dollar counts. This trend shows how independents stay nimble, renewing coverage that matches their scale and daily grind. It highlights real grit in the business.

For Instance, in December 2025, Nationwide stood out for offering the lowest rates on business insurance tailored to small independent shops at around $113 monthly. This affordability covers essentials like tools and liability for tight-budget operations handling routine jobs. It eases the burden on family-run garages without corporate support.

Policy Duration Analysis

In 2024, The Annual Policies segment held a dominant market position, capturing an 88.2% share of the Global Auto Repair Shop Insurance Market. Shops prefer the chance to review and adjust coverage each year as repair volumes shift or rates change. It offers flexibility for owners watching costs closely amid fluctuating workloads. This rhythm suits the hands-on nature of garage life perfectly.

Multi-year options appeal to some for stability, but most stick with yearly renewals. It lets them switch carriers if needed or add riders for new equipment. In practice, this approach keeps things simple and responsive to real-world ups and downs in the shop.

For Instance, in July 2025, Progressive highlighted flexible garage insurance renewals in their commercial updates, aligning with the preference for annual policies among repair shops. Owners value the yearly review to adjust for changing workloads and rates, keeping coverage fresh and cost-effective. This fits the practical needs of hands-on businesses.

Sales Channel Analysis

In 2024, The Independent Insurance Agents/Brokers segment held a dominant market position, capturing a 71.6% share of the Global Auto Repair Shop Insurance Market. They build relationships with shop owners, understanding local risks like weather damage or high-traffic bays. By comparing multiple carriers, they land deals that fit budgets and needs. This personal touch builds lasting trust in a hands-on industry.

Online direct sales pick up for simple needs, yet agents shine for tailored garage policies. Brokers navigate complex claims history and endorsements effortlessly. Shop owners lean on them for advice that saves time and money over the long haul.

For Instance, in August 2024,Allstate saw auto insurance applications surge 17% through independent agents, boosting growth in complex policies like those for auto repair shops. Agents’ local knowledge helps secure better fits for garage needs, from liability to property coverage. This channel’s trust factor drives its strong market hold.

U.S. Market Size

The market for Auto Repair Shop Insurance within the U.S. is growing tremendously and is currently valued at USD 247.2 million, the market has a projected CAGR of 11.7%. The market is growing due to rising vehicle ownership and frequent repairs from aging cars on busy roads.

Shop owners face higher claims from accidents and daily operations, pushing demand for garage liability and tools coverage. Strict regulations require solid policies, while small independents seek affordable options amid economic pressures. Tech like online quoting also speeds up sales through trusted agents.

For instance, In July 2025, Berkshire Hathaway GUARD expanded its commercial auto coverage to Delaware, Kentucky, and the District of Columbia, reaching 43 U.S. jurisdictions. The policy, aimed at auto service operations, includes features like automatic physical damage for newly acquired vehicles and towing coverage up to 10,000 pounds. This growth highlights the U.S. leadership in providing tailored insurance solutions for repair shops.

In 2024, North America held a dominant market position in the Global Auto Repair Shop Insurance Market, capturing more than a 32.6% share, holding USD 274.6 million in revenue. This dominance is due to high vehicle density and long commutes that boost repair volumes across the US and Canada.

Harsh weather, like winter storms, raises claims for garage liability and property damage. Strict safety rules force shops to carry robust coverage, while small independents drive demand for affordable annual policies via local agents. Rising accident rates from aging fleets add steady pressure for reliable protection.

For instance, in September 2025, State Farm expanded estimating platform options nationwide for its Select Service collision repair network, allowing shops to choose between CCC One and Mitchell Cloud Estimating following a successful Ohio pilot. This flexibility improves efficiency for auto repair partners while maintaining quality standards.

Driver Analysis

The auto repair shop insurance market is being driven by the increasing complexity and risk exposure associated with modern vehicle service operations. Auto repair shops handle a wide range of vehicles, mechanical systems, and diagnostic tools, which exposes them to potential property damage, equipment loss, customer vehicle damage, and third‑party liability.

Rising labour costs and specialised repair technologies such as hybrid and electric vehicle systems further heighten financial risk when accidents or errors occur. Insurance products tailored to auto repair operations help protect businesses from unexpected costs, legal claims, and regulatory penalties, making risk transfer a key priority for shop owners and managers.

Restraint Analysis

A significant restraint in the auto repair shop insurance market is the limited awareness among smaller or independent repair businesses about the full scope of exposures they face. Many owners emphasise operational costs and customer service over comprehensive risk management, leading them to underinsure or choose basic policies that may not adequately cover equipment breakdown, business interruption, or professional liability.

In addition, the perceived complexity of insurance terms and coverage options can discourage investment in broader protection, particularly for shops with constrained financial resources or informal management structures.

Opportunity Analysis

Emerging opportunities in this market are linked to the development of modular and scalable insurance products that can be tailored to specific risk profiles, shop sizes, and service offerings. Flexible policies that allow repair shops to add coverage for specialised equipment, customer vehicle damage, cyber threats, or business interruption can make comprehensive insurance more accessible and cost‑effective.

Embedded insurance solutions that integrate directly with business management software or point‑of‑sale systems can streamline policy selection, premium calculation, and claims reporting, improving convenience and uptake. Partnerships between insurers and automotive associations or service networks can also expand education and distribution.

Challenge Analysis

A central challenge confronting the auto repair shop insurance market involves balancing adequate risk coverage with affordable premiums. Repair shop exposures vary widely depending on location, service mix, staff experience, and customer volume, which complicates underwriting and pricing. Insurers must assess these variables accurately to offer competitive premiums while maintaining financial sustainability.

Frequent changes in repair technology, regulatory requirements, and hazard profiles require ongoing adjustment of coverage terms and risk models. Achieving clarity for shop owners about what is covered, excluded, and required under policies demands effective communication and transparent documentation.

Emerging Trends

Emerging trends in the auto repair shop insurance landscape include the integration of risk management services and loss prevention programs that help shops reduce exposure before claims occur. Insurers are offering safety audits, training resources, and guidance on equipment maintenance to support safer workplaces.

Another trend involves usage‑based pricing models that reflect shop size, claims history, and operational practices to deliver more personalised premium structures. Digital claims handling and mobile reporting tools are also improving the speed and transparency of the claims process for policyholders.

Growth Factors

Growth in the auto repair shop insurance market is supported by the continued expansion of vehicle ownership, ageing vehicle fleets, and the increasing complexity of automotive systems requiring specialised maintenance. As customers demand timely, reliable repair services, business owners are seeking ways to protect revenue, reputation, and assets.

The rise of hybrid and electric vehicles introduces new technical risks that emphasise the importance of comprehensive liability and equipment coverage. Regulatory compliance expectations and business continuity planning further reinforce the role of insurance as a strategic risk management tool for auto repair operations.

Key Market Segments

By Coverage Type

- Garage Liability Insurance

- Garagekeepers Liability Insurance

- Commercial Property Insurance

- Business Interruption Insurance

- Workers’ Compensation Insurance

- Commercial Auto Insurance

By Shop Type

- General Auto Repair Shops

- Collision & Body Shops

- Specialty Repair Shops (Transmission, Brakes, etc.)

- Franchise/Dealership Service Centers

By Shop Size

- Small Independent Shops

- Medium-Sized Shops

- Large/Multi-Bay Operations

By Policy Duration

- Annual Policies

- Monthly Payment Plans

By Sales Channel

- Independent Insurance Agents/Brokers

- Direct/Online Carriers

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading insurers such as The Hartford Financial Services Group, Inc., Travelers Companies, Inc., and Progressive Casualty Insurance Company focus on tailored coverage for auto repair businesses. Their policies address property damage, garage liability, workers compensation, and business interruption risks. Strong underwriting expertise supports shops of different sizes. These players benefit from long-standing relationships with small and mid-sized businesses.

Large national insurers including Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, and State Farm Mutual Automobile Insurance Company offer broad distribution and bundled insurance solutions. Allstate Insurance Company and Farmers Insurance Group support independent repair shops with flexible policy structures. Their strong agent networks improve market reach.

Specialty and regional insurers such as Berkshire Hathaway GUARD Insurance Companies, AmTrust Financial Services, Inc., and CNA Financial Corporation address niche repair shop risks. Markel Corporation, Erie Insurance Group, Acuity Insurance, and Sentry Insurance strengthen regional coverage. Other players increase competition and customization.

Top Key Players in the Market

- The Hartford Financial Services Group, Inc.

- Travelers Companies, Inc.

- Progressive Casualty Insurance Company

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Allstate Insurance Company

- Farmers Insurance Group (a Zurich company)

- Berkshire Hathaway GUARD Insurance Companies

- AmTrust Financial Services, Inc.

- CNA Financial Corporation

- Markel Corporation

- Erie Insurance Group

- Acuity Insurance

- Sentry Insurance, a Mutual Company

- Others

Recent Developments

- In January 2025, Nationwide Mutual Insurance Company Acquired Allstate’s stop-loss business for $1.25 billion, bolstering capital to expand commercial lines, including auto service shop policies. This deal lets Nationwide offer more robust garagekeepers coverage, a win for repair businesses facing higher liability risks.

- In November 2025, Farmers Insurance resumed new commercial multi-peril policies for auto service and repair shops after market improvements. This opens doors for more coverage in key areas. It reflects the agility of American carriers responding to shop demands in a tough environment.

Report Scope

Report Features Description Market Value (2025) USD 842.5 Mn Forecast Revenue (2035) USD 2,834.7 Mn CAGR (2025-2035) 12.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Garage Liability Insurance, Garagekeepers Liability Insurance, Commercial Property Insurance, Business Interruption Insurance, Workers’ Compensation Insurance, Commercial Auto Insurance), By Shop Type (General Auto Repair Shops, Collision & Body Shops, Specialty Repair Shops (Transmission, Brakes, etc.), Franchise/Dealership Service Centers), By Shop Size (Small Independent Shops, Medium-Sized Shops, Large/Multi-Bay Operations), By Policy Duration (Annual Policies, Monthly Payment Plans), By Sales Channel (Independent Insurance Agents/Brokers, Direct/Online Carriers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Hartford Financial Services Group, Inc., Travelers Companies, Inc., Progressive Casualty Insurance Company, Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, Allstate Insurance Company, Farmers Insurance Group (a Zurich company), Berkshire Hathaway GUARD Insurance Companies, AmTrust Financial Services, Inc., CNA Financial Corporation, Markel Corporation, Erie Insurance Group, Acuity Insurance, Sentry Insurance a Mutual Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Auto Repair Shop Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Auto Repair Shop Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- The Hartford Financial Services Group, Inc.

- Travelers Companies, Inc.

- Progressive Casualty Insurance Company

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Allstate Insurance Company

- Farmers Insurance Group (a Zurich company)

- Berkshire Hathaway GUARD Insurance Companies

- AmTrust Financial Services, Inc.

- CNA Financial Corporation

- Markel Corporation

- Erie Insurance Group

- Acuity Insurance

- Sentry Insurance, a Mutual Company

- Others