Global Auto Loan Market Size, Share, Trends Analysis Report By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Loan Provider (OEMs, Banks, NBFCs), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132115

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

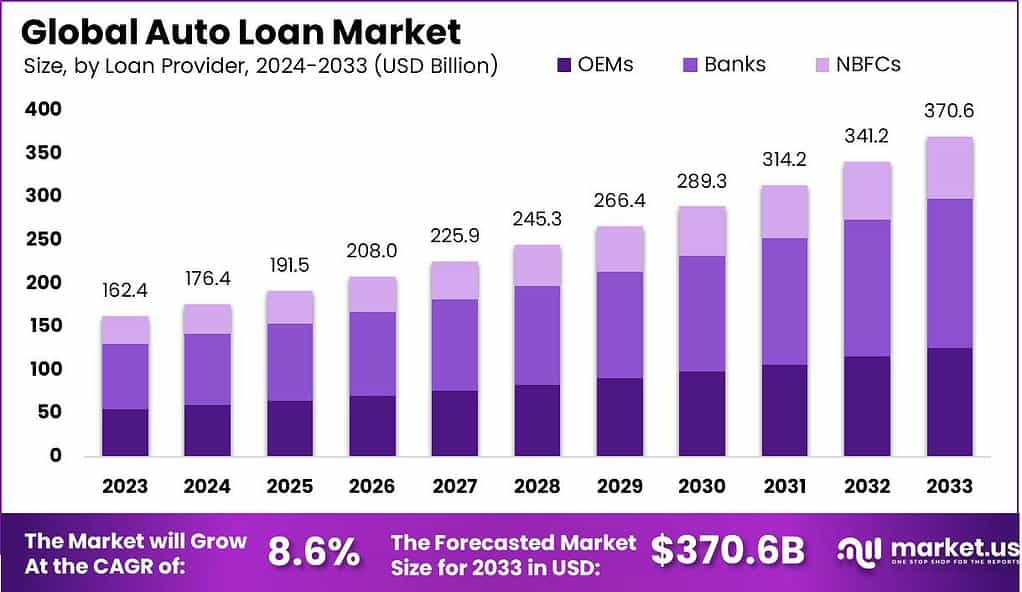

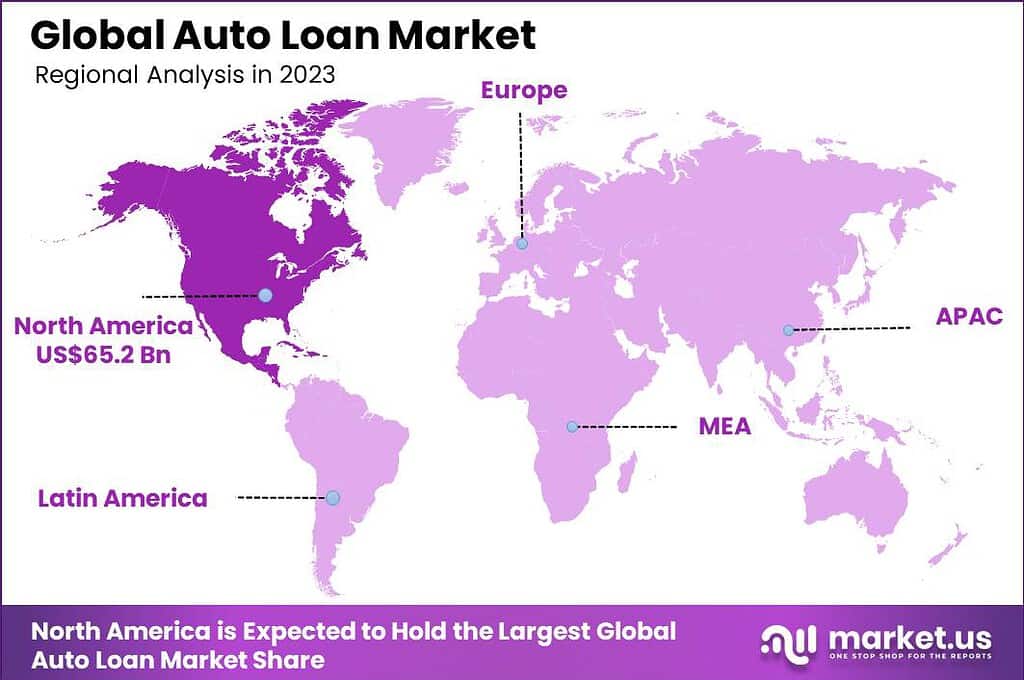

The Global Auto Loan Market size is expected to be worth around USD 370.6 Billion By 2033, from USD 162.4 Billion in 2023, growing at a CAGR of 8.60% during the forecast period from 2024 to 2033. In 2023, North America maintained its leadership in the auto loan market, securing more than 40.2% of the market share and generating a robust revenue of USD 65.2 billion.

An auto loan is a financial arrangement where a lender provides funds to a borrower specifically for the purchase of a vehicle. The borrower agrees to repay the borrowed amount over a set period, along with interest, usually through monthly installments. This loan can be used to purchase either new or used vehicles, and the terms of the loan, including interest rate and repayment period, are predetermined based on the borrower’s creditworthiness and other factors.

The auto loan market is significant, reflecting the global demand for vehicle financing. This market is competitive and fragmented, with many financial institutions offering loans, including banks, credit unions, and online lenders. The market has seen growth due to the increasing sales of vehicles, particularly light trucks in the U.S., which has influenced the direction of lending practices and product offerings by financial institutions.

The primary drivers of the auto loan market include an increase in vehicle sales, particularly due to the demand for passenger vehicles and the convenience of digital loan processing which speeds up the financing process. The rising affordability of vehicles due to competitive loan terms and the growing preference for vehicle ownership over leasing in many regions also significantly contribute to market expansion.

Market demand in the auto loan sector is fueled by various factors, including the expansion of the automotive industry and the introduction of new vehicle models. The demand for refinancing to take advantage of lower interest rates and better loan terms further boosts this market’s growth. Additionally, the rising popularity of electric vehicles has opened new opportunities for tailored auto loan products.

Technological advancements are significantly shaping the auto loan market. The use of AI to improve credit assessments and the development of digital platforms for loan management are pivotal. These technologies not only streamline the lending process but also enhance the accuracy of underwriting, reducing the risk of defaults. Digital solutions like online payment systems and automated loan processing are becoming standard, offering convenience and faster service to consumers.

The auto loan market is ripe with opportunities, particularly through the integration of flexible and competitive financing solutions. Innovations in financial technology, like the use of artificial intelligence for risk assessment and the offering of cryptocurrency as collateral, are creating new financing avenues. Furthermore, the trend towards digitalization in the finance sector allows lenders to provide more personalized and efficient services, enhancing customer satisfaction and loyalty.

Based on data from Finmasters, $1.55 trillion is the total car loan debt in the U.S., which accounts for 9.17% of all consumer debt. As of the fourth quarter of 2022, the average financing amount for new car purchases was $41,445. A significant majority, 80.85%, of new cars in the U.S. are bought with some form of financing. In contrast, less than half of used vehicle purchases, 39.81%, involve financing.

The typical monthly payment for new cars is $716, with interest rates varying from 4.75% to 13.42%, influenced by the borrower’s credit score and other factors. LendingTree reports a slight uptick in the average monthly payment for new vehicles to $734 in the second quarter of 2024, marking a 0.1% increase from the previous year.

Conversely, payments for used and leased vehicles saw declines of 2.1% and 2.3%, respectively. The August 2024 data from the U.S. Bureau of Labor Statistics reveals a 10.4% decrease in used car and truck prices year-over-year, whereas new vehicle prices have fallen by 1.2%. According to Experian, the average borrowing amounts are $40,927 for new vehicles and $26,248 for used ones.

Key Takeaways

- The global auto loan market is projected to reach USD 370.6 billion by 2033, growing from USD 162.4 billion in 2023. This represents a compound annual growth rate (CAGR) of 8.60% during the forecast period from 2024 to 2033.

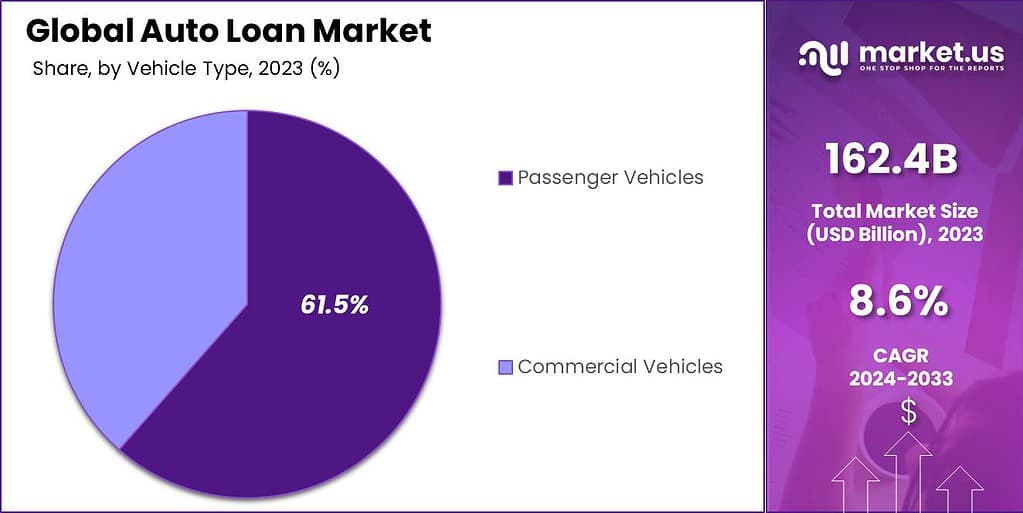

- In 2023, the Passenger Vehicles segment held the largest share of the auto loan market, capturing more than 61.5% of the total market share.

- The Banks segment dominated the auto loan market in 2023, accounting for over 46.5% of the market share.

- In 2023, North America led the global auto loan market, holding more than 40.2% of the market share, with a revenue of USD 65.2 billion.

Vehicle Type Analysis

In 2023, the Passenger Vehicles segment held a dominant market position within the auto loan market, capturing more than a 61.5% share. This prominence can largely be attributed to the widespread use of passenger vehicles for personal transportation.

As a fundamental component of daily life, from commuting to leisure travel, the demand for passenger vehicles consistently drives a significant volume of auto loan originations. Passenger vehicles are often seen as more accessible and necessary for the average consumer, leading to higher sales volumes compared to commercial vehicles.

This segment benefits from a broader demographic appeal, encompassing families, young professionals, and first-time car buyers who may find passenger vehicles more aligned with their budget and lifestyle needs. The availability of diverse financing options tailored to this market segment makes obtaining loans for passenger vehicles more straightforward, further cementing its leadership in the auto loan sector.

Moreover, the push towards personal vehicle ownership due to lifestyle changes, such as the increase in remote work and suburban living, continues to bolster the passenger vehicle market. The financing of passenger vehicles is not only about facilitating mobility but also about enhancing personal freedom and quality of life, which resonates strongly with consumer values.

Loan Provider Analysis

In 2023, the Banks segment held a dominant market position in the Auto Loan Market, capturing more than a 46.5% share. This significant market share can be attributed primarily to the comprehensive range of financial solutions that banks offer, which appeal to a broad customer base.

Banks have been able to leverage their extensive networks and established customer trust to provide competitive loan options. Their ability to offer lower interest rates compared to other loan providers, due to their access to cheaper funding sources, also plays a crucial role in attracting consumers seeking auto loans.

Another reason for the dominance of banks in the auto loan market is their robust risk assessment capabilities. Banks employ advanced credit evaluation techniques to assess loan applicants’ creditworthiness, which minimizes the risk of defaults.

Banks have been proactive in embracing technological advancements to improve the auto loan application process. Many banks now offer online loan approval services, which simplify the borrowing process and make it faster and more convenient for customers. This digital approach not only improves customer satisfaction but also helps banks to streamline their operations and reduce processing times.

Key Market Segments

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Loan Provider

- OEMs

- Banks

- NBFCs

Driver

Increasing Vehicle Ownership and Consumer Demand

The global rise in personal vehicle ownership is a primary driver of growth in the auto loan market. As individuals seek personal mobility, the demand for new and used cars has surged, particularly in emerging markets where economic growth is enabling first-time buyers to enter the auto market.

This demand is coupled with low-interest rates offered by financial institutions, making auto loans more attractive and affordable. Urban expansion and the growing need for reliable transportation contribute to this trend. For many, especially in sprawling metropolitan areas with limited public transportation, car ownership is a necessity rather than a luxury.

A significant factor boosting this demand is the increase in disposable income, allowing more people to finance vehicles over time. Financial institutions have recognized this and are increasingly offering flexible loan options to meet varied customer needs, such as extended loan terms, low down payments, and bundled insurance packages.

Restraint

Rising Interest Rates and Economic Instability

A significant restraint for the auto loan market is the fluctuation in interest rates, particularly in times of economic uncertainty. With inflationary pressures driving central banks to raise interest rates, the cost of borrowing has increased, making auto loans less affordable for some consumers.

This situation is particularly concerning for lower-income buyers, who are often more sensitive to interest rate changes and may delay or forego car purchases due to high loan costs. Rising rates increase the monthly payment for borrowers, limiting their financial flexibility and potentially impacting default rates. Economic instability also adds to this challenge.Financial institutions may become more risky, tightening their lending criteria and making it harder for high-risk borrowers to qualify for loans.

Opportunity

Growth in the Electric Vehicle (EV) Sector

The shift toward electric vehicles (EVs) presents a promising opportunity for the auto loan market. As more consumers seek eco-friendly transportation options, the demand for EVs has grown, with government incentives and subsidies further accelerating this transition.

Many governments are introducing favorable policies, including tax credits and rebates, to encourage EV adoption, making it more affordable for consumers. This shift not only opens a new segment within the auto loan market but also aligns with the global push for sustainability, making it a long-term growth area for lenders.

Financial institutions are now introducing specialized loan products tailored to the needs of EV buyers, such as lower interest rates or green auto loans. Some lenders are even offering extended loan terms to account for the higher upfront cost of EVs compared to traditional vehicles.

Challenge

Increased Regulatory and Economic Pressures

The auto loan market faces challenges from heightened regulatory and economic pressures, including changing emission standards and the fluctuating economic landscape. These factors influence market dynamics by altering consumer behavior and lending standards. Banks and lenders must navigate these complex regulations while managing the risk of non-repayment amid economic uncertainties, which can hinder market growth and operational stability.

Emerging Trends

The auto loan industry is evolving with technological advancements and changing consumer preferences, transforming how people finance vehicles. A key trend is the rapid shift towards digital auto loan applications. Many lenders now offer online platforms that allow customers to complete the entire loan process, from application to approval, digitally.

Another notable development is the rise of personalized loan products. Using advanced algorithms and data analysis, lenders can tailor loan offers based on individual credit profiles, making it easier for people with different financial backgrounds to access financing.

Electric vehicle (EV) financing is also emerging as a specialized segment within the auto loan industry. With governments worldwide pushing for greener transportation options, lenders are increasingly offering favorable terms for EV purchases, such as lower interest rates and extended repayment periods. Also, an increasing number of auto lenders are incorporating sustainability into their offerings.

Business Benefits

The evolution in auto loans offers several notable benefits for businesses in the lending space. By digitizing the loan application process, lenders can significantly reduce processing time and operational costs. Digital applications eliminate the need for manual paperwork, reducing human error and streamlining approval workflows.

Personalized loan products enable lenders to reach a broader range of consumers, including those with non-traditional credit backgrounds. By using data-driven assessments, lenders can make better-informed decisions and offer competitive rates tailored to each borrower’s financial profile.

Additionally, with the shift towards environmentally friendly auto loans, lenders can tap into the growing market for EVs and other sustainable vehicles. Offering favorable terms for green vehicles allows businesses to attract a socially conscious customer base, which can enhance brand reputation. These green loan products can align with broader corporate sustainability initiatives, giving lenders an opportunity to demonstrate commitment to environmental goals.

Regional Analysis

In 2023, North America held a dominant market position in the Auto Loan Market, capturing more than a 40.2% share with revenue amounting to USD 65.2 billion. This commanding presence can largely be attributed to the robust automotive industry in the region, characterized by high vehicle ownership rates and substantial consumer spending on automobiles.

The prevalence of favorable credit conditions in North America also significantly contributes to its leadership in the auto loan market. Interest rates in this region have been relatively low, making auto loans more affordable for a larger segment of the population. The presence of major global banks and financial institutions, which offer competitive loan terms, ensures a steady supply of auto loan products to meet growing consumer demand.

Technological advancements have further solidified North America’s dominance in the auto loan market. The integration of fintech solutions in the lending process, such as online loan applications and automated approval systems, has streamlined the borrowing process, making it faster and more user-friendly. This tech-forward approach attracts tech-savvy consumers who value convenience and speed in their financial transactions.

Moreover, the strategic partnerships between automakers and financial institutions in this region have played a pivotal role. These collaborations often result in tailored financing packages for consumers, directly offered through dealerships. This seamless integration of financing and car purchasing has not only simplified the buying process but has also encouraged more consumers to opt for financed purchases.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The global auto loan market is highly competitive, with numerous financial institutions, banks, and fintech companies vying for market share. Several key players dominate the auto loan space, each offering a range of products to meet the diverse needs of consumers.

Bank of America Corporation stands out as a leading entity in the Auto Loan Market due to its extensive range of flexible financing solutions tailored to a diverse customer base and known for its competitive interest rates and customer-centric services.The bank leverages its vast network of branches across the United States, offering convenient access to potential borrowers.

General Motors Financial Company Inc., the finance arm of the automotive giant General Motors, specializes in offering auto financing products directly linked to the purchase of GM vehicles. This integration allows customers to access a seamless buying and financing experience.

JPMorgan Chase & Co. is another major player in the auto loan market, recognized for its robust financial offerings and strong market presence. Their auto loans are known for competitive rates and a straightforward application process, facilitated by both their extensive physical presence and strong online platform.

Top Key Players in the Market

- Bank of America Corporation

- General Motors Financial Company Inc.

- JPMorgan Chase & Co.

- Volkswagen Finance Private Limited

- Novuna

- Capital One Financial Corporation

- Ally Financials Inc.

- Mercedes-Benz Mobility

- Ford Motor Company

- Toyota Financial Services

- Other Key Players

Recent Developments

- In April 2024, Private equity firms like Apollo, Ares, Blackstone, and KKR expanded into asset-based finance, including auto loans, credit cards, and mortgages. The companies are making a strong push into “asset-based finance,” which includes auto loans, credit cards, real estate mortgages, and loans secured by assets like fiber-optic networks and other equipment.

- In October 2024, Volkswagen Financial Services U.S. has entered into a cooperation agreement with Wells Fargo to provide vehicle purchase financing for the Volkswagen, Audi, and Ducati brands in the United States.

- In October 2024, Australian non-bank lender Resimac acquired Westpac’s auto finance loan portfolio, valued between A$1.4 billion and A$1.6 billion. The deal is expected to complete by the first half of 2025.

Report Scope

Report Features Description Market Value (2023) USD 162.4 Bn Forecast Revenue (2033) USD 370.6 Bn CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Loan Provider (OEMs, Banks, NBFCs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bank of America Corporation, General Motors Financial Company Inc., JPMorgan Chase & Co., Volkswagen Finance Private Limited, Novuna, Capital One Financial Corporation, Ally Financials Inc., Mercedes-Benz Mobility, Ford Motor Company, Toyota Financial Services, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bank of America Corporation

- General Motors Financial Company Inc.

- JPMorgan Chase & Co.

- Volkswagen Finance Private Limited

- Novuna

- Capital One Financial Corporation

- Ally Financials Inc.

- Mercedes-Benz Mobility

- Ford Motor Company

- Toyota Financial Services

- Other Key Players