Global Augmented Reality and Virtual Reality Market By Technology (Augmented Reality (Marker-based AR, Markerless AR, Projection-based AR), Virtual Reality (Non-immersive VR, Semi-immersive VR, Fully immersive VR)), By Component (Hardware, Software), By End-User (Gaming and Entertainment, Healthcare, Education, Retail, Manufacturing, Real Estate, Automotive, Aerospace and Defense, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 46650

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

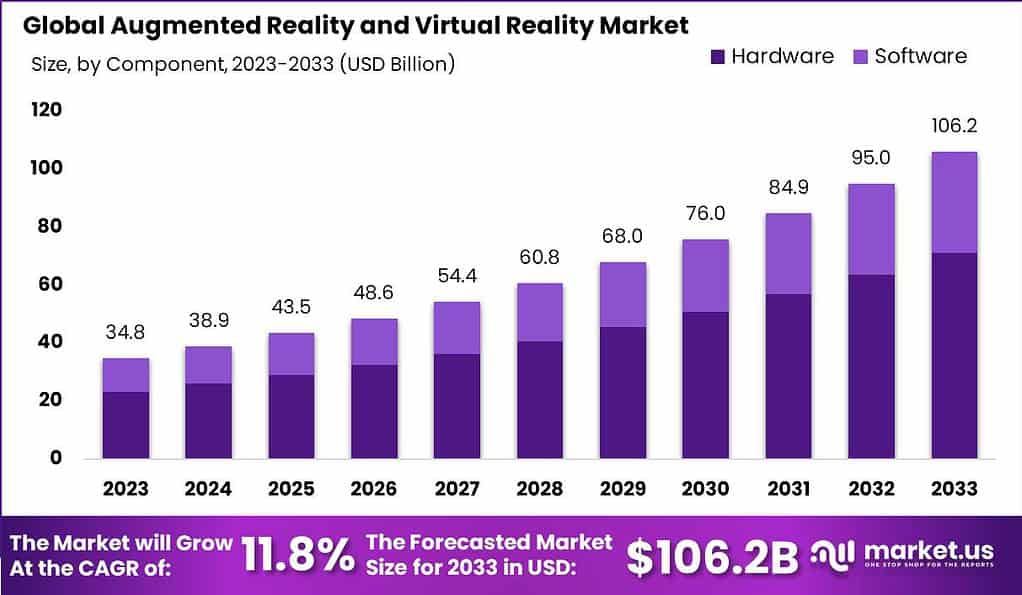

The Global Augmented Reality and Virtual Reality Market size is expected to be worth around USD 106.2 Billion by 2033, from USD 34.8 Billion in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

Augmented Reality (AR) and Virtual Reality (VR) are cutting-edge technologies that have revolutionized the way we interact with digital content. AR overlays digital information onto the real world, enhancing our perception of reality, while VR immerses users in a completely virtual environment, providing a fully immersive experience.

The Augmented Reality (AR) and Virtual Reality (VR) market is undergoing rapid expansion, projected to grow significantly in the coming years. Growth factors include the increasing demand for immersive technology in sectors such as gaming, training, and remote collaboration. As technology advances, AR and VR are becoming more accessible, driving their adoption across a wider array of industries.

One significant growth factor is the increasing demand for enhanced user experiences. AR and VR technologies allow users to interact with digital content in a more engaging and realistic manner, whether for entertainment, education, training, or visualization purposes. This heightened level of immersion has captured the interest of consumers and businesses alike, driving the adoption of AR and VR solutions.

Another driving force behind the growth of the AR and VR market is the continuous advancements in technology. Improvements in hardware, such as headsets and devices, as well as software development, have made AR and VR experiences more accessible and compelling. As these technologies become more sophisticated and affordable, the potential for widespread adoption across various industries continues to expand.

Moreover, the versatility of AR and VR presents diverse opportunities for businesses. From virtual product demonstrations and interactive training simulations to augmented retail experiences and virtual meetings, organizations can leverage AR and VR to enhance customer engagement, improve operational efficiency, and drive innovation. These applications offer a competitive edge by delivering unique and memorable experiences to users.

However, alongside the growth opportunities, the AR and VR market also faces challenges. One of the primary challenges is the need for seamless integration with existing technologies and workflows. Ensuring compatibility and interoperability with different systems can be complex, requiring careful planning and technical expertise.

Key Takeaways

- The global Augmented Reality and Virtual Reality market is expected to reach USD 106.2 billion by 2033, growing at a CAGR of 11.8% from USD 34.8 billion in 2023. This signifies substantial market expansion over the forecast period.

- In 2023, Augmented Reality (AR) dominated the market with a 61.0% share. AR includes Marker-based AR, Markerless AR, and Projection-based AR. Each technology has unique applications, such as advertising, gaming, and education for Marker-based AR, and retail for Markerless AR.

- In 2023, hardware held a dominant market position with over 67% share. High-quality hardware components like headsets, glasses, and sensors play a crucial role in delivering immersive AR and VR experiences.

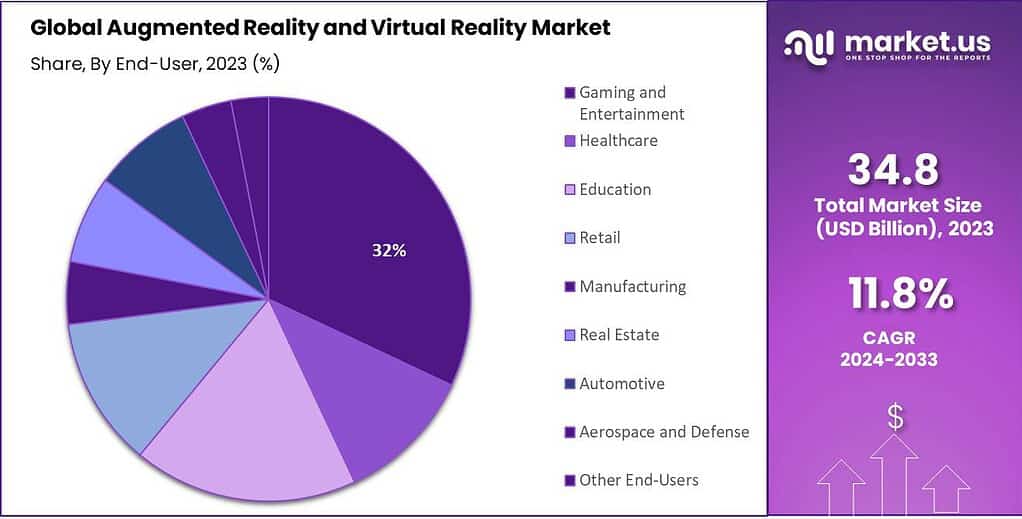

- Gaming and Entertainment were the leading end-users in 2023, capturing over 32% of the market share. The gaming industry, in particular, has been a major adopter of AR and VR technologies, offering more engaging and lifelike experiences.

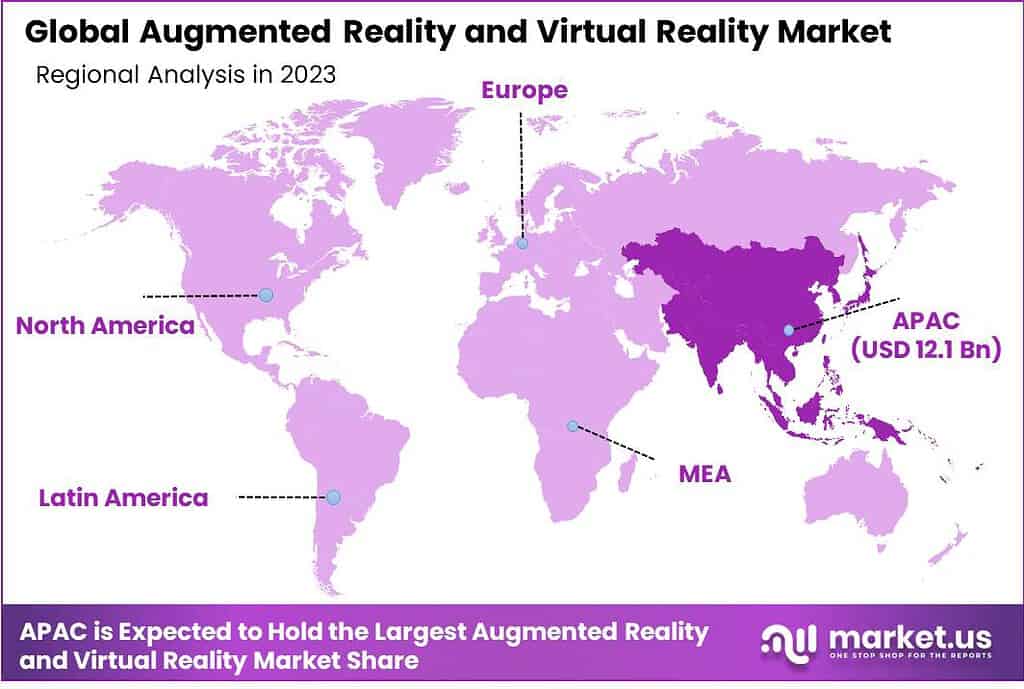

- In 2023, Asia-Pacific held the largest market share, exceeding 35%. This was driven by rapid technological advancements, a large consumer base, and significant investments in AR and VR technologies in countries like China, Japan, and South Korea.

Technology Analysis

In 2023, the Augmented Reality (AR) segment emerged as the dominant player in the AR and VR market, capturing over 61.0% of the market share. This substantial market presence can be attributed to the versatility and wide range of applications offered by AR technology.

AR encompasses various technologies, including Marker-based AR, Markerless AR, and Projection-based AR. Marker-based AR utilizes visual markers or codes to overlay digital content onto the real world, enabling interactive and engaging experiences. This technology finds applications in fields such as advertising, gaming, and education, where users can interact with virtual objects in their physical environment.

Markerless AR, on the other hand, relies on computer vision algorithms and sensors to detect and track real-world objects, eliminating the need for markers. This technology is especially popular in industries like retail and e-commerce, where virtual try-on experiences and product visualizations are in high demand. Markerless AR offers a seamless and intuitive way for customers to engage with products, leading to enhanced customer satisfaction and increased sales.

Projection-based AR utilizes projectors to display digital content onto real-world objects or surfaces. This technology is commonly used in immersive installations, exhibitions, and interactive displays. It enables users to interact with projected images or animations, creating captivating and immersive experiences.

The dominance of the Augmented Reality segment can be attributed to several factors. Firstly, AR technology has gained significant traction across industries due to its ability to enhance customer experiences and provide interactive solutions. It allows businesses to create personalized and engaging content that resonates with their target audience, leading to increased brand loyalty and customer engagement.

Moreover, AR has a lower entry barrier compared to fully immersive Virtual Reality (VR) experiences, as it does not require specialized headsets or equipment. This accessibility makes AR more widely adopted across various sectors, such as retail, marketing, healthcare, and education.

Furthermore, AR technology offers practical and functional applications in real-world scenarios. From virtual try-on for fashion and cosmetics to augmented navigation in automotive and aviation industries, AR has proven its value in enhancing productivity, efficiency, and customer satisfaction.

Component Analysis

In 2023, the Hardware segment held a dominant market position in the Augmented Reality (AR) and Virtual Reality (VR) market, capturing more than a 67% share. This significant dominance can be attributed to the critical role that hardware plays in the functionality and advancement of AR and VR technologies. Hardware components, including headsets, glasses, gloves, and sensors, are fundamental in delivering the immersive experiences associated with AR and VR. The demand for high-quality, user-friendly, and technologically advanced hardware has been a key driver for the market’s growth.

Moreover, the development and sales of hardware have been bolstered by continuous technological advancements and investments from leading tech companies. These innovations have led to the production of more sophisticated and accessible devices, catering to a growing consumer base seeking advanced AR and VR experiences. The market has observed a notable rise in the adoption of AR glasses and VR headsets in various sectors, including gaming, education, healthcare, and military training, necessitating robust hardware solutions.

Additionally, the cost associated with developing and manufacturing this hardware represents a significant portion of the market’s financial volume. While software plays a vital role in driving the content and applications for AR and VR, the initial investment and ongoing developments in hardware are considerably higher, justifying the larger market share. The trend towards wireless and more ergonomically designed headsets, along with advancements in sensor technology and display resolutions, further underlines the dynamic and expanding nature of the hardware segment in the AR and VR markets. This sustained focus on hardware innovation and improvement is a key factor in its market dominance.

End-User Analysis

In 2023, the Gaming and Entertainment segment held a dominant market position in the Augmented Reality (AR) and Virtual Reality (VR) market, capturing more than a 32% share. This significant dominance is primarily attributable to the immersive and interactive experiences that AR and VR technologies offer in gaming and entertainment. These technologies have revolutionized the way users engage with digital content, providing a level of depth and realism previously unattainable.

The gaming industry, in particular, has been a forerunner in adopting AR and VR technologies, with numerous games and interactive experiences being developed specifically for these platforms. This adoption is driven by the demand for more engaging and lifelike gaming experiences among consumers. AR games like Pokémon GO have demonstrated the potential for mass-market appeal, while VR gaming platforms have grown in popularity, offering experiences ranging from casual to complex immersive environments.

Moreover, the entertainment sector, including film and live events, has begun to integrate AR and VR to provide enhanced viewer experiences. This includes virtual concerts, immersive film experiences, and interactive art installations, which have broadened the market reach beyond traditional gaming audiences.

Financially, the gaming and entertainment sectors have seen substantial investments in AR and VR development, with major tech companies and independent developers alike contributing to an ever-expanding library of content. The accessibility of AR through mobile devices and the increasing affordability of VR headsets have further facilitated the growth of this market segment.

Furthermore, advancements in graphics quality, user interface design, and hardware performance have continued to elevate the gaming and entertainment experiences, making them more appealing to a broader audience. This combination of technological innovation, financial investment, and a growing interest in immersive digital experiences solidifies the gaming and entertainment sector’s position as a leading force in the AR and VR market.

Key Market Segments

Technology

- Augmented Reality

- Marker-based AR

- Markerless AR

- Projection-based AR

- Virtual Reality

- Non-immersive VR

- Semi-immersive VR

- Fully immersive VR

Component

- Hardware

- Software

End-User

- Gaming and Entertainment

- Healthcare

- Education

- Retail

- Manufacturing

- Real Estate

- Automotive

- Aerospace and Defense

- Other End-Users

Driver

Increasing Adoption in Various Industries

The escalating adoption of Augmented Reality (AR) and Virtual Reality (VR) across diverse industries is a key driver propelling the growth of the global market. Initially popular in gaming and entertainment, these technologies are now permeating sectors such as healthcare, education, automotive, real estate, and manufacturing.

In healthcare, AR and VR are revolutionizing medical training and patient care by facilitating complex surgical simulations and enhancing patient-therapist interactions in mental health care. In the field of education, these technologies offer immersive, interactive learning environments, making complex subjects more accessible and engaging for students. The automotive industry uses AR for advanced vehicle design and testing, while in real estate, VR enables virtual property tours, enhancing customer engagement.

Restraint

High Cost of Implementation, Privacy and Security Concerns Related to AR

While the AR and VR market is growing, it faces significant restraints, including the high cost of implementation and privacy and security concerns. The development, deployment, and maintenance of AR and VR technologies require substantial investment.

High-quality AR glasses and VR headsets, along with the necessary software and hardware infrastructure, represent a significant expense, which can be a barrier to entry for small and medium-sized enterprises and individual consumers. Additionally, creating customized AR and VR content is often resource-intensive, requiring specialized skills and technology. These costs can limit market growth, particularly in sectors where budget constraints are a primary concern.

Privacy and security concerns are another significant restraint. AR applications, especially those that integrate with mobile devices and wearable technology, can collect vast amounts of personal data, including location, visual recordings, and biometric data. This raises concerns about data privacy and the potential misuse of personal information. Security vulnerabilities in AR applications and platforms can lead to data breaches, compromising user privacy and corporate data. These concerns are heightened by the increasing sophistication of cyber threats and the sensitivity of data collected by AR technologies.

Opportunity

Advancements in 5G and IoT

Advancements in 5G technology and the Internet of Things (IoT) present significant opportunities for the AR and VR market. The deployment of 5G networks is set to revolutionize these technologies by providing faster, more reliable, and lower-latency internet connections. This enhancement in connectivity is crucial for AR and VR applications, which require high bandwidth and low latency to deliver smooth, immersive experiences. With 5G, AR and VR applications can achieve more realistic and interactive experiences, free from the constraints of slower network speeds.

The convergence of AR/VR with IoT opens up new possibilities for interactive and automated environments. IoT devices, when integrated with AR and VR, can provide users with enhanced, contextually relevant experiences. In industrial settings, for instance, AR can overlay critical information on IoT-enabled machinery, aiding in maintenance and operations. In smart homes, VR can control IoT devices, creating highly immersive and interactive home environments.

Challenge

High Demand for Robust Network Infrastructure, User Experience and Health Concerns

The AR and VR market faces the challenge of meeting the high demand for robust network infrastructure, alongside addressing user experience and health concerns. The effective deployment of AR and VR technologies requires a strong, reliable network infrastructure capable of handling high data volumes and providing low-latency connections. This is particularly important for applications requiring real-time interactions and data processing.

However, in many regions, the existing network infrastructure may not be sufficient to support the demands of advanced AR and VR applications, particularly in rural or underdeveloped areas. This limitation can hinder the adoption and effectiveness of AR and VR technologies, especially in applications that rely on cloud computing and real-time data transmission.

User experience is another critical challenge. For AR and VR technologies to be widely adopted, they must offer comfortable, intuitive, and engaging experiences. Issues such as motion sickness, eye strain, and general discomfort associated with prolonged use of VR headsets are concerns that need to be addressed. The design and ergonomics of wearable AR and VR devices play a crucial role in user acceptance and satisfaction.

Additionally, there are health concerns related to prolonged exposure to AR and VR environments. Studies have highlighted potential impacts on vision, spatial awareness, and even psychological effects from extended use of these technologies. Ensuring the health and safety of users is paramount, requiring ongoing research and development to improve the design and functionality of AR and VR devices. Addressing these challenges is essential for the sustainable growth of the AR and VR market, ensuring that these technologies are accessible, comfortable, and safe for all users.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the Augmented Reality (AR) and Virtual Reality (VR) market, capturing more than a 35% share. This significant market share is attributable to several factors, including rapid technological advancements, a large consumer base, and substantial investments in AR and VR technologies. Asia-Pacific, home to tech-savvy nations like China, Japan, and South Korea, has witnessed a surge in AR and VR adoption, particularly in industries such as gaming, education, healthcare, and real estate.

The region’s dominance is further bolstered by the presence of major AR and VR hardware manufacturers and software developers. China, in particular, has emerged as a global hub for AR and VR development, backed by strong governmental support and investments. The region’s gaming industry, one of the largest globally, has been a significant contributor to the growth of the AR and VR market. Japan and South Korea are known for their innovative applications of these technologies in entertainment and automotive sectors.

Furthermore, the increasing use of mobile devices and internet penetration in the Asia-Pacific region provides a conducive environment for the growth of mobile-based AR applications. The region’s expanding e-commerce sector also utilizes AR technology for enhancing online shopping experiences. Educational initiatives incorporating AR and VR for interactive learning are gaining momentum in several Asia-Pacific countries, further driving the market growth.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Augmented Reality (AR) and Virtual Reality (VR) market is characterized by the presence of several key players who are actively contributing to the growth and development of these technologies. These companies are driving innovation, developing cutting-edge solutions, and establishing strong footholds in the market. Facebook’s Oculus Rift and Oculus Quest headsets have gained significant popularity among consumers, offering immersive VR experiences and a wide range of content through the Oculus platform.

In addition to these established players, numerous startups and smaller companies are also making notable contributions to the AR and VR market. These innovative companies are focused on niche applications, developing specialized hardware, software, and content that cater to specific industries or user needs.

Overall, the AR and VR market is highly competitive, with key players continuously pushing the boundaries of technology and driving market growth. Their investments in research, development, and strategic partnerships are shaping the future of AR and VR, unlocking new opportunities and driving widespread adoption across industries.

Top Key Players

- Microsoft Corporation

- Meta (formerly Facebook Technologies LLC)

- Sony Corporation

- HTC Corporation

- Google LLC

- Samsung Electronics Co. Ltd.

- Magic Leap Inc.

- Vuzix Corporation

- PTC Inc.

- Qualcomm Technologies Inc.

- Atheer Inc.

- Epson America Inc.

- Other Key Players

Recent Developments

- During July 2023, Google and Taito will join forces to develop Space Invaders, an augmented reality game that immerses players in a unique experience. The game allows participants to safeguard the Earth directly from within their neighborhoods.

- The Apple Vision Pro was introduced by Apple in June 2023. This advanced spatial computing device seamlessly blends digital content with the real world, providing users with enhanced engagement and connectivity.

Report Scope

Report Features Description Market Value (2023) USD 34.8 Bn Forecast Revenue (2033) USD 106.2 Bn CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Augmented Reality (Marker-based AR, Markerless AR, Projection-based AR), Virtual Reality (Non-immersive VR, Semi-immersive VR, Fully immersive VR)), By Component (Hardware, Software), By End-User (Gaming and Entertainment, Healthcare, Education, Retail, Manufacturing, Real Estate, Automotive, Aerospace and Defense, Other End-Users) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft Corporation, Meta (formerly Facebook Technologies LLC), Sony Corporation, HTC Corporation, Google LLC, Samsung Electronics Co. Ltd., Magic Leap Inc., Vuzix Corporation, PTC Inc., Qualcomm Technologies Inc., Atheer Inc., Epson America Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Augmented Reality (AR) and Virtual Reality (VR)?Augmented Reality (AR) overlays digital information onto the real world, enhancing the user's perception of their surroundings. Virtual Reality (VR), on the other hand, immerses users in a simulated environment, detached from the real world.

How are AR and VR technologies applied in industries?AR and VR find applications in various industries such as healthcare, education, gaming, manufacturing, and retail. They enhance training, design visualization, customer experiences, and more.

How big is Augmented Reality and Virtual Reality Market?The Global Augmented Reality and Virtual Reality Market size is expected to be worth around USD 106.2 Billion by 2033, from USD 34.8 Billion in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

Who are the winners in the global augmented and virtual reality market?Companies such as Microsoft Corporation, Meta (formerly Facebook Technologies LLC), Sony Corporation, HTC Corporation, Google LLC, Samsung Electronics Co. Ltd., Magic Leap Inc., Vuzix Corporation, PTC Inc., Qualcomm Technologies Inc., Atheer Inc., Epson America Inc. and Other Key Players

Which region is expected to hold the highest market share?Asia Pacific regions are expected to hold the largest market share (35%) for the augmented and virtual reality market.

Augmented Reality and Virtual Reality MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Augmented Reality and Virtual Reality MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Meta (formerly Facebook Technologies LLC)

- Sony Corporation

- HTC Corporation

- Google LLC

- Samsung Electronics Co. Ltd.

- Magic Leap Inc.

- Vuzix Corporation

- PTC Inc.

- Qualcomm Technologies Inc.

- Atheer Inc.

- Epson America Inc.

- Other Key Players