Global Atherectomy Devices Market By Product (Directional Atherectomy Devices, and Support Devices), By Application (Peripheral Vascular Applications, and Neurovascular Applications ), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 101181

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

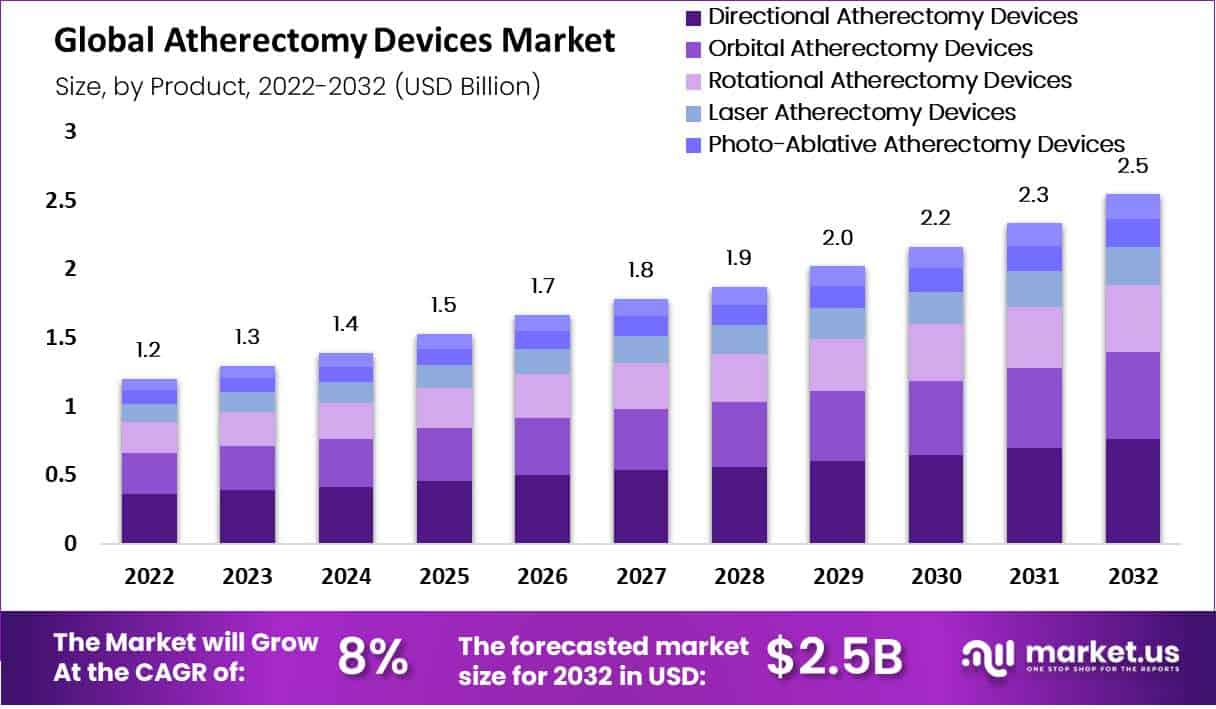

In 2022, Atherectomy Devices Market was valued at USD 1.2 Billion and is expected to reach USD 2.5 billion in 2032. This market is estimated to register the highest CAGR of 8% between 2023 and 2032.

A surgical treatment called an atherectomy uses a catheter with a sharp blade to remove plaque and atherosclerosis from the blood arteries in the body. Essentially, it is a local anesthetic-assisted endovascular minimally invasive surgical treatment. Atherectomy works by removing plaque and hardened lesions from the artery to create a substantial lumen, which aids in reviving blood flow in the arteries. They are frequently employed in peripheral, neurovascular, and cardiovascular applications.

Minimally invasive (MIS) procedures and surgeries are becoming more and more popular. Compared to invasive operations, these techniques cause the patient less trauma and has a quicker recovery. The potential for infection from invasive operations is another factor driving this move. Since Atherectomy is a minimally invasive operation, the market’s anticipated growth will be significantly influenced by the rising demand for less invasive procedures.

The global atherectomy devices market refers to the market for medical devices used in atherectomy procedures. The procedure involves the use of a catheter equipped with a cutting or ablating tool that is inserted into the artery to remove the plaque.

The global Atherectomy devices market is driven by the growing prevalence of cardiovascular diseases, such as coronary artery disease, peripheral artery disease, and others. Additionally, technological advancements in Atherectomy devices, increasing demand for minimally invasive surgeries, and rising healthcare expenditures are expected to further boost market growth.

Key Takeaways

- Atherectomy Devices Market sales will top US$ 2.5 billion by 2032.

- In 2022, the Atherectomy Devices Market was valued at USD 1.2 billion.

- The market will register a CAGR of 8% between 2023 and 2032.

- By product, in 2022, the directional atherectomy segment dominated the market in terms of revenue.

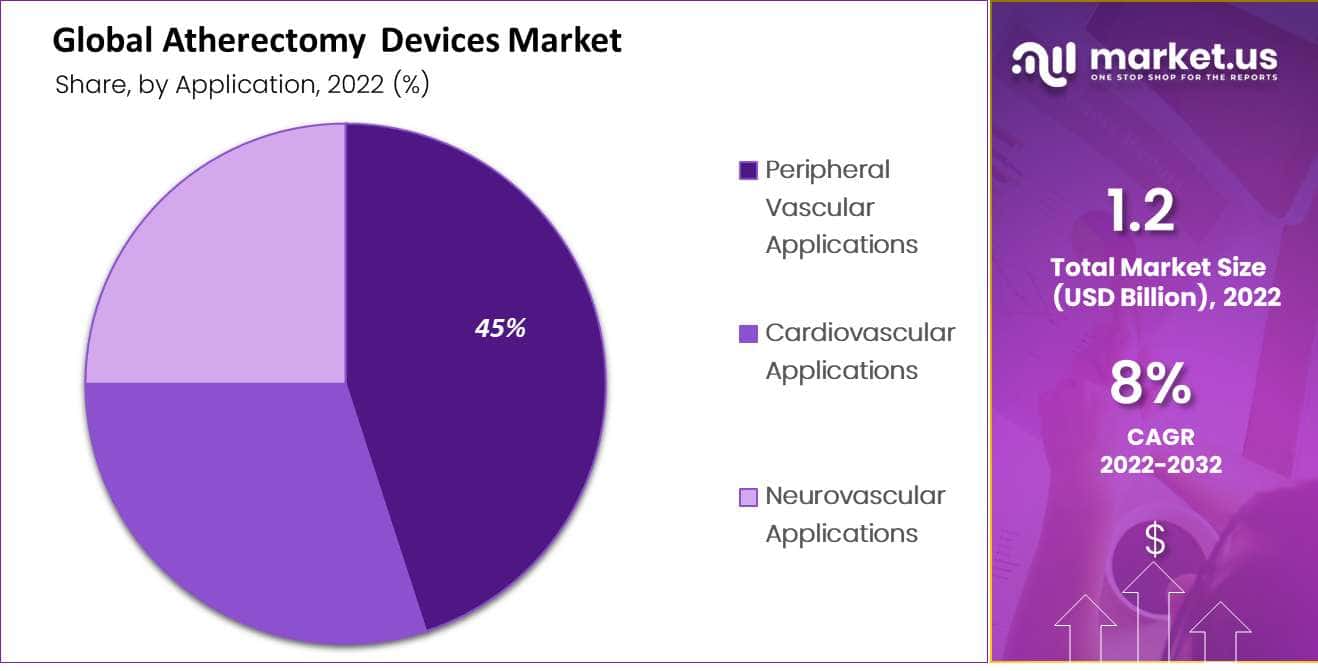

- By application, the market share for atherectomy devices for peripheral vascular applications was 45%.

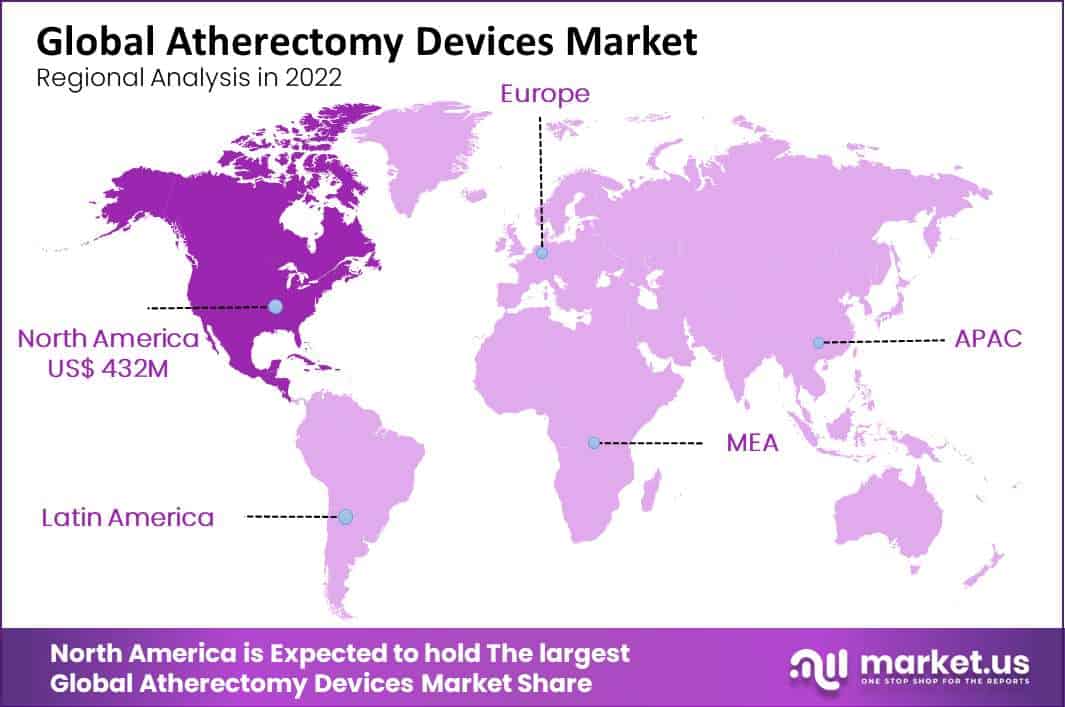

- In 2022, North America held the highest revenue share in the market at 36%.

- APAC is expected to have the highest growth rate among all regions.

- The American Heart Association estimated that CVD caused 18.6 million deaths worldwide in 2019.

- More than 200 million people globally are estimated to have peripheral artery disease (PAD).

- According to an American Heart Association (AHA) study, atherectomy devices were successful in 94.7% of patients.

- The rate of restenosis after atherectomy was 37.7%.

Driving Factors

Increasing Desire for Less Extensive Surgery, Increased Incidence of Diseases, Expanding Elderly Population, and Better Success Rate. The prevalence of vascular disorders is increasing among people worldwide (peripheral artery disease, coronary artery disease).

The NCBI estimates that peripheral artery disease (PAD) affects more than 200 million people worldwide. The population of elderly people has also increased noticeably. In 2021, 18.5% of Canadians will be 65 years of age or older, making them more vulnerable to coronary artery disease. As a result, the market for atherectomy devices has grown more in demand.

Lately, the use of minimally invasive procedures like atherectomy has expanded among both physicians and patients. As a result, there is now a greater need for atherectomy devices, which significantly drives the market’s growth. An American Heart Association (AHA) study found that 94.7% of patients treated with atherectomy devices experienced success. As a result, it is anticipated that market growth would accelerate and have a greater success rate.

Restraining Factors

Patients must choose alternate forms of treatment because atherectomy is so expensive. An NCBI study found that the typical angioplasty expense is roughly USD 7300. Atherectomy, on the other hand, typically costs USD 9300. The demand for atherectomy is impacted by the high expenses, which hinders the market’s expansion.

Although atherectomy has a high probability of success, the high rate of restenosis forces patients to choose alternative treatments, which slows the market’s expansion. Atherectomy had a 37.7% restenosis rate.

Product Analysis

The market for atherectomy devices is expected to be dominated by the directional atherectomy segment in terms of revenue

Based on type, the market for atherectomy devices is expected to be dominated by the directional atherectomy segment in terms of revenue. Over the projection period, the laser atherectomy segment is anticipated to experience the greatest share of approximately 21%. This is mostly attributable to technological advancements in the field of directed atherectomy that are most appropriate to the clinical benefits provided.

A promising new technique for treating various artery disorders, such as CAD and PAD, is orbital atherectomy systems. The prevalence of surgical treatments for the treatment of arterial plaque is steadily rising as a result of global population aging and rising coronary and peripheral artery calcification risk. As a result, more people are purchasing orbital gadgets, which will fuel future market expansion. Furthermore, there is a greater demand for orbital implants due to low procedural difficulties and low rates of restenosis.

Application Analysis

The market for atherectomy devices is expected to be dominated by Peripheral Vascular Applications

By distribution channel, the market for atherectomy devices is expected to be dominated by Peripheral Vascular Applications with a share of 45%. Occlusive or stenotic lesions brought on by thromboembolic or atherosclerotic illness are categorized clinically as “peripheral artery disease.” Invasive operations are frequently needed in patients with peripheral artery disease to clear blockages and stop the disease from getting worse.

Traditional methods for treating focal lesions include balloon angioplasty and percutaneous transluminal angioplasty. The demand for these treatments is however constrained by the possibility of rebound and the inadequacy of patency rates for extended lesions.

Moreover, the presence of hard calcifications may result in stent expansion that is imperfect or only partially completed and residual stenosis.

Due to the absence of effective therapy for restenosis, researchers are now looking into alternative therapies such as atherectomy-based plaque remodeling. Peripheral artery disease is the condition that directional atherectomy is most frequently used to treat. These tools resect and remove plaque using revolving cutters with carbide tips.

These tools have a demonstrated benefit in lowering the risk of barotrauma, which lowers the risk of dissection and neointimal hyperplasia. Nonetheless, distal embolization is a significant issue with directed devices, and cases of severely calcified lesions also call for the use of distal protective devices.

End-user Analysis

The hospitals and surgical centers end user segment is anticipated to contribute a significant revenue contribution to the global atherectomy devices market

Based on end-user, the hospitals, and surgical centers end-user segment is anticipated to contribute a significant revenue contribution to the global atherectomy devices market and is anticipated to see the highest share of over 27% in terms of revenue over the forecast period among all end-user segments. This can be due to atherectomy’s rising popularity as a treatment for peripheral and heart vascular disease over the anticipated period.

Ambulatory surgery centers (ASCs) are economical and provide excellent care for a low indirect cost of care. Advanced operating technology, specialized surgeons, and well-equipped operating rooms are all provided by ASCs without the need for laborious administrative procedures, which is likely to support the segment’s expansion.

Furthermore, as the focus of end-users increasingly shifts from open cardiovascular surgical techniques to percutaneous-based techniques, ASCs are predicted to experience significant expansion in developed countries.

Key Market Segments

Based on Product

- Directional Atherectomy Devices

- Rotational Atherectomy Devices

- Orbital Atherectomy Devices

- Laser Atherectomy Devices

- Photo-Ablative Atherectomy Devices

- Support Devices

- Others

Based on Application

- Peripheral Vascular Applications

- Cardiovascular Applications

- Neurovascular Applications

Based on End-User

- Hospitals & Surgical centres

- Ambulatory Care Centres

- Research Laboratories

- Academic Institutes

Growth Opportunity

The industry growth can be expedited to create more growth prospects with newer and better atherectomy devices. Atherectomy devices might be improved through procedures like percutaneous revascularization, which make use of interventional radiology and optical coherence tomography as therapeutic philosophies.

Furthermore, thrombectomy and vitrectomy methods for atherectomy could be employed. Even for individuals over 60 years old, the vitrectomy has a 90% success rate, according to Healthline.

Latest Trends

Growing demand for minimally invasive procedures

Atherectomy devices are minimally invasive, which means they offer several advantages over traditional surgical techniques. Patients generally experience less pain, shorter hospital stays, and quicker recovery times. This has led to an increasing adoption of these procedures, particularly in developed countries.

Advancements in device technologies

The market is witnessing a constant influx of new technologies aimed at improving the safety, efficacy, and outcomes of atherectomy procedures. These include new materials, delivery systems, and imaging techniques, as well as the development of new devices and applications.

Emergence of new market players

The market is experiencing an increasing number of new entrants, particularly in emerging markets. These players are expected to offer low-cost, locally-manufactured devices, which could expand access to these procedures in areas where they are currently limited.

Increasing adoption of image-guided procedures

The use of imaging technologies, such as fluoroscopy and ultrasound, is increasing in atherectomy procedures. This presents an opportunity for manufacturers to develop devices that are optimized for use with these imaging technologies.

Integration of artificial intelligence and machine learning

The integration of artificial intelligence and machine learning is expected to play a growing role in the development of atherectomy devices. These technologies can help improve the accuracy and precision of procedures, as well as patient outcomes.

Increasing focus on patient safety and outcomes

Patient safety and outcomes are becoming increasingly important in healthcare, and there is a growing focus on improving the safety and effectiveness of medical procedures. Device manufacturers can capitalize on this trend by developing devices that are optimized for safety and outcomes.

Overall, these trends are expected to continue shaping the atherectomy devices market in the coming years, as demand for minimally invasive procedures grows and device technologies continue to advance.

Device manufacturers that are able to develop innovative, safe, and effective devices will be well-positioned to capture these opportunities and grow their market share.

Regional Analysis

North America is estimated to be the most lucrative market in the Atherectomy Devices Market, with the largest market share of 36%.

Atherectomy systems are becoming more widely accepted among medical experts, there is a large patient population suffering from peripheral and coronary artery disorders, and there are more clinical trials being conducted.

According to the American Heart Association, 18.6 million deaths worldwide in 2019 were attributed to CVD. The demand for atherectomy devices is expected to rise during the forecast period as a result of the stress it places on the nation’s healthcare system.

Also, a favorable reimbursement environment and a large variety of FDA-approved devices support the market’s expansion.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

the major players in the atherectomy devices market account for a significant share of the global market. In 2020, Cardiovascular Systems, Inc. was identified as the leading player in the atherectomy devices market, with a significant share of the market. Other leading players in the market include Boston Scientific Corporation and Medtronic.

These key players are focusing on product innovation and new product launches to maintain their market position. For instance, in 2021, Boston Scientific Corporation launched its new Vici VERT Catheter, a specialized atherectomy device used for the treatment of deep vein thrombosis. Similarly, in 2020, Cardiovascular Systems, Inc. launched its new Diamondback 360 Coronary Orbital Atherectomy System, an advanced atherectomy device used for the treatment of calcified coronary lesions.

Key Players

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic

- Becton, Dickinson, and Company (BD Interventional)

- Koninklijke Philips N.V.

- Avinger Inc.

- Rex Medical

- AngioDynamics

- Cardiovascular Systems Inc.

- Bard Peripheral Vascular Inc.

- Spectranetics St.

- Jude Medical Inc.

- Straub Medical AG

- Terumo IS

- Volcano Corporation

- Others Key Players

Recent Developments

AngioDynamics announced in August 2022 that it has acquired FDA approval to market its more sophisticated Auryon-Atherectomy System.

AngioDynamics also intends to introduce the 2.35 mm and 2.0 mm catheters from the Auryon System for the treatment of arterial thrombosis. Both catheters can be utilized to treat ISR/In-Stent Restenosis and are very effective atherectomy conducting devices.

Cardiovascular Systems, Inc. (CSI) announced its partnership with Innova Vascular, Inc. in February 2022 with the goal of creating a broad line of innovative thrombectomy devices. Innova thinks that working with CSI will enable it to take advantage of that company’s commercial position in the market for thrombectomy devices and hasten the marketing of its products after they have received regulatory approval.

Report Scope

Report Features Description In (2022) USD 1.2 Bn Forecast Revenue (2032) USD 2.5 Bn CAGR (2023-2032) 8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product, By Application, By End-User Regional Analysis North America – The US, Canada,&Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, &Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, &Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, &Rest of MEA Competitive Landscape Abbott Laboratories, Boston Scientific Corporation, Bard Peripheral Vascular Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Atherectomy Devices Market in 2032?In 2032, the Atherectomy Devices Market will reach USD 2.5 billion.

What CAGR is projected for the Atherectomy Devices Market?The Atherectomy Devices Market is expected to grow at 8% CAGR (2023-2032).

List the segments encompassed in this report on the Atherectomy Devices Market?Market.US has segmented the Atherectomy Devices Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Product , market has been segmented into Directional Atherectomy Devices, Rotational Atherectomy Devices, Orbital Atherectomy Devices, Laser Atherectomy Devices, Photo-Ablative Atherectomy Devices, Support Devices and Others. By Application, the market has been further divided into Peripheral Vascular Applications, Cardiovascular Applications and Neurovascular Applications.

Which segment dominate the Atherectomy Devices industry?With respect to the Atherectomy Devices industry, vendors can expect to leverage greater prospective business opportunities through the Directional Atherectomy Devices segment, as this dominate this industry.

Name the major industry players in the Atherectomy Devices Market.Abbott Laboratories, Boston Scientific Corporation, Medtronic, Becton, Dickinson, and Company (BD Interventional), Koninklijke Philips N.V., Avinger Inc., Rex Medical and Other Key Players are the main vendors in this market.

-

-

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic

- Becton, Dickinson, and Company (BD Interventional)

- Koninklijke Philips N.V.

- Avinger Inc.

- Rex Medical

- AngioDynamics

- Cardiovascular Systems Inc.

- Bard Peripheral Vascular Inc.

- Spectranetics St.

- Jude Medical Inc.

- Straub Medical AG

- Terumo IS

- Volcano Corporation

- Others Key Players