Global Asset Liability Management Market By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Interest Rate Risk Management, Liquidity Risk Management, Others), By End-User Industry (Banking, Insurance Companies, Pension Funds & Asset Managers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176568

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraints Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User Industry

- Investor Type Impact Matrix

- Key Challenges

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

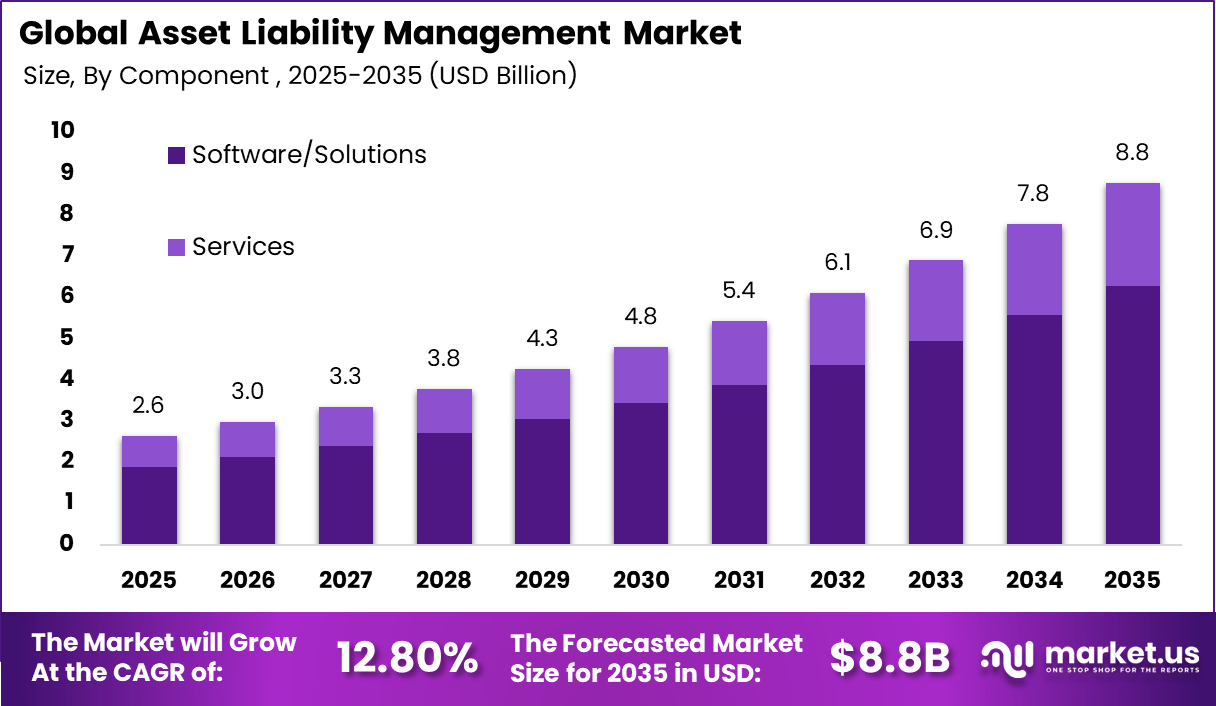

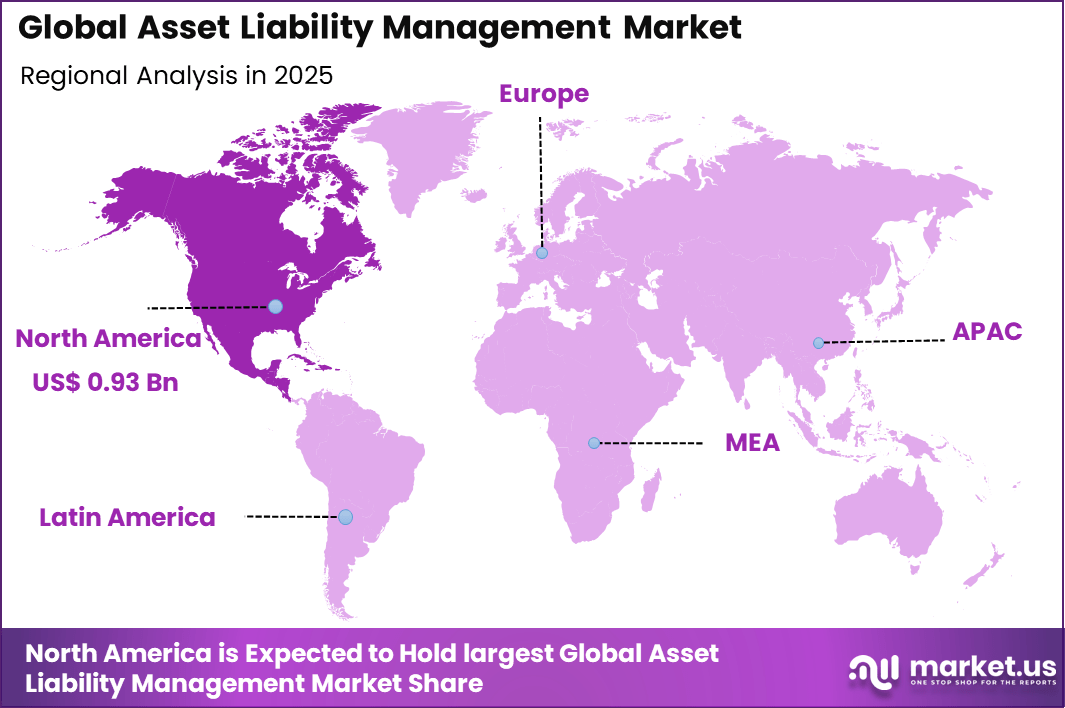

The Global Asset Liability Management Market generated USD 2.6 billion in 2025 and is predicted to register growth from USD 3 billion in 2026 to about USD 8.8 billion by 2035, recording a CAGR of 12.80% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 35.6% share, holding USD 0.93 Billion revenue.

The Asset Liability Management Market refers to the systems, tools, and frameworks used by financial institutions to manage the balance between assets and liabilities over time. The objective is to control risks related to interest rates, liquidity, currency movements, and maturity mismatches. Asset liability management is widely applied across banks, insurance companies, pension funds, and large financial institutions where long term obligations must be matched with income generating assets.

The market includes software platforms, risk models, and advisory practices that support balance sheet planning and scenario analysis. These solutions help institutions align profitability goals with regulatory and risk constraints. Industry data indicates that more than 70% of global banks actively use structured asset liability management frameworks to guide interest rate and liquidity decisions. The role of ALM has expanded as financial markets become more volatile and interconnected.

One of the key drivers of the Asset Liability Management Market is interest rate volatility. Frequent changes in policy rates directly affect asset yields and liability costs, creating pressure on margins. Financial institutions rely on ALM tools to measure sensitivity and manage exposure across different time horizons. This need has intensified in environments where rate cycles shift rapidly.

Demand for asset liability management solutions is strong among banks and insurers facing tighter capital and liquidity expectations. Institutions are required to demonstrate control over maturity gaps and funding risks. Internal studies show that liquidity stress events can increase funding costs by more than 25% if not managed proactively. This has made ALM a priority function within treasury and risk teams.

Top Market Takeaways

- By component, software/solutions account for 71.5% of the market, providing advanced tools for balance sheet optimization, liquidity forecasting, and regulatory compliance.

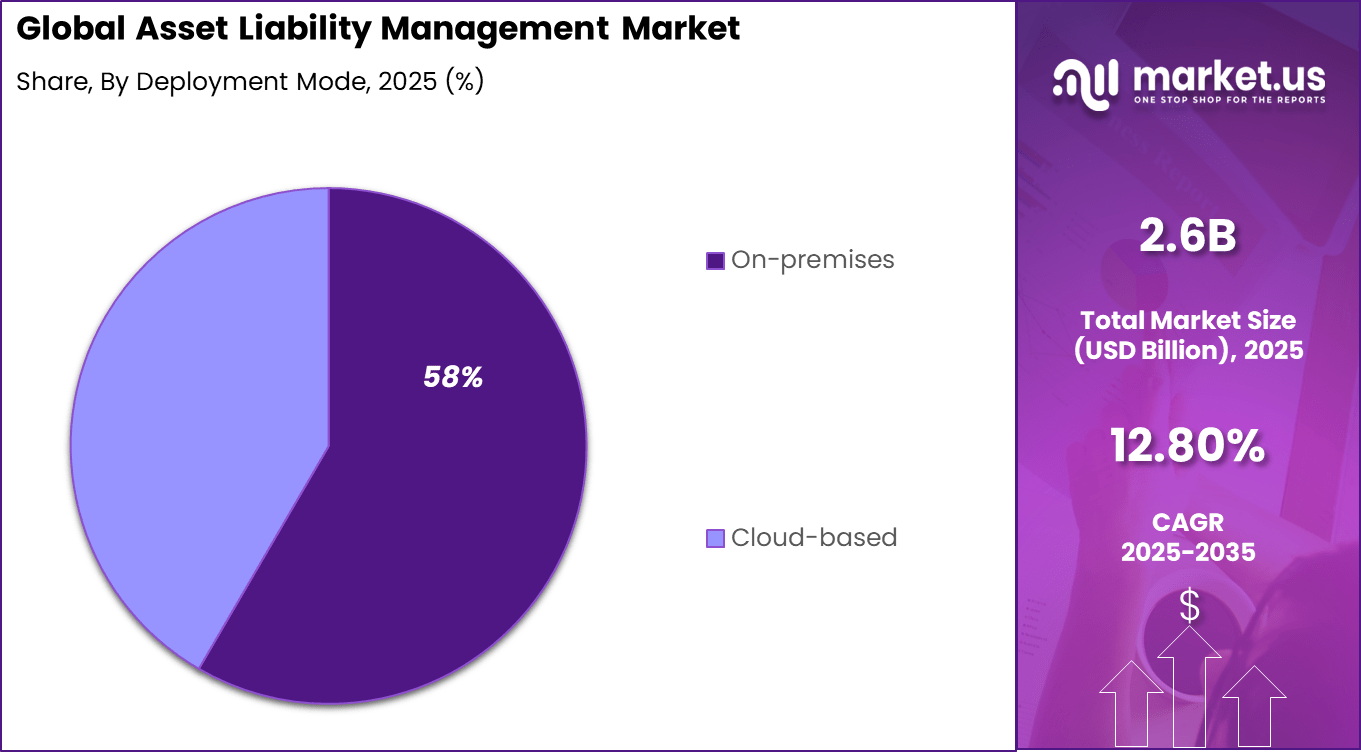

- By deployment mode, on-premises solutions represent 58.4%, preferred for data security, customization, and integration with legacy banking systems.

- By organization size, large enterprises hold 82.7% share, leveraging ALM for complex portfolios, capital adequacy, and stress testing under global regulations.

- By application, interest rate risk management captures 35.8%, focusing on hedging mismatches between assets and liabilities amid volatile monetary policies.

- By end-user industry, banking commands 67.3%, driven by Basel III/IV requirements and needs for real-time risk analytics.

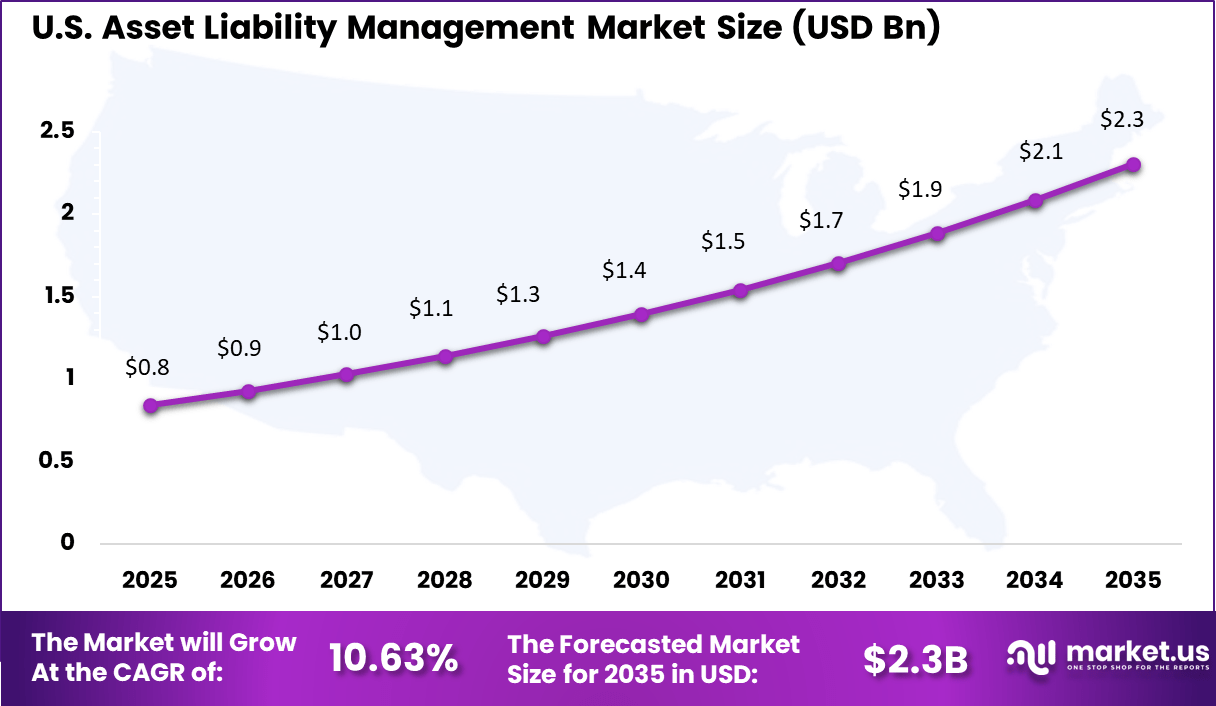

- By region, North America leads with 35.6% of the global market, where the U.S. is valued at USD 0.84 billion with a projected CAGR of 10.63%, supported by sophisticated financial institutions and FinTech adoption.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising interest rate volatility and balance sheet risk exposure +3.4% North America, Europe Short to medium term Increasing regulatory requirements for liquidity and capital adequacy +2.9% North America, Europe Medium term Growing adoption of advanced risk management practices by banks +2.4% Global Medium term Expansion of ALM usage beyond banks into insurers and asset managers +2.1% North America, Europe Medium to long term Integration of ALM with enterprise risk and treasury systems +2.0% Global Long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High implementation and customization costs of ALM platforms -2.6% Emerging Markets Short to medium term Complexity in modeling diverse asset and liability structures -2.1% Global Medium term Limited ALM expertise among mid-sized financial institutions -1.8% Asia Pacific, Latin America Medium term Data quality and integration challenges across legacy systems -1.5% Global Medium term Long procurement and decision cycles in regulated institutions -1.2% North America, Europe Medium to long term By Component

Software and solution based components account for 71.5% of adoption within the asset liability management market, as financial institutions rely on advanced analytical tools to manage balance sheet risk. These solutions support real time modeling of assets and liabilities under varying economic conditions.

Their ability to integrate risk metrics, reporting, and compliance functions makes them central to ALM operations.

The growing complexity of financial products has increased dependence on automated platforms. Manual processes are no longer sufficient for scenario analysis and stress testing. As a result, software driven ALM systems continue to see strong preference among institutions managing large and diversified portfolios.

By Deployment Mode

On premises deployment holds a 58% share, driven by the need for greater data control and system customization. Financial institutions often manage sensitive customer and transaction data, which increases concern around external data exposure. On premises systems provide tighter governance and internal security oversight.

These deployments also allow deeper integration with legacy core banking and treasury systems. Institutions with established IT infrastructure prefer retaining operational control over critical risk management functions. This deployment mode remains relevant despite gradual cloud adoption in other banking applications.

By Organization Size

Large enterprises represent 82.7% of ALM solution usage due to their complex balance sheet structures. These organizations operate across multiple geographies and product lines, which increases exposure to liquidity and interest rate risks. Advanced ALM systems are required to maintain financial stability under such conditions.

Regulatory scrutiny is also higher for large institutions. Compliance reporting and stress testing requirements increase the need for sophisticated ALM tools. This continues to reinforce strong adoption among large scale financial organizations.

By Application

Interest rate risk management accounts for 35.8% of ALM applications, reflecting its importance in profitability protection. Fluctuating interest rates directly affect net interest margins and asset valuations. Institutions therefore prioritize tools that help measure and mitigate rate related exposure.

Changing monetary policies and market volatility have increased focus on interest rate sensitivity analysis. ALM platforms support simulation of rate shocks and repricing gaps. This application remains a core use case within ALM frameworks.

By End User Industry

The banking sector holds a 67.3% share as asset liability management is fundamental to banking operations. Banks manage large volumes of deposits and loans with varying maturities and rates. Effective ALM practices are essential to maintain liquidity and earnings stability.

Banks are also subject to strict regulatory oversight related to capital adequacy and risk exposure. ALM systems help support internal governance and regulatory reporting requirements. This structural dependence ensures sustained demand from the banking industry.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Financial risk management software providers Very High Medium North America, Europe Strong recurring license and SaaS revenue Core banking and treasury system vendors High Medium Global Cross-sell and platform expansion Banks and financial institutions Medium Low to Medium Global Strategic investment for compliance Private equity firms Medium Medium North America, Europe Consolidation of mature ALM platforms Venture capital investors Medium High North America Selective interest in AI-driven ALM tools Key Challenges

- High implementation and customization costs for complex financial institutions

- Difficulty in integrating ALM systems with legacy core banking and treasury platforms

- Dependence on high quality data for accurate risk modeling and scenario analysis

- Increasing regulatory complexity across regions affecting system configuration

- Limited in house expertise among smaller institutions to manage advanced ALM tools

Emerging Trends

Key Trend Description Cloud based tools Banks use online software to check assets and debts in real time. AI for risk checks Computer programs predict interest rate changes and cash needs. Real time data use Live information helps banks make quick choices on loans and deposits. Better rules follow Software helps banks meet new banking laws on risk and money. Tools for all sizes Small and big banks use the same easy software for money balance. Growth Factors

Key Factors Description New banking rules Governments make banks use better tools to watch money risks. Interest rate changes Banks need software to handle loan and deposit rate shifts. Digital banking growth More online banking means more data to track for balance. Cash flow worries Banks want to keep the right amount of cash ready for customers. Lower costs goal Software cuts time and people needed to check assets and debts. Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Interest Rate Risk Management

- Liquidity Risk Management

- Capital Management

- Funds Transfer Pricing

- Others

By End-User Industry

- Banking

- Insurance Companies

- Pension Funds & Asset Managers

- Others

Regional Analysis

North America accounts for 35.6% of the asset liability management market, supported by the region’s mature financial services sector and early adoption of advanced risk management practices. Demand is driven by the need to manage interest rate risk, liquidity gaps, and balance sheet volatility across banks and large financial institutions. Regulatory oversight and stress testing requirements further reinforce the use of structured asset liability frameworks as part of routine financial governance.

The United States market is valued at USD 0.84 Bn and is growing at a CAGR of 10.63%, reflecting rising complexity in balance sheet management and funding structures. Adoption is influenced by fluctuating interest rate environments, tighter capital requirements, and the need for more frequent scenario analysis. Growth is supported by increased use of data-driven decision tools and stronger focus on long-term financial stability across banking and non-banking institutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Large enterprise software providers such as Oracle Corporation, SAP SE, and IBM Corporation play a central role in the asset liability management market. Their solutions support balance sheet modeling, liquidity risk analysis, and regulatory reporting. Strong integration with core banking and finance systems improves data consistency. SAS Institute, Inc. strengthens this segment with advanced modeling and stress testing capabilities. These players are widely adopted by large banks and financial institutions.

Risk analytics and financial intelligence specialists such as Moody’s Analytics, Inc., Wolters Kluwer N.V., and Thomson Reuters Corporation focus on regulatory-driven ALM requirements. QRM and Kamakura Corporation emphasize interest rate risk, liquidity forecasting, and scenario analysis. These platforms help institutions align capital planning with regulatory compliance. Demand is driven by volatile interest rate environments and stricter supervisory expectations.

Banking technology and specialized ALM vendors such as FIS, Fiserv, Inc., and Murex S.A.S. support integrated treasury and balance sheet management. SS&C Technologies Holdings, Inc., RiskSpan, Inc., and AxiomSL address data aggregation and reporting accuracy. Other vendors expand innovation and regional coverage, supporting steady growth of ALM solutions across global financial institutions.

Top Key Players in the Market

- Oracle Corporation

- SAP SE

- IBM Corporation

- SAS Institute, Inc.

- Moody’s Analytics, Inc.

- Wolters Kluwer N.V.

- FIS (Fidelity National Information Services, Inc.)

- Fiserv, Inc.

- Murex S.A.S.

- RiskSpan, Inc.

- QRM (Quantitative Risk Management)

- Kamakura Corporation

- Thomson Reuters Corporation

- SS&C Technologies Holdings, Inc.

- AxiomSL

- Others

Future Outlook

The future outlook for the Asset Liability Management Market indicates continued expansion as financial institutions strengthen risk management practices. Growing regulatory requirements and focus on solvency and liquidity positions are expected to drive adoption of advanced ALM tools and services. Demand for real-time analytics, scenario planning, and integrated risk dashboards is likely to increase as banks, insurers, and asset managers seek to balance returns with risk controls.

Technology advancement such as cloud-based solutions and automation will support scalability and efficiency. Overall, growth can be attributed to heightened risk awareness, evolving financial regulations, and the need for robust strategies to manage interest rate and liquidity risks.

Recent Developments

- December 2025, Wolters Kluwer N.V. wrapped up selling its Finance, Risk, and Regulatory Reporting unit to Regnology for €725 million, letting it zero in on core tax and health tech while handing off ALM-heavy risk tools to a specialist.

- November 2025, FIS debuted an Asset Servicing Management Suite on cloud tech, unlocking ops efficiency for balance sheets with AI-driven reconciliation and real-time reporting tailored for ALM workflows.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Billion Forecast Revenue (2035) USD 8.8 Billion CAGR(2025-2035) 12.80% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Interest Rate Risk Management, Liquidity Risk Management, Others), By End-User Industry (Banking, Insurance Companies, Pension Funds & Asset Managers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle Corporation, SAP SE, IBM Corporation, SAS Institute, Inc., Moody’s Analytics, Inc., Wolters Kluwer N.V., FIS (Fidelity National Information Services, Inc.), Fiserv, Inc., Murex S.A.S., RiskSpan, Inc., QRM (Quantitative Risk Management), Kamakura Corporation, Thomson Reuters Corporation, SS&C Technologies Holdings, Inc., AxiomSL, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asset Liability Management MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Asset Liability Management MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle Corporation

- SAP SE

- IBM Corporation

- SAS Institute, Inc.

- Moody's Analytics, Inc.

- Wolters Kluwer N.V.

- FIS (Fidelity National Information Services, Inc.)

- Fiserv, Inc.

- Murex S.A.S.

- RiskSpan, Inc.

- QRM (Quantitative Risk Management)

- Kamakura Corporation

- Thomson Reuters Corporation

- SS&C Technologies Holdings, Inc.

- AxiomSL

- Others