Global Artificial Sports Turf Market By Material (Nylon, Polypropylme, Polyethylene, Hybrid , Others), By Type (Sand Filled, Water-Based, Sand Dressed, Third Generation), By Filament (Monofilament, Multi-Filament), By Application (Football Pitches, Baseball Pitches, Hockey Pitches, Rugby Pitches, Tennis Pitches, Golf Pitches, Others), By End-Use (Residential, Commercial, Sports, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 132962

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

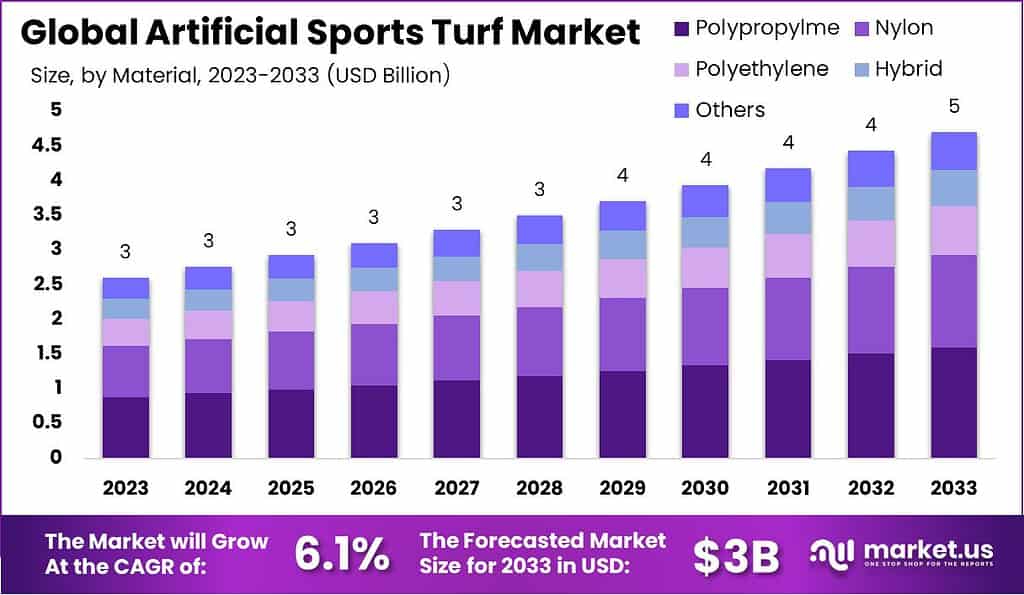

The Global Artificial Sports Turf Market size is expected to be worth around USD 5.0 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The artificial sports turf market refers to the production, installation, and maintenance of synthetic grass systems used in sports facilities, recreational fields, and landscaping applications. Driven by advancements in technology and the increasing demand for low-maintenance, durable playing surfaces, artificial turf has become a popular alternative to natural grass, offering year-round usability in various climates.

The demand for artificial sports turf has been steadily increasing, driven by the growing need for low-maintenance and durable playing surfaces. This demand is particularly strong in regions with challenging weather conditions, where natural grass fields struggle to maintain quality.

Artificial turf provides a consistent playing surface regardless of climate, making it a popular choice for sports fields, schools, and recreational areas. Its ability to withstand heavy foot traffic and its long lifespan have further contributed to its preference in the sports industry.

The market for artificial sports turf is expanding rapidly, largely due to its advantages over traditional grass fields. Artificial turf offers a cost-effective, low-maintenance solution, which is especially beneficial in areas with harsh weather conditions where natural grass requires frequent upkeep. It is commonly used in various sports, including soccer, football, hockey, and golf.

Governments globally have implemented regulations to ensure the safety, quality, and environmental sustainability of artificial turf. For example, the European Union (EU) and the United States Environmental Protection Agency (EPA) have set guidelines for the use of materials in artificial turf products, including safe handling of crumb rubber and other infill materials. The EU’s REACH regulation ensures that the chemical substances in synthetic turf are assessed for environmental and health risks.

The global market for artificial sports turf is shaped by key players in North America, Europe, and Asia-Pacific. The U.S. exports a significant portion of its production, with key markets in Canada, Mexico, and Europe.

Key Takeaways

- The Global Artificial Sports Turf Market size is expected to be worth around USD 5.0 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

- Polyethylene dominated the Artificial Sports Turf Market with a 34.4% share.

- Third Generation (3G) turf dominated the market with a 43.3% share, leading.

- Monofilament dominated the fiber-type segment, capturing 54.4% of the market.

- Football Pitches dominated the Artificial Sports Turf Market with a 35.4% share.

- The Sports segment dominated the Artificial Sports Turf Market with a 54.2% share.

- The Asia Pacific region dominates the artificial sports turf market with a 32.5% share, valued at USD 1.1 billion.

By Material Analysis

Polyethylene dominated the Artificial Sports Turf Market with a 34.4% share.

In 2023, Polyethylene held a dominant market position in the By Material segment of the Artificial Sports Turf Market, capturing more than a 34.4% share. This material’s preference is primarily due to its durability, resilience, and low maintenance requirements, making it highly suitable for sports applications that demand long-lasting performance. The material’s ability to withstand various weather conditions and retain its aesthetic appeal with minimal care contributes significantly to its leading status.

Following Polyethylene, Nylon accounts for a significant portion of the market. Known for its robustness and ability to maintain fiber height and aesthetic quality, nylon is favored in sports applications that experience high foot traffic, such as soccer and American football fields. Its resilience under physical stress makes it an excellent choice for professional sports venues.

Polypropylene holds the third position in the material segmentation. It is valued for its lightweight and less abrasive texture compared to its counterparts. While it offers a softer surface, making it safer for players, its durability under frequent use is somewhat less than that of nylon and polyethylene, positioning it as a cost-effective alternative for less demanding applications.

The Hybrid materials category is gaining traction, offering a blend of the attributes of nylon, polyethylene, and polypropylene. This category is engineered to maximize durability and visual appeal while maintaining the play characteristics essential for various sports. Hybrids are increasingly preferred for newer, multipurpose sports facilities that host a variety of sporting events, ensuring optimal performance across different sports disciplines.

By Type Analysis

Third Generation (3G) turf dominated the market with a 43.3% share, leading.

In 2023, Third Generation (3G) artificial sports turf held a dominant market position in the By Type segment of the Artificial Sports Turf Market, capturing more than 43.3% share. This type of turf, recognized for its durability and performance, has become the go-to option for many sports fields, particularly in football, rugby, and hockey. 3G turfs combine synthetic fibers with a mix of sand and rubber infill, providing superior shock absorption and traction, making them suitable for high-impact sports.

In comparison, sand-filled turf, often used for lower-intensity sports or recreational fields, held a smaller share of the market. Sand-filled surfaces use sand infill to mimic the natural playing experience but tend to lack the shock-absorption quality of 3G turfs, limiting their application in competitive sports.

Water-based turf, which is primarily designed for field hockey, remains a specialized option. These fields require a water-based infill system that maintains a consistent playing surface. While providing excellent ball control, water-based systems require higher maintenance, including regular watering, which makes them less popular than the more versatile 3G systems.

Lastly, Sand-dressed turf, a hybrid between sand-filled and 3G types, offers moderate shock absorption but does not perform as well in high-contact sports. Sand-dressed fields are often found in multi-sport complexes and provide a middle ground between sand-filled and 3G solutions, offering some durability without the added complexity of water-based systems.

By Filament Analysis

Monofilament dominated the fiber-type segment, capturing 54.4% of the market.

In 2023, Monofilament held a dominant market position in the “By Fiber Type” segment of the Artificial Sports Turf Market, capturing more than a 54.4% share. This material is favored for its durability, resilience, and enhanced performance, making it a preferred choice for a wide range of sports applications, particularly football and rugby fields.

The monofilament fibers, with their single-strand construction, offer superior consistency in performance, simulating natural grass more effectively than other fiber types. Their ability to maintain an upright structure under high-impact conditions further solidifies their position in the market, as they provide a consistent playing surface over extended periods of use.

In contrast, the Multi-Filament segment, while holding a smaller share, is also a key player in the artificial turf market, capturing a significant portion of the remaining market. Multi-filament fibers are comprised of multiple smaller strands, which provide a softer, more flexible texture compared to monofilament fibers.

This makes them particularly suitable for applications where player comfort is prioritized, such as in tennis or multi-purpose sports fields. Although multi-filament fibers offer advantages in terms of surface softness, they are generally less durable than their monofilament counterparts, which may limit their use in high-traffic environments.

Ultimately, the dominance of monofilament fibers can be attributed to their superior durability, enhanced performance characteristics, and cost-effectiveness, factors that have driven their continued growth in the artificial sports turf market.

By Application Analysis

Football Pitches dominated the Artificial Sports Turf Market with a 35.4% share.

In 2023, Football Pitches held a dominant market position in the By Application segment of the Artificial Sports Turf Market, capturing more than a 35.4% share. The significant adoption of artificial turf in football pitches can be attributed to its durability, low maintenance requirements, and the growing demand for year-round playing surfaces.

These factors have led to increased installations in both professional and recreational facilities, contributing to football pitches’ leadership in market share. Artificial football pitches are favored for their ability to withstand heavy usage and various weather conditions, making them a practical choice for maintaining high-quality playability.

Following football pitches, Baseball Pitches accounted for a substantial portion of the market, with artificial turf systems gaining traction in baseball fields due to their ability to provide consistent, even surfaces that enhance player performance.

Baseball-specific turf systems are designed to mimic natural grass, providing optimal bounce and speed for the ball while requiring minimal upkeep. The market for baseball pitches continues to expand, driven by the increasing focus on upgrading sports facilities and reducing maintenance costs.

Hockey Pitches have also emerged as a key segment, with artificial turf being widely adopted in both field hockey and indoor hockey venues. These pitches offer superior ball control, consistency, and safety, making them ideal for high-performance sports. The demand for artificial turf in hockey has been supported by international tournaments and sporting events that require the highest standards of playing surfaces.

The Rugby Pitches segment has seen steady growth, driven by the demand for all-weather playing surfaces that can withstand intensive training and match schedules. Rugby pitches made from artificial turf provide a resilient and durable alternative to natural grass, which can be challenging to maintain, particularly in regions with adverse weather conditions.

Tennis Pitches represent a smaller but growing portion of the market. Artificial turf in tennis courts provides a consistent playing experience while reducing maintenance costs compared to natural grass or clay courts. It is increasingly being adopted in recreational facilities and smaller-scale venues, where upkeep costs are a major consideration.

The Golf Pitches segment, while niche, is also gaining traction. Artificial grass is utilized for putting greens, offering high durability and requiring minimal maintenance. It is becoming a popular choice for both commercial and residential golf course applications.

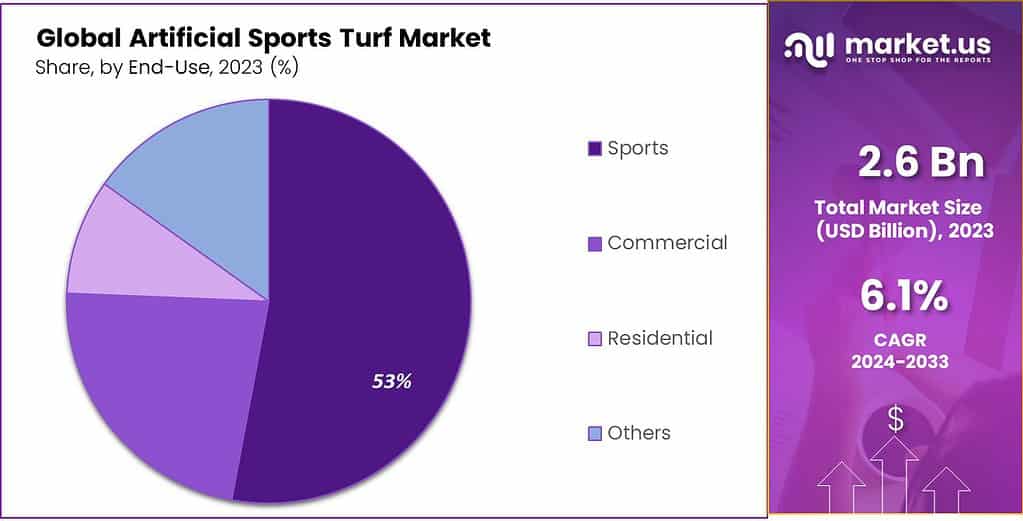

By End-Use Analysis

The Sports segment dominated the Artificial Sports Turf Market with a 54.2% share.

In 2023, The Sports segment held a dominant market position in the Artificial Sports Turf Market, capturing more than a 54.2% share of the total market. This segment’s growth can be attributed to the increasing demand for high-performance turf in sports facilities such as football fields, rugby pitches, and tennis courts, where durability, performance, and cost-effectiveness are key factors. The growing trend of installing artificial turf in professional and recreational sports venues has significantly driven this market share.

The Residential segment was a notable contributor, accounting for a substantial portion of the market. The growing interest in low-maintenance landscaping solutions, especially in urban areas where water conservation and space optimization are priorities, has driven the adoption of artificial turf for private lawns, gardens, and residential play areas.

The Commercial segment also demonstrated a strong presence in 2023, fueled by the increasing use of artificial grass in commercial properties such as office complexes, malls, and event venues. Artificial turf is favored for its aesthetic appeal, minimal upkeep, and long-lasting nature, offering a cost-effective alternative to natural grass in spaces with high foot traffic.

Key Market Segments

By Material

- Nylon

- Polypropylme

- Polyethylene

- Hybrid

- Others

By Type

- Sand Filled

- Water-Based

- Sand Dressed

- Third Generation

By Filament

- Monofilament

- Multi-Filament

By Application

- Football Pitches

- Baseball Pitches

- Hockey Pitches

- Rugby Pitches

- Tennis Pitches

- Golf Pitches

- Others

By End-Use

- Residential

- Commercial

- Sports

- Others

Driving factors

Investment in Sports Infrastructure

The growth of the artificial sports turf market is significantly driven by robust investments in sports infrastructure. Governments and private sector entities are increasingly allocating funds towards the construction of sports facilities and the renovation of existing venues, aiming to accommodate a growing interest in sports.

Such developments are not only seen in traditional sports powerhouses but also in emerging markets where sports are becoming pivotal to economic and social development. As these infrastructures require high-quality, durable, and low-maintenance surfaces, artificial sports turf becomes a preferred choice, given its ability to withstand extensive use in various climatic conditions.

The escalation in sports infrastructure investment directly correlates with increased demand for artificial turf, as these installations are seen as crucial for enhancing player performance and safety.

Rising Popularity of Sports Events

Concurrently, the rising popularity of sports events globally fuels the expansion of the artificial sports turf market. Major sporting events like the FIFA World Cup and the Olympic Games have a profound influence on the construction of new sports facilities and the upgrade of existing ones, which in turn drives the adoption of artificial turf.

The visibility of artificial turf during high-profile sports broadcasts often acts as an advertisement of its benefits, thereby increasing its attractiveness to facility operators. The trend towards hosting regular national and international sports events ensures a continuous demand for artificial sports turf, as organizers seek to provide the best possible playing conditions.

Health Awareness and Participation

Moreover, the growing public awareness regarding health and fitness plays a critical role in the expansion of the artificial sports turf market. As individuals become more health-conscious, participation in sports and recreational activities increases, prompting educational institutions, municipal authorities, and residential communities to develop more sports and recreational facilities.

These facilities frequently opt for artificial turf due to its durability and lesser maintenance needs compared to natural grass. The correlation between public health initiatives and the proliferation of sports programs establishes a sustained demand for artificial turf, which is seen as an investment in public health and community well-being.

Restraining Factors

Impact of Ongoing Maintenance Expenses on Market Growth

The artificial sports turf market is significantly influenced by the costs associated with its ongoing maintenance. While artificial turf is often marketed as low maintenance compared to natural grass, it does incur various upkeep expenses that can affect its market appeal and growth. These expenses include periodic cleaning, infill replenishment, and eventual replacement due to wear and tear.

Financially, the initial cost savings from less frequent water use and no need for mowing are sometimes offset by these maintenance requirements. This economic dynamic can deter potential new adopters who are wary of long-term financial commitments, thereby restraining market growth.

On the other hand, advancements in turf technology that aim to reduce these maintenance costs could enhance market appeal, presenting an opportunity for growth among budget-conscious consumers and institutions.

Environmental Concerns Shaping Market Dynamics

Environmental factors play a crucial role in shaping the artificial sports turf market. Critics argue that artificial turf contributes to microplastic pollution and requires the use of potentially harmful chemicals for maintenance.

Moreover, the disposal of old artificial turf, which is non-biodegradable, poses significant environmental challenges. These concerns can influence consumer and regulatory attitudes, leading to stricter regulations and possibly a shift in consumer preference towards more eco-friendly alternatives.

However, the industry’s response by innovating more environmentally sustainable options, like biodegradable infills and low-emission manufacturing processes, is helping to mitigate these concerns and could drive market growth by appealing to environmentally conscious buyers.

Heat Retention Issues and Their Market Impact

Heat retention in artificial sports turf is a well-documented issue that can affect its popularity and market expansion. Synthetic turf tends to absorb and retain more heat than natural grass, which can lead to higher surface temperatures, making sports fields uncomfortably hot and potentially unsafe in warm climates. This factor can limit the adoption of artificial turf in regions with high-temperature averages, affecting its overall market penetration.

However, this challenge also drives innovation within the market. The development of heat-resistant turf varieties and cooling technologies like subsurface cooling systems or reflective infill materials can counteract these effects. By addressing the heat issue, manufacturers can broaden the market’s geographical reach and appeal, thus potentially accelerating market growth.

Growth Opportunity

Rising Demand for Sports Infrastructure

The growing popularity of sports, particularly in emerging markets, is fueling a surge in demand for advanced sports infrastructure. Artificial sports turf, known for its durability, low maintenance, and ability to withstand extreme weather conditions, has become a preferred choice for new stadiums, training grounds, and recreational facilities.

Countries across Asia-Pacific, the Middle East, and Africa are investing heavily in sports infrastructure to support both professional and grassroots sports development. The FIFA World Cup in Qatar and the Olympic Games in Paris are prime examples of large-scale sporting events that have accelerated the adoption of artificial turf to ensure reliable, high-quality playing surfaces. This rising demand presents a significant growth opportunity for manufacturers and suppliers of artificial sports turf.

Environmental Concerns and Sustainability

As sustainability becomes a critical concern globally, artificial sports turf is gaining traction due to its eco-friendly advantages. Traditional grass fields require extensive water, fertilizers, and pesticides, all of which contribute to environmental degradation. Artificial turf, on the other hand, is water-efficient, reducing the need for irrigation, and often made from recycled materials, promoting circular economy practices.

Additionally, advancements in eco-conscious turf manufacturing processes are addressing concerns about plastic waste. As governments and sports organizations commit to sustainability goals, the market for environmentally friendly artificial turf is poised for significant growth and beyond.

Expansion of Commercial Applications

Beyond sports arenas, artificial turf is increasingly being used in commercial applications such as landscaping, playgrounds, and even urban spaces. The aesthetic appeal and low-maintenance characteristics of synthetic grass make it an attractive option for corporate parks, malls, and private properties.

This diversification into non-sporting sectors is opening up new revenue streams for artificial turf manufacturers. The commercial sector’s growing preference for artificial turf is an exciting opportunity that will help drive market expansion in the coming years.

Latest Trends

Urbanization and Landscaping Trends

Urbanization remains a central driver of the artificial turf market. As cities grow and the available land for traditional sports fields becomes more scarce, synthetic grass offers a practical solution for urban planners. Urban areas increasingly rely on artificial turf for sports complexes, recreational areas, and even public parks.

The high demand for low-maintenance landscaping solutions is pushing synthetic turf into new applications, beyond traditional sports fields, including residential, commercial, and institutional settings.

In 2024, this trend is expected to accelerate, as cities invest in artificial turf to accommodate both aesthetic and functional needs in urban landscapes.

The shift from Natural to Synthetic Grass

A notable trend in the artificial sports turf market is the ongoing shift from natural grass to synthetic turf. This transition is fueled by the superior durability, reduced maintenance requirements, and all-weather performance of synthetic grass. Natural grass fields often require significant upkeep, including irrigation, mowing, and pest control, which can be both costly and labor-intensive.

Synthetic grass, on the other hand, offers a consistent playing surface that can withstand heavy use without the need for frequent maintenance. As more sports facilities, schools, and recreational organizations recognize these benefits, the preference for artificial turf over natural grass is expected to increase.

Technological Advancements

Technological advancements in artificial turf production are further enhancing the performance and appeal of synthetic grass. Innovations in materials, such as the use of eco-friendly and recycled components, are expected to drive both environmental sustainability and market growth.

Additionally, advancements in fiber technology have resulted in turf that closely mimics the look and feel of natural grass, improving player comfort and performance. In 2024, the integration of smart technology into sports turf, such as sensors that monitor field conditions, is expected to further drive interest, particularly in professional sports settings. These innovations not only improve the playing experience but also make turf more versatile and sustainable in a variety of applications.

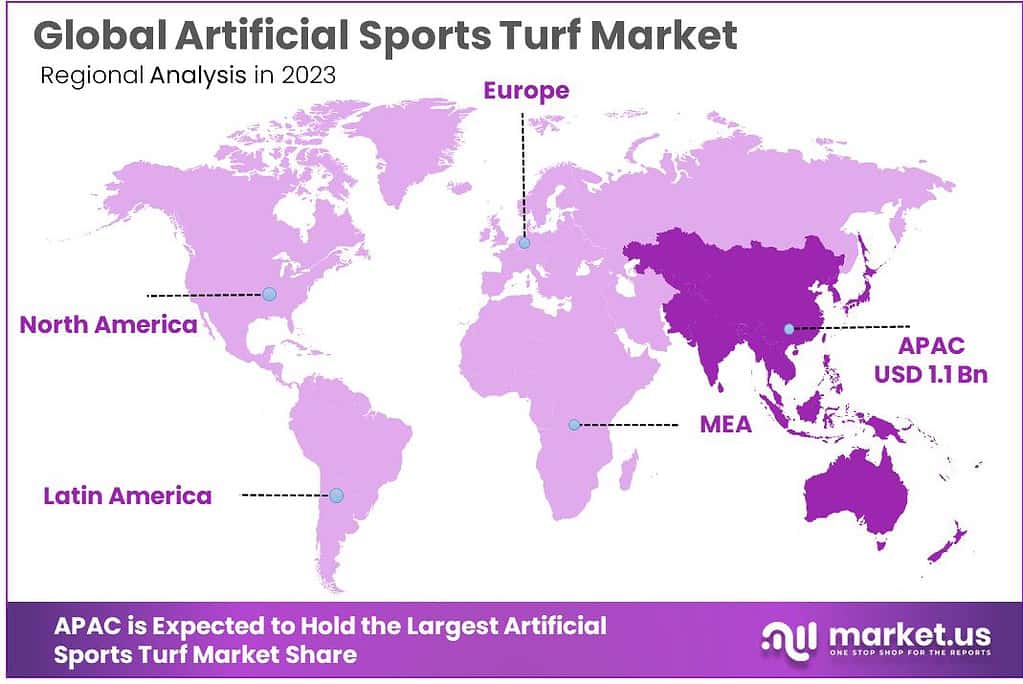

Regional Analysis

The Asia Pacific region dominates the artificial sports turf market with a 32.5% share, valued at USD 1.1 billion.

The Artificial Sports Turf Market is experiencing significant growth across various regions, driven by increasing demand for durable and low-maintenance sports surfaces. Among these regions, Asia Pacific (APAC) dominates the global market, holding a substantial share of 32.5% in 2023, valued at approximately USD 1.1 billion. This growth can be attributed to rapid urbanization, increased investment in sports infrastructure, and the rising popularity of sports like football, rugby, and cricket in countries such as China, India, and Japan.

In North America, the market is also seeing significant expansion, driven by a combination of technological advancements in turf materials and the growing preference for artificial turf in both professional sports and recreational applications. North America held a share of approximately 25% in 2023, with the U.S. being the largest contributor due to the high adoption rate of synthetic fields across schools, colleges, and sports facilities.

The European market is equally strong, with countries such as Germany, the UK, and France leading the demand for artificial sports turf. In Europe, the market is valued at USD 900 million in 2023, with an estimated growth rate of 5.5% CAGR over the next five years. The region benefits from robust investments in sports infrastructure, particularly for football, where artificial turf is increasingly preferred for its low maintenance and high-durability characteristics.

In the Middle East & Africa (MEA) region, the market is also witnessing growth, with countries such as the UAE, Qatar, and Saudi Arabia investing in sports facilities due to harsh climatic conditions that make maintaining natural grass challenging. The MEA market accounts for around 10% of the global share in 2023, with a projected growth rate of 6.7% CAGR over the next five years, driven by the region’s booming sports tourism and growing interest in sports leagues.

Latin America, though smaller in comparison, is showing increasing demand for artificial turf, particularly in countries like Brazil and Argentina, where football is a key driver. The Latin American market contributed 8% to the global artificial sports turf market in 2023, with a promising growth outlook fueled by the rising popularity of synthetic turf in recreational and community sports facilities.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Artificial Sports Turf Market continues to see key players driving growth through innovation and strategic expansion. Companies like ACT Global, FieldTurf, DuPont, and TigerTurf are particularly notable for their contributions to the market’s development.

ACT Global is a recognized leader in the artificial turf industry, offering high-quality turf products for sports fields, residential lawns, and landscaping. Their reputation for sustainability and focus on eco-friendly materials gives them an edge in meeting the growing demand for green building solutions. Their expertise in custom turf design and installation also positions them strongly in both commercial and athletic markets.

FieldTurf, a division of Tarkett, has been a dominant player in sports turf for decades, with a broad portfolio of synthetic turf products used in professional sports stadiums, schools, and parks. Their strong focus on innovation, including advanced infill systems and durability enhancements, has made them a go-to brand for top-tier sports organizations worldwide.

DuPont, with its advanced materials and science-based approach, has been instrumental in supplying high-performance fibers for synthetic turf applications. Their investment in research and development enables them to offer innovative products, such as their nylon-based fibers, which contribute to improved turf longevity and player safety.

TigerTurf, another prominent player, excels in providing turf solutions that balance performance with environmental sustainability. Their focus on manufacturing quality artificial grass for both sports and recreational fields, combined with cutting-edge technology for ease of installation, makes them a key competitor in global markets.

These companies represent the dynamic forces shaping the growth of the artificial sports turf industry, offering a mix of expertise, innovation, and sustainability.

Market Key Players

- ACT Global

- CC Grass

- Challenger Industries Inc.

- Creative Recreation Solutions (CRS)

- Dixie Group, Inc.

- DuPont

- FieldTurf

- ForeverLawn

- Global Syn-Turf

- Interface, Inc.

- Lowe’s Companies, Inc.

- Mohawk Industries, Inc.

- Oriental Weavers

- Shaw Industries Group, Inc.

- SiS Pitches

- Sports Group

- Tai Ping Carpets International Limited

- Tarkett

- Tencate Grass

- The Home Depot, Inc

- TigerTurf

- Victoria PLC

Recent Development

- In April 2024, FieldTurf, a leading manufacturer of artificial turf, unveiled its next-generation turf systems aimed at enhancing the performance and safety of athletes. The new product line incorporates advanced polymers and shock-absorbing layers designed to reduce injuries while maintaining high durability and playability. This move aligns with growing concerns over player safety and the increasing adoption of synthetic surfaces in competitive sports.

- In February 2024, Shaw Sports Turf, a major player in the artificial turf industry, announced plans to expand its manufacturing capacity in North America. The company is investing in new production facilities to meet the rising demand for artificial turf, particularly in the U.S. market where synthetic fields are increasingly being adopted in schools, universities, and professional sports facilities. This expansion is expected to increase production by over 20% by the end of 2024.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Billion Forecast Revenue (2033) USD 5.0 Billion CAGR (2024-2032) 6.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Nylon, Polypropylene, Polyethylene, Hybrid, Others), By Type (Sand Filled, Water-Based, Sand Dressed, Third Generation), By Filament (Monofilament, Multi-Filament), By Application (Football Pitches, Baseball Pitches, Hockey Pitches, Rugby Pitches, Tennis Pitches, Golf Pitches, Others), By End-Use (Residential, Commercial, Sports, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ACT Global, CC Gras, Challenger Industries Inc, Creative Recreation Solutions (CRS, Dixie Group, Inc., DuPont, FieldTurf, ForeverLaw, Global Syn-Tur, Interface, Inc., Lowe’s Companies, Inc., Mohawk Industries, Inc., Oriental Weavers, Shaw Industries Group, Inc., SiS Pitche, Sports Grou, Tai Ping Carpets International Limited, Tarkett, Tencate Gras, The Home Depot, In, TigerTurf, Victoria PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artificial Sports Turf MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Artificial Sports Turf MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ACT Global

- CC Grass

- Challenger Industries Inc.

- Creative Recreation Solutions (CRS)

- Dixie Group, Inc.

- DuPont

- FieldTurf

- ForeverLawn

- Global Syn-Turf

- Interface, Inc.

- Lowe's Companies, Inc.

- Mohawk Industries, Inc.

- Oriental Weavers

- Shaw Industries Group, Inc.

- SiS Pitches

- Sports Group

- Tai Ping Carpets International Limited

- Tarkett

- Tencate Grass

- The Home Depot, Inc

- TigerTurf

- Victoria PLC