Global Artificial Eye Market By Type (Ocular Prosthesis, Prosthetic Contact Lens, Scleral Shell, Conformer and Orbital Prosthesis), By Application (Therapeutic (Retinoblastoma, Glaucoma, Eye Injury and Eye Infection) and Aesthetic), By Material (Acrylic/PMMA, Silicone and Glass), By End-User (Hospital, Ophthalmology Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172739

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

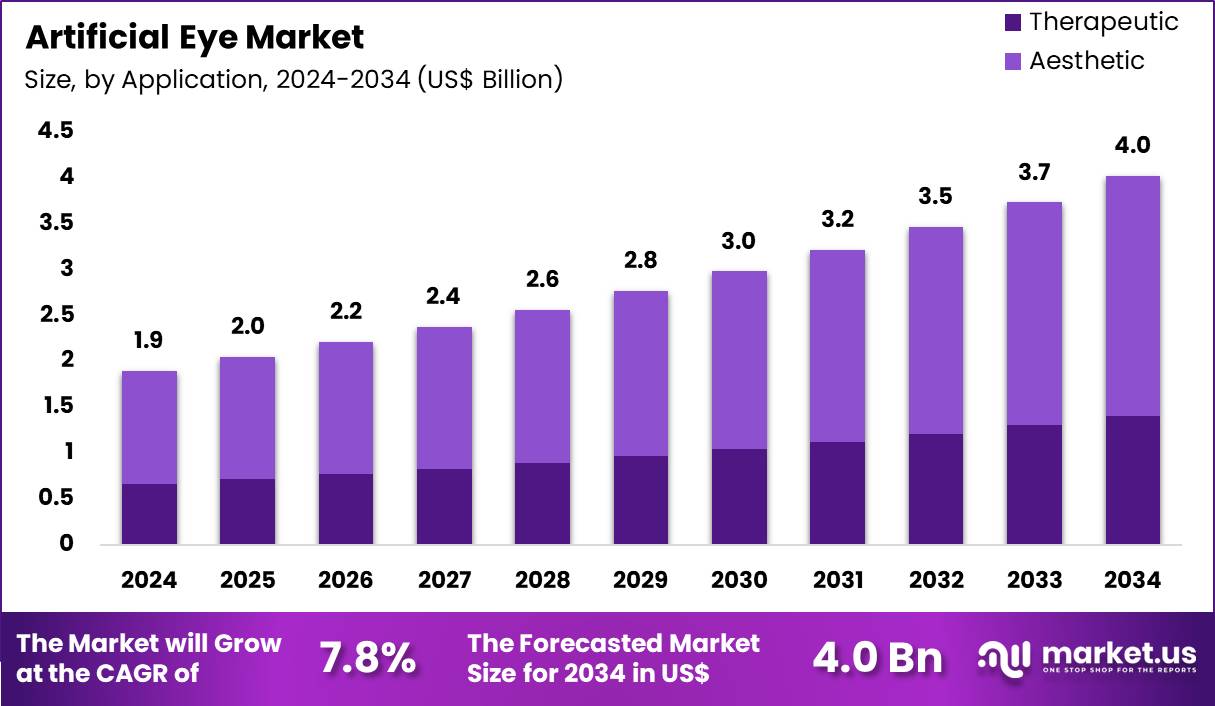

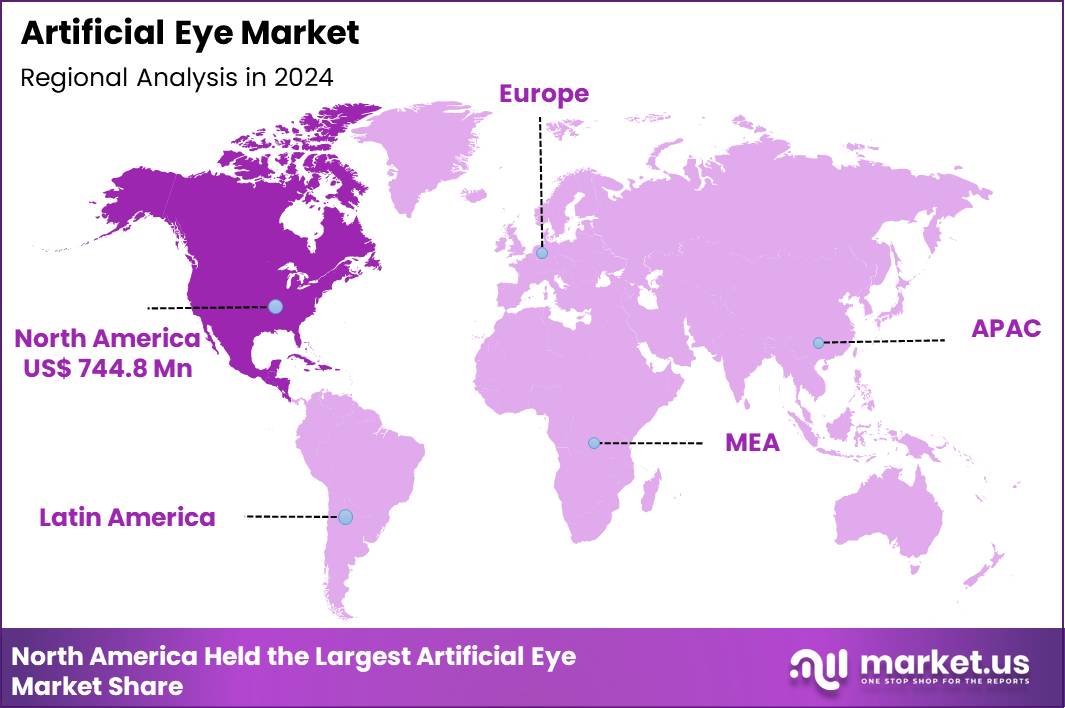

The Global Artificial Eye Market size is expected to be worth around US$ 4.0 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.2% share with a revenue of US$ 744.8 Million.

Rising incidence of ocular trauma and congenital anomalies fuels the expansion of the artificial eye market as manufacturers develop sophisticated prosthetics to restore facial symmetry and psychological well-being for affected individuals. Ocularists craft these devices primarily for post-enucleation rehabilitation, fitting them over orbital implants to mimic natural eye appearance and subtle movements in cancer survivors.

These prosthetics address evisceration outcomes by preserving socket volume and supporting conjunctival tissue integrity in severe infection cases. Providers utilize artificial eyes in anophthalmia management, progressively sizing conformers to stimulate orbital growth in pediatric patients born without eyes. These solutions also benefit microphthalmia corrections, where shrunken sockets require customized expansions to prevent facial asymmetry over time.

In March 2024, Moorfields Eye Hospital in the UK implemented an artificial intelligence enabled 3D printing process for the production of prosthetic eyes. The new workflow reduced manufacturing timelines from several weeks to only a few days while improving anatomical accuracy and cosmetic realism, highlighting the role of digital automation in personalized ophthalmic care.

Prosthetic specialists identify opportunities to incorporate biometric sensors into artificial eyes, enabling basic light detection for enhanced environmental awareness in blind users beyond cosmetic restoration. Innovators engineer modular designs that facilitate easy iris and sclera replacements, extending device longevity for patients with frequent socket changes due to aging or growth. These advancements open avenues for pediatric applications, where rapid prototyping accommodates facial development in congenital defect treatments.

Opportunities expand in post-traumatic reconstructions, integrating artificial eyes with orbital floor repairs to stabilize aesthetics after facial injuries. Companies pursue biocompatible coatings that minimize allergic reactions, broadening accessibility for sensitive individuals in long-term socket maintenance. Firms explore subscription-based fitting services that provide periodic adjustments, ensuring optimal fit in dynamic socket environments.

Market leaders advance digital scanning technologies to capture socket topography, generating hyper-realistic prosthetics with vascular patterns and subtle color gradients for seamless integration. Developers refine robotic polishing systems that achieve glass-like finishes, elevating durability against daily wear in active lifestyles. Industry participants emphasize multidisciplinary collaborations between ocularists and psychologists to address emotional adaptation in prosthetic users.

Innovators integrate antimicrobial surfaces to reduce infection risks in vulnerable post-surgical sockets. Companies prioritize eco-friendly acrylic alternatives that maintain translucency while supporting sustainability goals in production processes. Ongoing efforts focus on virtual reality simulations for patient previews, refining expectations and satisfaction in final fittings.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.9 billion, with a CAGR of 7.8%, and is expected to reach US$ 4.0 billion by the year 2034.

- The type segment is divided into ocular prosthesis, prosthetic contact lens, scleral shell, conformer and orbital prosthesis, with ocular prosthesis taking the lead in 2024 with a market share of 38.4%.

- Considering application, the market is divided into therapeutic and aesthetic. Among these, therapeutic held a significant share of 34.9%.

- Furthermore, concerning the material segment, the market is segregated into acrylic/PMMA, silicone and glass. The acrylic/pmma sector stands out as the dominant player, holding the largest revenue share of 46.3% in the market.

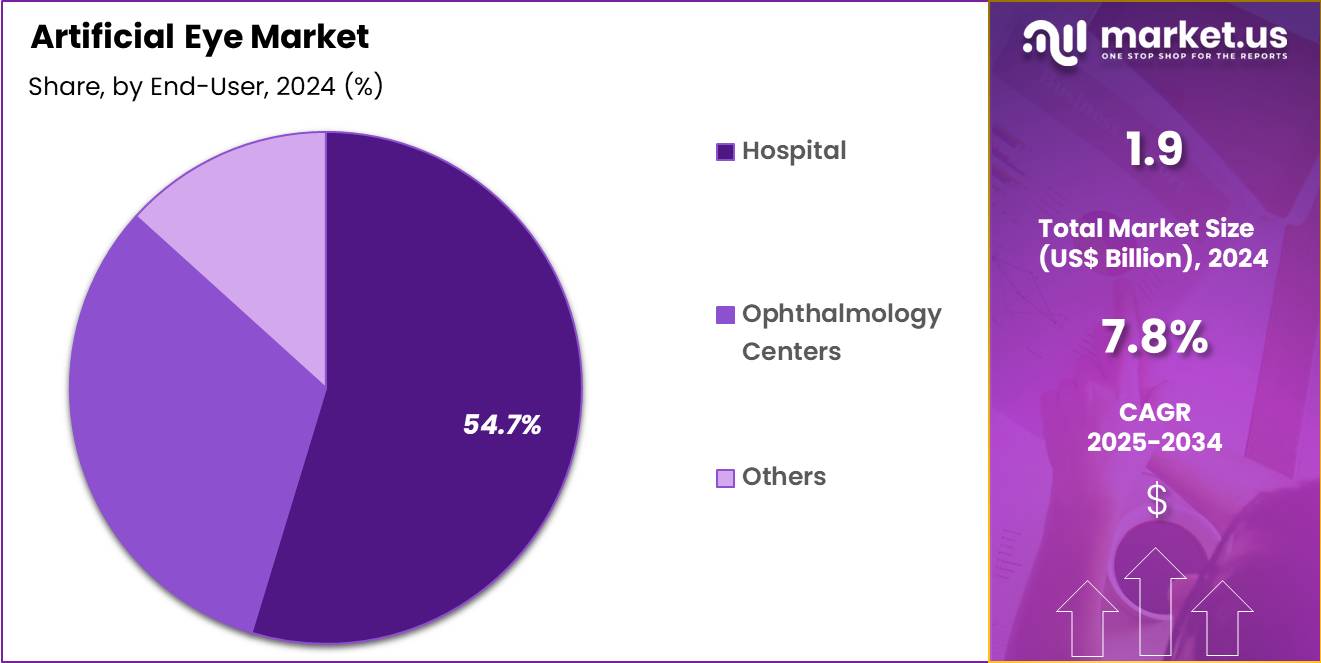

- The end-user segment is segregated into hospital, ophthalmology centers and others, with the hospital segment leading the market, holding a revenue share of 54.7%.

- North America led the market by securing a market share of 39.2% in 2024.

Type Analysis

Ocular prosthesis accounted for 38.4% of the Artificial Eye market, reflecting its essential role in restoring ocular structure after enucleation or evisceration procedures. Ophthalmic surgeons routinely recommend ocular prostheses to support socket healing and maintain facial symmetry. Rising incidence of eye trauma, ocular tumors, and severe infections expands procedural volumes. Improved customization techniques enhance comfort and mobility, which increases patient acceptance.

Advances in digital imaging and impression methods support better anatomical fit. Prosthetic specialists increasingly collaborate with hospitals to streamline post surgical rehabilitation. Growing awareness of psychological well being following eye loss strengthens demand for functional restoration. Reimbursement support in select healthcare systems improves affordability. Long term durability of modern prostheses supports sustained usage. This segment is projected to grow steadily due to its clinical necessity and restorative effectiveness.

Application Analysis

Therapeutic applications represented 34.9% of the Artificial Eye market, driven by increasing focus on post surgical care and ocular health management. Clinicians use artificial eye solutions to protect ocular sockets and prevent tissue contraction. Therapeutic use supports pain reduction and infection control following eye removal surgeries. Rising prevalence of trauma related eye loss increases therapeutic intervention demand. Hospitals emphasize early prosthetic fitting to accelerate healing outcomes.

Ophthalmologists integrate therapeutic artificial eyes into standardized treatment protocols. Improved material biocompatibility enhances patient comfort during recovery phases. Multidisciplinary care approaches strengthen adoption across surgical centers. Clinical training programs reinforce therapeutic application usage. As a result, therapeutic applications are anticipated to expand due to their role in recovery optimization.

Material Analysis

Acrylic or PMMA materials accounted for 46.3% of the Artificial Eye market, supported by their durability, lightweight structure, and ease of customization. Prosthetists prefer PMMA due to its strong polish retention and natural appearance. High resistance to breakage improves long term patient safety. Material stability supports consistent color matching and aesthetic outcomes. Cost effectiveness compared to silicone or glass increases accessibility.

PMMA supports efficient fabrication using both manual and digital techniques. Ease of modification allows adjustments over time without full replacement. Clinical familiarity with acrylic materials strengthens practitioner confidence. Supply availability supports consistent production volumes. This segment is expected to maintain leadership due to balanced performance, aesthetics, and affordability.

End-User Analysis

Hospitals held a 54.7% share of the Artificial Eye market, reflecting their central role in surgical eye care and rehabilitation services. These settings manage most eye removal procedures requiring immediate prosthetic planning. Access to ophthalmic surgeons and prosthetic specialists improves care coordination.

Hospitals provide diagnostic imaging that supports accurate prosthesis fitting. Post operative monitoring encourages early adoption of artificial eye solutions. Integrated patient pathways enhance treatment adherence and follow up. Higher patient inflow sustains consistent procedural demand. Institutional procurement supports standardized prosthetic solutions. Training hospitals further promote clinical adoption. Consequently, hospitals are likely to remain dominant end users due to centralized expertise and surgical volume concentration.

Key Market Segments

By Type

- Ocular prosthesis

- Prosthetic contact lens

- Scleral shell

- Conformer

- Orbital prosthesis

By Application

- Therapeutic

- Retinoblastoma

- Glaucoma

- Eye injury

- Eye infection

- Aesthetic

By Material

- Acrylic/PMMA

- Silicone

- Glass

By End-User

- Hospital

- Ophthalmology Centers

- Others

Drivers

Increasing incidence of eye injuries is driving the market

The artificial eye market is propelled by the escalating incidence of eye injuries, which often result in severe vision loss or enucleation requiring prosthetic or bionic solutions for functional and cosmetic restoration. Healthcare professionals increasingly rely on artificial eyes to address trauma-related damage from sports, accidents, or occupational hazards, thereby sustaining market demand. Advancements in prosthetic design cater to individualized fitting, enhancing patient satisfaction and driving adoption in rehabilitation settings.

Public health organizations advocate for preventive measures while acknowledging the need for effective restorative technologies in injury aftermath. Manufacturers focus on biocompatible materials to improve durability and aesthetics for injury victims. Clinical protocols integrate artificial eyes into post-injury care plans to support psychological recovery alongside physical healing.

Global demographic shifts toward active lifestyles contribute to higher injury rates, expanding the patient base. Research institutions collaborate on injury epidemiology to inform product development priorities. Prevent Blindness reported that more than 43,300 sports-related eye injuries received treatment in 2024, marking a 33 percent increase from the prior year. This upward trend underscores the critical role of artificial eyes in managing the consequences of preventable injuries.

Restraints

High costs of advanced bionic implants are restraining the market

The artificial eye market faces significant constraints due to the elevated costs of advanced bionic implants, which limit accessibility for many patients requiring vision restoration. Developers incur substantial expenses in research and production of sophisticated retinal prostheses, passing these onto healthcare systems. Insurance providers often restrict coverage for experimental or high-tech options, deterring widespread adoption.

Smaller clinics lack the financial resources to invest in necessary surgical infrastructure for implantation. Patients in low-income regions encounter barriers to affording these life-changing devices, exacerbating global disparities. Manufacturers struggle to scale production without compromising quality, maintaining premium pricing.

Regulatory requirements for long-term safety data add to development overheads. Clinical trials demand extensive funding, delaying cost reductions through economies of scale. Professional training for surgeons increases operational burdens on facilities. These financial hurdles collectively impede market expansion and equitable distribution of innovative solutions.

Opportunities

Expanding research in retinal prostheses is creating growth opportunities

The artificial eye market offers substantial growth opportunities through expanding research in retinal prostheses, which aims to restore partial vision for individuals with degenerative conditions like retinitis pigmentosa. Investigators explore electrode arrays and optogenetic approaches to enhance neural stimulation efficacy. Funding agencies support multidisciplinary teams to refine device integration with the visual cortex.

Clinicians anticipate broader indications as research validates safety in diverse patient cohorts. Developers partner with academic centers to accelerate prototyping and clinical validation. Regulatory bodies provide pathways for breakthrough designations, facilitating faster market entry. Patient registries contribute data to inform iterative improvements in prosthesis design.

Global collaborations address ethical considerations in vision restoration trials. BrightFocus Foundation highlighted ongoing advancements in electronic retinal implants, including higher-resolution arrays and wireless power systems. These research efforts position the market for diversified applications and improved outcomes in vision rehabilitation.

Impact of Macroeconomic / Geopolitical Factors

Rising healthcare allocations and increasing cases of ocular loss from accidents or diseases stimulate demand in the artificial eye market, prompting specialists and clinics to source high-quality custom prosthetics that restore appearance and comfort for patients. Prominent producers focus on advanced acrylic and silicone formulations, responding to demographic shifts toward older populations and better post-surgical rehabilitation options in various regions.

Ongoing inflationary trends and fluctuating economies, nevertheless, boost prices for essential polymers and coloring agents, causing ophthalmic centers to ration orders and postpone expansions where funds remain limited. Trade disputes between the U.S. and China, along with broader international disruptions, often hinder deliveries of specialized fabrication tools and biocompatible supplies, resulting in extended lead times and added complexities for suppliers tied to global networks.

Present U.S. tariff frameworks, incorporating a standard 10% rate on numerous imported medical goods with potential escalations pending Section 232 reviews for prosthetics, heighten acquisition costs for U.S. importers and distributors while exemptions provide some relief in select categories. Such policies additionally encourage foreign retaliatory steps that restrict American shipments of specialized ocular devices and complicate shared advancement initiatives.

Nonetheless, these dynamics drive focused efforts toward building local production capabilities and alternative supplier relationships, establishing stronger foundations that support continued progress and broader availability in the sector over time.

Latest Trends

Integration of artificial intelligence in visual prostheses is a recent trend

In 2025, the artificial eye market has demonstrated a prominent trend toward the integration of artificial intelligence in visual prostheses to optimize image processing and user adaptation. Engineers incorporate AI algorithms to enhance saliency detection, improving the interpretation of visual inputs for implant recipients.

Clinicians utilize these systems to customize stimulation patterns based on individual neural responses. Researchers develop machine learning models to predict and mitigate phosphene distortions in real-time. Developers focus on edge computing to enable faster processing within compact devices. Regulatory reviews emphasize validation of AI-driven enhancements for clinical reliability.

Academic studies explore deep learning for scene recognition in prosthetic vision. Collaborative projects address bias in AI training datasets for inclusive performance. Ethical guidelines ensure transparent AI applications in human augmentation. A 2025 review in PubMed Central detailed AI’s promise in refining stimulation strategies for retinal prostheses.

Regional Analysis

North America is leading the Artificial Eye Market

In 2024, North America maintained a 39.2% share of the global artificial eye market, propelled by advancements in bionic prosthetics and heightened awareness of ocular rehabilitation options amid rising incidences of retinal diseases and traumatic enucleations. Ophthalmologists increasingly prescribe custom-fitted scleral shells and integrated visual implants to restore aesthetic and functional integrity for patients post-ocular melanoma or severe injuries, bolstered by federal reimbursements that expand access in specialized clinics.

Biotechnology firms innovate with biocompatible materials and sensor-embedded devices, enabling partial vision restoration in cases of retinitis pigmentosa, while telemedicine integrations facilitate remote fittings for rural populations. Aging demographics exacerbate macular degeneration cases, compelling insurers to cover premium prosthetic solutions that enhance quality of life through natural mobility.

Collaborative research between universities and device manufacturers refines 3D-printed orbital conformers, reducing rejection rates and surgical revisions. Regulatory approvals from health authorities accelerate market entry for hybrid electronic eyes, addressing unmet needs in pediatric congenital anomalies.

Supply chain enhancements ensure timely distribution of hypoallergenic variants, aligning with stringent biocompatibility standards. The Centers for Disease Control and Prevention states that approximately 6 million Americans experience vision loss, including 1 million with blindness.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The artificial eye market in Asia Pacific is expected to grow steadily over the forecast period, supported by rising demand for affordable ocular prosthetics. Increasing vision loss linked to diabetes, trauma, and industrial accidents is driving adoption across urban and semi-urban healthcare settings. Lightweight acrylic implants are widely used in major eye hospitals to improve cosmetic outcomes for enucleated patients.

Government-backed programs are expanding access through subsidized fitting services at district hospitals. Manufacturers are developing modular prostheses tailored to regional facial anatomy. Partnerships between biotech firms and local producers are improving the availability of low-cost silicone conformers in underserved rural areas. Training initiatives are strengthening clinical skills in prosthesis fitting and post-trauma rehabilitation.

Economic growth is encouraging private investment in premium, custom-designed artificial eyes. Policy support for domestic manufacturing is improving supply stability in tropical climates. According to the World Health Organization, over 90 million people in the Western Pacific Region live with visual impairment. This large patient base underpins long-term market expansion across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Artificial Eye market drive growth by investing in custom fabrication techniques, advanced biocompatible materials, and digital imaging to deliver highly realistic ocular prostheses that improve patient confidence and comfort. Companies in the Artificial Eye market expand demand through close collaboration with ophthalmologists, maxillofacial surgeons, and ocularists to integrate prosthetic solutions into standardized post-enucleation care pathways.

Strategic focus within the Artificial Eye market includes personalized design workflows, faster turnaround times, and improved fitting precision that enhance clinical outcomes and referral rates. Commercial teams strengthen global reach by building specialist distribution networks and training programs that support adoption in emerging healthcare markets.

Innovation efforts also target lightweight materials and enhanced surface finishes to improve durability and long-term wear. HumanOptics exemplifies a leading participant in the Artificial Eye market through its expertise in custom ocular prostheses, strong collaboration with clinical specialists, and global presence that supports high-quality aesthetic and functional rehabilitation for patients worldwide.

Top Key Players

- Advanced Ocular Prosthetics Inc.

- D. Danz & Sons, Inc.

- Center for Ocular Prosthetics, LLC

- Ocular Prosthetics, Inc.

- Global Prosthetics

- Boston Ocular Prosthetics, Inc.

- GB Ocular Prosthetics

- Erickson’s Eyes

- Southeastern Ocularists, Inc.

- Mager & Gougelman

- Kind Eyes Prosthetics

- F. Ad. Müller Söhne GmbH and Co. KG

- Oculus Prosthetics

- Second Sight Medical Products, Inc.

- Pixium Vision SA

- Retina Implant AG

- Bionic Vision Technologies

- Nano Retina, Inc.

Recent Developments

- In February 2025, the US FDA granted Regenerative Medicine Advanced Therapy designation to Bionic Sight’s BS01 program, which combines gene therapy with a visual prosthesis approach. Early findings from Phase 1 and Phase 2 studies showed meaningful improvements in visual acuity among participants receiving higher doses, with the majority demonstrating measurable gains. This designation supports continued clinical development of regenerative solutions for severe vision loss.

- In February 2025, Bionic Vision Technologies in Australia released clinical results from trials of its next-generation suprachoroidal visual implant. Patients with advanced retinitis pigmentosa demonstrated functional vision improvements, including enhanced object recognition and spatial awareness, indicating progress toward restoring usable vision in late-stage retinal degeneration.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 4.0 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Ocular Prosthesis, Prosthetic Contact Lens, Scleral Shell, Conformer and Orbital Prosthesis), By Application (Therapeutic (Retinoblastoma, Glaucoma, Eye Injury and Eye Infection) and Aesthetic), By Material (Acrylic/PMMA, Silicone and Glass), By End-User (Hospital, Ophthalmology Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Ocular Prosthetics Inc., D. Danz & Sons, Inc., Center for Ocular Prosthetics, LLC, Ocular Prosthetics, Inc., Global Prosthetics, Boston Ocular Prosthetics, Inc., GB Ocular Prosthetics, Erickson’s Eyes, Southeastern Ocularists, Inc., Mager & Gougelman, Kind Eyes Prosthetics, F. Ad. Müller Söhne GmbH and Co. KG, Oculus Prosthetics, Second Sight Medical Products, Inc., Pixium Vision SA, Retina Implant AG, Bionic Vision Technologies, Nano Retina, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Ocular Prosthetics Inc.

- D. Danz & Sons, Inc.

- Center for Ocular Prosthetics, LLC

- Ocular Prosthetics, Inc.

- Global Prosthetics

- Boston Ocular Prosthetics, Inc.

- GB Ocular Prosthetics

- Erickson’s Eyes

- Southeastern Ocularists, Inc.

- Mager & Gougelman

- Kind Eyes Prosthetics

- F. Ad. Müller Söhne GmbH and Co. KG

- Oculus Prosthetics

- Second Sight Medical Products, Inc.

- Pixium Vision SA

- Retina Implant AG

- Bionic Vision Technologies

- Nano Retina, Inc.