Global Archery Range Insurance Market By Coverage Type (General Liability, Property Insurance, Equipment Insurance, Workers’ Compensation, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User (Commercial Archery Ranges, Recreational Facilities, Educational Institutions, Others), By Distribution Channel (Direct Sales, Online Platforms), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176539

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Coverage Type

- By Provider

- By End User

- By Distribution Channel

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Regional Analysis

- Drivers Impact Analysis

- Restraints Impact Analysis

- Investment Opportunities

- Key Challenges

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

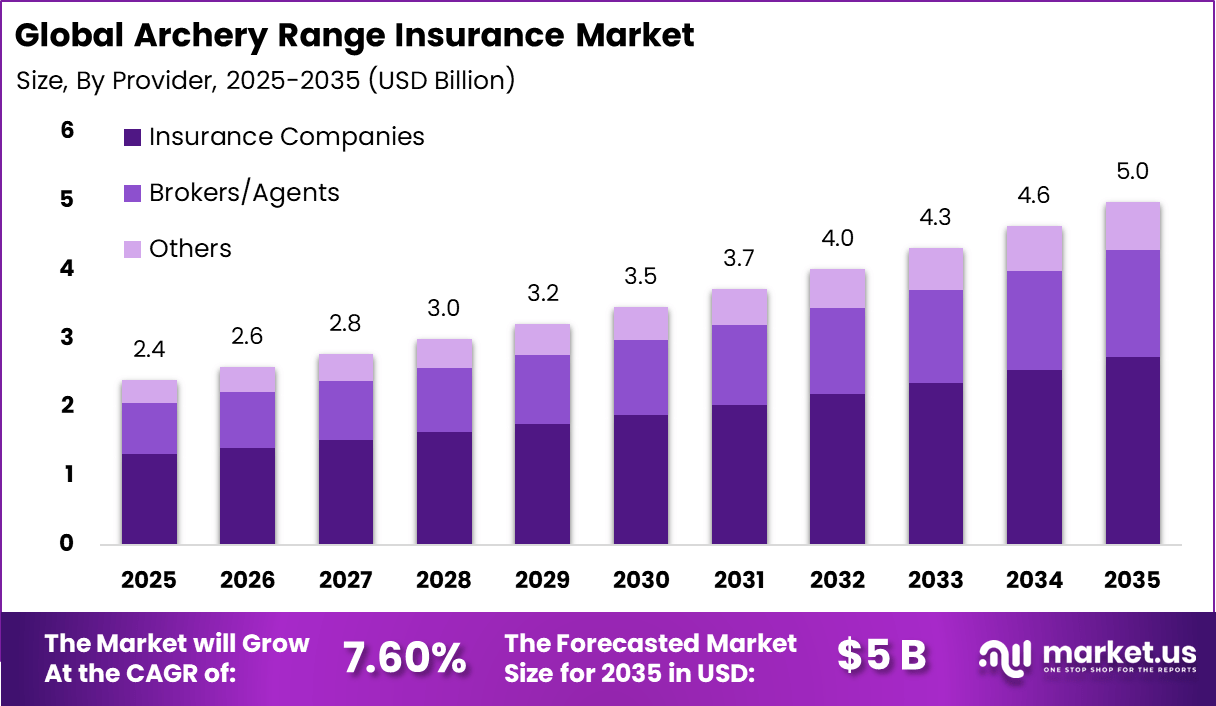

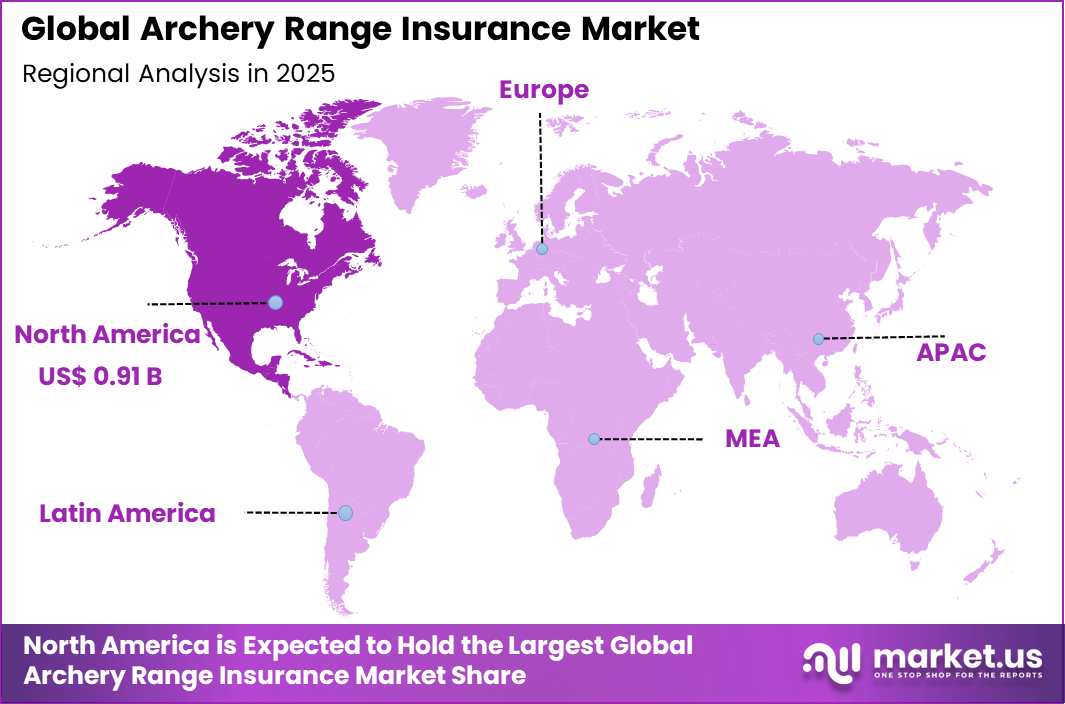

The Global Archery Range Insurance Market generated USD 2.4 billion in 2025 and is predicted to register growth from USD 2.6 billion in 2026 to about USD 5 billion by 2035, recording a CAGR of 7.60% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 38.2% share, holding USD 0.91 Billion revenue.

The archery range insurance market focuses on liability and risk protection products designed for businesses and facilities that operate archery ranges. These insurance solutions address financial exposures arising from accidents, property damage, participant injuries, equipment failures, and third-party claims.

Archery ranges vary in format from commercial indoor facilities to outdoor clubs and training centres, each with unique risk profiles related to flying projectiles, varying user skill levels, and equipment usage. The increasing popularity of archery as a recreational and competitive sport has created greater demand for tailored risk management solutions that support safe operation and financial resilience.

A primary driver of the archery range insurance market is the inherent risk associated with projectile sports. Archery ranges host activities where arrows travel at high speeds within a contained environment. Participant injuries or accidents involving bystanders pose significant liability exposure. Insurance coverage provides financial protection against claims, medical costs, and legal expenses that can arise from such incidents.

According to industry survey, Archery has a sizeable participation base in the United States, with an estimated 6.8 million people taking part in the sport each year. Participation spans recreational archers, competitive athletes, and hunting enthusiasts, supporting steady activity across clubs, schools, and outdoor ranges. Despite its controlled nature, archery does carry measurable injury risk. Around 4,300 archery related injuries require emergency room treatment annually in the U.S.

Facility owners and operators increasingly recognise insurance as a core component of responsible risk management. A significant opportunity in the archery range insurance market lies in developing modular and scalable coverage options. Policies that allow facilities to select coverage elements based on their specific activities, location, and customer base can improve relevance and affordability.

Top Market Takeaways

- By coverage type, general liability accounts for 39.4% of the market, providing protection against third-party bodily injury and property damage claims arising from archery activities.

- By provider, insurance companies represent 54.7% of the market, offering specialized policies tailored to shooting sports, safety compliance, and facility operations.

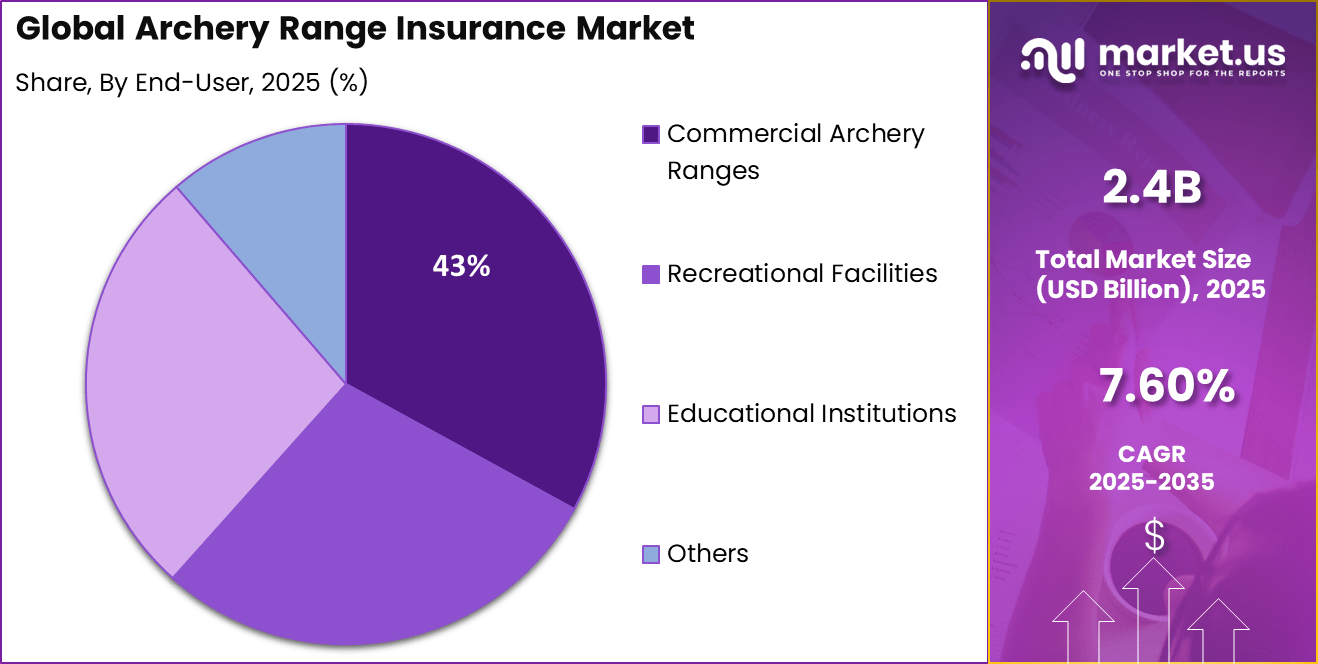

- By end-user, commercial archery ranges hold 42.6% share, driven by the need to insure high-footfall venues, equipment use, coaching activities, and tournaments.

- By distribution channel, direct sales lead with 58.4%, as range owners increasingly purchase coverage straight from insurers via dedicated portals or agents for faster underwriting and policy customization.

By Coverage Type

General liability coverage accounts for 39.4% of insurance demand within the archery range insurance market, as it directly addresses high risk participant activities. Archery ranges involve the use of sharp projectiles, supervised shooting lanes, and close proximity between users. This creates exposure to bodily injury and third party property damage claims.

From an operational standpoint, general liability insurance is treated as mandatory rather than optional. Range owners rely on this coverage to meet safety obligations and venue requirements. Increased participation in recreational and training based archery continues to support consistent demand for liability focused coverage.

By Provider

Insurance companies represent 54.7% of policy provision, reflecting their established underwriting capacity for sports and recreational risks. These providers offer structured policies that align with standardized safety practices and regulatory expectations. Their scale allows them to absorb higher risk exposure linked to public participation activities.

Insurance companies also benefit from experience in pricing risk based on participant volume and supervision standards. Their ability to bundle liability with property or accident coverage improves adoption among range operators. This strengthens their role across both urban and rural archery facilities.

By End User

Commercial archery ranges account for 43% of end user demand due to their revenue driven operations and public access model. These facilities host regular customers, training sessions, and competitive events, which increases exposure frequency. Insurance coverage is therefore embedded into day to day business operations.

Commercial operators also face stricter compliance expectations from landlords and local authorities. Proof of insurance is often required to maintain operating licenses. This reinforces sustained insurance uptake among professionally managed archery ranges.

By Distribution Channel

Direct sales channels hold a 58.4% share, supported by the need for clear and customized coverage terms. Archery range owners often prefer direct interaction to clarify exclusions, safety conditions, and claim procedures. This approach improves confidence in policy suitability.

Direct sales also allow insurers to assess risk more accurately through site specific evaluations. Factors such as lane design, safety barriers, and instructor presence are reviewed directly. This improves underwriting quality and supports long term insurer client relationships.

Emerging Trends Analysis

An emerging trend in the archery range insurance market is the integration of safety technology with coverage incentives. Facilities that adopt range management systems, participant tracking, and automated incident reporting tools may qualify for premium discounts or enhanced policy terms. This trend reflects a shift toward proactive risk mitigation rather than reactive claims management.

Another trend is growing interest in coverage for special event and competition liabilities. As archery events attract larger audiences and participation, insurance products are evolving to include short-term event policies that address specific exposures related to tournaments and exhibitions.

Growth Factors Analysis

One of the key growth factors for the archery range insurance market is the rising popularity of archery as both a recreational activity and competitive sport. Increased participation drives demand for organised facilities and training centres, which in turn creates a need for professional liability and risk protection solutions.

Another growth factor is heightened public interest in adventure and experiential sports. Archery range operators are expanding offerings that include interactive sessions, beginner classes, and family events. These diversified activities increase exposure and reinforce the need for comprehensive risk management solutions.

Key Market Segments

By Coverage Type

- General Liability

- Property Insurance

- Equipment Insurance

- Workers’ Compensation

- Others

By Provider

- Insurance Companies

- Brokers/Agents

- Others

By End-User

- Commercial Archery Ranges

- Recreational Facilities

- Educational Institutions

- Others

By Distribution Channel

- Direct Sales

- Online Platforms

Regional Analysis

North America holds a 38.2% share of the archery range insurance market, supported by the high number of indoor and outdoor archery facilities and structured recreational shooting activities. Insurance demand is driven by elevated liability exposure related to participant safety, equipment use, and range operations, particularly in commercial and club-based settings. Coverage is commonly required by property owners and local authorities, making liability and accident coverage a standard operating requirement.

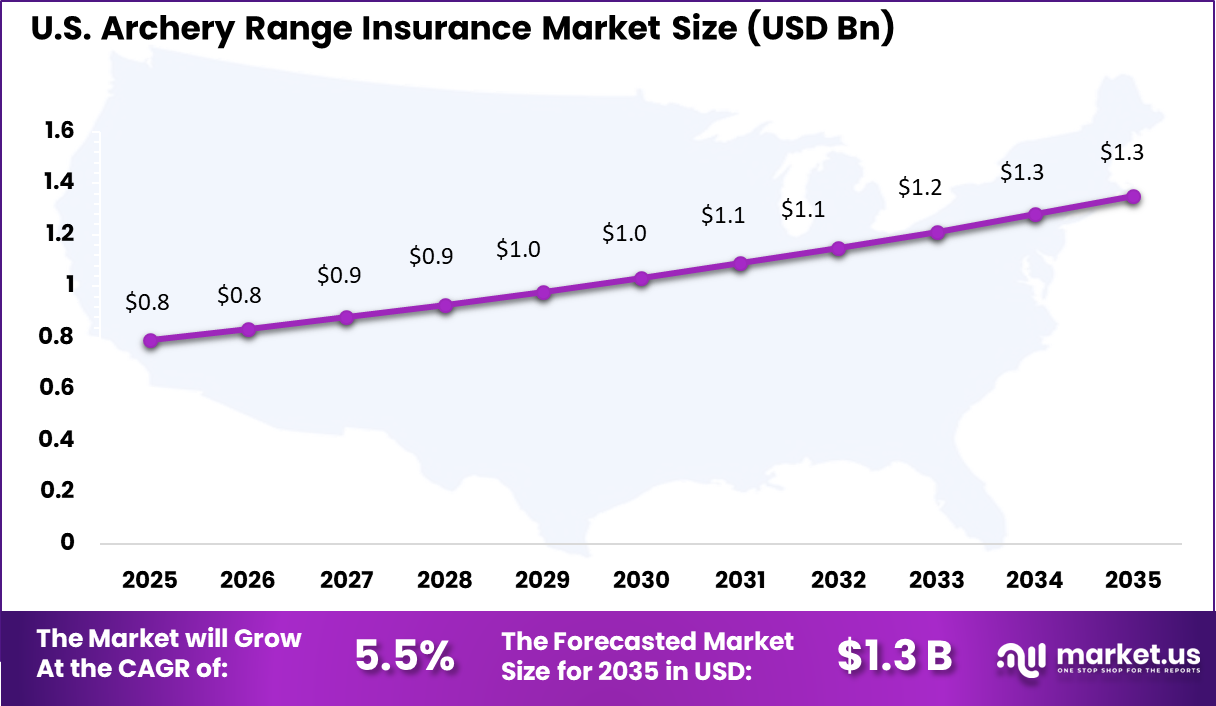

The United States market is valued at USD 0.79 Bn and is expanding at a CAGR of 5.5%, reflecting stable participation in archery sports and training programs. Insurance adoption is influenced by regulatory compliance, instructor-led programs, and the need to manage injury risks and property damage. Growth is supported by consistent demand from recreational users, schools, and competitive archery events, with insurers focusing on risk controls and safety protocols to manage long-term claims exposure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising participation in archery sports and recreational shooting +2.3% North America, Europe Medium term Increased liability exposure related to participant safety +1.9% Global Short to medium term Growth in commercial archery ranges and training facilities +1.6% North America, Europe Medium term Stricter insurance requirements by landlords and regulators +1.2% North America Medium term Expansion of youth programs and competitive archery events +0.9% North America, Asia Pacific Long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Premium sensitivity among small and community-run ranges -1.7% Global Short to medium term Limited insurance awareness among informal archery clubs -1.4% Asia Pacific, Latin America Medium term Perceived low risk at low-traffic or seasonal ranges -1.2% Global Medium term Variability in safety standards across regions -1.0% Emerging Markets Medium to long term Inconsistent regulatory enforcement -0.8% Emerging Markets Long term Investment Opportunities

Investment opportunities in the archery range insurance market are expanding as recreational archery, training academies, and competitive ranges gain wider participation. Archery ranges require specialized liability coverage due to the use of high risk equipment, structured training activities, and public access sessions.

Investors can focus on developing clear and affordable insurance products that cover participant injuries, equipment damage, and instructor liability. Digital policy management and risk guidance services also offer potential, especially for small privately owned ranges seeking simple compliance solutions.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Specialty sports and recreation insurers High Medium North America, Europe Stable niche premium growth Large commercial insurers Medium Low to Medium Global Portfolio diversification Mutual and cooperative insurers Medium Medium North America Strong alignment with clubs Private equity firms Low to Medium Medium North America, Europe Selective niche consolidation Venture capital investors Low High North America Limited relevance Key Challenges

- High liability exposure linked to participant safety and equipment handling

- Limited availability of insurers experienced in archery specific risk assessment

- Strict safety compliance requirements increasing operational costs for range owners

- Premium sensitivity among community run and training focused archery ranges

- Variation in local regulations affecting coverage terms and underwriting processes

Competitive Analysis

Specialty sports and recreation insurers such as Sadler Sports & Recreation Insurance, K&K Insurance Group, and American Specialty Insurance & Risk Services play a central role in the archery range insurance market. Their policies are tailored to cover participant injury, third-party liability, equipment damage, and instructional risk. Deep understanding of sports-related exposures supports accurate underwriting. These players are widely used by clubs, schools, and training centers.

Large commercial insurers such as Markel Corporation, The Hartford, and Nationwide Mutual Insurance Company offer broader insurance programs for archery ranges operating as businesses. Philadelphia Insurance Companies and Great American Insurance Group support mid-sized operators with bundled coverage options. These insurers emphasize risk management guidance, claims support, and scalable policies.

Global insurers and brokerage firms such as Chubb Limited, AXA XL, AIG, and Zurich Insurance Group provide capacity for higher-risk or multi-location ranges. Allianz Global Corporate & Specialty and Tokio Marine HCC strengthen coverage options. Brokers including Gallagher and Marsh & McLennan Companies assist with placement. Other insurers expand competition and customization across the market.

Top Key Players in the Market

- Sadler Sports & Recreation Insurance

- Markel Corporation

- K&K Insurance Group

- The Hartford

- Nationwide Mutual Insurance Company

- American Specialty Insurance & Risk Services

- Philadelphia Insurance Companies

- Allianz Global Corporate & Specialty

- Chubb Limited

- AXA XL

- AIG (American International Group)

- Zurich Insurance Group

- Liberty Mutual Insurance

- Hiscox Ltd

- Gallagher (Arthur J. Gallagher & Co.)

- SportsCover

- Marsh & McLennan Companies

- Tokio Marine HCC

- Great American Insurance Group

- Cincinnati Insurance Company

- Others

Future Outlook

The future outlook for the Archery Range Insurance Market is positive as participation in archery as a sport and recreational activity continues to grow. Demand for insurance products that cover liability, property damage, and participant safety is expected to increase as more ranges open and events expand. Insurers are likely to develop tailored solutions that address specific risks such as equipment loss, injuries, and facility operations.

Growth can be attributed to rising awareness of safety standards, increased commercial investment in archery facilities, and a stronger focus on risk management by range operators. Overall, the market is anticipated to expand steadily with broader adoption of customized coverage.

Recent Developments

- July, 2025 – Sadler launched tailored archery insurance for teams, leagues and events, including general liability, accident, D&O and equipment protection with up to 38% savings and instant proof-of-coverage.

- August, 2025 – Markel Insurance sold reinsurance renewal rights to Nationwide, streamlining operations to focus on specialty segments like recreation insurance while retaining motorsports/events coverage via K&K partnership.

Report Scope

Report Features Description Market Value (2025) USD 2.4 Billion Forecast Revenue (2035) USD 5.0 Billion CAGR(2025-2035) 7.6% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (General Liability, Property Insurance, Equipment Insurance, Workers’ Compensation, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User (Commercial Archery Ranges, Recreational Facilities, Educational Institutions, Others), By Distribution Channel (Direct Sales, Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sadler Sports & Recreation Insurance, Markel Corporation, K&K Insurance Group, The Hartford, Nationwide Mutual Insurance Company, American Specialty Insurance & Risk Services, Philadelphia Insurance Companies, Allianz Global Corporate & Specialty, Chubb Limited, AXA XL, AIG (American International Group), Zurich Insurance Group, Liberty Mutual Insurance, Hiscox Ltd, Gallagher (Arthur J. Gallagher & Co.), SportsCover, Marsh & McLennan Companies, Tokio Marine HCC, Great American Insurance Group, Cincinnati Insurance Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Archery Range Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Archery Range Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sadler Sports & Recreation Insurance

- Markel Corporation

- K&K Insurance Group

- The Hartford

- Nationwide Mutual Insurance Company

- American Specialty Insurance & Risk Services

- Philadelphia Insurance Companies

- Allianz Global Corporate & Specialty

- Chubb Limited

- AXA XL

- AIG (American International Group)

- Zurich Insurance Group

- Liberty Mutual Insurance

- Hiscox Ltd

- Gallagher (Arthur J. Gallagher & Co.)

- SportsCover

- Marsh & McLennan Companies

- Tokio Marine HCC

- Great American Insurance Group

- Cincinnati Insurance Company

- Others