Global Anxiety Disorders & Depression Treatment Market By Product Type (Antidepressants, Anticonvulsants, Anxiolytics, Antipsychotics and Others), By Indication (Depression and Anxiety Disorders), By Therapy (Pharmacotherapy, Brain Stimulation Therapy and Psychotherapy), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178244

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

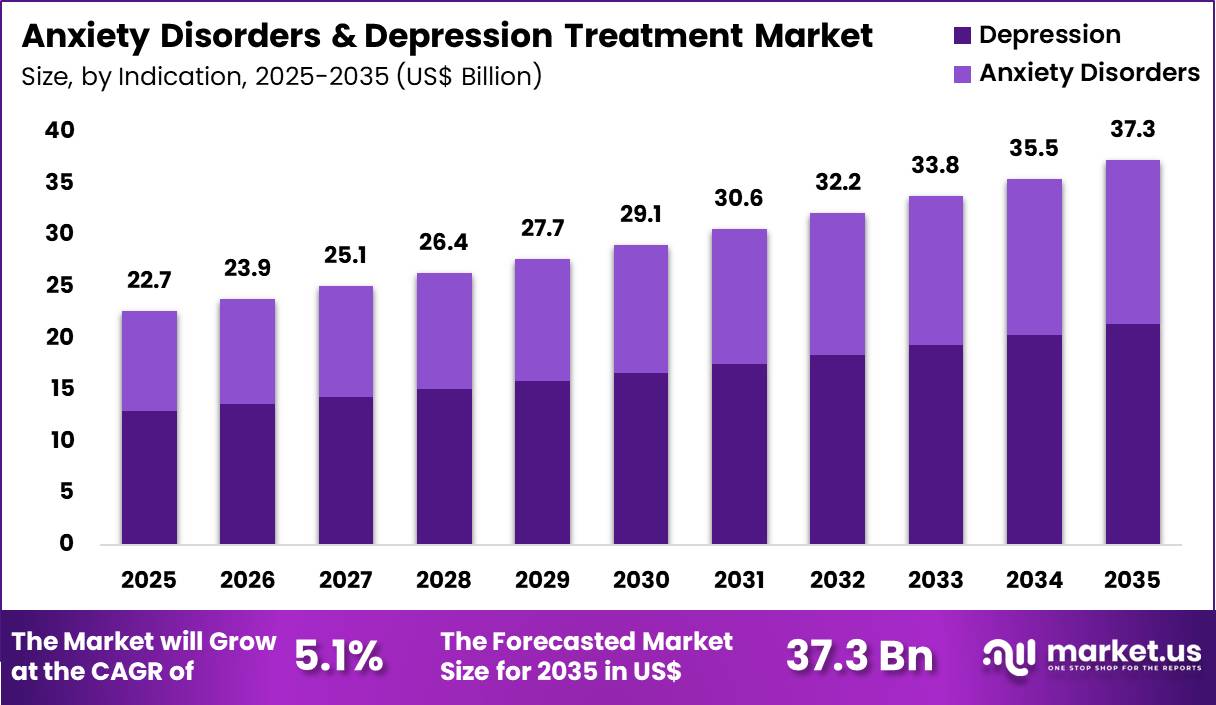

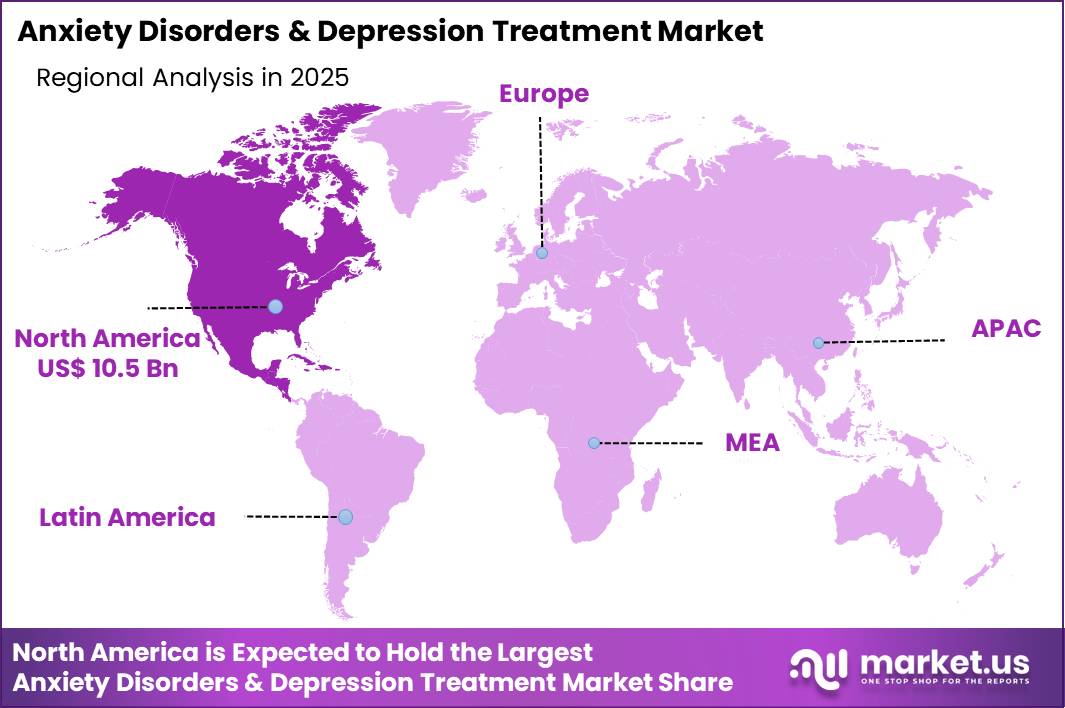

The Global Anxiety Disorders & Depression Treatment Market size is expected to be worth around US$ 37.3 Billion by 2035 from US$ 22.7 Billion in 2025, growing at a CAGR of 5.1% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 64.2% share with a revenue of US$ 10.5 Billion.

Rising prevalence of anxiety disorders and major depressive disorder, coupled with greater societal acceptance of mental health treatment, propels the Anxiety Disorders & Depression Treatment market as patients and providers seek effective interventions that restore daily functioning and prevent long-term disability.

Psychiatrists increasingly prescribe selective serotonin reuptake inhibitors to alleviate core symptoms of major depressive disorder, including persistent low mood, anhedonia, and sleep disturbances, while also addressing generalized anxiety disorder by reducing excessive worry and somatic complaints. These agents support panic disorder management, where rapid symptom control prevents avoidance behaviors and improves social and occupational participation.

Clinicians utilize serotonin-norepinephrine reuptake inhibitors for patients with comorbid chronic pain or fibromyalgia, targeting both emotional distress and physical manifestations to enhance overall quality of life. Benzodiazepines provide acute relief during severe panic attacks or situational anxiety, offering short-term stabilization until longer-acting therapies take effect. Cognitive behavioral therapy delivered via digital platforms complements pharmacological options, equipping patients with practical skills to manage phobias, social anxiety, and obsessive-compulsive tendencies.

Pharmaceutical developers seize opportunities to advance rapid-acting antidepressants and glutamatergic modulators that deliver relief within hours for treatment-resistant depression, expanding applications in emergency psychiatric settings and inpatient care. Companies explore neuromodulation technologies such as transcranial magnetic stimulation and ketamine infusions for non-responders, broadening therapeutic choices beyond traditional oral medications.

These innovations facilitate precision psychiatry through pharmacogenomic testing that predicts individual drug responses, optimizing treatment selection and minimizing trial-and-error periods. Opportunities also arise in combination regimens that integrate pharmacotherapy with digital therapeutics, improving long-term adherence in chronic anxiety and depression.

Recent trends emphasize holistic, patient-centered approaches that incorporate lifestyle modifications and mindfulness-based interventions alongside medical treatments, positioning the market for continued innovation in comprehensive mental health solutions.

Key Takeaways

- In 2025, the market generated a revenue of US$ 22.7 Billion, with a CAGR of 5.1%, and is expected to reach US$ 37.3 Billion by the year 2035.

- The product type segment is divided into antidepressants, anticonvulsants, anxiolytics, antipsychotics and others, with antidepressants taking the lead with a market share of 38.7%.

- Considering indication, the market is divided into depression and anxiety disorders. Among these, depression held a significant share of 57.3%.

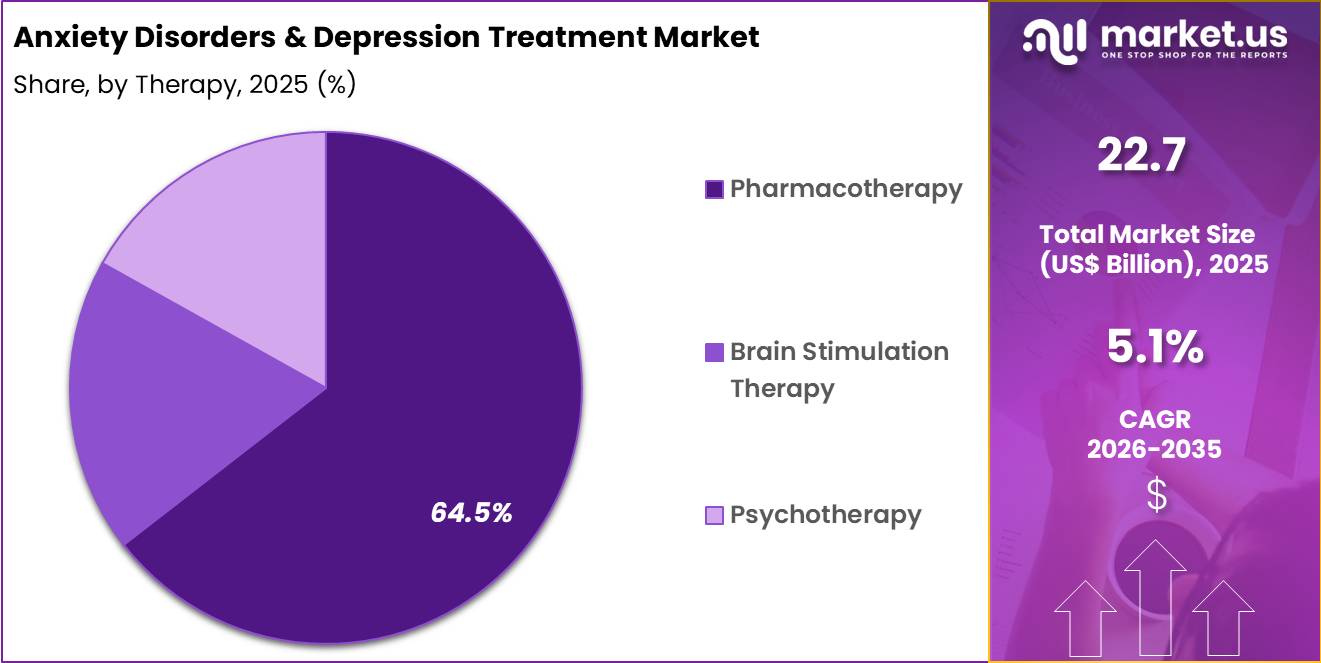

- Furthermore, concerning the therapy segment, the market is segregated into pharmacotherapy, brain stimulation therapy and psychotherapy. The pharmacotherapy sector stands out as the dominant player, holding the largest revenue share of 64.5% in the market.

- North America led the market by securing a market share of 64.2%.

Product Type Analysis

Antidepressants contributed 38.7% of growth within product type and led the anxiety disorders and depression treatment market due to their central role in managing mood disorders. Clinicians prescribe antidepressants as first-line therapy for major depressive disorder and related conditions because they target neurotransmitter imbalances effectively.

High prevalence of depressive symptoms across age groups increases prescription volumes. Expanded awareness and reduced stigma around mental health encourage more patients to seek pharmacological treatment.

Growth strengthens as new-generation antidepressants improve tolerability and safety profiles. Long-term maintenance therapy for recurrent depression increases treatment duration and refill frequency. Integration of digital mental health screening programs improves early diagnosis, which raises prescription rates.

Primary care physicians increasingly manage mild to moderate cases, which broadens access. The segment is expected to remain dominant as antidepressants continue to form the backbone of pharmacological management strategies.

Indication Analysis

Depression generated 57.3% of growth within indication and emerged as the leading segment due to its high global burden and recurrent nature. Healthcare systems prioritize depression screening in primary and specialty care settings, which increases diagnosis rates. Functional impairment and productivity loss associated with depressive disorders drive patients toward sustained treatment. Public health campaigns highlight the importance of early intervention, which strengthens demand for therapy.

Growth accelerates as socioeconomic stressors and lifestyle changes influence mental health trends. Comorbidity with chronic diseases further increases treatment complexity and duration. Expanded telepsychiatry services improve accessibility in underserved regions.

Insurance coverage for mental health treatment improves affordability. The segment is anticipated to maintain leadership as depression continues to represent a major share of mental health-related healthcare utilization.

Therapy Analysis

Pharmacotherapy accounted for 64.5% of growth within therapy and dominated the anxiety disorders and depression treatment market due to its scalability and structured dosing approach. Clinicians rely on medication-based regimens to stabilize symptoms and prevent relapse.

Pharmacotherapy offers measurable outcomes and standardized treatment pathways that align with clinical guidelines. Availability across retail and hospital pharmacies improves access for diverse patient populations.

Growth continues as combination strategies integrate medication with supportive therapies to enhance outcomes. Advances in psychopharmacology improve side-effect management and patient adherence. Long-term treatment plans increase medication continuity.

Healthcare providers adopt stepped-care models that begin with pharmacological intervention. The segment is projected to remain the primary growth driver as structured medication management continues to anchor mental health treatment protocols.

Key Market Segments

By Product Type

- Antidepressants

- Anticonvulsants

- Anxiolytics

- Antipsychotics

- Others

By Indication

- Depression

- Anxiety Disorders

By Therapy

- Pharmacotherapy

- Brain Stimulation Therapy

- Psychotherapy

Drivers

Increasing prevalence of anxiety and depression symptoms is driving the market.

The rising occurrence of anxiety and depression symptoms among adults has substantially increased the demand for effective pharmacological and therapeutic interventions. Greater public awareness and improved screening tools have contributed to higher reporting rates of these conditions. Healthcare providers are expanding treatment protocols to address the growing number of individuals experiencing moderate to severe symptoms.

The correlation between mental health disorders and reduced quality of life further amplifies the need for accessible treatment options. Government health initiatives are allocating resources to support expanded mental health services in response to this trend. The association between chronic stress and symptom severity underscores the urgency for timely interventions.

National surveillance programs highlight the scale of the issue, prompting broader adoption of antidepressants and psychotherapy. Key pharmaceutical companies are responding by advancing new compounds for these indications.

This driver fosters innovation in both pharmacological and digital treatment approaches. During 2022, about one in five adults age 18 and older experienced any symptoms of anxiety (18.2%) or symptoms of depression (21.4%) in the past 2 weeks.

Restraints

High cost of innovative therapies is restraining the market.

The elevated pricing of newer antidepressants and specialized treatments limits accessibility for many patients in cost-sensitive healthcare systems. Manufacturing complexities and extensive clinical trials contribute to substantial expenses that are passed on to consumers and payers. Smaller clinics and public health programs often face budget constraints that prevent widespread adoption of premium options.

Insurance coverage frequently imposes strict criteria or high co-pays for advanced therapies, deterring patient adherence. Providers may default to older, less expensive generics to manage operational finances. This restraint disproportionately affects lower-income populations and regions with limited reimbursement frameworks.

Efforts to introduce patient assistance programs provide partial relief but do not fully resolve the issue. Regulatory requirements for safety data further increase development costs reflected in final pricing. Despite proven efficacy, economic barriers slow penetration of cutting-edge treatments. Addressing affordability through policy reforms remains critical for overcoming this market limitation.

Opportunities

Strong revenue growth from key products is creating growth opportunities.

The robust sales performance of established and emerging treatments signals significant potential for market expansion in anxiety and depression therapies. Increased adoption in clinical practice supports investments in next-generation formulations and delivery methods. Healthcare collaborations facilitate access programs that broaden patient reach in underserved areas.

Strategic partnerships with distributors enable compliance and entry into new geographic markets. The substantial revenue base amplifies funding for research into combination therapies and personalized approaches. Policy advancements in mental health reimbursement strengthen infrastructure for broader distribution.

Johnson & Johnson reported Spravato worldwide sales of $780 million in the first nine months of 2024, a 62% increase from the same period in 2023. This opportunity aligns with global efforts to improve outcomes in treatment-resistant cases. Primary corporations are pursuing expansions to capitalize on rising demand in both developed and emerging economies. Focused developments can yield notable progress in integrated mental health solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the anxiety disorders and depression treatment market through healthcare funding levels, insurance coverage decisions, and patient affordability. Inflation and higher interest rates increase pressure on public health budgets and employer sponsored plans, which can tighten reimbursement terms for medications and therapy services.

Geopolitical tensions disrupt global supply chains for active pharmaceutical ingredients, excipients, and packaging materials, creating cost volatility and occasional shortages. Current US tariffs on imported APIs and certain pharmaceutical inputs raise manufacturing expenses, which narrows margins and adds complexity to pricing negotiations.

These pressures can delay product launches and strain smaller generic manufacturers. On the positive side, trade exposure encourages domestic API production, diversified sourcing, and stronger supply security. Rising awareness of mental health needs and expanded telehealth access sustain consistent treatment demand. With policy support, innovation in novel therapies, and resilient supply strategies, the market remains positioned for steady and confident growth.

Latest Trends

Clearance of prescription digital therapeutics is a recent trend in the market.

In 2024, regulatory clearance of software-based interventions has expanded non-pharmacological options for managing anxiety and depression. These digital therapeutics provide structured cognitive behavioral therapy through mobile applications under medical supervision. Manufacturers have prioritized clinical validation to ensure safety and efficacy comparable to traditional treatments.

Evaluations in 2024 demonstrated improved symptom reduction when used alongside or instead of medication. The FDA cleared Rejoyn in April 2024 as the first prescription digital therapeutic for major depressive disorder. This approval facilitates integration into standard care pathways for adults with residual symptoms.

The trend emphasizes accessibility for patients seeking convenient, home-based solutions. Regulatory pathways have adapted to evaluate digital health tools with rigorous evidence standards. Industry collaborations refine algorithms for personalized user experiences. These innovations aim to address treatment gaps while maintaining clinical oversight in mental health management.

Regional Analysis

North America is leading the Anxiety Disorders & Depression Treatment Market

North America accounted for a 46.2% share of the Anxiety Disorders & Depression Treatment market in 2024, supported by rising diagnosis rates and expanded access to mental health services. Healthcare providers increased screening in primary care settings, which improved early identification and intervention.

Telepsychiatry platforms and digital therapy tools widened treatment reach, especially in underserved and rural communities. Employers and insurers strengthened mental health coverage, encouraging patients to seek professional support. Growing awareness campaigns reduced stigma and promoted medication adherence alongside psychotherapy.

Pharmaceutical innovation in novel antidepressants and adjunct therapies also contributed to prescription growth. A strong supporting indicator comes from the National Institute of Mental Health, which reported that an estimated 21 million US adults experienced at least one major depressive episode in 2022, underscoring substantial clinical demand for structured therapeutic interventions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Anxiety Disorders & Depression Treatment market in Asia Pacific is expected to expand steadily during the forecast period as governments prioritize mental health within public health agendas. Policymakers integrate psychological services into primary healthcare systems to improve accessibility.

Urbanization, work related stress, and changing social dynamics increase awareness and help seeking behavior among younger populations. Digital counseling platforms and mobile based therapy applications strengthen outreach across large and diverse populations.

Regional pharmaceutical companies collaborate with global innovators to introduce advanced treatment options. Training programs expand the number of licensed psychiatrists and psychologists in emerging economies.

A verifiable indicator appears in 2023 data from the World Health Organization, which estimates that depression affects roughly 5% of adults worldwide, highlighting the significant regional need that supports continued service and therapy expansion across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the anxiety disorders and depression treatment market grow by expanding therapeutic portfolios with novel pharmacologic agents, including next-generation antidepressants and anxiolytics that target previously unmet neurobiological pathways and improve tolerability for patients.

They also strengthen engagement with healthcare providers through education on evidence-based prescribing, outcomes data, and adherence support programs that help clinicians tailor treatment plans and monitor long-term response.

Firms pursue strategic alliances with mental health clinics, payers, and digital therapeutics platforms to broaden access and integrate complementary care options that support holistic management. Geographic expansion into Europe, North America, and high-growth Asia Pacific diversifies revenue and responds to rising prevalence and improved diagnosis rates across demographic segments. Pfizer Inc.

exemplifies a leading global pharmaceutical company with a broad CNS portfolio that includes established therapies and ongoing research in mood and anxiety disorders, backed by coordinated global commercialization and substantial R&D investment. The company drives performance through disciplined pipeline development, targeted collaborations, and a patient-centric approach that aligns innovation with evolving clinical and payer expectations.

Top Key Players

- Pfizer

- Eli Lilly

- GlaxoSmithKline

- Johnson & Johnson

- AbbVie

- AstraZeneca

- Bristol Myers Squibb

- Otsuka Pharmaceutical

- H. Lundbeck

- Takeda Pharmaceutical

Recent Developments

- In June 2025, Johnson & Johnson finalized its USD 14.6 billion acquisition of Intra-Cellular Therapies. The transaction brings lumateperone into Johnson & Johnson’s portfolio, strengthening its pipeline in central nervous system therapies, including potential use as an adjunctive treatment for major depressive disorder.

- In May 2025, Supernus Pharmaceuticals announced plans to acquire Sage Therapeutics in a deal valued at up to USD 795 million. The proposed acquisition is intended to expand Supernus’ presence in the CNS treatment landscape and enhance its development pipeline in mood and neuropsychiatric disorders.

Report Scope

Report Features Description Market Value (2025) US$ 22.7 Billion Forecast Revenue (2035) US$ 37.3 Billion CAGR (2026-2035) 5.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Antidepressants, Anticonvulsants, Anxiolytics, Antipsychotics and Others), By Indication (Depression and Anxiety Disorders), By Therapy (Pharmacotherapy, Brain Stimulation Therapy and Psychotherapy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer, Eli Lilly, GlaxoSmithKline, Johnson & Johnson, AbbVie, AstraZeneca, Bristol Myers Squibb, Otsuka Pharmaceutical, H. Lundbeck, Takeda Pharmaceutical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anxiety Disorders & Depression Treatment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Anxiety Disorders & Depression Treatment MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer

- Eli Lilly

- GlaxoSmithKline

- Johnson & Johnson

- AbbVie

- AstraZeneca

- Bristol Myers Squibb

- Otsuka Pharmaceutical

- H. Lundbeck

- Takeda Pharmaceutical