Global Antimicrobial Additives Market Size, Share, And Business Benefits By Type (Organic (Silver, Copper, Zinc), Inorganic (OBPA, DCOIT, Triclosan)), By Application (Paints, Fabric/Textile, Inks, Paper, Plastic, Silicone, Rubber, Others), By End-Use (Construction, Food and Beverage, Automotive, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 16009

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

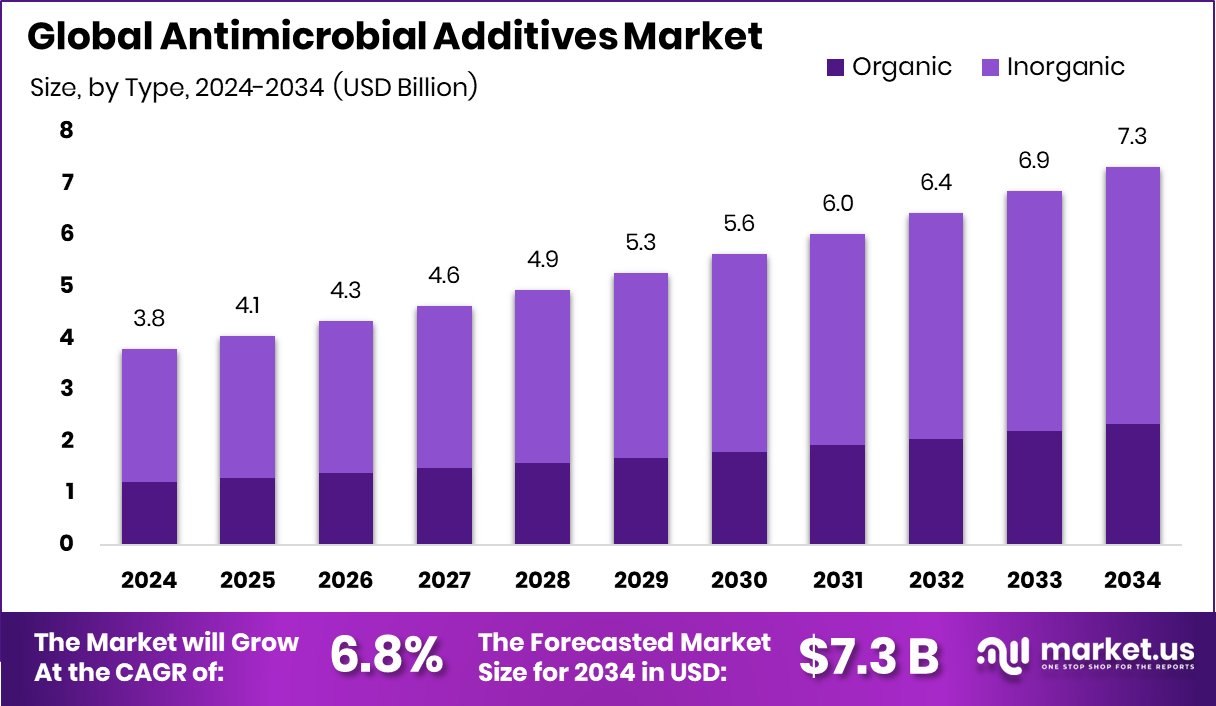

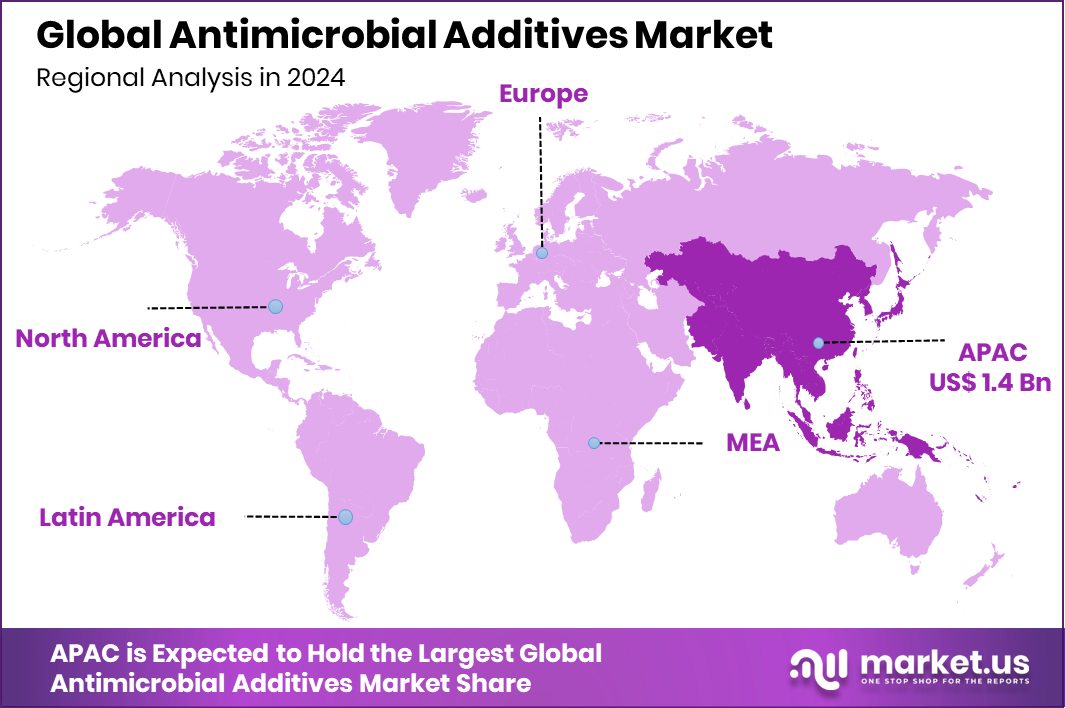

The Global Antimicrobial Additives Market is expected to be worth around USD 7.3 billion by 2034, up from USD 3.8 billion in 2024, and grow at a CAGR of 6.8% from 2025 to 2034. With a 39.40% market share, Asia-Pacific’s antimicrobial additives market was valued at USD 1.4 billion.

Antimicrobial additives are substances incorporated into materials to prevent the growth of microorganisms such as bacteria, fungi, and algae. These additives can be added to plastics, paints, textiles, and other materials during manufacturing to enhance hygiene and extend the product’s usable life by preventing degradation caused by microbial action.

The antimicrobial additives market is driven by growing health and hygiene awareness, especially in the wake of global health concerns. Industries such as healthcare, which require stringent infection control, heavily influence the demand for products with antimicrobial properties. This demand is also propelled by the consumer goods sector, where there is a significant emphasis on products that offer added hygiene benefits, from kitchenware to sports equipment.

One of the key growth factors for the antimicrobial additives market is the increasing demand in the healthcare sector. As hospitals and medical facilities seek more effective ways to reduce the spread of infections, the use of antimicrobial-treated surfaces and medical devices has surged. This trend is further supported by the global rise in health awareness and hygiene practices among consumers.

Another significant growth factor is the expansion of antimicrobial additives application in the food and beverage industry. These additives are used to enhance the safety and shelf life of products by inhibiting the growth of harmful bacteria and fungi in food packaging and processing equipment.

Opportunities in the antimicrobial additives market are abundant, especially in developing regions where industrial growth is coupled with rising health awareness. Innovations that offer sustainable and environmentally friendly antimicrobial solutions are particularly poised for growth.

Key Takeaways

- The Global Antimicrobial Additives Market is expected to be worth around USD 7.3 billion by 2034, up from USD 3.8 billion in 2024, and grow at a CAGR of 6.8% from 2025 to 2034.

- Inorganic antimicrobial additives make up 67.20% of the antimicrobial additives market share globally.

- Paints account for 23.60% of the antimicrobial additives market, improving product durability and hygiene.

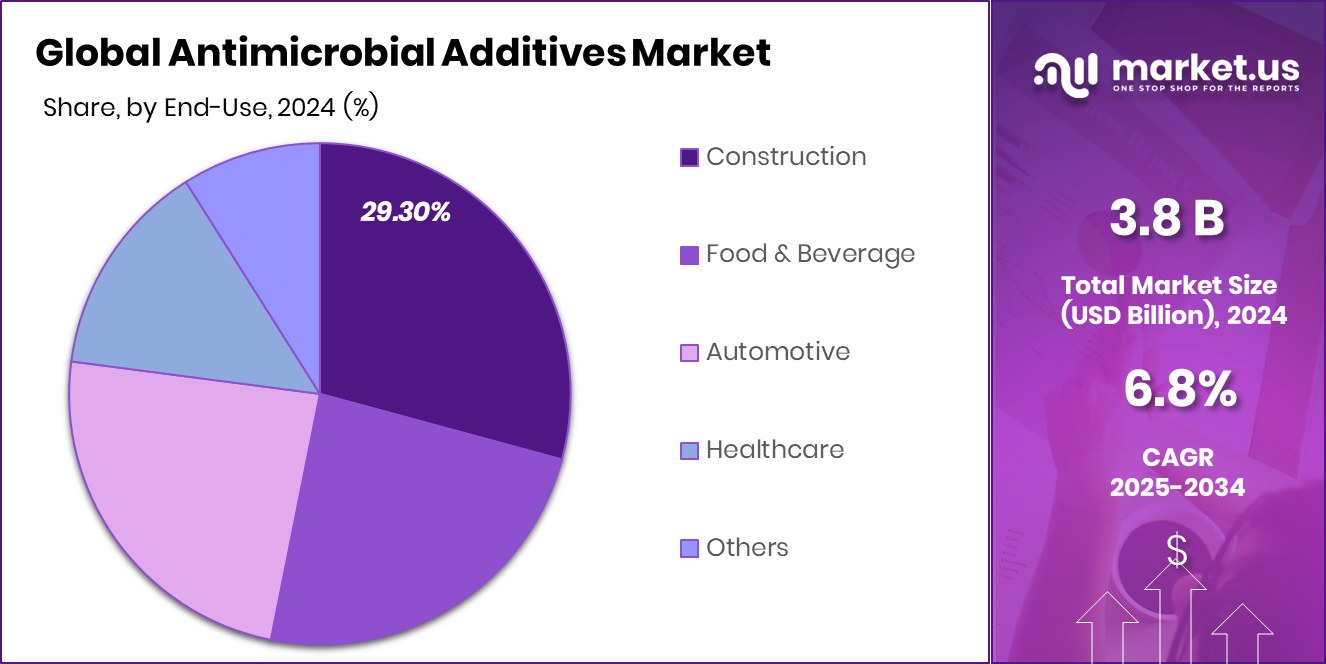

- The construction industry holds a 29.30% share in the antimicrobial additives market worldwide.

- Asia-Pacific’s antimicrobial additives market reached USD 1.4 billion, accounting for a 39.40% share.

By Type Analysis

In the antimicrobial additives market, inorganic additives dominate with a 67.20% share.

In 2024, Inorganic held a dominant market position in the By Type segment of the Antimicrobial Additives Market, with a 67.20% share. This substantial market share underscores the strong demand for inorganic antimicrobial additives, which are widely used due to their broad-spectrum effectiveness, long-lasting properties, and ability to prevent microbial growth in a variety of materials.

Inorganic antimicrobial additives are preferred in industries such as healthcare, packaging, and consumer goods, driven by increasing awareness of hygiene and the need for materials that offer continuous protection against bacteria, fungi, and other pathogens. The robust growth in end-use industries, coupled with advancements in additive technologies, is likely to support the continued dominance of inorganic additives.

Furthermore, inorganic antimicrobial additives are recognized for their cost-effectiveness and ability to withstand high temperatures and environmental stress, which makes them particularly attractive in industrial and outdoor applications.

By Application Analysis

Antimicrobial additives are extensively used in paints, accounting for a 23.60% market share.

In 2024, Paints held a dominant market position in the By Application segment of the Antimicrobial Additives Market, with a 23.60% share. This leading position reflects the increasing demand for antimicrobial properties in paints, particularly in sectors where hygiene and protection against microbial contamination are critical. Antimicrobial additives in paints help prevent the growth of bacteria, fungi, and mold on painted surfaces, contributing to the longevity and cleanliness of the coating.

The growing use of antimicrobial paints in industries such as healthcare, hospitality, and residential and commercial buildings is driving the demand for these additives. These paints are widely used in environments where maintaining a clean and sterile environment is essential, such as hospitals, kitchens, and schools.

Additionally, the construction industry’s focus on improving the durability and aesthetic appeal of buildings, alongside the growing adoption of eco-friendly solutions, supports the strong market position of antimicrobial paints.

By End-Use Analysis

Construction applications drive antimicrobial additives’ growth, contributing 29.30% to the market.

In 2024, Construction held a dominant market position in the By Application segment of the Antimicrobial Additives Market, with a 29.30% share. This significant market share highlights the critical role of antimicrobial additives in construction applications, where the demand for long-lasting, hygienic, and durable materials is on the rise.

The growing awareness of hygiene standards in residential, commercial, and industrial buildings is a major factor driving the adoption of antimicrobial additives in construction. These additives are particularly valued in high-traffic areas and environments that require strict sanitation, such as hospitals, schools, and public buildings.

Additionally, antimicrobial properties help to extend the lifespan of building materials by preventing damage caused by microbial growth, reducing maintenance costs, and improving the overall safety of structures.

The construction sector’s increasing focus on sustainability and the growing trend of smart buildings are also contributing to the widespread use of antimicrobial additives in building materials. As demand for safer and more durable buildings continues to grow, the construction sector is expected to maintain its dominant position in the antimicrobial additives market.

Key Market Segments

By Type

- Organic

- Silver

- Copper

- Zinc

- Inorganic

- OBPA

- DCOIT

- Triclosan

By Application

- Paints

- Fabric/Textile

- Inks

- Paper

- Plastic

- Silicone

- Rubber

- Others

By End-Use

- Construction

- Food and Beverage

- Automotive

- Healthcare

- Others

Driving Factors

Raising Awareness of Hygiene and Sanitation

One of the key driving factors of the antimicrobial additives market is the growing awareness of hygiene and sanitation. As people become more conscious of the importance of cleanliness, especially in public spaces and homes, there is a heightened demand for materials that can protect against harmful microorganisms.

Antimicrobial additives, which are integrated into products like paints, coatings, textiles, and plastics, play a vital role in preventing the growth of bacteria, fungi, and mold. This awareness is especially high in sectors like healthcare, food packaging, and construction, where hygiene is critical.

The need for continuous protection against microbes is pushing industries to adopt these additives, thus driving market growth. This trend is expected to grow as hygiene standards evolve globally.

Restraining Factors

High Cost of Antimicrobial Additives Integration

One of the main restraining factors for the antimicrobial additives market is the high cost of integrating these additives into products. Many antimicrobial additives, especially those with advanced formulations, can be expensive to produce and incorporate into materials like paints, plastics, and textiles.

This cost can make it challenging for manufacturers to offer antimicrobial products at competitive prices, particularly in industries where cost-efficiency is crucial. Smaller businesses may also find it difficult to invest in these additives, which could limit their adoption.

Furthermore, the higher production costs may be passed on to consumers, potentially slowing down the growth of the market in price-sensitive regions. This factor remains a key challenge for wider acceptance and market expansion.

Growth Opportunity

Expanding Healthcare Sector Boosts Additive Demand

The rapid growth of the healthcare sector presents a significant growth opportunity for the antimicrobial additives market. Antimicrobial additives are essential in medical devices, hospital furnishings, and protective coatings as they help prevent infections by inhibiting the growth of harmful microorganisms.

With the increasing global emphasis on health and hygiene, especially in the wake of health crises like the COVID-19 pandemic, the demand for antimicrobial solutions in healthcare settings has surged.

This trend is expected to continue, driving the need for advanced antimicrobial additives. Investments in healthcare infrastructure, particularly in emerging economies, further amplify this demand. Consequently, companies offering antimicrobial additives have a substantial opportunity to expand their presence in the healthcare industry, contributing to improved patient safety and care.

Latest Trends

Integration of Sustainable and Bio-Based Additives

A notable trend in the antimicrobial additives market is the integration of sustainable and bio-based additives. As environmental concerns grow, manufacturers are increasingly adopting eco-friendly solutions to meet consumer demand for green products.

Bio-based antimicrobial additives, derived from renewable resources, offer effective microbial protection without relying on traditional petrochemical sources. This shift not only reduces the environmental footprint but also aligns with stringent sustainability regulations.

For instance, companies are developing additives that are biodegradable and non-toxic, ensuring that products maintain their antimicrobial properties while being environmentally responsible. This trend reflects a broader commitment within the industry to innovate responsibly, balancing performance with ecological considerations.

Regional Analysis

The Asia-Pacific region held a 39.40% share in the antimicrobial additives market, valued at USD 1.4 billion.

The Antimicrobial Additives Market is segmented into several key regions, with Asia-Pacific leading the charge, holding a substantial 39.40% market share valued at USD 1.4 billion. This dominance is attributed to rapid industrialization across major economies such as China and India, coupled with increasing regulations on hygiene standards in the manufacturing sector.

In North America, the market is driven by stringent regulatory standards regarding product safety and hygiene, particularly in the healthcare and food & beverage sectors. This region has seen consistent growth due to the high adoption of advanced materials integrated with antimicrobial properties.

Europe follows a similar pattern, with a strong emphasis on safety and environmental sustainability. European manufacturers are keen on incorporating antimicrobial additives to comply with strict EU regulations aimed at reducing microbial resistance and enhancing product longevity.

The Middle East & Africa region, though smaller in market size, is experiencing gradual growth due to increasing awareness of health and hygiene, particularly in the food processing and packaging industries.

Latin America, while still developing in this sector, shows potential due to rising urbanization and health awareness. The region is slowly adopting antimicrobial solutions in various applications, aiming to improve overall public health standards and product quality.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, RTP Company, Milliken Chemical, and BioCote Limited are positioned as influential players in the global Antimicrobial Additives Market. Each company brings unique strengths and strategies to the table, highlighting their roles in shaping the industry landscape.

RTP Company has been a pivotal force, renowned for its innovative solutions in custom-engineered thermoplastics, which include antimicrobial properties. Their ability to tailor products to specific customer needs makes them a preferred partner across various industries, from automotive to consumer goods.

Milliken Chemical, on the other hand, stands out for its expertise in chemical manufacturing combined with a deep commitment to sustainability. Their antimicrobial solutions are integrated into a wide range of products, ensuring safety and durability. Milliken’s focus on environmentally friendly practices and products that meet stringent regulatory standards positions them favorably among customers prioritizing both performance and sustainability.

BioCote Limited offers a distinct competitive edge through its specialized antimicrobial technology that can be incorporated into a myriad of materials, including plastics, textiles, and metals. Their proven track record of reducing microbes by up to 99.99% on treated products appeals to sectors with high hygiene requirements, such as healthcare and food services.

Top Key Players in the Market

- NanoBioMatters Industries S.L

- BASF SE

- RTP Company

- Milliken Chemical

- BioCote Limited

- Microban International

- Clariant AG

- Avient Corporation

- Momentive Performance Materials Inc.

- Life Materials Technologies Limited

- Sanitized AG

- Dow Inc.

- LyondellBasell Industries Holdings B.V.

Recent Developments

- In February 2025, Avient launched Cesa™ WithStand™ SX Low Haze Antimicrobial Additives. These additives are designed for clear polycarbonate and plexiglass applications, helping maintain visual clarity while protecting against bacteria, mold, and fungi. They are particularly beneficial for products using recycled materials.

- In December 2024, Microban launched Freshology™, a nature-inspired, heavy metal-free odor control technology designed to neutralize a wide range of odors in textiles and apparel.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 7.3 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Organic (Silver, Copper, Zinc), Inorganic (OBPA, DCOIT, Triclosan)), By Application (Paints, Fabric/Textile, Inks, Paper, Plastic, Silicone, Rubber, Others), By End-Use (Construction, Food and Beverage, Automotive, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NanoBioMatters Industries S.L, BASF SE, RTP Company, Milliken Chemical, BioCote Limited, Microban International, Clariant AG, Avient Corporation, Momentive Performance Materials Inc., Life Materials Technologies Limited, Sanitized AG, Dow Inc., LyondellBasell Industries Holdings B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antimicrobial Additives MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Antimicrobial Additives MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NanoBioMatters Industries S.L

- BASF SE

- RTP Company

- Milliken Chemical

- BioCote Limited

- Microban International

- Clariant AG

- Avient Corporation

- Momentive Performance Materials Inc.

- Life Materials Technologies Limited

- Sanitized AG

- Dow Inc.

- LyondellBasell Industries Holdings B.V.