Global Antilock Braking System Market Size, Share, Growth Analysis By Vehicle (Two-Wheeler, Passenger Cars, Commercial Vehicle), By Component (Sensors, Electronic Control Unit (ECU), Hydraulic Unit), By Technology (Conventional ABS, Electronic Stability Control (ESC), Electronic Brake-Force Distribution (EBD)), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175088

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

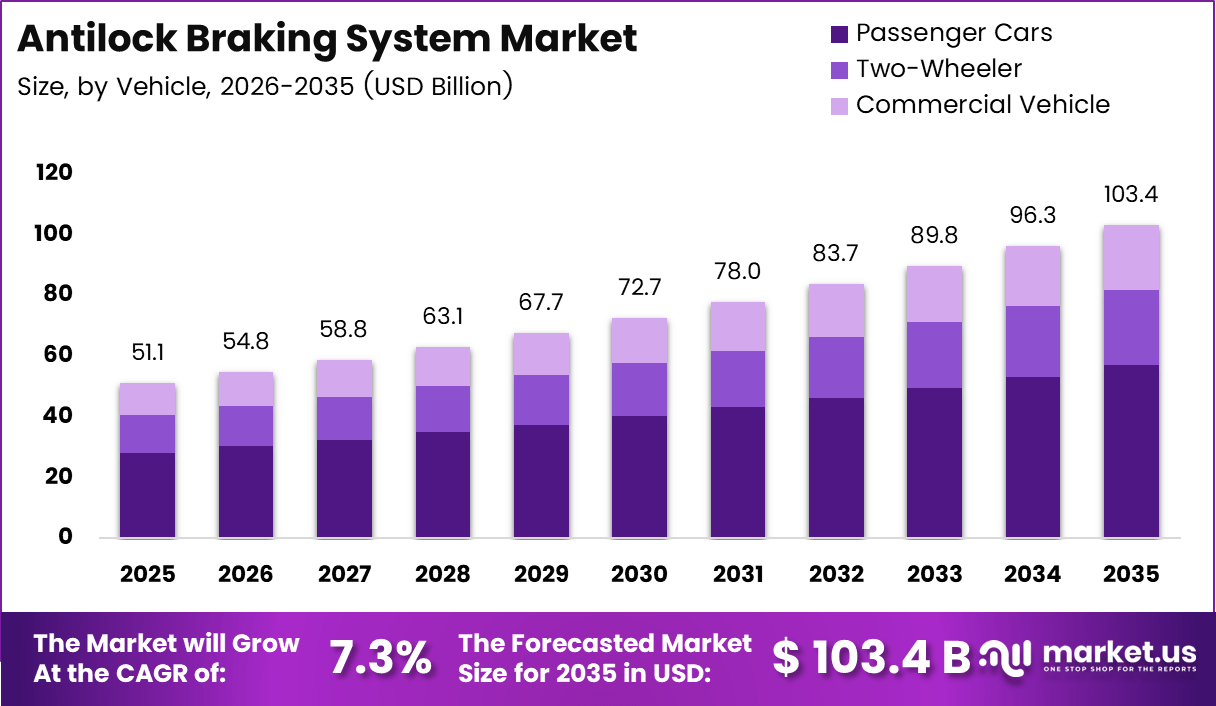

The Global Antilock Braking System Market size is expected to be worth around USD 103.4 Billion by 2035, from USD 51.1 billion in 2025, growing at a CAGR of 7.3% during the forecast period from 2026 to 2035.

The antilock braking system market represents the ecosystem of electronic, hydraulic, and software technologies that prevent wheel lock during sudden braking events. From a system perspective, ABS improves steering control and vehicle stability under emergency conditions. Consequently, adoption is closely aligned with road safety priorities, vehicle electrification trends, and intelligent braking architectures across global automotive platforms.

From an analyst viewpoint, an antilock braking system functions by continuously modulating brake pressure to maintain controlled wheel rotation. Instead of skidding, the system allows drivers to retain directional control during aggressive deceleration. As a result, ABS is positioned as a foundational safety feature supporting advanced driver assistance systems and integrated chassis control strategies.

Market growth is primarily driven by tightening vehicle safety regulations and rising consumer awareness regarding accident prevention technologies. Governments increasingly mandate electronic safety systems across passenger and commercial vehicles. Therefore, ABS demand remains structurally strong, supported by policy-backed compliance requirements, increasing urban traffic density, and sustained vehicle production activities.

In terms of opportunity, the antilock braking system market benefits from the accelerating transition toward electric and hybrid vehicles. These platforms require highly responsive braking systems compatible with regenerative braking architectures. Additionally, software-driven brake control algorithms create opportunities for optimization, predictive braking, and enhanced integration with semi-autonomous driving safety layers.

Government investment and regulatory frameworks further strengthen the market outlook. Public spending on road safety programs and vehicle standardization initiatives accelerates ABS penetration. Moreover, regulators emphasize reduced stopping distances and improved vehicle controllability, indirectly encouraging continuous upgrades in braking system technologies and supporting long-term market sustainability.

From a technical perspective, automotive braking research indicates that peak longitudinal braking force occurs at approximately 15% wheel slip. When wheels fully lock, slip reaches 100%, resulting in loss of steering control. Therefore, most anti-skid systems are designed to operate within an 8–30% wheel slip range to balance braking efficiency and stability.

According to original equipment manufacturer engineering documentation, advanced ABS architectures can modulate brake pressure up to 100 cycles per second, maintaining optimal traction across varying surface conditions. This high-frequency control enhances braking precision during sudden maneuvers, reinforcing ABS as a critical safety technology within the antilock braking system market.

Key Takeaways

- The Global Antilock Braking System Market is projected to grow from USD 51.1 billion in 2025 to around USD 103.4 billion by 2035, registering a CAGR of 7.3% during 2026–2035.

- Passenger Cars emerged as the dominant vehicle segment in 2025, accounting for a 55.3% share, driven by rising safety regulations and standard ABS integration.

- Sensors led the component landscape with a 47.9% share in 2025, reflecting their critical role in real-time wheel speed detection and braking accuracy.

- Conventional ABS dominated the technology segment with a 51.7% share in 2025, supported by cost-effectiveness and widespread deployment across vehicle platforms.

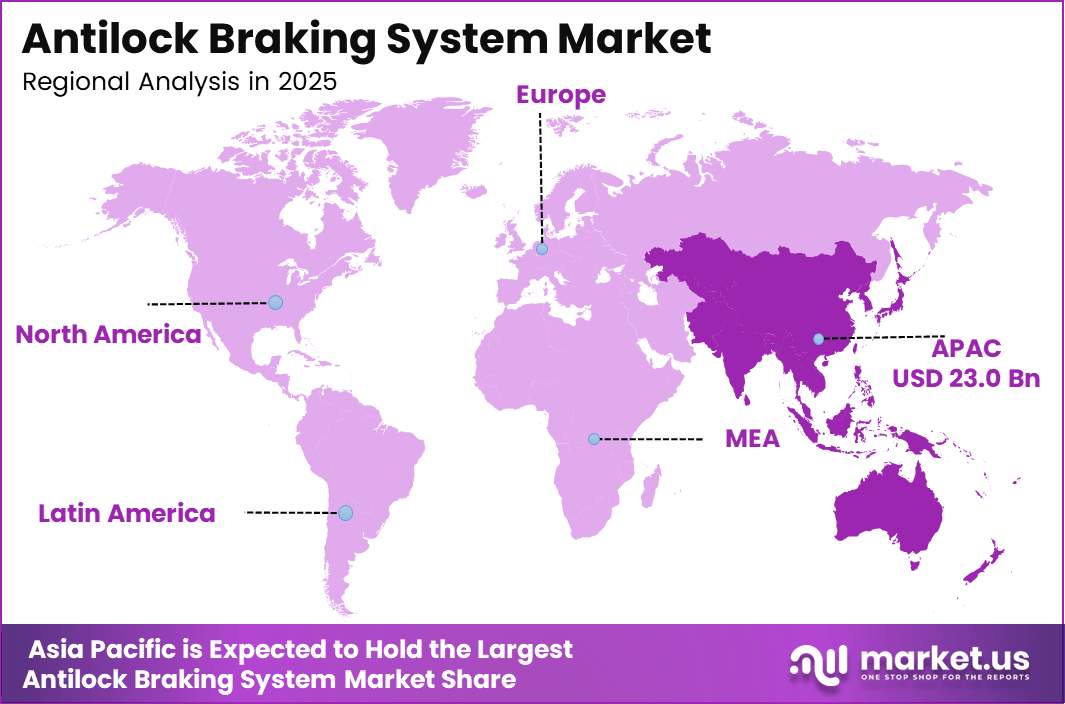

- Asia Pacific remained the leading region, capturing 45.2% of global demand and generating USD 23.0 billion in revenue, backed by high vehicle production and stricter safety mandates.

By Vehicle Analysis

Passenger Cars dominates with 55.3% due to rising safety expectations, regulatory mandates, and increasing integration of advanced braking technologies.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Analysis segment of Antilock Braking System Market, with a 55.3% share. This dominance is supported by higher vehicle production volumes and growing consumer awareness of road safety. Moreover, manufacturers increasingly integrate ABS as a standard feature, strengthening adoption across mid-range and premium passenger vehicles.

Two-Wheeler vehicles represent a steadily expanding sub-segment, driven by urban mobility growth and rising accident rates in densely populated regions. As regulations evolve, ABS adoption in two-wheelers is gradually increasing. Additionally, improved affordability and lightweight ABS designs are encouraging wider penetration, particularly in commuter motorcycles and scooters.

Commercial Vehicles form a crucial sub-segment where ABS supports load stability and braking efficiency. Fleet operators prioritize safety to reduce downtime and insurance risks. Consequently, ABS adoption aligns with stricter safety norms and logistics efficiency goals, especially in heavy-duty trucks and buses operating over long distances.

By Component Analysis

Sensors dominates with 47.9% as accurate wheel speed detection remains the foundation of effective ABS performance.

In 2025, Sensors held a dominant market position in the By Component Analysis segment of Antilock Braking System Market, with a 47.9% share. Sensors continuously monitor wheel rotation and transmit real-time data, enabling precise brake modulation. Their reliability and constant operational role make them indispensable across all vehicle categories.

The Electronic Control Unit (ECU) plays a central role by processing sensor data and executing braking commands. As vehicle electronics advance, ECUs are becoming more compact and intelligent. This evolution supports better integration with other vehicle safety systems, improving overall braking responsiveness and system coordination.

The Hydraulic Unit is responsible for regulating brake pressure during sudden braking events. Its mechanical precision ensures controlled braking under varying road conditions. Continuous improvements in hydraulic design enhance durability and pressure accuracy, making this component essential for consistent ABS functionality.

By Technology Analysis

Conventional ABS dominates with 51.7% due to its widespread implementation and cost-effective safety benefits.

In 2025, Conventional ABS held a dominant market position in the By Technology Analysis segment of Antilock Braking System Market, with a 51.7% share. Its proven reliability and simpler architecture support mass adoption. Manufacturers continue to rely on this technology to meet baseline safety requirements across vehicle segments.

Electronic Stability Control (ESC) builds upon ABS by improving vehicle stability during sharp turns or sudden maneuvers. This technology enhances directional control and reduces skidding risks. As driving conditions become more complex, ESC integration gains importance in enhancing overall vehicle safety performance.

Electronic Brake-Force Distribution (EBD) optimizes braking force between front and rear wheels. By adapting to vehicle load and road conditions, EBD improves braking efficiency and reduces stopping distances. Its compatibility with ABS systems supports smoother braking behavior and balanced vehicle control.

By Sales Channel Analysis

OEM dominates with 79.5% as ABS is increasingly installed directly during vehicle manufacturing.

In 2025, OEM held a dominant market position in the By Sales Channel Analysis segment of Antilock Braking System Market, with a 79.5% share. Automakers integrate ABS at the production stage to comply with safety regulations. This approach ensures system compatibility and consistent quality across vehicle models.

The Aftermarket segment addresses replacement and upgrade needs for existing vehicles. Demand arises from wear-related component replacements and retrofitting in older models. Although smaller in comparison, this channel remains relevant for maintaining vehicle safety and extending operational lifecycles.

Key Market Segments

By Vehicle

- Two-Wheeler

- Passenger Cars

- Commercial Vehicle

By Component

- Sensors

- Electronic Control Unit (ECU)

- Hydraulic Unit

By Technology

- Conventional ABS

- Electronic Stability Control (ESC)

- Electronic Brake-Force Distribution (EBD)

By Sales Channel

- OEM

- Aftermarket

Drivers

Mandated Installation of Advanced Braking Safety Systems Drives Market Growth

Regulatory mandates for advanced braking safety systems are a primary driver for the Antilock Braking System market. Many countries now require ABS in passenger cars, commercial vehicles, and two-wheelers to improve road safety. These rules push automakers to make ABS a standard feature rather than an optional add-on, increasing overall system adoption. As safety norms tighten, compliance becomes a basic requirement for vehicle certification and sales.

Another strong driver is the rising penetration of electronic stability control systems that rely on ABS modules for effective operation. ABS acts as a core building block within broader vehicle safety architectures, supporting traction control and stability functions. As manufacturers shift toward integrated safety platforms, ABS demand grows naturally alongside these systems.

Reducing road fatalities remains a key policy and industry objective. ABS helps drivers maintain steering control during hard braking, especially on wet or slippery roads. Governments, safety agencies, and manufacturers increasingly promote active safety technologies to lower accident severity, strengthening the long-term relevance of ABS.

In two-wheelers, ABS adoption is growing due to urban traffic congestion and rising safety awareness among riders. Dense traffic conditions increase braking risks, making ABS a valuable safety feature for everyday commuting.

Restraints

Higher System Cost and Integration Complexity Limits Wider Adoption

Higher system costs remain a notable restraint for the Antilock Braking System market, especially in low-cost vehicle segments. ABS requires sensors, control units, and precise calibration, which raises production expenses. For entry-level vehicles, manufacturers often struggle to balance safety upgrades with strict cost targets, slowing adoption in price-sensitive markets.

Integration complexity also acts as a barrier. Adding ABS to basic vehicle platforms demands changes in braking architecture, electronic systems, and software tuning. Smaller manufacturers and low-volume models face higher per-unit integration costs, making ABS less attractive without regulatory pressure.

Another limitation is the reduced effectiveness of ABS on loose gravel, snow, or off-road surfaces. In such conditions, traditional braking can sometimes stop vehicles faster than ABS. This performance perception affects acceptance among off-road users and in regions with harsh driving environments.

These factors together limit universal ABS penetration, particularly in rural markets and utility-focused vehicles. While safety benefits are clear, cost and functional trade-offs continue to influence adoption decisions.

Growth Factors

Expansion of ABS Adoption in Electric and Hybrid Vehicles Creates New Opportunities

Electric and hybrid vehicles present strong growth opportunities for the Antilock Braking System market. These vehicles rely on regenerative braking, which must work smoothly with ABS to ensure safety and consistent stopping performance. As electrified vehicle production rises, demand for advanced ABS solutions that support energy recovery also increases.

Emerging economies offer another major opportunity due to rising vehicle production and stricter safety regulation enforcement. Governments in these regions are gradually aligning with global safety standards, expanding the addressable market for ABS across passenger and commercial vehicles.

Integration of ABS with autonomous driving and advanced driver assistance systems further supports growth. ABS provides critical data and control functions needed for automated braking and collision avoidance systems. As automation levels increase, ABS becomes more technologically sophisticated and essential.

OEM demand for modular and lightweight ABS components is also rising. Manufacturers seek flexible systems that reduce vehicle weight, improve efficiency, and simplify platform sharing. This trend encourages innovation and opens space for next-generation ABS designs.

Emerging Trends

Shift Toward Sensor Fusion and Smart Diagnostics Shapes Market Trends

A major trend in the Antilock Braking System market is the shift toward sensor fusion. ABS is increasingly combined with traction control and vehicle dynamics systems to deliver coordinated safety responses. This integration improves braking precision and overall vehicle stability under complex driving conditions.

The growing use of smart sensors and AI-enabled diagnostics is another key trend. Advanced ABS units can monitor performance in real time, detect faults early, and support predictive maintenance. This improves reliability while reducing long-term ownership costs for fleet operators and consumers.

Compact ABS units designed for motorcycles and micro-mobility vehicles are gaining attention. Urban mobility growth drives demand for smaller, lighter systems that fit limited vehicle space without compromising safety performance.

Cybersecurity and functional safety standards are also becoming more important as braking systems become more electronic and connected. Manufacturers now focus on protecting ABS software and ensuring fail-safe operation, shaping future product development priorities.

Regional Analysis

Asia Pacific Dominates the Antilock Braking System Market with a Market Share of 45.2%, Valued at USD 23.0 Billion

Asia Pacific holds the leading position in the Antilock Braking System Market, accounting for 45.2% of global demand and generating revenues of USD 23.0 Billion. This dominance is supported by high vehicle production volumes, rising two-wheeler and passenger car penetration, and stricter vehicle safety mandates across emerging economies. Rapid urbanization and increasing consumer awareness of road safety features continue to strengthen adoption. The presence of cost-sensitive manufacturing ecosystems further supports large-scale integration of ABS across vehicle categories.

North America Antilock Braking System Market Trends

North America represents a mature and technology-driven market for antilock braking systems, supported by long-standing safety regulations and high penetration of advanced driver safety features. Demand remains steady due to replacement cycles and sustained sales of passenger vehicles and light commercial vehicles. Consumer preference for safety-rated vehicles and regulatory compliance across the U.S. and Canada continues to support consistent market performance.

Europe Antilock Braking System Market Trends

Europe maintains a strong position in the antilock braking system market due to stringent automotive safety standards and early adoption of vehicle safety technologies. Regulatory frameworks mandating ABS installation across vehicle classes contribute to stable demand. Growth is further supported by the region’s emphasis on reducing road fatalities and promoting advanced braking systems in both passenger and commercial vehicles.

Middle East and Africa Antilock Braking System Market Trends

The Middle East and Africa region shows gradual growth in the antilock braking system market, driven by improving vehicle safety regulations and increasing vehicle parc in urban centers. Rising imports of passenger cars equipped with standard safety features support adoption. Infrastructure development and growing awareness of road safety are expected to strengthen demand over time.

Latin America Antilock Braking System Market Trends

Latin America is witnessing steady expansion in the antilock braking system market, supported by evolving automotive safety norms and increasing vehicle production in key countries. Governments are progressively enforcing safety compliance, encouraging OEMs to integrate ABS as standard equipment. Economic recovery trends and rising vehicle ownership levels contribute to consistent regional demand growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Antilock Braking System Company Insights

In 2025, Robert Bosch GmbH continues to hold a leadership position in the global Antilock Braking System market, supported by its long-standing expertise in automotive safety technologies. The company’s focus on integrating ABS with electronic stability control and advanced vehicle dynamics systems aligns well with rising safety regulations. Bosch’s ability to deliver scalable solutions across passenger and commercial vehicles strengthens its relevance across global OEM platforms.

Continental AG remains a critical contributor to the ABS market, leveraging its strong capabilities in sensors, control electronics, and braking software. The company emphasizes modular braking architectures that allow automakers to optimize cost, performance, and system integration. Continental’s strategic alignment with connected and automated driving trends supports its sustained demand in both mature and emerging automotive markets.

Autoliv Inc. maintains its competitive edge by prioritizing safety reliability and system robustness within its braking technology portfolio. Its ABS solutions are designed to complement broader occupant and vehicle safety systems, reinforcing its value proposition to OEMs. Autoliv’s focus on consistent quality standards and long-term supply partnerships enhances trust and adoption across global vehicle production programs.

Nissin Kogyo Co., Ltd. continues to strengthen its position through compact and lightweight ABS designs tailored for efficient vehicle integration. The company’s expertise in hydraulic control and brake actuation supports demand from manufacturers focused on performance optimization and fuel efficiency. Nissin Kogyo’s close collaboration with regional automakers and its emphasis on next-generation braking control technologies position it well for evolving market requirements.

Top Key Players in the Market

- Robert Bosch GmbH

- Continental AG

- Autoliv Inc.

- Nissin Kogyo Co., Ltd.

- WABCO Holdings Inc.

- Hitachi Automotive Systems, Ltd.

- ZF Friedrichshafen AG

- Denso Corporation

- Haldex AB

- Hyundai Mobis

Recent Developments

- Jan 2025, NOVOSENSE launched AMR-based anti-braking sensors designed to improve the accuracy and reliability of automotive braking systems, These sensors enhance vehicle safety by enabling faster and more precise detection of wheel speed and braking force under demanding driving conditions.

- Dec 2024, Italian brake manufacturer Brembo and French tire maker Michelin signed a global agreement to collaborate on intelligent solutions aimed at improving vehicle performance and safety, The partnership focuses on integrating braking and tire intelligence to optimize stopping distance, stability, and real-time vehicle control.

Report Scope

Report Features Description Market Value (2025) USD 51.1 billion Forecast Revenue (2035) USD 103.4 Billion CAGR (2026-2035) 7.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Two-Wheeler, Passenger Cars, Commercial Vehicle), By Component (Sensors, Electronic Control Unit (ECU), Hydraulic Unit), By Technology (Conventional ABS, Electronic Stability Control (ESC), Electronic Brake-Force Distribution (EBD)), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Continental AG, Autoliv Inc., Nissin Kogyo Co., Ltd., WABCO Holdings Inc., Hitachi Automotive Systems, Ltd., ZF Friedrichshafen AG, Denso Corporation, Haldex AB, Hyundai Mobis Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antilock Braking System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Antilock Braking System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Continental AG

- Autoliv Inc.

- Nissin Kogyo Co., Ltd.

- WABCO Holdings Inc.

- Hitachi Automotive Systems, Ltd.

- ZF Friedrichshafen AG

- Denso Corporation

- Haldex AB

- Hyundai Mobis