Global Aluminium Conductor Steel-reinforced Cable (ACSR) Market By Type(Aluminium Conductor Steel Reinforced (ACSR), ACSR/AW – Aluminum Conductor Aluminum Clad Steel Reinforced, ACSR/TW – Trapezoidal Aluminum Conductor Steel Reinforced), By Voltage Rating(Medium, High, Extra High), By Current Capacity(Below 200 A, 200 - 400 A, 400 - 600 A, Above 600 A), By Application, Bare Overhead Transmission Conductor, Primary and Secondary Distribution Conductor, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025–2034

- Published date: Jan 2025

- Report ID: 21509

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

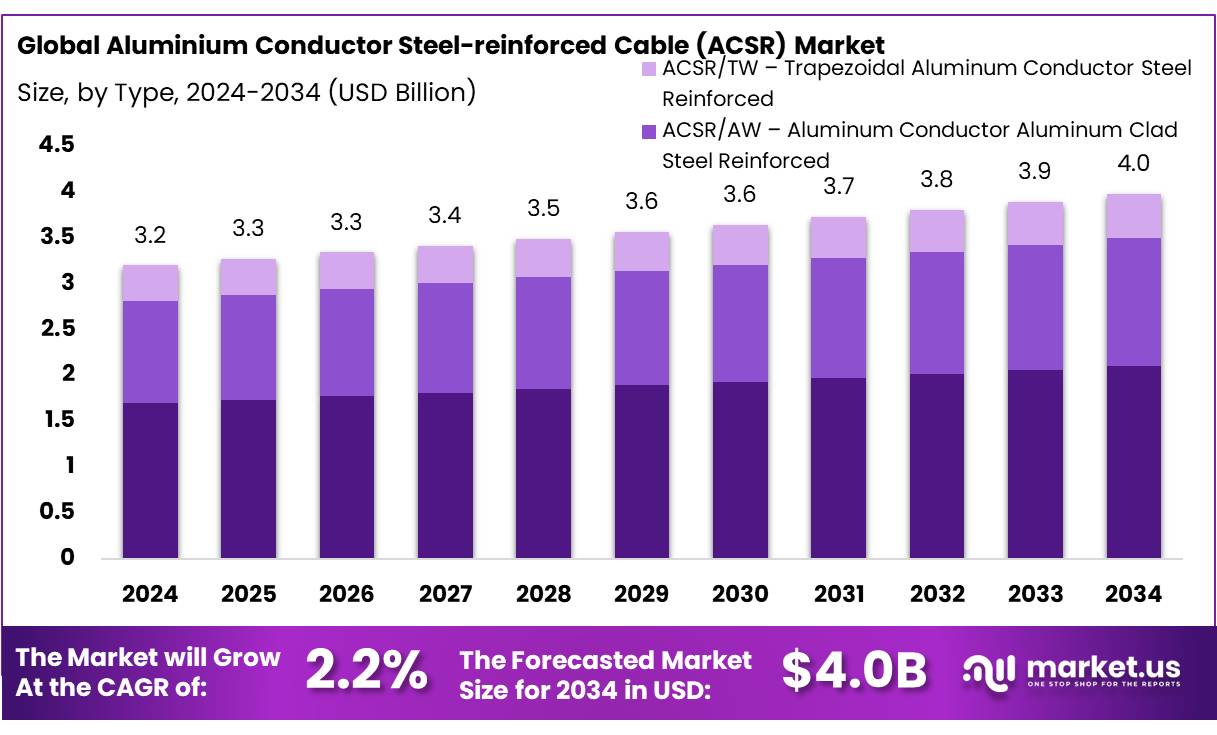

The Global Aluminium Conductor Steel-reinforced Cable (ACSR) Market size is expected to be worth around USD 4.0 billion by 2034, from USD 3.2 Bn in 2024, growing at a CAGR of 2.2% during the forecast period from 2025 to 2034.

The global Aluminium Conductor Steel-Reinforced Cable (ACSR) market plays a crucial role in power transmission infrastructure, particularly in overhead power lines due to its high mechanical strength, lightweight design, and ability to carry high-voltage electricity over long distances. These cables consist of a core of galvanized steel strands surrounded by aluminum layers, ensuring a balance of conductivity and durability. Their widespread adoption makes them essential for efficient energy transmission, especially in regions undergoing rapid grid expansion.

Developed markets like North America and Europe are heavily investing in upgrading aging power grids, while emerging economies in Asia-Pacific and Africa are expanding their transmission networks to meet growing energy needs. China and India, which together account for nearly 40% of global electricity consumption, are key drivers of ACSR cable demand. India alone is set to invest over USD 50 billion in power grid expansion between 2024 and 2030. Similarly, infrastructure projects in the Middle East are boosting the market, highlighting the growing demand for reliable transmission solutions.

One of the primary factors driving ACSR market growth is the increasing global electricity demand. According to the International Energy Agency (IEA), electricity consumption is expected to rise by 2.4% annually through 2030, necessitating further investments in transmission infrastructure. The global transition toward renewable energy is also fueling demand, as solar and wind projects require extensive transmission networks to connect remote power sources to urban centers. With renewable capacity projected to grow by 60% between 2024 and 2030, ACSR cables will play a key role in supporting efficient energy distribution.

Future opportunities in the ACSR market are particularly strong in developing regions with low electrification rates. Africa, where only about 40% of the population has reliable electricity access, presents a significant demand for transmission infrastructure investments. Technological advancements, such as high-temperature low-sag (HTLS) ACSR cables, are further enhancing efficiency and performance under extreme conditions. Additionally, the increasing adoption of smart grids, which rely on advanced transmission networks, is set to drive further growth in the ACSR market.

Key Takeaways

- Aluminium Conductor Steel-reinforced Cable (ACSR) Market size is expected to be worth around USD 4.0 billion by 2034, from USD 3.2 Bn in 2024, growing at a CAGR of 2.2%.

- Aluminium Conductor Steel Reinforced (ACSR) emerged as the leading type in the Aluminium Conductor Steel-reinforced Cable (ACSR) market, capturing more than a 53.60% share.

- High voltage segment of the Aluminium Conductor Steel-reinforced (ACSR) cable market held a dominant position, capturing more than a 48.30% share.

- 400 – 600 A segment of the Aluminium Conductor Steel-reinforced (ACSR) cable market held a dominant position, capturing more than a 38.20% share.

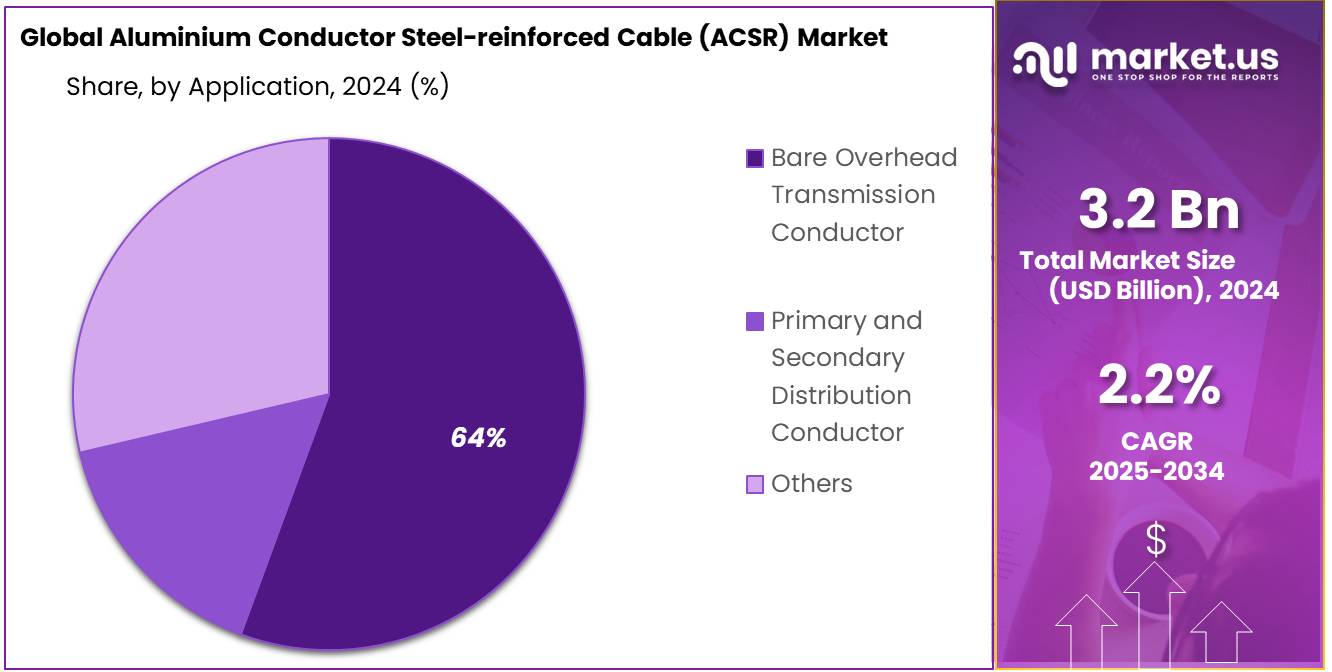

- Bare Overhead Transmission Conductor segment of the Aluminium Conductor Steel-reinforced (ACSR) cable market held a dominant position, capturing more than a 64.30% share.

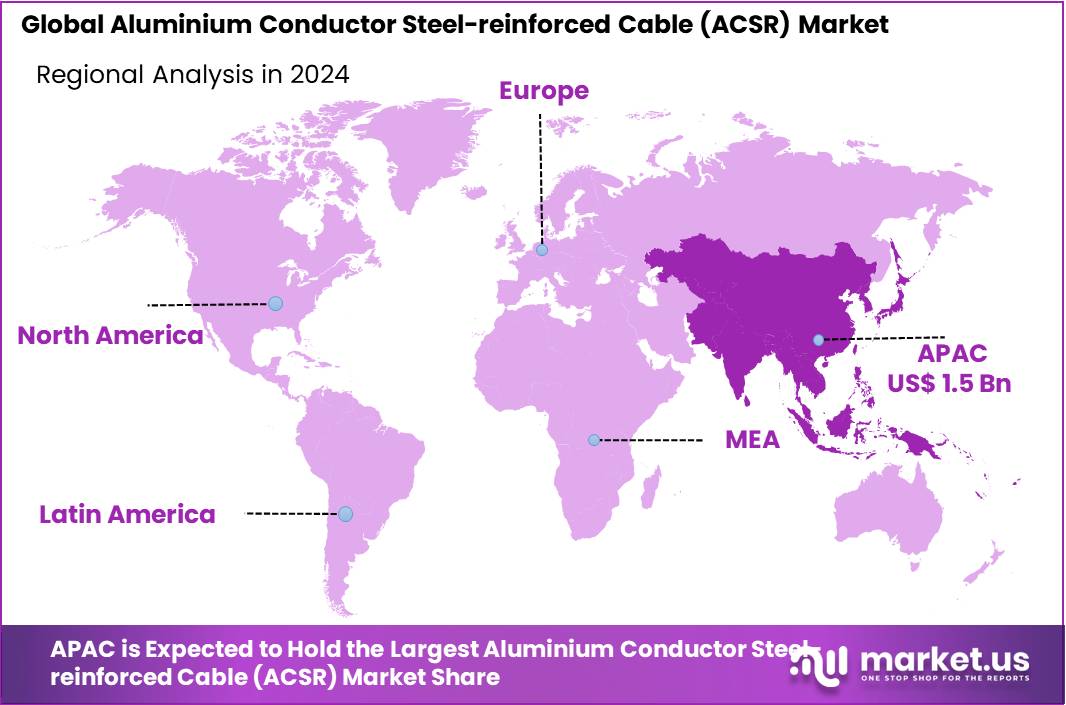

- Asia Pacific region dominated the Aluminium Conductor Steel-reinforced (ACSR) cable market, holding a 46.90% share with a market value of USD 1.5 billion.

By Type

In 2024, Aluminium Conductor Steel Reinforced (ACSR) emerged as the leading type in the Aluminium Conductor Steel-reinforced Cable (ACSR) market, capturing more than a 53.60% share. ACSR cables are widely used in electrical transmission and distribution systems due to their high tensile strength, conductivity, and durability.

The ACSR/AW – Aluminum Conductor Aluminum Clad Steel Reinforced and ACSR/TW – Trapezoidal Aluminum Conductor Steel Reinforced variants also play significant roles in the market. ACSR/AW cables feature an aluminum-clad steel core, offering improved corrosion resistance and conductivity, making them suitable for coastal and corrosive environments.

ACSR/TW cables feature a trapezoidal-shaped aluminum conductor, designed to reduce the wind-induced vibrations and noise levels in overhead transmission lines, particularly in areas prone to high winds and extreme weather conditions. While ACSR remains dominant, the specialized features of ACSR/AW and ACSR/TW variants cater to specific industry requirements and niche applications, contributing to the overall diversity of the market.

By Voltage Rating

In 2024, the high voltage segment of the Aluminium Conductor Steel-reinforced (ACSR) cable market held a dominant position, capturing more than a 48.30% share. This segment primarily caters to long-distance and high-load power transmission needs, making it crucial for the backbone of national grids. Medium voltage ACSR cables, used in regional and urban power distribution networks, also play a significant role in the industry.

While High voltage remains dominant, the Medium and Extra High voltage segments also contribute significantly to the market. Medium voltage-rated ACSR cables are commonly used in local distribution networks, industrial plants, and commercial buildings for distributing power to consumers. These cables typically operate at voltages ranging from 2.4 kV to 69 kV, catering to a wide range of applications in urban and rural areas.

By Current Capacity

In 2024, the 400 – 600 A segment of the Aluminium Conductor Steel-reinforced (ACSR) cable market held a dominant position, capturing more than a 38.20% share. This segment effectively meets the needs of mid to large-scale utility and industrial applications, where higher current capacity is essential for efficient power distribution. Smaller capacity cables, such as those below 200 A and those ranging from 200 – 400 A, serve lower demand environments, whereas cables above 600 A are tailored for heavy-duty applications, including major power transmission lines that require robust, high-capacity conduits.

In 2024, the Aluminium Conductor Steel-reinforced Cable (ACSR) market saw diverse segments based on current capacity, with the 200 – 400 A range holding the dominant position. This segment represents ACSR cables capable of carrying electrical currents ranging from 200 to 400 amperes, making them suitable for a wide range of medium-capacity applications.

While the 200 – 400 A segment leads the market, other segments also play essential roles. The Below 200 A segment caters to low-capacity applications, such as residential buildings, small businesses, and rural electrification projects, where electrical currents typically fall below 200 amperes.

By Application

In 2024, the Bare Overhead Transmission Conductor segment of the Aluminium Conductor Steel-reinforced (ACSR) cable market held a dominant position, capturing more than a 64.30% share. This segment is pivotal for long-distance transmission of electricity, showcasing its critical role in national power grids. Additionally, the Primary and Secondary Distribution Conductor segment caters to the distribution networks, essential for the delivery of electricity to end users. Other applications include niche uses in various industrial and infrastructure projects, emphasizing the versatility of ACSR cables in meeting diverse electrical needs.

The dominance of the Primary and Secondary Distribution Conductor segment reflects the significant demand for ACSR cables in local distribution networks and urban infrastructure projects. These cables are essential for ensuring reliable power distribution to homes, businesses, and industrial facilities, supporting the growth and development of communities and industries.

While the Primary and Secondary Distribution Conductor segment leads the market, other segments also play vital roles. The Bare Overhead Transmission Conductor segment caters to high-voltage transmission lines used for transmitting bulk power over long distances. These cables are critical components of overhead transmission systems, facilitating the efficient and reliable transmission of electricity across regions.

The Others segment encompasses a variety of niche applications for ACSR cables, including railway electrification, rural electrification projects, and specialized industrial applications. These applications require custom-designed ACSR cables to meet specific requirements such as increased durability, resistance to environmental factors, and compatibility with unique installation conditions.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Aluminium Conductor Steel Reinforced (ACSR)

- ACSR/AW – Aluminum Conductor Aluminum Clad Steel Reinforced

- ACSR/TW – Trapezoidal Aluminum Conductor Steel Reinforced

By Voltage Rating

- Medium

- High

- Extra High

By Current Capacity

- Below 200 A

- 200 – 400 A

- 400 – 600 A

- Above 600 A

By Application

- Bare Overhead Transmission Conductor

- Primary and Secondary Distribution Conductor

- Others

Drivers

Rising Demand for Renewable Energy and Infrastructure Expansion

One major driving factor for the Aluminium Conductor Steel-reinforced Cable (ACSR) market is the global shift towards renewable energy and the corresponding need for expanded power infrastructure. Governments worldwide, particularly in rapidly developing regions such as Asia Pacific, are investing heavily in renewable energy projects like wind and solar farms. These projects require extensive power transmission networks to connect remote renewable energy sources with national grids. For example, initiatives like China’s commitment to increasing its renewable energy capacity significantly by 2030 necessitate the expansion of its transmission infrastructure to handle higher capacities and longer distances typical of renewable setups.

Additionally, the ongoing urbanization in emerging economies leads to increased demand for reliable and efficient power distribution systems. ACSR cables are critical in these scenarios due to their durability and efficiency in power transmission over long distances. The push for infrastructure modernization in developed countries, aimed at making energy systems more sustainable and less carbon-intensive, further propels the ACSR market. This includes replacing older power lines with ACSR cables to handle increased loads and prevent energy loss.

Moreover, policy initiatives such as incentives for clean energy and penalties for carbon emissions encourage utilities to upgrade their old systems to more efficient solutions like ACSR cables. This regulatory environment, combined with the physical demands of new energy generation and distribution technologies, creates a robust market for ACSR cables, positioning them as essential components in the global transition to a more sustainable and energy-efficient future.

Restraints

High Costs and Availability of Alternatives as Restraints

A significant restraining factor in the Aluminium Conductor Steel-reinforced Cable (ACSR) market is the high cost associated with the manufacturing and installation of these cables. The production of ACSR cables requires substantial quantities of aluminum and steel, materials whose prices can fluctuate widely due to market demand and geopolitical factors. This variability can lead to unpredictable costs for manufacturers and ultimately for power companies and other end-users.

Moreover, the emergence of alternative technologies that offer similar or better performance characteristics with potentially lower environmental impacts or installation costs also poses a challenge. For instance, newer composite materials and technologies like High-Temperature Low-Sag (HTLS) conductors are gaining traction. These alternatives not only promise greater efficiency and reduced line losses but also come with potentially lower lifecycle costs due to better durability and less maintenance requirement.

Government regulations and industry standards that push for more environmentally sustainable and energy-efficient solutions can further complicate the market dynamics for ACSR cables. As countries tighten regulations on energy efficiency and carbon emissions, the industry may see a shift towards these newer, ‘greener’ technologies, which could restrain the growth of the traditional ACSR market.

Opportunities

Expanding Grid Infrastructures in Emerging Markets

A significant growth opportunity for the Aluminium Conductor Steel-reinforced Cable (ACSR) market lies in the expansion of electrical grid infrastructures in emerging markets. Countries across Africa, Asia, and Latin America are rapidly developing their electrical grids to support growing urban populations and industrial activities. These expansions often require robust, high-capacity transmission lines, where ACSR cables are ideally suited due to their durability and efficiency in power transmission over long distances.

Government initiatives and international funding are increasingly directed towards infrastructure projects in these regions, aiming to improve access to electricity and support economic development. For example, the World Bank and various regional development banks offer financial support for power infrastructure projects, which often include substantial investments in transmission and distribution networks. This presents a lucrative opportunity for manufacturers and distributors of ACSR cables to participate in large-scale projects that demand high-quality, reliable transmission solutions.

Additionally, the push for renewable energy integration into the grid further drives the need for ACSR cables. Renewable projects, such as wind and solar farms, are often located in remote areas and require efficient connection to national power systems. ACSR cables’ capacity to handle high voltages and currents make them suitable for these applications, ensuring minimal energy loss over extensive transmission distances.

Challenges

The Aluminium Conductor Steel-reinforced Cable (ACSR) market faces several challenges that could impact its growth trajectory and market dynamics. One significant challenge is the increasing competition from alternative technologies and materials. With advancements in cable technology and the emergence of alternative materials such as aluminum alloys, optical fibers, and composite materials, traditional ACSR cables face competition from solutions offering advantages such as reduced weight, improved conductivity, and greater flexibility.

This presents a challenge for ACSR manufacturers to differentiate their products and maintain market share in the face of increasing competition. The volatility in raw material prices poses a significant challenge for manufacturers in the ACSR market. ACSR cables are primarily made of aluminum, steel, and other metals whose prices are subject to fluctuations due to factors such as supply-demand dynamics, geopolitical tensions, and currency fluctuations.

Fluctuations in raw material prices can impact manufacturing costs, profit margins, and pricing strategies, creating challenges for manufacturers to manage their production costs and remain competitive in the market.

Another challenge is the regulatory and environmental compliance requirements governing the use of ACSR cables. Regulatory authorities impose stringent standards and regulations related to safety, environmental impact, and quality assurance for ACSR cables used in electrical transmission and distribution systems.

Compliance with these regulations requires significant investments in testing, certification, and documentation, adding to the overall production costs and operational complexity for manufacturers. The shift towards underground transmission and distribution systems poses a challenge for the ACSR market.

Regional Analysis

In 2024, the Asia Pacific region dominated the Aluminium Conductor Steel-reinforced (ACSR) cable market, holding a 46.90% share with a market value of USD 1.5 billion. This region’s significant market share is driven by extensive infrastructure development and rapid industrialization, particularly in countries like China and India. North America and Europe also hold substantial shares, reflecting steady demand linked to the renovation of aging power grids and increased renewable energy integration.

Meanwhile, the Middle East & Africa and Latin America are experiencing growth due to rising energy demands and governmental initiatives to expand electricity access, though they start from a smaller base compared to more developed regions. The robust performance of the Asia Pacific underscores its critical role in the global ACSR market, driven by both volume and strategic advancements in power transmission.

Organizations can leverage the imaging capabilities of drones to enhance crop production yield and profitability in the ACSR market. Farm mechanization, driven by technology infusion, has substantially improved the profitability of the agricultural sector in developed countries.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Aluminium Conductor Steel-Reinforced Cable (ACSR) market is highly competitive and features a mix of established global players and regional manufacturers. Leading companies such as Nexans S.A., Prysmian Group, Southwire Company LLC, and Midal Cables Ltd. hold significant market shares due to their strong global presence and advanced manufacturing capabilities. These companies focus on innovation and sustainable solutions to meet the growing demand for efficient power transmission infrastructure.

Apar Industries Limited, Dynamic Cables Limited, and Sterlite Power, which have a strong presence in Asia-Pacific, a region that accounts for a substantial portion of ACSR demand due to rapid urbanization and electrification projects. Companies like Tongda Cable Co., Ltd., Taihan Cable & Solution Co., Ltd., and Qingdao Hanhe Cable Company Limited cater to both domestic and international markets with cost-effective and durable cable solutions.

LS VINA Cable & System, POSCO, and Yifang Electric Group Inc. contribute to the market’s growth by leveraging advanced manufacturing techniques and competitive pricing strategies. Emerging players and regional manufacturers, such as CMI Limited, Caledonian Cables Ltd., and others, continue to enhance the market dynamics by addressing localized needs and expanding their export portfolios.

Маrkеt Кеу Рlауеrѕ

- Nexans S.A.

- Prysmian

- Midal Cables Ltd.

- Southwire Company LLC

- Apar Industries Limited

- Qingdao Hanhe Cable Company Limited

- AFL Global

- Tongda Cable Co., Ltd.

- Taihan Cable & Solution Co., Ltd.

- CMI Limited

- Dynamic Cables Limited

- Yifang Electric Group Inc.

- Caledonian Cables Ltd.

- Sterlite Power

- LS VINA Cable & System

- POSCO

- Other Key Players

Recent Developments

2023 Nexans S.A: Launched a new low-carbon footprint ACSR cable with reduced environmental impact.

2023 Prysmian: Announced investment in a new ACSR manufacturing facility in China, expanding production capacity.

Report Scope

Report Features Description Market Value (2024) US$ 3.2 Bn Forecast Revenue (2034) US$ 4.0 Bn CAGR (2025-2034) 2.2% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Aluminium Conductor Steel Reinforced (ACSR), ACSR/AW – Aluminum Conductor Aluminum Clad Steel Reinforced, ACSR/TW – Trapezoidal Aluminum Conductor Steel Reinforced), By Voltage Rating(Medium, High, Extra High), By Current Capacity(Below 200 A, 200 – 400 A, 400 – 600 A, Above 600 A), By Application, Bare Overhead Transmission Conductor, Primary and Secondary Distribution Conductor, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nexans S.A., Prysmian, Midal Cables Ltd., Southwire Company LLC, Apar Industries Limited, Qingdao Hanhe Cable Company Limited, AFL Global, Tongda Cable Co., Ltd., Taihan Cable & Solution Co., Ltd., CMI Limited, Dynamic Cables Limited, Yifang Electric Group Inc., Caledonian Cables Ltd. , Sterlite Power, LS VINA Cable & System, POSCO, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aluminium Conductor Steel-reinforced Cable (ACSR) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Aluminium Conductor Steel-reinforced Cable (ACSR) MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nexans S.A.

- Prysmian

- Midal Cables Ltd.

- Southwire Company LLC

- Apar Industries Limited

- Qingdao Hanhe Cable Company Limited

- AFL Global

- Tongda Cable Co., Ltd.

- Taihan Cable & Solution Co., Ltd.

- CMI Limited

- Dynamic Cables Limited

- Yifang Electric Group Inc.

- Caledonian Cables Ltd.

- Sterlite Power

- LS VINA Cable & System

- POSCO

- Other Key Players