Global Air Taxi Market Size, Share, Growth Analysis By Propulsion Type (Electric, Parallel Hybrid, Turboshaft, Turboelectric), By Aircraft Type (Multicopter, Quadcopter, Others), By Passenger Capacity (One, Two, Four, More than six), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169623

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

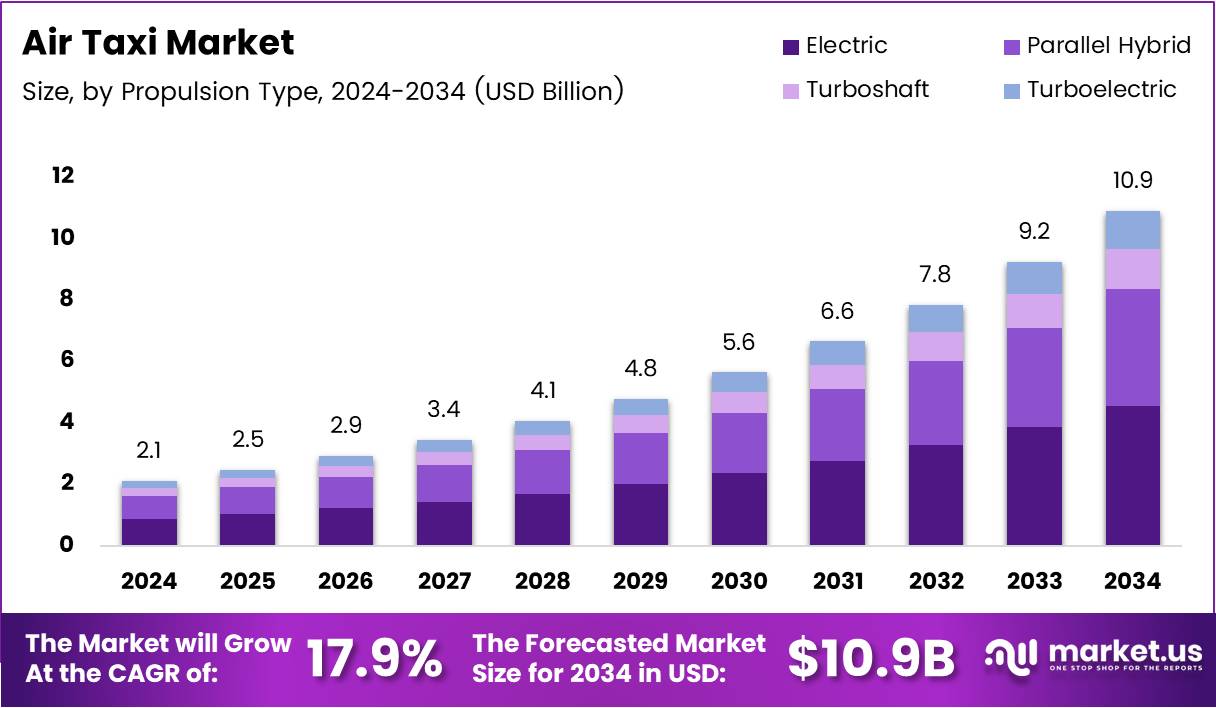

The global Air Taxi Market is projected to reach nearly USD 10.9 Billion by 2034, rising from around USD 2.1 Billion in 2024, driven by a strong CAGR of 17.9%. Growing congestion challenges encourage authorities and developers to adopt air taxi solutions that increase transportation efficiency and reduce travel times across urban environments. These advancements support smarter city designs and foster long-term mobility transformation.

The Air Taxi Market describes a developing aviation segment that provides rapid, on-demand aerial transport using electric or hybrid aircraft. These services streamline urban movement, reduce pressure on overcrowded road networks, and contribute to environmental goals through reduced emissions. As technology advances, air taxis increasingly demonstrate strong feasibility for short distances, reinforcing demand across passenger travel and specialized mobility services.

Analyst viewpoints highlight strong momentum as technological innovation accelerates. Developers continue optimizing battery density, autonomous guidance, and lightweight structural components to improve safety and efficiency. These transitions reshape commercial viability, allowing operators to explore appealing service offerings. Evolving design strategies enable flexible application across varied environments, ensuring adoption remains sustainable and strategically aligned.

Regulatory structures further influence market progress by ensuring operational safety and structured airspace integration. Although certification processes remain lengthy, global aviation agencies emphasize clearer pathways for emerging mobility platforms. Enhanced guidance frameworks motivate increased investment from developers seeking commercial readiness. These coordinated policies build predictable environments supporting both innovation and responsible deployment.

Manufacturers also expand research in electric propulsion, improving efficiency while reducing noise and operational costs. These enhancements allow developers to meet sustainability targets while ensuring compatibility with urban environments. As air mobility solutions continue evolving, stakeholders observe stronger interest in scalable systems capable of handling diverse transport needs across highly populated areas.

Market opportunities grow as infrastructure initiatives accelerate. Planned vertiports, advanced landing zones, and intelligent traffic management frameworks support large-scale deployment prospects. Improved connectivity encourages operational expansion into airport shuttles, tourism, and emergency logistics. These applications strengthen the economic value of air taxis, creating resilient growth avenues for businesses and city planners.

Statistical evidence reinforces positive sentiment toward urban air mobility. A South Korean survey of 1,613 respondents in 2025 revealed nearly 60% preferring human-piloted UAM airport shuttles, while autonomous options attracted close to 30%. This indicates early comfort with pilot-assisted systems and highlights areas where public communication can enhance future acceptance and readiness.

An Airbus perception study across 1,540 participants reported 44.5% initial support for UAM and 41.4% noting it safe or very safe. These findings confirm gradually increasing awareness of air taxi technology, supporting developers as they refine system reliability, battery performance, and noise optimization to improve broader market adoption.

Key Takeaways

- Air Taxi Market projected to reach USD 10.9 Billion by 2034 from USD 2.1 Billion in 2024.

- Expected CAGR across forecast period remains strong at 17.9%.

- Electric propulsion leads market share with 47.9%.

- Multicopter aircraft type dominates with 44.1%.

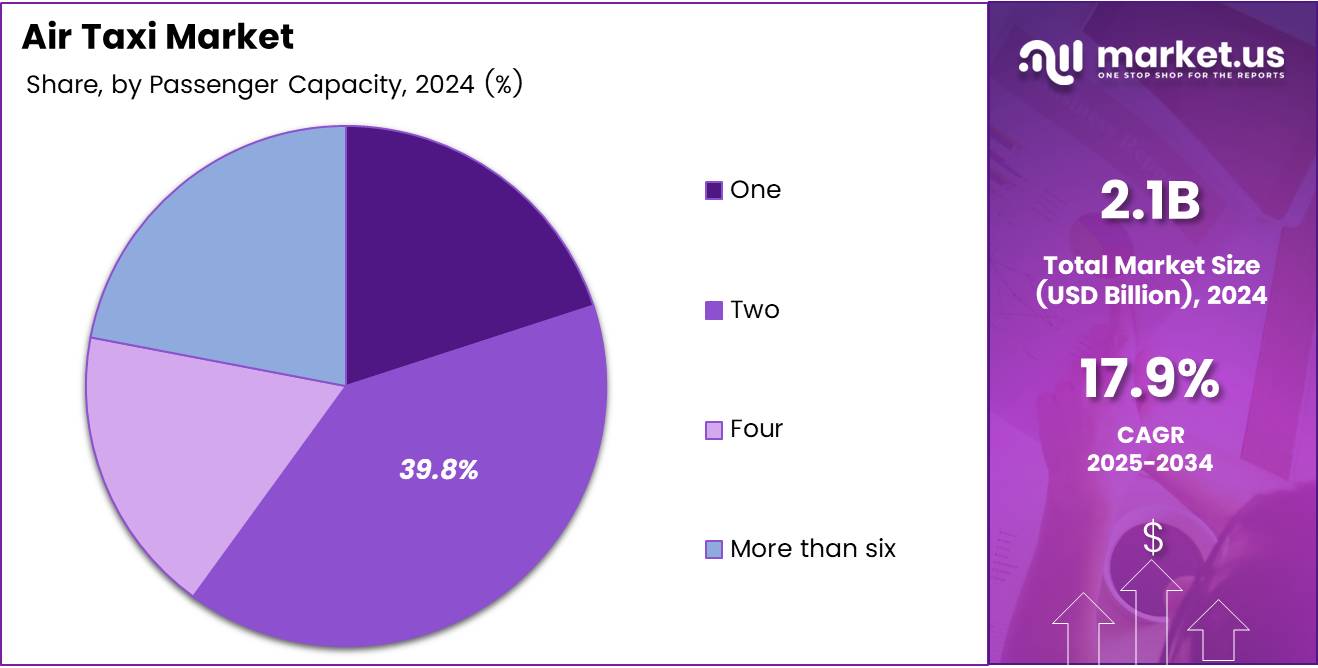

- Two-passenger capacity segment holds a leading 39.8%.

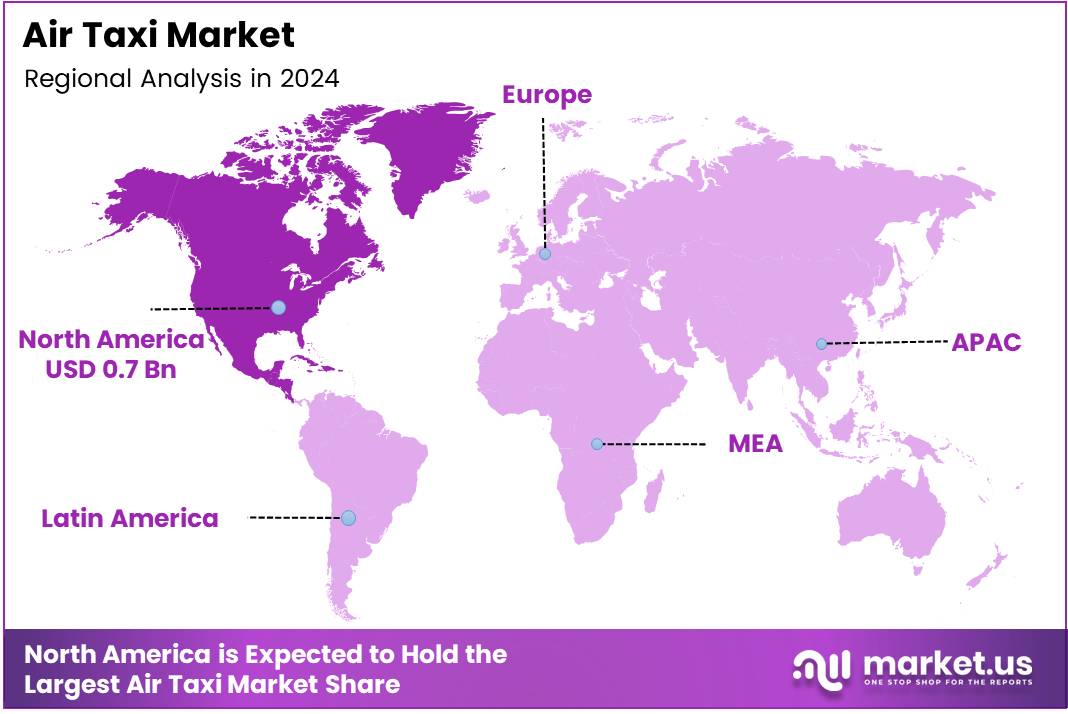

- North America leads with 37.8% share valued at USD 0.7 Billion.

By Propulsion Type Analysis

Electric dominates with 47.9% due to its efficiency and environmental compatibility.

In 2024, Electric held a dominant market position in the By Propulsion Type Analysis segment of the market, with a 47.9% share. Electric propulsion systems support reduced noise levels, lower emissions, and efficient operating structures well suited for urban deployments. Their performance advantages encourage broader adoption, reflecting emerging expectations for reliable and sustainable mobility within high-density metropolitan regions adapting to modern transportation demands.

Parallel Hybrid held a significant position in the By Propulsion Type Analysis segment of the market. These configurations provide extended travel ranges while reducing operational interruptions, making them suitable for early-stage networks that lack comprehensive charging availability. Their hybrid capabilities ensure dependable performance, allowing providers to implement suitably flexible service models across varying geographic and infrastructural environments supporting transitional urban air transportation development.

Turboshaft held an important role in the By Propulsion Type Analysis segment of the market. Turboshaft systems contribute improved reliability and stronger endurance, supporting routes needing consistent stability. Their enhanced output enables adaptable utilization across different operational scenarios, assisting various stakeholders seeking performance consistency while bridging gaps between conventional aviation engineering and evolving urban air mobility expectations shaping future transport networks.

Turboelectric retained a meaningful presence within the By Propulsion Type Analysis segment of the market. Turboelectric platforms combine conventional turbine mechanisms with electric power distribution to provide hybrid efficiency improvements. These systems enable increased operational range, better energy management, and support for pilots transitioning to partially electrified aircraft models, strengthening their value across urban mobility frameworks implementing scalable transportation solutions.

By Aircraft Type Analysis

Multicopter dominates with 44.1% due to design simplicity and stability.

In 2024, Multicopter held a dominant market position in the By Aircraft Type Analysis segment of the market, with a 44.1% share. Multicopter configurations offer exceptional maneuverability, vertical lift efficiency, and reduced mechanical complexity. These advantages align closely with urban mobility requirements, supporting dependable short-range flight operations and reinforcing strategic opportunities for commercial deployment across airport transfers, intra-city connections, and early-stage public demonstration programs.

Quadcopter held a considerable position within the By Aircraft Type Analysis segment of the market. Quadcopters deliver stable navigation, ease of control, and compatibility with emerging automation technologies, making them suitable for controlled testing environments and short-distance urban routes. Their lightweight design and adaptability promote progressive commercial adoption while encouraging ongoing innovation to strengthen air taxi reliability and operational performance under evolving mobility standards.

The Others represented a growing category within the By Aircraft Type Analysis segment of the market. This includes tiltrotor aircraft, ducted fan systems, and lifting-body models that emphasize expanded range, higher cruising speeds, and multi-mission capabilities. These innovative concepts broaden urban air mobilitys operational scope, supporting specialized missions and promoting advanced platform development for future air taxi ecosystems.

By Passenger Capacity Analysis

Two-passenger capacity dominates with 39.8% due to optimized economic viability.

In 2024, Two held a dominant market position in the By Passenger Capacity Analysis segment of the market, with a 39.8% share. Two-seat configurations provide ideal balance between cost efficiency, operational reliability, and route suitability. They closely align with urban commuting patterns by enabling compact designs, reduced energy consumption, and profitable service models that help providers implement seamless early operations across targeted districts and airport corridors.

One held a significant position in the By Passenger Capacity Analysis segment of the market. Single-passenger aircraft deliver highly personalized mobility, allowing rapid deployment within emergency, executive, and private transport applications. These aircraft optimize efficiency through streamlined weight distribution and simpler control systems, making them well suited for markets experimenting with individual mobility solutions before adopting larger-scale shared transportation options.

Four demonstrated a growing presence within the By Passenger Capacity Analysis segment of the market. These aircraft address demand for shared travel across families, business groups, and premium tourist routes. With increased seat availability, operators benefit from enhanced earnings potential and improved fleet utilization, enabling broader commercial opportunities as infrastructure expands across major metropolitan networks seeking efficient group transport solutions.

More than six represented an emerging category in the By Passenger Capacity Analysis segment of the market. Larger-capacity air taxis support shuttle services, airport transfers, and extended-distance routes. They enable higher passenger throughput, improving operational economics across well-established travel corridors. Their deployment encourages infrastructure scalability and fosters long-term transition toward more complex and integrated urban air mobility frameworks.

Key Market Segments

By Propulsion Type

- Electric

- Parallel Hybrid

- Turboshaft

- Turboelectric

By Aircraft Type

- Multicopter

- Quadcopter

- Others

By Passenger Capacity

- One

- Two

- Four

- More than six

Drivers

Rapid Urbanization Intensifying Demand for High-Efficiency On-Demand Mobility

Rapid urbanization increases traffic complexity, prompting the need for faster and more flexible transportation. Air taxis shorten travel time and reduce congestion through efficient vertical mobility pathways. These capabilities support economic productivity and encourage broader development of integrated transport ecosystems, helping metropolitan regions manage rising populations and shifting mobility expectations across expanding urban landscapes.

Advancements in electric propulsion and lightweight airframes continue improving aircraft performance. These enhancements reduce overall fuel consumption, boost battery endurance, and strengthen environmental compatibility. As stakeholders invest in sustainable designs, air taxis emerge as reliable alternatives to ground-based transport, fostering long-term technological maturity and encouraging early adoption across global mobility corridors undergoing modernization.

Growing venture capital and supportive government funding accelerate commercialization efforts. Authorities prioritize innovation through strategic incentive programs, cooperative test environments, and targeted research assistance. These elements help reduce development risks, speed prototype certification, and motivate stakeholders to scale production capacity for broader market deployment across international air mobility frameworks.

AI-enabled air traffic management solutions enhance safety and operational feasibility by improving route planning, collision avoidance, and predictive monitoring. These intelligent systems support controlled airspace integration, enabling coordinated fleet movements across densely populated regions. Their adoption strengthens operational trust and encourages regulators to define wider-scale commercial approval frameworks.

Restraints

Complex Regulatory Certification Frameworks Delaying Large-Scale Deployment

Certification processes remain complex due to stringent aviation regulations designed to ensure long-term public safety. Air taxi manufacturers undergo extensive testing and documentation, extending timelines and increasing cost structures. Regulatory bodies collaborate with developers to establish standard practices, improve clarity, and create smoother pathways toward commercial readiness while maintaining safety and environmental compliance.

Battery limitations continue restricting operational ranges and payload options. Current battery density technologies struggle to meet extended-distance flight needs, requiring ongoing research and development. Improvements in battery chemistry and thermal management remain essential for ensuring viable commercial scalability. Manufacturers invest aggressively to resolve these challenges, recognizing strong long-term benefits across the industry.

Growth Factors

Development of Vertiport Infrastructure Networks Across Smart Cities

Smart city initiatives encourage development of vertiports and integrated landing networks supporting air taxi movement. These modern facilities provide structured platforms for seamless takeoff, landing, and passenger handling, strengthening operational stability. Infrastructure planning aligns with emerging regulations, enabling coordinated implementation of air mobility systems across major urban centers adapting to next-generation transport requirements.

Expanding applications across tourism, emergency logistics, and medical transport broaden revenue potential. Specialized operations demonstrate strong feasibility, helping cities adopt air taxis for niche services. These additional use cases increase commercial attractiveness and improve value-chain diversification, strengthening investor confidence and enabling operators to refine service design based on real-world operational feedback.

Partnerships between automotive and aerospace manufacturers enhance production scalability. These collaborations combine expertise in mobility engineering, safety systems, and mass manufacturing. As integrated development models expand, production efficiency improves, reducing overall system costs and accelerating the readiness of air taxi fleets intended for large-scale deployment.

The emergence of hybrid-electric and hydrogen-powered eVTOL solutions introduces significant long-term potential. These technologies extend range capabilities, reduce emissions, and support a broader spectrum of operational environments. Their development aligns with global sustainability objectives, offering promising pathways for enhanced performance and wider market adoption over future decades.

Emerging Trends

Increasing Adoption of Autonomous Flight Control Systems in Prototype Air Taxis

Autonomous flight control integration improves navigation accuracy and reduces pilot workload. Advanced sensors, automated decision frameworks, and safety mechanisms enhance operational predictability and reliability. These capabilities support commercial scalability and enable flexible fleet management models that align with evolving mobility needs across densely populated metropolitan corridors transitioning toward modernized air transportation systems.

Subscription-based air mobility models gain traction as users seek cost-efficient solutions. These models provide predictable pricing, improved accessibility, and flexible scheduling for daily or frequent travelers. They support stable revenue cycles and encourage operators to expand service coverage across urban centers adopting streamlined transportation plans.

Noise-reduction aerodynamic designs strengthen community support by minimizing perceived sound levels during takeoff and landing. Reduced noise enhances acceptance across residential areas and aligns with regulatory expectations for environmental sustainability. Manufacturers prioritize optimizations that contribute to quieter operations, ensuring long-term integration into urban air corridors.

Digital twin technologies allow real-time monitoring of aircraft performance, predictive maintenance, and lifecycle management. These capabilities reduce downtime, enhance safety, and support sustainable fleet expansion. Digital simulations also help operators refine operational strategies, improving efficiency across emerging air mobility supply chains.

Regional Analysis

North America Dominates the Air Taxi Market with a Market Share of 37.8%, Valued at USD 0.7 Billion

North America holds the leading market position with a 37.8% share valued at nearly USD 0.7 Billion. Strong regulatory support, established aerospace capabilities, and extensive research programs drive early adoption. Pilot projects across major cities strengthen commercial readiness, while public-private partnerships accelerate development of air traffic systems and vertiport infrastructure guiding long-term urban air mobility expansion.

Europe Air Taxi Market Trends

Europe demonstrates strong market growth due to its sustainability-driven transportation goals. Countries across the region invest in electric mobility solutions, focusing on low-emission aircraft and noise reduction technologies. Pilot corridors and test routes expand as EU frameworks advance standardized guidelines. These strategic developments strengthen development momentum and encourage coordinated cross-border adoption.

Asia Pacific Air Taxi Market Trends

Asia Pacific shows rising investment as megacities confront traffic congestion and demand for faster travel. Regional governments support prototype testing, infrastructure planning, and development incentives. Growing population density and rapid technological adoption increase interest in air taxis, enabling long-term commercialization opportunities across both mature and emerging urban centers.

Middle East & Africa Air Taxi Market Trends

The region focuses on premium transport solutions integrated within smart city projects. Air taxi services attract strong interest due to their ability to provide rapid point-to-point travel. Government-backed innovation programs accelerate development, while expanding tourism and business activity create favorable conditions for early operational deployment.

Latin America Air Taxi Market Trends

Latin America gradually adopts air mobility solutions through tourism routes, remote access missions, and early-stage testing programs. Regulatory agencies modernize frameworks to support safe adoption. Although still emerging, interest continues rising as cities seek efficient alternatives to road congestion and explore partnerships for infrastructure development.

Key Air Taxi Company Insights

- Ab Corporate Aviation

- Airbus SE

- Fly Aeolus

- Honeywell International Inc.

- Hyundai Motor Company

- Joby Aviation

- Kitty Hawk Corporation

- Neva Aerospace Ltd.

- Nurol Holding

- Skyway Air Taxi

- Talkeetna Air Taxi Inc.

- Volocopter GmbH

Ab Corporate Aviation contributes to the air taxi landscape by focusing on specialized aviation services aligned with evolving mobility expectations. Its experience in operational management and customer-centric mobility solutions helps strengthen readiness for integrating advanced platforms into real-world applications, allowing it to transition smoothly as technologies mature.

Airbus SE invests in next-generation propulsion systems, automation technologies, and mobility ecosystems supporting long-term air taxi expansion. Its initiatives drive research collaboration, regulatory engagement, and development of scalable platforms aligned with safety and sustainability goals. These advancements reinforce its strategic presence across global air mobility markets.

Fly Aeolus enhances accessibility to regional air travel by delivering personalized mobility services aligned with urban air taxi goals. Its operational approach strengthens market readiness for distributed mobility networks. The companies service adaptability supports wider adoption as modern air transport models evolve and expand toward broader passenger engagement.

Honeywell International Inc. accelerates air taxi advancement through its high-performance avionics, navigation systems, and integrated safety technologies. Its expertise provides critical support for automation, flight stability, and real-time monitoring, enabling safer operations and enhancing the reliability of aircraft platforms intended for commercial-scale mobility programs.

Recent Developments

- In October 2025, Archer Aviation acquired approximately 300 advanced-air-mobility patent assets from Lilium for €18 million, strengthening its intellectual property base and accelerating development of next-generation electric vertical lift platforms to support global commercial expansion.

- In August 2025, Joby Aviation confirmed a USD 125 million acquisition of Blade Air Mobilitys passenger operations, expanding its service portfolio and aligning with long-term strategies to enhance route accessibility and integrate advanced air mobility services across major transit markets.

- In May 2025, Joby Aviation secured a strategic USD 250 million equity investment from Toyota, enabling scaled production and deeper supply-chain collaboration. The investment reinforces rapid commercialization and accelerates efforts to mass-produce eVTOL aircraft.

- In December 2025, GACA signed an MoU with Archer to advance air taxi deployment across Saudi Arabia, supporting infrastructure development and regulatory enablement to prepare for early operational rollout across key metropolitan regions.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 10.9 Billion CAGR (2025-2034) 17.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (Electric, Parallel Hybrid, Turboshaft, Turboelectric), By Aircraft Type (Multicopter, Quadcopter, Others), By Passenger Capacity (One, Two, Four, More than six) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ab Corporate Aviation, Airbus SE, Fly Aeolus, Honeywell International Inc., Hyundai Motor Company, Joby Aviation, Kitty Hawk Corporation, Neva Aerospace Ltd., Nurol Holding, Skyway Air Taxi, Talkeetna Air Taxi Inc., Volocopter GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ab Corporate Aviation

- Airbus SE

- Fly Aeolus

- Honeywell International Inc.

- Hyundai Motor Company

- Joby Aviation

- Kitty Hawk Corporation

- Neva Aerospace Ltd.

- Nurol Holding

- Skyway Air Taxi

- Talkeetna Air Taxi Inc.

- Volocopter GmbH