Global AI Smartphone Market Size, Share, Industry Analysis Report By Price Range (Premium, Mid-Range, Budget / Low), By Distribution Channel (Offline, Online), By Application (Healthcare, Education, Entertainment, Mobility, Others), By User (Personal, Commercial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161819

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Global Shipments

- AI Feature Adoption Rates

- Sales

- Dominant Segments

- Analysts’ Viewpoint

- Investment and Business Benefits

- US Market Size

- By Price Range

- By Distribution Channel

- By Application

- By User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

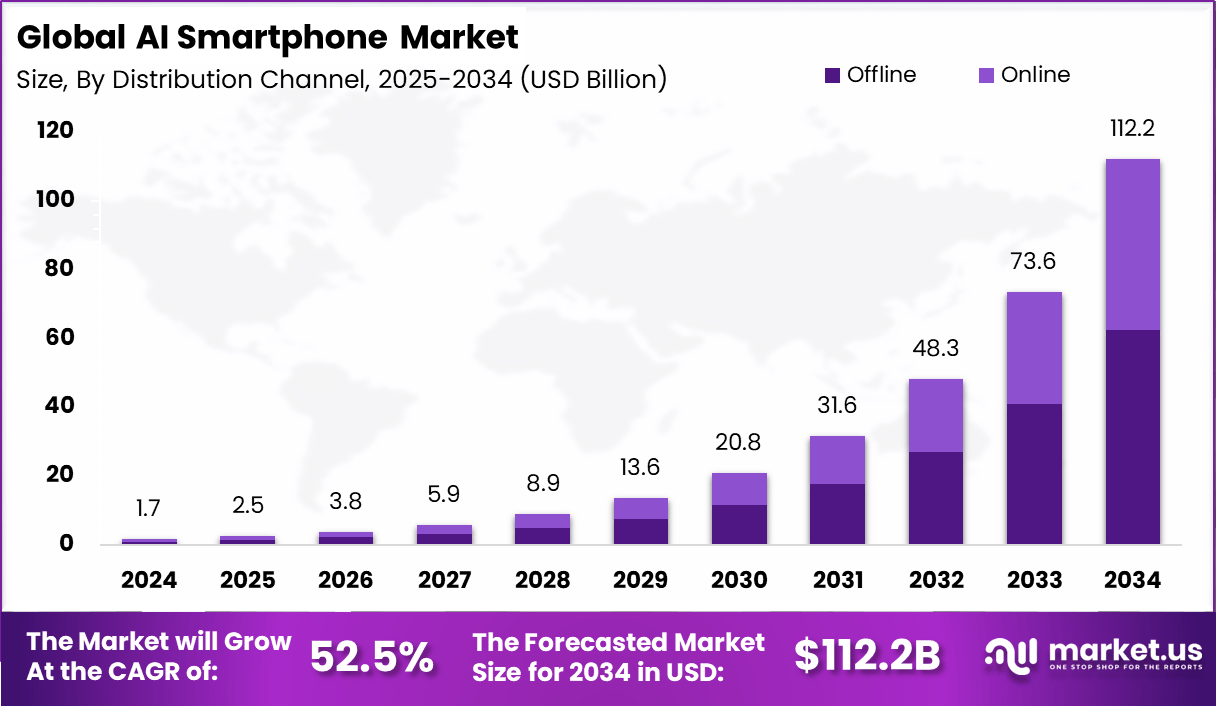

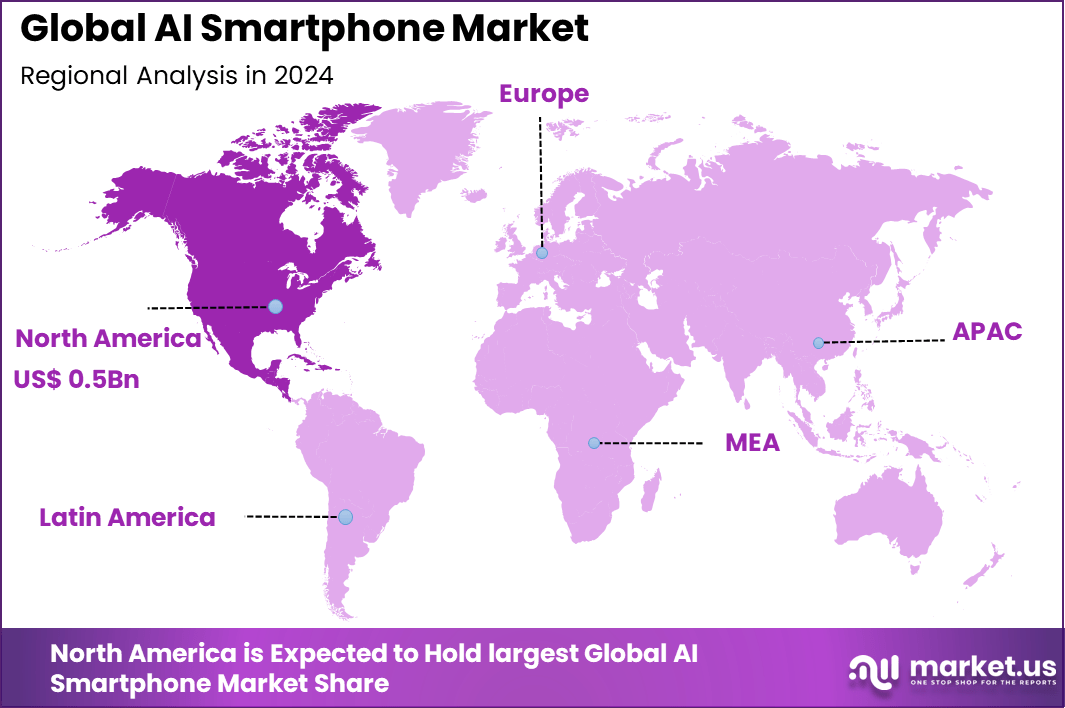

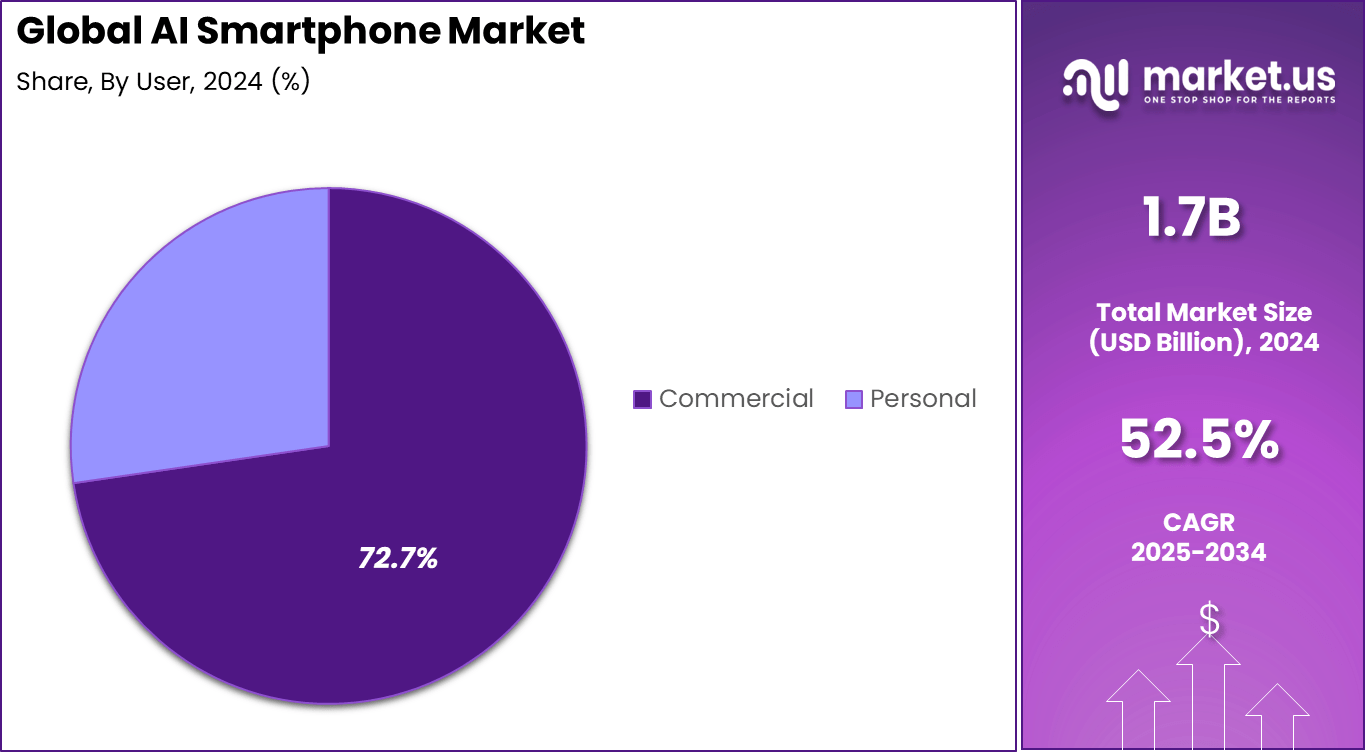

The Global AI Smartphone Market generated USD 1.7 billion in 2024 and is predicted to register growth from USD 2.5 billion in 2025 to about USD 112.2 billion by 2034, recording a CAGR of 52.5% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 34.6% share, holding USD 0.5 Billion revenue.

The AI smartphone market includes mobile devices equipped with hardware and software that run artificial intelligence functions directly on the device or through integrated platforms. These smartphones use AI for photography enhancement, voice interaction, predictive text, device optimization, security features, personalization, and real-time translation. Chipsets with neural processing capabilities and optimized operating systems support these functions.

Top driving factors fueling this market’s growth include advances in machine learning algorithms, expanding 5G networks, and consumer appetite for smarter, more adaptive devices. AI enables enhanced image processing, voice assistants, predictive text, and personalized content, which all contribute to a richer mobile experience. Furthermore, technological improvements are reducing costs of AI-capable chipsets, making these features more accessible to a broad range of users.

Top Market Takeaways

- Mid-range devices hold about 45.8%, showing that most buyers prefer AI smartphones with balanced pricing and advanced features.

- Offline channels account for nearly 55.7%, reflecting strong retail influence and in-person purchasing habits, especially for device demonstrations and financing options.

- Healthcare applications make up around 45.7%, driven by interest in diagnostics, wellness tracking, and AI-enabled monitoring.

- Commercial users represent about 72.7%, indicating heavy adoption by enterprises for workforce productivity and secure communication.

- North America captures close to 34.6%, supported by strong device penetration and AI integration in everyday services.

- The U.S. leads within the region with rising interest in AI-enabled functions across sectors.

- A 45.3% national share signals rapid adoption as AI features become standard across commercial and health-focused smartphones.

Global Shipments

Based on data from Smart AI Daily News, Global smartphone shipments are expected to reach 1.26 billion units in 2025, marking a 2.3% year-over-year increase. This follows a 6.1% rise in 2024, signaling a continued recovery. From 2024 to 2029, the market is projected to grow at a 1.6% CAGR, indicating stable, low single-digit expansion over the forecast period.

Year Global Shipments (Billion Units) YoY Growth (%) Android Share (%) iOS Share (%) Others (%) 2025 1.26 2.3 76 19 5 2026 1.28 1.6 77 18 5 2027 1.30 1.6 78 17 5 2028 1.32 1.5 79 16 5 2029 1.34 1.5 80 15 5 2030 1.36 1.5 81 14 5 AI Feature Adoption Rates

AI Feature Category 2025 Adoption (%) 2027 Adoption (%) 2030 Adoption (%) AI Photography 65 85 95 Voice Assistants 80 90 95 Predictive Features 40 70 90 Real-time Translation 30 60 85 On-device AI Processing 45 75 90 AI Security Features 50 80 95 Sales

- Number of devices shipped: Around 370 million GenAI-capable smartphones are expected to ship globally in 2025, with volumes forecasted to surge by 290% to reach 912 million units by 2028.

- Fast adoption vs. other tech: AI adoption is advancing at a pace far quicker than past technologies such as smartphones or e-commerce. The industry is projected to achieve a 10% adoption rate by late 2025.

- Premium and Gen Z driven: Adoption is led by high-end flagship models and younger consumers. A 2024 survey revealed that 59% of Gen Z and 52% of millennials are more likely to purchase a new smartphone specifically for AI features.

Dominant Segments

- Price tier: Premium smartphones priced above $600 dominate, accounting for 70.4% of the market.

- AI capability: On-device AI – powered by neural processing units (NPUs) – is expected to capture 65.7% of market share in 2025, compared with cloud-based AI that depends on remote servers.

- Application: Personal use cases such as photography, content personalization, and voice commands are projected to hold 47.1% of the market share in 2025.

- Distribution channel: Offline retail remains dominant with 77.3% share, as consumers continue to prefer hands-on, in-person experiences when purchasing premium smartphones.

Analysts’ Viewpoint

Increasing adoption technologies powering AI smartphones include on-device AI processing, which enhances privacy and responsiveness by handling data locally rather than relying on cloud computing. AI processors are becoming more energy-efficient, supporting longer battery life and sustained device performance.

The integration of AI with emerging 5G connectivity enables faster data handling and smarter app functionality. The key reasons driving adoption of AI smartphones are improved user experience, better security, and the value proposition of intelligent features that simplify everyday tasks.

Consumers appreciate AI’s help with managing schedules, automating communication, and providing navigation assistance. Security is enhanced through AI-powered biometric systems like facial recognition, which are seen as safer than traditional passwords.

Investment and Business Benefits

Investment opportunities in the AI smartphone sector are expanding as companies innovate in AI chipsets, software algorithms, and user interface design. Investors can look towards the growing demand across regions such as North America and Asia-Pacific, which dominate adoption.

The sector’s growth is supported by the integration of AI with other technologies like IoT and AR, opening new application areas. Moreover, the competitive landscape encourages ongoing R&D, which drives product differentiation and market expansion. Those investing in AI technology for smartphones can benefit from the strong innovation pipeline and rising consumer demand for smarter devices.

Businesses adopting AI in smartphones gain numerous benefits including increased productivity, improved decision-making based on data insights, and enhanced customer engagement through personalized features. AI smartphones act as powerful mobile command centers, providing real-time analytics and efficient communication tools for professionals.

For companies, investing in AI-enabled mobile technology means better security, automation of routine tasks, and improved operational efficiency. The competitive edge gained through AI integration supports growth and innovation in various industries, making AI smartphones essential for business success today.

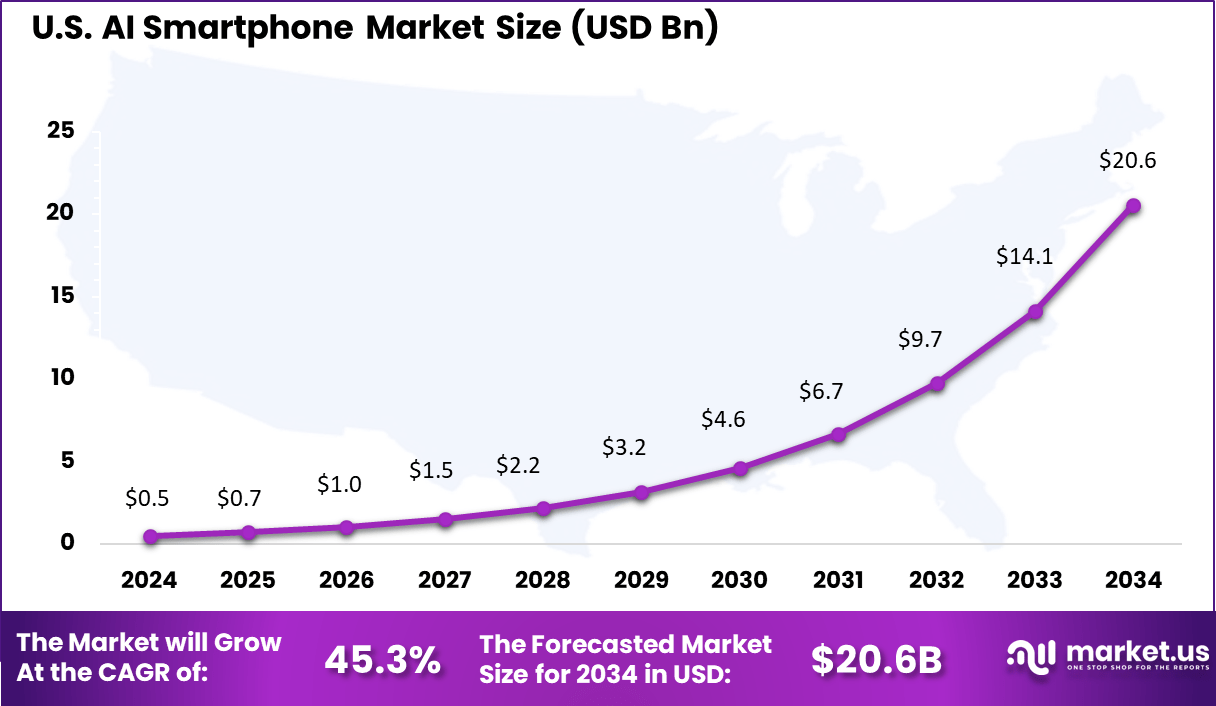

US Market Size

The US specifically accounts for about 45.3% of North America’s market share. The US market is characterized by high demand for premium and mid-range AI smartphones equipped with cutting-edge AI features.

Consumer awareness and enterprise adoption in the US drive this demand, supported by a mature retail ecosystem combining online and offline channels. The US also leads in AI smartphone innovations that focus on performance, security, and AI integration to meet both personal and professional needs.

In 2024, North America holds a significant 34.6% share in the AI smartphone market, making it a leading regional market. The region benefits from advanced technological infrastructure, high consumer purchasing power, and early adoption of AI-powered devices. Strong investments from tech companies and the presence of key AI smartphone vendors contribute to the steady market growth.

By Price Range

In 2024, The mid-range segment holds a strong position in the AI smartphone market, capturing 45.8% of the share. This segment appeals to a wide range of consumers looking for smart features powered by AI but who also seek affordability and value for money.

Advances in mobile processors and AI chipsets have enabled manufacturers to embed AI functionalities that were once exclusive to premium models into mid-range devices. Buyers increasingly expect capabilities such as AI-assisted photography, voice recognition, and personalized user experiences without the high price tag.

The demand for mid-range AI smartphones is also driven by the expanding smartphone user base in emerging markets. These regions prioritize cost-effective devices that do not compromise on performance, fueling mid-range segment growth. Additionally, as AI features become more mainstream, the mid-range segment acts as a bridge enabling broader demographic segments to access AI-powered mobile technology.

By Distribution Channel

In 2024, Offline channels dominate the AI smartphone market with a 55.7% share, reflecting the enduring importance of physical retail. Consumers often prefer hands-on experiences when purchasing smartphones, especially AI-enabled models with new and advanced capabilities.

In-store expert advice and the ability to test devices before buying remain key factors driving offline sales. Additionally, promotional activities and exclusive retail partnerships enhance the appeal of buying in person. Despite the rise of e-commerce, offline distribution remains strong due to regions where internet penetration and online shopping convenience are limited.

Retail chains and local stores continue to play a crucial role in smartphone sales, especially in areas where buyers seek personal interaction and immediate product availability. Manufacturers have stepped up training for retail staff to effectively communicate AI benefits, enriching the offline customer experience.

By Application

In 2024, Healthcare stands out as a leading application for AI smartphones, covering 45.7% of the market segment. AI-powered mobile devices are increasingly used to support telemedicine, remote patient monitoring, and health data analytics.

These smartphones integrate applications that assist healthcare professionals with diagnostics, medication adherence, and personalized care plans, improving patient outcomes outside traditional clinical settings. The growth in healthcare AI smartphones is propelled by rising demand for accessible medical services, especially in underserved areas.

Patients and providers benefit from real-time health tracking, AI-driven symptom analysis, and virtual consultations made possible by these devices. As healthcare technologies continue to evolve, AI smartphones are becoming essential tools for both medical professionals and consumers focused on health management.

By User

In 2024, The commercial user segment dominates the AI smartphone market with a commanding 72.7% share. Businesses increasingly rely on AI-enabled smartphones to enhance productivity, streamline operations, and support customer engagement.

AI applications like virtual assistants, automated workflows, and real-time data analysis are widely adopted in sectors ranging from retail to logistics, finance, and field services. Commercial users value AI smartphones for their ability to integrate with enterprise software, cloud platforms, and security protocols.

These devices improve decision-making speeds, reduce manual effort, and foster collaboration, which are critical in fast-paced work environments. The rapid digital transformation across industries ensures that AI smartphone adoption in commercial settings will continue to expand.

Emerging Trends

Emerging trends in AI smartphones highlight a shift towards on-device AI processing, allowing many AI tasks to run locally without constant cloud connectivity. This improves data privacy and reduces response time. In 2025, about 60% of consumers consider AI features an important factor when choosing a smartphone, with over 20% calling them very important.

AI-powered mid-range devices contribute notably to market growth, supporting faster upgrade cycles with devices traded in at younger ages than before. Another growing trend is the enhanced personalization that AI brings to mobile experiences. Smartphones increasingly adapt to individual preferences for screen layout, app suggestions, and daily task management.

As AI models become more energy efficient, smartphones deliver these powerful features without sacrificing battery life, addressing a key consumer concern. This trend encourages deeper integration of AI into both hardware and software, driving innovation and expanding use cases in everyday life.

Growth Factors

Growth factors fueling AI smartphone adoption include improved AI chip technology and expanding consumer demand for smarter, more intuitive devices. By 2025, AI smartphones benefit from better processors specifically designed for AI tasks, enabling complex functions without major energy trade-offs.

Longer upgrade cycles are shortening as users seek the added value AI provides, pushing more frequent purchases of AI-enabled premium models. The rising penetration of 5G also supports AI smartphone growth by enabling faster data transfers and enhanced cloud connectivity for AI applications.

This allows advanced features like augmented reality, virtual reality, and seamless AI services to flourish. Furthermore, the decline in AI hardware costs is starting to make generative AI features accessible across more price segments, expanding the user base beyond premium customers.

Key Market Segments

By Price Range

- Premium

- Mid-Range

- Budget / Low

By Distribution Channel

- Offline

- Online

By Application

- Healthcare

- Education

- Entertainment

- Mobility

- Others

By User

- Personal

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

AI Enhances Smartphone Premiumization

AI integration is driving a rise in premium smartphone sales. Leading brands like Apple, Samsung, and Xiaomi are embedding AI chips and software features such as advanced photography, real-time language translation, and battery optimization. This boosts the value of high-end devices, which now account for over 60% of global smartphone revenue, with average prices rising by 5% annually.

Consumers are upgrading to AI-powered models seeking smarter, more personalized experiences, helping this segment grow steadily. The AI-driven premium features provide a clear reason for buyers to choose new models despite saturated markets. This premium push reflects a deeper shift beyond hardware improvements – AI is becoming integral for brand differentiation and user engagement.

The enhanced user experience these AI capabilities enable triggers consumer interest to replace older phones sooner, supporting market growth. As companies invest heavily in AI R&D, this trend promises to sustain momentum in sales growth in a competitive environment where differentiation is key.

Restraint

Privacy and Data Concerns Limit Adoption

The rise of AI in smartphones also brings concerns about privacy and data security. As AI features rely on collecting and processing personal data for predictive and personalized services, consumers are increasingly wary of how their data is used and protected.

Heightened awareness around potential misuse or breaches acts as a brake on the rapid adoption of AI functionalities in smartphones for some users. Manufacturers must navigate this carefully to maintain trust. This privacy concern is compounded by regulatory scrutiny in many regions, requiring firms to implement strict data protections and transparency measures.

These costs and complexities slow down innovation cycles and may delay the introduction of some AI features. Therefore, privacy considerations stand as an important restraint that tech companies must address to prevent loss of consumer confidence and hindered market growth.

Opportunity

Expansion in Emerging Markets

Emerging markets, especially in Asia including India and Southeast Asia, represent a large growth opportunity for AI smartphones. These regions are witnessing rising smartphone penetration driven by an expanding middle class and younger tech-savvy consumers who eagerly adopt new technology features. Increasing affordability of AI-enabled devices and localized innovations tailored to these markets further accelerate adoption.

The opportunity is amplified by the mid-range smartphone segment’s rising demand, as AI features gradually become accessible beyond the premium segment. This demographic shift combined with growing 5G availability opens a vast untapped user base. Manufacturers focusing on emerging markets with competitive pricing and relevant AI-driven functionality can capture significant growth and broaden market reach amidst global competition.

Challenge

High Cost of AI Hardware and R&D

Developing and integrating AI hardware like neural processing units and advanced AI software requires substantial investment. This raises the production cost of smartphones, making it challenging to balance price against consumer willingness to pay, especially in cost-sensitive markets. The high R&D expenses and supply chain complexities also increase risks for manufacturers.

Additionally, rapid technological advancements mean maintaining a competitive edge demands continuous innovation and upgrades. This puts pressure on companies to invest heavily and iterate quickly, which could limit profit margins. Smaller players may struggle to keep pace, concentrating market power among well-funded giants.

Competitive Analysis

The AI Smartphone Market is led by major global manufacturers such as Samsung, Apple, and Google. These companies integrate advanced AI processors, on-device machine learning, intelligent voice assistants, and adaptive camera systems into their flagship smartphones. Their focus on personalized user experiences, performance optimization, and privacy-centric AI features positions them at the forefront of market innovation.

Fast-growing brands such as Xiaomi, OPPO, and Honor Device Co., Ltd. strengthen the market with AI-driven enhancements in photography, battery management, user interface customization, and real-time translation. These companies target both premium and mid-range segments, expanding AI smartphone accessibility across Asia-Pacific, Europe, and emerging markets.

Additional contributors such as Motorola Mobility LLC. and other major players offer AI-enabled capabilities for gesture control, voice recognition, and contextual automation. Their devices incorporate AI chips and cloud-based intelligence to improve performance, security, and system efficiency. Together, these companies continue to accelerate the adoption of AI smartphones across global consumer segments.

Top Key Players in the Market

- Samsung

- Xiaomi

- Apple

- OPPO

- Honor Device Co., Ltd.

- Motorola Mobility LLC.

- Other Major Players

Recent Developments

- September 2025: Samsung’s AI ecosystem, Galaxy AI, is projected to reach 400 million devices worldwide by the end of 2025, driven by strong uptake of AI features like Photo Assist and Audio Eraser in the Galaxy S25 series. Collaboration with Google enhanced AI capabilities with Gemini Live and Circle to Search features, leveraging advanced Qualcomm Snapdragon 8 Elite chips.

- September 2025: Xiaomi unveiled HyperOS 3, its new operating system based on Android 16, emphasizing dynamic AI-driven features and improved interconnectivity with Apple devices, providing users with more intelligent, seamless experiences. The Xiaomi 15T Series received a free 3-month Gemini Pro subscription enhancing AI-powered usability.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 112.2 Bn CAGR(2025-2034) 52.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Price Range (Premium, Mid-Range, Budget / Low), By Distribution Channel (Offline, Online), By Application (Healthcare, Education, Entertainment, Mobility, Others), By User (Personal, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung, Xiaomi, Google, Apple, OPPO, Honor Device Co., Ltd., Motorola Mobility LLC., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samsung

- Xiaomi

- Apple

- OPPO

- Honor Device Co., Ltd.

- Motorola Mobility LLC.

- Other Major Players