Global AI SDR Market Size, Share Analaysis Report By Offering (Software, Service), By Use Case(Lead Generation & Qualification, Prospecting & Outreach, CRM Integration & Data Management, Meeting & Appointment Scheduling, Research, Coaching & SDR Enablement, Follow Up & Nurturing, Sales Reporting & Analytics, Integration Environment, Others), By Deployment Model (Cloud-Native SAAS, Chrome Extensions, API-First Modular Embeds), By Sales Channel (Outbound, Inbound, Hybrid), By Industry Vertical (Retail & E-commerce, BFSI, Telecommunications, Healthcare & Life Sciences, Education, Media & Entertainment, Manufacturing, Travel & Hospitality, Real Estate & Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154686

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

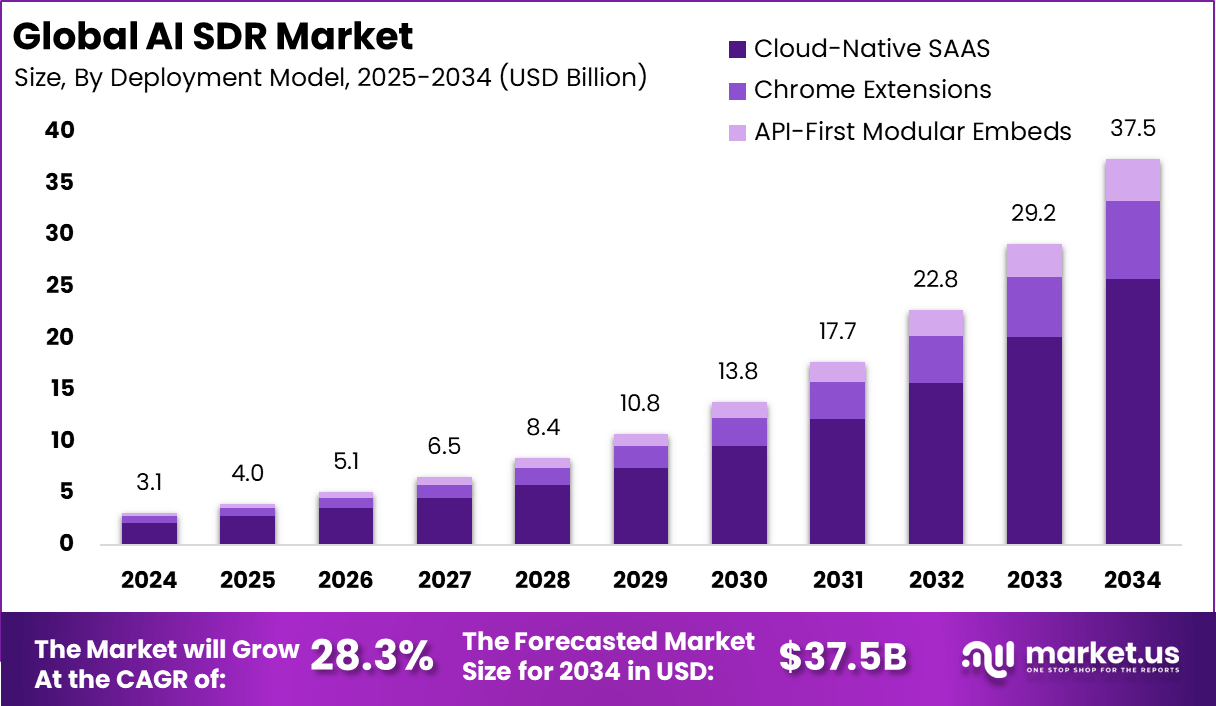

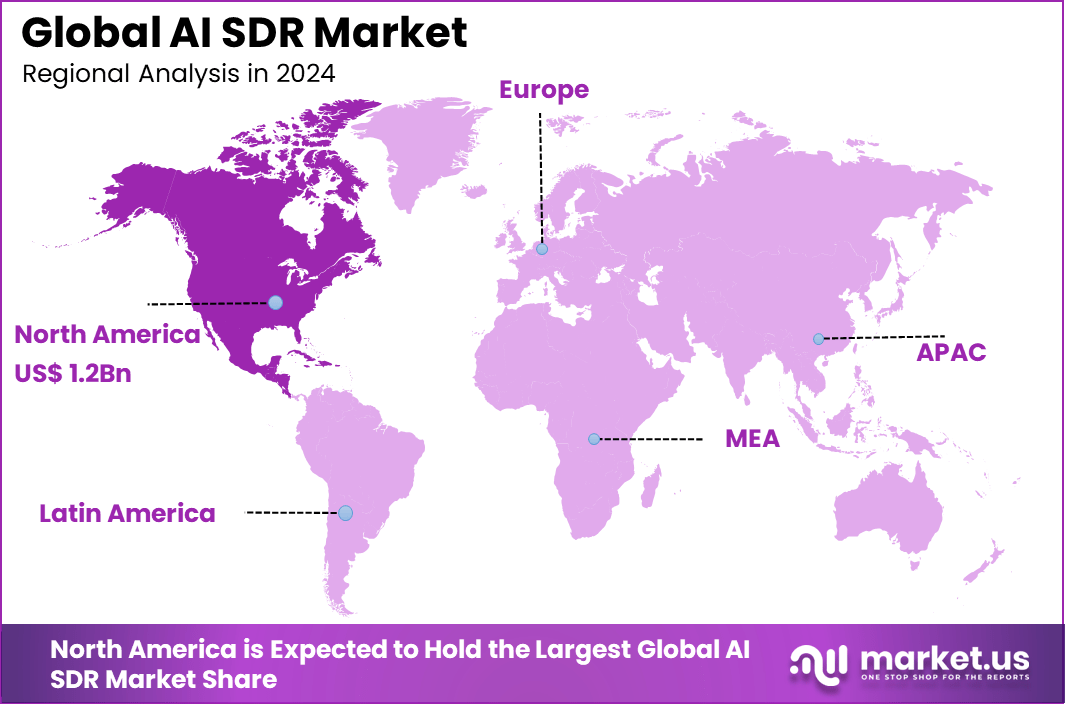

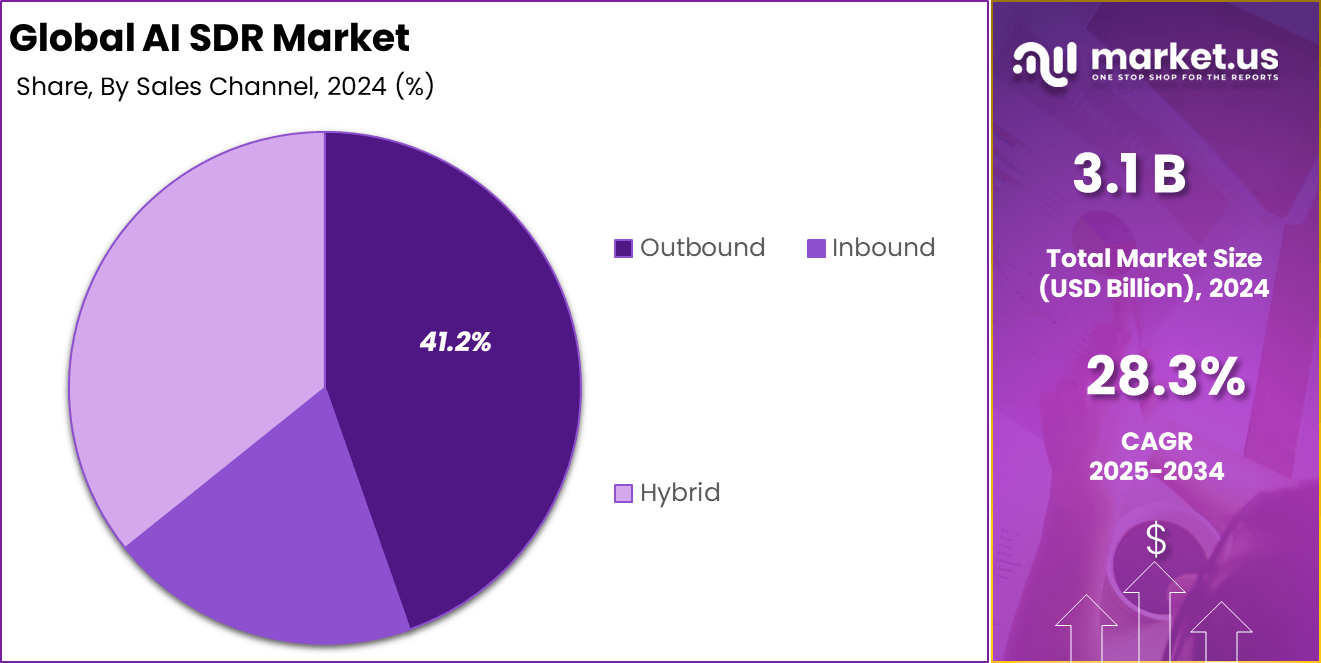

The Global AI SDR Market size is expected to be worth around USD 37.5 Billion By 2034, from USD 3.1 billion in 2024, growing at a CAGR of 28.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.2% share, holding USD 1.2 Billion revenue.

The AI SDR (Sales Development Representative) market represents a dynamic intersection of artificial intelligence and sales automation. AI SDRs are advanced systems designed to automate and optimize top-of-funnel sales activities that were traditionally managed by human SDRs. Leveraging machine learning, natural language processing, and predictive analytics, these solutions streamline tasks such as lead research, personalized multichannel outreach, and appointment scheduling.

One of the top driving factors behind the rapid adoption of AI SDR technology is the need for greater sales efficiency and precision. Businesses across industries experience increasing pressure to grow at scale while maintaining personalization in communications with potential clients. Automated tools enable real-time response, eliminate human downtime, and help manage larger volumes of leads without sacrificing the quality of customer experience.

The global demand for scalable outreach and hyper-targeted engagement, especially in competitive B2B environments, is fueling this shift. In terms of demand analysis, businesses operating in fast‑moving B2B verticals are increasingly seeking ways to accelerate top‑of‑funnel throughput. AI SDR adoption is especially strong where large lead volumes exist and where precision outreach can materially improve conversion rates.

Based on data from SuperAGI, AI SDRs can deliver a potential ROI of up to 300% within the first year, compared to about 200% over 2 to 3 years for human SDRs. In terms of scalability, AI SDRs can reach over 1,000 contacts daily, while human SDRs typically manage only 30 to 50 contacts. Additionally, businesses using AI in sales processes have seen up to a 50% increase in sales-qualified leads.

Adoption rates are notably high in the technology sector, where around 63% of businesses have integrated AI SDR solutions, followed closely by finance at 57% and healthcare at 45%. This dramatic uptake is powered by quantifiable improvements in sales performance, including higher conversion rates, shorter sales cycles, and improved lead quality. AI SDRs boost sales pipeline speed and improve resource use, making them essential for modern sales teams.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 37.5 Bn CAGR(2025-2034) 28.3% Leading Segment Software – 71.5% Region with Largest Share North America [41.2% Market Share] Largest Country U.S. [USD 1.26 bn Market Revenue], CAGR: 26.4% Key Insight Summary

- The global market is projected to rise from USD 3.1 billion in 2024 to approximately USD 37.5 billion by 2034, reflecting a strong CAGR of 28.3%, driven by the automation of sales processes and increasing demand for real-time customer engagement.

- North America led the global market with a 41.2% share, generating USD 1.2 billion in revenue, supported by early enterprise adoption of AI-driven sales tools and CRM integrations.

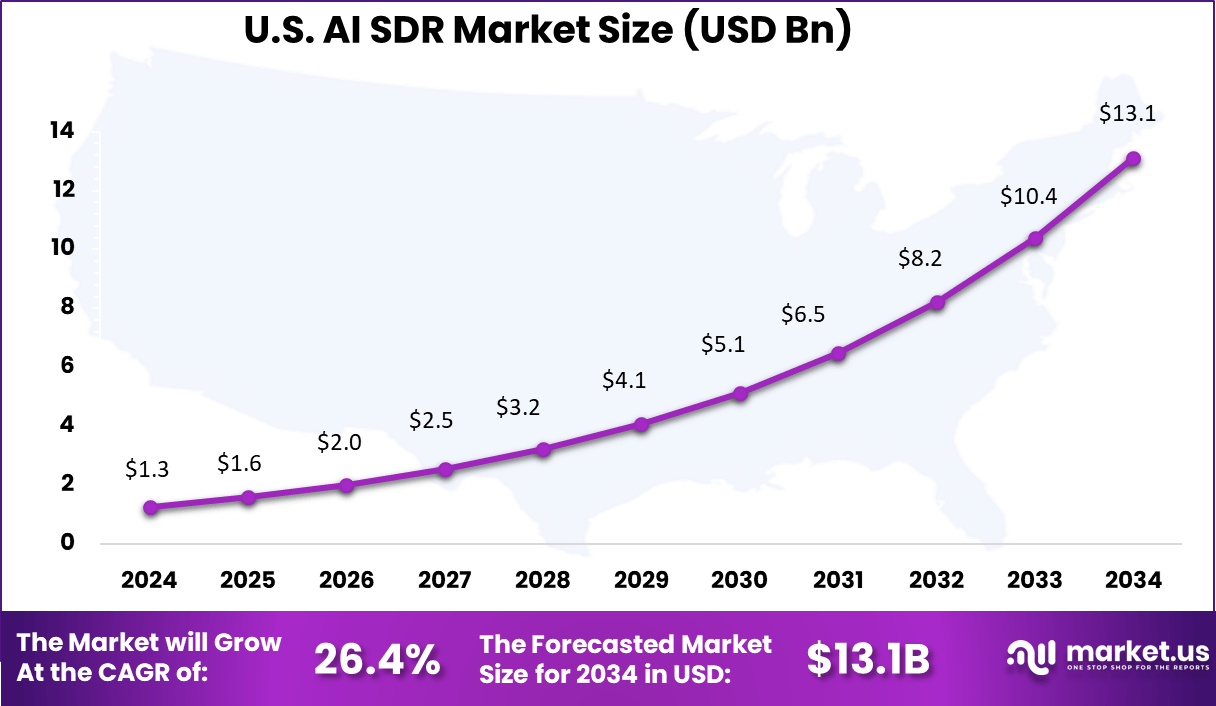

- The U.S. market alone contributed USD 1.26 billion in 2024 and is expected to grow at a CAGR of 26.4%, driven by a highly digitized sales ecosystem and strong SaaS investment.

- The Software segment dominated by offering, accounting for 71.5%, as companies prioritize intelligent automation platforms for outreach, scheduling, and pipeline management.

- Lead Generation & Qualification led by use case with a 20.7% share, highlighting the role of AI SDRs in identifying high-value prospects and streamlining handoff to sales teams.

- The Cloud-Native SaaS deployment model captured 68.9%, due to its scalability, lower onboarding costs, and ease of integration with existing CRM platforms.

- Outbound sales channels held a leading 41.2% share, as AI SDRs are increasingly used for automated outreach, follow-ups, and cold prospecting strategies.

- The Retail & E-commerce sector represented 17.3% of industry adoption, leveraging AI SDRs for customer acquisition, personalized messaging, and conversion optimization.

US Market Size

The U.S. AI SDR Market was valued at USD 1.3 billion in 2024 and is anticipated to reach approximately USD 13.1 billion by 2034, expanding at a compound annual growth rate (CAGR) of 26.4% during the forecast period from 2025 to 2034.

This exceptional growth trajectory reflects the increasing dependence of U.S. enterprises on AI-powered tools to automate lead generation, personalize outreach, and boost sales productivity in a competitive environment. The rapid expansion is also driven by the rising integration of generative AI, NLP, and predictive analytics into sales operations across key sectors such as technology, SaaS, financial services, and professional services.

In 2024, North America held a dominant market position, capturing more than a 41.2% share, holding USD 1.2 billion in revenue. This leadership can be primarily attributed to the region’s strong foundation in enterprise SaaS infrastructure and widespread adoption of AI-driven sales technologies across B2B sectors.

U.S. based organizations, in particular, have actively embraced AI SDR (Sales Development Representative) tools to streamline lead qualification, accelerate outreach, and improve conversion rates. The maturity of cloud platforms, coupled with a culture of early adoption among sales teams, has further fueled regional dominance.

North America’s robust venture funding ecosystem and access to high-performance AI compute resources have also played a key role. Companies across technology, financial services, and healthcare are leveraging AI SDR platforms to manage complex sales cycles and reduce reliance on manual prospecting. Additionally, the presence of a skilled workforce and advanced integration of CRM systems with generative AI has enabled businesses to scale outbound sales efforts efficiently.

Emerging Trends

Trend/Innovation Description Agentic and Multi-Agent AI Multiple AI agents collaborate to orchestrate complex sales workflows and tackle broader activities Large Action Models (LAMs) Move beyond LLMs, enabling AI SDRs to execute intent-driven sales actions autonomously Intent-Based Prospecting AI identifies high-value accounts using behavioral and firmographic data Autonomous Scheduling & Follow-Up AI SDRs independently handle appointment setting and ongoing nurturing without human intervention Multimodal AI Communication Emerging ability to interact with prospects via email, calls, chat, and video Growth Factors

Key Factors Description Need for Scalable Lead Generation Companies seek to accelerate pipeline growth and improve conversion rates via automation Advanced Personalization Hyper-personalized engagement made possible by AI boosts response and conversion rates Data-driven Sales Strategies Real-time insights enable smarter, faster decisions and targeting Hybrid Human-AI Engagement Models Blending automation with human oversight enhances efficiency and ensures contextual relevance Global Digital Adoption Expansion of cloud-based sales tools and increased remote work fuel market growth By Offering Analysis

In 2024, Software dominates the AI SDR market with a significant 71.5% share. Companies are increasingly adopting advanced software platforms that can automate and streamline the initial stages of the sales process.

These platforms offer features such as intelligent lead scoring, automated email outreach, and conversational analytics, which help sales teams identify high-potential prospects more efficiently. The widespread adoption of AI-powered software tools reflects an industry shift toward data-driven, scalable, and cost-effective sales development solutions, replacing many manual and time-consuming tasks.

By Use Case Analysis

Within the use‑case dimension, Lead Generation & Qualification occupies the leading niche with approximately 20.7 % market share. This focus underscores the utilitarian role of AI SDR systems in automating identification of high-fit prospects, enrichment of contact data, and lead scoring based on predictive intent signals.

Automation of lead identification and filtering has been favoured because it reduces manual workload and enhances pipeline precision. By processing behavioural indicators such as website activity, job role changes, and engagement history, AI SDR tools enable sales teams to prioritize outreach with higher conversion potential. This systematic qualification process ensures that human SDRs engage only with leads most likely to progress through the funnel.

By Deployment Model

In 2024, the deployment model leadership resides with Cloud‑Native SaaS, which captures 68.9 % of the market. This prominence is explained by the recognized advantages of cloud delivery, including minimal installation, elastic scalability, subscription-based pricing, and remote access across distributed sales teams.

Preference for SaaS deployment is also driven by organizations’ desire to reduce infrastructure overhead while ensuring continuous feature updates and data security. Cloud-native platforms offer rapid onboarding, centralized management, and ease of maintenance, aligning with the operational needs of modern sales teams seeking agility and low ongoing IT burden.

By Sales Channel

In 2024, Outbound sales remain the dominant channel, with a 41.2% share. AI SDR tools have proven particularly effective for outbound campaigns, empowering sales teams to personalize messaging at scale and automate cold calling and outreach efforts.

By using AI to research prospects and optimize the timing and content of communications, companies can increase engagement rates and drive more consistent pipeline growth through targeted outbound strategies.

By Industry Vertical

In 2024, Retail and e-commerce represent the leading industry vertical, holding 17.3% of the market. These sectors rely heavily on rapid and personalized communication to attract and convert customers in a highly competitive landscape.

AI SDR platforms help online retailers quickly process inbound interest, nurture leads, and support omnichannel sales campaigns. The retail sector’s digital-first approach aligns well with AI tools that enhance efficiency, customization, and customer experience from initial contact to conversion.

Key Market Segments

By Offering

- Software

- AI Outreach Assistants

- Conversation Intelligence Tools

- AI-Enhanced Sales Engagement Platforms

- Lead Research & Enrichment Bots

- Email Deliverability Optimizers

- AI Script & Template Generators

- Service

- Workflow Automation Setup & Integration

- AI Personalization & Prompt Consulting

- Deliverability & Spam Audit Services

By Use Case

- Lead Generation & Qualification

- Prospecting & Outreach

- CRM Integration & Data Management

- Meeting & Appointment Scheduling

- Research, Coaching & SDR Enablement

- Follow Up & Nurturing

- Sales Reporting & Analytics

- Integration Environment

- Others

By Deployment Model

- Cloud-Native SAAS

- Chrome Extensions

- API-First Modular Embeds

By Sales Channel

- Outbound

- Inbound

- Hybrid

By Industry Vertical

- Retail & E-commerce

- BFSI

- Telecommunications

- Healthcare & Life Sciences

- Education

- Media & Entertainment

- Manufacturing

- Travel & Hospitality

- Real Estate & Construction

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Adoption of Intent-Based Prospecting in Sales

The AI SDR (Sales Development Representative) market is experiencing strong growth, driven by the adoption of intent-based prospecting. Sales teams now use AI tools that sift through digital behaviors – such as website visits or engagement with company content – to spot leads who are more likely to be interested in what is being offered.

This use of advanced analytics for prioritizing sales prospects is a game-changer because it lets sales teams put their effort into high-potential leads, rather than wasting time on low-interest contacts. The result is more effective outreach, higher responses, and better utilization of resources. When sales teams combine this data-driven approach with personalized messaging, they consistently see improvements in how quickly and successfully they move leads through the sales funnel.

Beyond the technology itself, this shift in prospecting behavior has changed how B2B organizations run sales operations. With AI-powered SDRs, companies can automate heavy research tasks and keep up with the demands of a fast-moving digital market. SDRs previously relied on gut instinct or static lists; now, they use AI to identify buyer intent signals in real time, supporting sales teams with relevant context.

Restraint

Segmentation Logic and Data Accuracy Challenges

Despite these advances, a significant restraint for AI SDR adoption lies in the potential weaknesses of segmentation logic and data quality. AI SDR systems are only as effective as the data and models they rely on for targeting. If underlying algorithms are trained on limited or biased datasets, or if data is out-of-date, AI-driven outreach can easily miss the mark by targeting the wrong prospects or sending irrelevant messages.

Companies have reported downward trends in engagement – such as lower open rates or off-target communications – when segmentation is poorly calibrated. Correcting these errors is not simple; it often requires data recleaning or retraining models, which can be both resource-intensive and technically demanding for smaller businesses.

These issues also create trust barriers for firms considering AI SDR deployment. Unlike human reps who can adjust in real time based on intuition, AI systems need structured, ongoing input to maintain targeting accuracy. This makes organizations hesitant, since an error-prone system could damage brand reputation or waste valuable resources on fruitless outreach.

Opportunity

Multi-Agent Architectures for Sales Development

On the opportunity side, the emergence of multi-agent AI SDR architectures is transforming sales development. Rather than relying on a single automated process, these systems use several AI agents that collaborate to cover more ground – handling tasks such as lead generation, qualification, and personalized outreach across different channels simultaneously.

Not only does this speed up processes, but it also broadens the sales funnel by enabling more accurate nurturing of leads at every touchpoint. Multi-agent models can adjust their tactics in response to real-time customer behaviors, boosting appointment bookings, conversions, and reducing sales cycle durations. For businesses, this means scaling up outreach without losing the personal touch.

Multi-agent systems allow for rapid coordination across voice, email, and other digital channels, ensuring that each potential customer receives timely and relevant communication. They also enable robust analytics feedback, which helps sales teams refine their approach on an ongoing basis. Early adopters are seeing substantial improvements – like higher lead quality and workload reductions – making these architectures a compelling opportunity for any organization looking to innovate their sales processes.

Challenge

Reliance on Data Fidelity and Over-Automation Risks

A critical challenge for AI SDR platforms is their reliance on high-fidelity, context-rich data inputs. If the system is fed incorrect or incomplete data, its decisions on who to target and what message to send will miss the point, resulting in outreach that feels impersonal, off-topic, or just plain wrong to prospects. This not only reduces the chance of a successful sale but can actively damage a company’s image if prospects feel spammed or misunderstood.

The risk increases as more processes are automated – if companies are not careful, they create a flood of low-quality communication that saturates the market and turns buyers away. Moreover, there is a risk of regulatory and compliance violations if sensitive customer information is handled incorrectly.

To counter these challenges, companies must invest in strict data governance, keep AI systems updated with accurate data, and ensure that automation is always paired with human oversight. Only by maintaining this careful balance can organizations maximize the benefits of AI SDRs without falling into the trap of over-automation and under-delivering on customer expectations.

Competitive Landscape

In the AI SDR Market, major players such as Hubspot Inc., Salesforce, Microsoft Corporation, and IBM Corporation have been instrumental in shaping the competitive landscape. These companies offer robust AI-powered sales automation tools that help streamline lead engagement, qualification, and outreach. Their established customer base, global presence, and heavy investment in AI and cloud technologies give them a clear advantage.

Emerging vendors including Klenty, Conversica, Plivo, and OpenAI are driving innovation by focusing on conversational intelligence and autonomous SDR agents. These platforms integrate AI-driven email sequencing, call tracking, and sentiment analysis to optimize sales efforts. OpenAI’s role has been particularly impactful in powering natural language generation and understanding in outreach campaigns.

Several fast-scaling companies such as Artisian, 11x AI Inc., LYZR, Luru, and Floworks are transforming the market with purpose-built AI SDR solutions tailored for outbound campaigns, lead nurturing, and CRM integration. These players focus on automation, personalization, and real-time insights to improve sales team efficiency.

Top Key Players in the Market

- Hubspot Inc.

- Salesforce

- Klenty

- OpenAI

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Plivo

- Conversica

- Artisian

- 11x AI Inc.

- LYZR

- Luru

- floworks

- Others

Recent Developments

- January 2025: HubSpot acquired Frame AI, a conversation intelligence platform. This technology will fuel the new Breeze AI suite, blending structured emails, call data, and meetings. The goal: elevate segmentation and create deeply personalized outreach campaigns – a bold step in AI SDR automation.

- In January 2025, HubSpot finalized its acquisition of Frame AI, an AI-driven conversation intelligence platform. The integration into HubSpot’s Breeze AI suite allows structured and unstructured data such as emails, calls, and meetings to be unified across the customer journey. This advancement supports hyper-personalized campaigns, refined segmentation, and more precise and effective sales strategies.

- June 2024: IBM unveiled expanded features across its watsonx Assistant and introduced new large speech models (LSMs) for advanced enterprise-ready speech-to-text and conversational AI use cases. Their systems now outperform established benchmarks like OpenAI’s Whisper on short-form business scenarios, accelerating SDR automation for global teams.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Software (AI Outreach Assistants, Conversation Intelligence Tools, AI-Enhanced Sales Engagement Platforms, Lead Research & Enrichment Bots, Email Deliverability Optimizers, AI Script & Template Generators), Service (Workflow Automation Setup & Integration, AI Personalization & Prompt Consulting, Deliverability & Spam Audit Services)), By Use Case(Lead Generation & Qualification, Prospecting & Outreach, CRM Integration & Data Management, Meeting & Appointment Scheduling, Research, Coaching & SDR Enablement, Follow Up & Nurturing, Sales Reporting & Analytics, Integration Environment, Others), By Deployment Model (Cloud-Native SAAS, Chrome Extensions, API-First Modular Embeds), By Sales Channel (Outbound, Inbound, Hybrid), By Industry Vertical (Retail & E-commerce, BFSI, Telecommunications, Healthcare & Life Sciences, Education, Media & Entertainment, Manufacturing, Travel & Hospitality, Real Estate & Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hubspot Inc., Salesforce, Klenty, OpenAI, IBM Corporation, Microsoft Corporation, Google LLC, Plivo, Conversica, Artisian, 11x AI Inc., LYZR, Luru, floworks, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hubspot Inc.

- Salesforce

- Klenty

- OpenAI

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Plivo

- Conversica

- Artisian

- 11x AI Inc.

- LYZR

- Luru

- floworks

- Others