Global AI-Powered Video Editing Software Market By Platform (Desktop and Mobile), By Deployment Mode(On-Premise and Cloud-Based), By End-User (Media and Entertainment, Advertising and Marketing, E-Learning, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 106140

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

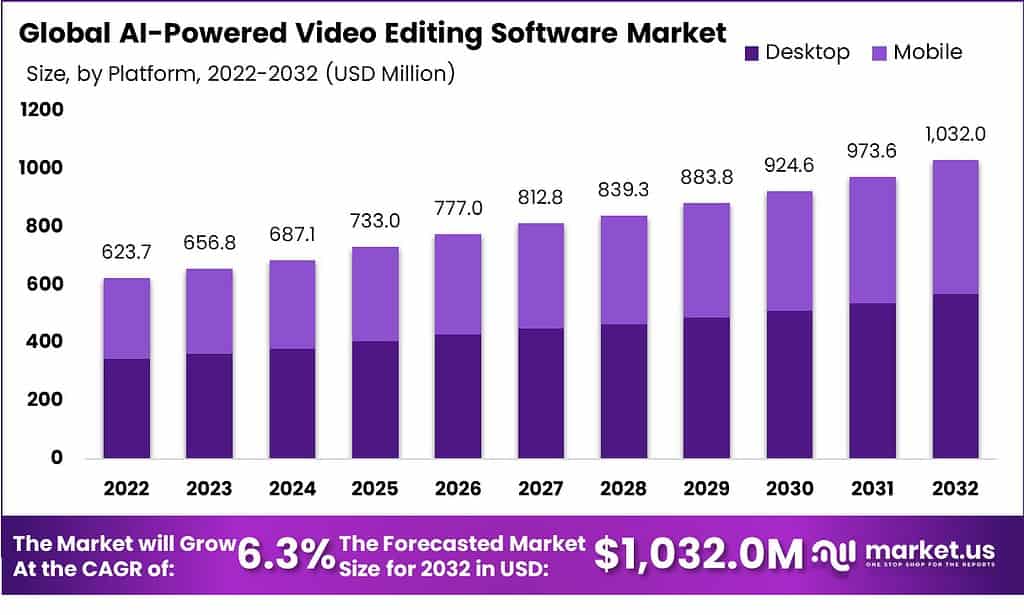

The Global AI-Powered Video Editing Software Market size is expected to witness a CAGR of 6.3% from 2023 to 2032. It is anticipated to hit a valuation of USD 1,032.0 Million by 2032 from USD 656.8 Million in 2023.

AI-powered video editing software is revolutionizing video production and post-production by leveraging artificial intelligence and machine learning. These tools enhance efficiency, elevate video quality, and unlock new creative possibilities. Key features include scene recognition and automated editing recommendations, audiovisual quality enhancement, and accessibility. Notable examples include Adobe Premiere Pro, Final Cut Pro X, Davinci Resolve, Lumen5, and Magisto, showcasing the transformative potential of AI in video editing. This technology’s continuous evolution promises further advancements in the field.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The AI-Powered Video Editing Software Market is projected to achieve a remarkable 6.3% CAGR, reaching a valuation of USD 1,032.0 Million by 2032, spurred by the rapid expansion of the e-learning sector.

- Technology Evolution: AI-powered video editing software, exemplified by leading tools such as Adobe Premiere Pro, Final Cut Pro X, and Davinci Resolve, is transforming video production and post-production by leveraging AI and machine learning. Key features include scene recognition, automated editing recommendations, audiovisual quality enhancement, and accessibility.

- Platform Analysis: Desktops currently dominate the market due to their widespread usage and larger screens for editing tasks, while mobile platforms, particularly Android and iOS, are experiencing rapid growth, catering to the increasing use of touchscreen devices such as smartphones and tablets.

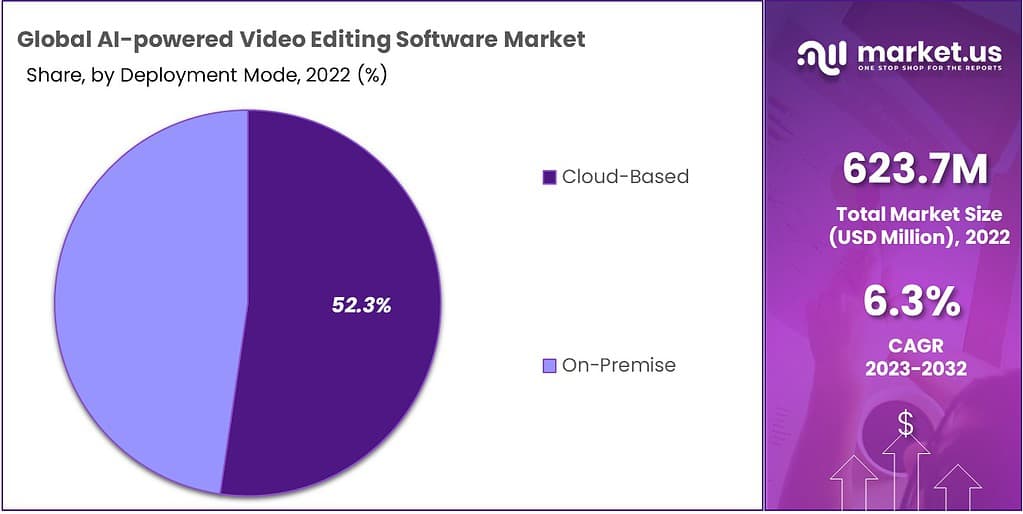

- Deployment Mode Trends: Cloud-based video editing software is gaining significant traction, offering accessibility from any location with internet connectivity, enabling swift editing. On-premise solutions, while less portable, are witnessing rapid growth, especially for high-end editing tasks.

- Market Drivers: The surge in social media influencers and YouTubers and the increasing demand for video content across various online platforms are key factors driving market revenue growth.

- Market Restraints: The availability of free editing tools with advanced features, such as VideoPad, OpenShot, Blender, and Shotcut, is dampening the growth of the paid video editing market, particularly among novice users.

- Market Opportunities: The increasing adoption of video editing software in the EdTech and OTT platforms is expected to create significant growth opportunities. Video content has proven to be an effective tool in education, enhancing student retention, and is increasingly utilized for streaming on OTT platforms.

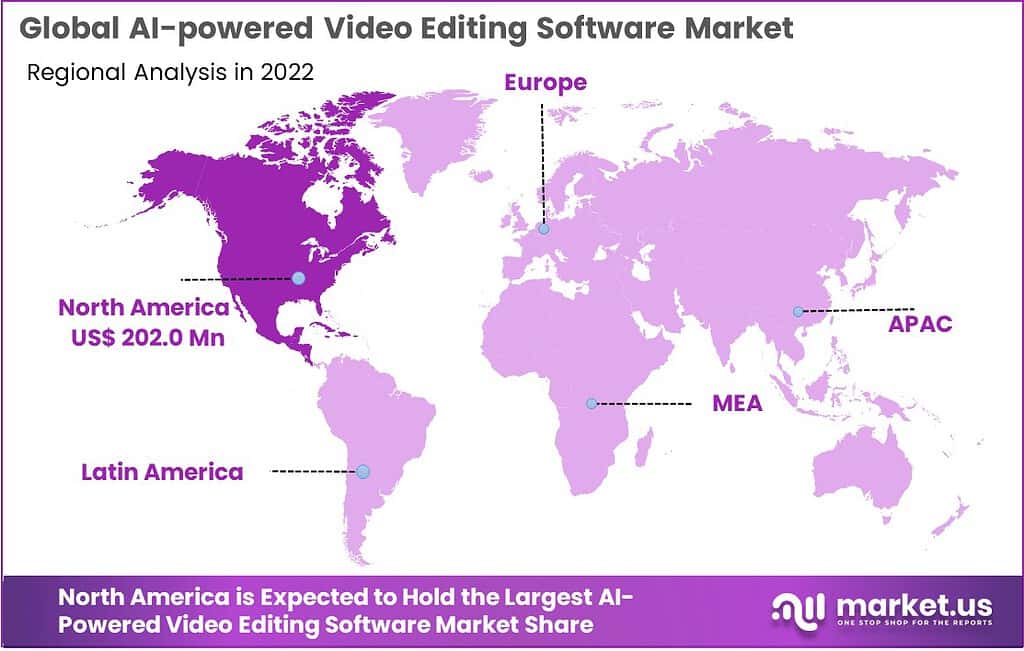

- Regional Dominance: North America is the leading market, accounting for a substantial share, owing to the high demand for video content, the popularity of OTT platforms, and the widespread use of smart devices. Europe is also a significant contributor, experiencing rising film production and increasing consumer demand.

- Key Market Players: Notable companies driving market growth include Adobe Inc., Autodesk, Inc., Animaker, VidMob, Apple, Magix, Pinnacle Systems, Inc., Avid Technology, Blackmagic Design Pty Ltd., and Animoto. These players are focusing on expanding operations and R&D, as well as developing new products through strategic investments, mergers, and acquisitions.

- Market Trends: Automated editing workflows with personalization and customization are gaining prominence, with AI-driven software automating complex editing tasks and enabling content creators to personalize video content based on audience preferences, enhancing engagement and retention.

Platform Analysis

Desktop Segment Hold the Largest Share in 2022

The global AI-powered video editing software market can be divided into desktop and mobile platforms. Mac and Windows computers dominate this segment due to their widespread usage and larger screens for video editing tasks, while Android and iOS mobile platforms represent the fastest-growing segment catering to touchscreen devices such as smartphones and tablets. Android, developed by Google, specializes in software applications while iOS from Apple provides unique advantages in this space.

Deployment Mode Analysis

Cloud-Based Segment is Most Lucrative In the Market

By deployment mode, the market can be further broken down into on-premise and cloud-based video editing software markets. Of these two markets, cloud-based video editing software is estimated to be the most lucrative one. A cloud-based platform provides video editors with access to software without downloading it to their system; instead, it’s accessible from any mobile phone, tablet, or desktop computer with internet access allowing fast editing from any location with internet connectivity.

Another benefit of using such cloud-based editing software is speed – editing can happen instantly anywhere! On-premise video editing software is one of the fastest growing segments, installed on a PC for use with high-end devices. Although not easily transportable, on-premise editing solutions have grown increasingly popular over time.

Note: Actual Numbers Might Vary In The Final Report

End-User Analysis

The media and Entertainment Segment will be Dominant In 2022

Based on end-users, the market is segmented into media and entertainment, advertising and marketing, e-learning, and Other end-users. Among these end-users, the media and entertainment segment is estimated to be the most lucrative segment in the global AI-powered video editing software market. Factors such as high penetration on the internet, YouTube channels, and OTT platforms are increasing the growth of the media and entertainment segment. Rapid growth in the media and entertainment sector, short films, steady release or upload of commercial or personal videos and films, high demand for quality video, the popularity of OTT platforms, and the constant need for video editing for films and advertisements are driving factors in this segment.

Drivers

The Increasing Number of Social Media Influencers and YouTubers

A major contributor to market revenue growth has been the advent of various short video-making applications like YouTube shorts, Facebook shorts and Instagram reels. Content creators can use these applications to add special effects, songs and transitions. New features were even introduced into applications such as TikTok and Dub Smash; with TikTok boasting approximately 80 million active monthly users in the US alone.

Increasing Video Content Demand

The continuous growth in the consumption of video content across online platforms, including social media, e-learning, and entertainment, fuels the demand for efficient video editing solutions. AI algorithms can improve video quality by removing noise, stabilizing shaky footage, adjusting lighting, and enhancing overall visual appeal.

Restraints

Availability of Free Editing Tools

The main factor decreasing the growth of the video editing market is the availability of free video editing software with new and updated features. Applications such as VideoPad, OpenShot, Blender, and Shotcut are among the best free video editing software widely used. Users, especially different content creators, are shifting to free editing tools, which decreases market revenue growth. Beginners with no idea or experience about this type of software face challenges operating new software versions.

Opportunity

Increasing Adoption of Video Editing Software for EdTech Platforms to Boost Market Opportunities

In academic institutes, video recordings and pre-recorded seminars and courses are widely used to provide instructions. The visual aspect of media significantly impacts student retention. As a result, market growth increases for multimedia companies using video content because such techniques are more effective for teaching than traditional educational methods. Also, this should positively impact the demand for the technology that creates and stores such multimedia.

Increasing Adoption of Video Editing Software for OTT Platforms

Filmmakers and video editors typically utilize editing software when producing films and TV shows, while over-the-top (OTT) platforms allow users to download any video content available for streaming online. Within a relatively short timeframe, these services evolved from niche streaming options into the most widely utilized means of watching television; bypassing traditional cable and satellite connections so viewers could stream shows directly via internet connection – offering easy access to entertainment!

Trends

Automated Editing Workflows with Personalization and Customization are Trending in Market

AI-powered video editing software is increasingly automating complex editing tasks, such as color correction, audio synchronization, and video stabilization. This trend streamlines the editing process, saving time and effort for users. AI algorithms are being used to analyze audience preferences and behavior, allowing content creators to personalize video content. This trend enhances viewer engagement and retention.

Key Market Segments

Based on Platform

- Desktop

- Mobile

Based on the Deployment Mode

- Cloud-Based

- On-Premise

Based on End-User

- Media and Entertainment

- Advertising and Marketing

- E-Learning

- Other End-Users

Regional Analysis

North America is estimated to be the most lucrative market in 2022, with a market share of 32.4%. Increasing demand for video content on social media, the increasing popularity of OTT platforms, the high use of smartphones and the internet, and the availability of free video editing software are key factors increasing market growth in North America. Also, the existence of key market players, online entrepreneurs, and the wide usage of smart devices, smart TVs, and smartphones are some factors increasing market revenue growth.

The European market accounted for a major revenue share in 2022. Rising film production, increasing consumer demand, and the creation of innovative features are key factors in the rising revenue growth of this region. Easy access to smartphones, which ultimately introduces the world of content and social media, increases revenue growth in this region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Emerging key players have adopted several strategic policies in order to expand their businesses in foreign markets. AI-powered video editing software companies, in particular, are prioritizing expanding existing operations and R&D facilities as well as developing new products through investments, mergers, or acquisitions. Furthermore, emerging key players are using various marketing strategies such as spreading awareness of video editing software which bolsters its growth.

Market Key Players

- Adobe Inc.

- Autodesk, Inc.

- Animaker

- VidMob

- Apple

- Magix

- Pinnacle Systems, Inc.

- Avid Technology

- Blackmagic Design Pty Ltd.

- Animoto

- Other Key Players

Recent Developments

- In April 2022, Adobe unveiled enhancements to its After Effects software, including native M1 support for cloud clients. They also announced the integration of Frame.io’s video collaboration platform, strengthening its video editing capabilities.

- Avid made headlines in April 2022 by collaborating with Haivision and Microsoft to showcase advanced remote control features for video production solutions, promising more refined and efficient workflows.

- In June 2020, Corel, the parent company of Pinnacle Systems, acquired Awingu, a remote access technology provider. This strategic move aimed to bolster Corel’s portfolio of remote access solutions.

Report Scope

Report Features Description Market Value (2023) US$ 656.8 Mn Forecast Revenue (2032) US$ 1,032.0 Mn CAGR (2023-2032) 6.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Platform (Desktop and Mobile), By Deployment Mode(On-Premise and Cloud-Based), By End-User (Media and Entertainment, Advertising and Marketing, E-Learning, and Other End-Users) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adobe Inc., Autodesk, Inc., Animaker, VidMob, Apple, Magix, Pinnacle Systems, Inc., Avid Technology, Blackmagic Design Pty Ltd. Animoto, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI-powered video editing software?AI-powered video editing software is a type of video editing software that uses artificial intelligence (AI) to automate tasks, such as color correction, object removal, and text insertion. This can save users time and effort, and it can also help them to create more professional-looking videos.

What are the key features of AI-powered video editing software?Common features include automatic video tagging, scene detection, motion tracking, voice recognition, and intelligent suggestions for transitions, effects, and music.

What are the benefits of using AI-powered video editing software?The benefits of using AI-powered video editing software include:

- Speed: AI can automate tasks that would otherwise be time-consuming and tedious, such as color correction and object removal. This can free up users' time so they can focus on more creative aspects of video editing.

- Accuracy: AI can be more accurate than humans at tasks such as object removal and color correction. This can help users to create more professional-looking videos.

- Creativity: AI can be used to generate new ideas and concepts for videos. This can help users to create more innovative and engaging videos.

How big is the AI-Powered Video Editing Software Market?The Global AI-Powered Video Editing Software Market size is expected to witness a CAGR of 6.3% from 2023 to 2032. It is anticipated to hit a valuation of USD 1,032.0 Million by 2032 from USD 623.7 Million in 2022.

AI-Powered Video Editing Software MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Video Editing Software MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Autodesk, Inc.

- Animaker

- VidMob

- Apple

- Magix

- Pinnacle Systems, Inc.

- Avid Technology

- Blackmagic Design Pty Ltd.

- Animoto

- Other Key Players