Global AI-powered Sales Tool Market Size, Share and Analysis Report By Type (Chatbots, Virtual Sales Assistants, Sales Automation, Others), By Deployment Mode (On-Premises, Cloud-based), By Organization Size (Small & Medium Enterpises (SMEs), Large Enterprises), By Application (Lead Generation, Customer Relationship Management, Sales Forecasting, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176567

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Type

- By Deployment Mode

- By Organization Size

- By Application

- Regional Perspective

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

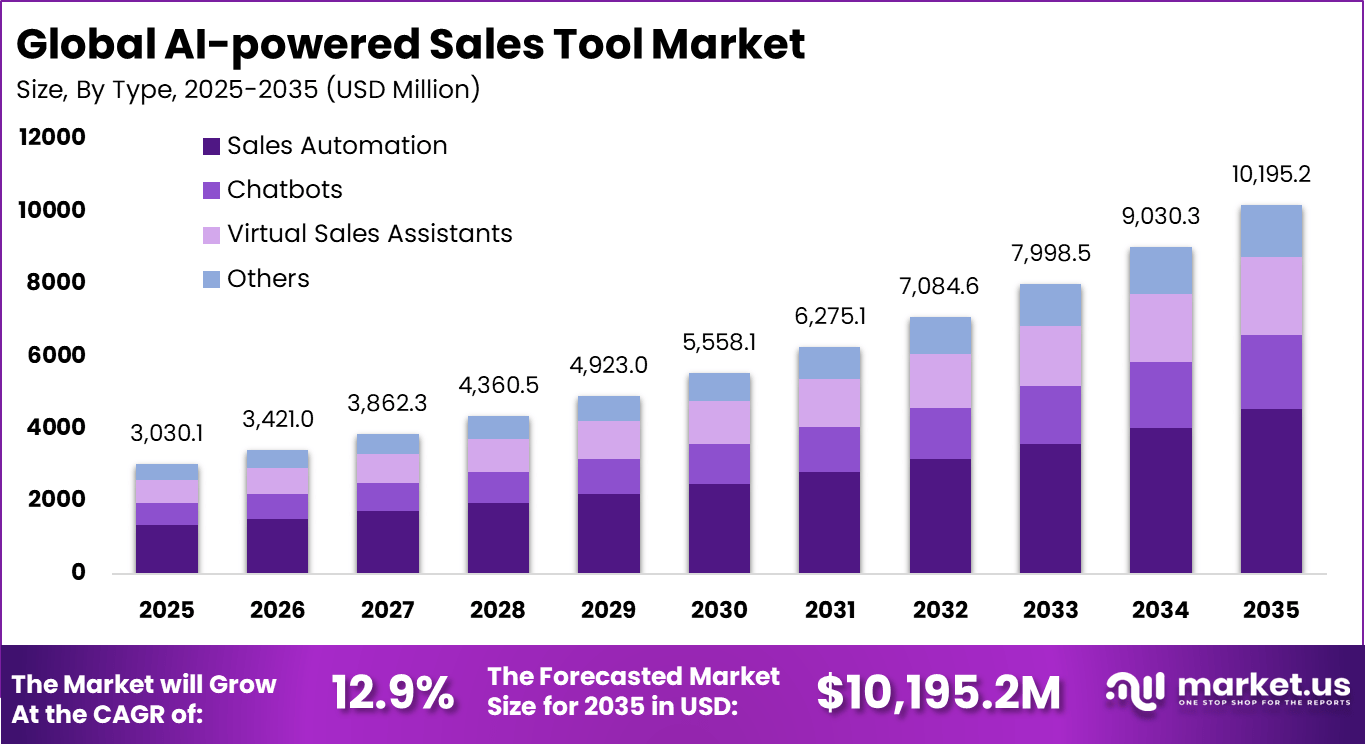

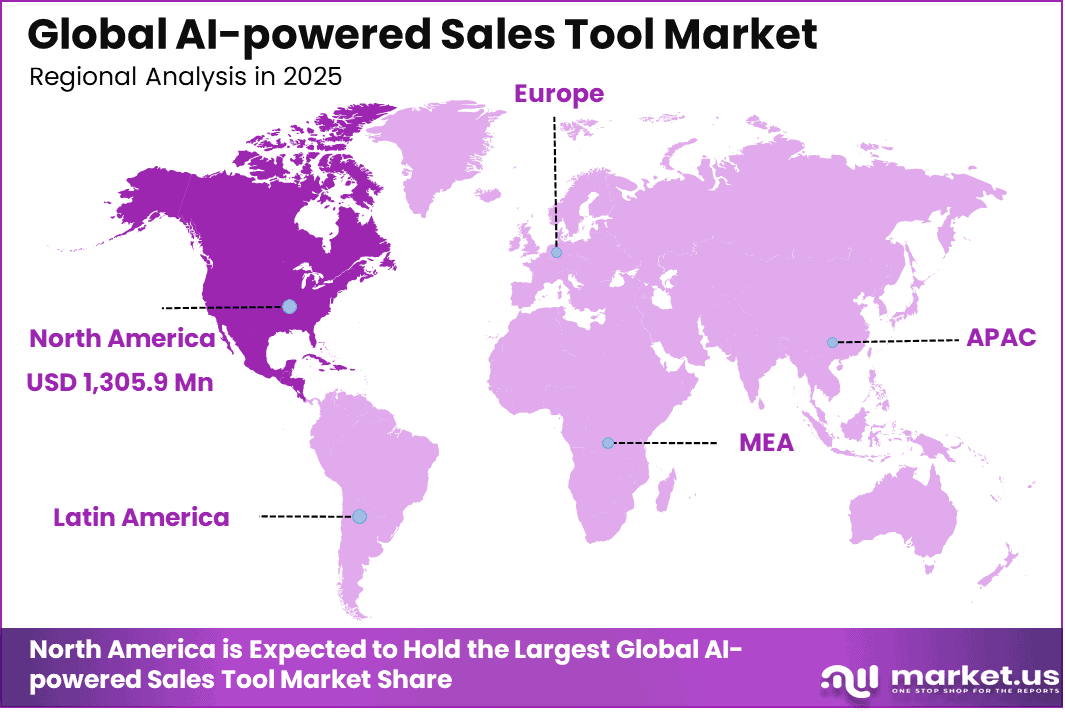

The Global AI-powered Sales Tool Market size is expected to be worth around USD 10,195.2 million by 2035, from USD 3,030.1 million in 2025, growing at a CAGR of 12.9% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 43.1% share, holding USD 1,305.9 million in revenue.

The AI-powered sales tool market includes software solutions that use artificial intelligence to support sales activities such as lead scoring, customer engagement, sales forecasting, and pipeline management. These tools analyze large volumes of customer and transaction data to help sales teams prioritize opportunities and improve conversion efficiency. Adoption has accelerated as organizations seek data driven selling approaches and more predictable revenue outcomes.

A primary driver of the AI-powered sales tool market is the growing need for data driven decision making in sales operations. Sales teams manage large datasets related to customer behavior, engagement history, and buying intent. AI tools process this information to identify high probability leads and recommend next best actions. This capability improves focus on qualified prospects and reduces time spent on low value activities.

A major opportunity in the AI-powered sales tool market lies in personalization at scale. AI enables tailored messaging, timing recommendations, and offer suggestions based on individual customer profiles. This level of personalization improves engagement and customer experience without increasing manual workload. Organizations adopting these capabilities can differentiate through more relevant sales interactions.

For instance, in November 2025, Gong.io landed DocuSign as a marquee enterprise customer, deploying its Revenue AI OS to boost sales productivity and IAM platform growth. The rollout emphasizes data privacy for global teams. Gong’s platform crunches conversation data for actionable insights, proving Revenue AI’s pull for large-scale GTM transformation.

Key Takeaway

- In 2025, the sales automation segment led the global AI powered sales tool market with a 44.7% share, driven by demand for automated lead scoring, pipeline management, and sales forecasting.

- The cloud based segment dominated with 96.3% share, reflecting strong preference for scalable deployment, rapid updates, and seamless integration with enterprise systems.

- Large enterprises accounted for 68.9% of market demand, supported by higher sales volumes, complex customer data, and greater investment capacity.

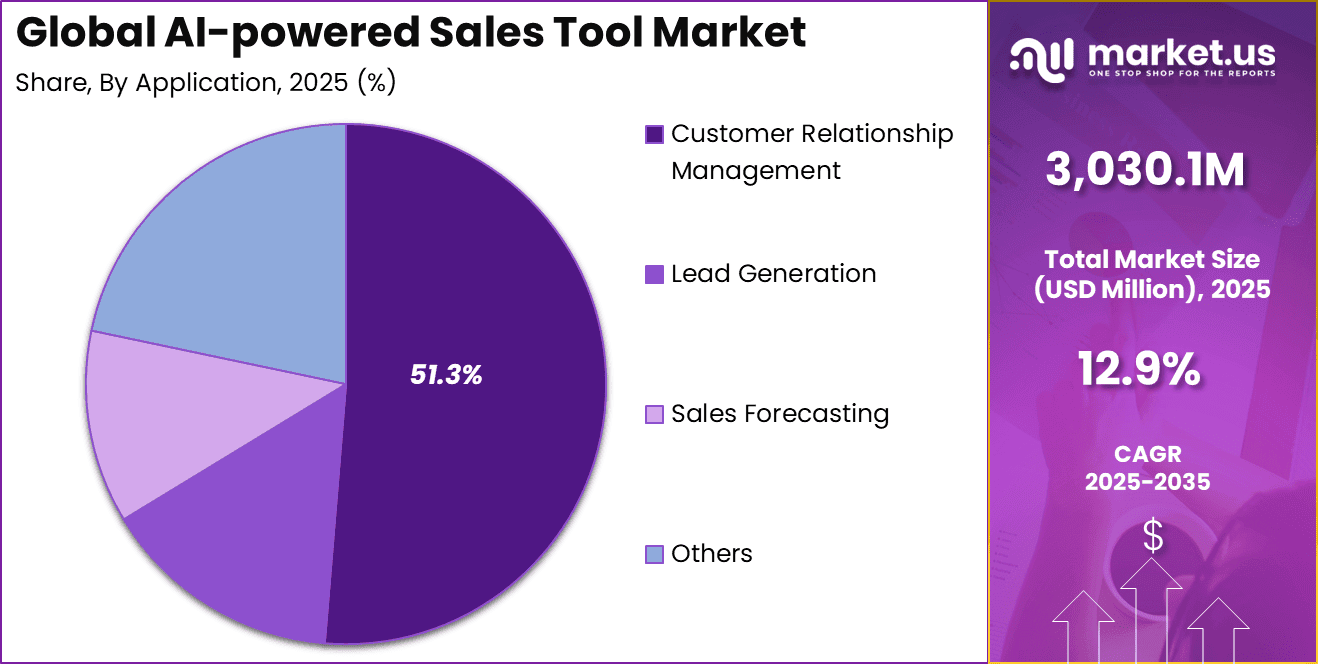

- The customer relationship management (CRM) segment held 51.3%, highlighting the central role of AI in improving customer insights, engagement, and retention.

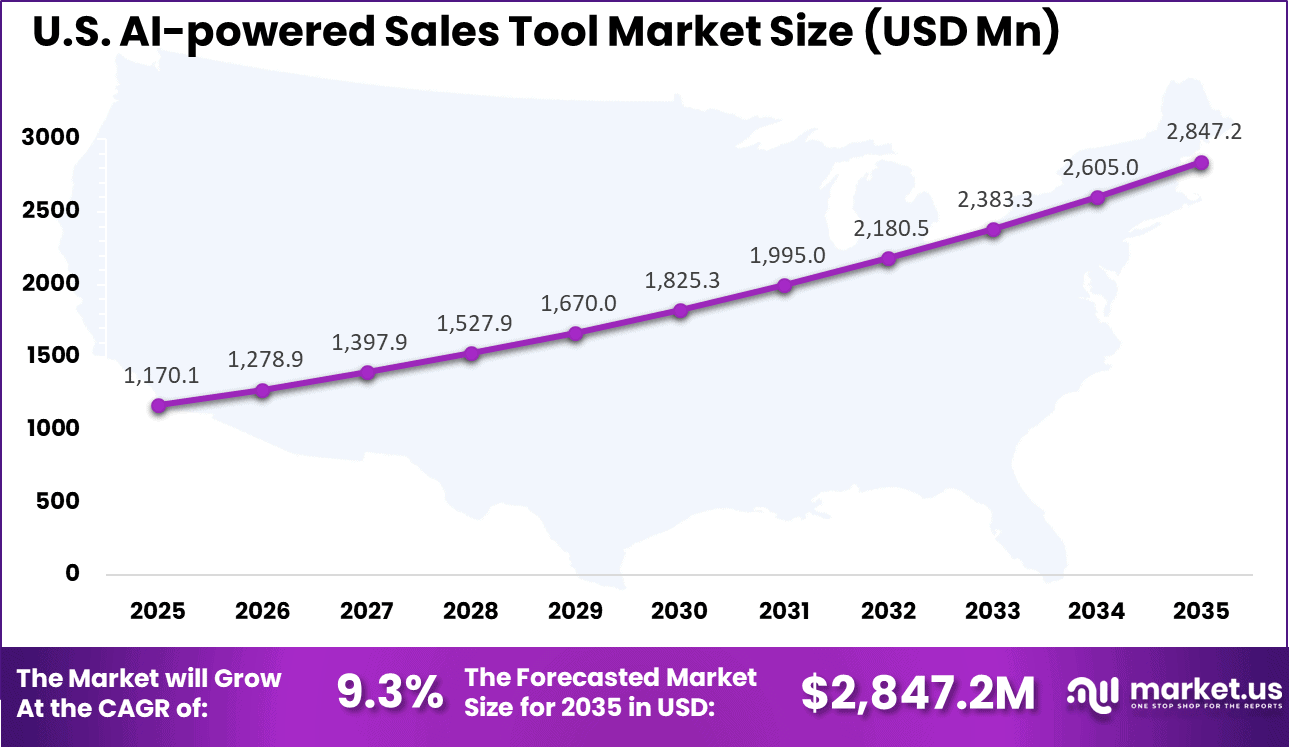

- The US market was valued at USD 1,170.1 million in 2025 and is expanding at a 9.3% CAGR, supported by widespread AI adoption in sales and marketing functions.

- North America led the global market with more than 43.1% share, driven by strong enterprise digitalization and early adoption of AI based sales technologies.

Key Insights Summary

- 81% of sales teams have already experimented with or fully deployed AI tools in their sales processes.

- Sales and marketing receive more than 50% of total corporate AI investment, making them the top funded AI functions.

- Over 56% of sales professionals use AI on a daily basis, and these users are twice as likely to exceed their sales targets.

- Early AI adoption has increased win rates by more than 30% across sales teams.

- Sales teams using AI are 1.3× more likely to report revenue growth compared with non users.

- Companies applying AI to lead prioritization report up to 50% higher revenue growth than peers.

- AI adoption has reduced sales cycle length by up to 25%, with similar reductions in deal closure time in sectors such as healthcare.

- Sales representatives save an average of 2 hours and 15 minutes per day by using AI, mainly through automation of routine tasks.

- AI can automate 30% to 40% of daily administrative work, including CRM updates and meeting documentation.

- While sales reps typically spend only 25% to 30% of their time selling, AI has the potential to double active selling time.

- Predictive lead scoring using AI improves lead to customer conversion rates by up to 28%.

- Sales forecasting accuracy reaches 90% to 98% by the second week of a quarter when AI models are applied.

- Real time AI call coaching can improve win rates by around 19%.

- 70% of employees report that their organizations do not provide formal AI training.

- About 81% of companies face data quality issues that limit AI performance and return on investment.

- 43% of marketers report uncertainty about how to extract full value from existing AI tools.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Growing adoption of AI-driven sales automation and analytics +3.8% North America, Europe Short to medium term Rising need for data-driven customer engagement and personalization +3.1% Global Medium term Expansion of CRM platforms with embedded AI capabilities +2.6% North America, Europe Medium term Increasing pressure to improve sales productivity and conversion rates +2.1% Global Short term Adoption of remote and digital-first sales models +1.3% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High implementation and integration costs for advanced AI tools -2.4% Emerging Markets Short to medium term Limited AI expertise within small and mid-sized sales teams -2.0% Asia Pacific, Latin America Medium term Data quality and integration challenges across sales systems -1.7% Global Medium term User resistance to AI-driven sales decision support -1.4% Global Short term Data privacy and compliance concerns -1.1% Europe, North America Medium to long term By Type

Sales automation represents 44.7% of total adoption within the AI powered Sales Tool Market. This segment leads due to its ability to streamline repetitive sales tasks such as lead scoring, follow ups, and pipeline management. Automation improves efficiency by reducing manual workload for sales teams.

The adoption of sales automation is also driven by the need for consistency in customer engagement. AI based tools help standardize outreach and response timing across large sales organizations. This improves conversion rates and reduces human error in the sales process.

Organizations increasingly rely on sales automation to support data driven decision making. Automated insights enable sales managers to track performance and optimize strategies in real time. These benefits continue to strengthen the position of sales automation tools.

For Instance, in October 2025, Oracle launched new AI agents in Fusion Cloud Applications for sales automation. These agents automate processes in marketing and sales, helping teams handle leads and workflows more efficiently. They analyze data to speed up tasks and improve customer outreach without manual effort.

By Deployment Mode

Cloud based deployment dominates the market with a share of 96.3%. This dominance reflects the preference for scalable and flexible infrastructure that supports remote sales operations. Cloud platforms enable seamless access to AI powered tools across locations and devices.

The shift toward cloud deployment is also influenced by lower upfront investment requirements. Organizations can deploy advanced sales tools without maintaining complex internal infrastructure. This reduces operational complexity and accelerates implementation timelines.

Continuous updates and integration capabilities further support cloud adoption. Vendors can deploy new features and security enhancements centrally. These advantages sustain cloud based deployment as the primary model in the market.

For instance, in September 2025, Microsoft expanded Dynamics 365 cloud AI with Copilot updates. This cloud deployment boosts sales forecasting and customer insights across teams. It integrates seamlessly for remote access and scales with business growth.

By Organization Size

Large enterprises account for 68.9% of total market demand by organization size. These organizations manage extensive sales teams, large customer bases, and complex sales cycles. AI powered tools help maintain efficiency and visibility across operations.

The adoption among large enterprises is driven by the need for advanced analytics and forecasting. AI tools support accurate revenue prediction and customer behavior analysis. This enables better resource allocation and strategic planning.

Enterprise wide digital transformation initiatives further reinforce adoption. Sales tools integrated with broader business systems improve alignment across departments. This maintains strong demand from large enterprises.

For Instance, in October 2025, Salesforce advanced Einstein GPT for large enterprise pipelines. It provides predictive analytics tailored for high-volume sales in big organizations. Enterprises gain from unified data views and automation at scale.

By Application

Customer relationship management applications represent 51.3% of total market usage. CRM platforms serve as the central hub for customer data, sales interactions, and performance tracking. AI enhances CRM systems by delivering predictive insights and personalized engagement. The integration of AI into CRM improves lead prioritization and customer retention strategies.

Sales teams gain deeper visibility into customer needs and buying patterns. This leads to more targeted and effective sales efforts. The widespread use of CRM across industries supports sustained demand. As organizations focus on long term customer value, AI powered CRM applications remain a key area of investment.

For Instance, in September 2025, Freshworks upgraded Freddy AI in its CRM suite. The enhancements improve lead management and customer personalization in CRM apps. Sales teams close deals quickly with real-time insights from customer data.

Regional Perspective

North America holds a leading position in the AI powered Sales Tool Market, accounting for 43.1% of total activity. The region benefits from high adoption of digital sales platforms and strong enterprise technology investment. AI integration is widely viewed as a competitive necessity.

Organizations in the region prioritize data driven sales strategies and automation. Strong cloud infrastructure and skilled workforce availability further support adoption. These factors reinforce North America’s leadership position.

For instance, in October 2025, Adobe expanded its AI agent platform with Agent Composer and AEP Agent Orchestrator for marketing and sales automation. The tools integrate real-time customer data across Experience Cloud apps to streamline workflows like audience building and journey planning, showcasing North American AI dominance in enterprise sales.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 1,170.1 Mn and a growth rate of 9.3% CAGR. Expansion is supported by widespread CRM usage and growing demand for sales efficiency. AI tools are increasingly embedded into daily sales operations.

Sales organizations in the U.S. focus on productivity improvement and customer engagement optimization. AI powered insights help manage competitive pressure and complex customer journeys. These dynamics support steady growth in the U.S. market segment.

For instance, in September 2025, HubSpot launched AI-powered features in Sales Hub, including AI-assisted meeting prep, conversation-powered deal risk identification, and new Breeze Agents for smarter sales workflows. These tools automate manual tasks, capture insights from interactions, and accelerate deal closure, reinforcing U.S. leadership in AI sales innovation.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Enterprise software and SaaS providers Very High Medium North America, Europe Strong recurring subscription revenue CRM and sales platform vendors High Medium Global Strategic AI feature expansion Cloud and AI infrastructure investors Medium Low to Medium Global Indirect but stable demand Private equity firms Medium Medium North America, Europe Consolidation and platform scaling Venture capital investors High High North America Focus on niche AI sales innovations Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Machine learning-based sales forecasting and lead scoring +3.9% Improved pipeline accuracy Global Short term Natural language processing for sales conversations +3.2% Better customer insights North America, Europe Medium term AI-driven recommendation engines for cross-sell and upsell +2.7% Revenue optimization Global Medium term Cloud-based AI sales platforms +2.1% Scalability and accessibility Global Medium to long term Integration with CRM, marketing automation, and analytics tools +1.8% Unified sales intelligence Global Long term Emerging Trends Analysis

An emerging trend in the AI-powered sales tool market is the use of conversational intelligence. Tools are increasingly analyzing sales calls and virtual meetings to extract insights on customer sentiment and objections. These insights support coaching and performance improvement. This trend enhances the role of AI in skill development, not just automation.

Another trend is the integration of AI sales tools with marketing and customer service platforms. Unified customer views improve alignment across revenue functions. This integration supports consistent messaging and smoother customer journeys. Cross functional intelligence is becoming a key differentiator.

Growth Factors Analysis

One of the key growth factors for the AI-powered sales tool market is increasing competition across industries. Organizations seek tools that improve win rates and shorten sales cycles. AI-powered insights help sales teams respond faster and more accurately to customer needs. This competitive pressure drives sustained demand.

Another growth factor is ongoing investment in artificial intelligence capabilities. Improvements in machine learning models and analytics platforms enhance tool performance and usability. As AI becomes more embedded in enterprise software, adoption of AI-powered sales tools continues to expand across sectors.

Key Market Segments

By Type

- Chatbots

- Virtual Sales Assistants

- Sales Automation

- Others

By Deployment Mode

- On-Premises

- Cloud-based

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Customer Relationship Management

- Lead Generation

- Sales Forecasting

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Large enterprise software providers such as Salesforce, Microsoft, and Oracle lead the AI-powered sales tool market through deeply integrated CRM ecosystems. Their platforms use AI for lead scoring, pipeline forecasting, and sales recommendations. Strong data integration across marketing, service, and finance improves accuracy. SAP and Adobe extend AI-driven insights into customer engagement and sales enablement.

Mid-market focused vendors such as HubSpot, Freshworks, and Zoho emphasize ease of use and fast deployment. Pipedrive and ActiveCampaign apply AI to deal prioritization and automated follow-ups. These tools are widely adopted by small and mid-sized businesses seeking productivity gains. Demand is driven by the need to shorten sales cycles and improve conversion rates.

Conversation intelligence and revenue operations specialists such as Gong.io, Chorus.ai, and Clari focus on AI-driven insights from calls, emails, and deal data. Outreach, InsideSales.com, and NICE support predictive coaching and performance optimization. Other vendors expand innovation and competitive diversity across sales automation and intelligence use cases.

Top Key Players in the Market

- HubSpot

- Freshworks

- Adobe

- Gong.io

- Microsoft

- Chorus.ai

- Zoho

- Pipedrive

- Oracle

- Clari

- SAP

- InsideSales.com

- ActiveCampaign

- NICE

- Outreach

- Salesforce

- Others

Recent Developments

- In February 2025, Pipedrive unveiled its agentic AI CRM vision with 24/7 digital agents for prospecting, task delegation, and real-time insights. Building on Pipedrive AI and Pulse (beta launch spring), it keeps sellers in control while automating routine work. Tailored for SMBs, this boosts outcomes without complexity.

- In March 2025, Microsoft launched Sales Agent and Sales Chat AI agents in 365 Copilot, integrating with Dynamics 365 and Salesforce. Sales Agent handles lead research and outreach autonomously; Sales Chat offers deal-closing plans via natural prompts. Paired with the AI Accelerator for Sales program, it’s streamlining workflows and cutting admin time for reps.

Report Scope

Report Features Description Market Value (2025) USD 3,030.1 Million Forecast Revenue (2035) USD 10,195.2 Million CAGR(2025-2035) 12.9% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Chatbots, Virtual Sales Assistants, Sales Automation, Others), By Deployment Mode (On-Premises, Cloud-based), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Application (Lead Generation, Customer Relationship Management, Sales Forecasting, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HubSpot, Freshworks, Adobe, Gong.io, Microsoft, Chorus.ai, Zoho, Pipedrive, Oracle, SAP, InsideSales.com, ActiveCampaign, NICE, Outreach, Salesforce, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-powered Sales Tool MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-powered Sales Tool MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- HubSpot

- Freshworks

- Adobe

- Gong.io

- Microsoft

- Chorus.ai

- Zoho

- Pipedrive

- Oracle

- Clari

- SAP

- InsideSales.com

- ActiveCampaign

- NICE

- Outreach

- Salesforce

- Others