Global AI-Powered Cognitive Search Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud-based), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (BFSI, Healthcare, Retail and E-commerce, Media and Entertainment, IT and Telecommunications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174393

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Key Insights Summary

- By Component

- By Deployment Mode

- By Enterprise Size

- By End-User

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

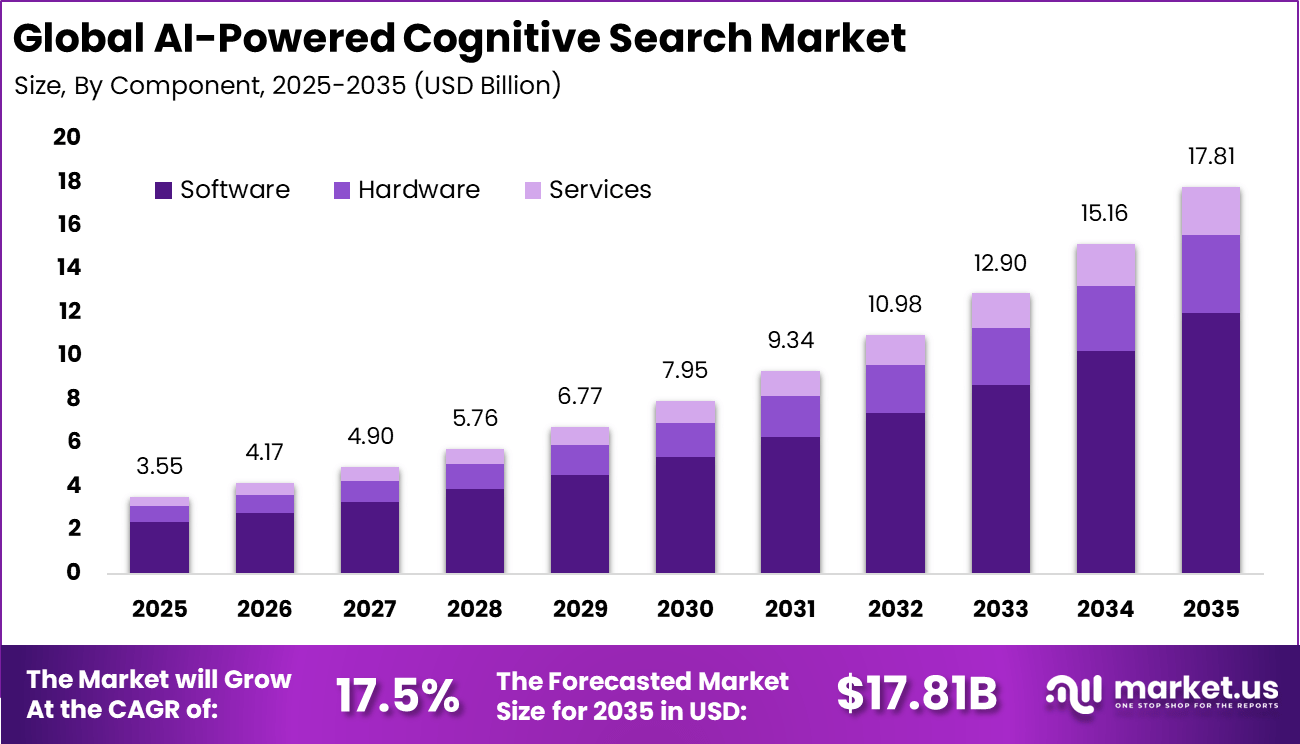

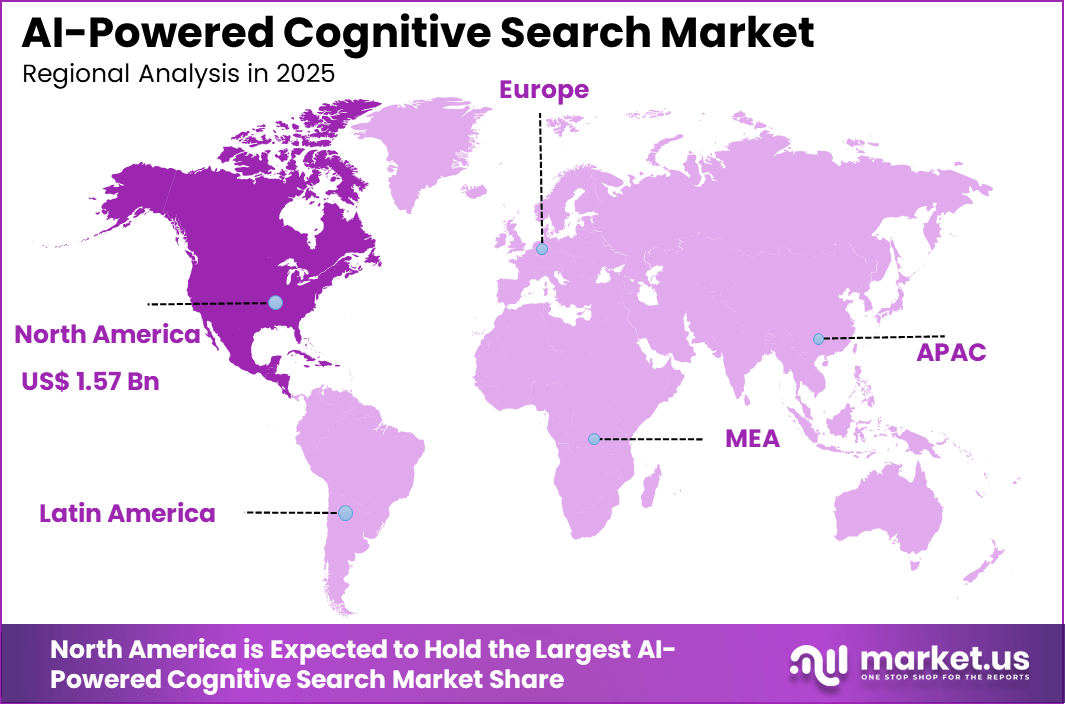

The Global AI-Powered Cognitive Search Market size is expected to be worth around USD 17.81 billion by 2035, from USD 3.55 billion in 2025, growing at a CAGR of 17.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 44.3% share, holding USD 1.57 billion in revenue.

The AI powered cognitive search market refers to search solutions that use artificial intelligence to understand user intent, context, and meaning rather than relying only on keyword matching. These platforms analyze structured and unstructured data such as documents, emails, images, and databases to deliver relevant search results. Cognitive search tools are used across enterprises, healthcare organizations, legal firms, financial institutions, and digital platforms.

One major driving factor of the AI powered cognitive search market is the need to improve knowledge access across organizations. Employees spend significant time searching for relevant information across multiple systems. Cognitive search tools reduce this effort by delivering context-aware results. Improved access enhances productivity and operational efficiency. Another key driver is rising adoption of digital workplaces and enterprise collaboration tools.

For instance, in March 2025, Lucidworks secured $100 million from Francisco Partners and TPG Sixth Street Partners to accelerate its AI-powered search platform growth. Funds target expansion in generative AI and relevance tuning. This cash infusion signals strong investor confidence in Lucidworks’ ability to handle complex enterprise search needs.

Demand for AI powered cognitive search solutions is influenced by the expansion of unstructured data. Documents, images, audio files, and emails form a major share of enterprise data. Traditional databases struggle to organize and retrieve such information effectively. Cognitive search addresses this challenge by extracting meaning from diverse content types. Demand is also shaped by customer experience and service requirements. Enterprises use cognitive search to support customer service agents and self-service portals.

Key Takeaway

- Software led the market by component with a 67.5% share, as organizations favored advanced search platforms that combine natural language processing, semantic understanding, and contextual relevance.

- Cloud based deployment dominated with a 72.6% share, reflecting strong demand for scalable infrastructure, faster implementation, and easier integration with enterprise data sources.

- Large enterprises represented the core user base with an 84.4% share, driven by complex information environments and the need to search across vast volumes of structured and unstructured data.

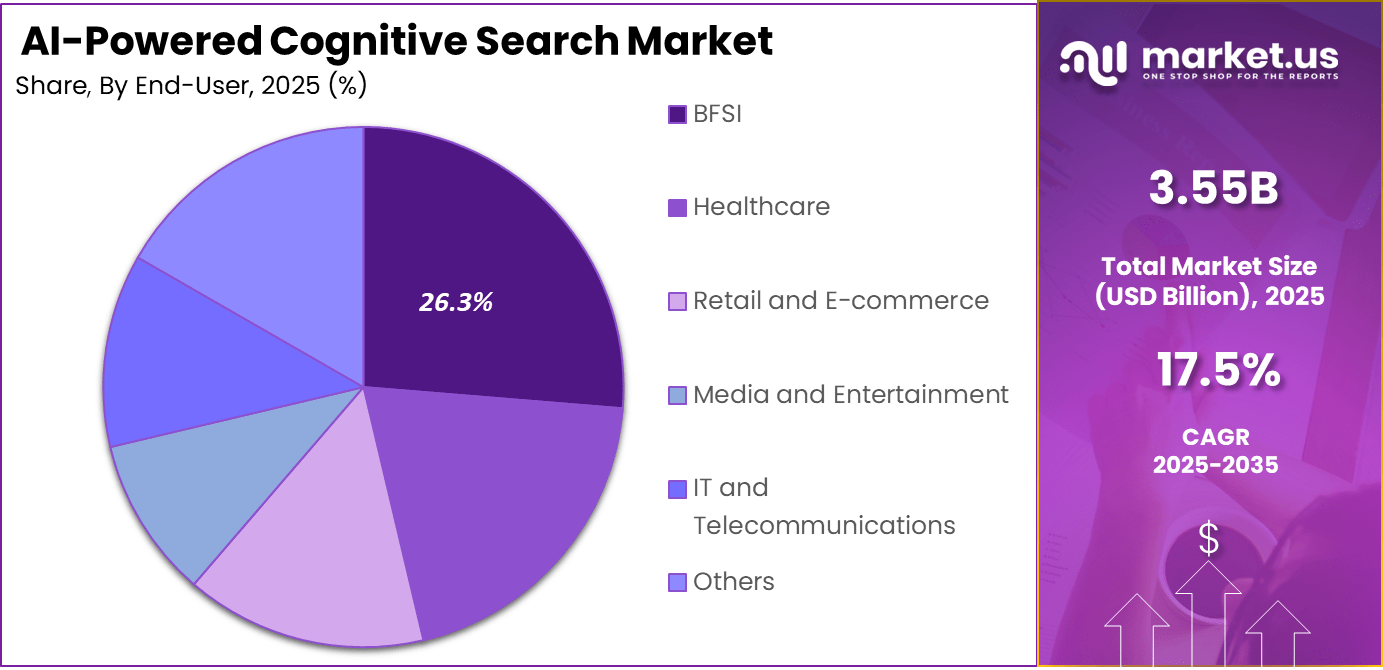

- The BFSI sector accounted for 26.3% of end user adoption, supported by use cases such as customer support automation, risk analysis, and compliance driven knowledge retrieval.

- North America held a leading 44.3% share, backed by early AI adoption, strong enterprise IT spending, and a mature data management ecosystem.

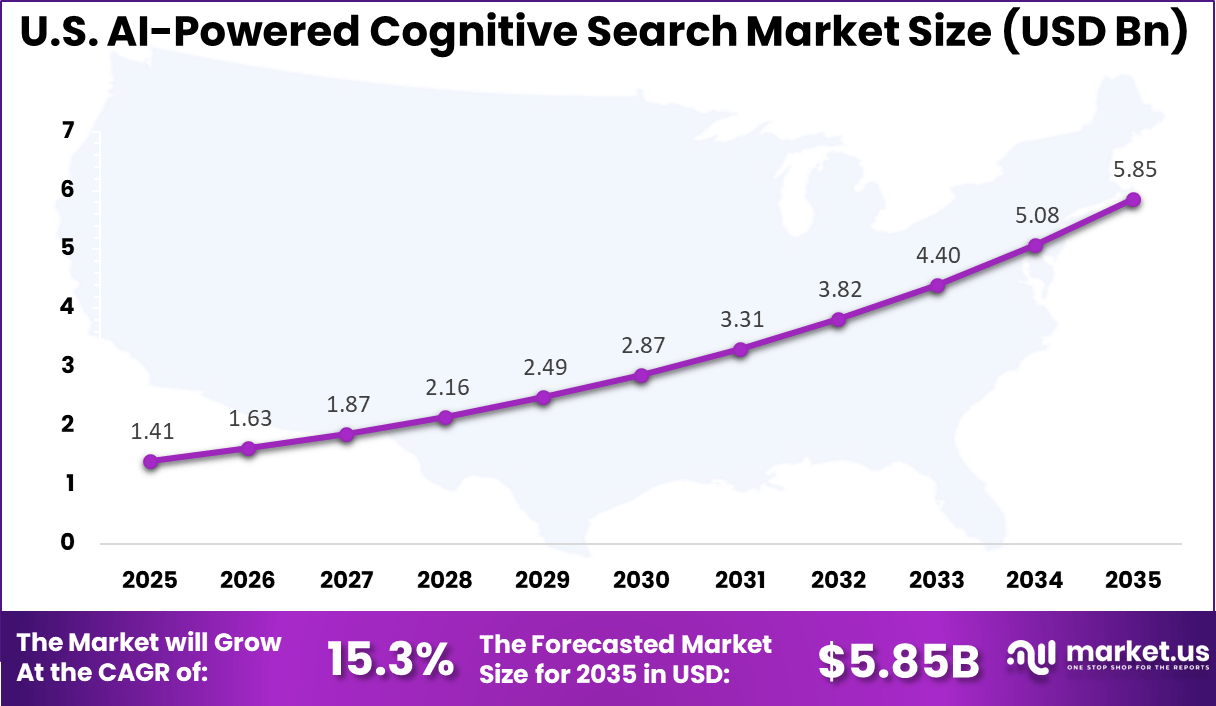

- The U.S. market reached USD 1.41 billion, expanding at a steady 15.3% growth rate, supported by increasing reliance on AI driven search for enterprise productivity and decision support.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Explosion of enterprise data Need for intelligent information retrieval ~4.1% Global Short Term Digital transformation in BFSI Faster access to risk and customer data ~3.7% North America, Europe Short Term Demand for improved employee productivity Reduced search time across repositories ~3.2% Global Mid Term Adoption of AI-driven analytics Context-aware and semantic search ~3.0% Global Mid Term Growth of compliance requirements Accurate document discovery and audit trails ~2.4% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data privacy and security risks Handling of sensitive enterprise data ~4.3% North America, Europe Short Term Integration complexity Connecting multiple legacy systems ~3.6% Global Mid Term Model accuracy limitations Irrelevant or biased search results ~3.0% Global Mid Term Regulatory uncertainty Data usage and AI governance rules ~2.5% Europe, North America Mid Term Skills shortage Limited AI and search expertise ~2.0% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High implementation cost Enterprise-scale deployment expenses ~4.6% Emerging Markets Short to Mid Term Legacy data silos Poor data quality and fragmentation ~3.8% Global Mid Term Change management challenges User resistance to new search systems ~3.1% Global Mid Term Customization complexity Industry-specific search tuning ~2.4% Global Long Term Unclear ROI measurement Difficulty quantifying productivity gains ~1.9% Global Long Term Key Insights Summary

Operational Impact and Efficiency Insights

- Discoverability and user satisfaction improved notably after adoption, as organizations reported a 35% increase in user satisfaction and a 28% improvement in content discoverability through cognitive search platforms.

- Time efficiency gains were substantial, with enterprise case studies showing that cognitive search reduced information discovery time by about 50%. This improvement directly supported faster decision making and higher employee productivity.

- User retention risks remained high with traditional search experiences, as nearly 53% of users abandoned a website if relevant information was not found within three seconds. This reinforced the value of intelligent, context aware search.

- Session level effectiveness increased on consumer facing platforms, where an estimated 92% to 94% of AI powered search sessions delivered answers directly without requiring users to navigate to additional pages.

Sector Specific Adoption Patterns

- Healthcare emerged as the fastest growing vertical, expanding at a 18.12% pace. Cognitive search was increasingly used to extract insights from unstructured clinical records, research publications, and medical data repositories.

- Enterprise data growth accelerated, with global enterprise data volumes rising by roughly 42% each year. This growth increased reliance on AI based tools capable of searching across text, video, and audio formats at scale.

- Business integration deepened, as by 2026 around 72% of organizations used AI in at least one business function. Cognitive search became a foundational component of broader digital transformation strategies.

- Implementation and Success Considerations

- Return on investment challenges persisted, as 70% to 85% of generative AI initiatives struggled to fully meet ROI expectations. Trust concerns and employee resistance to change were identified as key limiting factors.

- Workforce readiness remained limited, with only 29% of companies reporting that at least a quarter of their workforce was skilled in AI and generative AI tools.

- Organizational factors played a decisive role in outcomes. Industry observations suggested that only 10% of success depended on algorithms and 20% on data and infrastructure, while the remaining 70% relied on people, culture, and change management practices.

By Component

Software accounts for 67.5%, highlighting its central role in AI-powered cognitive search solutions. Software platforms enable intelligent indexing, search, and retrieval of large data sets. These solutions process structured and unstructured information efficiently. Advanced algorithms improve relevance and accuracy of search results. Organizations rely on software for continuous knowledge access.

The dominance of software is driven by the growing complexity of enterprise data. Businesses manage documents, emails, and databases across systems. Software solutions integrate search capabilities into workflows. Automation reduces manual effort in information discovery. This sustains strong demand for software components.

By Deployment Mode

Cloud-based deployment holds 72.6%, reflecting strong preference for scalable infrastructure. Cloud platforms allow organizations to deploy cognitive search quickly. Centralized access supports collaboration across teams. Cloud environments reduce maintenance overhead. Flexibility remains a key advantage.

Adoption of cloud-based deployment is driven by digital transformation initiatives. Enterprises operate across distributed environments. Cloud deployment supports rapid updates and improvements. Secure access controls enhance data protection. This keeps cloud-based models widely adopted.

By Enterprise Size

Large enterprises represent 84.4%, making them the primary adopters of cognitive search solutions. These organizations manage vast volumes of information daily. Cognitive search improves knowledge discovery across departments. Centralized systems support governance and compliance. Scale requires reliable search capabilities.

Adoption among large enterprises is driven by productivity needs. Employees require fast access to accurate information. Cognitive search reduces time spent searching manually. Integration with enterprise platforms improves efficiency. This sustains strong enterprise adoption.

By End-User

The BFSI sector accounts for 26.3%, making it a key end-user industry. Financial institutions manage large amounts of sensitive data. Cognitive search supports document retrieval and compliance checks. Accurate information access improves decision-making. Security remains a priority.

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity BFSI Compliance documents and customer insights 26.3% Advanced IT and software Developer and knowledge search 23.8% Advanced Healthcare Clinical and research data discovery 18.9% Developing Manufacturing Engineering and process documentation 16.4% Developing Government Secure public records search 14.6% Developing Growth in this sector is driven by regulatory requirements. BFSI organizations rely on structured knowledge management. Cognitive search improves audit readiness. Automation reduces operational risk. This sustains steady adoption in the BFSI industry.

By Region

North America accounts for 44.3%, supported by strong adoption of enterprise AI solutions. Organizations in the region invest in intelligent data management tools. Cloud infrastructure maturity supports deployment. Knowledge-driven operations increase demand. The region remains a major contributor.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Early enterprise AI adoption 44.3% USD 1.57 Bn Advanced Europe Compliance-driven content discovery 27.6% USD 0.98 Bn Advanced Asia Pacific Rapid enterprise digitization 20.4% USD 0.72 Bn Developing to Advanced Latin America Modernization of enterprise IT 4.5% USD 0.16 Bn Developing Middle East and Africa Early AI-enabled search deployment 3.2% USD 0.11 Bn Early

The United States reached USD 1.41 Billion with a CAGR of 15.3%, reflecting healthy market growth. Expansion is driven by enterprise digitization. Cognitive search adoption improves operational efficiency. Demand for AI-driven insights continues to rise. Market momentum remains steady.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior BFSI enterprises Very High ~26.3% Risk, compliance, and customer insights Platform-wide deployment Large enterprises High ~31% Knowledge management efficiency Phased rollout Technology providers High ~18% AI platform expansion R&D focused Government organizations Moderate ~15% Secure information access Program-based SMEs Low to Moderate ~10% Cost-sensitive automation Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Natural language processing Semantic and contextual search ~4.6% Mature Machine learning algorithms Relevance ranking and learning ~3.9% Growing Knowledge graphs Relationship-based discovery ~3.1% Growing Cloud-based AI platforms Scalable search processing ~2.7% Mature Security and access controls Role-based information governance ~2.1% Developing Opportunity Analysis

Emerging opportunities in the AI-powered cognitive search market are linked to its expanding applicability across sectors that rely heavily on knowledge discovery and contextual information retrieval. Organisations in healthcare, financial services, education, and customer support can benefit from search systems that personalise results, interpret natural language queries, and provide insights from unstructured data such as documents, images, and multimedia.

The ability to integrate semantic search with advanced analytics creates value by enhancing user experience, accelerating research workflows, and supporting digital transformation initiatives. Adoption in enterprise knowledge management and virtual assistants presents further avenues for growth as businesses seek to harness cognitive search to improve productivity and data usability.

Challenge Analysis

A central challenge confronting the AI-powered cognitive search market is balancing advanced AI capabilities with interpretability, performance, and user trust. While cognitive search systems aim to deliver highly relevant and contextually rich results, the underlying algorithms and AI components must be transparent and understandable to users and administrators.

Inaccurate interpretation of queries or misalignment with user intent can reduce confidence in search outcomes. Ensuring robust data privacy, managing bias in AI models, and maintaining high performance at scale across multilingual and multimodal content further complicate deployment. Addressing these technical and governance issues requires ongoing refinement of AI models and close attention to user experience design.

Emerging Trends

Emerging trends within the AI-powered cognitive search landscape include the integration of natural language understanding and vector-based semantic retrieval to improve relevance and context recognition in search results. Systems increasingly support hybrid search models that combine traditional indexing with AI-driven interpretation of user intent, enabling more accurate results over diverse data types, including text, images, and structured records.

Another trend is the use of personalisation techniques that tailor search responses based on user behaviour and preferences, which enhances productivity and satisfaction for both enterprise users and customers. Organisations are also exploring cognitive search integration with conversational AI and virtual assistant platforms to support more intuitive query interfaces and faster access to knowledge.

Growth Factors

Growth in the AI-powered cognitive search market is strongly influenced by the exponential increase in digital data and the resulting need for intelligent search tools that can handle complex, unstructured information. Traditional search solutions often struggle to process large volumes of diverse data efficiently, while AI-driven cognitive search provides improved accuracy and contextual understanding.

Continued advancements in artificial intelligence, natural language processing, and machine learning expand the capabilities of cognitive search platforms, making them more attractive to organisations seeking to unlock actionable insights from their data. Additionally, demand for enhanced user experience and faster information retrieval in both enterprise applications and customer-centric platforms supports sustained investment in cognitive search technologies.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-based

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- BFSI

- Healthcare

- Retail and E-commerce

- Media and Entertainment

- IT and Telecommunications

- Others

Key Players Analysis

One of the leading players in May 2025, IBM partnered with Lumen Technologies to integrate WatsonX AI with edge cloud infrastructure, delivering real-time AI inferencing for enterprise cognitive search applications. This collaboration tackles latency and security hurdles, enabling faster data processing at the source. It’s a smart move for businesses handling massive data volumes, showing how established players keep innovating to stay ahead.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- SAP SE

- Oracle Corporation

- Sinequa

- Lucidworks

- Elastic N.V.

- Coveo Solutions Inc.

- Attivio, Inc.

- Mindbreeze GmbH

- BA Insight

- Others

Recent Developments

- In November 2025, Microsoft rolled out Azure AI Search 2025-11-01-preview API with agentic retrieval and scoring function aggregation. These updates boost relevance through parallel subquery processing and weighted signal combination. Developers love the flexibility for building sophisticated conversational search experiences powered by proprietary data.

- In October 2025, Oracle launched Autonomous AI Lakehouse at AI World 2025, blending AI Vector Search with Apache Iceberg for seamless cognitive querying across multi-cloud data. The platform speeds up large-scale analytics with the Data Lake Accelerator. It’s practical for enterprises wanting unified AI-ready data without migration headaches.

Report Scope

Report Features Description Market Value (2025) USD 3.5 Bn Forecast Revenue (2035) USD 17.8 Bn CAGR(2025-2034) 17.5% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud-based), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (BFSI, Healthcare, Retail and E-commerce, Media and Entertainment, IT and Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, Inc., SAP SE, Oracle Corporation, Sinequa, Lucidworks, Elastic N.V., Coveo Solutions Inc., Attivio, Inc., Mindbreeze GmbH, BA Insight, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Cognitive Search MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Cognitive Search MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- SAP SE

- Oracle Corporation

- Sinequa

- Lucidworks

- Elastic N.V.

- Coveo Solutions Inc.

- Attivio, Inc.

- Mindbreeze GmbH

- BA Insight

- Others