Global AI Lighting Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning, Natural Language Processing (NLP), Machine Vision, Generative AI), By Connectivity (Wired, Wireless), By Application (Indoor, Outdoor), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163503

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Growth and Adoption

- Role of Generative AI

- Investment and Business Benefits

- U.S. AI Lighting Market Size

- Component Analysis

- Technology Analysis

- Connectivity Analysis

- Application Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

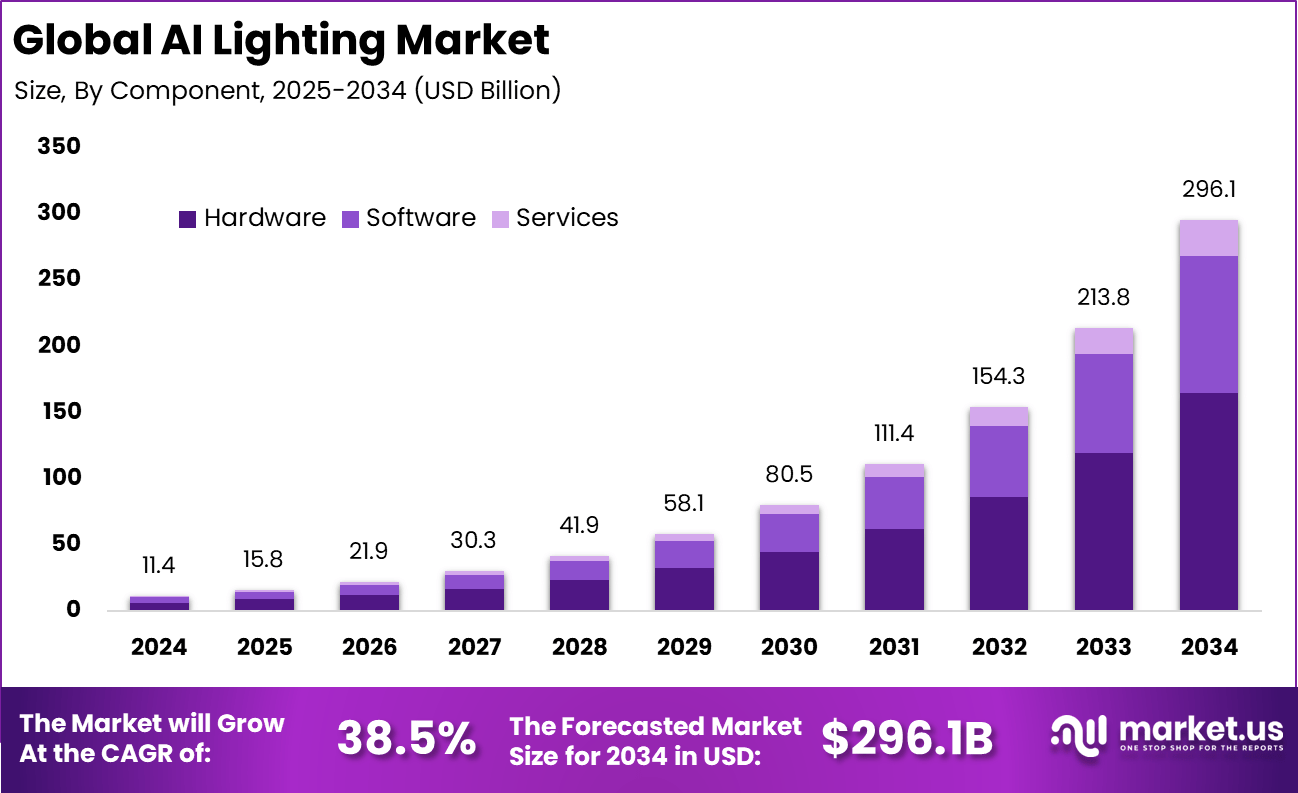

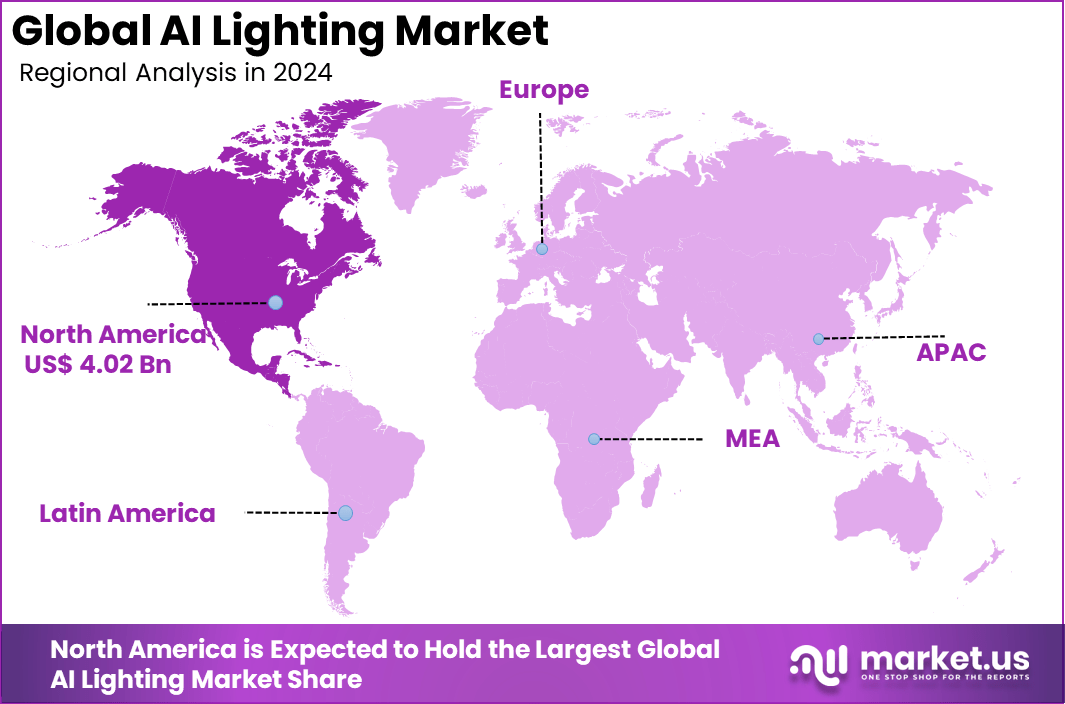

The Global AI Lighting Market size is expected to be worth around USD 296.1 billion by 2034, from USD 11.4 billion in 2024, growing at a CAGR of 38.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.3% share, holding USD 4.02 billion in revenue.

The AI lighting market refers to the integration of artificial intelligence technologies with lighting systems to create smarter, more efficient, and adaptive illumination solutions. These AI-powered lighting systems use sensors, machine learning algorithms, and real-time data analytics to automatically adjust lighting based on factors such as occupancy, ambient light, and user preferences.

This innovation is transforming traditional lighting by enhancing energy efficiency, user comfort, and operational intelligence in residential, commercial, and urban environments. Top driving factors for the AI lighting market include rising energy costs, strong regulatory support, and an emphasis on reducing carbon footprints. Many countries have introduced policies that incentivize energy-efficient lighting, pushing users to upgrade from traditional systems.

Moreover, the ongoing push for smart city development fuels large-scale adoption of AI-integrated lighting in public spaces, contributing significantly to market expansion. Another key driver is the enhanced user experience that adaptive lighting provides, such as improved mood and productivity through human-centric lighting designs tailored to biological rhythms. Demand for AI lighting is rising sharply in both residential and commercial sectors.

Residential users are drawn to smart bulbs and fixtures that adapt color temperature and brightness according to time of day or mood, enhancing well-being and convenience. On the commercial side, offices and retail stores adopt AI lighting to reduce energy costs and meet sustainability targets, with studies showing productivity gains of up to 18% when lighting supports natural circadian rhythms.

For instance, in January 2025, Verizon introduced AI Connect, its AI strategy and service suite aimed at managing resource-intensive AI applications, including in lighting and smart infrastructure. Verizon’s network and edge compute services support AI-driven lighting operations for enterprises and cities, positioning Verizon as a foundational player in AI ecosystems.

Key Takeaway

- The Hardware segment dominated with 55.8%, driven by strong adoption of AI-enabled sensors, smart bulbs, and intelligent control systems.

- Deep Learning technology held 38.7%, reflecting its growing use in predictive illumination, occupancy detection, and adaptive lighting environments.

- The Wired segment accounted for 58.7%, supported by demand for stable and high-performance connectivity in large-scale commercial and industrial lighting systems.

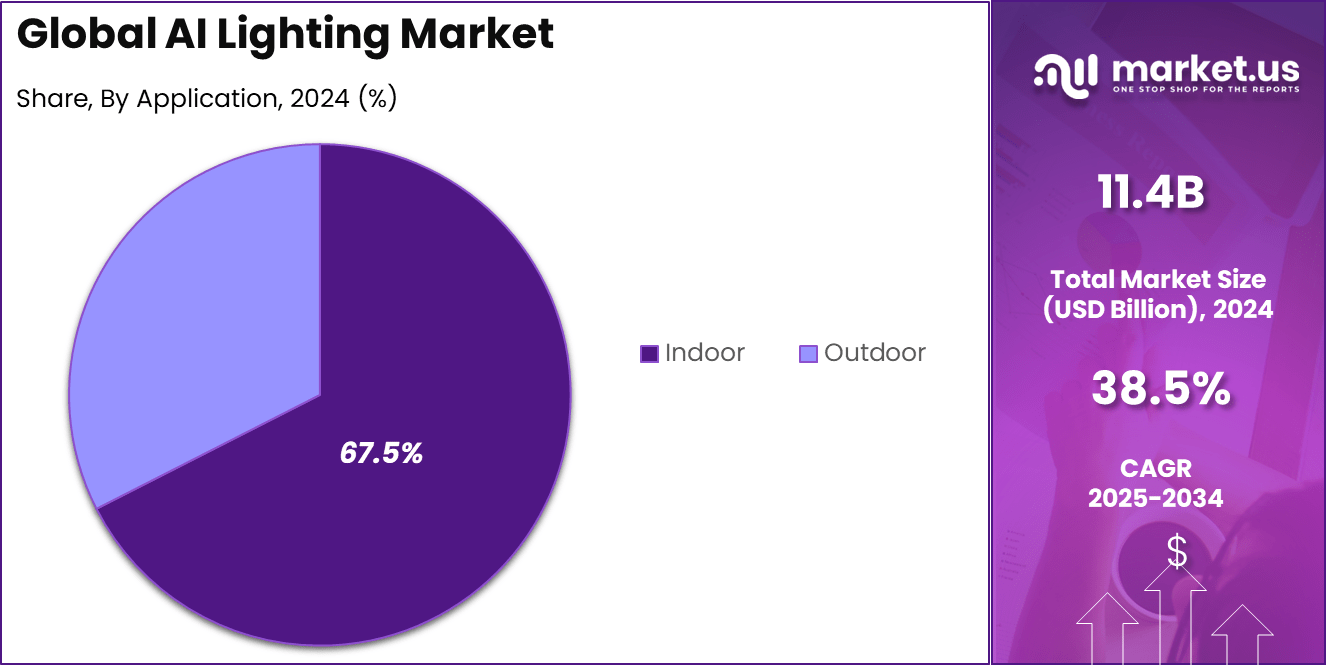

- Indoor applications led with 67.5%, fueled by smart building projects and energy-efficient lighting automation in homes, offices, and retail spaces.

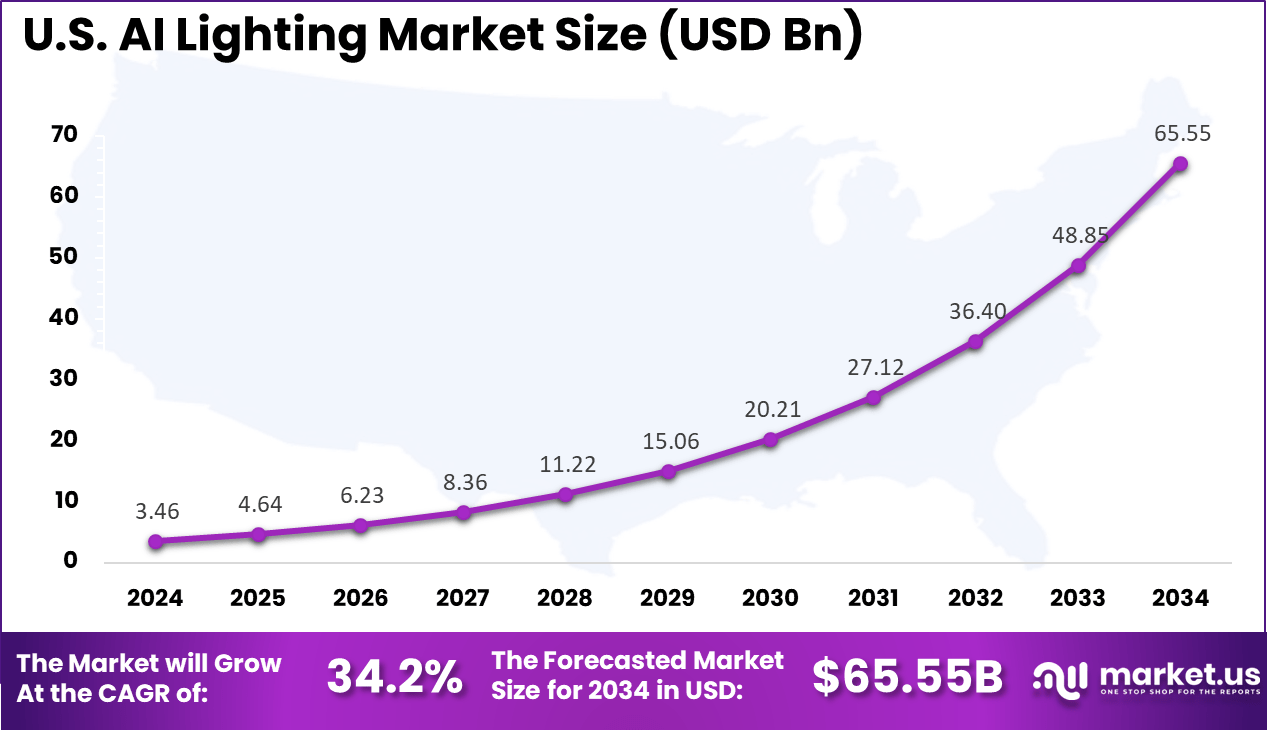

- The US market reached USD 3.46 Billion in 2024, expanding at a robust 34.2% CAGR, driven by smart city development and advanced lighting control infrastructure.

- North America captured 35.3% of the global market, supported by high IoT penetration, sustainability initiatives, and rapid AI integration in building automation systems.

Growth and Adoption

- Energy efficiency and cost savings: AI-driven lighting systems have shown strong potential in reducing energy use. Adaptive controls based on occupancy and daylight can cut consumption by up to 50% compared with traditional systems. Some advanced platforms claim even greater reductions, reaching as high as 80%. These efficiency gains support broader sustainability targets by lowering both energy demand and greenhouse gas emissions.

- AI’s energy footprint: While AI contributes to efficiency at the end-user level, the infrastructure supporting it requires significant power. Data center electricity consumption was estimated at 415 terawatt-hours (TWh) in 2024 and is projected to more than double to about 945 TWh by 2030. Much of this growth will come from the United States and China, which are expected to account for the largest share of rising demand.

Role of Generative AI

Generative AI is playing an increasingly important role in the AI lighting market by enabling advanced automation and customization. It helps create smart lighting systems that learn and adapt to user preferences and environmental conditions, improving both energy efficiency and user experience.

Recent data shows that over 50% of marketers are already utilizing generative AI, which is an indicator of its growing adoption in smart technologies, including lighting. These AI models enable lighting systems to generate personalized lighting scenarios, optimize energy consumption, and improve predictive maintenance, reducing downtime by up to 40%.

The integration of generative AI allows smart lighting to respond to immediate inputs and also anticipate future needs by analyzing patterns in occupancy, daylight availability, and user behavior. This capability makes lighting more intuitive and human-centric, enhancing comfort and productivity in residential and commercial spaces.

The smart lighting market is experiencing a surge in adoption of such AI-enabled systems, contributing to a projected growth rate of over 16% annually, demonstrating how generative AI drives value through innovation and efficiency.

Investment and Business Benefits

Investment potential is significant as AI lighting intersects with growing smart city projects, green building initiatives, and expanding smart home markets. Companies developing AI algorithms, sensor technologies, and IoT platforms stand to benefit.

Infrastructure modernization efforts worldwide offer substantial capital deployment opportunities, while consumer electronics firms integrating AI lighting into their portfolios may tap rising demand. The drive toward carbon neutrality and government energy regulations also supports long-term investment in AI-driven lighting innovations.

Businesses benefit from AI lighting through improved operational efficiency, cost reductions, and stronger sustainability credentials. These solutions extend the lifecycle of lighting systems by enabling proactive maintenance that detects issues early. Energy savings realized over time contribute to healthier profit margins.

Additionally, AI lighting enhances building value by offering modern, tech-enabled environments that appeal to tenants and customers. Sustainability gains support for company branding and meets growing stakeholder demands for environmentally responsible practices.

U.S. AI Lighting Market Size

The market for AI Lighting within the U.S. is growing tremendously and is currently valued at USD 3.46 billion, the market has a projected CAGR of 34.2%. The market is growing due to the increasing adoption of energy-efficient and smart lighting systems that integrate AI and IoT technologies. Consumers and businesses are driving demand for lighting solutions that offer real-time control, automation, and personalized user experiences.

Additionally, government policies promoting sustainability and smart city initiatives are encouraging investments in AI lighting. The rise of smart buildings, coupled with cost reductions in LED and sensor technologies, further supports the expanding market. These factors combine to create strong momentum for AI lighting adoption across commercial, residential, and public sectors.

For instance, in October 2025, Honeywell International unveiled advanced AI-powered building management solutions designed to optimize lighting, energy use, and security within commercial buildings. Their Honeywell Forge IoT platform integrates lighting with predictive analytics to significantly enhance operational efficiency and cut downtime.

In 2024, North America held a dominant market position in the Global AI Lighting Market, capturing more than a 35.3% share, holding USD 4.02 billion in revenue. This dominance is due to widespread adoption of smart lighting solutions in new residential and commercial construction, fueled by evolving building codes and consumer demand for energy-efficient, intelligent lighting.

The region’s emphasis on green building certifications, such as LEED and WELL, has further boosted smart lighting integration in office complexes, healthcare, and educational facilities. Additionally, North America’s advanced technological infrastructure, strong government incentives for energy efficiency, and significant investments in smart city projects accelerate market growth.

Leading companies continuously innovate to enhance lighting hardware and control systems, while growing awareness of sustainability motivates faster adoption in both retrofit and new installations across urban and suburban areas. These factors collectively maintain North America’s dominant market position.

For instance, in September 2025, Itron Inc. formed a joint marketing agreement with Current Lighting Solutions to deliver a combined smart streetlight solution. This partnership merges Itron’s intelligent controls with Current’s high-efficiency LED fixtures, helping cities optimize lighting performance, reduce energy waste, and improve safety.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 55.8% share of the Global AI Lighting Market. This dominance is due to the essential role hardware components, such as sensors, LED drivers, and luminaires, play in the system. These physical parts enable the practical implementation of AI technologies by capturing and responding to environmental data, which is crucial for adaptive lighting control.

Moreover, the increasing use of advanced sensors like occupancy and ambient light sensors adds to the value of hardware in smart lighting. These components help create energy-efficient and user-friendly lighting solutions that enhance the overall experience. The demand for smart switches and dimmers, which allow remote and voice-controlled adjustments, further fuels this hardware-driven growth.

For Instance, in September 2025, Acuity Brands Lighting was recognized for its innovative lighting solutions, including precision spot and high bay LED luminaires, which showcase advancements in hardware components that enable smart lighting functionality. These solutions emphasize improved light control and quality, highlighting the critical role of hardware in delivering intelligent and efficient lighting systems.

Technology Analysis

In 2024, the Deep Learning segment held a dominant market position, capturing a 38.7% share of the Global AI Lighting Market. This technology allows lighting systems to interpret complex patterns like occupancy and natural light variations, enabling automatic and intelligent lighting adjustments. These smart systems optimize energy use and improve comfort by learning user habits and environmental changes over time.

This increasing adoption of deep learning in lighting reflects its ability to make real-time, precise decisions for improved lighting management. By powering features like predictive adjustments and adaptive brightness control, deep learning enhances both energy efficiency and user satisfaction in various lighting applications.

For instance, in July 2025, Signify announced a partnership with Origin AI to develop next-generation smart home lighting systems leveraging deep learning capabilities. Their AI assistant personalizes lighting scenes based on user preferences, enhancing both convenience and energy efficiency.

Connectivity Analysis

In 2024, The Wired segment held a dominant market position, capturing a 58.7% share of the Global AI Lighting Market. This dominance is due to its offering reliable and secure communication necessary for larger lighting installations. Protocols such as DALI and Power over Ethernet are commonly used to connect multiple devices in commercial and industrial settings, ensuring consistent and uninterrupted lighting control.

The preference for wired systems in key environments like office buildings and shopping centers is driven by their ability to handle high data loads and maintain security. While wireless solutions grow in popularity, wired networks remain the backbone for extensive AI lighting deployments that require stability and robustness.

For Instance, in September 2025, Itron partnered with Current Lighting Solutions to provide smart streetlight systems combining Itron’s advanced management controls with Current’s LED luminaires. Their solution uses wired communication protocols like DALI to ensure stable, reliable control and energy efficiency in urban lighting infrastructure.

Application Analysis

In 2024, The Indoor segment held a dominant market position, capturing a 67.5% share of the Global AI Lighting Market. This dominance is due to growing demand across commercial offices, homes, and industrial facilities, where intelligent lighting can significantly impact productivity and comfort.

AI-powered indoor lighting dynamically adjusts brightness and color based on occupancy and time of day, making it highly efficient and user-centric. The indoor segment benefits from the integration of smart lighting with building management systems, supporting enhanced energy savings and better user environments.

For Instance, in January 2025, Signify rolled out new AI-powered personal lighting features within the Philips Hue ecosystem, designed to enhance indoor residential and commercial spaces with customizable lighting atmospheres responding to mood and activities.

Emerging trends

Human-centric lighting is gaining attention, where lighting adjusts color and intensity to support health by syncing with our natural daily rhythms. Buildings now feature lighting that mimics daylight during working hours and shifts to softer tones in the evening to promote relaxation.

Research shows that such lighting can improve productivity and well-being by helping regulate sleep and mood better than fixed lighting solutions. Another trend is predictive maintenance powered by AI, which monitors system health and predicts failures before they happen, reducing downtime by nearly 40%.

Also growing rapidly is the integration of AI and IoT to create fully connected lighting ecosystems. These systems communicate with other devices and react instantly to environmental changes like room occupancy or ambient daylight.

This technology supports smart city initiatives where streetlights adjust automatically to pedestrian and traffic flows, saving up to 70% in energy costs compared to traditional systems. The move toward interconnectivity makes lighting smarter, easier to control, and more energy efficient.

Growth Factors

Energy savings remain a core factor pushing AI lighting adoption. LED lighting already cuts energy use by roughly 70% compared to older technology, and combining it with AI-driven control systems multiplies these savings by adjusting light only when needed.

Increasing urbanization and public infrastructure development also expand the demand for energy-efficient lighting solutions. Consumers’ growing preference for smart systems in homes and workplaces that promise convenience and reduced utility bills drives further market growth. Adoption of IoT and data analytics enables smart lighting to be more responsive and user-friendly.

By linking lighting to sensors and apps, users gain precise control and can automate adjustments based on real conditions and preferences. Additionally, global policy shifts toward sustainability and regulations supporting energy efficiency encourage stakeholders to invest in advanced lighting solutions. These combined factors foster innovation and a shift away from traditional lighting to smarter, greener alternatives.

Key Market Segments

By Component

- Hardware

- Lamp

- Luminaire

- Software

- Services

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing (NLP)

- Machine Vision

- Generative AI

By Connectivity

- Wired

- Wireless

By Application

- Indoor

- Residential

- Commercial

- Outdoor

- Highways and Roadways

- Architectural

- Others

Drivers

Increasing Demand for Energy Efficiency

The market is growing due to rising demand for energy-efficient lighting solutions. AI-enabled systems use smart sensors and algorithms to adjust lighting levels based on occupancy and natural light, which minimizes unnecessary power usage. This results in significant energy savings and cost reduction for both commercial and residential users, making AI lighting an attractive choice.

Moreover, AI lighting extends the lifespan of fixtures by preventing overuse and enabling predictive maintenance. Consumers and businesses are increasingly adopting these solutions to meet sustainability goals and reduce utility bills, driving steady market growth.

For instance, in October 2025, Acuity Brands Lighting launched an advanced LED horticulture lighting solution designed to offer precise energy management and improved lifecycle efficiency. Their digital lighting networks include AI-driven controls that optimize outdoor lighting usage, further reducing energy consumption and operational costs.

Restraint

High Initial Investment Costs

One major restraint in the AI lighting market is the high upfront cost required for installation and system integration. AI lighting solutions involve advanced hardware components like sensors and controllers, which can be expensive relative to traditional lighting options. This initial investment is a significant barrier for many small businesses and homeowners.

Additionally, integrating AI lighting within existing infrastructure often demands technical expertise and additional expenses. This complexity and cost deter some potential users from adopting AI lighting despite its long-term benefits and savings.

For instance, in October 2024, Honeywell introduced new AI-enabled solutions aimed at the industrial energy sectors. While powerful, these advanced systems come with significant upfront costs and integration complexity, which can dampen adoption among smaller customers who face budget constraints.

Opportunities

Expansion of Smart Cities and Infrastructure

Smart city development offers a strong growth opportunity for AI lighting. Governments worldwide are investing in intelligent street and public lighting to improve safety, reduce energy use, and enhance urban living conditions. AI enables adaptive lighting that responds dynamically to traffic and pedestrian flow.

The adoption of AI lighting is also growing in commercial and residential buildings, driven by increasing interest in automation and energy management. Advances in IoT and edge computing enhance local control and responsiveness, widening the market potential.

For instance, in September 2025, Itron announced a partnership with Current Lighting Solutions to provide smart lighting systems aimed at cities and utilities, emphasizing energy efficiency and safety. These solutions incorporate AI and IoT technologies to enable real-time adaptive street lighting, significantly improving urban living conditions and resource management.

Challenges

Integration Complexity and Interoperability

A core challenge for AI lighting adoption is the difficulty of system integration and ensuring interoperability with other smart devices. Lighting systems often use different protocols and components, making seamless communication challenging. This can result in higher costs, technical issues, and delayed deployments.

Without standardized platforms and easy integration options, potential customers hesitate to invest in AI lighting, fearing compatibility problems. Addressing these issues is critical to unlocking wider adoption and realizing the full technological potential of AI lighting solutions.

For instance, in May 2025, Schneider Electric launched AI-powered edge room controllers that intelligently adjust environmental controls, including lighting. Despite technological advances, challenges remain in seamlessly integrating these AI lighting control systems within existing building management platforms due to differing protocols and security requirements.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI Lighting Market is driven by major innovators such as Acuity Brands Lighting, Inc., Signify Holding, Honeywell International Inc., and Schneider Electric. These companies are integrating artificial intelligence with connected lighting systems to improve energy efficiency, automate illumination, and enable smart environmental control across residential, commercial, and industrial sectors.

Key players including Itron Inc., IDEAL INDUSTRIES, INC., Wipro Lighting, and Häfele America Co. are developing IoT-enabled lighting networks powered by AI analytics. Their systems use sensors and adaptive algorithms to optimize brightness, reduce energy waste, and support human-centric lighting in smart buildings and urban infrastructure.

Emerging brands such as Sengled Optoelectronics Co., Ltd., YEELIGHT, and Verizon, along with other market participants, focus on AI-based automation for homes and public spaces. Their innovations in voice control, gesture-based interaction, and personalized lighting experiences continue to accelerate the adoption of intelligent and sustainable lighting solutions worldwide.

Top Key Players in the Market

- Acuity Brands Lighting, Inc.

- Signify Holding

- Honeywell International Inc.

- Itron Inc.

- IDEAL INDUSTRIES, INC.

- Sengled Optoelectronics Co., Ltd.

- Verizon

- Schneider Electric

- Häfele America Co.

- Wipro Lighting

- YEELIGHT

- Others

Recent Developments

- In September 2025, Lepro announced the launch of its AI Lighting Pro series at IFA 2025. These innovative LED lights come embedded with AI microphones, enabling the lights to respond naturally to voice commands and ambient sounds. The company plans to roll out the first wave of products in North America later in 2025, setting a new benchmark for human-centric AI lighting solutions.

- In October 2025, Acuity Brands continued to set industry standards with nine innovative smart lighting solutions selected for the 2025 Illuminating Engineering Society Progress Report, demonstrating leadership in precise and energy-efficient lighting technologies.

Report Scope

Report Features Description Market Value (2024) USD 11.4 Bn Forecast Revenue (2034) USD 296.1 Bn CAGR(2025-2034) 38.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning, Natural Language Processing (NLP), Machine Vision, Generative AI), By Connectivity (Wired, Wireless), By Application (Indoor, Outdoor) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acuity Brands Lighting, Inc., Signify Holding, Honeywell International Inc., Itron Inc., IDEAL INDUSTRIES, INC., Sengled Optoelectronics Co., Ltd., Verizon, Schneider Electric, Häfele America Co., Wipro Lighting, YEELIGHT, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acuity Brands Lighting, Inc.

- Signify Holding

- Honeywell International Inc.

- Itron Inc.

- IDEAL INDUSTRIES, INC.

- Sengled Optoelectronics Co., Ltd.

- Verizon

- Schneider Electric

- Häfele America Co.

- Wipro Lighting

- YEELIGHT

- Others