Global AI In Warehouse Management Market By Component(Solution, Services), By Application(Inventory Management, Order Picking and Fulfilment, Demand Forecasting, Predictive Maintenance, Others Applications), By End-Use Industry(Retail & E-commerce, Food & Beverage, Transportation & Logistics, Healthcare & Pharmaceuticals, Automotive, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 126325

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

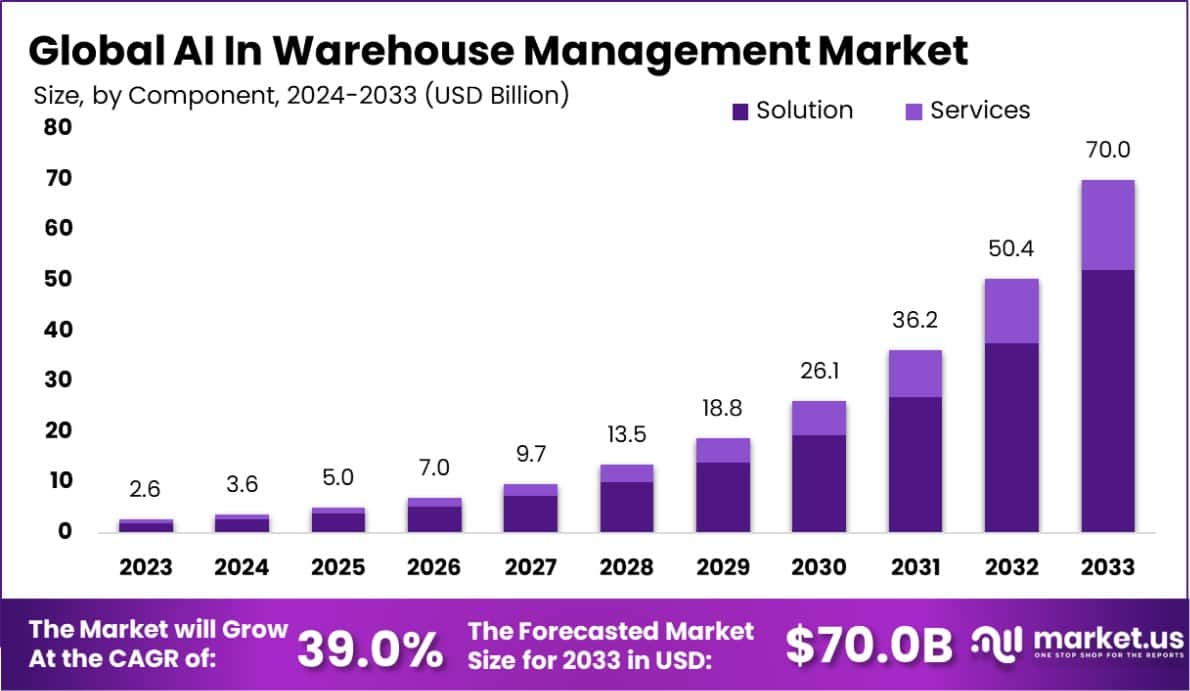

The Global AI In Warehouse Management Market size is expected to be worth around USD 70 Billion By 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 39.0% during the forecast period from 2024 to 2033.

Artificial Intelligence (AI) in warehouse management refers to the integration of AI technologies, such as machine learning, robotics, and predictive analytics, to optimize various operations within warehouse environments. This technological infusion helps enhance inventory management, streamline order processing, and improve overall logistics efficiency by predicting product demand, optimizing stock levels, and automating repetitive tasks.

The AI in Warehouse Management Market is poised for significant growth, driven by the escalating demand for automation across the supply chain and the continuous advancements in AI technology.

Key opportunities in this market include the development of intelligent robotic systems for automated picking and sorting, the use of AI-driven analytics for real-time decision-making, and the implementation of AI for predictive maintenance to reduce downtime and operational costs. These innovations not only enhance operational efficiency but also support a more responsive supply chain ecosystem.

The integration of Artificial Intelligence (AI) in warehouse management is positioned as a pivotal driver of operational efficiencies and strategic differentiation in the logistics sector. As warehouse and storage facilities in the U.S. have experienced a significant expansion – growing by 26% from 2011 to 2020—the demand for advanced technological solutions to manage these enlarged spaces efficiently has surged. This growth trajectory is underscored by a substantial 87% of decision-makers in smart warehousing, logistics, and retail who anticipate or are already undertaking expansions of their warehouse capacities by 2024.

The expanding warehouse footprint, which has seen average sizes increase from approximately 65,000 square feet in 2000 to about 181,370 square feet in 2017, underscores the escalating need for sophisticated warehouse management systems. However, despite the apparent growth and expansion in physical footprint, only 10% of warehouses reported the adoption of advanced automation technologies in 2016, highlighting a significant gap in technology penetration. This gap presents a considerable opportunity for the integration of AI-driven solutions that can streamline operations and enhance efficiency.

Furthermore, the anticipated increase in business inventories, which could necessitate an additional 700 million to 1 billion square feet of warehouse space, reinforces the urgency for robust AI applications in inventory and warehouse management. Plans to implement mobile inventory management solutions in approximately 73% of warehouses by 2021 further indicate a shift towards more agile, AI-enhanced operational frameworks, suggesting a robust growth trajectory for AI applications in this sector.

Key Takeaways

- The Global AI In Warehouse Management Market size is expected to be worth around USD 70 Billion By 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 39.0% during the forecast period from 2024 to 2033.

- In 2023, Solution held a dominant market position in the Component segment of AI In Warehouse Management Market, capturing more than a 74.5% share.

- In 2023, Inventory Management held a dominant market position in Application segment of AI In Warehouse Management Market, capturing more than a 32.1% share.

- In 2023, Retail & E-commerce held a dominant market position in End-Use Industry segment of AI In Warehouse Management Market, capturing more than a 34.0% share.

- North America dominated a 38.8% market share in 2023 and held USD 1.0 Billion in revenue of the AI In Warehouse Management Market.

Component Analysis

In 2023, Solution held a dominant market position in the Component segment of the AI Warehouse Management Market, capturing more than a 74.5% share. This substantial market share underscores the efficacy and market acceptance of Solution’s advanced AI-driven tools and platforms within the logistics and supply chain sectors.

The company’s offerings are primarily distinguished by their innovative use of machine learning algorithms and data analytics to optimize warehouse operations, including inventory management, logistics planning, and automation of repetitive tasks.

The proliferation of e-commerce and a surge in demand for faster delivery times have catalyzed the adoption of AI technologies in warehouse management, with Solution at the forefront of this transformation. Their technology not only enhances operational efficiency but also supports scalability and adaptability in warehouse operations, key factors driving their market dominance. Moreover, the integration of IoT devices and smart sensors into their systems has enabled real-time data collection and analysis, further boosting productivity and reducing operational costs.

As businesses continue to recognize the critical role of AI in achieving operational efficiencies, Solution’s market presence is expected to grow, supported by ongoing advancements in AI technology and increasing investments in digital transformation strategies within the warehouse management sector.

Application Analysis

In 2023, Inventory Management held a dominant market position in the Application segment of the AI in Warehouse Management Market, capturing more than a 32.1% share. This leadership is attributed to the pivotal role of AI-driven inventory systems in optimizing stock levels, reducing waste, and enhancing order accuracy. As organizations increasingly focus on supply chain optimization to meet consumer expectations for prompt and accurate deliveries, AI-powered inventory management solutions have become essential.

The integration of AI not only automates the tracking and management of inventory but also facilitates real-time decision-making and predictive analytics, enabling warehouses to preempt stock shortages or surpluses. This capability significantly minimizes costs and improves service delivery, aligning with the operational goals of modern logistics operations.

Further, AI technologies extend beyond inventory management to other critical applications such as order picking and fulfillment, demand forecasting, and predictive maintenance. Each of these applications leverages AI to enhance accuracy, efficiency, and reliability across warehouse operations. As AI continues to evolve, its adoption across these applications is expected to expand, driving further efficiencies and reshaping warehouse management practices.

End-Use Industry Analysis

In 2023, Retail & E-commerce held a dominant market position in the End-Use Industry segment of the AI in Warehouse Management Market, capturing more than a 34.0% share. This significant market share highlights the sector’s rapid adoption of AI technologies to cater to the increasing consumer demand for faster and more accurate online shopping experiences. Retail and e-commerce companies are leveraging AI to streamline warehouse operations, enhance inventory control, and optimize logistics for quicker delivery times.

The deployment of AI-driven solutions in warehouse management enables retailers to achieve higher efficiency levels by automating processes such as order processing, picking, packing, and shipping. These technologies also support the scalability of operations during peak shopping seasons without compromising accuracy or customer satisfaction.

Moreover, AI applications are not limited to the retail sector but extend across various industries, including food and beverage, transportation and logistics, healthcare and pharmaceuticals, and automotive, each benefiting from enhanced operational efficiencies. As industries continue to face challenges related to supply chain complexity and customer demands, AI’s role in warehouse management is poised for further growth and deeper integration across these sectors.

Key Market Segments

Component

- Solution

- Services

Application

- Inventory Management

- Order Picking and Fulfilment

- Demand Forecasting

- Predictive Maintenance

- Others Applications

End-Use Industry

- Retail & E-commerce

- Food & Beverage

- Transportation & Logistics

- Healthcare & Pharmaceuticals

- Automotive

- Other End-Use Industries

Drivers

AI Boosts Warehouse Management Efficiency

The AI in Warehouse Management Market is primarily driven by the increasing need for automation to enhance efficiency and accuracy in warehouse operations. As e-commerce expands globally, companies are pressured to deliver products faster and more reliably, which AI technologies facilitate by optimizing tasks like inventory management, order picking, and logistics.

These AI systems not only speed up operations but also significantly reduce errors and labor costs. Furthermore, the integration of AI allows for real-time data analysis, which improves decision-making and forecasting abilities, crucial for maintaining a competitive edge in fast-moving markets.

With the surge in online shopping and the complexity of supply chains, AI’s role in warehouse management becomes increasingly vital, driving its adoption across various industries seeking to improve service delivery and operational efficiency.

Restraint

Challenges Limiting AI Warehouse Adoption

One of the main restraints in the AI in Warehouse Management Market is the significant cost associated with implementing and maintaining AI systems. These costs can be prohibitively high, especially for small to medium-sized enterprises (SMEs) that may not have the financial flexibility of larger corporations.

Additionally, the integration of AI into existing warehouse infrastructures often requires substantial upgrades and modifications, further escalating initial investment requirements. Another barrier is the lack of skilled professionals capable of managing and optimizing AI-driven systems, which can hinder effective deployment and utilization.

There is also some resistance to change within organizations, as employees fear job displacement due to automation. These factors collectively slow down the broader adoption of AI technologies in warehouse management, despite their potential benefits in enhancing operational efficiencies.

Opportunities

Expanding Opportunities in AI Warehousing

The AI in Warehouse Management Market offers substantial opportunities, particularly through the advancement and integration of technologies such as machine learning development, IoT, and robotics. These technologies are revolutionizing warehouse operations by enabling more precise inventory management, faster order processing, and enhanced supply chain visibility.

As global trade grows and consumer expectations for rapid delivery increase, there is a rising demand for efficient warehouse operations, presenting significant market opportunities for AI solutions. Additionally, the ongoing digital transformation in various sectors creates a conducive environment for AI adoption in warehouses.

The potential for AI to connect with other digital tools and platforms also opens up new avenues for innovation, improving not just speed and accuracy but also operational flexibility. This integration can lead to smarter, more responsive, and highly efficient warehouse environments, catering to the evolving needs of industries worldwide.

Challenges

Navigating AI Warehouse Management Hurdles

Integrating AI into warehouse management systems presents several challenges that can hinder its widespread adoption. First, the high initial costs associated with setting up AI technologies can be a significant barrier, especially for smaller operations.

The complexity of AI systems also demands a higher level of technical expertise, which can lead to difficulties in finding and retaining qualified staff. Moreover, integrating these advanced technologies with existing warehouse infrastructures often requires extensive modifications, disrupting current operations. Privacy and security concerns related to data handling by AI systems are another critical challenge, as warehouses handle a vast amount of sensitive information.

Lastly, there’s cultural resistance within many organizations as workers fear job losses due to automation. These challenges must be addressed to fully harness the potential of AI in improving warehouse efficiency and accuracy.

Growth Factors

- E-commerce Expansion: The boom in online shopping demands faster, more accurate warehouse operations, driving the adoption of AI to manage increased order volumes.

- Labor Cost Reduction: AI automates repetitive tasks, reducing the need for manual labor and associated costs while increasing productivity.

- Demand for Real-Time Data: AI enables real-time inventory and operations management, crucial for timely decision-making and enhancing operational transparency.

- Supply Chain Complexity: As supply chains become more complex, AI helps manage and streamline operations, reducing errors and improving efficiency.

- Technological Advancements: Continuous improvements in AI, machine learning, and robotics technology make these solutions more accessible and effective for warehouse management.

- Regulatory Compliance: AI helps ensure that warehouses comply with increasingly stringent regulations by automating record-keeping and maintaining standards of operation.

Emerging Trends

- Robotics and Automation: Increasing the use of robots for picking and packing speeds up operations and reduces human error, making warehouses more efficient.

- Predictive Analytics: AI tools analyze data to predict inventory needs and manage supply chain disruptions, helping warehouses stay proactive rather than reactive.

- Internet of Things (IoT): IoT devices collect and share real-time data across warehouse systems, enhancing inventory tracking and optimizing equipment maintenance.

- Enhanced Customer Experience: AI is being used to improve order accuracy and delivery speeds, directly boosting customer satisfaction and loyalty.

- Sustainability Practices: AI helps in designing greener operations by optimizing routes and reducing energy consumption, supporting the push towards sustainability in logistics.

- Advanced Security Measures: AI-driven security systems enhance surveillance and access control, safeguarding assets from theft or damage and ensuring compliance with regulations.

Regional Analysis

The AI in Warehouse Management Market is segmented across several key regions, each exhibiting unique growth dynamics and opportunities influenced by local economic conditions, technological adoption rates, and sector-specific needs.

North America is the dominating region, holding a 38.8% market share with a valuation of USD 1.0 billion, driven by advanced technological infrastructure and the presence of major e-commerce and retail giants investing heavily in AI solutions. Europe follows, with significant growth due to its strong automotive and manufacturing sectors, which are increasingly integrating AI for logistics and supply chain management.

The Asia Pacific region is witnessing rapid growth, fueled by the expansion of e-commerce, rising tech-savvy populations, and government initiatives toward digitalization, particularly in China, Japan, and India. This region is poised for the highest growth rate in the coming years due to these factors.

Meanwhile, the Middle East & Africa and Latin America are emerging markets with growing potential. Investments in infrastructure development and an increasing focus on diversifying economies present opportunities for AI integration in warehouse management, although these regions currently contribute a smaller share compared to others.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global AI in Warehouse Management Market is significantly shaped by contributions from key players like IBM Corporation, Microsoft Corporation, and Oracle Corporation. Each of these companies brings distinct technologies and strategic initiatives to the forefront, catering to a diverse range of industries with their advanced AI solutions.

IBM Corporation has been a pioneer in integrating AI with cloud computing, offering solutions that enhance real-time data analysis and operational efficiency in warehouse management. IBM’s AI, through Watson, provides cognitive insights that enable better decision-making and predictive analytics, making it invaluable for complex supply chain dynamics. Their commitment to continuous innovation ensures their AI solutions are among the most advanced in the market.

Microsoft Corporation leverages its Azure AI platform to empower warehouse operations, focusing on scalability and security. Their AI solutions facilitate smarter data-driven decisions, automate mundane tasks, and optimize logistics operations efficiently. Microsoft’s AI also enhances connectivity between various warehouse operations, promoting a more integrated and responsive supply chain network.

Oracle Corporation focuses on comprehensive enterprise AI solutions that integrate seamlessly with existing warehouse management systems. Oracle’s AI-driven analytics offer deep insights into inventory levels, demand forecasting, and operational bottlenecks, enhancing overall productivity and strategic planning.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Honeywell International Inc.

- Manhattan Associates

- Blue Yonder Group, Inc.

- ABB Ltd.

- SAP SE

- Swisslog Holding AG

- Pivotree

- C3.ai, Inc.

- GreyOrange

- KNAPP AG

- Other Key Players

Recent Developments

- In March 2023, Blue Yonder acquired a startup specializing in AI-driven logistics optimization, aiming to expand its real-time supply chain management capabilities and reach.

- In July 2022, Manhattan Associates introduced a next-generation warehouse management system designed to optimize mobile and robotic workflows, significantly improving operational efficiencies.

- In May 2021, Honeywell launched a new AI-powered automation solution, enhancing warehouse productivity and safety. This tool predicts and mitigates operational risks effectively.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Billion Forecast Revenue (2033) USD 70 Billion CAGR (2024-2033) 39.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Component(Solution, Services), Application(Inventory Management, Order Picking and Fulfilment, Demand Forecasting, Predictive Maintenance, Others Applications), End-Use Industry(Retail & E-commerce, Food & Beverage, Transportation & Logistics, Healthcare & Pharmaceuticals, Automotive, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Oracle Corporation, Honeywell International Inc., Manhattan Associates, Blue Yonder Group, Inc., ABB Ltd., SAP SE, Swisslog Holding AG, Pivotree, C3.ai, Inc., GreyOrange, KNAPP AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI In Warehouse Management Market?Artificial Intelligence (AI) in warehouse management refers to the integration of AI technologies, such as machine learning, robotics, and predictive analytics, to optimize various operations within warehouse environments. This technological infusion helps enhance inventory management, streamline order processing, and improve overall logistics efficiency by predicting product demand, optimizing stock levels, and automating repetitive tasks.

How big is AI In Warehouse Management Market?The Global AI In Warehouse Management Market size is expected to be worth around USD 70.0 Billion By 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 39.0% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the AI In Warehouse Management Market?AI technologies enhance warehouse management by optimizing operations, reducing errors and costs, and improving decision-making, crucial for competitiveness in fast-evolving e-commerce and complex supply chains.

What are the emerging trends and advancements in the AI In Warehouse Management Market?AI and robotics optimize warehouse operations, enhance predictive analytics, IoT integration, and security, while improving customer experience and supporting sustainability in logistics.

What are the major challenges and opportunities in the AI In Warehouse Management Market?AI in warehouse management offers vast opportunities through technology integration, enhancing operations and global trade efficiencies, but faces challenges like high costs, complexity, and cultural resistance.

Who are the leading players in the AI In Warehouse Management Market?IBM Corporation, Microsoft Corporation, Oracle Corporation, Honeywell International Inc., Manhattan Associates, Blue Yonder Group, Inc., ABB Ltd., SAP SE, Swisslog Holding AG, Pivotree, C3.ai, Inc., GreyOrange, KNAPP AG, Other Key Players

AI In Warehouse Management MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

AI In Warehouse Management MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Honeywell International Inc.

- Manhattan Associates

- Blue Yonder Group, Inc.

- ABB Ltd.

- SAP SE

- Swisslog Holding AG

- Pivotree

- C3.ai, Inc.

- GreyOrange

- KNAPP AG

- Other Key Players