Global AI in Mining and Natural Resources Market Size, Share, Industry Analysis Report By Solution (Software, Hardware, Services), By Mining Type (Surface Mining, Underground Mining, Others), By Technology (Machine Learning & Deep Learning, Robotics & Automation, Computer Vision, NLP, Others), By Deployment (Cloud, On-premises), By Application (Exploration & Resource Discovery, Mine Planning & Design, Drilling & Blasting Optimization, Other Applications), By End-User (Mining Companies, Equipment Manufacturers, Government & Regulatory Bodies, Consulting & Engineering Firms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164770

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- China Market Size

- By Solution: Hardware

- By Mining Type: Surface Mining

- By Technology: ML and DL

- By Deployment: On-premises

- By Application: Predictive Maintenance

- By End-User: Mining Companies

- Key Market Segment

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Player Analysis

- Recent Development

- Report Scope

Report Overview

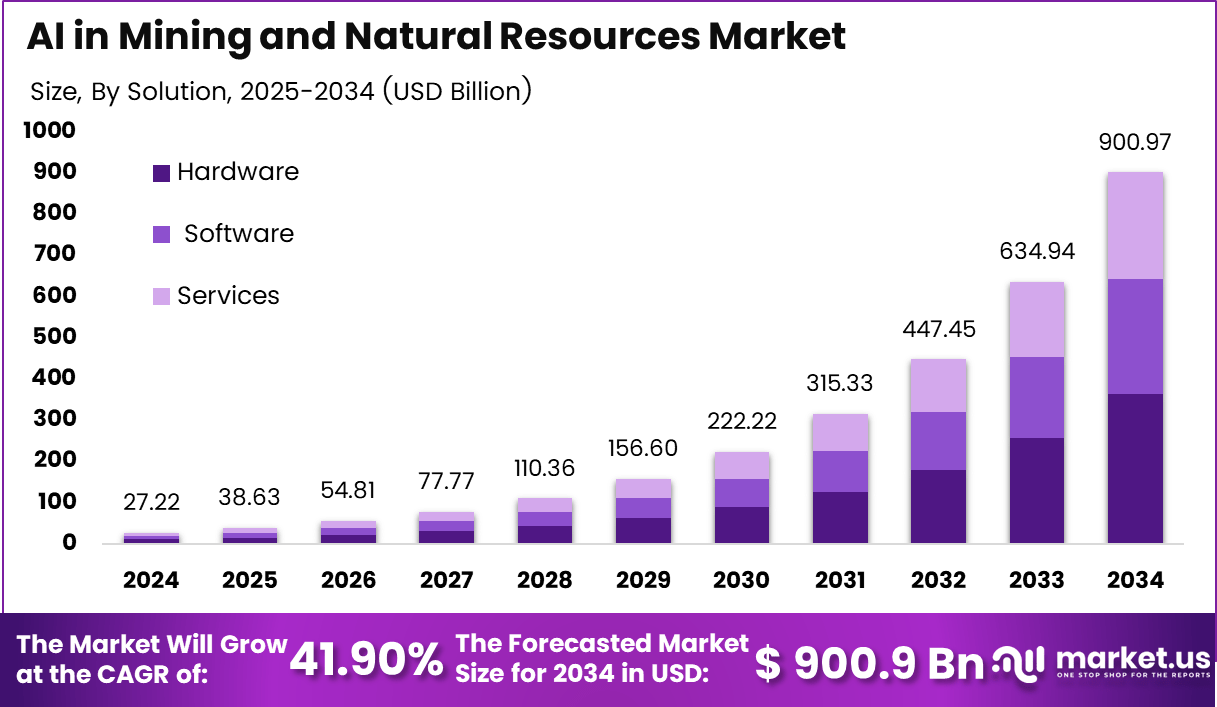

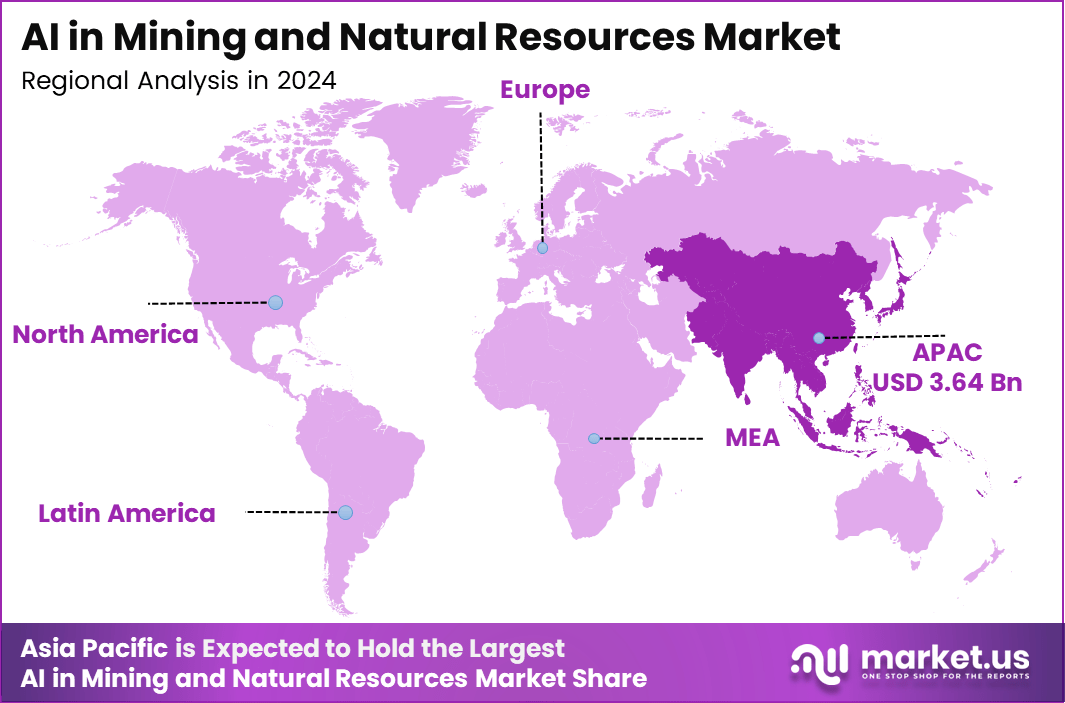

The Global AI in Mining and Natural Resources Market generated USD 27.22 billion in 2024 and is predicted to register growth from USD 38.63 billion in 2025 to about USD 900.97 billion by 2034, recording a CAGR of 41.9% throughout the forecast span. In 2024, Asia-Pacific held a dominan market position, capturing more than a 35.9% share, holding USD 3.64 Billion revenue.

The AI in mining and natural resources market has been expanding as mining companies and extraction industries adopt intelligent systems to improve efficiency, safety and decision making. The market has gradually moved from pilot-level experimentation to large scale operational use. Growth reflects increasing reliance on digital platforms, autonomous systems and predictive analytics across mines, quarries and resource extraction sites.

The growth of the market can be attributed to rising focus on productivity improvement, cost reduction and enhanced operational safety. Mining operators face growing pressure to optimise resource utilisation and reduce equipment downtime, which strengthens the need for AI enabled systems. Environmental and regulatory expectations also drive companies to adopt more precise monitoring and reporting tools. Expanded sensor networks and high performance computing capabilities further support adoption.

Demand is rising across both open pit and underground mining environments. Companies require AI tools to forecast equipment failures, analyse geological data, automate haulage and improve ore grade control. Natural resource operations rely on AI to predict reservoir behaviour, improve drilling accuracy and assess environmental impact. Demand is also supported by remote operations, where AI assists in controlling and coordinating equipment from central command centres.

Key technologies driving adoption include machine learning based geological modelling, computer vision for inspection, autonomous haulage systems, robotic drilling and predictive maintenance platforms. Integration of IoT sensors, real time telemetry, satellite imaging and drones provides continuous data streams for AI analysis. Cloud based platforms and edge computing enable faster decision cycles even in remote mining regions.

Key Takeaways

- Hardware solutions accounted for 40.3%, reflecting strong demand for advanced sensors, robotics, and autonomous systems that support AI-driven extraction and resource management.

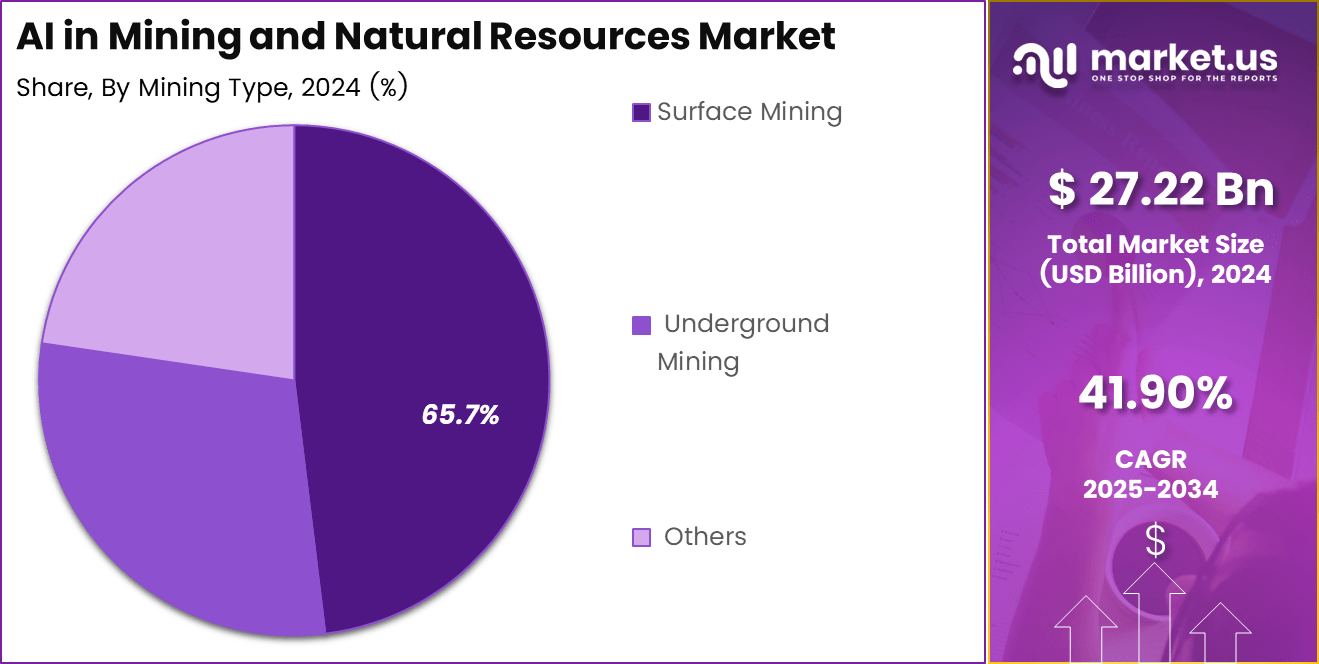

- Surface mining led with a 65.7% share, supported by large-scale operations adopting AI for fleet automation, terrain analysis, and safety monitoring.

- Machine Learning and Deep Learning technologies captured 51.6%, underscoring their importance in ore prediction, operational forecasting, and process optimization.

- On-premises deployment held 60.4%, showing a continued preference for secure, low-latency data processing in high-risk, mission-critical mining environments.

- Predictive maintenance represented 23.8%, driven by the need to reduce equipment failures, cut operational downtime, and extend asset lifespan.

- Mining companies dominated end-user demand with 73.6%, as major operators scale AI tools to improve efficiency, safety, and cost performance.

- Asia Pacific accounted for 35.9%, supported by the rapid modernization of mining industries across key economies.

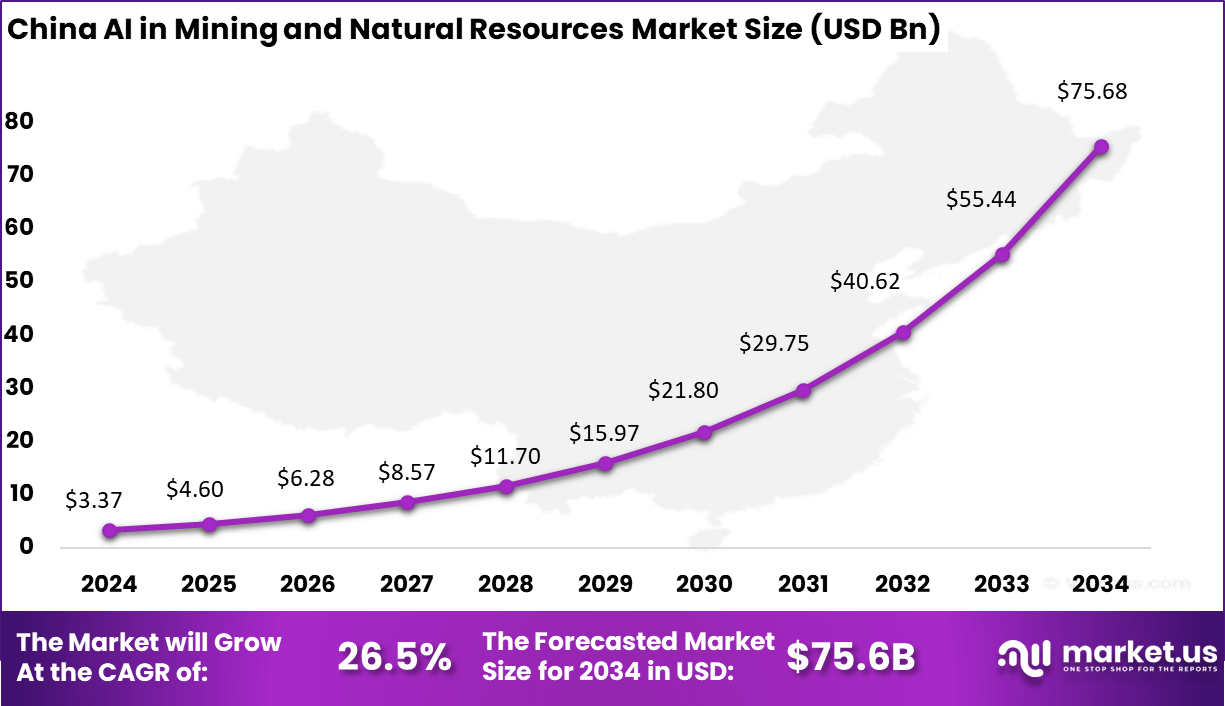

- China reached USD 3.73 billion in 2024, expanding at a fast 36.5% CAGR, driven by heavy investment in AI-enabled mining automation and intelligent resource extraction.

China Market Size

China’s contribution is particularly notable, with the market surpassing USD 3.73 billion in value in 2025. China’s aggressive investment in AI-driven mining solutions supports its goal to modernize its vast mining sector and enhance operational efficiency. The country remains a dominant player, with forecasts indicating continued growth supported by government-backed projects and industry modernization efforts. The rapid growth in these markets makes China a key driver of AI’s expansion in the global mining industry.

The Asia-Pacific region leads the AI in mining market with a significant 35.9% share in 2025, driven by extensive mineral resources and rapidly expanding mining operations in countries like China, India, and Australia. This region’s large-scale projects and government initiatives focused on digital transformation and automation fuels a high rate of AI adoption. The market is expected to grow at an impressive CAGR of 42.09% from 2025 to 2034, reflecting the increasing integration of AI technologies to optimize resource extraction and improve safety standards.

By Solution: Hardware

In 2024, hardware plays a crucial role in the mining and natural resources market, accounting for a significant 40.3% share of the solution segment. Heavy-duty devices such as sensors, cameras, autonomous vehicle components, and edge computing hardware enable real-time data collection and on-site processing.

These hardware components form the backbone of AI systems used for optimization, safety, and automation in mining. Investing in robust and reliable hardware ensures efficient deployment of AI solutions in harsh mining environments, increasing operational reliability and lowering downtime.

Hardware’s importance also lies in enabling advanced algorithms to function properly on the field, including those for machine learning and predictive maintenance. Mining operations benefit from this tangible layer of technology that integrates with existing machinery and infrastructure while supporting growth towards autonomous systems and remote monitoring.

By Mining Type: Surface Mining

In 2024, Surface mining dominates with a 65.7% share in AI adoption, reflecting its suitability due to accessible terrain and large-scale operations. AI technologies are applied extensively to optimize equipment like excavators and haul trucks, improving logistics efficiency and fuel consumption. Surface mines produce large volumes of extractable resources and are ideal for integrating automation and AI-driven process improvements.

The open-pit nature of surface mining allows AI solutions to track vehicle routes, optimize payloads, and monitor equipment health in real-time. These capabilities reduce costs and increase productivity in surface operations, which are often less complex than underground mining but benefit greatly from scalable AI deployment.

By Technology: ML and DL

In 2024, Machine learning and deep learning constitute the core AI technologies in mining, representing 51.6% of technology usage in the sector. These techniques analyze large datasets from sensors and geological surveys to enable predictive models for equipment maintenance, mineral exploration, and operational decision-making. The ability to learn from data patterns and improve predictions is key to minimizing risks and maximizing yields.

Deep learning models support complex tasks such as mineral identification and autonomous system controls. Their widespread application reflects the shift from traditional rule-based automation to intelligent systems that adapt based on ongoing input and environmental changes.

By Deployment: On-premises

In 2024, On-premises deployment holds a leading share of 60.4% in AI system installations for mining. This approach provides mining companies with greater control over their data, security, and system customization. It is especially favored in regions or segments where connectivity is limited or data privacy concerns are paramount.

On-premises AI solutions integrate closely with existing infrastructure and allow real-time processing with minimal latency, which is critical for safety-related applications like equipment monitoring and hazard detection. This deployment model supports scalability and flexibility while maintaining operational continuity in remote mining sites.

By Application: Predictive Maintenance

In 2024, Predictive maintenance is the top application, representing 23.8% of AI use cases in mining. AI systems leverage sensors and machine learning algorithms to monitor equipment condition continuously and predict failures before they occur. This proactive maintenance reduces unexpected downtime, extends machinery lifespan, and lowers operational costs.

Mining operations face high costs related to equipment breakdowns and repair delays. AI-driven predictive maintenance helps avoid such losses by scheduling interventions only when necessary, thereby improving asset reliability and safety on-site. The tangible impact on cost savings makes it a key driver for AI adoption in the industry.

By End-User: Mining Companies

In 2024, Mining companies are the primary end-users of AI technologies, accounting for a dominant 73.6% share. These companies incorporate AI to enhance operational efficiency, safety, and resource management across the value chain. The direct benefits include improved productivity, reduced environmental footprint, and better compliance with safety regulations.

The high adoption rate reflects ongoing digital transformation efforts within mining companies to modernize exploration, extraction, and processing through AI and IoT integration. Companies increasingly invest in tailor-made AI solutions that address their unique challenges and strategic priorities.

Key Market Segment

By Solution

- Software

- AI Platforms

- Data Management Tools

- AI-Driven Analytics Software

- Hardware

- Robotics and Drones

- Sensors and Actuators

- Autonomous Mining Vehicles

- Services

- AI Consulting

- System Integration

- Support and Maintenance

By Mining Type

- Surface Mining

- Underground Mining

- Others

By Technology

- Machine Learning & Deep Learning

- Robotics & Automation

- Computer Vision

- NLP

- Others

By Deployment

- Cloud

- On-premises

By Application

- Exploration & Resource Discovery

- Mine Planning & Design

- Drilling & Blasting Optimization

- Predictive Maintenance

- Ore Grade Control & Sorting

- Safety & Risk Management

- Sustainability & ESG Compliance

- Supply Chain & Logistics Optimization

- Environmental Monitoring

- Energy Management

- Other Applications

By End-User

- Mining Companies

- Equipment Manufacturers

- Government & Regulatory Bodies

- Consulting & Engineering Firms

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Emerging Trends

Key Trend Description Automation of Equipment The use of autonomous trucks, drills, and loaders is accelerating extraction activities and improving mine safety. Automated systems operate continuously, reducing the need for human presence in hazardous environments. AI-Driven Exploration Machine learning and satellite data are revolutionizing mineral exploration by minimizing manual processes and speeding up decision-making. These tools improve the accuracy of identifying new resource deposits. Predictive Maintenance Real-time IoT data combined with AI analytics is enabling the prediction of equipment failures before they occur, reducing downtime, lowering maintenance costs, and extending machinery lifespan. Environmental and Safety Monitoring AI-powered sensors continuously track mine conditions, reduce environmental risks, and enhance worker safety. These systems support regulatory compliance and promote sustainability. Data-Driven Decision Support AI integrates geological, operational, and geophysical data to deliver actionable insights. This helps mining companies make faster, more informed decisions across the entire mining value chain. Growth Factors

Key Factors Description Need for Higher Productivity Rising global demand for critical minerals is increasing the need for efficient extraction and processing, and AI improves productivity by optimizing each step from exploration to logistics. Sustainability Pressures Growing emphasis on environmental, social, and governance goals is making AI vital for reducing waste, lowering emissions, and ensuring accountable and sustainable mining practices. Cost Reduction Imperatives Remote and hazardous mining operations are costly, and AI helps automate processes, reduce labor expenses, and maximize output with minimal disruptions. Improvements in Technology Advances in AI software, IoT sensors, and cloud analytics enhance the accuracy and usefulness of AI in rigorous and complex mining environments. Growing Data Availability Mining companies now gather vast amounts of geological and equipment data, which AI analyzes to deliver insights that were difficult or impossible to identify manually. Driver Analysis

Operational Efficiency and Cost Optimization

The rise of artificial intelligence in mining is largely driven by the need to improve operational efficiency and reduce costs. Mining companies face increasing pressure to enhance productivity while managing tight profit margins. AI technologies enable automation of complex tasks such as mineral exploration, equipment maintenance, and real-time monitoring of operations.

This reduces manual labor and increases precision, leading to significant savings in time and expenses. Companies using AI can analyze vast geological data faster and more accurately, which helps in making informed decisions that optimize resources and reduce waste.

This drive is supported by the broader digital transformation trend in the industry. By adopting AI, mining firms are able to streamline operations from resource identification to extraction and processing. The growing demand for more cost-effective mining operations, especially in challenging or remote locations, continues to fuel AI adoption worldwide.

Restraint Analysis

High Implementation Costs and Skilled Workforce Shortage

Despite its benefits, AI adoption in mining faces restraints primarily due to high initial investment costs. Procuring advanced AI systems, sensors, and integrating them into existing infrastructure requires substantial capital spending, which smaller mining operators find difficult to afford. Moreover, the maintenance and updating of AI technologies add ongoing expenses that can be burdensome.

Another significant restraint is the shortage of skilled professionals capable of managing AI tools and interpreting their data outputs. Mining operations are often situated in remote areas, where attracting and retaining AI talent is challenging. The lack of expertise slows down deployment and limits the ability of companies to fully leverage AI capabilities. These cost and talent barriers collectively hamper the rapid scaling of AI applications across the industry.

Opportunity Analysis

Automation and Sustainable Mining Practices

The use of AI in automation presents a huge opportunity for transforming mining. Autonomous vehicles, robotic drilling, and AI-driven process control systems enhance safety by reducing human presence in hazardous environments. These technologies increase operational continuity and reduce downtime while improving precision in extraction processes.

Additionally, AI contributes to sustainable mining by enabling better environmental monitoring and resource management. Predictive maintenance reduces equipment failures and energy consumption, while AI-powered data analytics help optimize water usage and tailings management. These developments align mining practices with stricter environmental regulations and growing social expectations around sustainability. Therefore, AI adoption not only boosts productivity but also helps mining companies meet environmental, social, and governance (ESG) goals.

Challenge Analysis

Integrating AI with Legacy Systems

A major challenge in AI adoption for mining lies in integrating new AI solutions with existing legacy infrastructure. Many mining operations still rely on traditional machinery and data systems that were not designed to work with AI technologies. This creates compatibility issues and complicates the deployment of AI-driven analytics and automation.

The complexity of subsurface environments also poses difficulties for reliable data collection and analysis. Variability in geology and operational conditions can affect sensor accuracy and AI model performance. Additionally, uncertainties in regulatory frameworks and concerns around data privacy and cybersecurity add layers of risk. Mining companies must carefully manage these technical and operational hurdles to fully reap the advantages of AI.

Key Player Analysis

Google, Microsoft, Amazon Web Services, and NVIDIA play a central role in the AI in mining and natural resources market. Their cloud platforms, AI engines, and high-performance computing systems support predictive maintenance, fleet optimization, and real-time geological analysis. These companies enable mining operators to process large data volumes with better accuracy. Their technologies improve safety and lower operational risks.

Caterpillar, Komatsu, Sandvik, Hexagon, ABB, Rockwell Automation, Hitachi Construction Machinery, and Wenco strengthen the market with autonomous equipment, smart drilling systems, and AI-enabled fleet management solutions. Their systems support continuous monitoring of machines, optimized haulage, and improved energy use. Integration of sensors and automated controls enhances productivity across surface and underground operations.

Major mining companies such as BHP, Rio Tinto, Vale, Anglo American, Freeport-McMoRan, Newmont, Teck Resources, Glencore, Gold Fields, Barrick Gold, and other participants accelerate AI adoption through large-scale deployment projects. Their focus is on reducing downtime, improving ore recovery, and strengthening environmental compliance. AI-assisted planning and autonomous site operations improve decision-making across complex value chains.

Top key players

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- Caterpillar Inc.

- Komatsu Ltd.

- Sandvik AB

- Hexagon AB

- ABB Ltd.

- Rockwell Automation, Inc.

- Hitachi Construction Machinery Co., Ltd.

- NVIDIA Corporation

- SAP SE

- Cisco Systems, Inc.

- Wenco International Mining Systems Ltd.

- BHP Group

- Rio Tinto Group

- Vale S.A.

- Anglo American plc

- Freeport-McMoRan Inc.

- Newmont Corporation

- Teck Resources Limited

- Glencore plc

- Gold Fields Limited

- Barrick Gold Corporation

- Other Market Players

Recent Development

- September 2025, Komatsu Ltd. Announced a strategic collaboration with Applied Intuition, Inc. to co-develop a software-defined vehicle and autonomy platform for its mining equipment. The initiative is described as a step-change in how Komatsu will bring AI, machine-learning and autonomy to its next-generation mining trucks.

- March 2025, Hexagon AB Launched a new dedicated Robotics division focused on delivering autonomous and AI-enabled solutions for mining, agriculture and industrial markets. The division is built on the company’s measurement, spatial intelligence and AI expertise.

Report Scope

Report Features Description Market Value (2024) USD 27.2 Bn Forecast Revenue (2034) USD 900.9 Bn CAGR(2025-2034) 41.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Solution (Software, Hardware, Services), By Mining Type (Surface Mining, Underground Mining, Others), By Technology (Machine Learning & Deep Learning, Robotics & Automation, Computer Vision, NLP, Others), By Deployment (Cloud, On-premises), By Application (Exploration & Resource Discovery, Mine Planning & Design, Drilling & Blasting Optimization, Other Applications), By End-User (Mining Companies, Equipment Manufacturers, Government & Regulatory Bodies, Consulting & Engineering Firms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Microsoft Corporation, Amazon Web Services, Inc., Caterpillar Inc., Komatsu Ltd., Sandvik AB, Hexagon AB, ABB Ltd., Rockwell Automation, Inc., Hitachi Construction Machinery Co., Ltd., NVIDIA Corporation, SAP SE, Cisco Systems, Inc., Wenco International Mining Systems Ltd., BHP Group, Rio Tinto Group, Vale S.A., Anglo American plc, Freeport-McMoRan Inc., Newmont Corporation, Teck Resources Limited, Glencore plc, Gold Fields Limited, Barrick Gold Corporation, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  AI in Mining and Natural Resources MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Mining and Natural Resources MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- Caterpillar Inc.

- Komatsu Ltd.

- Sandvik AB

- Hexagon AB

- ABB Ltd.

- Rockwell Automation, Inc.

- Hitachi Construction Machinery Co., Ltd.

- NVIDIA Corporation

- SAP SE

- Cisco Systems, Inc.

- Wenco International Mining Systems Ltd.

- BHP Group

- Rio Tinto Group

- Vale S.A.

- Anglo American plc

- Freeport-McMoRan Inc.

- Newmont Corporation

- Teck Resources Limited

- Glencore plc

- Gold Fields Limited

- Barrick Gold Corporation

- Other Market Players