Global AI in Energy Market By Component (Solutions, Services), By Deployment Mode (Cloud, On-premise), By Application (Robotics, Renewables Management, Demand Forecasting, Safety and Security, Infrastructure, Others), By End user (Energy Transmission, Energy Generation, Energy Distribution, Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116964

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

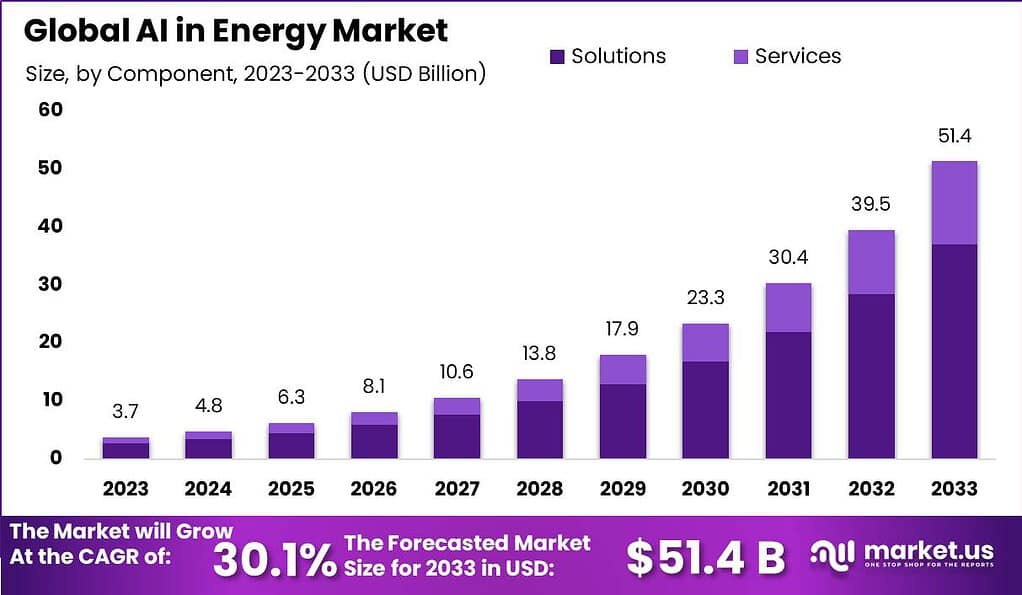

The Global AI in Energy Market size is expected to be worth around USD 51.4 Billion by 2033, from USD 3.7 Billion in 2023, growing at a CAGR of 30.1% during the forecast period from 2024 to 2033.

Artificial intelligence (AI) is playing a transformative role in the energy sector, revolutionizing the way energy is generated, distributed, and consumed. The application of AI technologies in the energy industry, often referred to as AI in Energy, has the potential to drive significant efficiency gains, improve sustainability, and enhance decision-making processes.

The AI in Energy Market is witnessing significant growth with increasing adoption by energy companies, utilities, and grid operators. The market is expected to expand further as organizations recognize the potential for AI to optimize operations, improve grid reliability, and accelerate the transition to a sustainable energy future.

Key components driving this market include solutions and services, with applications ranging from robotics, renewables management, demand forecasting, safety & security, and infrastructure. The utility sector, in particular, is seeing considerable benefits from AI, leveraging it for market price prediction, planning, scheduling, inventory management, and enhancing delivery times.

AI in Energy is driving advancements in energy storage and management. AI algorithms can optimize energy storage systems by predicting demand patterns, adjusting storage operations, and maximizing the utilization of stored energy. This helps to stabilize the grid, improve energy reliability, and enable efficient integration of intermittent renewable energy sources.

AI-powered energy management systems are also enabling demand response programs, where AI algorithms analyze real-time data to optimize energy consumption and reduce peak demand, providing financial benefits to consumers and minimizing strain on the grid.

By 2024, the energy sector is on track to witness a transformative shift with over 70% of energy companies expected to have implemented AI solutions in at least one aspect of their operations, according to Deloitte. This reflects a growing recognition of AI’s potential to enhance efficiency and decision-making within the industry.

GE Power’s research further supports this trend, projecting a 45% increase in the use of AI for predictive maintenance and asset optimization between 2022 and 2024. These AI applications are crucial for prolonging the lifespan of equipment and ensuring optimal performance, thereby reducing operational costs and enhancing reliability.

Additionally, IBM highlights that approximately 55% of energy companies are planning to integrate AI for demand forecasting and load balancing by the end of 2024. This move is aimed at more accurately predicting energy needs and efficiently distributing resources, which is essential for managing the complex dynamics of energy supply and demand.

Key Takeaways

- The AI in Energy Market is anticipated to achieve substantial growth, with an estimated value of USD 51.4 billion by 2033. This impressive figure reflects a robust Compound Annual Growth Rate (CAGR) of 30.1% throughout the forecast period from 2024 to 2033.

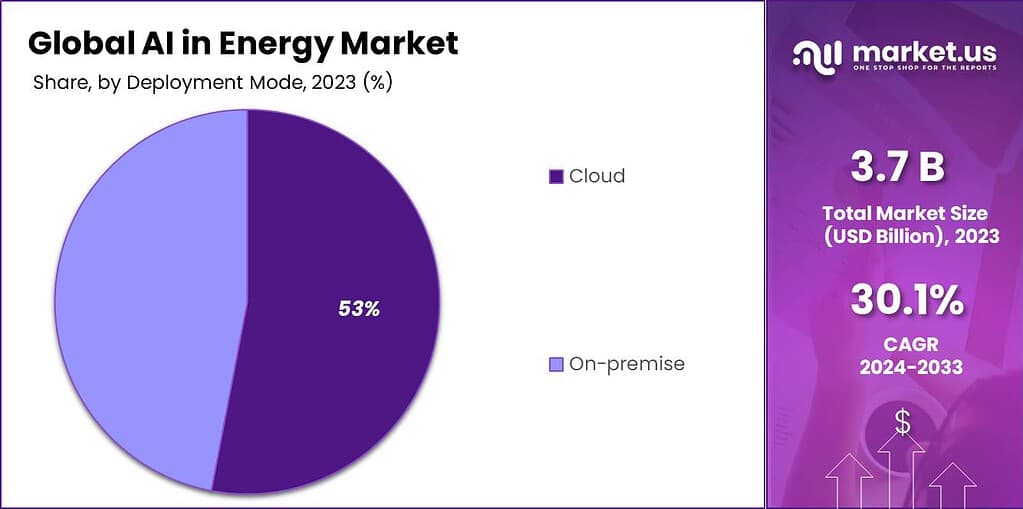

- Cloud deployment dominates the market, capturing over 53% share. This dominance is attributed to the flexibility, scalability, and cost-effectiveness of cloud solutions, facilitating rapid deployment and enabling real-time optimization of energy production and distribution.

- Demand forecasting emerges as a key application, holding over a 27% market share. Leveraging AI for demand forecasting enables energy providers to predict future energy demands accurately, optimize production, and minimize waste, particularly crucial in the context of renewable energy integration.

- Utilities constitute the largest segment, capturing over 48% of the market share. Their pivotal role in integrating AI technologies to improve efficiency, reliability, and sustainability underscores the significance of AI in transforming traditional utility operations.

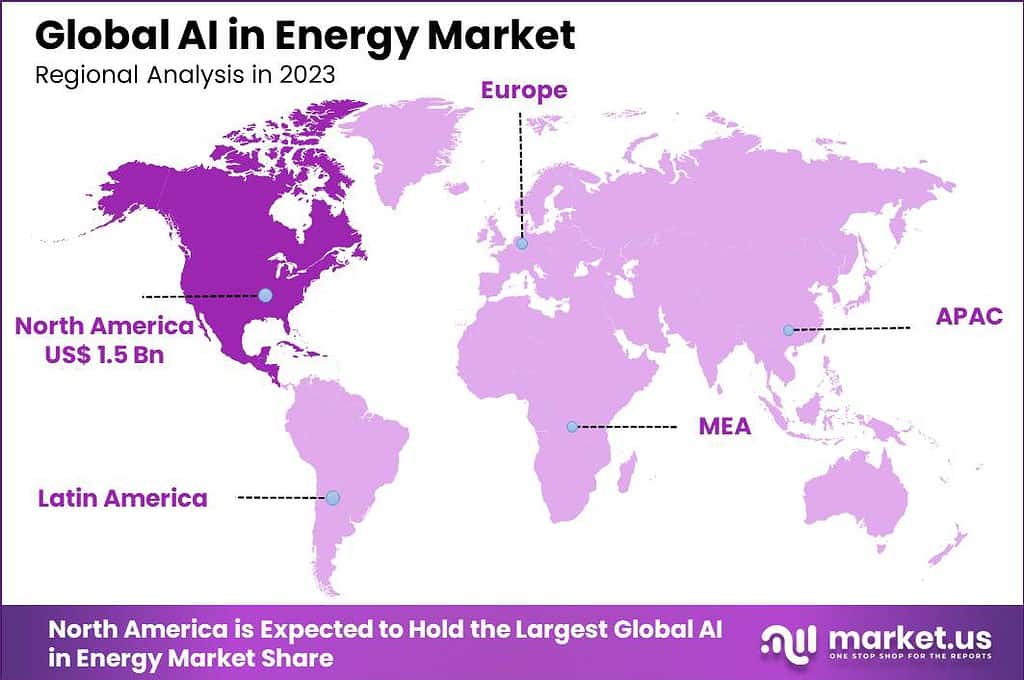

- North America leads the AI in Energy Market, holding more than 41% of the global market share. Factors such as early adoption of advanced technologies, substantial investments in AI research, and supportive policy frameworks contribute to the region’s dominance.

- By 2024, it’s expected that over 65% of AI platforms for the energy industry will be equipped with advanced data visualization and analytics capabilities. This means these platforms will make it easier to see and understand energy patterns and predictions.

- The use of AI in energy trading and market analysis is on the rise, with an expected growth of 40% among utility companies from 2022 to 2024. This shows how more companies are starting to rely on AI to make smarter decisions in buying and selling energy.

- It’s also projected that by 2024, more than 60% of AI applications in the energy sector will use machine learning to spot unusual patterns and diagnose problems. This could mean quicker responses to issues and less downtime.

- Around 50% of energy companies are planning to bring AI on board for integrating renewable energy and managing the grid by the end of 2024. This highlights the growing importance of AI in making green energy more reliable and easier to distribute.

- By 2024, it’s estimated that over 70% of AI platforms in the energy industry will work seamlessly with Industrial Internet of Things (IIoT) devices. This integration could lead to more efficient and smarter energy systems.

- The adoption of AI for making buildings and facilities more energy-efficient is projected to rise by 35% between 2022 and 2024. This means that in the near future, AI could help us use less energy and save money on utilities.

- By 2024, over 55% of AI deployments in the energy sector are expected to involve digital twin technology. This technology allows for simulations and modeling that can improve planning and operation without risking actual assets.

- Also, by 2024, over 65% of AI platforms for the energy industry are anticipated to offer advanced cybersecurity features. This is crucial for protecting our energy infrastructure from hackers and cyber threats.

- Lastly, the use of AI in the oil and gas industry for exploration and production optimization is expected to grow by 30% between 2022 and 2024. This indicates that AI could help in finding and extracting energy resources more efficiently and safely.

Component Analysis

In 2023, the Solutions segment held a dominant position in the AI in Energy Market, capturing more than a 72% share. This significant market share can be attributed to the escalating demand for integrated solutions that leverage artificial intelligence to enhance energy efficiency, optimize power generation, and ensure reliable energy distribution.

Solutions in the AI energy sector encompass advanced analytics, machine learning models, and IoT integration, which facilitate predictive maintenance, energy demand forecasting, and renewables management. These solutions not only improve operational efficiency but also contribute to substantial cost savings and carbon footprint reduction for energy companies.

The lead of the Solutions segment is also underpinned by the rapid technological advancements and the growing adoption of smart grid technologies. As the energy sector continues to evolve, there’s a pressing need for sophisticated AI solutions that can handle complex data analysis, automate decision-making processes, and provide actionable insights for energy management. This is particularly important in the context of increasing renewable energy sources, which require more advanced management to integrate seamlessly into the existing grid infrastructure.

Additionally, the push towards digital transformation by energy companies has fueled the investment in AI solutions, further solidifying this segment’s leading position. The integration of AI into energy solutions not only addresses immediate operational efficiencies but also paves the way for future innovations in energy sustainability and security.

Deployment Mode Analysis

In 2023, the Cloud segment held a dominant position in the AI in Energy Market, securing over a 53% share. This predominance is largely driven by the segment’s flexibility, scalability, and cost-effectiveness, which are critical attributes for energy companies navigating the complexities of digital transformation.

The cloud deployment model offers energy firms the agility to deploy AI solutions rapidly across various operations without the need for significant upfront investment in IT infrastructure. Furthermore, cloud-based AI services enable energy companies to leverage advanced analytics and machine learning capabilities to optimize energy production, distribution, and consumption in real-time, enhancing operational efficiencies and reducing costs.

The leadership of the Cloud segment is also reinforced by its inherent ability to facilitate innovation and collaboration. Through cloud platforms, energy companies can easily access, share, and analyze vast amounts of data, fostering insights that drive smarter energy management and decision-making processes.

This is particularly relevant as the energy sector moves towards more decentralized and renewable energy sources, requiring more dynamic and interconnected systems. Moreover, the scalability of cloud solutions allows energy companies to adjust their AI capabilities as their needs evolve, ensuring they can meet future energy demands and regulatory requirements efficiently.

Application Analysis

In 2023, the Demand Forecasting segment held a dominant position in the AI in Energy Market, capturing more than a 27% share. This leading stance can be attributed to the increasing necessity for precise and efficient energy management strategies within the rapidly evolving energy sector.

Demand forecasting employs AI to analyze historical consumption data alongside various influencing factors such as weather patterns, economic conditions, and consumer behaviors. This analysis enables energy providers to predict future energy demands with remarkable accuracy, ensuring optimal energy production and distribution while minimizing waste and reducing operational costs.

Moreover, the significance of the Demand Forecasting segment is magnified by the global shift towards renewable energy sources and the imperative for grid stability amidst fluctuating supply and demand. AI-driven demand forecasting provides the agility needed to adapt to these fluctuations, facilitating the integration of renewable energy into the grid.

By predicting peak demand times and potential shortfalls, energy providers can optimize resource allocation, engage in more effective load balancing, and even influence consumer energy consumption through demand response programs. This not only enhances energy efficiency but also contributes to environmental sustainability by reducing reliance on fossil fuels and minimizing carbon emissions.

End user Analysis

In 2023, the Utilities segment held a dominant position in the AI in Energy Market, capturing more than a 48% share. This segment’s prominence is primarily due to the critical role utilities play in integrating AI technologies to improve efficiency, reliability, and sustainability in energy systems.

Utilities are at the forefront of adopting AI for a range of applications, from predictive maintenance and load forecasting to customer service and grid optimization. This wide array of applications underscores the versatility and impact of AI in transforming traditional utility operations into more intelligent, responsive, and customer-centric services.

Furthermore, the Utilities segment leads due to the increasing pressures of climate change, regulatory requirements, and the rising demand for renewable energy sources. AI enables utilities to tackle these challenges head-on by optimizing energy flow, enhancing renewable energy integration, and providing data-driven insights for better decision-making.

The dominance of the Utilities segment is indicative of a broader trend towards digital transformation within the energy sector. As utilities continue to embrace AI, they are setting new standards for operational excellence, customer satisfaction, and environmental stewardship. This trend highlights the essential role of AI in enabling utilities to meet the evolving demands of a more dynamic and sustainable energy landscape, promising a future where energy systems are not only more efficient but also more adaptable and resilient.

Key Market segments

By Component

- Solutions

- Services

By Deployment Mode

- Cloud

- On-premise

By Application

- Robotics

- Renewables Management

- Demand Forecasting

- Safety and Security

- Infrastructure

- Others

By End user

- Energy Transmission

- Energy Generation

- Energy Distribution

- Utilities

Driver

Increasing Demand for Renewable Energy Integration

The escalating global focus on sustainability and reduction of carbon emissions is a significant driver for the AI in Energy Market. With renewable energy sources like solar and wind becoming increasingly vital to the energy mix, the challenge of integrating these intermittent energy sources into the grid is paramount.

AI’s ability to predict energy supply from renewables, based on weather conditions and historical data, enables more effective balancing of supply and demand. This predictive capability not only enhances grid stability but also optimizes the generation and distribution of renewable energy, driving the market’s growth as nations strive to meet their green energy targets.

Restraint

High Initial Investment and Complexity

A major restraint in the AI in Energy Market is the significant initial investment required for implementing AI technologies, coupled with the complexity of integrating these systems into existing energy infrastructure. The costs associated with acquiring, processing, and maintaining the vast amounts of data needed for AI applications can be prohibitive for some utilities, especially in regions with less financial flexibility.

Moreover, the complexity of retrofitting legacy systems with AI capabilities poses technical challenges that can hinder adoption rates, slowing down the overall market growth despite the potential benefits of AI in optimizing energy systems.

Opportunity

Advancements in IoT and Big Data Analytics

The rapid advancements in IoT (Internet of Things) and big data analytics represent a substantial opportunity for the AI in Energy Market. The proliferation of smart sensors and devices across energy networks generates vast datasets that, when analyzed with AI, can uncover insights to drive efficiency, predict equipment failures, and automate energy management processes.

This convergence of technologies enables more nuanced and dynamic control of energy systems, from generation through distribution to consumption, opening new avenues for innovation in energy management and operational efficiency.

Challenge

Data Privacy and Security Concerns

One of the primary challenges facing the AI in Energy Market is addressing concerns related to data privacy and security. As energy systems become more connected and reliant on data, they also become more vulnerable to cyber-attacks and breaches.

Ensuring the integrity and security of the data that AI applications depend on is crucial. Utilities and technology providers must navigate a complex landscape of regulations and implement robust cybersecurity measures to protect sensitive information, a task that requires constant vigilance and investment to keep pace with evolving threats.

Regional Analysis

In 2023, North America held a dominant market position in the AI in Energy sector, capturing more than a 41% share of the global market. The demand for AI in Energy in North America was valued at USD 1.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

This substantial market share can be attributed to several pivotal factors, including the region’s early adoption of advanced technologies, substantial investments in AI research and development, and the presence of a robust digital infrastructure.

North America, particularly the United States, has been at the forefront of the technological revolution, with numerous tech giants and startups driving innovation in artificial intelligence. This environment has facilitated the development and integration of AI solutions across various segments of the energy sector, including smart grid management, energy storage, and predictive maintenance.

The leadership of North America in this sector is further bolstered by its comprehensive policy framework and government support for AI and renewable energy initiatives. For example, initiatives aimed at reducing carbon footprints and enhancing energy efficiency have received substantial backing. This includes investments in smart grids and renewable energy sources where AI plays a critical role in optimization and management.

Moreover, the region’s commitment to tackling climate change and transitioning to more sustainable energy sources has accelerated the adoption of AI technologies. These efforts are supported by a highly skilled workforce, cutting-edge research institutions, and collaborations between the private sector and academic communities, ensuring continued innovation and growth in the AI in energy market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Artificial Intelligence (AI) in the Energy Market is undergoing transformative growth, driven by the increasing demand for operational efficiency and sustainable energy solutions. This analysis focuses on the key players in the AI in Energy sector, highlighting their strategic initiatives, product offerings, and market positioning. The integration of AI technologies in the energy sector aims to enhance grid management, forecast energy demand, optimize renewable energy usage, and improve energy storage solutions.

Top Market Leaders

- Schneider Electric

- Siemens AG

- Hazama Ando Corporation

- General Electric

- AppOrchid Inc

- Alpiq AG

- ABB Group

- ATOS SE

- Zen Robotics Ltd

- SmartCloud Inc.

- Other Key Players

Recent Developments

- ABB Group: Announced strategic partnership with Microsoft in February 2023 to focus on AI-powered industrial automation solutions, which could have applications in the energy sector.

- General Electric: There have been mentions of GE’s continued focus on AI for predictive maintenance in the energy sector in industry publications from early 2023.

- AVEVA, a global leader in industrial software, announced the completion of its acquisition by Schneider Electric in January 2023. This move signifies Schneider Electric’s continued expansion and investment in digital transformation solutions, particularly those enhancing the AI capabilities within the energy sector.

Report Scope

Report Features Description Market Value (2023) USD 3.7 Bn Forecast Revenue (2033) USD 51.4 Bn CAGR (2024-2033) 30.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Deployment Mode (Cloud, On-premise), By Application (Robotics, Renewables Management, Demand Forecasting, Safety and Security, Infrastructure, Others), By End user (Energy Transmission, Energy Generation, Energy Distribution, Utilities) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Schneider Electric, Siemens AG, Hazama Ando Corporation, General Electric, AppOrchid Inc, Alpiq AG, ABB Group, ATOS SE, Zen Robotics Ltd, SmartCloud Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI’s role in the energy market?AI plays a significant role in optimizing energy generation, transmission, distribution, and consumption. It helps in predicting energy demand, managing energy grids more efficiently, optimizing renewable energy sources, and improving overall operational efficiency.

How big is AI in Energy Market?The Global AI in Energy Market size is expected to be worth around USD 51.4 Billion by 2033, from USD 3.7 Billion in 2023, growing at a CAGR of 30.1% during the forecast period from 2024 to 2033.

Who are the major players operating in the artificial intelligence (AI) in energy market?The major players operating in the artificial intelligence (AI) in energy market are Schneider Electric, Siemens AG, Hazama Ando Corporation, General Electric, AppOrchid Inc, Alpiq AG, ABB Group, ATOS SE, Zen Robotics Ltd, SmartCloud Inc., Other Key Players

Which region will lead the global AI in Energy Market?In 2023, North America held a dominant market position in the AI in Energy sector, capturing more than a 41% share of the global market.

What are the challenges of implementing AI in the energy market?Some challenges include data quality and availability, regulatory constraints, integration with existing infrastructure, and the need for skilled personnel to develop and maintain AI systems. Additionally, there are concerns about privacy, security, and ethical implications associated with the use of AI in the energy sector.

-

-

- Schneider Electric

- Siemens AG

- Hazama Ando Corporation

- General Electric

- AppOrchid Inc

- Alpiq AG

- ABB Group

- ATOS SE

- Zen Robotics Ltd

- SmartCloud Inc.

- Other Key Players