Global AI Hiring Software Market Size, Share, Industry Analysis Report By Component (Software/Platform, Services (Implementation & Integration, Consulting & Training, Support & Maintenance)), By Deployment Mode (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Candidate Sourcing & Rediscovery, Resume Screening & Matching, Candidate Engagement (Chatbots), Skills & Psychometric Assessment, Interviewing & Analysis, Bias Reduction, Others), By End-User Industry (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166418

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Quick Market Facts

- Key Statistics on AI Hiring Software

- US Market Size

- By Component: Software/Platform

- By Deployment Mode: Cloud-Based

- By Organization Size: Large Enterprises

- By Application: Resume Screening & Matching

- By End-User Industry: IT & Telecom

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

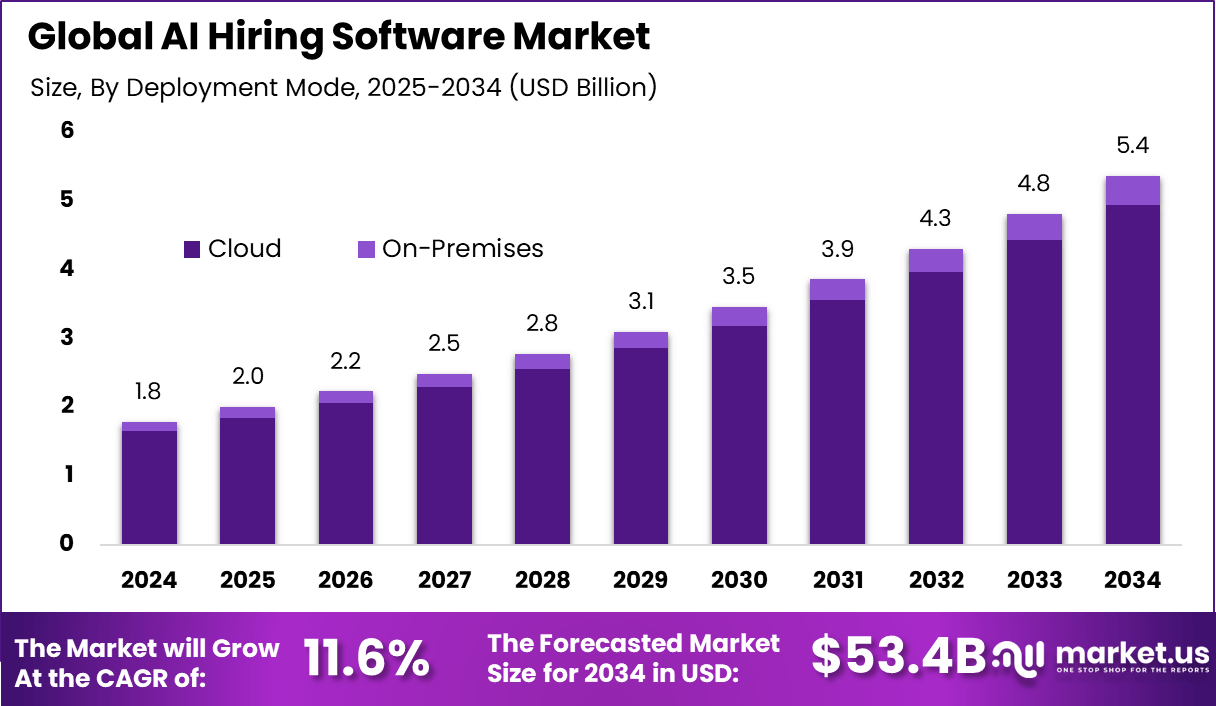

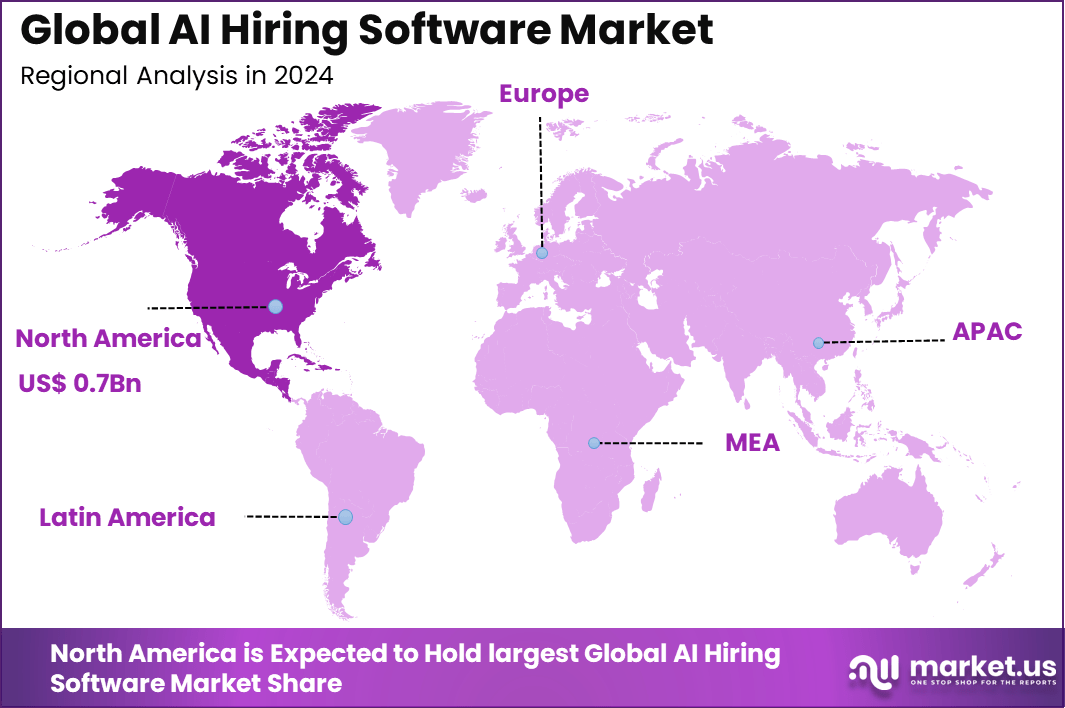

The Global AI Hiring Software Market generated USD 1.8 billion in 2024 and is predicted to register growth from USD 2.0 billion in 2025 to about USD 5.4 billion by 2034, recording a CAGR of 11.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.8% share, holding USD 0.7 Billion revenue.

The AI hiring software market has grown as organisations adopt intelligent recruitment tools to manage large applicant volumes and improve decision making in talent acquisition. The market has shifted from basic screening tools to advanced platforms that analyse resumes, evaluate skills, assist interviews and support end to end recruitment workflows. Growth reflects the rising need for faster, data driven hiring processes and improved candidate experience.

About 87% of companies reportedly use some form of AI recruiting software as of 2025, highlighting its widespread adoption as a core part of talent acquisition strategies. The growth of the market can be attributed to increasing recruitment activity across expanding industries, rising pressure to reduce hiring time and the need to improve match quality between applicants and job requirements. Organisations also seek to minimise bias in hiring decisions and ensure consistent evaluation standards.

Quick Market Facts

- By component, software/platform dominates with 78.5%, reflecting strong adoption of AI-driven recruitment and assessment tools across enterprises.

- By deployment mode, cloud-based solutions hold a commanding 92.2%, driven by scalability, accessibility, and seamless integration with HR systems.

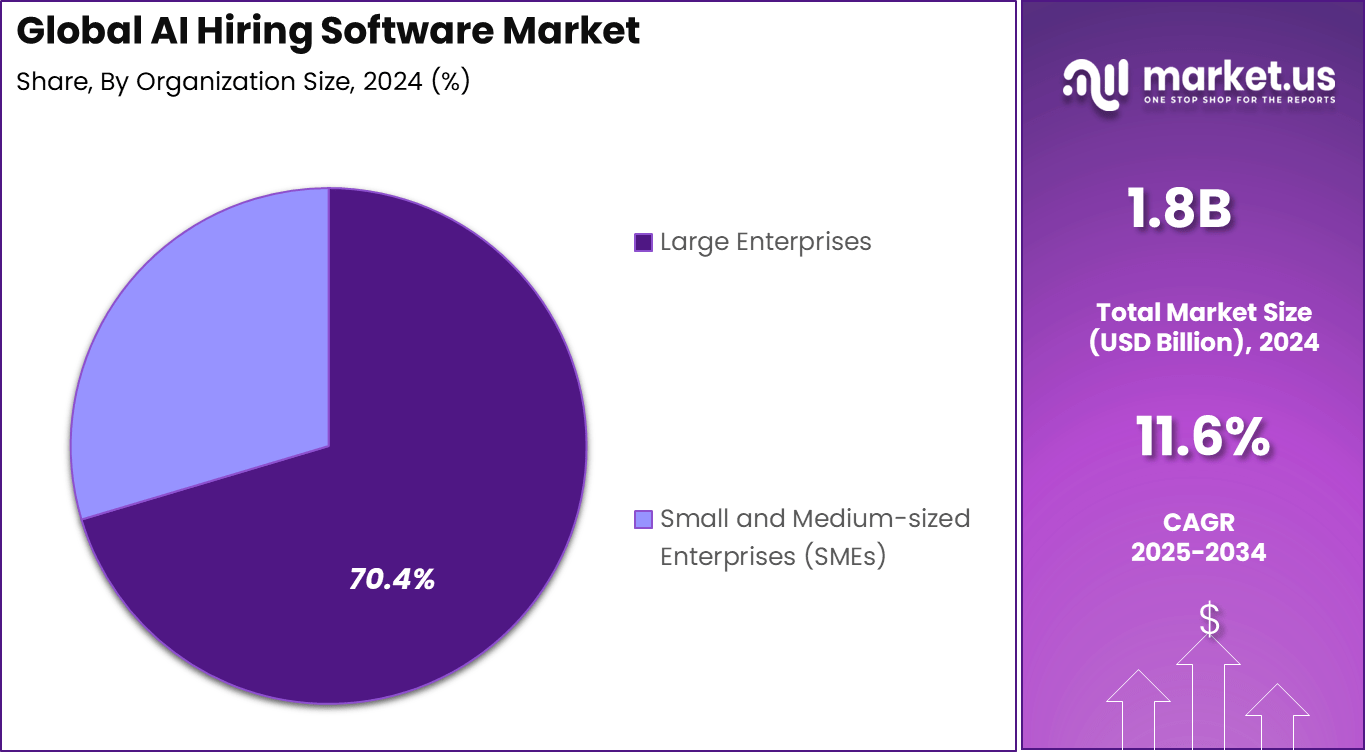

- By organization size, large enterprises lead with 70.4%, leveraging AI to streamline hiring processes and enhance candidate selection accuracy.

- By application, resume screening and matching accounts for 25.8%, highlighting AI’s growing role in automating candidate shortlisting and reducing bias.

- By end-user industry, IT & telecom represents 35.3%, where competition for skilled talent fuels investment in intelligent hiring technologies.

- North America leads with 41.8%, supported by early adoption and widespread digital transformation in HR operations.

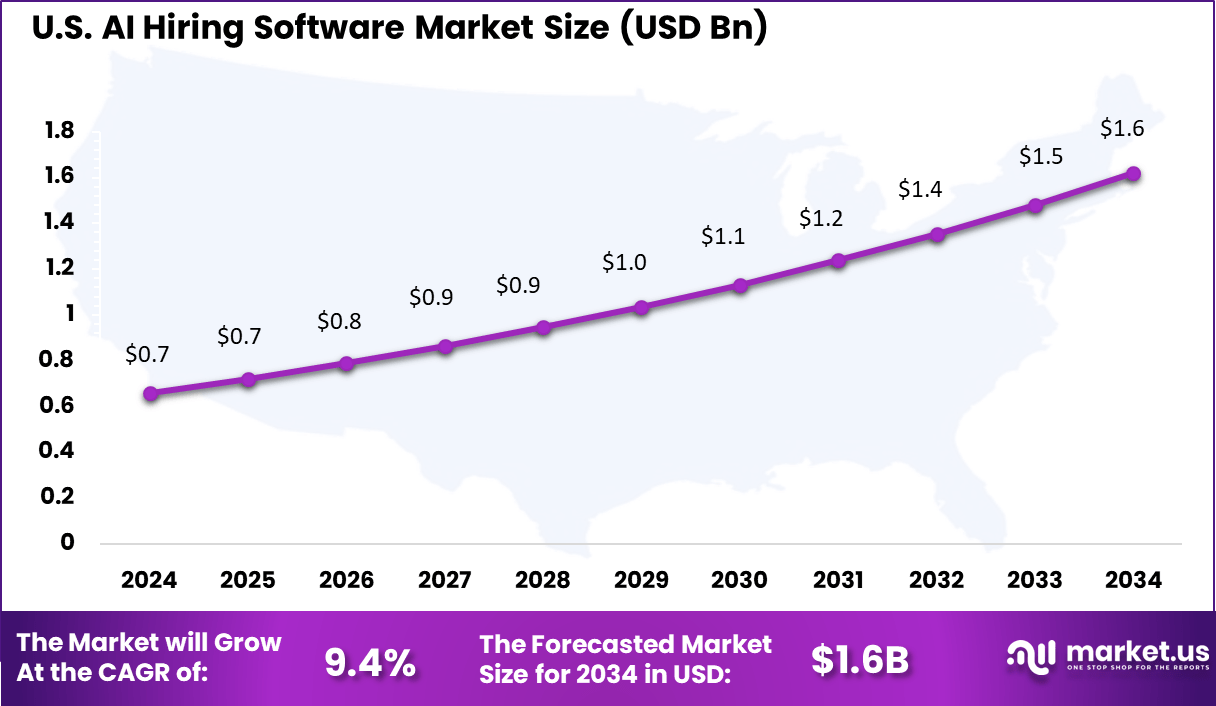

- The US market reached USD 0.66 billion and is growing at a steady CAGR of 9.4%, underscoring consistent demand for AI-enabled recruitment solutions.

Key Statistics on AI Hiring Software

Key Adoption

- About 88% of global organizations have integrated AI into their HR and hiring functions, and usage reaches 99% among Fortune 500 companies.

- AI adoption in HR is projected to grow by 35% annually through 2025, with 80% of organizations expected to fully integrate AI into HR functions by year end.

- Adoption is strongest in technology, finance, and healthcare, supported by high hiring volume and demand for specialized skills.

Efficiency and Cost Savings

- AI tools can reduce time-to-hire by 50%, helping companies accelerate recruitment cycles.

- Organizations report up to a 30% reduction in recruitment costs per hire when using AI-driven platforms.

- AI can automate about 40% of repetitive hiring tasks, including resume screening and interview scheduling.

- Recruiter productivity can increase by up to 60%, and AI screening tools show 89 to 94% accuracy in skill matching and resume parsing.

Bias and Fairness

- When properly designed and monitored, AI systems can reduce hiring bias by 56 to 61% by focusing on skills and objective criteria.

- Despite this potential, 67% of companies using AI hiring tools have experienced some form of bias due to training data reflecting historical patterns.

- 79% of candidates want to know when AI is used in the hiring process, and only 31% are comfortable with AI making a final hiring decision without human review.

US Market Size

The U.S. market alone contributes significantly, generating revenues around USD 0.66 billion, reflecting broad adoption across large companies and diverse industries. The market here is growing steadily with a compound annual growth rate (CAGR) of approximately 9.4%, driven by ongoing digital transformation efforts and the need for automated, bias-reducing recruitment technologies.

In 2024, North America holds a strong position in the AI hiring software market with a share of about 41.8%. This region benefits from advanced digital infrastructure and a culture that rapidly adopts innovative technologies. Enterprises in North America, especially in the United States, are heavily investing in AI-driven recruitment tools to streamline hiring processes and reduce costs.

By Component: Software/Platform

The AI hiring software market is heavily led by software and platform solutions, making up a dominant share of around 78.5%. This dominance shows companies prefer integrated software suites that automate key hiring tasks like resume parsing, candidate matching, and interview scheduling. Such software solutions provide the backbone for smarter recruitment processes, driving efficiency and reducing manual work for HR teams.

The focus on software reflects the market’s shift towards digitization and advanced automation in hiring. This software component forms the foundation for many AI hiring tools, including conversational agents, predictive analytics, and skill inference modules.

It supports HR departments with data-driven decision-making and scalable recruitment workflows, essential for meeting modern talent demands. Software’s leadership in this segment highlights its critical role in transforming traditional recruitment into a more agile, technology-enabled process.

By Deployment Mode: Cloud-Based

Cloud-based deployment dominates the AI hiring software market with a commanding share of around 92.2%. This high percentage reflects organizations’ preference for cloud platforms due to their scalability, ease of integration, and reduced infrastructure costs. Cloud solutions also enable continuous updates and seamless access to AI-driven hiring tools from anywhere, supporting hybrid and remote workforces efficiently.

Cloud deployment offers fast onboarding and simplified maintenance, allowing companies of all sizes to quickly adopt AI hiring systems without heavy upfront IT investment. Its popularity signals confidence in cloud security and reliability while providing flexibility to adapt recruitment processes dynamically as needs evolve.

By Organization Size: Large Enterprises

Large enterprises represent about 70.4% of AI hiring software users, indicating stronger adoption among bigger corporations. These organizations benefit from AI’s ability to handle high volumes of applications, automate repetitive tasks, and enhance recruitment outcomes at scale. Large companies often integrate AI deeply within global HR systems, using it to improve both efficiency and quality in talent acquisition.

This majority uptake by large enterprises also implies higher investment capabilities and a strategic focus on technology to maintain competitive advantage. AI tools help these organizations reduce time-to-hire and improve candidate matching, critical in meeting complex and evolving staffing needs across multiple business units.

By Application: Resume Screening & Matching

Resume screening and matching constitute the largest application segment in AI hiring software, accounting for about 25.8% of usage. This shows recruiters rely heavily on AI to automate the initial candidate selection process, which traditionally consumes substantial time.

AI-powered resume screening goes beyond keyword matching, analyzing contextual relevance, skills, experience, and qualifications to surface the best fits quickly. This application enhances hiring efficiency by drastically reducing manual resume reviews while improving the quality of candidate shortlists. It is particularly valuable in high-volume recruitment scenarios, ensuring that recruiters focus their efforts on the most promising applicants from the start.

By End-User Industry: IT & Telecom

The IT and telecom sector leads AI hiring software adoption among industries, making up around 35.3% of end users. This dominance reflects the sector’s need for rapid, precise recruitment to fill technically specialized roles in competitive talent markets. AI hiring tools in IT and telecom help automate sourcing, screening, and evaluation processes, addressing the high hiring volumes and speed requirements typical of this industry.

Technology firms and telecom companies benefit from AI’s ability to match candidates based on required skills and certifications, reducing time-to-hire and lowering recruitment costs. The industry’s openness to innovation complements the adoption of AI-driven hiring solutions to maintain agility and operational excellence.

Emerging Trends

Key Trends Description Agentic AI Automation AI hiring software is moving beyond recommendations to agentic AI that automates actions like posting jobs, sourcing candidates, scheduling interviews, and refining processes automatically. This shift helps recruiters focus on strategy instead of manual tasks. Skills-Based Hiring There is increasing focus on evaluating skills and competencies instead of traditional credentials. AI tools now simulate tasks and soft-skill scenarios to assess candidates more accurately, helping companies match the best fit for roles. Ethical and Transparent AI With rising regulatory scrutiny, AI hiring systems are incorporating bias detection, transparency, and explainability to support fair hiring and comply with major hiring regulations across the US, EU, and APAC. Predictive Analytics AI software uses predictive models to forecast workforce needs, retention risks, and candidate success rates, enabling recruiters to plan hiring strategies more effectively and support long-term talent retention. Hybrid Human-AI Collaboration Recruiters are increasingly partnering with AI tools that automate repetitive tasks while humans manage decision-making, ethics, diversity, and candidate engagement, creating a balanced and efficient recruitment workflow. Growth Factors

Key Factors Description Increasing AI Adoption Growing awareness and rising investments in AI-powered HR technology are accelerating the adoption of AI hiring software across global industries. Integration with HR Systems AI hiring platforms now integrate seamlessly with HR systems such as payroll, employee engagement tools, and learning management systems, enabling unified and efficient talent management. Demand for Faster Hiring Organizations are prioritizing reduced time-to-hire and lower recruitment costs. AI automation accelerates sourcing, screening, and interviewing processes to meet these expectations effectively. Growing Focus on Diversity AI-driven hiring supports diversity goals by minimizing unconscious bias through structured, data-driven skills assessments, improving fairness in candidate selection. Expansion in APAC Rapid digital transformation and increasing investment in talent acquisition technologies are fueling strong AI hiring software adoption in Asia Pacific, complementing stable growth in North American and European markets. Key Market Segments

By Component

- Software/Platform

- Services

- Implementation & Integration

- Consulting & Training

- Support & Maintenance

By Deployment Mode

- Cloud-Based

- On-Premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Candidate Sourcing & Rediscovery

- Resume Screening & Matching

- Candidate Engagement (Chatbots)

- Skills & Psychometric Assessment

- Interviewing & Analysis

- Bias Reduction

- Others

By End-User Industry

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Improved Efficiency and Cost Savings in Hiring

A key driver for AI hiring software is its ability to significantly improve recruitment efficiency while reducing costs. AI automates time-consuming tasks like resume screening, candidate sourcing, and interview scheduling. This allows HR teams to focus on strategic decision-making rather than repetitive work. These efficiencies shorten hiring cycles by 30-50% and help companies fill roles faster without compromising quality.

The continuous engagement enabled by AI-powered chatbots also enhances the candidate experience, positively impacting employer branding. This improvement is essential as businesses face increasing pressure to optimize resources and compete for talent in tight markets.

AI-driven hiring tools provide data-driven insights that improve candidate matching and reduce bias, leading to better hires. These benefits make AI adoption attractive for companies looking to modernize hiring processes and increase overall productivity in talent acquisition.

Restraint Analysis

High Implementation Costs and Integration Challenges

Despite its advantages, high initial costs and technical challenges restrain the widespread adoption of AI hiring software. Building and deploying AI systems requires investments in infrastructure, software, and skilled personnel.

Small and medium enterprises often struggle to afford these upfront expenses. Moreover, integrating AI tools into existing HR systems can be complex and time-consuming, slowing adoption especially in companies with legacy systems.

The need for robust cybersecurity and compliance measures further adds to costs, limiting how quickly organizations can deploy AI hiring solutions. These financial and operational hurdles create a barrier for some firms, particularly those without dedicated IT resources or large budgets.

Opportunity Analysis

Expansion into Hybrid Human-AI Hiring Models

The biggest opportunity lies in hybrid models that combine human judgment with AI automation to improve recruiting outcomes. Newer AI systems go beyond recommendations to autonomously execute tasks such as job posting, candidate outreach, and interview scheduling. This allows recruiters to focus on nuanced decisions while AI handles volume and workflow orchestration.

Such hybrid approaches present the chance to redefine hiring by increasing speed, personalization, and fairness. They also open markets across industries facing talent shortages and high volumes of hiring. Continued adoption of cloud-based AI recruitment platforms supports scalability and seamless collaboration, underscoring the growth potential in both large enterprises and fast-growing companies.

Challenge Analysis

Ethical Concerns and Algorithmic Bias

A pressing challenge for AI hiring software is addressing ethical concerns, particularly algorithmic bias and fairness. AI systems trained on historical data can inadvertently perpetuate biased hiring practices or exclude qualified candidates. This has sparked regulatory scrutiny and demands for transparency and explainability.

Recruitment AI vendors must build safeguards and auditing tools to detect and mitigate bias. Maintaining candidate trust requires clear communication and visible human oversight of AI decisions. Navigating this complex landscape is crucial for software providers and users to ensure compliance and fairness while realizing AI’s full potential in hiring.

Competitive Analysis

HireVue, Pymetrics, Eightfold.ai, and HiredScore play a leading role in the AI hiring software market. Their platforms use video analytics, behavioral assessments, and machine-learning models to improve talent screening accuracy. These companies support employers with faster candidate evaluation, reduced bias, and stronger prediction of job fit.

Beamery, Talview, X0PA AI, Ideal, Harver, XOR.ai, SeekOut, Knockri, Entelo, and Modern Hire strengthen the market with broader AI-driven recruitment capabilities. Their systems offer automated sourcing, structured assessments, and conversational hiring workflows. These providers focus on improving candidate engagement through real-time communication and intelligent matching engines.

Phenom People, SmartRecruiters, Oracle Recruiting Cloud, SAP SuccessFactors, Workday, Cornerstone OnDemand, Breezy HR, Greenhouse, and other participants expand the landscape with unified talent platforms. Their offerings combine applicant tracking, AI recommendations, and automated workflows to streamline the entire hiring cycle. These companies support global HR operations with strong integrations, advanced analytics, and scalable architectures.

Top Key Players in the Market

- HireVue

- Pymetrics

- Eightfold.ai

- HiredScore

- Beamery

- Talview

- X0PA AI

- Ideal

- Harver

- XOR.ai

- SeekOut

- Knockri

- Entelo

- Modern Hire

- Phenom People

- SmartRecruiters

- Oracle Recruiting Cloud

- SAP SuccessFactors

- Workday

- Cornerstone OnDemand

- Breezy HR

- Greenhouse

- Others

Recent Developments

- June 2025: HireVue released its 2025 Global Guide to AI in Hiring, highlighting how AI accelerates hiring processes and decision-making globally. They also introduced the Talent Engagement Agent, which empowers candidates with AI-driven control over their hiring journey, enhancing the overall experience.

- July 2025: Beamery launched a Workforce Intelligence Suite featuring first-to-market Task Intelligence technology that breaks down job roles into tasks, revealing automation and workforce optimization opportunities. They also introduced Ray, an embedded AI consultant to assist leaders in talent decisions.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 5.4 Bn CAGR(2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform, Services (Implementation & Integration, Consulting & Training, Support & Maintenance)), By Deployment Mode (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Candidate Sourcing & Rediscovery, Resume Screening & Matching, Candidate Engagement (Chatbots), Skills & Psychometric Assessment, Interviewing & Analysis, Bias Reduction, Others), By End-User Industry (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HireVue, Pymetrics, Eightfold.ai, HiredScore, Beamery, Talview, X0PA AI, Ideal, Harver, XOR.ai, SeekOut, Knockri, Entelo, Modern Hire, Phenom People, SmartRecruiters, Oracle Recruiting Cloud, SAP SuccessFactors, Workday, Cornerstone OnDemand, Breezy HR, Greenhouse, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HireVue

- Pymetrics

- Eightfold.ai

- HiredScore

- Beamery

- Talview

- X0PA AI

- Ideal

- Harver

- XOR.ai

- SeekOut

- Knockri

- Entelo

- Modern Hire

- Phenom People

- SmartRecruiters

- Oracle Recruiting Cloud

- SAP SuccessFactors

- Workday

- Cornerstone OnDemand

- Breezy HR

- Greenhouse

- Others