Global AI Fridge Market Size, Share, Growth Analysis By Product Type (Single Door, Double Door, Side-by-Side Door, French Door, Others), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Application (Residential, Commercial, Industrial), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161762

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Key Takeaways

- Role of AI in Electronics

- Analysts’ Viewpoint

- AI Industry Adoption

- US Market Size

- Emerging trends

- Investment and Business Benefits

- By Product Type

- By Technology

- By Application

- By Distribution Channel

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunity

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

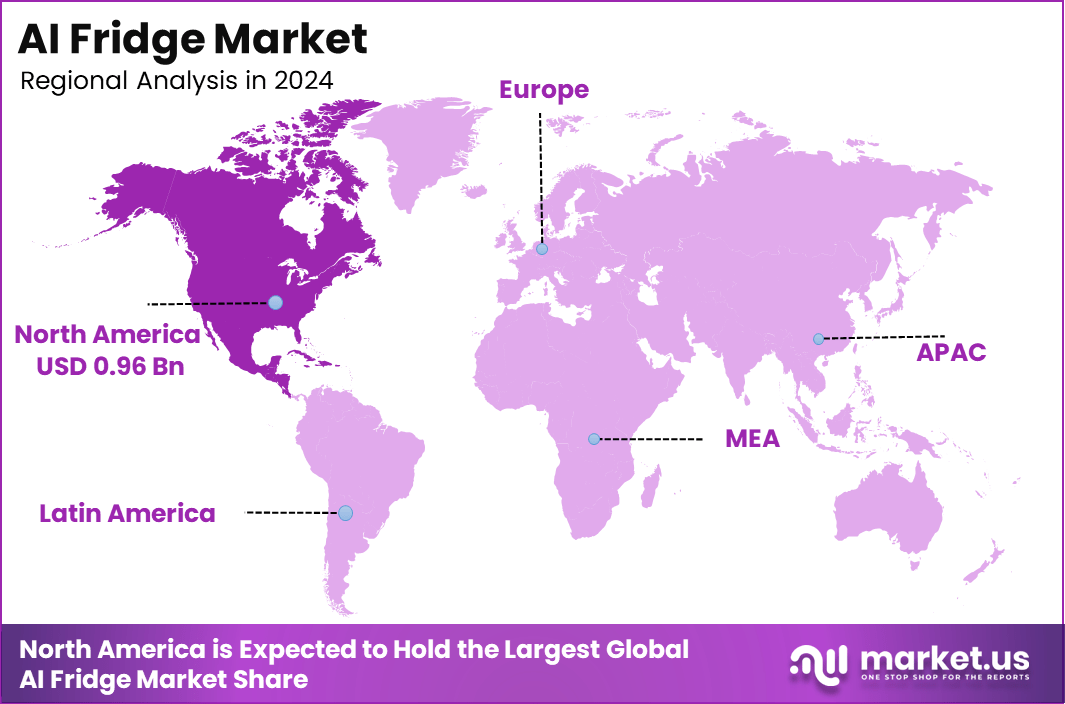

The Global AI Fridge Market was valued at USD 2.56 billion in 2024 and is projected to witness substantial growth, reaching approximately USD 16.0 billion by 2034, registering a CAGR of 20.2% throughout the forecast period. In 2024, North America held a dominant position in the global market, capturing around 37.5% of the total share with a market size of USD 0.96 billion. Within the region, the United States emerged as the leading contributor, accounting for USD 0.81 billion in 2024, and is expected to grow significantly to approximately USD 4.34 billion by 2034, expanding at a CAGR of 18.3% during the forecast timeline.

The AI refrigerator market continues to see notable advancements. In 2025, new product launches emphasize deeper AI integration with features like advanced food expiry tracking using AI vision technology, predictive grocery ordering powered by machine learning, and improved voice assistant capabilities compatibile with popular smart home ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit.

For example, Samsung launched its latest AI fridge model in early 2025, equipped with a fully autonomous food inventory system and AI-powered meal planning, which is expected to boost its market share by 8-10% this year. Funding rounds remain robust, with over $250 million raised globally in Q1-Q3 2025 among startups focusing on AI algorithms for smart kitchen appliances. The market is also witnessing strategic partnerships between refrigerator manufacturers and AI software firms to co-develop innovative solutions.

Key players like LG, Samsung, Panasonic, Haier, and others are heavily investing in AI features such as smart inventory management, personalized food recommendations, voice controls, and integration with smart home systems. Annually, around 15 million AI fridges are sold worldwide, with fast adoption in developed countries and growing demand in emerging markets.

There are about 10 to 15 relevant mergers and acquisitions yearly, mostly involving smaller AI and IoT tech firms, valued at over $500 million collectively. Funding and R&D focus on improving energy efficiency, reducing food waste, and enhancing user convenience through AI-driven innovations. Despite challenges like high costs and data privacy concerns, the market trend is shifting towards more affordable models and broader consumer acceptance, indicating a robust growth trajectory in this segment.

Additionally, sustainability is gaining traction; companies are investing in AI models to optimize energy consumption and extend food freshness, contributing to global waste reduction efforts. On the M&A front, recent deals include a major merger between two AI appliance companies valued at $200 million and acquisitions by larger firms aiming to consolidate AI technology expertise. The Asia-Pacific region is a significant growth hub, contributing to nearly 30-35% of global sales driven by rising disposable incomes and smart home adoption in China, Japan, and South Korea.

Overall, the AI fridge market is rapidly evolving with increasing consumer demand, significant investments, and innovation focusing on convenience, connectivity, and sustainability, pushing the market growth beyond the $20 billion mark by the end of the decade.

Top Key Takeaways

- The Global AI Fridge Market reached USD 2.56 billion in 2024 and is expected to expand at a CAGR of 20.2% through 2034 growing at USD 16.0 billion, driven by the integration of AI for energy efficiency and smart home connectivity.

- North America accounted for 37.5% of the total market, valued at USD 0.96 billion in 2024, showcasing early consumer adoption and advanced digital infrastructure.

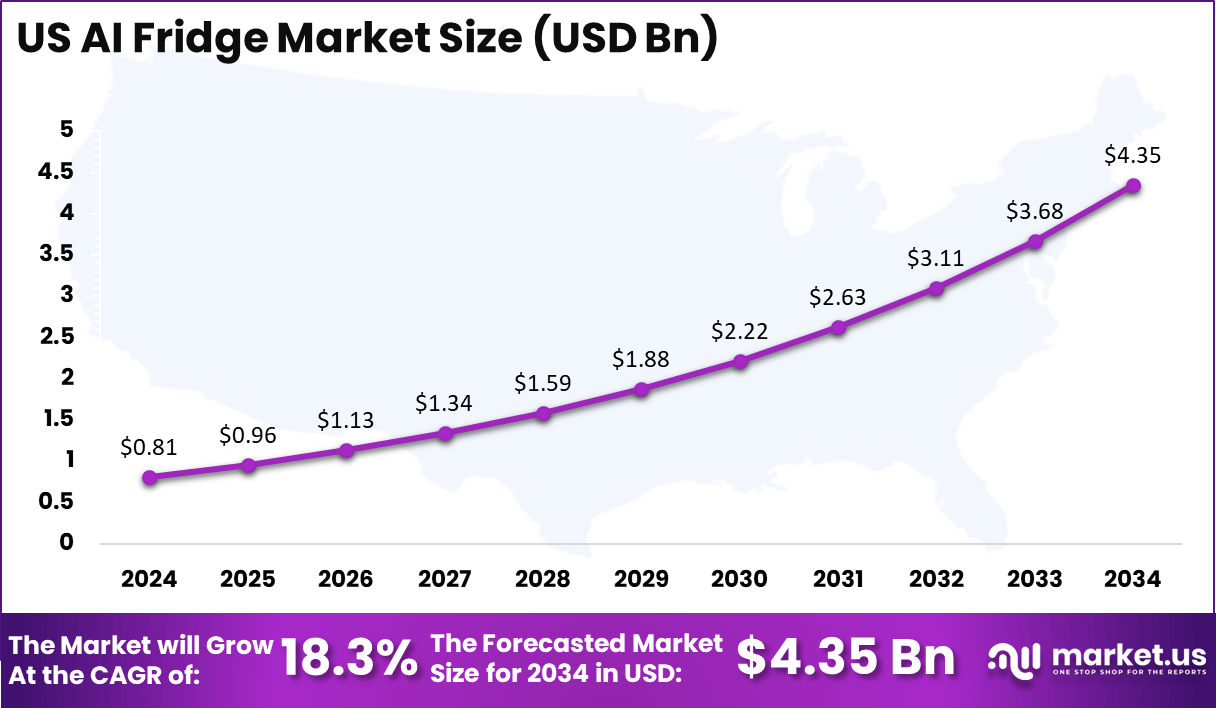

- The U.S. market generated USD 0.81 billion in 2024 and is projected to grow steadily at a CAGR of 18.3%, supported by increasing demand for connected kitchen appliances.

- By product type, double-door AI fridges held a 35.8% share, driven by their enhanced storage capacity and popularity among middle to high-income households.

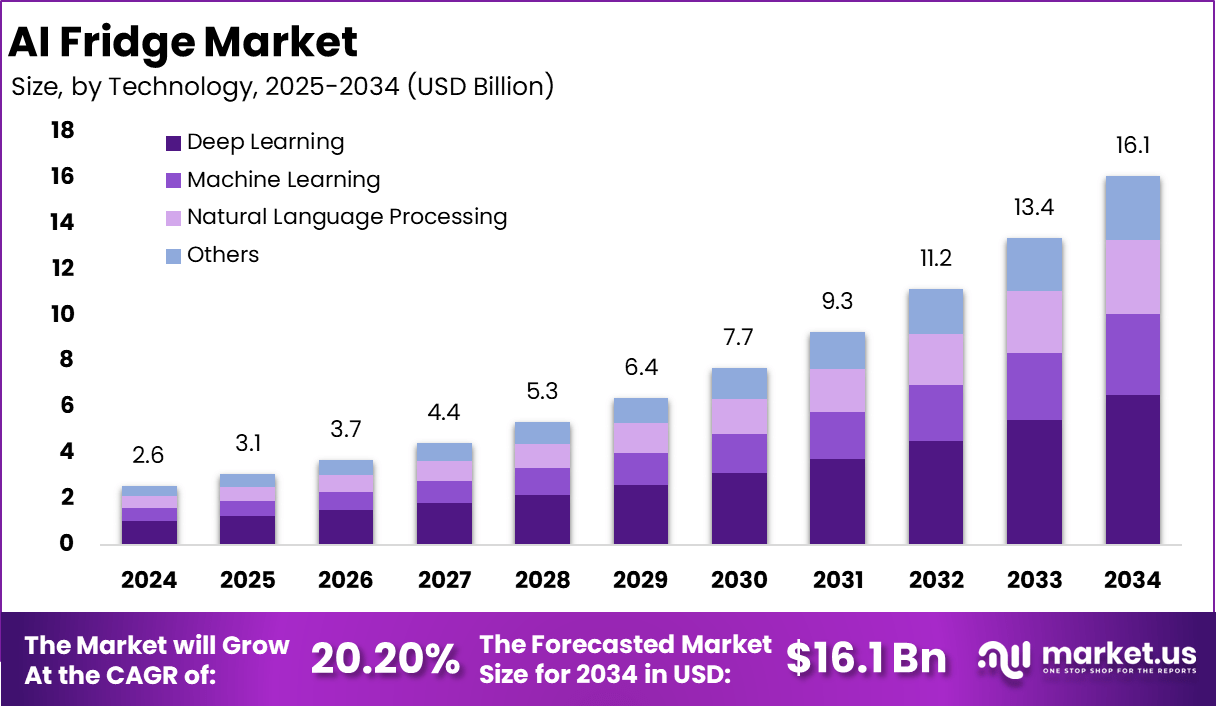

- By technology, deep learning dominated with 40.5%, reflecting its growing role in improving energy management, food tracking, and predictive maintenance.

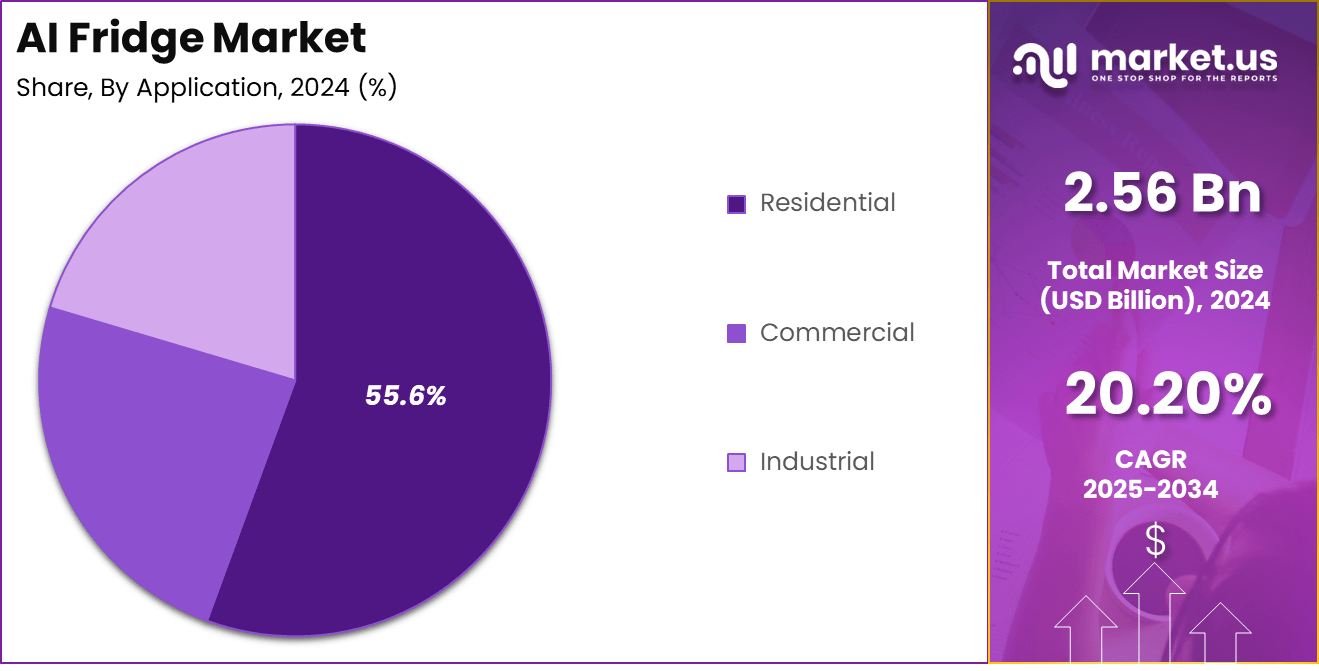

- By application, the residential segment led the market with 55.6%, fueled by rising smart home integration and consumer preference for convenience-based technologies.

- By distribution channel, supermarkets and hypermarkets accounted for 44.8% of sales, benefiting from brand visibility, product variety, and consumer trust in in-store appliance purchases.

Role of AI in Electronics

Artificial Intelligence (AI) is revolutionizing the electronics industry by enabling smarter, more efficient, and adaptive devices across consumer and industrial applications. In consumer electronics, AI enhances personalization and automation in products such as smartphones, smart TVs, AI-enabled refrigerators, and wearable devices.

These systems learn from user behavior to optimize performance, energy consumption, and functionality. For instance, AI-powered appliances can monitor usage patterns, predict maintenance needs, and provide real-time operational insights, improving both convenience and sustainability. In manufacturing, AI-driven predictive maintenance, quality control, and process automation are transforming production efficiency and reducing downtime.

Semiconductor companies are integrating AI algorithms into chips, enabling faster data processing and real-time decision-making in edge devices. Moreover, AI supports the development of energy-efficient electronics through intelligent power management systems that dynamically adjust operations to minimize waste. The growing integration of AI in robotics, IoT, and embedded systems is also accelerating the evolution of smart homes, autonomous vehicles, and connected industrial ecosystems.

Analysts’ Viewpoint

Analysts generally regard the AI fridge market as a high-potential niche within the broader smart appliances segment. They highlight that its growth will be anchored in consumer demand for convenience, energy efficiency, and seamless integration into smart home ecosystems. Many believe that as AI algorithms mature, features like inventory tracking, predictive food spoilage alerts, and recipe recommendations will transition from differentiators to standard expectations.

However, analysts also note that adoption is likely to be gradual, constrained by high price premiums, consumer concerns over data privacy, and the incremental nature of value added by AI in refrigerators compared to core cooling functions. They anticipate that early growth will come from premium segments in developed markets, before trickling down to mainstream consumers as costs fall and technology matures.

Geographically, analysts expect North America to maintain leadership initially due to strong purchasing power and digital infrastructure, but envision significant catch-up growth in Asia-Pacific markets, driven by rising middle class, urbanization, and smart home adoption. Strategic moves such as partnerships between appliance manufacturers and AI software firms, as well as acquisitions aimed at enhancing AI capability, are predicted to intensify competition. Ultimately, analysts see success in this market going to those who combine robust AI features with reliable hardware, consumer trust, and affordability.

AI Industry Adoption

The proliferation of AI across industries has accelerated sharply in recent years, moving beyond pilot projects to core business operations. Over three-quarters of companies now use AI in at least one business function, and generative AI adoption is rising rapidly. Although nearly all firms invest in AI, only about 1% claim full AI maturity, indicating that many are still in early or intermediate stages of deployment.

The adoption is particularly strong in large enterprises and information-intensive sectors. Companies with annual revenue over USD 500 million are leading the restructuring of workflows and governance practices around AI. Industries such as IT & telecommunications (≈ 38%), retail & consumer goods (≈ 31%), financial services (≈ 24%), and healthcare (≈ 22%) are among the frontrunners in AI uptake. Despite widespread interest, challenges remain.

Many organizations struggle to scale AI beyond proofs-of-concept due to talent gaps, data silos, lack of leadership buy-in, and governance concerns. For the foreseeable future, the AI adoption curve will be defined by how effectively firms embed AI into their processes, build organizational capabilities, and manage ethical, security, and regulatory aspects.

US Market Size

The United States holds a leading position in the global AI Fridge Market, accounting for approximately USD 0.81 billion in 2024 grow to USD 4.35 billion. The country’s strong consumer base, advanced digital infrastructure, and rapid adoption of smart home technologies have positioned it as a key growth driver in the sector. Increasing demand for energy-efficient and connected household appliances, coupled with the integration of AI for predictive maintenance and food management, continues to fuel market expansion.

The growing penetration of IoT devices and the availability of high-speed internet are further supporting AI-enabled appliance adoption. Major appliance manufacturers in the U.S. are investing heavily in R&D to introduce AI-driven features that enhance convenience, sustainability, and personalization. The market is projected to reach substantial levels by 2034, expanding at a CAGR of 18.3%. This sustained growth underscores the U.S. consumer preference for intelligent, eco-friendly, and digitally integrated home solutions.

In addition, government initiatives promoting energy efficiency and sustainable technologies are strengthening AI appliance adoption across American households. Programs such as ENERGY STAR and smart home incentive schemes are encouraging consumers to transition toward intelligent, low-power appliances like AI fridges.

The integration of advanced sensors, machine learning algorithms, and smart connectivity is transforming traditional refrigerators into interactive, data-driven systems capable of reducing waste and optimizing energy use. The growing ecosystem of voice assistants, home automation platforms, and cloud-based analytics further supports interoperability between appliances and mobile devices.

As leading U.S. manufacturers collaborate with AI software developers and semiconductor companies, the market is expected to see continued innovation in performance optimization and user experience, reinforcing the nation’s position as a global leader in AI-driven home electronics.

Emerging trends

AI-Enabled Food Computing & Vision Systems

Next-generation fridges increasingly integrate computer vision with IoT sensors to monitor food items, detect spoilage, and automatically manage inventory in real time. For example, a recent system architecture uses ESP32-CAM modules and a calibrated focal-loss deep learning model to improve detection accuracy under challenging lighting and occlusion conditions.

Hybrid Cooling & Energy Optimization Techniques

Brands like Samsung are experimenting with hybrid approaches combining traditional compressors and Peltier (thermoelectric) modules to reduce temperature fluctuations while improving energy efficiency. Meanwhile, AI algorithms adjust cooling cycles dynamically based on usage patterns and external conditions to optimize performance and lower electricity consumption.

Seamless Smart Home & Retail Integration

AI fridges are increasingly acting as nodes in broader smart-home ecosystems, communicating with climate systems, voice assistants, and grocery platforms. For instance, Samsung’s “AI Vision Inside” enables the fridge to detect when stocks are low and trigger automated restocking orders via partners.

Investment and Business Benefits

Investments in the AI Fridge Market are accelerating as manufacturers and technology firms recognize its potential to transform home automation and energy efficiency. Companies are channeling capital into AI algorithm development, smart sensor integration, and IoT connectivity to enhance appliance performance and sustainability.

The growing demand for energy-efficient and self-learning home appliances is attracting venture funding and strategic partnerships between appliance makers, AI software developers, and semiconductor manufacturers. Investors view AI refrigerators as a long-term opportunity, driven by global trends in smart homes, climate-friendly technologies, and digital lifestyle adoption.

From a business perspective, AI-enabled refrigerators provide multiple benefits, including optimized energy consumption, predictive maintenance, and enhanced user convenience through real-time monitoring and automation. Retailers and brands gain valuable consumer insights from AI-powered data analytics, improving inventory planning and product design.

The market’s projected between 2024 and 2034 underscores its high return potential. Businesses investing early in AI-based appliance innovation are expected to secure competitive advantages through brand differentiation, operational efficiency, and alignment with sustainability goals, positioning themselves strategically within the expanding smart home ecosystem.

By Product Type

The Double Door segment commands a substantial share of approximately 35.8% within the AI fridge market, underscoring its popularity among consumers seeking a balance between storage capacity and functionality. These refrigerators typically offer more flexibility in compartmentalization with separate cooling zones for fresh and frozen items, which aligns well with smart AI features like adaptive temperature control, internal monitoring, and selective cooling. Because many households demand moderate to high storage volume without entering the oversized or premium “French door” category, double-door models hit a compelling sweet spot for AI integration.

Single-door models are often more affordable and space-efficient, catering to smaller homes or apartments, but they generally lack the luxury of separate zones and advanced AI capabilities. Side-by-side door designs offer a more vertical layout, enabling easier organization and access, making them a good platform for AI-driven inventory monitoring and food tracking.

French door units, with their premium positioning and expansive capacity, are well-suited for advanced smart features but tend toward the higher end of the price spectrum, potentially slowing mass adoption. Other configurations (like bottom-freezer, top-freezer, or convertible models) capture niche preferences and can also adopt AI capabilities for specialized use cases such as compact layouts or hybrid zones.

By Technology

Deep Learning – 40.5%: Deep learning leads the technology segment in the AI fridge market, reflecting its strength in handling complex tasks such as image recognition for inventory management, anomaly detection, and advanced pattern analysis. Its capacity for processing large volumes of sensor and visual data makes it ideal for enabling features like spoilage prediction and adaptive temperature control.

Machine Learning: ML techniques are widely used for predictive modeling, usage-pattern recognition, and demand forecasting. Lighter-weight ML models support energy-saving functions and behavioral adaptation in AI fridges.

Natural Language Processing (NLP): NLP enables more intuitive user interaction, letting consumers issue voice commands or textual queries (e.g. “What’s inside my fridge?”). While still emerging, it offers convenience and accessibility, especially when paired with voice assistants.

Others: Other techniques may include rule-based systems, classical statistics, or hybrid AI approaches combining expert systems with learning models. These simpler or supporting methods fill gaps where full deep learning or ML may be overkill.

By Application

The residential segment dominates the AI fridge market with a 55.6% share, reflecting consumers’ preference for smart home integration, convenience, and energy efficiency. Homeowners are increasingly adopting intelligent refrigerators that manage food stocks, suggest recipes, monitor spoilage, and optimize energy use, driving growth in the residential space.

In the commercial domain, AI fridges are being deployed in retail settings, vending stations, convenience stores, and supermarkets for unattended retail and display refrigeration. Innovations such as smart vending fridges that detect product removal, perform inventory tracking, and enable cashless payment illustrate commercial adoption.

The industrial segment, though smalle,r sees use of AI-enabled refrigerators in food processing, cold storage, and logistics sectors, where large-scale temperature control and predictive maintenance are critical. In industrial applications, AI monitors compressor health, humidity, and load patterns to improve uptime and energy efficiency.

Overall, the dominance of residential use suggests that consumer demand is the primary driver of the AI fridge market’s near-term growth, while commercial and industrial applications present high-efficiency and scale opportunities over the longer term.

By Distribution Channel

The supermarkets and hypermarkets channel leads distribution in the AI fridge market with a 44.8% share, making it the most popular route for consumers to purchase these smart appliances. This dominance is attributable to the wide physical presence, extensive product variety, trustworthy retail environment, and the ability for customers to see, touch, and compare models firsthand. Furthermore, on-site promotional displays, staff demonstrations, and bundled offers (e.g., free installation or extended warranties) enhance sales through these traditional retail formats.

Meanwhile, online stores are gaining traction, especially among tech-savvy and younger users who prefer researching detailed product specs, reading reviews, and availing of doorstep delivery services. The convenience and comparison features of e-commerce platforms make them an increasingly compelling alternative, particularly for high-end appliances with long lifecycles.

Specialty stores—such as appliance showrooms and dedicated smart home outlets—cater to niche and premium segments, offering expert consultations, installations, and bundled smart home solutions. Finally, other channels (like B2B distribution, direct-to-consumer from manufacturers, or home improvement chains) also contribute to market coverage, especially in regions where supermarket density is low or consumers favor direct deals.

Key Market Segments

By Product Type

- Single Door

- Double Door

- Side-by-Side Door

- French Door

- Others

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Others

By Application

- Residential

- Commercial

- Industrial

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis

The North American region leads the AI fridge market, capturing 37.5% of global share in 2024, with revenue of approximately USD 0.96 billion. This dominance stems from high disposable incomes, mature smart home adoption, advanced digital infrastructure, and early consumer acceptance of intelligent appliances. The U.S., in particular, contributes heavily, with USD 0.81 billion in 2024, reflecting its role as a primary innovation and consumption center.

In Europe, market growth is driven by stringent energy efficiency regulations, environmental awareness, and high levels of smart home integration in countries like Germany, the U.K., France, and Scandinavia. Consumers in these markets are receptive to AI features and are incentivized by energy-efficiency policies and subsidies, making Europe a key secondary region.

The Asia-Pacific region is emerging as the fastest-growing market, supported by rising urbanization, expanding middle classes, and increasing smart appliance penetration in countries such as China, South Korea, Japan, and India. The large population base and growing affordability of technology amplify the market potential here.

Latin America and the Middle East & Africa remain in earlier adoption phases but offer growth opportunities as incomes rise and smart home awareness spreads. Manufacturers targeting these markets may need to focus on cost-effective models and localized features (e.g., power stability, language interfaces) to drive penetration.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The AI fridge market is driven by growing consumer demand for smart home appliances that offer convenience, energy efficiency, and intelligent automation. Integration of AI and IoT technologies allows refrigerators to monitor temperature, manage inventory, and suggest personalized food choices, improving lifestyle and reducing waste.

Increasing awareness of sustainable energy consumption and government initiatives promoting smart energy use further accelerate adoption. The rise in disposable income and expanding middle-class populations in developing countries are also fueling demand for connected appliances. Continuous innovation in AI algorithms and sensor technologies is enhancing product performance and user experience, supporting long-term market growth.

Restraint Factors

Despite strong growth prospects, high product costs and limited affordability in developing economies remain significant restraints for the AI fridge market. Data privacy concerns and cyber risks associated with connected appliances discourage some consumers from adopting smart refrigerators. Additionally, inconsistent internet connectivity in emerging regions limits the functionality of cloud-based AI systems.

Integration complexity and lack of standardization among manufacturers create interoperability challenges between appliances and smart home ecosystems. Moreover, the need for periodic software updates and maintenance increases operational costs. These factors, coupled with limited consumer awareness in rural areas, continue to hinder widespread adoption of AI-enabled fridges globally.

Growth Opportunity

Expanding AI capabilities and the rapid adoption of IoT present significant opportunities for the AI fridge market. Growing smart home penetration in developing economies, combined with declining component costs, is making AI refrigerators more accessible. Manufacturers are increasingly investing in edge computing and deep learning technologies to enhance real-time performance and privacy.

Partnerships between appliance makers, AI software firms, and energy utilities are unlocking new business models such as predictive maintenance and energy optimization. The rising emphasis on sustainability and demand for connected, low-energy appliances creates lucrative opportunities for brands to differentiate through innovation and eco-friendly smart home solutions worldwide.

Challenging Factors

Key challenges in the AI fridge market include data management, privacy protection, and hardware-software compatibility across multiple ecosystems. The integration of advanced AI algorithms requires high processing power, raising production and maintenance costs. Manufacturers face difficulties in achieving seamless connectivity among diverse IoT platforms and home automation systems.

Consumer skepticism regarding AI reliability and fear of data misuse further slow adoption. Additionally, limited AI expertise and technical infrastructure in developing regions restrict market scalability. Balancing product affordability, data security, and consistent performance remains a major challenge for companies striving to gain a competitive advantage in the rapidly evolving AI appliance landscape.

Competitive Analysis

The AI fridge market is increasingly dominated by established home-appliance and consumer electronics giants that combine deep hardware expertise with software, AI, and connectivity capabilities. Samsung, LG, Haier, Whirlpool, Bosch (BSH), and Electrolux are among the leading names leveraging strong brand equity, global distribution networks, and R&D investments.

Samsung leads by aggressively integrating AI and connectivity features such as its AI Vision Inside platform, which can recognize food items and trigger automated shopping via partner platforms like Instacart. LG’s ThinQ ecosystem offers interoperability across appliances, emphasizing energy efficiency and voice control as differentiators.

Haier, with its strong presence in China and ownership of GE Appliances, leverages scale and IoT infrastructure to compete aggressively, especially in emerging markets. Meanwhile, appliance incumbents like Whirlpool and Bosch are increasingly adopting AI and smart features, focusing on reliability, service ecosystems, and backward compatibility to retain existing customers.

The competitive battleground is shifting to service integration, AI software platforms, and ecosystems, rather than hardware superiority alone. Vendors now compete on analytics, intelligent features (e.g. predictive food spoilage, voice recognition), and smart home compatibility (e.g. Matter, Alexa, Google Home). New entrants and niche players may differentiate via specialized AI modules, energy-optimization models, or regional market focus.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- Haier Group Corporation

- Panasonic Corporation

- Bosch Siemens Hausgeräte (BSH) GmbH

- Electrolux AB

- Midea Group Co., Ltd.

- GE Appliances

- Hisense Co., Ltd.

- Hitachi, Ltd.

- Toshiba Corporation

- Sharp Corporation

- Daewoo Electronics Corporation

- Fujitsu General Limited

- Liebherr Group

- Sub-Zero Group, Inc.

- Viking Range, LLC

- Godrej & Boyce Manufacturing Company Limited

- Other Major Players

Major Developments

- October 2025: Samsung Introduces Bespoke AI Refrigerator with Vision Recognition Technology

Samsung launched its next-generation Bespoke AI Refrigerator in October 2025, featuring advanced Vision Recognition Technology that automatically identifies stored food items and tracks expiration dates. The appliance integrates with Samsung SmartThings and AI Energy Mode, optimizing power usage and offering recipe suggestions based on available ingredients. This innovation highlights Samsung’s continued focus on sustainability, automation, and seamless smart home connectivity.

- September 2025: LG Expands ThinQ AI Ecosystem with Next-Gen Smart Fridge Series

LG Electronics unveiled its upgraded ThinQ AI Refrigerator lineup in September 2025, introducing enhanced deep learning algorithms for food management and energy optimization. The new series includes voice-controlled features, predictive cooling systems, and real-time food freshness monitoring. LG’s expansion of the ThinQ platform strengthens its position in the premium smart appliance market and reinforces its commitment to connected living solutions.

- August 2025: Haier Launches Smart Kitchen 4.0 with AI-Integrated Fridge Connectivity

Haier introduced its Smart Kitchen 4.0 platform in August 2025, integrating AI-driven refrigerators capable of synchronizing with cooking appliances and mobile apps. The system enables automated grocery management, inventory tracking, and nutritional recommendations. This development demonstrates Haier’s strategic push toward creating fully interconnected kitchen ecosystems, aligning with its vision for intelligent, user-centric home environments.

Report Scope

Report Features Description Market Value (2024) USD 2.56 Billion Forecast Revenue (2034) USD 16.0 billion CAGR(2025-2034) 20.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Product Type (Single Door, Double Door, Side-by-Side Door, French Door, Others), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Application (Residential, Commercial, Industrial), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Haier Group Corporation, Panasonic Corporation, Bosch Siemens Hausgeräte (BSH) GmbH, Electrolux AB, Midea Group Co., Ltd., GE Appliances, Hisense Co., Ltd., Hitachi, Ltd., Toshiba Corporation, Sharp Corporation, Daewoo Electronics Corporation, Fujitsu General Limited, Liebherr Group, Sub-Zero Group, Inc., Viking Range, LLC, Godrej & Boyce Manufacturing Company Limited, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- Haier Group Corporation

- Panasonic Corporation

- Bosch Siemens Hausgeräte (BSH) GmbH

- Electrolux AB

- Midea Group Co., Ltd.

- GE Appliances

- Hisense Co., Ltd.

- Hitachi, Ltd.

- Toshiba Corporation

- Sharp Corporation

- Daewoo Electronics Corporation

- Fujitsu General Limited

- Liebherr Group

- Sub-Zero Group, Inc.

- Viking Range, LLC

- Godrej & Boyce Manufacturing Company Limited

- Other Major Players