Global Agricultural Robot Market By Product Type (Milking robots, UAV, and Others), By Offering (Hardware, Software, Service), By Application (Field farming, Crop management, Animal management, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 46532

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

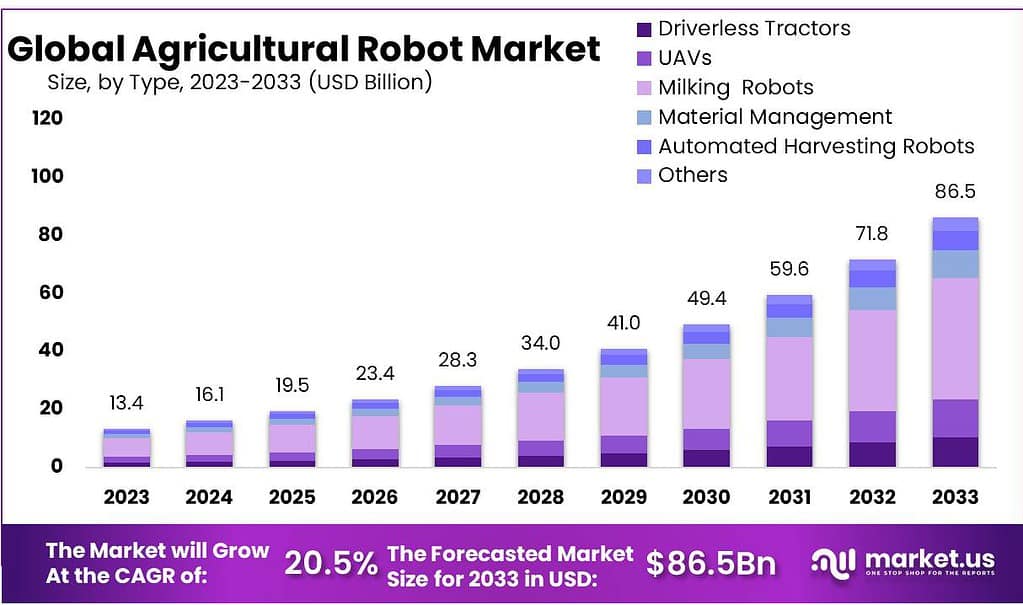

The global Agricultural Robot market size is expected to be worth around USD 86.5 billion by 2033, from USD 13.4 billion in 2023, growing at a CAGR of 20.5% during the forecast period from 2023 to 2033.

This is due to electronic technologies like Global Positioning System and Geographic Information System. The market is increasingly embracing precision farming, which uses Big Data as well as GPS to manage crops. This market report gives an overview of the agricultural Robot market value, industry growth factor, size, and other key factors.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Agricultural Robots Market is anticipated to surge to approximately USD 86.5 billion by 2033, from a baseline of USD 13.4 billion in 2023, exhibiting an impressive CAGR of 20.5%.

- Primary Product Types: Milking Robots lead the market in 2023, holding a dominant 48.6% share, transforming dairy farming through automation. Drones and driverless tractors are also witnessing substantial growth, fueled by increased funding and industrialization.

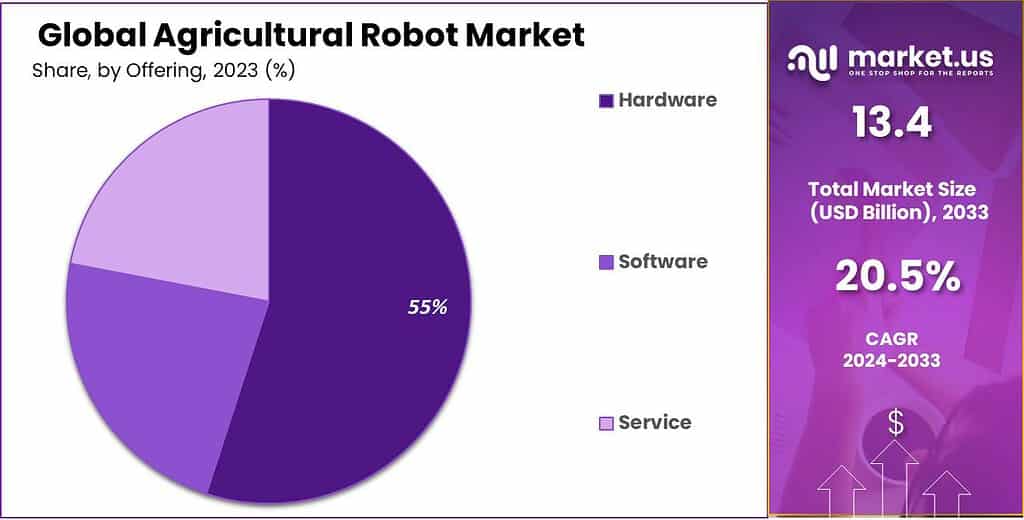

- Offering Dynamics: Hardware comprises over 55% of the market, encompassing physical robots like automated tractors and drones. Software plays a pivotal role in powering these robots’ functionalities, while services ensure their operational efficiency.

- Application Insights: Planting and Seeding represent a significant segment, emphasizing precision in crop distribution. Soil management is poised for rapid growth due to the utilization of mobile robots for fertilizing and weeding.

- Market Drivers and Restraints: Labor shortages and rising costs drive the demand for agricultural robots, enhancing productivity and efficiency. However, the high initial cost of digitization poses a challenge, particularly for smaller farms.

- Untapped Opportunities: Robotics integration in livestock management shows promise, leveraging IoT and remote sensing for tracking and optimizing crop and livestock quality. Drones and robotic tech streamline farming processes, aiding in precision plowing and spraying.

- Challenges in Full Automation: Fully autonomous robots, while in development, are hindered by complexity and high costs. Current prototypes like autonomous tractors and inspection robots are emerging but may not be operationally feasible until after 2025.

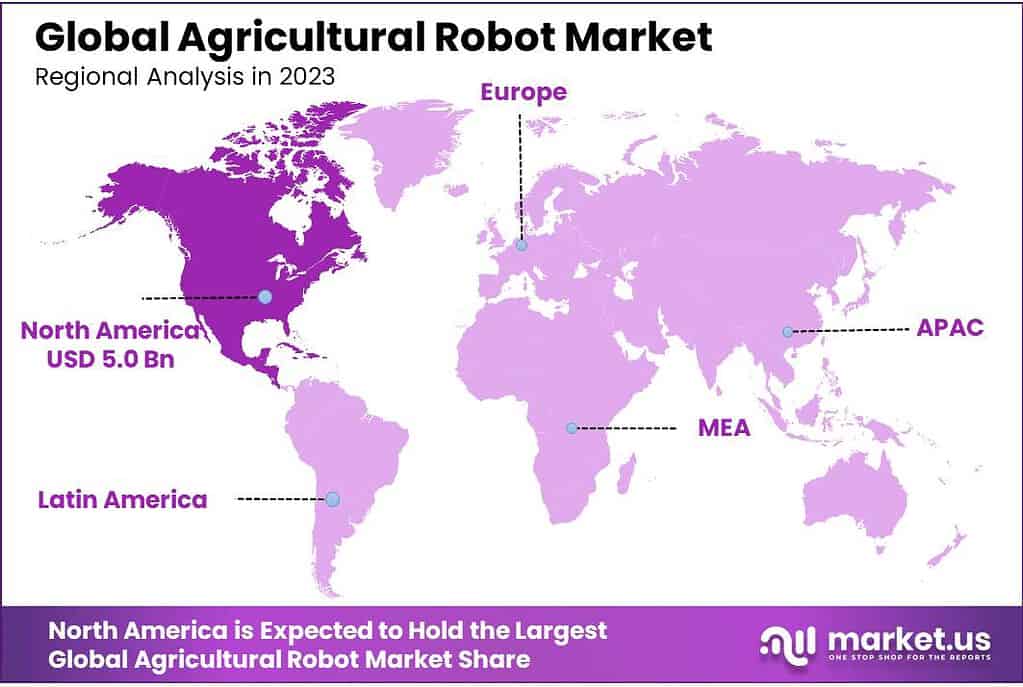

- Regional Analysis: North America leads in drone sales, with regulatory policies promoting commercial drone use. The European Union’s regulations favoring targeted pesticide application via robots are expected to bolster industry growth in the region.

- Key Players and Recent Developments: Major companies like AGCO Corporation and John Deere are innovating with precision spraying and route planning technologies, propelling the advancement of agricultural robotics.

Type Analysis

In 2023, Milking Robots stood out as the major player in the agricultural robot market, holding over 48.6% of the market share. These robots revolutionize dairy farming by automating the milking process, improving efficiency, and ensuring better herd management.

Major manufacturers have been encouraged to create efficient and effective drones for agriculture by increasing venture funding. Drones are used extensively in agriculture to capture innovative videos of harvesting systems, planting, and scouting fields. This is driving the segment demand.

It is expected that the driverless tractor segment will see significant growth. The autonomous tractor can be used for planting, seeding, and tillage in both row and broad-acre crop farming. This segment is expected to grow due to the increasing industrialization of agriculture across the globe, including in India and China.

By Offering

In 2023, hardware was the big player in the agricultural robot market, grabbing over 55% of the market share. These hardware components include the physical robots used on farms, such as automated tractors, drones, and robotic arms.

Software, another essential part of this market, contributed significantly to the agricultural robot sector. It’s the brains behind the operations, powering the functionalities of these robots, and enabling tasks like data analysis, crop monitoring, and autonomous navigation.

Services, comprising maintenance, repair, and support, also made a notable impact. They ensure that these high-tech agricultural robots remain operational and efficient, providing farmers with essential assistance and expertise.

Each segment—hardware, software, and services—plays a crucial role in driving the growth and functionality of agricultural robots, catering to different needs within the farming community.

Application Analysis

In 2023, Planting and Seeding emerged as a key player in the agricultural robotics market, commanding over 24.6% of the market share. These robots specialize in precision planting and seeding, optimizing crop distribution, and reducing seed wastage.

The segment of soil management is expected to experience the fastest growth over the forecast period. This growth is due to the increasing use of mobile robots for fertilizing and weeding.

Crop management applications are mainly used by medium-sized to small-sized farms as well as horticulture. Crop management applications are being driven by the growing awareness of farmers and the available software solutions for field surveys and data analytics.

UAV manufacturers are receiving more venture funding and farmers are becoming more aware of the advantages of drones, which is expected to drive the growth of the field farming segment. The segment’s demand is further boosted by drones’ ability to detect diseases and other health issues in crops, which can help reduce crop damage.

*Actual Numbers Might Vary In The Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Milking robots

- UAV

- Driverless tractor

- Materials management

By Offering

- Hardware

- Software

- Service

By Application

- Field farming

- Crop management

- Animal management

- Dairy management

- Soil management

Driver

Growing cost of labor encouraging automation

The agriculture robots market is on the rise due to a surging global population and escalating labor costs. With the demand for food increasing, farmers are grappling with the challenge of boosting production while contending with limited labor availability and rising expenses. These robots step in by automating crucial tasks like planting, harvesting, and monitoring, diminishing the reliance on human labor. By doing so, they drive up productivity, efficiency, and precision, leading to higher yields and reduced production expenses.

As labor shortages persist even in agricultural hubs like California, where farm wages can soar beyond USD 20 per hour, the appeal of agricultural robots becomes evident. These robots not only tackle labor-intensive and repetitive jobs, such as berry picking but also free up skilled workers to focus on more diverse tasks. For instance, in dairy farms, robots can automate chores like cleaning and feeding, allowing farmers to concentrate on critical decision-making.

Major farming corporations are actively supporting startups engaged in agricultural robotics by investing in their technology. Harvest CROO, a US-based initiative, draws two-thirds of its investment from stakeholders affiliated with the strawberry industry. This backing propels the development and implementation of agricultural robotic solutions, driving innovation in the sector.

Restraint

High cost of digitisation for small farms

The agricultural sector faces a hurdle in embracing digitalization due to the substantial costs associated with agriculture robots. Despite their potential for boosting efficiency, and precision, and reducing labor needs, the steep prices of these robots pose a challenge, particularly for small and medium-sized farmers. The initial investment and ongoing maintenance expenses create financial barriers that hinder many farmers from accessing advanced technology.

This disparity contributes to a widening digital gap in agriculture, where larger and more financially equipped farms reap the benefits of technological advancements, leaving smaller farms behind. Additionally, the high costs deter agricultural tech companies from developing more affordable solutions, limiting choices for budget-conscious farmers.

Addressing this cost challenge necessitates collaborative efforts involving governments, industry players, and research institutions. Encouraging research and development in cost-effective robot technology is vital. Providing increased funding, subsidies, and incentives to encourage the adoption of agricultural robots can narrow this digital gap. Such measures could unlock the full potential of digitalization in agriculture, fostering a sustainable and inclusive transformation across the sector.

Opportunity

Untapped market potential and scope for automation in agriculture

Robotic technology has found extensive use in food processing but isn’t as prevalent in agriculture, despite its potential. Yet, opportunities abound, particularly in livestock management, where autonomous platforms like IoT tags show promise. Remote sensing, utilizing different identification tags, enhances the ability to track raw materials or livestock, optimizing crop and livestock quality and quantity.

The integration of drones and robotic tech has made farming more manageable. Technologies like GPS navigation and vision systems aid in precise plowing and crop spraying. Smaller, lightweight robots are envisioned as future replacements for heavy tractors.

A 2018 white paper from the UK-Robotics and Autonomous Systems Network predicts that half of Europe’s herds will be milked by robots by 2025. These robotic systems are diversifying tasks, from waste removal in animal pens to transporting feed. Advanced automation and big data analytics offer significant advantages in farming robot technology, leveraging IoT, big data, and AI.

Government regulations in the EU, favoring targeted pesticide application using robots, have limited new pesticides entering the market. Robots applying fertilizers and pesticides can curb environmental impact, aided by built-in sensors that precisely target application areas. Meanwhile, research into robotic weeding aims to find methods to remove unwanted plants without harming crops.

The less stringent regulations on autonomous driving in agricultural fields facilitate the deployment of farming robots. Unlike self-driving cars, agricultural robot encounter fewer limitations as they operate away from human proximity. As self-driving technology advances in the automotive sector, its adoption in agricultural equipment and vehicles is anticipated.

Challenge

High cost and complexity of fully autonomous robots

Presently, technologies aren’t quite ready for field deployment in agriculture. Prototypes of fully autonomous tractors have surfaced from companies like John Deere, Autonomous Tractor Corporation, Case IH, Kubota, and Yanmar. In April 2021, ANYbotics introduced an autonomous four-legged robot, ANYmal, geared for inspection work. It offers a scalable solution for automating routine equipment and infrastructure monitoring.

However, fruit-picking robots are still in need of advancements in sensing, manipulation, and soft robotics. These robots are costly, ranging from USD 250,000 to USD 750,000, which makes them unfeasible for most farmers. To make them more accessible, many companies are exploring leasing options rather than outright purchases. Despite drone use, industry experts foresee fully autonomous robots in agriculture, such as driverless tractors or weeding robots, becoming operational only after 2025.

Regional Analysis

North America accounted for a large share of drone sales, accounting for around 37% of the global total. This market has grown to be one of the most important due to its adaptability to new technology. Agricultural Robot Market growth has been influenced by the Federal Aviation Administration’s shift in regulatory policy, which encourages commercial drone use.

Organizations can also reap the benefits of drones’ imaging capabilities, which improve crop production yield and profit.

Technology infusion is essential for the agriculture industry to increase its production. The profitability of the agricultural sector has been dramatically improved in developed countries by farm mechanization.

Regional Market demand will be driven by increased government support for modern agriculture techniques. The Farm Advisory System (FAS), for instance, helps farmers better understand EU rules regarding the environment, animal health, good agricultural practices, and environmental conditions.

The European Union has established rules and regulations that govern drone operations. These are expected to encourage industry growth in the region. Segment demand is expected to be positively impacted by the growing venture capital and industrialization of agriculture.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Agribotix LLC (U.S.), AGCO Corporation, Autonomous Solutions, Inc., and BouMatic Robotics (Netherlands) are some of the largest companies. Common strategies expected to be adopted are vertical integration and licensing technologies.

Following are the agricultural companies in this industry including Agribotix LLC, AGCO Corporation, Autonomous Solutions Inc, AgEagle Aerial Systems, Inc, BouMatic Robotics B.V., Naio Technologies, Deere & Company, Deepfield Robotics, and other key companies.

Маrkеt Кеу Рlауеrѕ

- Agribotix LLC

- AGCO Corporation

- Autonomous Solutions, Inc.

- BouMatic Robotics B.V.

- СNН Industrial

- СLААЅ

- Drone deploy

- GЕА Grоuр

- Harvest Automation Inc.

- Тrіmblе Іnс.

- AgEagle Aerial Systems, Inc

- Naio Technologies

- Deere & Company

- John Deere

- Deepfield Robotics

- Other Key Players

Recent Developments

2023, Advanced route planning technology was presented by Trimble in 2023. With the help of this software-based technology, Trimble end users and equipment producers may automate and optimise the trajectory, speed, and general route design of industrial equipment to boost productivity.

In 2022, Precision spraying solution integration was announced by CNH Industrial and ONE SMART SPRAY. The integration of ONE SMART SPRAY is a crucial solution that will hasten the development of CNH Industrial’s automated and precise spraying capabilities. It will achieve this using several cameras that are mounted on the boom of a sprayer. Customers will receive selective spraying and weed identification using the green-on-green (plant on plant) and green-on-brown (plant on soil) methods.

Report Scope

Report Features Description Market Value (2023) USD 13.4 Billion Forecast Revenue (2033) USD 86.5 Billion CAGR (2024-2033) 20.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Milking robots, UAV, and Others), By Offering (Hardware, Software, Service), By Application (Field farming, Crop management, Animal Management, and Others) Regional Analysis North America-US, Canada, Mexico; Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe; APAC-China, Japan, South Korea, India, Rest of Asia-Pacific; South America-Brazil, Argentina, Rest of South America; MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Agribotix LLC, AGCO Corporation, Autonomous Solutions, Inc., BouMatic Robotics B.V., СNН Industrial, СLААЅ, Drone deploy, GЕА Grоuр, Harvest Automation Inc., Тrіmblе Іnс., AgEagle Aerial Systems, Inc, Naio Technologies, Deere & Company, John Deere, Deepfield Robotics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are agricultural robots market?Agricultural robots are automated machines designed to assist in various farming tasks, such as planting, harvesting, monitoring, and livestock management.

How do agricultural robots benefit farmers?These robots offer increased efficiency, precision, and reduced labor requirements. They help farmers tackle labor shortages, optimize resource utilization, and enhance productivity.

What tasks can agricultural robots perform?Agricultural robots can handle a range of tasks, including planting seeds, harvesting crops, monitoring crop health, managing livestock, and conducting routine equipment inspections.

What is the future outlook for agricultural robots?While progress is being made, full-scale deployment of fully autonomous robots, like driverless tractors or weeding robots, is anticipated to become commonplace after 2025. Advancements in sensing, manipulation, and affordability are key areas of focus for future development.

-

-

- Agribotix LLC

- AGCO Corporation

- Autonomous Solutions, Inc.

- BouMatic Robotics B.V.

- СNН Industrial

- СLААЅ

- Drone deploy

- GЕА Grоuр

- Harvest Automation Inc.

- Тrіmblе Іnс.

- AgEagle Aerial Systems, Inc

- Naio Technologies

- Deere & Company

- John Deere

- Deepfield Robotics

- Other Key Players