Global Affective Computing Market By Technology (Touchless, Touch-Based), By Software (Analytics Software, Speech Recognition, Gesture Recognition, Enterprise Software, Facial Recognition), By Hardware (Cameras, Storage Devices & Processors, Sensors, Other Hardware), By End-Use Industry (IT & Telecommunications, Automotive, BFSI, Healthcare, Retail & E-commerce, Media & Entertainment, Government, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 62463

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

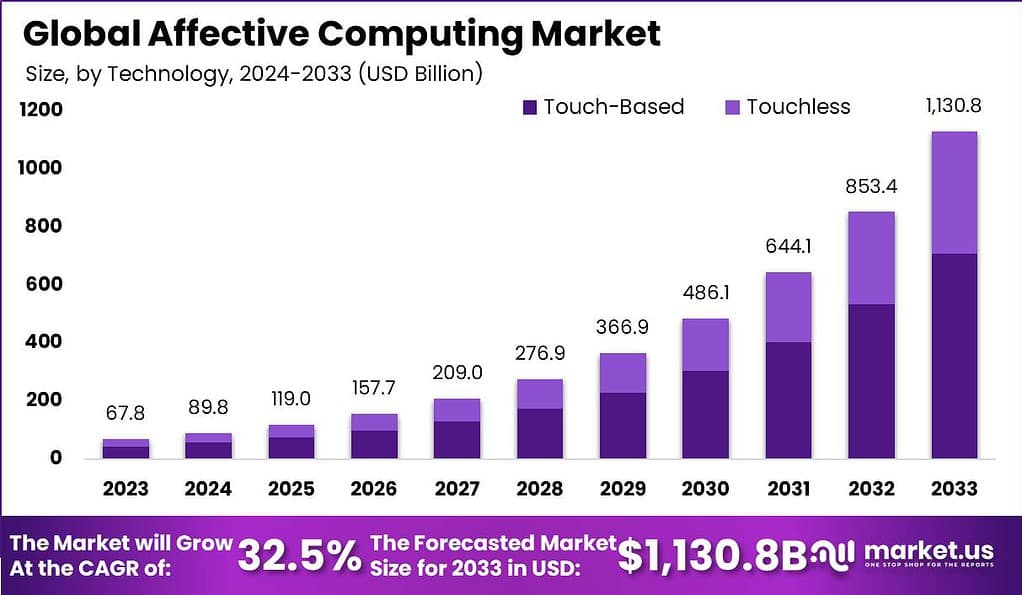

The global Affective Computing Market is anticipated to reach a valuation of USD 89.8 billion in 2024. The trend is expected to create new opportunities for the market, leading to a projected CAGR of 32.5% between 2024 and 2033, and reaching a total valuation of approximately USD 1,130.8 Billion by 2033.

The affective computing refers to the field of technology that deals with recognizing, interpreting, processing, and simulating human affects such as emotions and feelings. It enables devices and applications to perceive, understand and appropriately respond to human emotions.

The global affective computing market is projected to grow significantly over the next decade driven by the rising demand for emotion detection and recognition technology in sectors like healthcare, automotive, advertisement, and education. Key capabilities of affective computing include facial feature extraction, speech recognition, natural language processing, machine learning, and sentiment analysis to obtain insights from visual, vocal and physiological cues.

Market Analysis

- The International Federation of Robotics (IFR) reported that global industrial robot installations reached approximately 517,385 last year. Projections indicate that by 2025, this figure is expected to increase to around 690,000. The World Robotics report by IFR highlights the growing significance of industrial robots in various sectors. A notable enhancement in these industrial robots involves the incorporation of additional features, such as affective computing. This innovation has the potential to significantly improve the acceptance of industrial robots and enhance human-computer interaction within industrial settings

- In August 2022, an innovative team at the Massachusetts Institute of Technology (MIT) utilized emotional AI to improve people’s mental well-being and overall quality of life. Recent research conducted by the MIT Media Lab’s Affective Computing Research Group provides empirical evidence suggesting that empathic artificial intelligence (AI) through machine learning has the potential to alleviate the adverse effects of anger on human creative problem-solving.

Key Takeaways

- Market Size and Growth: The Affective Computing market is projected to reach a high of USD 1,130.8 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 32.5% between 2024 and 2033.

- Definition and Scope: Affective computing refers to technology that recognizes, interprets, processes, and simulates human emotions, enabling devices and applications to understand and respond to human emotions.

- Market Drivers: The rising demand for emotion detection and recognition technology in sectors like healthcare, automotive, advertisement, and education is driving the growth of the affective computing market. Key capabilities include facial feature extraction, speech recognition, natural language processing, machine learning, and sentiment analysis.

- Technology Analysis: Touch-Based technology held a dominant market position in 2023, with a share of over 62.7%, due to its integration in daily devices like smartphones and tablets.

- Software Analysis: Speech Recognition software dominated the market in 2023, with a share of over 28.3%, thanks to increasing integration of voice-enabled technologies.

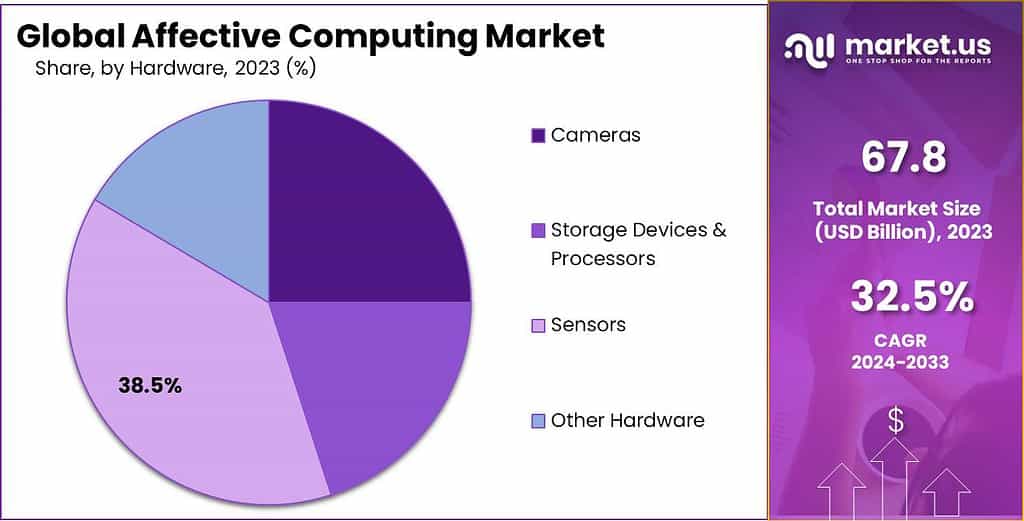

- Hardware Analysis: Sensors emerged as the dominant hardware segment in 2023, capturing over 38.5% of the market share. They play a vital role in detecting and interpreting human emotions.

- End-Use Analysis: Healthcare held the dominant market position in 2023, with a share of over 21.9%, as it utilizes affective computing for mental health and well-being monitoring.

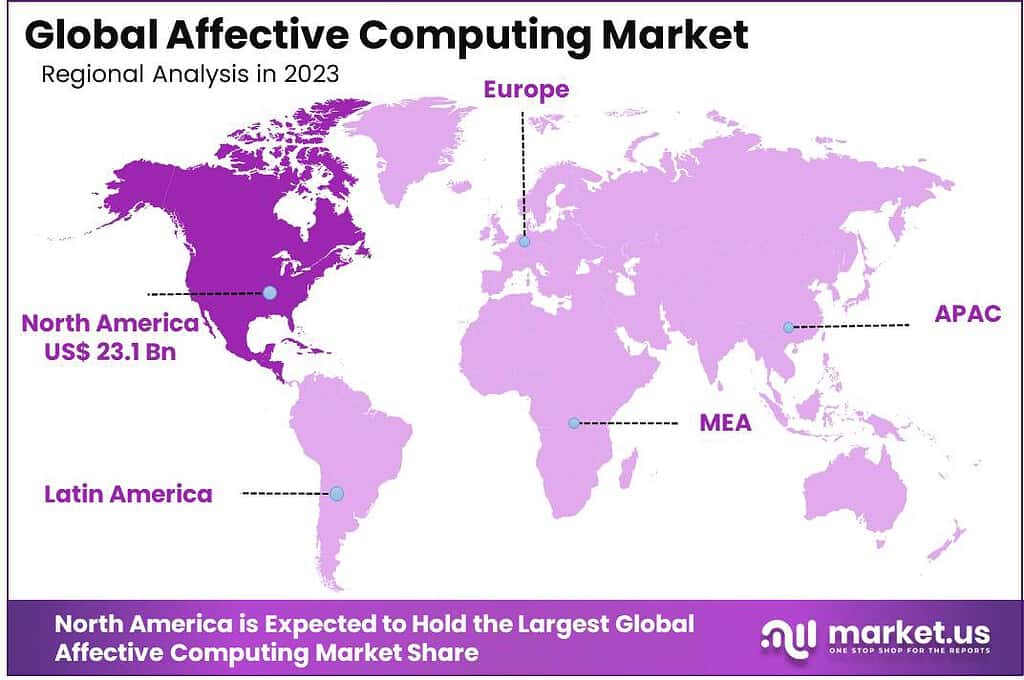

- Global Presence: North America dominated the market in 2023 with a share of over 34.2%, driven by key market players and technological infrastructure.

- Key Players: Major companies in the affective computing market include Microsoft Corporation, IBM Corporation, Google LLC, Intel Corporation, Affectiva, and more.

Technology Analysis

In 2023, the Touch-Based segment held a dominant market position in the Affective Computing Market, capturing more than a 62.7% share. This prominence is largely due to the widespread integration of touch-based technologies in daily devices, such as smartphones and tablets, which utilize touch to interpret user emotions and gestures.

The technology’s intuitive nature and ease of use contribute to its widespread adoption. Industries like retail and healthcare heavily invest in touch-based affective computing for enhanced customer service and patient care. Despite its significant share, this segment is continually evolving with advancements in haptic feedback and pressure-sensitive technologies, making interactions more natural and responsive.

The Touchless technology segment, though currently smaller, is rapidly gaining traction. Driven by the demand for hygiene and the need for remote interaction, particularly highlighted by the recent pandemic, touchless affective computing is set to revolutionize user experience. Utilizing sensors, cameras, and voice recognition, this technology interprets user emotions and intentions without physical contact.

Industries like automotive and entertainment are keen adopters, using touchless technology for safety features and immersive experiences, respectively. As innovations continue and awareness grows, the touchless segment is expected to increase its market share, offering a more hygienic and advanced alternative to touch-based interactions.

Software Analysis

In 2023, the Speech Recognition segment held a dominant market position in the Affective Computing Market, capturing more than a 28.3% share. This prominence can be attributed to the increasing integration of voice-enabled technologies across various consumer devices and enterprise solutions. The segment’s growth is further fueled by advancements in natural language processing and machine learning, enhancing the accuracy and efficiency of speech recognition systems.

Simultaneously, the Analytics Software segment is witnessing substantial growth, driven by the need for sophisticated tools to interpret complex emotional data. Businesses are leveraging these tools to gain deeper insights into consumer behavior and to enhance customer experience. As of the latest data, this segment accounts for a significant portion of the market, reflecting its crucial role in providing actionable intelligence.

Gesture Recognition technology is also evolving rapidly. As it becomes more refined and accessible, its market share is expected to increase significantly. This technology’s intuitive nature is particularly beneficial in the gaming and automotive industries, offering a more interactive and immersive user experience.

The Enterprise Software segment is not far behind, with a steady increase in demand noted from businesses seeking to improve their internal communications and operational efficiency. This software’s ability to analyze and respond to human emotions in real-time is revolutionizing workplace dynamics and productivity.

Lastly, the Facial Recognition segment is gaining momentum, particularly in security and surveillance applications. Its ability to accurately identify individuals based on facial features is critical in various sectors, including law enforcement and personalized marketing. With ongoing technological enhancements, this segment is anticipated to grow substantially in the coming years.

Hardware Analysis

In 2023, the affective computing market exhibited a robust performance across different hardware segments. Among these segments, the Sensors segment emerged as the dominant player, capturing more than a 38.5% share.

Sensors are integral components of affective computing systems, facilitating the detection and interpretation of human emotions and behaviors. These sensors are capable of capturing a range of physiological signals, including heart rate, skin conductance, facial expressions, and body movements. By capturing and analyzing such data, affective computing systems can provide valuable insights into the emotional state of individuals.

The Sensors segment’s dominant position can be attributed to the increasing adoption of affective computing applications in various sectors such as healthcare, gaming, and marketing. In the healthcare industry, for instance, affective computing systems equipped with sensors can help detect and monitor patients’ emotional responses, aiding in the diagnosis and treatment of mental health disorders.

In the gaming sector, sensors enable more immersive and interactive gameplay experiences by detecting players’ emotions and adjusting the game dynamics accordingly. In marketing, affective computing systems utilize sensors to gather data on consumers’ emotional responses to advertisements, enabling companies to tailor their marketing strategies more effectively.

Moreover, advancements in sensor technologies have played a crucial role in the growth of the Sensors segment. The development of wearable sensors and non-invasive monitoring techniques has expanded the possibilities of affective computing, allowing for continuous and convenient emotion tracking. These advancements have contributed to the increased integration of affective computing systems into various devices and applications, further propelling the demand for sensors.

Looking ahead, the Sensors segment is expected to maintain its dominant position in the affective computing market. The growing emphasis on personalized experiences, human-computer interaction, and emotion-based decision-making is anticipated to drive the demand for sensors in affective computing systems. With ongoing technological advancements and the integration of sensors into a wider range of devices and applications, the Sensors segment is poised to continue its growth trajectory, unlocking new opportunities in the affective computing market.

End-use Analysis

In 2023, the Healthcare segment held a dominant market position in the Affective Computing Market, capturing more than a 21.9% share. This prominence is largely due to the sector’s rapid adoption of technology to improve patient care and diagnostics. Affective computing is particularly transformative in mental health and well-being monitoring, where understanding patient emotions is crucial.

The IT & Telecommunications sector is also a significant user of affective computing. As these industries are at the forefront of technological integration, they utilize emotional analytics to enhance customer service and user experience. The latest figures indicate a robust growth trend as more companies invest in understanding and responding to consumer emotions in real-time.

In the Automotive industry, affective computing is revolutionizing safety and user experience. By monitoring driver emotions and fatigue, the technology enhances road safety and vehicle comfort. As vehicles become more connected and autonomous, the role of emotional recognition is expected to grow, reflecting in its increasing market share.

The Banking, Financial Services, and Insurance (BFSI) sector is utilizing affective computing to improve security and customer interaction. By recognizing customer emotions, banks and financial institutions are enhancing their services and fraud detection systems. The adoption rate is steadily increasing as the sector seeks more personalized and secure customer experiences.

Retail & E-commerce industries are leveraging affective computing to revolutionize shopping experiences. By understanding customer emotions, retailers can provide personalized recommendations and services, significantly enhancing customer satisfaction. This segment’s market share is growing as more businesses recognize the value of emotional data in driving sales and customer loyalty.

Media & Entertainment industries are harnessing affective computing to create more engaging and interactive content. By analyzing audience emotions, creators can tailor their offerings to better meet viewer preferences, leading to an increase in this segment’s market share.

Government initiatives are increasingly incorporating affective computing for public safety, education, and services. The technology’s ability to gauge public sentiment and improve interactions is driving its adoption, indicating a gradual increase in market share.

Other End-Use Industries, including education, real estate, and manufacturing, are beginning to explore the benefits of affective computing. These sectors are recognizing the potential for enhanced interaction and operational efficiency, contributing to the overall growth of the market.

Кеу Маrkеt Ѕеgmеntѕ

By Technology

- Touchless

- Touch-based

By Software

- Analytics Software

- Gesture Recognition

- Enterprise Software

- Speech Recognition

- Facial Recognition

By Hardware

By End-use

- Automotive

- IT & Telecom

- BFSI

- Healthcare

- Government

- Retail & E-commerce

- Media & Entertainment

- Other End-uses

Driver

- Integration with IoT and Smart Devices: Advancements in the Internet of Things (IoT) and smart devices have made it easier to implement affective computing, driving its adoption across various sectors.

- Improved Algorithm Efficiency: Continuous improvements in algorithms and machine learning models have significantly enhanced the accuracy and reliability of emotion detection, making affective computing more appealing to industries.

- Advances in Sensor Technology: The development of sophisticated and sensitive sensors has allowed for more accurate readings of emotional states, broadening the scope and applicability of affective computing.

- Increased Computing Power: As global computing power increases, systems can process emotional data more quickly and accurately, driving the adoption of affective computing in real-time applications.

Restraint

- Complex Software and Hardware Requirements: The intricate software and hardware necessary for effective affective computing systems result in high initial setup and maintenance costs, deterring some potential adopters.

- Research and Development Expenses: Ongoing research and development to enhance affective computing systems add to the overall cost, making the technology less accessible for smaller businesses and organizations.

- Specialized Skill Requirements: The need for specialized personnel to develop and maintain affective computing systems further increases operational costs, limiting market growth.

- Cost of Data Management and Security: Ensuring the privacy and security of sensitive emotional data incurs additional costs, contributing to the overall expense of affective computing systems.

Opportunity

- Public Sector Applications: Government initiatives to integrate affective computing in public sectors like healthcare, education, and security present significant opportunities for market expansion.

- Funding and Grants: Increased government funding and grants for research in emotional AI and affective computing are encouraging innovation and development in the field.

- Policy and Regulation Development: Governments are increasingly interested in developing policies and regulations that encourage the ethical use of affective computing, promoting its adoption.

- Public-Private Partnerships: Encouragement of collaborations between public sectors and private companies to deploy affective computing solutions opens new avenues for market growth.

Challenge

- Understanding and Trust Issues: A general lack of understanding and trust in how affective computing works restrains potential users from adopting this technology, fearing inaccuracies and privacy issues.

- Technical Complexity: The technical complexity involved in setting up and maintaining affective computing systems is a significant hurdle, particularly for organizations without the requisite technical expertise.

- Data Privacy Concerns: Potential users are often wary of how emotional data is handled, processed, and stored, leading to hesitancy in adopting affective computing solutions.

- Interdisciplinary Integration: Affective computing requires the integration of various disciplines like psychology, computer science, and data analysis, which can be challenging and slow down development and implementation.

Regional Analysis

In 2023, North America emerged as the dominant regional market in the field of affective computing, capturing a significant share of over 34.2%. This can be attributed to several factors, including the presence of key market players, robust technological infrastructure, and early adoption of advanced technologies in the region. The demand for affective computing in North America was valued at US$ 23.1 billion in 2023 and is anticipated to grow significantly in the forecast period.

Following North America, Europe showcased a substantial market position in the affective computing landscape. Europe has been proactive in embracing affective computing technologies to enhance customer experiences, improve healthcare outcomes, and optimize business processes. The region is home to leading technology hubs and research institutions that have played a vital role in driving innovation and development in affective computing. Furthermore, favorable government policies and initiatives have supported the growth of the affective computing market in Europe.

The Asia-Pacific (APAC) region has witnessed significant market growth in affective computing, capturing a noteworthy share. APAC is characterized by a large population, rapid digitalization, and a thriving technology ecosystem. Countries such as China, Japan, and South Korea have been at the forefront of adopting affective computing technologies, particularly in sectors like healthcare, retail, and entertainment. The increasing demand for personalized services, coupled with the rising focus on enhancing customer experiences, has driven the adoption of affective computing solutions in the region.

Latin America region has witnessed increased investments in technology infrastructure and digital transformation initiatives across various sectors. Affective computing has found applications in sectors such as healthcare, education, and media, enabling organizations to better understand and respond to customers’ emotions and preferences.

Additionally, the Middle East and Africa have demonstrated a growing interest in affective computing technologies, albeit with a relatively smaller market share. The region has been witnessing rapid technological advancements and digital transformation initiatives, which are expected to drive the adoption of affective computing solutions in the coming years.

Overall, the regional analysis of the affective computing market indicates a strong presence and dominance of North America, followed by Europe, APAC, Latin America, and the Middle East and Africa. Each region brings its unique strengths and opportunities, driven by factors such as technological advancements, regulatory frameworks, market maturity, and customer demands. Continued investments in research and development, along with collaborations between industry stakeholders, academia, and governments, will play a crucial role in further expanding the reach and impact of affective computing technologies across the globe.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Affective Computing Market Key Players Analysis refers to the evaluation and assessment of the major companies operating in the affective computing market. This analysis provides insights into the competitive landscape, market position, strategies, product offerings, and financial performance of key players in the industry.

Key players in the affective computing market are typically technology companies, software developers, and research institutions that specialize in developing and providing solutions related to emotion recognition, sentiment analysis, and affective computing technologies. These companies play a pivotal role in driving innovation, shaping industry trends, and catering to the growing demand for affective computing solutions across various sectors.

The key players analysis helps stakeholders, including investors, researchers, and decision-makers, to understand the competitive dynamics and market leadership of the major companies in the affective computing market. It provides valuable insights into factors such as market share, revenue growth, product portfolio, partnerships, collaborations, and mergers and acquisitions.

Top Kеу Рlауеrѕ

- Microsoft Corporation

- IBM Corporation

- Google LLC

- Intel Corporation

- Affectiva

- Cognitec Systems GmbH

- Kairos AR, Inc.

- Qualcomm Technologies, Inc.

- NuraLogix Corporation

- nViso SA

- Emotibot Technologies Limited

- Other Key Players

Recent Developments

- In September 2022, Nuance Communications, Inc. announced the expansion of Nuance Dragon TV for Virgin Media O2 customers in the United Kingdom. This expansion introduced new features, including enhanced support for visually impaired customers. Notably, these features enable the reading aloud of program information, contributing to a more inclusive viewing experience.

- In August 2022, CallMiner, a leading provider of conversation intelligence for business enhancement, revealed new integrations with Genesys Cloud CX and Amazon Connect. These integrations empower organizations to seamlessly access powerful real-time analytics capabilities within their existing or future Contact Center as a Service (CCaaS) deployments. With these integrations, organizations can leverage CallMiner’s platform based on live voice audio availability, facilitating improved insights and analytics.

Report Scope

Report Features Description Market Value (2023) USD 67.8 Bn Forecast Revenue (2033) USD 1,130.8 Bn CAGR (2024-2033) 32.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Touchless, Touch-Based), By Software (Analytics Software, Speech Recognition, Gesture Recognition, Enterprise Software, Facial Recognition), By Hardware (Cameras, Storage Devices & Processors, Sensors, Other Hardware), By End-Use Industry (IT & Telecommunications, Automotive, BFSI, Healthcare, Retail & E-commerce, Media & Entertainment, Government, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Google LLC, Intel Corporation, Affectiva, Cognitec Systems GmbH, Kairos AR, Inc., Qualcomm Technologies, Inc., NuraLogix Corporation, nViso SA, Emotibot Technologies Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Affective Computing?Affective Computing refers to the study and development of systems and devices that can recognize, interpret, and respond to human emotions.

How big is the affective computing market?The global Affective Computing Market is anticipated to reach a valuation of USD 89.8 billion in 2024. The trend is expected to create new opportunities for the market, leading to a projected CAGR of 32.5% between 2024 and 2033, and reaching a total valuation of approximately USD 1,130.8 Billion by 2033.

Who are the key players in affective computing market?Some key players operating in the affective computing market include Microsoft Corporation, IBM Corporation, Google LLC, Intel Corporation, Affectiva, Cognitec Systems GmbH, Kairos AR, Inc., Qualcomm Technologies, Inc., NuraLogix Corporation, nViso SA, Emotibot Technologies Limited, Other Key Players

What are the key applications of Affective Computing?Affective Computing finds applications in diverse fields, including human-computer interaction, healthcare, customer service, education, and entertainment, enhancing user experiences.

What role does Affective Computing play in healthcare?In healthcare, Affective Computing can be used to monitor patient emotions, assist in mental health assessments, and improve the overall patient experience.

Which industries are adopting Affective Computing technologies?Affective Computing is being adopted across various industries, including technology, automotive, retail, and education, to create emotionally intelligent systems and products.

Affective Computing MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Affective Computing MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- IBM Corporation

- Google LLC

- Intel Corporation

- Affectiva

- Cognitec Systems GmbH

- Kairos AR, Inc.

- Qualcomm Technologies, Inc.

- NuraLogix Corporation

- nViso SA

- Emotibot Technologies Limited

- Other Key Players