Global Aerosol Refrigerants Market By Product Type (Aluminum, and Steel), By Application (Industrial, Household, Commercial, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jan 2024

- Report ID: 32208

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

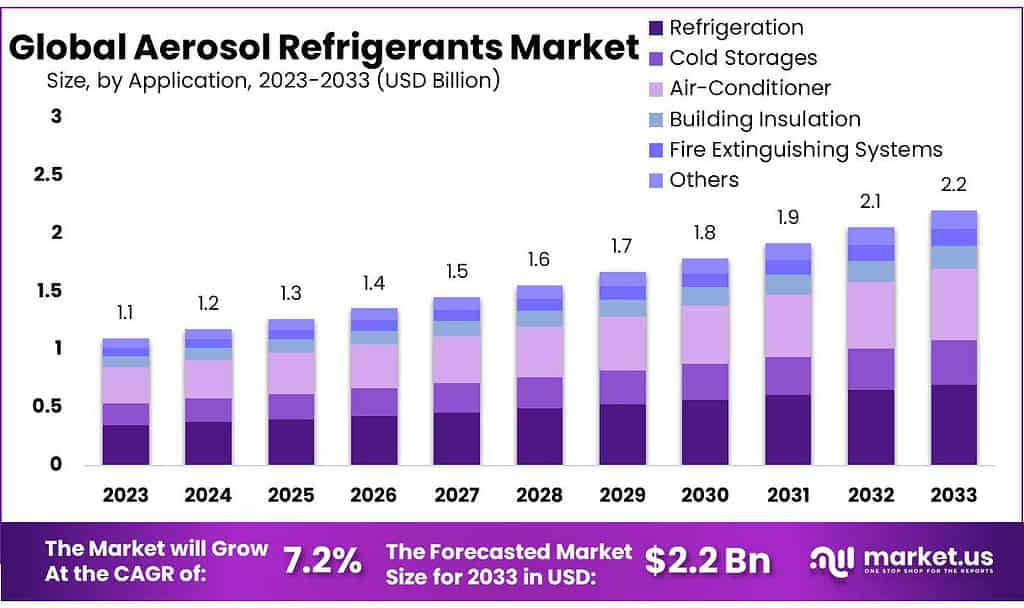

The Aerosol Refrigerants Market size is expected to be worth around USD 2.2 billion by 2033, from USD 1.1 Bn in 2023, growing at a CAGR of 7.2% during the forecast period from 2023 to 2033.

The Aerosol Refrigerants Market refers to the industry involved in the production, distribution, and utilization of refrigerants in aerosol form. Aerosol refrigerants are substances that, when released from pressurized containers, disperse as fine particles or droplets into the air. These refrigerants play a crucial role in various applications, primarily in the cooling and refrigeration systems of appliances, vehicles, and industrial equipment.

The aerosol form of refrigerants offers advantages in terms of ease of application and efficiency. It allows for targeted and controlled delivery of the refrigerant, ensuring precise application in specific areas or components. Aerosol refrigerants are commonly used in automotive air conditioning, household refrigeration appliances, and industrial cooling systems.

Key Takeaways

- Market Growth: Aerosol Refrigerants Market to reach USD 2.2 billion by 2033, with a robust CAGR of 7.2% from USD 1.1 billion in 2023.

- HFC-134a Dominance: HFC-134a holds a substantial market share of over 29.6% in 2023, showcasing versatility in air conditioning and automotive applications.

- Container Dynamics: Steel aerosol refrigerants demand grows at 4.2% revenue rate, while aluminum containers gain popularity for their lightweight and corrosion resistance.

- Refrigeration Leadership: Refrigeration claims the largest market share with over 31.6% in 2023, emphasizing its vital role in household and industrial cooling systems.

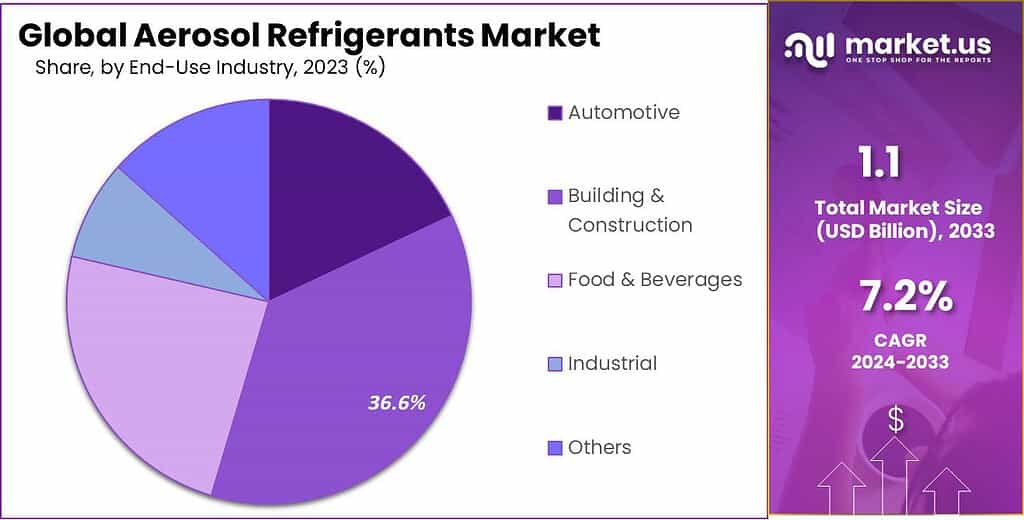

- Building & Construction Sector: Dominant sector with over 36.7% market share in 2023, highlighting extensive use of aerosol refrigerants in construction cooling systems.

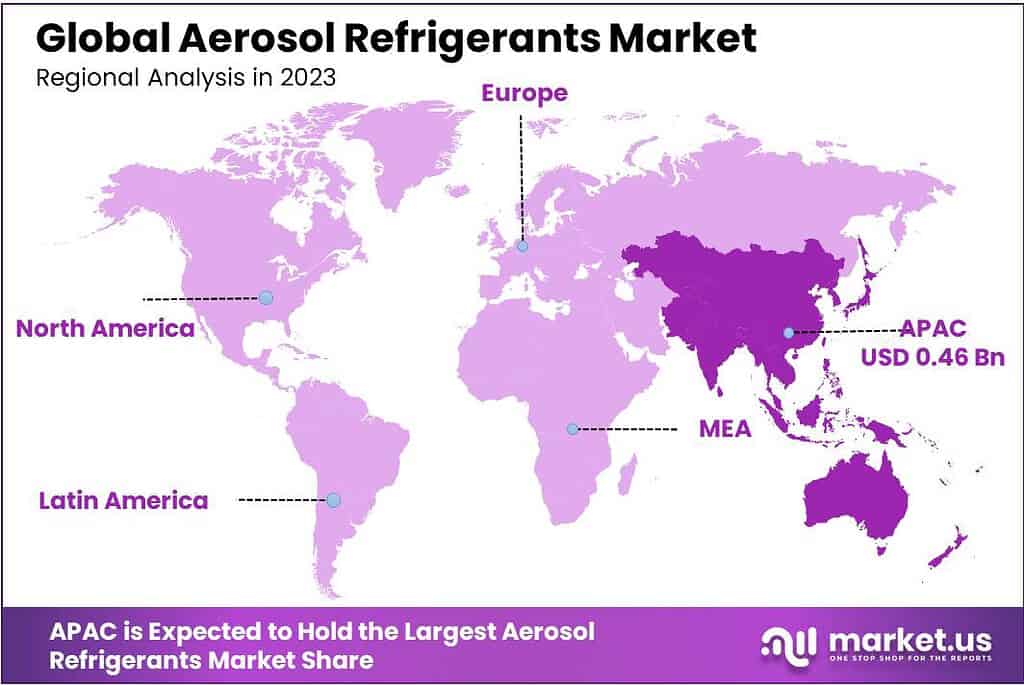

- Regional Trends: Asia Pacific leads with a revenue share of over 42.3% in 2023, projecting a CAGR of 5.6% from 2023 to 2032.

Product Type Analysis

HFC-134a became a dominant force in the Aerosol Refrigerants Market by 2023, holding over 29.6% market share. HFC-134a’s prevalence across various industries makes it essential in air conditioning and automotive cooling systems; its significant market share indicates its extensive use in aerosol applications and cooling solutions compared to other refrigerants in aerosol cooling applications; its dominance cements its status as a key player within this market.

Amidst the diverse range of refrigerants available, HFC-134a stood out for its versatility and effectiveness in different applications. Its popularity and usage in various cooling systems and aerosol products contributed significantly to its dominant market position.

Over the forecast period, steel aerosol refrigerant demand is expected to increase at a rate of 4.2% revenue. Demand is expected to be driven by the low cost of steel cans and their superior strength. The cans are also resistant to impact and will likely see high growth during the forecast period.

The aluminum container has excellent protection against moisture and ultraviolet light. It is also resistant to oxygen, carbon dioxide, hydrogen, and other gases. Aluminum cans are expected to be more popular due to their lightweight, portability, and corrosion resistance.Aluminum aerosol refrigerants are expected to see a rise in demand due to their ease of printing, embossing, and shaping. The container also provides pressure-handling capabilities that will drive industry growth in the future. The market is expected to see an increase in aluminum-based products due to its superior inertia.

Application Analysis

In 2023, Refrigeration took the lead in the Aerosol Refrigerants Market, securing over 31.6% of the market share. This application plays a vital role in various settings, from household refrigerators to large-scale industrial cooling systems. Refrigeration was the big leader in the Aerosol Refrigerants Market in 2023, grabbing more of the market share than other uses like air conditioning, building insulation, and fire extinguishing systems.

Refrigeration is super important because it keeps food fresh, helps in transporting things that need to stay cold, and supports lots of industries that need cooling solutions. Out of all the uses for these sprays, Refrigeration stood out as the most crucial.

It’s a big deal because it keeps stuff cold, making sure things like food stay fresh for longer. Its extensive use across residential, commercial, and industrial sectors solidifies its leading position in the market. The reliance placed on refrigeration systems in diverse settings, from food storage to pharmaceuticals, highlights the indispensability of effective refrigerants like those used in aerosol forms, substantiating its dominance within the Aerosol Refrigerants Market.

While other applications such as air conditioners, building insulation, and fire extinguishing systems are present in the market, Refrigeration’s substantial market share signifies its unparalleled adoption and significance. Its indispensable role in maintaining cool temperatures for a wide array of purposes places it at the forefront of the Aerosol Refrigerants Market, illustrating its prevalence and necessity in numerous everyday and industrial cooling applications.

By End Use Industry

In 2023, Building & Construction emerged as the dominant sector in the Aerosol Refrigerants Market, securing more than a 36.7% share. This segment involves utilizing refrigerants in various construction aspects, predominantly in cooling systems for buildings. Its leading position indicates the extensive use of these refrigerants in constructing cooling solutions compared to their application in other industries such as automotive, food & beverages, and industrial sectors.

Building & Construction’s significant market share underscores the pivotal role of refrigerants in maintaining optimal temperatures within structures, emphasizing its criticality in the construction and cooling processes. Among the diverse end-use industries utilizing aerosol refrigerants, Building & Construction stands out as a key driver due to its substantial reliance on cooling systems. These systems are integral in regulating temperatures within constructed spaces, ensuring comfort and functionality in various architectural settings.

The dominant position of Building & Construction underscores the indispensable nature of refrigerants in maintaining cooling functionalities within buildings, showcasing their importance in the construction industry’s cooling processes.

While other sectors like automotive, food & beverages, and industrial areas utilize aerosol refrigerants, Building & Construction’s substantial market share highlights its unparalleled adoption and prominence. Its critical role in providing cooling solutions for buildings solidifies its leading position in the Aerosol Refrigerants Market, emphasizing the significant impact of refrigerants in the construction industry’s cooling infrastructure.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Aluminum

- Steel

By Application

- Industrial

- Household

- Commercial

- Other Applications

By End Use Industry

- Automotive

- Building & Construction

- Food & Beverages

- Industrial

- Others

Drivers

The Aerosol Refrigerants Market experiences significant momentum driven by various factors. One key driver is the escalating demand for effective cooling solutions across industries like automotive, building & construction, and industrial sectors. As these sectors expand, the need for reliable aerosol refrigerants to support their cooling systems intensifies, propelling the market growth. Technological advancements represent another crucial driver, continually shaping the market landscape. Ongoing innovations in aerosol refrigerants, particularly in developing environmentally friendly options and enhancing efficiency, attract both consumer interest and industry adoption, stimulating market expansion.

More buildings popping up everywhere really help drive the market forward. These refrigerants are super important in keeping houses, offices, and factories cool. They’re a big part of the cooling systems that keep these places comfy, and that’s why they’re getting used a lot. Cars and trucks needing air conditioning also push the market ahead. People want refrigerants that work well and are good for the environment in their vehicle cooling systems. This makes these refrigerants more popular and helps the market grow.

Also, people worry about keeping food fresh, especially in stores and during transportation. These refrigerants do a lot to keep the right temperatures for storing and moving food, and that’s why they’re getting used more in this industry, making the market bigger. Rules about taking care of the environment really affect how things work in this market.

Everyone wants refrigerants that are kinder to the planet. Because of strict rules and more people caring about sustainability, there’s a bigger use of aerosol refrigerants that are better for the environment. This matches the bigger goal of reducing greenhouse gases and helping the Earth. These driving forces collectively propel the Aerosol Refrigerants Market, fostering innovation, expanding market boundaries, and encouraging wider adoption across diverse industries.

Restraints

The Aerosol Refrigerants Market has some tough hurdles to overcome. First off, following strict environmental rules is hard for the companies making these refrigerants. Making new ones that work well while meeting these rules can be complicated and expensive. Moving away from refrigerants that hurt the environment a lot is also tricky. Creating new ones that work just as well but are better for the environment needs a lot of studying and development. This slows down how fast things can change in the market.

Making refrigerants that are nice to the environment and not too expensive to produce is hard. Companies need to find a good balance: they want refrigerants to help the environment, be affordable to make, and still work well. It’s a big challenge for them to get it just right. There are also limits in the technology used to create better refrigerants. Making new ones that work super well and are good for the environment is a big challenge. It slows down how quickly these new kinds of refrigerants can be used by everyone.

Not many people know about refrigerants that are good for the environment. It’s important to teach people and industries about how these better options work and why they’re good. This way, more folks will use them, helping these eco-friendly refrigerants become more popular in the market. The retrofitting of existing equipment to accommodate newer, eco-friendly refrigerants also presents challenges.

Ensuring compatibility and effectiveness without compromising system integrity poses constraints in transitioning to alternative refrigerants, hindering their implementation. Addressing these challenges requires substantial investments in research and development, technological advancements, and collaborative efforts among industry stakeholders to overcome regulatory, technical, and economic barriers in the Aerosol Refrigerants Market.

Opportunities

The Aerosol Refrigerants Market holds promising opportunities for companies willing to innovate and focus on sustainability. One notable avenue lies in the rising demand for environmentally friendly solutions. More and more people care about how things affect the environment. That’s why there’s a big change towards using eco-friendly refrigerants.

This change means companies have a special chance to make and sell better options for people who care about the environment. Companies that spend money on clever research can make really good refrigerants. By doing this, they can create refrigerants that work better and don’t harm the environment as much. Such novel products have the potential to capture market attention and establish a competitive edge.

Working together in the industry is a big chance for companies. When they team up and share their skills and resources, they can make better and eco-friendly refrigerants faster. This teamwork helps create refrigerants that are more effective and good for the environment, meeting what people want. Making use of new technology helps make better refrigerants. Using new ideas and technology helps create refrigerants that work well and are kinder to the environment. This matches what the market wants: great refrigerants that don’t harm the planet.

The support and bonuses given by the government are super important. When the government makes rules that promote eco-friendly ways and gives bonuses for using these better refrigerants, it helps them get used more in different industries. This government help pushes the market to grow and makes more people use refrigerants that are better for the Earth.

Exploring new applications for aerosol refrigerants presents an opportunity for market expansion. Identifying and developing novel uses, especially in emerging industries or unique cooling applications, can diversify market reach and enhance product utilization, driving further growth in the Aerosol Refrigerants Market.

Challenges

The Aerosol Refrigerants Market faces several tough challenges that slow down its progress and the use of eco-friendly options. First, following strict environmental rules is hard for companies making these refrigerants. Creating new ones that work well while meeting these rules can be complicated and expensive. Moving away from refrigerants that harm the environment a lot is also tricky.

Making new ones that work just as well but are better for the environment needs a lot of studying and developing. Making eco-friendly refrigerants that aren’t too expensive to produce is tough. Companies want these refrigerants to be kind to the environment, not expensive to make and still work great. Getting this balance just right is a big challenge for them.

There are also limits in the technology used to create better refrigerants. Making new ones that work super well and are good for the environment is a big challenge. It slows down how quickly these new kinds of refrigerants can be used by everyone. Not everyone knows about eco-friendly refrigerants. It’s really important to tell people and businesses why these better options are good.

This will help more people use them, making these eco-friendly refrigerants more popular. Changing old equipment to use the new eco-friendly refrigerants is hard. Making sure everything works together without causing problems is a challenge. It needs a lot of effort and money to fix these challenges and make eco-friendly refrigerants more common.

Regional Analysis

The Asia Pacific is expected to experience strong growth due to a favorable environment and the growth of its industrial sector. Asia Pacific (APAC) had the largest revenue share at over 42.3% in 2023. The industry is expected to grow due to an increase in household income, as well as increased consumption of refrigerators and other household products.

From 2023 to 2032, the industry is expected to grow at a 5.6% CAGR by revenue. The significant use of this product in mobile air conditioning and domestic refrigeration has led to a substantial increase in hydrocarbon and inorganic refrigerants in Europe. This will likely drive the aerosol refrigerants market.

China’s large number of refrigeration equipment and cooling equipment manufacturing companies is expected to help the industry. The country’s refrigerant market has been boosted by factors such as rapid industrialization and rapid urbanization.Japan is likely to see a high demand for natural aerosol refrigerants. The Japanese gov. has undertaken initiatives to accelerate the phasing out of hydrofluorocarbon-based refrigerants and promote the use of natural products. The industry is expected to grow due to increased demand for organic aerosol refrigerants because of their wider application range.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

This market is characterized in that it has a large number of local manufacturers, as well as a few global players who account for a significant share of global annual production. Companies compete on price and product technology to position themselves as producers of high-end products.

Low profit margins in the industry limit the price reductions that companies offer. This market is known for its extensive research and development in product and production technology. Many small, unorganized players deal primarily with local distribution and serve the domestic and adjacent economies.

Companies like The Chemours Company and FJC Inc. dominate the development and production of aerosol refrigeration products. They also contribute a large share to the overall production. Their market knowledge and experience are a benefit to the companies.

Маrkеt Кеу Рlауеrѕ

- Тhе Chemours Соmраnу

- Arkema Group

- Groupe Gazechim

- Honeywell International Inc.

- DAIKIN INDUSTRIES, Ltd.

- Baltic Refrigeration Group

- Dongyue Group

- Navin Fluorine International Ltd

- SINOCHEM GROUP CO., LTD.

- SRF Limited

- A-Gas

Recent Developments

In August 2023, Fastenal Co. agreed with Virginia-based Trex Co. to supply it with polyethylene (PE) film scrap for use in its production of railing, wood-alternative composite decking, and other outdoor building products.

In May 2023, Daikins India will become a billion-dollar company and plans to double its business in three years.

In May 2023, Arkema SA (Colombes, France) acquired Polytec PT, a company specializing in adhesives for batteries and electronics.

Report Scope

Report Features Description Market Value (2022) US$ 1.1 Bn Forecast Revenue (2032) US$ 2.2 Bn CAGR (2023-2032) 7.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Aluminum, Steel), By Application(Industrial, Household, Commercial, Other Applications), By End Use Industry(Automotive, Building & Construction, Food & Beverages, Industrial, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Тhе Chemours Соmраnу, Arkema Group, Groupe Gazechim, Honeywell International Inc., DAIKIN INDUSTRIES, Ltd., Baltic Refrigeration Group, Dongyue Group, Navin Fluorine International Ltd, SINOCHEM GROUP CO., LTD., SRF Limited, A-Gas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Aerosol Refrigerants Market?Aerosol Refrigerants Market size is expected to be worth around USD 2.2 billion by 2033, from USD 1.1 Bn in 2023

What is the CAGR for the Aerosol Refrigerants Market?The Aerosol Refrigerants Market is expected to grow at a CAGR of 7.2% during 2023-2033.Who are the key players in the Aerosol Refrigerants Market?Тhе Chemours Соmраnу, Arkema Group, Groupe Gazechim, Honeywell International Inc., DAIKIN INDUSTRIES, Ltd., Baltic Refrigeration Group, Dongyue Group, Navin Fluorine International Ltd, SINOCHEM GROUP CO., LTD., SRF Limited, A-Gas

Aerosol Refrigerants MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Aerosol Refrigerants MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Тhе Chemours Соmраnу

- Arkema Group

- Groupe Gazechim

- Honeywell International Inc.

- DAIKIN INDUSTRIES, Ltd.

- Baltic Refrigeration Group

- Dongyue Group

- Navin Fluorine International Ltd

- SINOCHEM GROUP CO., LTD.

- SRF Limited

- A-Gas