Global Advertising Service Market Size, Share, Growth Analysis By Platform (Online (Digital), Offline (Traditional)), By Advertising Channel (Social-Media Publishing, Search-Engine Ads, Display & Online Video, Influencer / Creator Marketing, Native Advertising, TV Spots, Radio Commercials, Print Media, Outdoor & Transit (OOH/DOOH), Direct Mail), By End-user (Retail, Ecommerce & DTC Brands, Travel & Tourism, Media & Entertainment, Financial Services, Healthcare & Pharma, Automotive, Others), By Agency Type (Full-Service Integrated Agency, Media-Buying & Planning Agency, Digital-Only Performance Agency, Creative Boutique, In-House Brand Studio) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173143

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

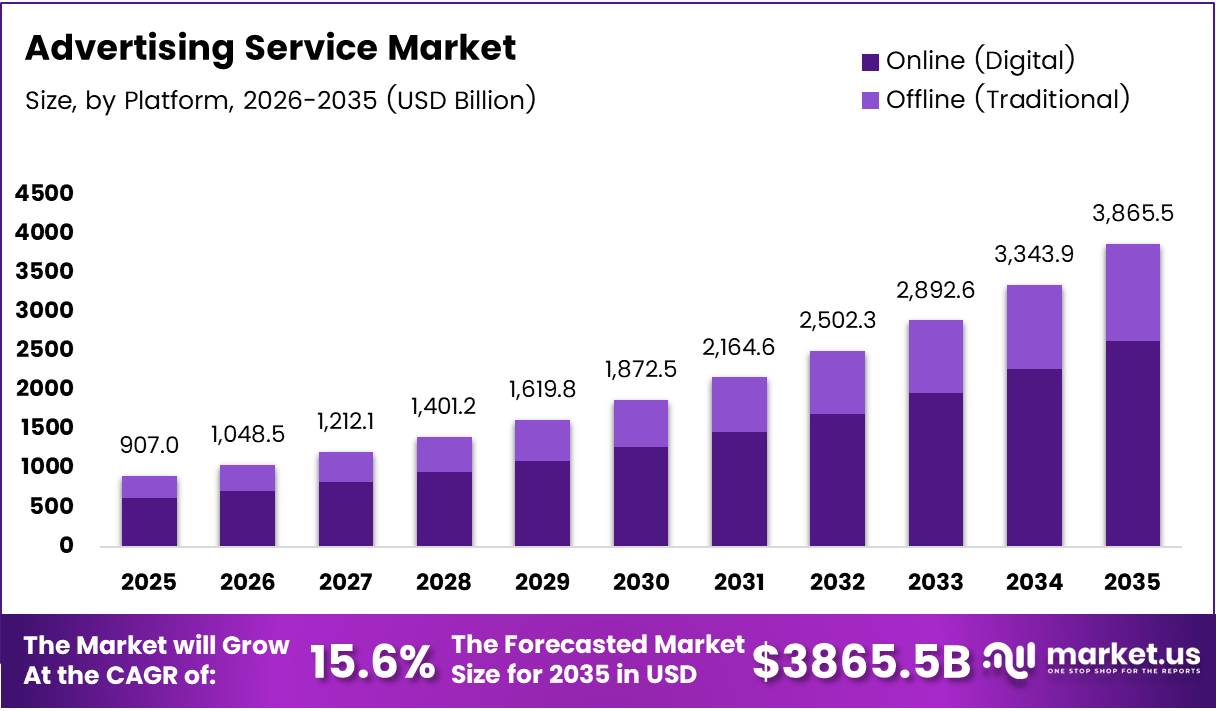

The global Advertising Service Market is projected to grow from USD 907.04 Billion in 2025 to USD 3865.5 Billion by 2035, expanding at a robust CAGR of 15.6% during the forecast period. This remarkable growth reflects the industry’s rapid transformation as brands accelerate their shift toward digital-first marketing strategies.

Advertising services encompass a comprehensive range of promotional activities designed to connect brands with target audiences across multiple channels. These services include strategic planning, creative development, media buying, campaign execution, and performance analytics. The scope extends from traditional media placements to advanced digital advertising solutions powered by artificial intelligence and data analytics.

The market is experiencing unprecedented momentum driven by the proliferation of digital platforms and changing consumer behaviors. Brands increasingly prioritize measurable outcomes and performance-driven campaigns over conventional mass-media approaches. This shift is fundamentally reshaping how advertising agencies structure their offerings and deliver value to clients.

E-commerce expansion and direct-to-consumer business models are creating substantial opportunities for advertising service providers. Companies are investing heavily in targeted advertising to capture consumer attention across fragmented media landscapes. Social media platforms have emerged as dominant advertising channels, offering precise targeting capabilities and real-time engagement metrics.

Technological innovation continues to redefine industry standards and competitive dynamics. Artificial intelligence and machine learning enable sophisticated audience segmentation, automated campaign optimization, and predictive analytics. Agencies are developing specialized capabilities in programmatic buying, influencer marketing, and connected television advertising to meet evolving client demands.

Regulatory developments around data privacy are reshaping targeting strategies and compliance requirements. Governments worldwide are implementing stricter regulations that impact how advertisers collect and utilize consumer information. This regulatory environment is pushing the industry toward first-party data strategies and privacy-compliant advertising methodologies.

According to HubSpot, 73% of consumers prefer learning about products through short-form video rather than text or static images. Furthermore, Unilever reports that more than 50% of consumers globally discover new brands through social media platforms, surpassing traditional TV and print channels.

Additionally, Silverpush indicates that 87% of U.S. households have at least one internet-connected TV device, driving rapid growth in connected television advertising inventory and creating new opportunities for advertisers.

Key Takeaways

- Global Advertising Service Market projected to reach USD 3865.5 Billion by 2035 from USD 907.04 Billion in 2025 at 15.6% CAGR

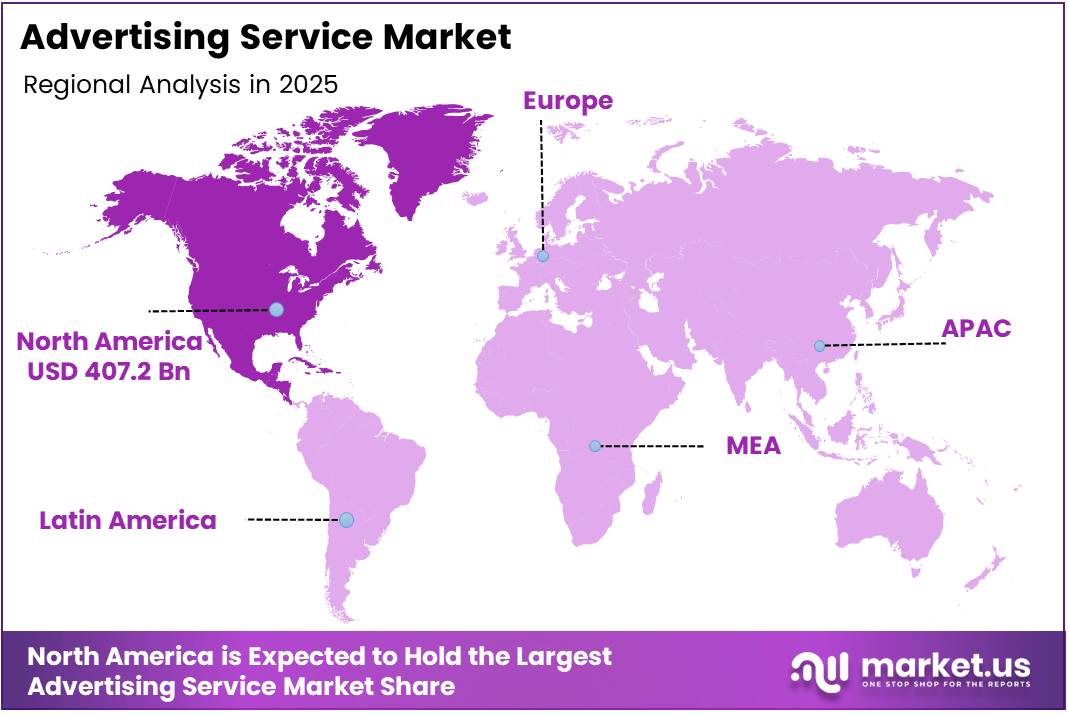

- North America dominates with 44.9% market share, valued at USD 407.2 Billion

- Online (Digital) platform segment leads with 74.8% market share

- Social-Media Publishing channel holds 25.3% share in advertising channel segment

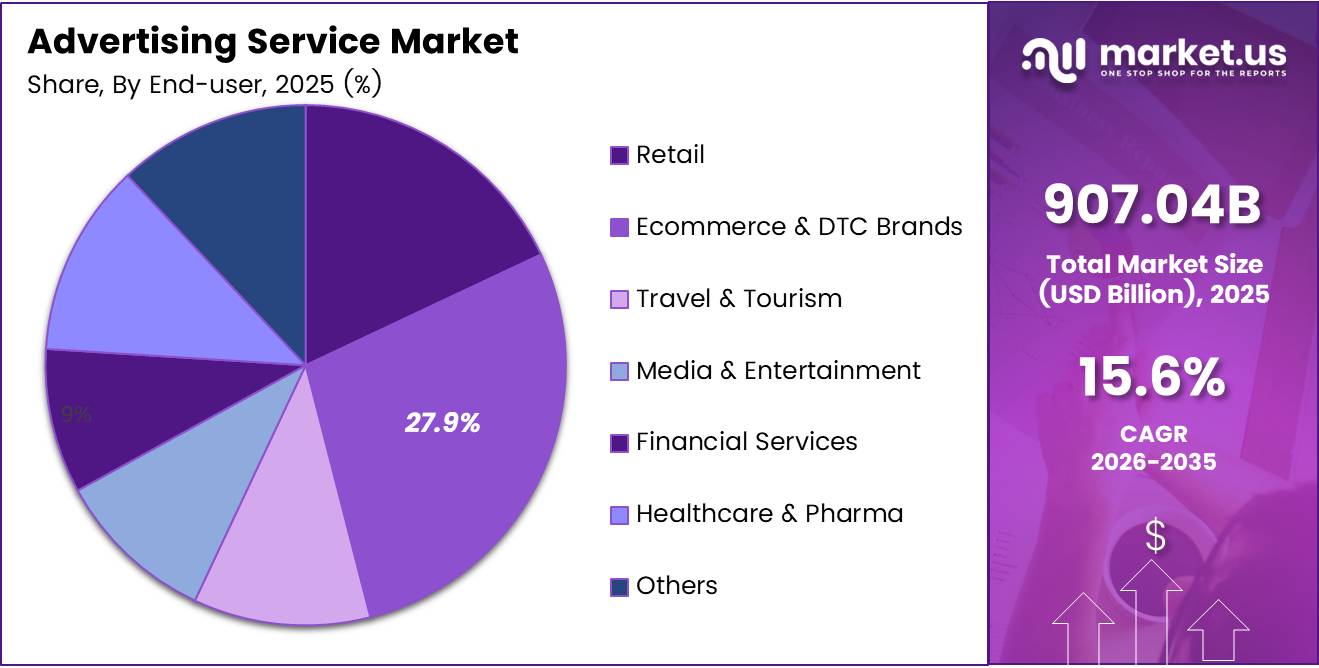

- Ecommerce & DTC Brands account for 27.9% in end-user segment

- Full-Service Integrated Agency type commands 34.1% market share

By Platform

Online (Digital) dominates with 74.8% due to superior targeting capabilities and measurable performance metrics.

In 2025, Online (Digital) held a dominant market position in the By Platform segment of Advertising Service Market, with a 74.8% share. Digital advertising continues to attract substantial brand investments due to its ability to deliver precise audience targeting and real-time campaign optimization.

Platforms offer comprehensive analytics that enable advertisers to track user behavior, measure conversion rates, and calculate return on investment with unprecedented accuracy. The proliferation of mobile devices and increased internet penetration globally have expanded digital advertising reach exponentially. Social media networks, search engines, and programmatic advertising exchanges provide diverse options for brands to engage consumers across multiple touchpoints throughout their purchase journey.

Offline (Traditional) advertising maintains relevance despite the digital surge, particularly for mass-market campaigns and brand-building initiatives. Television, radio, print media, and outdoor advertising continue to deliver broad reach and high-impact visibility for certain demographic segments.

Traditional channels excel in creating brand awareness and emotional connections through storytelling and large-format creative executions. Many advertisers adopt integrated approaches that combine offline and online strategies to maximize campaign effectiveness. Traditional media also benefits from established measurement methodologies and trusted relationships between brands and media outlets.

By Advertising Channel

Social-Media Publishing dominates with 25.3% driven by direct consumer engagement and viral content potential.

In 2025, Social-Media Publishing held a dominant market position in the By Advertising Channel segment of Advertising Service Market, with a 25.3% share. Social platforms provide unparalleled opportunities for brands to build communities, engage directly with consumers, and leverage user-generated content for authentic marketing.

The visual nature of social media enables creative storytelling through images, videos, and interactive formats that resonate with younger demographics. Advanced targeting algorithms allow advertisers to reach specific audience segments based on interests, behaviors, and demographic characteristics with remarkable precision.

Search-Engine Ads represent a critical channel for capturing high-intent consumers actively seeking products or services. These advertisements appear alongside search results, connecting brands with users at crucial decision-making moments. Search advertising offers excellent return on investment through keyword targeting and pay-per-click models that ensure advertisers pay only for measurable engagement.

Display & Online Video advertising encompasses banner ads, video pre-rolls, and rich media formats across websites and applications. These channels excel in building brand awareness and delivering visually compelling messages to broad audiences. Video advertising has experienced particularly strong growth as streaming content consumption increases across connected devices.

Influencer / Creator Marketing leverages trusted personalities to promote products through authentic recommendations and sponsored content. This channel has proven highly effective for reaching niche audiences and generating genuine engagement. Brands increasingly collaborate with micro-influencers who maintain strong connections with specific communities.

Native Advertising blends promotional content seamlessly into editorial environments, providing less disruptive user experiences. This approach generates higher engagement rates compared to traditional display advertising by matching the form and function of surrounding content.

TV Spots remain a cornerstone for mass-market campaigns, delivering extensive reach and powerful emotional impact through audiovisual storytelling. Television advertising continues to command significant budgets for major brand launches and awareness campaigns.

Radio Commercials offer cost-effective reach for local and regional advertisers while providing excellent frequency for message reinforcement. Radio maintains strong listener loyalty and delivers targeted daypart advertising opportunities.

Print Media including newspapers and magazines serves specific audience segments with longer-form content and premium positioning. Print advertising appeals to demographics that value tangible media and in-depth editorial context.

Outdoor & Transit (OOH/DOOH) advertising captures attention in high-traffic physical locations through billboards, transit shelters, and digital displays. This channel provides unavoidable visibility and location-based targeting capabilities.

Direct Mail delivers personalized messages directly to consumers’ physical addresses, offering tactile engagement and high response rates for specific campaigns. This channel excels in driving conversions for financial services, retail promotions, and local businesses.

By End-user

Ecommerce & DTC Brands dominate with 27.9% due to aggressive digital marketing investments and performance-focused strategies.

In 2025, Ecommerce & DTC Brands held a dominant market position in the By End-user segment of Advertising Service Market, with a 27.9% share.

Online retailers and direct-to-consumer companies invest heavily in advertising to acquire customers, drive website traffic, and compete in crowded digital marketplaces. These brands rely extensively on data-driven marketing strategies that emphasize measurable outcomes and customer lifetime value optimization. Performance marketing channels including search advertising, social media campaigns, and affiliate marketing form the backbone of ecommerce advertising strategies.

Retail companies utilize advertising services to drive foot traffic to physical stores while supporting omnichannel shopping experiences. Retailers combine traditional mass-media campaigns with location-based digital advertising to reach local consumers effectively. Promotional advertising and seasonal campaigns represent significant portions of retail marketing budgets.

Travel & Tourism businesses depend on advertising to inspire destination interest and drive booking conversions. This sector leverages visual storytelling, influencer partnerships, and search marketing to capture travelers during research and planning phases. Recovery from pandemic-related disruptions has intensified advertising investments as tourism operators rebuild demand.

Media & Entertainment companies use advertising to promote content releases, drive subscriptions, and build audience anticipation. Entertainment marketing campaigns often generate significant buzz through teaser campaigns and integrated promotional strategies across multiple channels.

Financial Services firms invest in advertising to build trust, promote products, and educate consumers about complex offerings. Compliance requirements and regulatory considerations shape advertising approaches in this highly regulated sector.

Healthcare & Pharma organizations utilize advertising for patient education, brand awareness, and product promotion within strict regulatory frameworks. Digital channels enable targeted health information delivery to specific patient populations.

Automotive manufacturers maintain substantial advertising budgets for new model launches and brand positioning campaigns. This sector combines emotional brand storytelling with performance-oriented lead generation strategies.

Others category encompasses diverse industries including technology, telecommunications, consumer goods, and business services that collectively represent significant advertising expenditure across various channels and formats.

By Agency Type

Full-Service Integrated Agency dominates with 34.1% offering comprehensive marketing solutions under unified management.

In 2025, Full-Service Integrated Agency held a dominant market position in the By Agency Type segment of Advertising Service Market, with a 34.1% share. These agencies provide end-to-end marketing services spanning strategy development, creative production, media planning, and campaign execution across all channels. Clients value the convenience and strategic coherence of working with single partners who coordinate complex multi-channel campaigns. Full-service agencies leverage extensive resources, diverse talent pools, and established media relationships to deliver comprehensive solutions.

Media-Buying & Planning Agencies specialize in securing optimal media placements and negotiating favorable rates across broadcast, digital, and print channels. These specialists bring deep expertise in audience analysis, media mix optimization, and performance measurement. Their focused approach enables efficient budget allocation and maximized campaign reach.

Digital-Only Performance Agencies concentrate exclusively on digital marketing channels with emphasis on measurable outcomes and data-driven optimization. These agencies excel in search marketing, social advertising, programmatic buying, and conversion rate optimization. Their technology-forward approach appeals to performance-oriented clients seeking transparent ROI metrics.

Creative Boutiques offer specialized creative development services with emphasis on distinctive brand positioning and innovative campaign concepts. These smaller agencies provide personalized attention and fresh creative perspectives that differentiate brands in competitive markets. Boutiques often partner with larger agencies or work directly with brand marketing teams.

In-House Brand Studios represent internal agency capabilities that brands develop to maintain direct control over creative assets and campaign execution. Companies establish in-house teams to reduce costs, accelerate production timelines, and maintain consistent brand expression. These studios increasingly handle routine creative work while partnering with external agencies for strategic initiatives.

Key Market Segments

By Platform

- Online (Digital)

- Offline (Traditional)

By Advertising Channel

- Social-Media Publishing

- Search-Engine Ads

- Display & Online Video

- Influencer / Creator Marketing

- Native Advertising

- TV Spots

- Radio Commercials

- Print Media

- Outdoor & Transit (OOH/DOOH)

- Direct Mail

By End-user

- Retail

- Ecommerce & DTC Brands

- Travel & Tourism

- Media & Entertainment

- Financial Services

- Healthcare & Pharma

- Automotive

- Others

By Agency Type

- Full-Service Integrated Agency

- Media-Buying & Planning Agency

- Digital-Only Performance Agency

- Creative Boutique

- In-House Brand Studio

Drivers

Rapid Shift of Brand Budgets from Traditional Media to Performance-Driven Digital Advertising Accelerates Market Expansion

Brands are fundamentally reallocating marketing budgets toward digital channels that offer measurable performance metrics and accountable outcomes. Traditional mass-media approaches are giving way to targeted digital strategies that enable precise audience segmentation and real-time campaign optimization. This transition reflects growing pressure on marketing teams to demonstrate tangible return on investment and justify advertising expenditures.

The availability of sophisticated analytics platforms empowers marketers to track customer journeys from initial awareness through final purchase. Digital advertising enables attribution modeling that connects specific marketing touches to conversion events, providing unprecedented visibility into campaign effectiveness. Consequently, chief marketing officers increasingly favor channels that deliver transparent performance data over legacy media with limited measurement capabilities.

E-commerce growth and direct-to-consumer business models have intensified demand for performance marketing services. Online retailers depend on continuous customer acquisition through paid advertising to sustain revenue growth in competitive digital marketplaces. Social media platforms, search engines, and programmatic exchanges have evolved to meet this demand with advanced targeting tools and automated optimization algorithms that maximize advertising efficiency.

Restraints

Increasing Ad Fatigue and Declining Consumer Engagement Rates Challenge Campaign Effectiveness

Consumers face overwhelming volumes of advertising messages across digital and traditional channels, leading to reduced attention spans and decreased ad receptivity. The proliferation of marketing content across social media, streaming platforms, and websites has created cluttered environments where individual messages struggle to break through. This saturation diminishes campaign effectiveness and forces advertisers to increase frequency and spending to achieve desired results.

Ad-blocking technology adoption continues rising as users seek to reduce interruptions and improve browsing experiences. Younger demographics particularly favor ad-free content consumption through subscription services and premium platform tiers. This trend limits advertiser reach and reduces the effectiveness of display advertising and video pre-roll formats.

Stricter data privacy regulations including GDPR and evolving cookie deprecation policies restrict targeted advertising capabilities. Advertisers face increasing limitations on tracking user behavior across websites and collecting personal information for audience segmentation. These regulatory constraints reduce targeting precision and complicate campaign measurement, potentially diminishing return on investment for digital advertising initiatives while raising compliance costs.

Growth Factors

Rising Adoption of AI-Powered Media Buying and Campaign Optimization Tools Enhances Advertising Efficiency

Artificial intelligence technologies are revolutionizing how agencies plan, execute, and optimize advertising campaigns across channels. Machine learning algorithms analyze vast datasets to identify optimal audience segments, predict consumer behavior, and automate bid management in real-time. These capabilities enable advertisers to maximize campaign performance while reducing manual workload and human error in media buying processes.

Growing demand for localized and vernacular advertising in emerging markets presents substantial expansion opportunities. As internet penetration increases across developing regions, brands seek to connect with local audiences through culturally relevant content and native language campaigns. This trend drives demand for agencies with regional expertise and multilingual creative capabilities.

Connected television and streaming platform advertising represents a rapidly expanding growth frontier. As consumers shift viewing habits from traditional broadcast to on-demand streaming services, advertisers follow audiences to these new environments. The expansion of advertising services for OTT and connected TV platforms combines the engagement power of video storytelling with digital targeting precision and measurement capabilities.

Small and medium enterprises increasingly outsource end-to-end marketing services as they recognize the complexity and specialization required for effective advertising. SMEs lack internal resources to manage sophisticated multi-channel campaigns but recognize advertising necessity for business growth. This trend expands the addressable market for agencies offering scalable solutions tailored to smaller budgets and simpler organizational structures.

Emerging Trends

Strong Growth of Influencer-Led and Creator-Driven Advertising Campaigns Reshapes Brand Communication

Influencer marketing has evolved from experimental tactics to mainstream advertising strategies as brands recognize the authentic connections creators maintain with engaged audiences. Micro-influencers and niche content creators offer cost-effective alternatives to celebrity endorsements while delivering higher engagement rates and credibility. Agencies are developing specialized capabilities in influencer identification, partnership management, and campaign measurement to capitalize on this trend.

Programmatic advertising and real-time bidding models have achieved mainstream adoption, automating media buying processes and optimizing campaign performance. These technologies enable advertisers to purchase ad inventory across multiple exchanges through unified platforms, improving efficiency and reducing manual trading costs. Real-time optimization algorithms continuously adjust bidding strategies based on performance data to maximize return on advertising spend.

First-party data strategies are gaining prominence as third-party cookies phase out across major browsers. Brands invest in building direct relationships with customers to collect proprietary data through loyalty programs, subscriptions, and owned digital properties. This shift requires new approaches to audience building and targeting that respect consumer privacy while maintaining campaign effectiveness.

Immersive advertising formats including augmented reality, virtual reality, and interactive experiences are gaining traction as technology becomes more accessible. These innovative formats enable deeper engagement and memorable brand interactions that differentiate products in crowded markets. Agencies are developing creative expertise and technical capabilities to produce compelling immersive content across emerging channels.

Regional Analysis

North America Dominates the Advertising Service Market with a Market Share of 44.9%, Valued at USD 407.2 Billion

North America maintains market leadership with a commanding 44.9% share, valued at USD 407.2 Billion, driven by mature digital infrastructure and high advertising expenditure per capita. The region hosts major global advertising agencies and technology platforms that drive industry innovation. Strong e-commerce growth, advanced marketing automation adoption, and sophisticated consumer data analytics capabilities support premium advertising service demand across diverse industries.

Europe Advertising Service Market Trends

Europe represents a significant market characterized by regulatory leadership in data privacy and consumer protection. The region’s emphasis on brand storytelling and creative excellence maintains demand for premium agency services. Digital transformation initiatives across European businesses drive steady growth in performance marketing and e-commerce advertising despite stricter targeting regulations.

Asia Pacific Advertising Service Market Trends

Asia Pacific demonstrates the fastest growth trajectory fueled by rapid internet penetration, mobile-first consumers, and booming e-commerce ecosystems. Markets including China, India, and Southeast Asian nations present substantial opportunities for localized advertising services. Social commerce integration and mobile payment systems create unique advertising formats tailored to regional consumer behaviors.

Middle East and Africa Advertising Service Market Trends

Middle East and Africa markets show emerging potential driven by young populations, increasing smartphone adoption, and growing digital economies. Investment in digital infrastructure and government initiatives supporting economic diversification create favorable conditions for advertising industry expansion. Regional content preferences and cultural considerations shape specialized agency offerings.

Latin America Advertising Service Market Trends

Latin America exhibits strong growth potential supported by expanding middle classes and increasing internet connectivity. Social media dominance in the region creates opportunities for influencer marketing and social commerce advertising. Economic volatility presents challenges but also drives demand for efficient performance-based advertising approaches that maximize limited marketing budgets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Advertising Service Company Insights

WPP stands as the world’s largest advertising and marketing services conglomerate, operating through multiple agency brands that serve diverse client needs across creative, media, and digital disciplines. The company maintains extensive global presence with specialized capabilities spanning traditional advertising, public relations, brand consulting, and digital transformation services.

Omnicom Group represents a major industry player with diversified agency portfolio encompassing advertising, marketing services, and specialty communications. The company excels in media planning and buying through OMD and PHD networks while maintaining creative excellence through BBDO and DDB agencies. Omnicom’s precision marketing group leverages advanced analytics and customer relationship management to deliver data-driven campaign strategies for blue-chip clients worldwide.

Publicis Groupe has positioned itself as a transformation partner combining advertising expertise with technology and consulting capabilities. The company’s Marcel AI platform connects employees globally to facilitate collaboration and knowledge sharing while optimizing resource allocation. Publicis demonstrates particular strength in digital marketing, performance advertising, and healthcare communications, serving clients seeking integrated solutions that bridge creative storytelling and technology-enabled customer engagement.

Interpublic Group operates leading agency brands including McCann, FCB, and Initiative, delivering comprehensive marketing solutions across industries. The company emphasizes organic growth through client retention and expanded service offerings within existing relationships. Interpublic’s media management capabilities through Mediabrands provide sophisticated audience targeting and campaign optimization, while creative agencies maintain reputations for award-winning campaigns that drive business results for multinational corporations.

Key Players

- WPP

- Omnicom Group

- Publicis Groupe

- Interpublic Group

- Dentsu

- Havas

- Accenture Interactive

- Deloitte Digital

- Ernst & Young

- PwC Digital Services

Recent Developments

- In February 2025, Appier announced an acquisition agreement with AdCreative.ai to lead generative AI-powered advertising and marketing innovation, strengthening capabilities in automated creative production and campaign personalization.

- In July 2024, Publicis Groupe acquired Influential, a U.S.-based influencer-marketing platform, to strengthen data-driven creator advertising capabilities across social platforms and expand influencer network access for clients.

- In February 2024, Adobe launched new generative AI advertising tools within Adobe Experience Cloud, enabling brands to create, personalize, and optimize ad creatives at scale using artificial intelligence.

- In June 2024, Meta Platforms announced global rollout of AI-powered ad creative tools, allowing advertisers to automatically generate multiple ad variations for Facebook and Instagram campaigns through machine learning algorithms.

Report Scope

Report Features Description Market Value (2025) USD 907.04 Billion Forecast Revenue (2035) USD 3865.5 Billion CAGR (2026-2035) 15.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Platform (Online (Digital), Offline (Traditional)), By Advertising Channel (Social-Media Publishing, Search-Engine Ads, Display & Online Video, Influencer / Creator Marketing, Native Advertising, TV Spots, Radio Commercials, Print Media, Outdoor & Transit (OOH/DOOH), Direct Mail), By End-user (Retail, Ecommerce & DTC Brands, Travel & Tourism, Media & Entertainment, Financial Services, Healthcare & Pharma, Automotive, Others), By Agency Type (Full-Service Integrated Agency, Media-Buying & Planning Agency, Digital-Only Performance Agency, Creative Boutique, In-House Brand Studio) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape WPP, Omnicom Group, Publicis Groupe, Interpublic Group, Dentsu, Havas, Accenture Interactive, Deloitte Digital, Ernst & Young, PwC Digital Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- WPP

- Omnicom Group

- Publicis Groupe

- Interpublic Group

- Dentsu

- Havas

- Accenture Interactive

- Deloitte Digital

- Ernst & Young

- PwC Digital Services