Global Advanced Glycation End Products Market Analysis By Type (Non-Fluorescent AGEs, Fluorescent AGEs), By Application (Cancer, Bone Diseases, Diabetic Complications, Neurodegenerative Diseases, Other Applications), By End-User (Hospitals, Specialty Clinics, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 84344

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

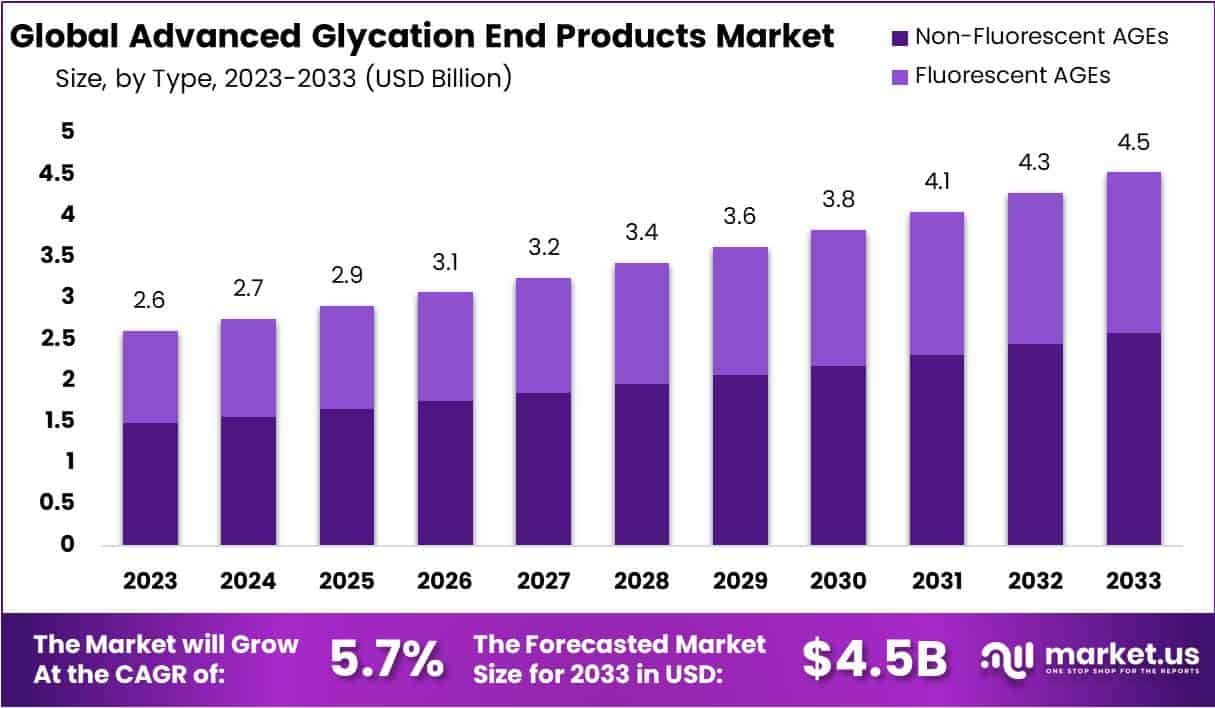

The Global Advanced Glycation End Products Market size is expected to be worth around USD 4.5 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

Advanced Glycation End Products (AGEs) are detrimental compounds formed within the body when sugars bind to proteins, a process known as glycation. These compounds have been linked to a range of chronic ailments, including diabetes, heart disease, Alzheimer’s, and kidney disease. AGEs develop naturally as part of the aging process, but their accumulation can lead to significant health issues. Additionally, AGEs are also ingested through diet, particularly from cooked or processed foods. AGEs induce inflammation, oxidative stress, and tissue damage, exacerbating various age-related conditions.

According to studies, the prevalence of diseases associated with AGE accumulation is on the rise globally. For instance, the number of cancer cases in the United States is projected to increase to 19 million by 2024, with lung cancer being a significant concern. Furthermore, 16.8 million new cancer diagnoses were reported in the United States in 2016 alone, according to the National Cancer Institute. Similarly, China recorded 4.3 million new cancer diagnoses and over 2.8 million cancer deaths in 2015, emphasizing the global impact of AGE-related diseases.

The Advanced Glycation End Products (AGEs) market encompasses a variety of products and services aimed at combating AGE accumulation and mitigating associated health risks. This market includes pharmaceuticals, diagnostic tools, dietary supplements, and preventive interventions. Market growth is driven by factors such as increased investment in AGE research and development, technological innovations, and collaborations between academia and industry.

However, market growth faces certain challenges, such as the high cost of cosmetic procedures and the impact of the COVID-19 pandemic on elective medical services. Despite these hurdles, the Advanced Glycation End Products (AGEs) market is expected to expand steadily, driven by ongoing research efforts, technological advancements, and the increasing prevalence of AGE-related diseases worldwide.

Key Takeaways

- Market Growth: Expected to reach USD 4.5 Billion by 2033, with a CAGR of 5.7% from 2024 to 2033.

- Types Dominance: Non-Fluorescent AGEs led with 57% market share in 2023 due to recognized cellular effects.

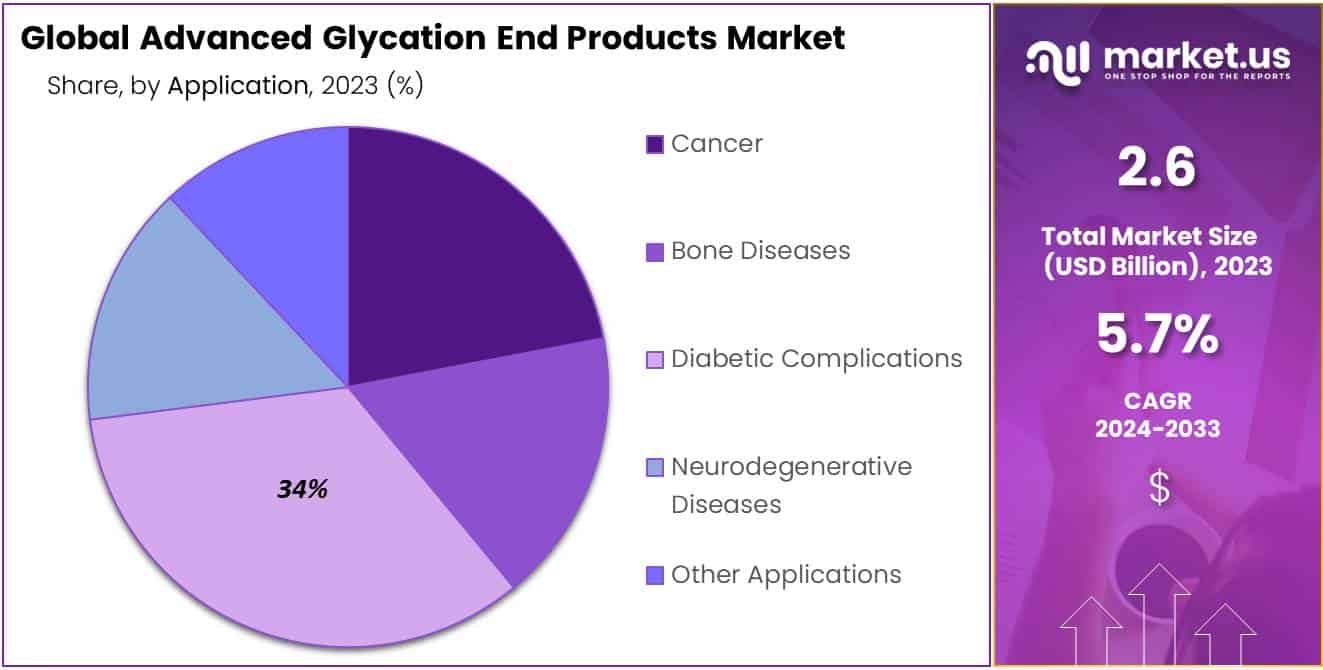

- Application Leader: Diabetic Complications segment claimed over 34% market share in 2023, driven by rising diabetes prevalence.

- Leading End-User: Hospitals captured 38.2% market share in 2023, emphasizing their pivotal role in healthcare provision.

- Market Driver: Aging Population and Chronic Diseases propel market growth, with diabetes projected to affect 700 million by 2045.

- Main Restraint: Regulatory Challenges and Safety Concerns hinder market progress, delaying drug approvals and causing uncertainty.

- Growth Opportunity: Rising Demand for Anti-AGE Therapies presents a lucrative market, expected to reach USD 1.5 billion by 2026.

- Key Trend: Technological Advancements in Diagnostics revolutionize disease detection, offering precision and efficiency in monitoring AGE-related conditions.

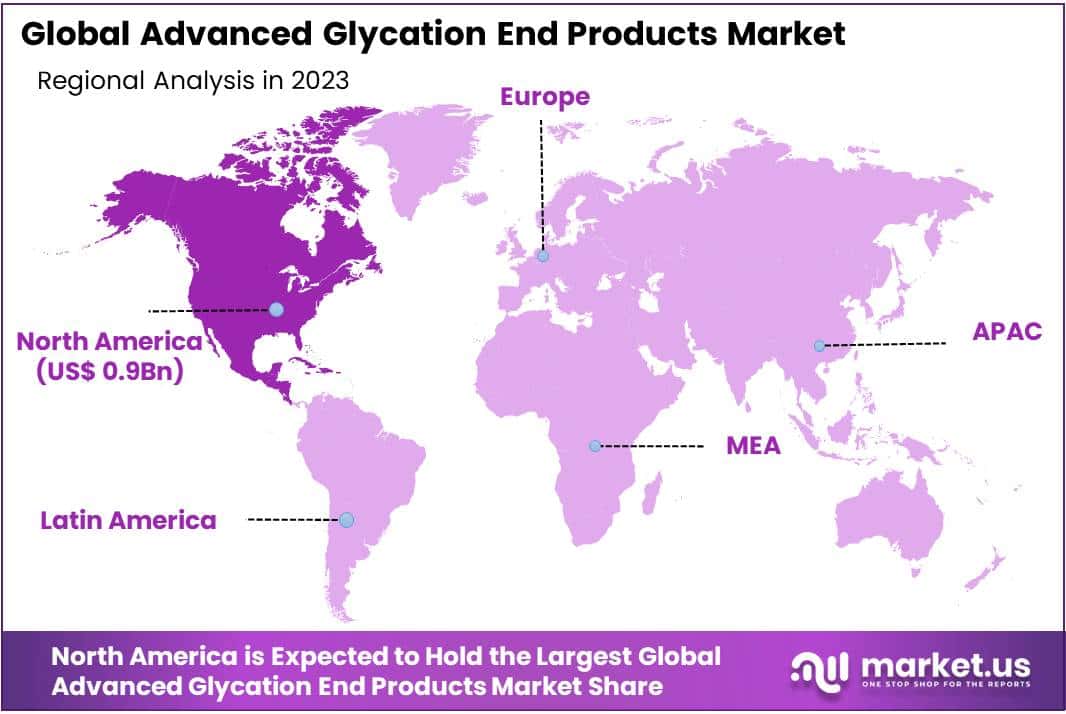

- Regional Analysis: North America held a dominant market position and capturing more than a 35% share and boasting a market value of USD 0.9 billion for the year.

Type Analysis

In 2023, the Non-Fluorescent AGEs segment took the lead in the Advanced Glycation End Products (AGEs) market, securing over 57% of the market share within the Type segment. This segment’s dominance reflects its widespread recognition across various research and clinical settings, particularly in diabetic complications and age-related diseases. Non-fluorescent AGEs have garnered significant attention due to their detrimental effects on cellular function and tissue integrity, driving their prominence in the market.

Conversely, the Fluorescent AGEs segment, although holding potential, lagged behind Non-Fluorescent AGEs in market share during the period under analysis. While Fluorescent AGEs offer diagnostic utility, challenges such as detection sensitivity and variability in fluorescence intensity hindered their widespread adoption. Moreover, the complex nature of these compounds and the requirement for specialized instrumentation posed additional barriers to market penetration.

Looking forward, both Non-Fluorescent AGEs and Fluorescent AGEs segments present growth opportunities fueled by advancing research, expanding clinical applications, and the increasing prevalence of age-related diseases globally. Market players aiming to capitalize on these opportunities must prioritize strategies focusing on technological advancements, product innovation, and strategic collaborations. By navigating the evolving landscape of AGEs effectively, stakeholders can unlock the full potential of this dynamic market.

Application Analysis

In 2023, the Advanced Glycation End Products (AGEs) market saw a significant dominance of the Diabetic Complications segment within the Application category. This segment took the lead with over 34% of the market share, reflecting its strong performance. The notable growth can be attributed to several factors, including the rising prevalence of diabetes worldwide, particularly in developing nations. Factors such as sedentary lifestyles, poor dietary habits, and an aging population contribute to this trend.

The increase in diabetes cases has led to a higher incidence of related complications, such as neuropathy, nephropathy, retinopathy, and cardiovascular diseases. This, in turn, has boosted the demand for advanced therapies targeting AGEs, which are known to exacerbate these complications.

Moreover, there has been a growing focus on early detection and monitoring of diabetic complications through advanced diagnostic techniques. This heightened awareness has spurred the demand for treatments that address AGE accumulation in diabetic patients.

Furthermore, significant investment in research and development activities aimed at identifying new therapeutic agents and drug candidates targeting AGE inhibition has contributed to the segment’s growth. Pharmaceutical companies and research institutions are actively involved in clinical trials and drug discovery efforts to develop effective treatments.

Looking ahead, the Diabetic Complications segment is expected to maintain its leadership position, driven by ongoing efforts to address the medical needs of diabetic patients and collaborations aimed at accelerating innovation in AGE-related therapies.

End-User Analysis

In 2023, the Hospitals segment emerged as the frontrunner in the End-User category of the Advanced Glycation End Products Market, seizing a commanding market share of over 38.2%. This dominance reflects the pivotal role hospitals play as primary healthcare providers, offering a comprehensive range of diagnostic and treatment services for conditions linked to advanced glycation end products.

Meanwhile, Specialty Clinics also made significant strides, contributing substantially to the market landscape. These clinics specialize in delivering targeted care for ailments like diabetes and cardiovascular diseases, where advanced glycation end products play a significant role.

Additionally, Other End-Users, including diagnostic labs, research institutions, and academic centers, played a vital role in advancing understanding and treatment options for advanced glycation end product-related conditions. These entities are instrumental in conducting research, developing diagnostic tools, and pioneering therapeutic interventions.

Looking forward, the market is poised for further evolution, driven by factors such as the expansion of healthcare infrastructure, heightened awareness of advanced glycation end product impacts, and the pursuit of personalized medical solutions.

Key Market Segments

Type

- Non-Fluorescent AGEs

- Fluorescent AGEs

Application

- Cancer

- Bone Diseases

- Diabetic Complications

- Neurodegenerative Diseases

- Other Applications

End-User

- Hospitals

- Specialty Clinics

- Other End-Users

Drivers

Aging Population and Chronic Diseases

The aging population worldwide, alongside the escalating prevalence of chronic conditions like diabetes, cardiovascular diseases, and renal disorders, acts as a compelling driver for the Advanced Glycation End Products (AGEs) market. With the aging process, there’s a natural increase in AGE accumulation within the body, exacerbating age-related diseases. According to the World Health Organization (WHO), the global population aged 60 years and older is expected to double from 12% in 2015 to 22% by 2050. Moreover, the International Diabetes Federation (IDF) estimates that the number of adults living with diabetes is projected to soar from 463 million in 2019 to 700 million by 2045. These statistics underscore the pressing need for therapies and diagnostic tools targeting AGEs, highlighting the market’s growth potential driven by the aging population and the associated rise in chronic diseases.

Restraints

Regulatory Challenges and Safety Concerns

The restraint of regulatory challenges and safety concerns significantly impacts the Advanced Glycation End Products (AGEs) market. Stringent regulations for drug approvals, imposed by health authorities worldwide, create barriers for market players seeking to introduce novel AGE inhibitors and therapeutic interventions. According to a report by the International Diabetes Federation, the stringent regulatory environment often prolongs the drug development process, leading to substantial financial investments and delayed market entry. Additionally, concerns regarding the long-term safety and efficacy of AGE-targeting therapies contribute to market uncertainty. For instance, the World Health Organization reports that only a fraction of drugs successfully navigate the regulatory pathway, with a considerable percentage failing in clinical trials due to safety issues. These challenges underscore the need for robust clinical data and adherence to regulatory standards to mitigate risks and ensure market viability for AGE-targeting therapies.

Opportunities

Rising Demand for Anti-AGE Therapies

The rising awareness of advanced glycation end products’ (AGEs) implications in age-related diseases presents a compelling opportunity for market growth. As per the World Health Organization, chronic diseases account for approximately 60% of all deaths globally, with diabetes alone affecting over 400 million individuals worldwide. This growing burden underscores the demand for effective anti-AGE therapies. Advanced research and development efforts are fueling the emergence of novel pharmacological agents, dietary supplements, and lifestyle interventions tailored to mitigate AGE accumulation and its associated adverse effects. This market opportunity is further accentuated by projections indicating a steady rise in the prevalence of age-related conditions over the coming years. With the global anti-AGE therapies market expected to reach USD 1.5 billion by 2026, stakeholders are poised to capitalize on this trend by delivering innovative solutions that address the unmet needs of patients grappling with AGE-related ailments.

Trends

Technological Advancements in Diagnostics

Technological advancements in diagnostics are revolutionizing the Advanced Glycation End Products (AGEs) market, providing unprecedented precision and efficiency in disease detection and monitoring. State-of-the-art imaging technologies, such as positron emission tomography (PET) and magnetic resonance imaging (MRI), offer detailed insights into AGE-related conditions, aiding in early diagnosis and personalized treatment strategies. Moreover, breakthroughs in biomarker identification and detection methodologies, such as enzyme-linked immunosorbent assays (ELISA) and mass spectrometry, enable clinicians to detect AGE accumulation with exceptional sensitivity and specificity

Regional Analysis

In 2023, North America held a dominant market position in the Advanced Glycation End Products (AGEs) market, capturing more than a 35% share and boasting a market value of USD 0.9 billion for the year. This stronghold can be attributed to several factors, including the high prevalence of chronic diseases such as diabetes and cardiovascular disorders, which are closely linked to AGE accumulation. Additionally, the region benefits from a well-established healthcare infrastructure, advanced diagnostic capabilities, and a strong focus on research and development initiatives aimed at addressing AGE-related complications.

Following North America, Europe emerged as another significant player in the AGEs market landscape, accounting for a substantial market share. With increasing awareness regarding the adverse effects of AGE accumulation and a growing elderly population prone to AGE-related diseases, Europe has witnessed a surge in demand for advanced diagnostic and therapeutic solutions. Furthermore, favorable government policies supporting healthcare innovation and the presence of key market players contribute to the region’s notable market position.

In contrast, the Asia-Pacific region is poised for exponential growth in the AGEs market, driven by rapid urbanization, lifestyle changes, and a burgeoning diabetic population. Countries like China, India, and Japan are witnessing a rising prevalence of diabetes and associated complications, fueling the demand for AGE-targeted diagnostics and therapies. Moreover, improving healthcare infrastructure, increasing healthcare expenditure, and initiatives to raise awareness about AGE-related diseases are expected to further bolster market growth in the region.

Overall, the regional analysis underscores the diverse dynamics shaping the global AGEs market, with North America leading the pack, Europe maintaining a strong foothold, and Asia-Pacific emerging as a promising growth hub. As the prevalence of chronic diseases continues to rise worldwide, fueled by aging populations and changing lifestyles, each region presents unique opportunities and challenges for stakeholders in the AGEs market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Advanced Glycation End Products (AGEs) market, prominent players such as Allergan Plc, Estée Lauder Companies, Shiseido Company, and Beiersdorf AG drive innovation and research to address AGE-related challenges. Allergan Plc, specializing in pharmaceuticals and medical aesthetics, brings expertise to develop therapies and diagnostics for AGE-related diseases. Estée Lauder Companies, a leader in skincare, explores AGE prevention through research and innovative product formulations.

Shiseido Company invests in understanding AGEs’ impact on skin health, integrating scientific advancements into skincare solutions. Beiersdorf AG focuses on preventive skincare, educating consumers and innovating products to manage AGE-related skin damage. Other key players also contribute to diagnostics, therapeutics, and skincare products, collectively advancing research and innovation in the AGEs market. Together, these companies collaborate and compete to deliver impactful solutions worldwide, enhancing scientific understanding and improving outcomes for individuals affected by AGE-related conditions.

Market Key Players

- Allergan Plc

- Estée Lauder Companies

- Shiseido Company

- Beiersdorf AG

- L’Oréal S.A

- NuFACE

- Ostium Cosmetics

- PhotoMedex Inc.

- Alma Laser

- Rodan & Fields LLC

- Other Key Players

Recent Developments

- In July 2023, L’Oréal S.A. acquired Youth Sciences International (YSI), gaining access to its range of anti-aging ingredients and technologies, particularly those targeting AGEs. This move is intended to bolster L’Oréal’s research and development capabilities in creating innovative anti-aging products.

- In April 2023, Shiseido Company introduced the WASO Bihada Lock Moisturiser, formulated with ingredients aimed at preventing AGEs formation and shielding the skin from damage. Designed to be lightweight and non-greasy, it caters to all skin types.

- In March 2023, Beiersdorf AG launched the NIVEA Hyaluron Cellular Filler Anti-Age Day Cream. This cream contains hyaluronic acid and other compounds to diminish wrinkles and fine lines while safeguarding the skin from AGE-related harm.

- In January 2023, NuFACE debuted the Trinity Ultra Pro Facial Device, leveraging microcurrent technology to boost collagen and elastin production, thereby reducing wrinkles and fine lines. It also purports to enhance skin tone and texture.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Bn Forecast Revenue (2033) USD 4.5 Bn CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Non-Fluorescent AGEs, Fluorescent AGEs), By Application (Cancer, Bone Diseases, Diabetic Complications, Neurodegenerative Diseases, Other Applications), By End-User (Hospitals, Specialty Clinics, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allergan Plc, Estée Lauder Companies, Shiseido Company, Beiersdorf AG, L’Oréal S.A, NuFACE, Ostium Cosmetics, PhotoMedex Inc., Alma Laser, Rodan & Fields LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Advanced Glycation End Products market in 2023?The Advanced Glycation End Products market size is USD 2.6 billion in 2023.

What is the projected CAGR at which the Advanced Glycation End Products market is expected to grow at?The Advanced Glycation End Products market is expected to grow at a CAGR of 5.7% (2024-2033).

List the segments encompassed in this report on the Advanced Glycation End Products market?Market.US has segmented the Advanced Glycation End Products market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Non-Fluorescent AGEs, Fluorescent AGEs. By Application the market has been segmented into Cancer, Bone Diseases, Diabetic Complications, Neurodegenerative Diseases, Other Applications. By End-User the market has been segmented into Hospitals, Specialty Clinics, Other End-Users.

List the key industry players of the Advanced Glycation End Products market?Allergan Plc, Estée Lauder Companies, Shiseido Company, Beiersdorf AG, L’Oréal S.A, NuFACE, Ostium Cosmetics, PhotoMedex Inc., Alma Laser, Rodan & Fields LLC, Other Key Players

Which region is more appealing for vendors employed in the Advanced Glycation End Products market?North America is expected to account for the highest revenue share of 35% and boasting an impressive market value of USD 0.9 billion. Therefore, the Advanced Glycation End Products industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Advanced Glycation End Products?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Advanced Glycation End Products Market.

Advanced Glycation End Products MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Advanced Glycation End Products MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Allergan Plc

- Estée Lauder Companies

- Shiseido Company

- Beiersdorf AG

- L’Oréal S.A

- NuFACE

- Ostium Cosmetics

- PhotoMedex Inc.

- Alma Laser

- Rodan & Fields LLC

- Other Key Players