Global Acai Berry Market Size, Share and Report Analysis By Product (Acai Berry Pulp, Dried Acai Berry), By Application (Food And Beverage, Nutraceuticals, Pharmaceutical, Personal Care And Cosmetics, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175816

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

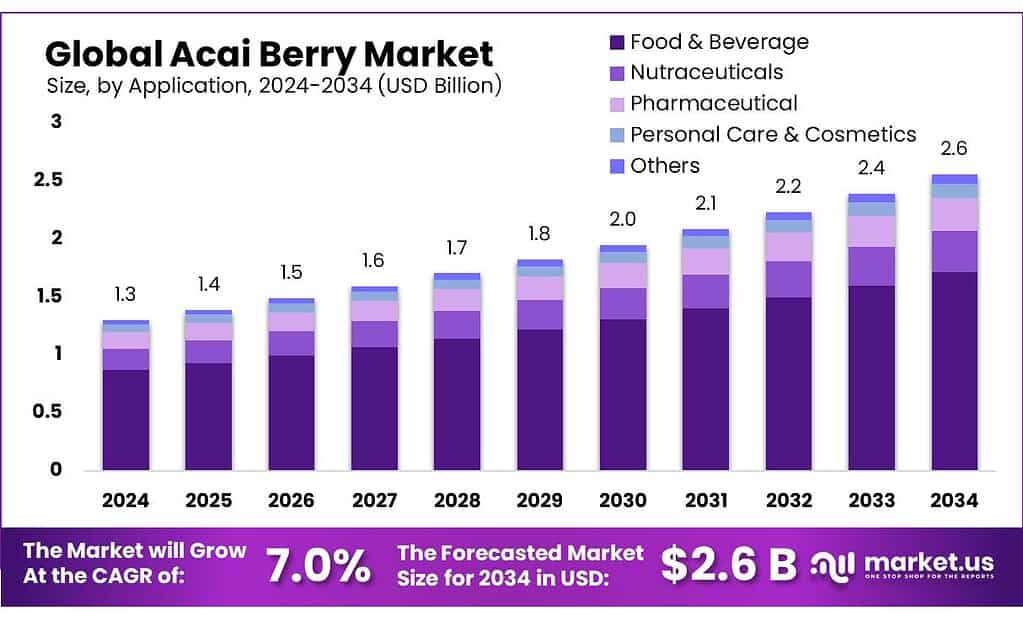

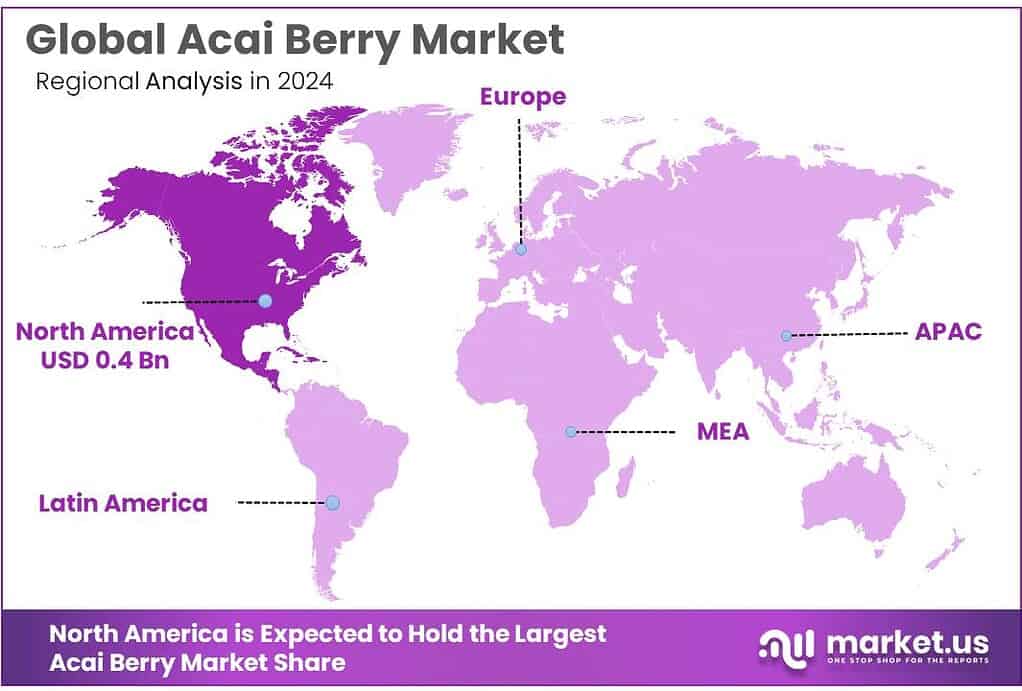

Global Acai Berry Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.2% share, holding USD 0.4 Billion in revenue.

Açaí berry has moved from a traditional Amazon food into a global “superfruit” ingredient used in smoothie bases, frozen purées, powders, capsules, and beauty formulations. The industry is anchored in Brazil’s North region, where production blends managed native stands with cultivated systems, creating a supply chain that starts with riverine harvesting and ends in pasteurised, frozen, or dehydrated ingredients for domestic and export buyers. Recent evidence shows the sector is no longer purely extractive: 87.3% of Brazil’s açaí output already comes from managed or cultivated areas, reaching about 1.7 million tonnes harvested across 233,400 hectares.

On the supply side, Brazil still anchors the industrial scenario. Brazil’s national statistics agency (IBGE) reports that 238.9 thousand metric tons of açaí were produced through extractive harvesting in 2023, with a production value of R$ 853.1 million. The same IBGE release shows how concentrated supply remains: Pará produced 167.6 thousand metric tons in 2023, equal to 70.2% of Brazil’s total. Reuters also describes Pará as the dominant producing state, putting it at 94% of Brazil’s output in recent years, reflecting the region’s role as the primary feedstock base for processors and exporters.

Brazil remains the anchor of primary supply, and official production statistics show how concentrated the chain is. In 2024, Brazil’s Amazonian açaí harvesting reached 247,500 tonnes (up 3.6% year over year), and the reported production value rose to about R$1.0 billion. Pará dominated output with 168,500 tonnes, equal to 68.1% of Brazil’s total, and an estimated value of R$801.9 million. The same release notes that 92.9% of harvesting is concentrated in Brazil’s North region, underlining how logistics and seasonality in the Amazon shape global availability and pricing.

Demand-side momentum is supported by the “everyday functional” trend in food and beverage—especially smoothies, bowls, and snack formats—where açaí is marketed for polyphenols and antioxidant associations. However, industrial performance is increasingly tied to trade policy and end-market affordability. For example, reporting in 2025 highlighted a proposed/announced U.S. tariff of 50% on Brazilian açaí imports, alongside retail benchmarks such as bowls priced around $18 in New York (with some competing offers near $13), illustrating how quickly consumer pricing can become a demand constraint when input costs jump.

Trade and policy signals point to further formalisation and geographic market expansion. Brazil’s government has highlighted export growth in processed formats: in 2023, açaí purée trade reached US$ 314,744 and 79 tonnes, a 41% volume increase versus 48 tonnes in 2022; the same update notes the U.S. as a leading importer and confirms market-opening work in Asia, including approval to export açaí powder to India. Alongside market access, regional industrialisation capacity is being supported by bioeconomy investment—Pará’s government opened a 300 million real Bioeconomy and Innovation Park with shared facilities aimed at scaling forest-product businesses.

Key Takeaways

- Acai Berry Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 7.0%.

- Acai Berry Pulp held a dominant market position, capturing more than a 69.9% share.

- Food & Beverage held a dominant market position, capturing more than a 67.3% share.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 45.7% share.

- North America stood out as the leading consumption hub for açaí-based products, holding a dominant position with 37.2% share and reaching US$ 0.4 Bn.

By Product Analysis

Acai Berry Pulp leads the category with a strong 69.9% share, driven by its wide use in food, beverage, and wellness applications.

In 2024, Acai Berry Pulp held a dominant market position, capturing more than a 69.9% share. This leadership reflects the product’s deep penetration across smoothie chains, frozen dessert brands, functional beverage makers, and household consumers who prefer ready-to-use pulp for convenience. The pulp format benefits from strong familiarity in global markets, especially where acai bowls and blended drinks have become daily consumption habits. Its dominance is also tied to stable sourcing from Brazil’s North Region, where large-scale processing ensures steady supply and consistent quality. As demand for natural antioxidants continues to rise, the pulp category remains the first choice for brands launching clean-label food and drink products.

By Application Analysis

Food & Beverage leads the Acai Berry Market with a strong 67.3% share, supported by rising demand for natural and functional nutrition.

In 2024, Food & Beverage held a dominant market position, capturing more than a 67.3% share. This leadership comes from the steady rise in acai-based bowls, smoothies, juices, flavored yogurts, and frozen desserts across both retail and food-service outlets. Consumers increasingly prefer nutrient-rich ingredients, and acai fits well into this shift due to its natural antioxidants and vibrant taste profile. Many cafés and quick-service restaurants incorporated acai blends into their menus, while packaged smoothie brands expanded product lines to meet everyday wellness preferences. These factors helped the segment maintain its strong position throughout the year.

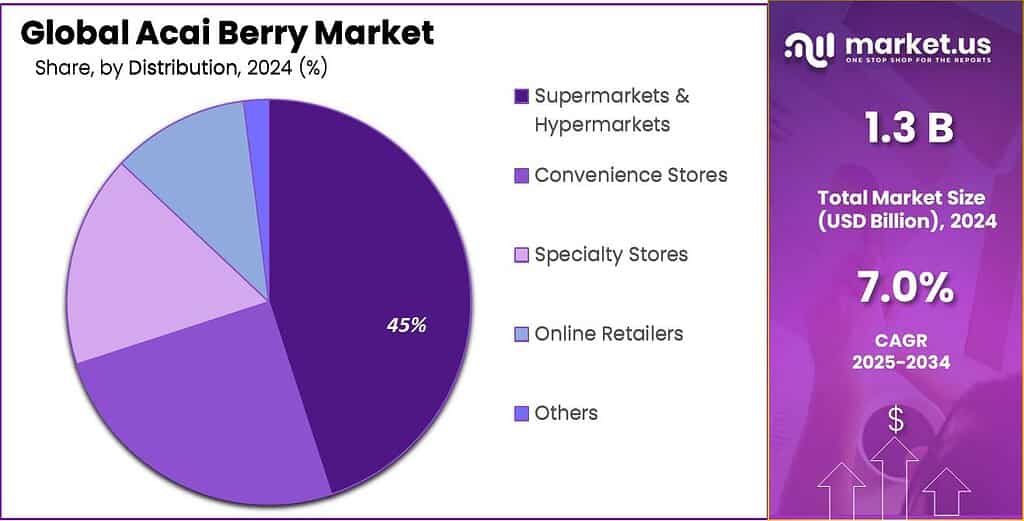

By Distribution Channel Analysis

Supermarkets & Hypermarkets lead the Acai Berry Market with a solid 45.7% share, supported by wide accessibility and strong product variety.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 45.7% share. This dominance is largely driven by the convenience these stores offer, allowing consumers to find acai pulp, frozen packs, powders, and ready-to-drink blends all in one place. Large retail chains expanded their health-focused aisles, giving acai products prominent shelf space as demand for natural and antioxidant-rich foods continued to grow. The availability of private-label acai offerings also made the category more affordable for mainstream shoppers, strengthening its reach and boosting overall sales through these channels.

Key Market Segments

By Product

- Acai Berry Pulp

- Dried Acai Berry

By Application

- Food & Beverage

- Nutraceuticals

- Pharmaceutical

- Personal Care & Cosmetics

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

- Others

Emerging Trends

Açaí is shifting from “wild harvest” to planned cultivation and export-ready formats

One major latest trend in the açaí berry industry is the move toward more organised cultivation and value-added processing, so the fruit can travel farther, meet stricter quality rules, and support larger food brands. For years, açaí supply depended heavily on seasonal harvesting in floodplain areas, followed by quick pulping and freezing. That model still matters, but the industry is clearly trying to reduce risk and improve consistency by expanding cultivation systems and modernising processing so açaí can be sold as stable, export-friendly ingredients like powder and industrial purée.

A strong proof point is the expansion of dryland cultivation supported by agricultural research. In March 2023, Embrapa reported that the planted area of açaí cultivars developed for dryland conditions increased by 675% over 12 years. This matters because dryland cultivation can reduce dependence on floodplain seasonality and make yields more predictable for processors that supply supermarkets, smoothie brands, and ingredient buyers year-round.

At the same time, Brazil is actively opening export pathways for processed formats—another sign that the industry’s future is less about raw fruit and more about ingredients that are easier to ship and store. In a November 14, 2024 update, Brazil’s Ministry of Agriculture (MAPA) confirmed that açaí powder and açaí juice were among the Brazilian products that gained access to the Indian market since 2023.

Trade signals in processed products reinforce this shift toward export-ready formats. A 2025 report citing MAPA states that foreign sales of açaí purée reached US$ 314,744 and 79 tonnes, showing that buyers are increasing volumes when products are standardised and logistically reliable. Public-sector and regional initiatives are also pushing this modernisation trend under the broader “bioeconomy” agenda. Reuters reported that Pará’s government opened a 300 million real Bioeconomy and Innovation Park to help entrepreneurs develop forest-based products such as açaí, with facilities intended to support research, testing, and product development.

Drivers

Health-first food choices are pushing açaí from a niche fruit into an everyday ingredient

One major driving factor for açaí berry demand is the steady shift toward health-first food and beverage choices, where consumers want natural ingredients that feel “functional” without looking like medicine. Açaí fits that need because it works in simple, familiar formats—smoothie bowls, blended drinks, frozen packs, and fruit bases—while still carrying a strong wellness image.

This consumer pull is now large enough to reshape the supply side in Brazil. Data compiled from Brazil’s official statistics show that 87.3% of açaí production already comes from managed or cultivated areas, totaling about 1.7 million tonnes harvested across 233,400 hectares—a sign that the industry is scaling beyond informal extraction to meet consistent food-industry demand.

That same demand pressure shows up in hard production numbers. In 2022, Brazil’s açaí fruit output reached 1.95 million tonnes, with an estimated production value of R$ 7.0 billion. The growth pace has also been strong in recent years: the açaí fruit production trend is described as expanding at about 6.8% per year between 2015 and 2022, reflecting how quickly the fruit moved from local consumption into large-scale commercial supply chains.

Trade policy and market access are adding fuel to the same driver by widening the buyer base for food applications. In a February 2024 update, Brazil’s Ministry of Agriculture (MAPA) reported that India opened its market for açaí powder, building on the prior authorization for Brazilian açaí juice. On the processed side, MAPA also reported that in 2023 the trade of açaí purée reached US$ 314,744, equal to 79 tonnes, which was a 41% increase versus 2022.

Restraints

Limited cold-chain capacity and logistics inefficiency continue to restrict the wider growth of the açaí industry

One major restraining factor for the açaí berry market is the heavy dependence on cold-chain infrastructure, which remains uneven across Brazil’s producing regions. Açaí is an extremely perishable fruit; it must be pulped within hours of harvest and kept under strict temperature control to maintain safety and colour stability. Even though production volume has grown sharply, the logistical backbone has not expanded at the same pace. Official data show that Brazil produced 1.95 million tonnes of açaí in 2022, valued at R$ 7.0 billion, but a significant share still moves through informal or low-tech collection routes that make industrial-scale consistency difficult.

The challenge becomes clearer when looking at the structure of production itself. Although 87.3% of national output now comes from managed or cultivated areas, supplying around 1.7 million tonnes across 233,400 hectares, much of this harvest is still concentrated in remote riverine regions of Pará and Amazonas. Movement from these areas to processing sites depends on basic boats, small distributors, and limited refrigerated transport.

Export data demonstrate this gap between production capacity and global market readiness. In 2023, Brazil exported only 79 tonnes of açaí purée, worth US$ 314,744, despite producing millions of tonnes domestically. Even though exports grew 41% from 48 tonnes in 2022, the scale remains tiny relative to supply. The Ministry of Agriculture (MAPA) has worked to open markets such as India for açaí powder and maintain access for açaí juice, but these regulatory wins cannot fully translate into export growth unless cold-chain and storage capacity improve.

Government interventions exist but are still emerging. While Pará’s Bioeconomy and Innovation Park, a R$ 300 million (US$ 56.29 million) investment, aims to support forest-based industries with processing and research facilities, the initiative will take time to influence large-scale cold-chain reliability. Until broader logistics upgrades reach remote harvesting zones, the industry will continue to face gaps between what it can grow and what it can reliably deliver to high-value food, beverage, and international buyers.

Opportunity

New market access in India and bioeconomy investment are opening a bigger runway for value-added açaí products

One major growth opportunity for the açaí berry industry is the expansion of export demand—especially into India—combined with a shift toward higher-value formats such as powder and industrial purée. This matters because açaí is already produced at scale in Brazil, yet international sales still represent only a small slice of what the country can supply. The opportunity is to convert Brazil’s production strength into steady, compliant exports by pushing more shelf-stable and standardized products that travel better than fresh fruit.

Export performance data also shows there is room to scale. A Brazil trade update linked to MAPA information reports that exports of açaí purée reached US$ 314,744 with 79 tonnes exported in 2023, which was a 41% volume increase compared with 2022. The absolute numbers are still small, but the direction is important: buyers are increasing orders when product specifications and logistics are reliable. For exporters, this creates a strong incentive to invest in better processing, stronger cold-chain controls for frozen formats, and consistent dehydration technology for powders—because those capabilities directly influence repeat orders and longer contracts.

The same policy direction is supported by economic evidence that forest products can compete with conventional activities. A 2019 study referenced in Reuters found that 30 forest-product value chains in Pará generated 4.24 billion reais in local income—nearly matching 4.25 billion reais from livestock grazing. For açaí, this comparison strengthens the investment case: scaling value-added processing can generate meaningful income while keeping forests standing, which aligns with climate goals and makes it easier to attract public support and private partnerships.

Another pillar of opportunity is that Brazil’s public and regional initiatives are now pushing the Amazon bioeconomy as a real industrial strategy, not just a sustainability slogan. In Pará—Brazil’s key açaí producing state—officials opened a 300 million real (about US$ 56 million) Bioeconomy and Innovation Park designed to help entrepreneurs develop new forest-based goods. Reporting on the facility notes it includes 6,000 square meters of warehouse space with equipment where businesses can test and scale products, including foods and natural ingredients.

Regional Insights

North America dominates with a market share of 37.2%, valued at US$ 0.4 Bn, supported by strong wellness demand and wide retail reach.

In 2024, North America stood out as the leading consumption hub for açaí-based products, holding a dominant position with 37.2% share and reaching US$ 0.4 Bn in value. The region benefits from a mature ecosystem of smoothie bars, health-forward cafés, and large-format retailers that can scale frozen and shelf-stable açaí products quickly. Demand is closely linked to broader “functional wellness” buying behavior. In the U.S., total retail sales of herbal dietary supplements reached US$ 13.231 billion in 2024, up 5.4% versus 2023—showing sustained consumer spending on natural health products that often overlap with açaí’s antioxidant-led positioning. Within that same report, the mass-market channel (including supermarkets and large retailers) generated US$ 2.607 billion in herbal supplement sales in 2024, highlighting how mainstream retail continues to pull health-focused products into everyday shopping baskets.

From a trade and supply standpoint, Canada also reflects strong activity in frozen formats that match North America’s cold-chain strengths. In 2023, Canada’s import value for frozen açaí berry was reported at about US$ 199.94 million, with total import volume near 104.17 thousand metric tons.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sambazon remains one of the most influential brands in the global açaí sector, operating across 30+ countries and supported by a sourcing network that works with over 30,000 family farmers in Brazil. The company runs certified processing facilities capable of producing several thousand tonnes of açaí purée and powder annually, strengthening its leadership in retail, foodservice, and ready-to-drink beverages.

Nossa! Fruits operates primarily in European markets, distributing açaí bowls, frozen packs, and smoothies to 3,500+ retail and foodservice locations. The company manages annual volumes exceeding 1,000 tons of açaí-based products, emphasizing clean-label, organic-certified sourcing. With operations across France, Belgium, and the U.K., the brand continues to scale through strong freezer-aisle placement.

Acai Roots focuses on premium frozen açaí and beverage lines, serving more than 3,000 retail outlets across the United States. The brand sources directly from Brazilian cooperatives and maintains strict cold-chain processes, enabling shipment volumes that exceed several million frozen packs per year. Its product portfolio spans 10+ SKUs, including energy shots, sorbets, and unsweetened açaí purées.

Top Key Players Outlook

- Sambazon, Inc.

- Acai Roots, Inc.

- The Berry Company Limited

- Nativo Acai

- Nossa! Fruits SAS

- Açaí Berry Foods

- AcaiExotic

- Sunfood

- Tropical Acai LLC

- Terrasoul Superfoods

- Frooty Comercio e Industria de Alimentos SA

Recent Industry Developments

In 2024, Sambazon, Inc. reported a Fair Trade–certified harvest footprint of 100,204 acres (40,552 hectares) and said it worked with 256 harvester communities and 827 individual harvesters; it has also invested $1+ million into Amazon harvesting communities over time, showing a long-run focus on community-linked sourcing.

In 2025, Nativo reinforced customer retention with freshness guidance and a quality message, posting notices such as “Best Buy ended 01/05/2025” and “Best Buy ended 04/2025,” and it promoted a 10% discount tied to 10-pack and 20-pack configurations—signals that it actively manages frozen inventory cycles while keeping price offers simple for regular buyers.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Acai Berry Pulp, Dried Acai Berry), By Application (Food And Beverage, Nutraceuticals, Pharmaceutical, Personal Care And Cosmetics, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sambazon, Inc., Acai Roots, Inc., The Berry Company Limited, Nativo Acai, Nossa! Fruits SAS, Açaí Berry Foods, AcaiExotic, Sunfood, Tropical Acai LLC, Terrasoul Superfoods, Frooty Comercio e Industria de Alimentos SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sambazon, Inc.

- Acai Roots, Inc.

- The Berry Company Limited

- Nativo Acai

- Nossa! Fruits SAS

- Açaí Berry Foods

- AcaiExotic

- Sunfood

- Tropical Acai LLC

- Terrasoul Superfoods

- Frooty Comercio e Industria de Alimentos SA