Global Automotive HMI Market Size, Share, Growth Analysis By Product (Voice Recognition System, Rotary Controllers, Gesture Recognition, Touch Screen Display, Instrument Cluster Display, Steering Mounted Control System, Multifunction Switches), By Access Type (Standard HMI System, Multimodal HMI System), By Technology (Visual Interface, Acoustic Interface, Others), By Display Size (5-10",

- Published date: Dec 2025

- Report ID: 169669

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

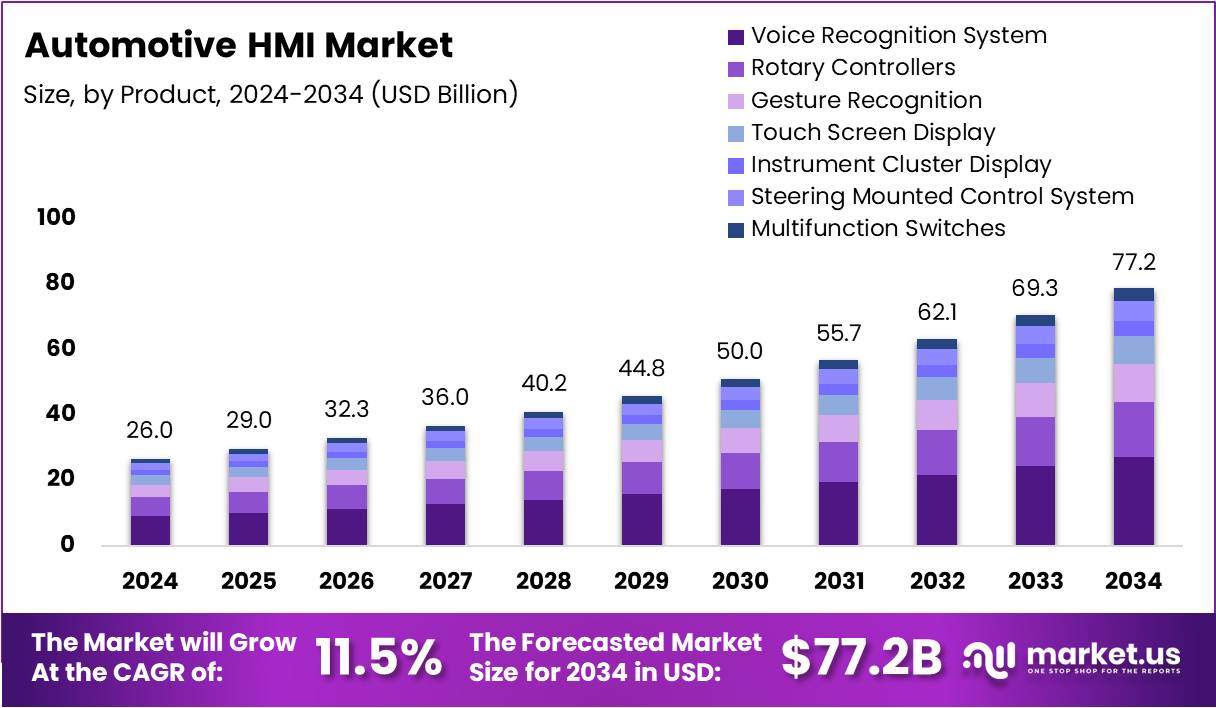

The Global Automotive HMI Market size is expected to be worth around USD 77.2 Billion by 2034, from USD 26.0 Billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034.

The Automotive HMI Market represents the technology enabling interaction between drivers and vehicle functions through touch, voice, and intelligent displays. It acts as the primary communication layer in modern vehicles, supporting safer navigation and improved control. As vehicles become more connected, HMI systems grow central to overall driving experience enhancement.

Moving forward, the market is expanding as consumers demand intuitive interfaces, cleaner layouts, and connected infotainment. Automakers increasingly focus on simplified interaction flows that reduce cognitive effort. This shift motivates suppliers to upgrade display technologies, embedded electronics, and UX design to support responsive and distraction-aware automotive environments.

Additionally, global investments in digital cockpit innovation create strong opportunities for advanced HMI development. Governments encourage safer driving technologies, prompting new capabilities such as voice-first commands, AR-enhanced displays, and real-time information layers. These supportive initiatives accelerate R&D and strengthen adoption across mainstream and premium vehicle segments.

Furthermore, evolving regulations shape how automotive HMIs are designed. Guidelines emphasize reducing driver distraction, improving visibility, and ensuring consistent readability during motion. As a result, manufacturers refine interface structures, adjust visual hierarchy, and integrate automated alerts to deliver compliant and more user-friendly experiences across diverse driving conditions.

At the same time, the shift toward electric and autonomous vehicles increases the importance of intelligent HMI systems. EVs require detailed displays for energy management, while autonomous features demand enhanced situational visualizations. These transitions accelerate demand for adaptive dashboards, gesture controls, context-aware menus, and AI-supported personalization.

Moreover, changing consumer expectations influence HMI adoption. Drivers increasingly prefer minimal steps, seamless interactions, and predictive assistance. These preferences guide UX strategies toward reduced complexity, conversational interfaces, and flexible display elements that support both safety and convenience in dynamic driving environments.

Research guidelines indicate that when vehicles are in motion, the minimum HMI font size should be 5.3–6 mm to ensure clear readability. Additional safety recommendations suggest drivers should limit each glance at the HMI to a maximum of 1.5 seconds to reduce distraction while driving.

Further driving studies show that interacting with an in-vehicle touchscreen can increase reaction time by 57% compared with undistracted driving. Moreover, survey insights reveal that 47% of respondents feel safe when a driver uses a hands-free phone function. These findings highlight the continued push toward safer and more intelligent Automotive HMI design.

Key Takeaways

- Global Automotive HMI Market expected to reach USD 77.2 Billion by 2034 from USD 26.0 Billion in 2024 at a CAGR of 11.5%.

- Voice Recognition System leads By Product segment with 34.8% share in 2024.

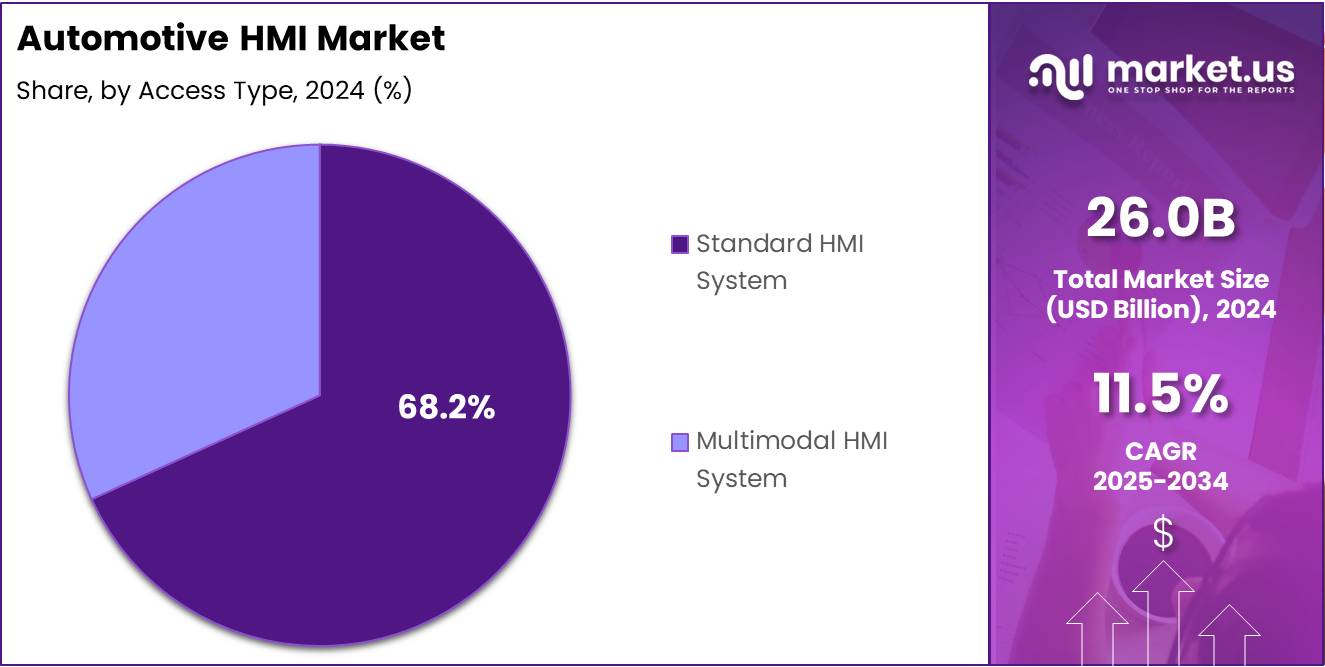

- Standard HMI System dominates By Access Type segment with 68.2% share in 2024.

- Visual Interface holds 58.3% share in By Technology segment in 2024.

- 5–10″ displays lead By Display Size segment with 67.1% share in 2024.

- Passenger Cars dominate By Vehicle Type segment with 78.4% share in 2024.

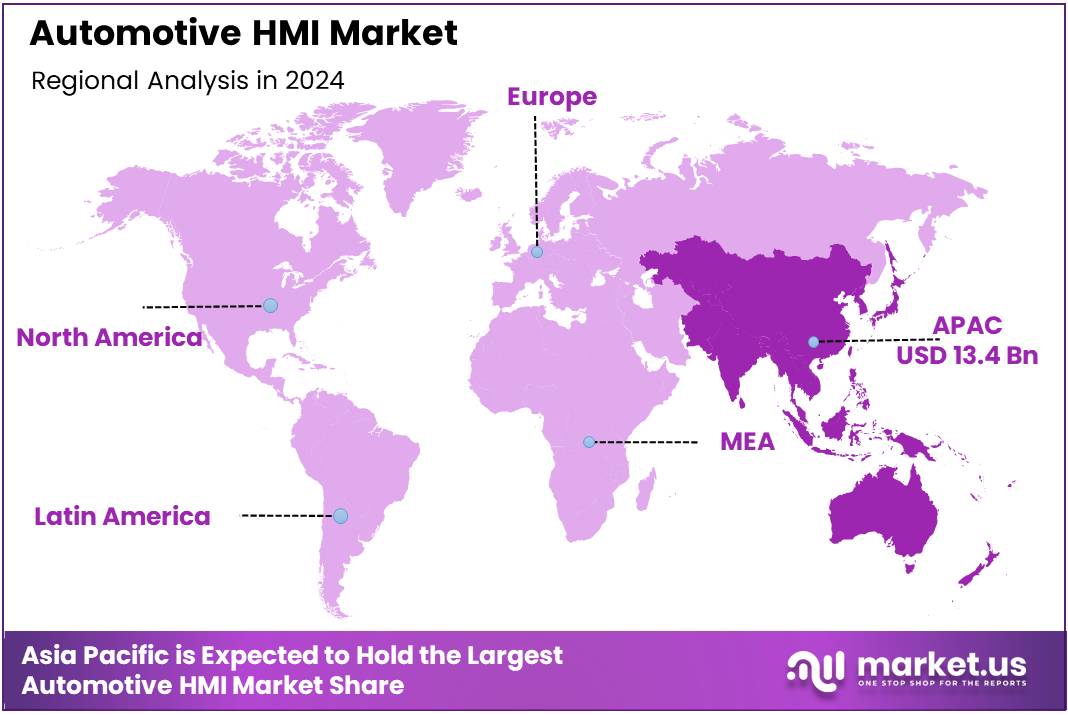

- Asia Pacific leads regional market with 51.8% share, valued at USD 13.4 Billion in 2024.

By Product Analysis

Voice Recognition System dominates with 34.8% due to its hands-free convenience and rising integration in connected vehicles.

In 2024, Voice Recognition System held a dominant market position in the By Product Analysis segment of the Automotive HMI Market, with a 34.8% share. Rising demand for safer, hands-free interaction and seamless in-car connectivity strengthened its adoption, further supported by advancements in natural language processing and AI-driven interfaces.

Rotary Controllers continued to gain traction as manufacturers enhanced tactile feedback. Their intuitive control and reduced driver distraction kept them relevant, especially in premium vehicles. Automakers increasingly paired these controllers with digital displays to offer hybrid HMI experiences balancing familiarity and modern digital usability.

Gesture Recognition advanced steadily as brands explored touchless controls for enhanced safety. Consumers valued the hygienic and futuristic interaction style, pushing OEMs to integrate cameras and sensors. Growing adoption in luxury vehicles and infotainment systems supported its gradual shift from niche to mainstream functionality.

Touch Screen Display expanded rapidly with digital cockpit evolution. Increasing use of large, high-resolution interfaces and seamless menu navigation boosted market growth. Automakers positioned touchscreens as central command units, driving consumer preference for visually rich and responsive controls in modern connected cars.

Instrument Cluster Display continued its transition from analog to fully digital layouts. Drivers preferred real-time information visualization with customizable views. Automakers integrated advanced graphics and safety alerts, improving situational awareness and elevating the premium feel of vehicle interiors.

Steering Mounted Control System remained vital due to its ergonomic design and safety benefits. Users appreciated quick access to essential functions without moving their hands. OEMs enhanced button layouts and haptic feedback to create more intuitive, distraction-free interactions.

Multifunction Switches sustained demand by offering reliable, tactile controls for essential operations. Their durability, familiarity, and low complexity kept them relevant, especially in cost-sensitive vehicle segments. OEMs optimized switch placement and design to enhance usability while complementing digital interfaces.

By Access Type Analysis

Standard HMI System dominates with 68.2% driven by widespread OEM adoption and cost efficiency.

In 2024, Standard HMI System held a dominant market position in the By Access Type Analysis segment of the Automotive HMI Market, with a 68.2% share. Its affordability, reliability, and broad integration across mass-market vehicles strengthened widespread consumer acceptance and supported consistent adoption across global automotive brands.

Multimodal HMI System gained momentum as vehicles incorporated blended inputs such as voice, touch, gesture, and haptic controls. Automakers leveraged this approach to improve accessibility and personalization. Consumers appreciated the flexibility of interacting using multiple modes, reinforcing its gradual adoption in connected and premium vehicle categories.

By Technology Analysis

Visual Interface dominates with 58.3% owing to its clarity and high user engagement.

In 2024, Visual Interface held a dominant market position in the By Technology Analysis segment of the Automotive HMI Market, with a 58.3% share. Increasing use of digital displays, advanced graphics, and rich visual layouts made it the preferred method for delivering clear information and enhancing user experience.

Acoustic Interface progressed as voice-based interactions improved. Drivers favored audio feedback for navigation and control, especially in hands-free scenarios. OEMs enhanced speech and voice recognition accuracy, enabling smoother communication and increasing trust in audio-centric vehicle controls.

Others included emerging haptic and mixed-reality-based HMIs. Automakers experimented with these solutions to elevate safety and immersion. These technologies enabled more intuitive guidance through vibrations, projections, and contextual cues, reinforcing future-oriented cockpit innovation.

By Display Size Analysis

5–10″ displays dominate with 67.1% due to balanced usability and strong OEM preference.

In 2024, 5–10″ displays held a dominant market position in the By Display Size Analysis segment of the Automotive HMI Market, with a 67.1% share. Their optimal size, ease of integration, and growing use in infotainment and instrument clusters significantly strengthened their market presence across mainstream vehicle models.

<5″ displays remained relevant for budget and compact vehicles. Their compact form, low power consumption, and ability to support essential information made them suitable for secondary displays. OEMs continued adopting them for simple, function-driven interfaces such as climate controls and basic cluster units.

>10″ displays expanded as brands embraced large digital dashboards and premium infotainment screens. Consumers preferred immersive, tablet-like interfaces offering improved visibility and multi-window functionality. This trend accelerated the shift toward wide, connected, and customizable cockpit layouts.

By Vehicle Type Analysis

Passenger Cars dominate with 78.4% supported by higher adoption of digital and connected HMI systems.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of the Automotive HMI Market, with a 78.4% share. Rapid digitalization, demand for comfort features, and integration of advanced driver assistance systems increased the use of sophisticated HMIs in sedans, SUVs, and hatchbacks.

Light Commercial Vehicles adopted HMIs gradually as fleet operators prioritized safety, navigation, and operational efficiency. Enhanced screens, voice interfaces, and connected controls improved driver productivity and reduced fatigue. Automakers introduced durable, user-friendly systems tailored for commercial usage environments.

Key Market Segments

By Product

- Voice Recognition System

- Rotary Controllers

- Gesture Recognition

- Touch Screen Display

- Instrument Cluster Display

- Steering Mounted Control System

- Multifunction Switches

By Access Type

- Standard HMI System

- Multimodal HMI System

By Technology

- Visual Interface

- Acoustic Interface

- Others

By Display Size

- 5-10″

- <5″

- >10″

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

Drivers

Strong Push for Advanced Safety Features Driving HMI Modernization

The automotive HMI market is growing steadily as carmakers continue to prioritize advanced safety features. Modern vehicles now rely on clearer displays, faster alerts, and intuitive controls to support safer driving. This shift is encouraging manufacturers to redesign HMIs with better visuals, simplified layouts, and smarter feedback systems.

Another key driver is the rising demand for smooth smartphone-to-vehicle integration. Consumers expect their cars to work like their mobile devices, enabling easy access to navigation, media, and communication apps. This preference is pushing OEMs to offer connected interfaces that deliver a seamless digital experience inside the vehicle.

Automakers are also focusing more on differentiated user experiences to strengthen brand loyalty. As vehicles become more similar in performance and design, UX-driven HMIs help companies stand out. This includes personalized dashboards, voice-enabled features, and interactive menus that enhance comfort and convenience for drivers.

Additionally, rapid electrification is increasing the need for intuitive energy-monitoring interfaces. Electric vehicles require clear displays that show battery health, range, charging status, and energy usage. This demand is accelerating HMI innovation, encouraging solutions that simplify complex EV information and support confident, informed driving decisions.

Restraints

High Integration Challenges and Cybersecurity Concerns Restrain Market Growth

The Automotive HMI market is experiencing steady progress, but integration complexity remains a major restraint. Modern vehicles now use multiple interaction modes such as touchscreens, voice control, gesture sensing, and haptic feedback. Bringing all these systems together in a smooth and reliable way is difficult for automakers. It often requires advanced software, long development timelines, and high coordination between hardware and software teams. As a result, companies face delays and higher costs, which slow down overall adoption.

Another significant restraint comes from rising cybersecurity risks linked to connected vehicle interfaces. As cars become more digital and cloud-connected, the number of potential cyberattack points increases. HMIs act as a front-end touchpoint for many vehicle functions, making them a sensitive entry point if not properly protected. Automakers must invest heavily in secure communication protocols, encryption, and real-time monitoring tools to avoid breaches. These added security layers increase system complexity and create additional compliance requirements.

Growth Factors

Rising Demand for Personalized In-Car Digital Ecosystems Drives Market Opportunities

The automotive HMI market is seeing strong growth prospects as automakers increasingly integrate AI-driven gesture and voice recognition into next-generation vehicles. These advanced interfaces help create safer and more intuitive interactions, supporting hands-free control and reducing driver distraction. As OEMs focus on user-friendly systems, this technological shift opens new opportunities for intelligent cockpit development.

Another major opportunity is the expanding adoption of augmented reality head-up displays. AR-HUDs are becoming popular because they project navigation cues, alerts, and driving data directly into the driver’s line of sight. This enhances situational awareness and enriches the overall driving experience. As premium and mid-range vehicles begin adopting these features, demand for immersive HMI technologies is expected to accelerate.

Personalized in-car digital ecosystems are also shaping new growth avenues. Consumers increasingly want customized layouts, adaptive interfaces, and content tailored to their preferences. This trend supports the development of modular HMI platforms that offer flexible control, seamless connectivity, and a more engaging driving experience.

Additionally, the shift toward connected electric vehicles is creating a strong need for specialized HMI solutions. EV drivers rely heavily on real-time energy insights, charging data, and battery diagnostics. This drives demand for HMIs designed specifically for EV platforms, helping automakers differentiate their products and enhance user satisfaction.

Emerging Trends

Surge in Multi-Modal Interaction Systems Drives Market Momentum

The Automotive HMI market is witnessing strong momentum as multi-modal interaction systems gain wider adoption. Automakers are combining touch, voice, and vision-based inputs to deliver smoother and safer in-car experiences. This trend is helping drivers interact with vehicle functions more naturally while reducing distraction. As vehicles become more connected and autonomous, the need for such flexible interfaces continues to grow.

Another major trend is the rapid transition toward software-defined cockpits. These digital-first cockpit architectures allow manufacturers to roll out continuous over-the-air (OTA) software enhancements, reducing dependency on hardware updates. This shift supports long-term feature upgrades, faster UI improvements, and better personalization, making the cabin experience more dynamic and future-ready.

In addition, the market is seeing rising use of haptics and tactile feedback across display interfaces. These subtle vibrations and touch cues help drivers receive immediate confirmation of commands without taking their eyes off the road. This enhances safety while improving interaction accuracy.

Finally, gaming-style user experiences and advanced 3D visualizations are becoming popular in infotainment systems. These immersive graphics make navigation, vehicle monitoring, and entertainment more engaging. As consumers expect smartphone-level experiences in vehicles, this design direction is gaining significant traction.

Regional Analysis

Asia Pacific Leads the Automotive HMI Market with a Market Share of 51.8%, Valued at USD 13.4 Billion

In 2024, Asia Pacific emerged as the dominant region in the global Automotive HMI Market, capturing 51.8% share and reaching a valuation of USD 13.4 Billion. Strong manufacturing ecosystems, rapid vehicle digitalization, and increasing adoption of connected features are accelerating market expansion. Governments across China, Japan, India, and South Korea continue to promote advanced in-car technology integration, reinforcing the region’s leadership position. Rising EV production and a tech-savvy consumer base further fuel HMI innovation and demand.

North America Automotive HMI Market Trends

North America shows strong growth driven by high consumer preference for advanced infotainment and safety-focused interfaces. The region benefits from rapid deployment of software-defined vehicles and increasing integration of voice assistants and gesture-based systems. Regulatory emphasis on driver safety also boosts the adoption of distraction-free display technologies. Moreover, rising demand for premium vehicles continues to support regional HMI upgrades.

Europe Automotive HMI Market Trends

Europe’s Automotive HMI Market is expanding steadily, supported by stringent safety regulations and growing interest in intuitive driver-assist technologies. The region is witnessing increasing implementation of multi-modal interaction systems and advanced cockpit displays. Additionally, the push for electrification and sustainability encourages OEMs to integrate enhanced energy-monitoring and user-centric interfaces. Strong adoption of AR-based dashboards further enhances market potential.

Middle East & Africa Automotive HMI Market Trends

Middle East & Africa show emerging opportunities as digital transformation in mobility gains momentum. Growing demand for premium vehicles with modern infotainment and connectivity features is driving gradual HMI adoption. Investments in smart mobility infrastructure and rising consumer expectations for advanced cockpit experience support market progress. Although at an early stage, the region is moving toward higher integration of intelligent display systems.

Latin America Automotive HMI Market Trends

Latin America is experiencing a moderate rise in HMI adoption, supported by growing interest in connected vehicles and improved in-car user experience. Countries like Brazil and Mexico are gradually integrating advanced display systems within mid-range vehicles. Economic recovery and expansion of digital services in the automotive sector further support market growth. Increasing focus on safety and comfort features is expected to accelerate adoption over the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive HMI Company Insights

Continental AG remains one of the most influential players, leveraging its strong portfolio of display systems, smart surfaces, and multi-modal interaction technologies. The company continues to integrate voice, touch, and haptic feedback elements into modern cockpits, ensuring drivers benefit from intuitive and distraction-free interactions. Its focus on scalable digital platforms also supports OEM strategies for personalized and software-driven interfaces.

Synaptics Incorporated plays a central role in enhancing the sensory intelligence of future HMI systems through its expertise in touch controllers, AI-enhanced gestures, and human-centric interaction sensors. Synaptics is increasingly supporting vehicle digitalization by enabling smoother, more accurate input recognition across complex environments. Its emphasis on low-latency touch and advanced haptic feedback positions it strongly as user expectations shift toward smartphone-like responsiveness inside vehicles.

Valeo S.A. strengthens its position by merging HMI technologies with its extensive competencies in ADAS, lighting, and in-cabin monitoring. The company’s integrated sensor-driven interfaces help automate routine functions, expand situational awareness, and enhance driver comfort. Valeo’s continued investment in ergonomic cockpit components and intelligent control modules aligns with the growing demand for safe, connected, and eco-efficient mobility systems.

Visteon Corporation remains a major catalyst for digital cockpit transformation, driven by its strong focus on domain controllers, infotainment platforms, and large-format curved displays. The company’s shift toward software-defined architectures enables continuous feature upgrades and creates a more cohesive, personalized driving experience. Visteon’s innovations in display consolidation and UI personalization make it a significant contributor to next-generation HMI adoption worldwide.

Top Key Players in the Market

- Continental AG

- Synaptics Incorporated

- Valeo S.A.

- Visteon Corporation

- Alpine Co. Ltd.

- Aptiv

- Tata Elxsi

- EAO AG

- Forciot Oy Ltd.

- Actia Corporation

Recent Developments

- In January 2025, DXC partnered with Ferrari to co-develop next-generation driver HMI systems.This collaboration focuses on advanced digital interfaces that enhance real-time vehicle interaction and cockpit intelligence.

- In February 2025, Unity was selected by Toyota Motor Corporation to power its next-gen HMI platform.The partnership aims to deliver more immersive, responsive, and visually rich in-car experiences for future Toyota models.

- In April 2025, EDATECH introduced new 7-inch, 10.1-inch, and 15.6-inch industrial HMI displays powered by Raspberry Pi CM5.These displays are designed to offer higher processing performance and improved usability for modern industrial and automotive applications.

Report Scope

Report Features Description Market Value (2024) USD 26.0 Billion Forecast Revenue (2034) USD 77.2 Billion CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Voice Recognition System, Rotary Controllers, Gesture Recognition, Touch Screen Display, Instrument Cluster Display, Steering Mounted Control System, Multifunction Switches), By Access Type (Standard HMI System, Multimodal HMI System), By Technology (Visual Interface, Acoustic Interface, Others), By Display Size (5-10″, <5″, >10″), By Vehicle Type (Passenger Cars, Light Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Continental AG, Synaptics Incorporated, Valeo S.A., Visteon Corporation, Alpine Co. Ltd., Aptiv, Tata Elxsi, EAO AG, Forciot Oy Ltd., Actia Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Continental AG

- Synaptics Incorporated

- Valeo S.A.

- Visteon Corporation

- Alpine Co. Ltd.

- Aptiv

- Tata Elxsi

- EAO AG

- Forciot Oy Ltd.

- Actia Corporation