Global 8X8 Armored Vehicle Market Size, Share, Growth Analysis By Product (Combat Vehicles, Combat Support Vehicles), By Mode of Operation (Manned Armored Vehicles, Unmanned Armored Vehicles), By Application (Defense, Homeland Security), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176784

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

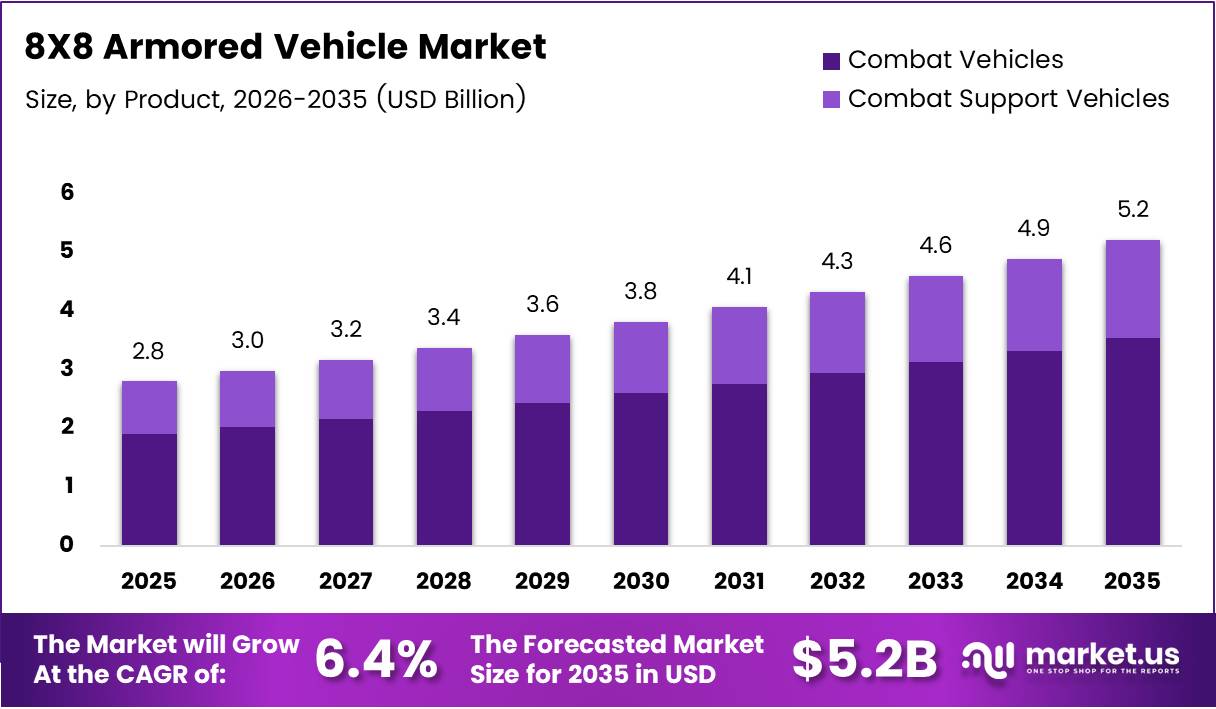

Global 8X8 Armored Vehicle Market size is expected to be worth around USD 5.2 Billion by 2035 from USD 2.8 Billion in 2025, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

The 8X8 armored vehicle market comprises wheeled combat platforms featuring eight-wheel drive configurations. These vehicles deliver superior mobility, payload capacity, and protection for military operations. Moreover, they support multiple mission roles including troop transport, reconnaissance, and fire support across diverse terrains.

Combat forces worldwide prioritize 8X8 platforms for rapid deployment capabilities. These vehicles combine tactical mobility with survivability features essential for modern warfare. Additionally, their wheeled design enables faster road movement compared to tracked alternatives while maintaining off-road performance.

Defense agencies invest heavily in 8X8 fleets to enhance force projection capabilities. These platforms support both conventional combat and peacekeeping missions effectively. Furthermore, modular architectures allow role customization without requiring entirely new vehicle variants, improving operational flexibility.

Hybrid powertrain integration represents a transformative advancement in armored vehicle technology. According to Climate and Security, advanced hybrid military vehicle architectures deliver approximately 48% improvement in fuel efficiency, substantially reducing operational fuel logistics burden. Consequently, this efficiency gain translates into roughly 32% reduction in fuel transport logistics demand, significantly enhancing mission endurance and operational range.

Modern 8X8 platforms increasingly incorporate modular protection systems enabling mission-specific survivability optimization. According to Partner technical documentation, contemporary 8×8 IFV platforms such as the Lazar 3M class support configurable ballistic protection with adjustable armor levels. Therefore, operators can adapt vehicle protection based on threat environments without platform replacement.

In May 2025, Patria unveiled a new AMV XP 8×8 configuration integrating the Turra 30 V10 remote-controlled turret with advanced sensors and strike capability. This development demonstrates the ongoing evolution toward network-centric warfare integration. Additionally, manufacturers focus on autonomous systems and AI-enabled battlefield awareness to maintain technological superiority.

Government investment in defense modernization programs accelerates market expansion globally. Regulatory frameworks increasingly mandate indigenous production partnerships, creating opportunities for local manufacturers. However, supply chain complexities and component availability remain critical considerations for sustained fleet development and operational readiness.

Key Takeaways

- Global 8X8 Armored Vehicle Market projected to reach USD 5.2 Billion by 2035 from USD 2.8 Billion in 2025.

- Market expected to grow at CAGR of 6.4% during forecast period 2026-2035.

- Combat Vehicles segment dominates By Product category with 67.2% market share in 2025.

- Manned Armored Vehicles segment leads By Mode of Operation with 79.1% share.

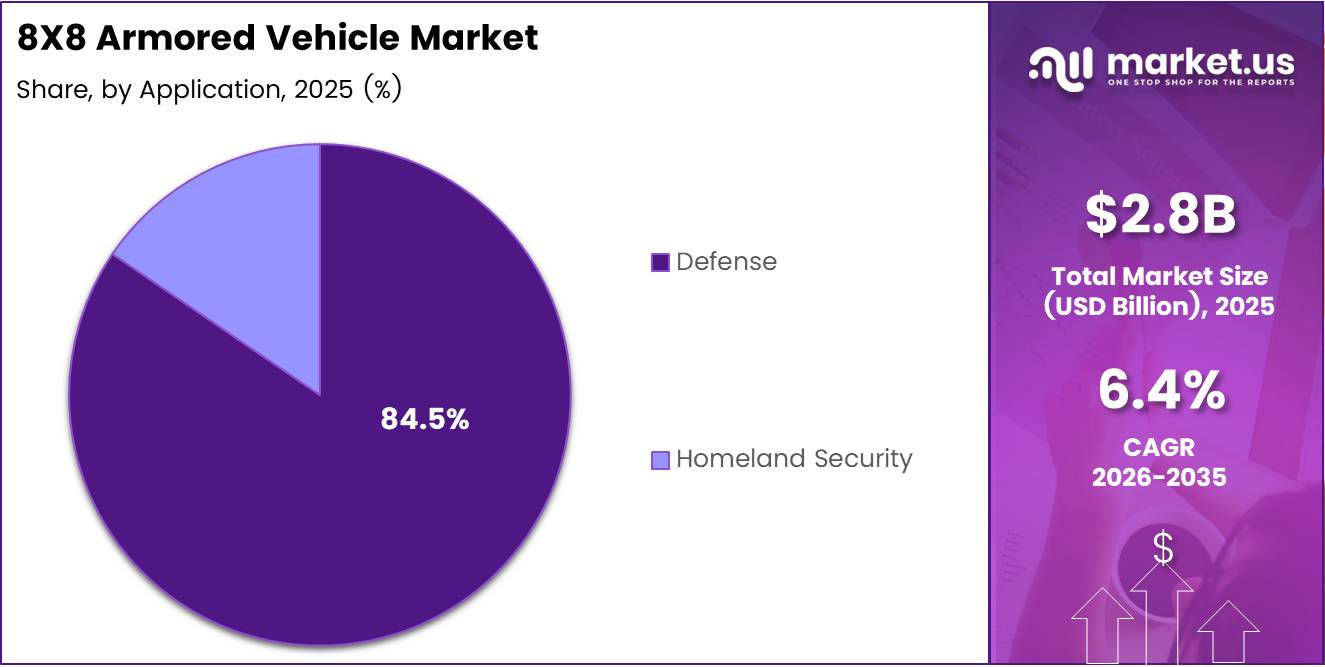

- Defense application holds dominant position with 84.5% market share.

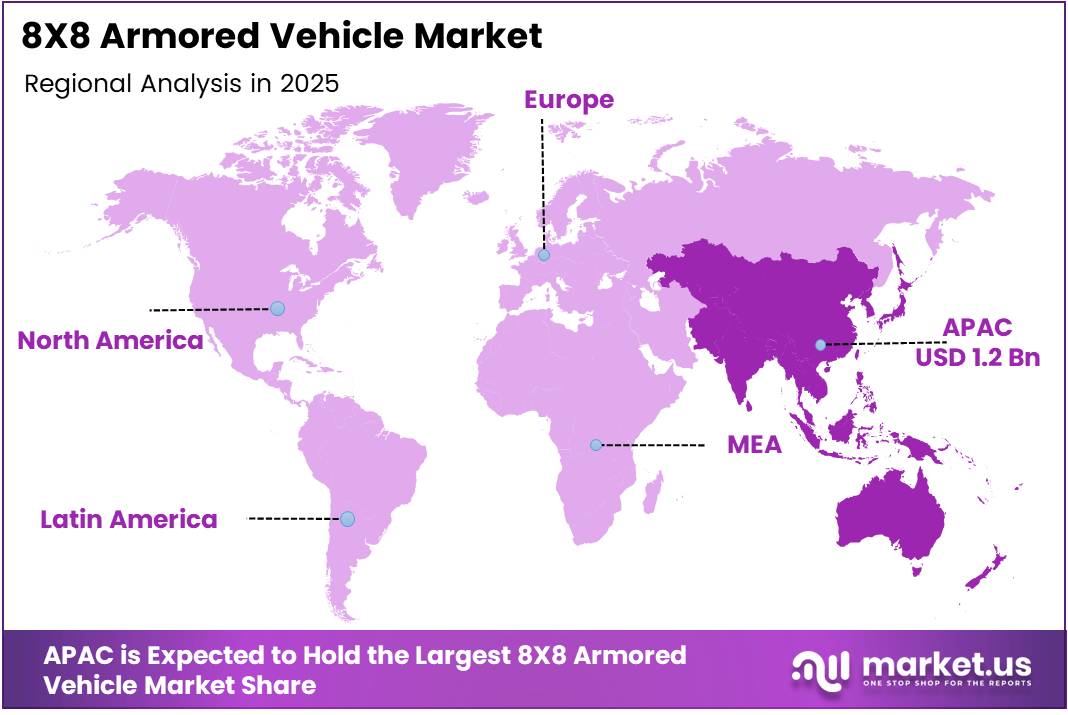

- Asia Pacific region dominates market with 43.20% share, valued at USD 1.2 Billion.

Product Analysis

Combat Vehicles dominates with 67.2% due to extensive military modernization programs requiring multi-role platforms.

In 2025, Armored Personnel Carriers (APC) held a dominant market position in the By Product segment of 8X8 Armored Vehicle Market, with a 67.2% share. APCs provide essential troop transport capabilities with protection against small arms and artillery fragments. Military forces prioritize these platforms for infantry mobility in contested environments. Additionally, modern APCs integrate communication systems enabling networked battlefield coordination and situational awareness enhancement.

Infantry Fighting Vehicles (IFV) represent advanced combat platforms combining troop transport with direct fire support capabilities. These vehicles mount medium-caliber cannons and anti-tank weapons for offensive operations. Moreover, IFVs enable mechanized infantry to fight from protected positions while maintaining tactical mobility. Consequently, defense agencies invest significantly in IFV procurement for combined arms operations.

Light Protected Vehicles (LPV) offer mobility-focused solutions for reconnaissance and rapid response missions. These platforms balance protection with speed for low-intensity conflict environments. Furthermore, LPVs provide cost-effective alternatives for security forces requiring patrol capabilities. Therefore, they serve essential roles in peacekeeping and border security operations worldwide.

Main Battle Tanks (MBT) deliver heavy firepower and maximum armor protection for frontline combat. These tracked platforms remain essential despite wheeled vehicle proliferation. Additionally, Mine-Resistant Ambush Protected (MRAP) Vehicles address asymmetric warfare threats through blast-deflecting hull designs. Tactical Vehicles and Others complete the combat vehicle portfolio for specialized mission requirements.

Combat Support Vehicles enable sustained operations through logistics and command capabilities. Armored Supply Trucks transport ammunition, fuel, and equipment under protection from hostile fire. These platforms ensure continuous combat unit sustainment in forward operating areas. Moreover, armored logistics vehicles reduce vulnerability during resupply operations significantly.

Armored Command & Control Vehicles provide mobile headquarters for tactical commanders with advanced communication systems. These platforms integrate sophisticated electronics for battlefield management and coordination. Furthermore, Repair & Recovery Vehicles enable field maintenance and vehicle evacuation under combat conditions. Unmanned Armored Ground Vehicles represent emerging technology for high-risk reconnaissance and logistics missions.

Mode of Operation Analysis

Manned Armored Vehicles dominates with 79.1% due to operational maturity and crew-intensive mission requirements.

In 2025, Manned Armored Vehicles held a dominant market position in the By Mode of Operation segment of 8X8 Armored Vehicle Market, with a 79.1% share. Traditional crewed platforms provide proven capabilities for complex combat scenarios requiring human judgment. Military doctrine emphasizes crew-operated systems for missions demanding rapid decision-making under uncertainty. Additionally, existing training infrastructure and operational experience favor manned vehicle deployment across global armed forces.

Unmanned Armored Vehicles represent an emerging segment addressing high-risk mission profiles. These autonomous or remotely operated platforms reduce personnel exposure in dangerous environments. Moreover, unmanned systems enable reconnaissance and logistics operations without crew casualties. However, technological maturity and operational doctrine development continue limiting widespread adoption compared to manned alternatives.

Application Analysis

Defense dominates with 84.5% due to primary military procurement for national security and combat operations.

In 2025, Defense held a dominant market position in the By Application segment of 8X8 Armored Vehicle Market, with an 84.5% share. National military forces constitute the primary customer base for armored vehicle procurement worldwide. Armed forces require 8X8 platforms for conventional warfare, counterinsurgency, and power projection missions. Additionally, defense budgets allocate substantial resources toward force modernization and combat vehicle fleet replacement programs.

Homeland Security applications address internal security threats and law enforcement requirements. Police and paramilitary forces deploy armored vehicles for riot control, counterterrorism, and border protection. Moreover, homeland security agencies prioritize mobility and protection for personnel operating in urban environments. Consequently, this segment grows as governments enhance domestic security capabilities against evolving threats.

Key Market Segments

By Product

- Combat Vehicles

- Armored Personnel Carrier (APC)

- Infantry Fighting Vehicles (IFV)

- Light Protected Vehicles (LPV)

- Main Battle Tanks (MBT)

- Mine-resistant Ambush Protected (MRAP) Vehicles

- Tactical Vehicle

- Others

- Combat Support Vehicles

- Armored Supply Trucks

- Armored Command & Control Vehicles

- Repair & Recovery Vehicles

- Unmanned Armored Ground Vehicles

By Mode of Operation

- Manned Armored Vehicles

- Unmanned Armored Vehicles

By Application

- Defense

- Homeland Security

Drivers

Rising Demand for Multi-Role Combat Vehicles Supporting Modern Hybrid Warfare

Contemporary military operations require platforms capable of adapting to diverse mission profiles. Armed forces prioritize versatile 8X8 vehicles that transition between combat, reconnaissance, and support roles. Moreover, hybrid warfare scenarios demand platforms integrating conventional and asymmetric capability packages. Consequently, defense agencies procure modular armored vehicles enabling rapid role reconfiguration without fleet diversification.

Defense budget allocations increasingly focus on rapid deployment and force modernization initiatives. Governments worldwide expand military spending to counter emerging security threats and geopolitical instability. In July 2025, Germany prepared over 60 major defense contracts including large armored vehicle procurement programs under military expansion plans. Therefore, sustained budgetary commitments drive manufacturer production capacity expansion and technological innovation investment.

Modern combat environments present severe threats from improvised explosive devices and asymmetric warfare tactics. According to arXiv research on maintenance optimization, predictive frameworks can reduce lifecycle maintenance costs by up to 50% in complex vehicle fleets. Additionally, according to advanced hybrid control research, machine-learning energy management systems reduce fuel consumption by approximately 2.87 L/100 km in hybrid vehicle operation. Border security and peacekeeping missions require protected mobility for personnel operating in contested territories. Therefore, nations invest in wheeled armored fleets balancing protection, mobility, and operational sustainability.

Restraints

High Lifecycle Maintenance and Upgrade Costs for Advanced Armored Vehicle Systems

Advanced armored vehicles demand substantial financial resources throughout their operational service life. Maintenance programs for sophisticated electronic systems, powertrains, and armor require specialized facilities and trained personnel. Moreover, technology upgrades necessary to maintain battlefield relevance impose recurring capital expenditures on defense budgets. Consequently, smaller nations face constraints in sustaining modern armored vehicle fleets over extended periods.

Supply chain complexities affect the availability of critical components for armored vehicle production. Specialized armor materials, advanced electronics, and precision mechanical systems depend on limited supplier networks. Furthermore, geopolitical tensions and export restrictions disrupt component flows to manufacturers and operators. Therefore, production delays and maintenance challenges arise from component scarcity and procurement complications.

Defense procurement cycles extend over multiple years creating budget allocation uncertainties. Economic fluctuations influence government spending priorities potentially delaying or reducing armored vehicle orders. Additionally, competing defense modernization requirements divert resources from ground vehicle programs. Consequently, manufacturers face demand volatility impacting production planning and research investment decisions significantly.

Growth Factors

Integration of Autonomous Driving and Remote Weapon Station Technologies in 8×8 Platforms

Autonomous systems transform armored vehicle capabilities by reducing crew requirements and enhancing operational safety. Manufacturers integrate self-driving technologies enabling unmanned logistics convoys and reconnaissance missions. According to arXiv predictive maintenance research, AI-enabled maintenance systems achieve approximately 98.9% failure prediction accuracy for armored vehicles, substantially improving uptime and reducing unexpected downtime. Moreover, remote weapon stations provide precision engagement capabilities without exposing personnel to direct fire.

Developing nations modernize aging armored vehicle inventories through new procurement programs. Legacy fleet replacement creates substantial market opportunities for contemporary 8X8 platform manufacturers. Furthermore, technology transfer agreements enable local production capabilities in emerging markets. According to West Point military innovation research, military electrification programs significantly reduce fuel dependency and improve energy resilience in forward operating environments, supporting silent mobility and lower thermal signatures.

Defense original equipment manufacturers establish partnerships with domestic producers for indigenous manufacturing. These collaborations satisfy offset requirements and build local industrial capabilities. Additionally, joint ventures reduce procurement costs through economies of scale and technology sharing. According to advanced hybrid vehicle research, sophisticated hybrid control algorithms demonstrate approximately 20% fuel consumption reduction versus conventional hybrid control strategies, offering significant operational advantages.

Emerging Trends

Shift Toward Hybrid-Electric and Silent Mobility Armored Vehicle Powertrains

Hybrid-electric propulsion systems revolutionize armored vehicle energy management and tactical capabilities. These powertrains enable silent operation modes for reconnaissance and reduce thermal signatures during operations. Moreover, electric drive components improve fuel efficiency while maintaining combat performance requirements. Consequently, manufacturers prioritize hybrid technology integration in next-generation 8X8 platform development programs.

Artificial intelligence transforms battlefield awareness through advanced sensor fusion and data processing. AI-based systems integrate multiple sensor inputs providing comprehensive situational awareness to vehicle crews. According to academic research on AI repair analytics, hybrid and electrified military vehicle maintenance optimization increasingly benefits from AI-supported repair analytics, showing measurable improvements in maintenance efficiency. Additionally, predictive threat detection algorithms enhance crew survivability against evolving battlefield dangers.

Lightweight composite armor materials reduce vehicle weight while maintaining ballistic protection levels. Engineers develop advanced materials enabling improved mobility without compromising crew safety. According to arXiv electric vehicle research, EV integration into military microgrids significantly reduces fuel consumption and operational energy costs while improving mission energy resilience.

Furthermore, according to hybrid vehicle machine learning studies, ML-optimized hybrid systems maintain full-electric driving range of approximately 84 km using 80% utilized 20-kWh battery packs. Network-centric warfare compatibility requires sophisticated communication systems enabling real-time data exchange between platforms and command elements.

Regional Analysis

Asia Pacific Dominates the 8X8 Armored Vehicle Market with a Market Share of 43.20%, Valued at USD 1.2 Billion

Asia Pacific commands the global 8X8 armored vehicle market through extensive military modernization programs and regional security dynamics. Nations including China, India, South Korea, and Australia invest heavily in armored vehicle procurement. The region’s 43.20% market share reflects defense budget growth and territorial security priorities.

Moreover, indigenous manufacturing capabilities expand through technology partnerships and domestic development initiatives. In December 2025, Peru advanced plans to acquire 141 K808 wheeled armored combat vehicles from South Korea under a modernization agreement, demonstrating regional manufacturing export growth.

North America 8X8 Armored Vehicle Market Trends

North America maintains substantial armored vehicle procurement through United States and Canadian defense programs. The region emphasizes technological superiority and fleet modernization for global deployment capabilities. Additionally, domestic manufacturers lead innovation in autonomous systems and hybrid powertrains. Therefore, North American demand focuses on high-capability platforms with advanced electronics integration.

Europe 8X8 Armored Vehicle Market Trends

Europe demonstrates strong market growth driven by collective defense commitments and security concerns. NATO standardization requirements influence procurement decisions across member nations. In March 2024, Germany signed a contract for up to 123 Boxer 8×8 heavy weapon carrier vehicles worth about €2.7 billion, with deliveries starting 2025. Moreover, European manufacturers excel in modular platform development and export to global markets.

Latin America 8X8 Armored Vehicle Market Trends

Latin America pursues armored vehicle modernization balancing budget constraints with security requirements. Nations prioritize cost-effective platforms for internal security and border protection missions. Furthermore, regional manufacturers develop indigenous capabilities through technology partnerships. Consequently, Latin American procurement emphasizes proven designs with manageable lifecycle costs.

Middle East & Africa 8X8 Armored Vehicle Market Trends

Middle East and Africa regions invest significantly in armored vehicles addressing diverse security challenges. Oil-rich nations procure advanced platforms while African countries focus on peacekeeping capabilities. Additionally, harsh environmental conditions drive demand for reliable wheeled vehicles. Therefore, regional procurement combines high-end systems with ruggedized commercial derivatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

BAE Systems plc maintains a leading position in global armored vehicle markets through extensive product portfolios and international partnerships. The company produces advanced 8X8 platforms including amphibious assault vehicles and wheeled combat systems. Moreover, BAE Systems invests significantly in autonomous technologies and hybrid powertrains for next-generation platforms. Consequently, the manufacturer secures contracts across North America, Europe, and Middle East regions through proven performance and technological innovation.

General Dynamics Corporation delivers versatile armored vehicle solutions emphasizing modularity and survivability. The company’s wheeled platforms serve multiple military branches worldwide with customizable mission packages. Additionally, General Dynamics integrates advanced protection systems and digital battlefield management capabilities. Therefore, defense agencies value the manufacturer’s comprehensive support infrastructure and upgrade pathways for extended service life.

Rheinmetall AG excels in European armored vehicle markets through engineering excellence and modular design philosophy. The company’s Boxer platform demonstrates exceptional versatility across multiple role configurations. In 2025 at IDET exhibition, Rheinmetall presented a Boxer 8×8 IFV variant equipped with Turra 30 V10 unmanned turret for modern infantry combat roles. Furthermore, Rheinmetall establishes partnerships for indigenous production in growth markets. Consequently, the manufacturer expands global presence through technology transfer and joint development programs.

Oshkosh Defense specializes in tactical wheeled vehicles combining commercial reliability with military protection requirements. The company’s platforms emphasize mobility and payload capacity for diverse mission profiles. In March 2025, Otokar established a Romanian subsidiary after securing an armored vehicle contract valued around €857 million, demonstrating competitive market dynamics. Additionally, Oshkosh Defense maintains strong aftermarket support networks ensuring operational readiness. Therefore, military forces appreciate the manufacturer’s focus on total ownership costs and sustained operations.

Key players

- BAE Systems plc

- General Dynamics Corporation

- Rheinmetall AG

- Oshkosh Defense

- Patria Group

- Hanwha Corporation

- ST Engineering

- Iveco Defence Vehicles

- KMW – Krauss-Maffei Wegmann

Recent Developments

- January 2025 – Romania planned acquisition of 150 Piranha 5 8×8 armored vehicles as part of an approximately €8 billion defense modernization package, significantly expanding national armored capabilities and strengthening NATO interoperability.

- March 2024 – Germany signed a contract for up to 123 Boxer 8×8 heavy weapon carrier vehicles worth about €2.7 billion, with deliveries starting 2025, reinforcing European defense industrial capacity and military modernization.

- March 2025 – Otokar established a Romanian subsidiary after securing an armored vehicle contract valued around €857 million, demonstrating strategic market expansion through regional manufacturing partnerships and local production capabilities.

- May 2025 – Excalibur Army unveiled the Pandur II 8×8 EVO IFV with upgraded turret, modular architecture, and enhanced protection at IDET 2025, showcasing advanced design evolution and combat system integration.

Report Scope

Report Features Description Market Value (2025) USD 2.8 Billion Forecast Revenue (2035) USD 5.2 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Combat Vehicles – Armored Personnel Carrier (APC), Infantry Fighting Vehicles (IFV), Light Protected Vehicles (LPV), Main Battle Tanks (MBT), Mine-resistant Ambush Protected (MRAP) Vehicles, Tactical Vehicle, Others; Combat Support Vehicles – Armored Supply Trucks, Armored Command & Control Vehicles, Repair & Recovery Vehicles, Unmanned Armored Ground Vehicles), By Mode of Operation (Manned Armored Vehicles, Unmanned Armored Vehicles), By Application (Defense, Homeland Security) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BAE Systems plc, General Dynamics Corporation, Rheinmetall AG, Oshkosh Defense, Patria Group, Hanwha Corporation, ST Engineering, Iveco Defence Vehicles, KMW – Krauss-Maffei Wegmann Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BAE Systems plc

- General Dynamics Corporation

- Rheinmetall AG

- Oshkosh Defense

- Patria Group

- Hanwha Corporation

- ST Engineering

- Iveco Defence Vehicles

- KMW - Krauss-Maffei Wegmann