Global 5G in Agriculture Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Application (Precision Farming, Livestock Monitoring, Smart Greenhouses, Autonomous Tractors, Drones, Others), By Deployment Mode (On-Premises, Cloud), By Farm Size (Small and Medium Farms, Large Farms), By End-User (Farmers, Agribusinesses, Research Institutes, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163518

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Performance and Efficiency

- Application Statistics

- Role of Generative AI

- US Market Size

- By Component

- By Application

- By Deployment Mode

- By Farm Size

- By End-User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

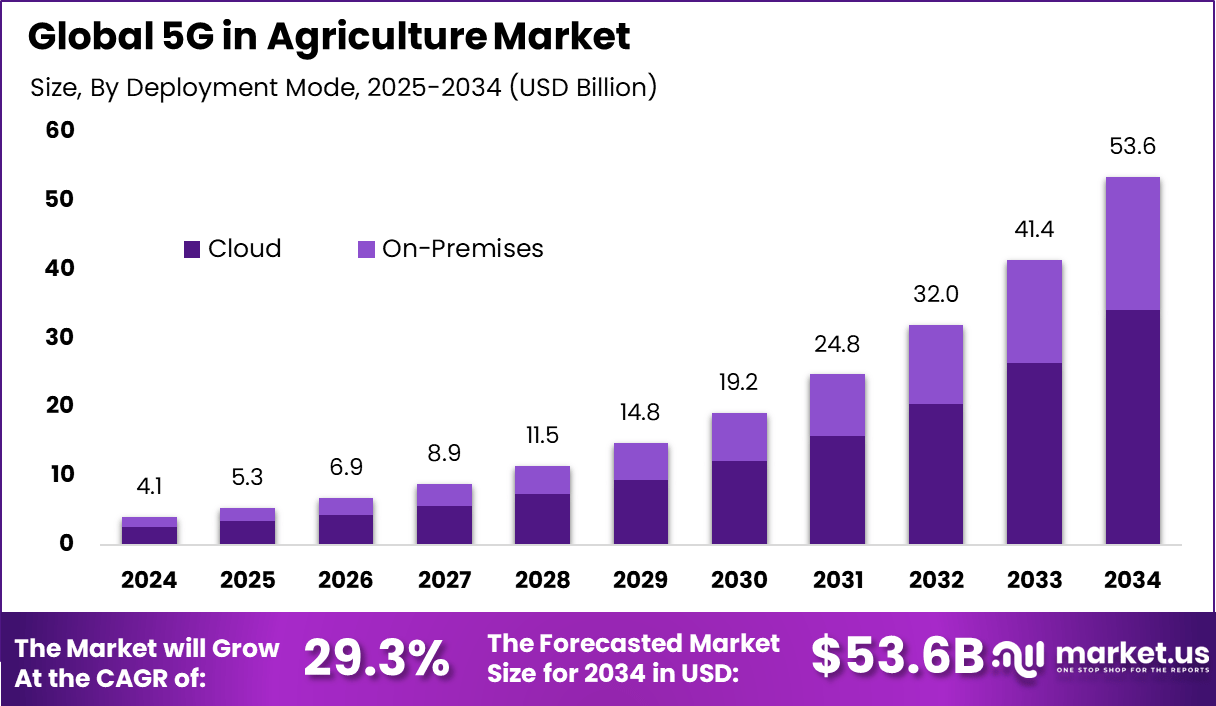

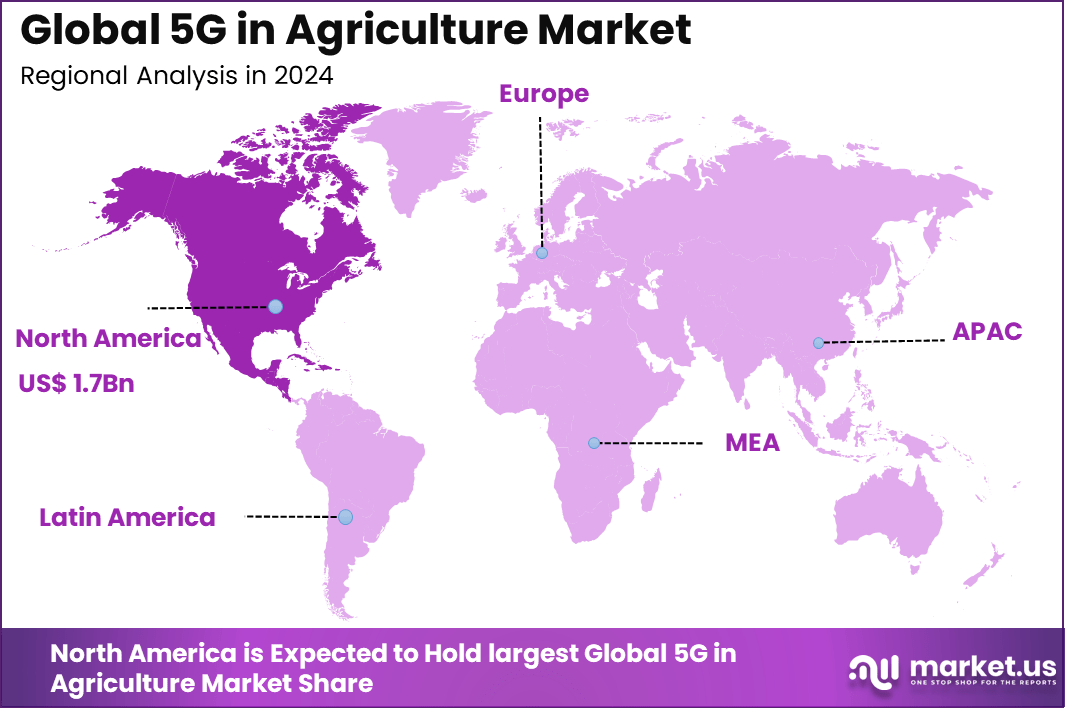

The Global 5G in Agriculture Market generated USD 4.1 billion in 2024 and is predicted to register growth from USD 5.3 billion in 2025 to about USD 53.6 billion by 2034, recording a CAGR of 29.3% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.6% share, holding USD 1.7 Billion revenue.

The 5G in agriculture market refers to the deployment of fifth-generation mobile networks to connect farm assets, people, and processes in real time. It spans field sensing, variable-rate irrigation and spraying, autonomous tractors and drones, livestock monitoring, and supply-chain traceability. The enabling network features are enhanced mobile broadband for video and imagery, massive machine-type communications for dense sensor fields, and ultra-reliable low-latency communications for time-critical control.

Key drivers for adopting 5G in agriculture include the rising demand for precision farming and the urgent need to produce more food sustainably. Precision agriculture can increase crop yields by around 15% while reducing input costs by 10-15%, primarily through accurate and timely data use. The growing scarcity of farm labor pushes the adoption of automation powered by 5G, such as autonomous tractors and drones, reducing manual work.

Businesses benefit from 5G in agriculture through enhanced operational efficiency, reduced resource wastage, and better supply chain transparency. Farmers gain higher crop yields and lower labor costs by automating tasks and using data-driven insights. Agribusinesses can track product quality and reduce environmental footprint using blockchain and real-time data.

Top Market Takeaways

- The Hardware segment dominated with 61.4%, driven by the widespread deployment of IoT sensors, autonomous machinery, and connected devices in modern farms.

- Precision Farming led by application with 42.8%, highlighting the growing reliance on real-time data and connectivity to optimize crop yields and resource management.

- Cloud deployment accounted for 63.8%, supported by scalable infrastructure that enables data analytics and remote monitoring across agricultural operations.

- Large Farms represented 61.3% of total adoption, reflecting greater investment capacity in advanced 5G-enabled farming technologies.

- Agribusinesses captured 42.7%, emphasizing their focus on integrating digital connectivity to streamline operations and supply chain efficiency.

- North America held 42.6% of the global market, driven by early adoption of smart farming technologies and government-backed connectivity initiatives.

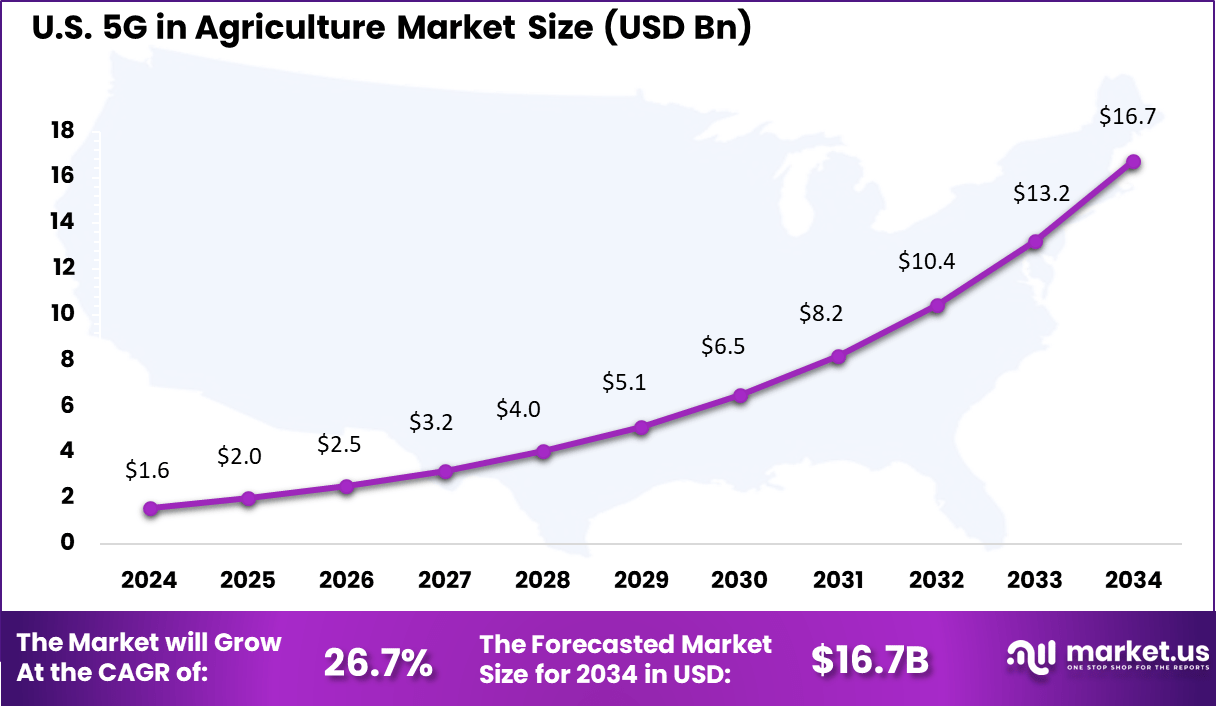

- The US market reached USD 1.57 Billion in 2024, expanding at a strong 26.7% CAGR, propelled by rapid digital transformation, high-speed network rollout, and demand for automation in agriculture.

Performance and Efficiency

- Crop output: In agricultural trials conducted in Jilin Province, China, the use of automated farming technologies resulted in a 10% increase in crop yield compared with conventional farming methods.

- Smart irrigation: The deployment of 5G-enabled smart irrigation systems demonstrated a 40% reduction in water usage, underscoring the potential of precision water management for sustainability and cost savings.

- Autonomous tractors: Field studies found that unmanned tractors achieved 50% higher operational efficiency than conventional manually operated tractors, improving both productivity and resource utilization.

- Harvesters: 5G-powered unmanned harvesters showed a remarkable 60% increase in efficiency compared with traditional models, highlighting how connectivity and automation can transform large-scale harvesting operations.

Application Statistics

- Water management: Water scarcity remains one of the most pressing challenges in agriculture. The water management segment is expected to dominate 5G-enabled agricultural applications. A pilot project demonstrated a 40% reduction in water usage through real-time monitoring and adaptive irrigation systems.

- Precision farming: The integration of 5G with precision agriculture technologies can boost yields by up to 15% while reducing input costs by 10-15%. A trial conducted in China achieved a 10% increase in crop output using a 5G-enabled solution, validating the technology’s effectiveness in optimizing farming practices.

- Autonomous equipment: Automation driven by 5G connectivity has led to major productivity gains. Unmanned harvesters have shown 60% greater efficiency, and unmanned tractors demonstrated 50% higher efficiency than conventional machinery, enabling faster and more accurate field operations.

- Pest and disease control: 5G-connected drones and robots are revolutionizing pest management. One robotic system achieved a 95% weed identification accuracy rate and was seven times faster than manual methods, reducing the need for chemical use and labor.

- Livestock monitoring: Enhanced connectivity enables precise animal tracking and health management. A 5G-based livestock monitoring system improved accuracy by 50%, providing real-time insights into animal behavior. One case study also reported a 50% reduction in calving mortality, emphasizing its potential for improving farm productivity and welfare standards.

Role of Generative AI

Generative AI is playing a significant role in agriculture by helping farmers monitor crop health and optimize resource use. With 5G networks enabling faster data transmission, AI models can analyze high-resolution images captured by drones to identify stressed plants and classify crops more accurately.

This technology helps reduce unnecessary use of fertilizers by about 20% and cuts water consumption by around 30%, making farming more efficient and sustainable. Additionally, generative AI saves farmers up to 50% of their time by providing actionable alerts in real time, improving decision-making on the farm.

By combining AI capabilities with 5G connectivity, agriculture moves toward precision farming that uses data-driven insights to enhance productivity while minimizing waste. The fast processing of large data sets enables customized treatments tailored to the specific needs of crops and soil conditions.

US Market Size

The United States leads with around USD 1.57 billion in market value and a strong CAGR of 26.7%. Federal and state initiatives promoting digital farming and broadband expansion are key contributors to this growth. Agricultural companies are experimenting with private 5G networks to improve data control and operational efficiency. With its combination of advanced infrastructure and innovation-oriented policies, the U.S. remains a central hub for global advancements in connected agriculture.

North America holds a 42.6% share of the global 5G in agriculture market, supported by rapid integration of smart farming technologies and strong rural connectivity infrastructure. The region’s commitment to precision agriculture, sustainable practices, and large-scale automation is fostering growth. Farmers are benefiting from partnerships with telecom operators focused on expanding 5G coverage in remote agricultural zones.

By Component

In 2024, Hardware accounts for about 61.4% of the 5G in agriculture market, marking it as the foundation of digital farm connectivity. Sensors, antennas, drones, and automated machinery form the backbone for real-time monitoring and data transmission.

Farmers rely heavily on hardware to capture accurate information on soil quality, weather, and crop conditions to improve output and minimize resource waste. The rapid expansion of IoT-enabled equipment and connected tractors also contributes to the dominance of this segment. Continuous improvements in 5G-integrated equipment are reshaping on-ground farming activities.

Manufacturers are embedding advanced chipsets and communication modules into agricultural tools for low-latency data management. These innovations support better decision-making, from irrigation scheduling to pesticide control. The hardware segment remains critical because it physically connects fields to data ecosystems, enabling seamless adoption of AI and analytics tools in modern agriculture.

By Application

In 2024, Precision farming makes up 42.8% of the market, driven by the need to optimize production while using fewer resources. 5G enhances precision agriculture by linking sensors and machines with real-time responsiveness, allowing farmers to adjust planting density, fertilizer use, and harvesting time instantly.

The technology improves both productivity and sustainability, helping reduce costs and environmental impact. This segment also gains momentum through the combination of 5G and autonomous technologies. Farms are increasingly deploying drones and robotic equipment that rely on fast, reliable networks for seamless coordination.

By improving sensor accuracy and connectivity, 5G empowers growers to practice data-driven farming across large areas. It represents a key shift from traditional crop management toward digitally assisted operations where every acre is monitored and optimized continuously.

By Deployment Mode

In 2024, Cloud deployment leads the market at 63.8%, reflecting the agricultural sector’s shift toward centralized data platforms. Farmers and agribusinesses prefer cloud-based tools for remote monitoring, predictive analysis, and automated alerts.

Cloud systems help store and process large volumes of field data captured through 5G sensors and drones, making real-time insights more accessible and easier to act upon. The growth of cloud computing in agriculture is also tied to scalability and cost efficiency. Service providers are offering modular solutions that can grow with a farm’s digital maturity.

With cloud-based 5G networks, devices across wide farm areas remain connected without heavy investment in local IT infrastructure. This model allows technicians, agronomists, and farm managers to collaborate more effectively using shared dashboards and analytics.

By Farm Size

In 2024, Large farms dominate the 5G adoption landscape with 61.3% share, as they have the financial and technical capacity to integrate next-generation connectivity. Their operations span thousands of acres, where the need for automation and continuous monitoring is greatest.

Advanced 5G tools help these farms coordinate machinery, monitor livestock, and manage water usage across dispersed zones. Increased efficiency translates directly into higher profitability and sustainability. Larger agricultural enterprises also view 5G as a strategic tool to reduce labor dependency and operational delays.

By connecting autonomous tractors, drones, and harvesting robots, these farms streamline workflows and minimize downtime. The scalability of 5G allows large farms to operate interconnected systems from a central control center, improving both yield quality and traceability across the supply chain.

By End-User

In 2024, Agribusinesses represent 42.7% of 5G in agriculture users due to their strong focus on productivity and supply chain coordination. These entities include input suppliers, food processors, and exporters that rely on consistent data flow between farm and factory.

5G connectivity ensures transparency in production, transport, and quality control, enhancing reliability in logistics and minimizing losses. The segment’s growth is powered by the pursuit of smarter operational models. Agribusinesses are adopting 5G-driven platforms for predictive analytics, crop health forecasting, and cost optimization.

The technology supports seamless data sharing across multiple facilities, promoting tighter integration between producers, distributors, and retailers. As global food demand increases, agribusinesses are leveraging 5G networks to streamline operations and maintain competitive advantage.

Emerging Trends

One emerging trend in 5G agriculture is the increasing use of drones and autonomous machinery connected via 5G networks for real-time crop monitoring and precision spraying. These tools provide farmers with detailed aerial views and instant insights, enabling better pest control and optimized chemical use.

Recent reports highlight that drone usage in farming is becoming mainstream, driven by 5G’s ability to transmit high-quality, high-frequency data, enhancing the accuracy and speed of interventions. Another significant trend is the adoption of private 5G networks on large farms to support dense IoT sensor deployments and data-heavy applications.

These private networks allow for faster, reliable communication across wide areas, integrating AI analytics for dynamic water management and supply chain tracking. This enables farms to efficiently manage irrigation cycles, reduce water consumption by up to 40%, and improve traceability from field to market, empowering sustainability and food safety.

Growth Factors

The growth of 5G in agriculture is fueled by the increasing global demand for precision farming, which relies heavily on timely data and analytics. Farmers are adopting 5G-enabled technologies that allow real-time monitoring of crops and livestock, which improve yield and reduce costs.

For instance, precision agriculture techniques have been shown to increase crop yields by up to 15% while lowering input costs by 10-15%, emphasizing the economic value of advanced connectivity and AI-driven insights. Government support and investment in 5G infrastructure also play a crucial role in market expansion.

Many agricultural agencies worldwide are funding initiatives that promote smart farming adoption by offering subsidies, knowledge programs, and incubators. This backing helps farmers overcome barriers to technology integration and drives wider use of 5G solutions that enable smarter resource management and sustainable agriculture practices.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Autonomous Tractors

- Drones

- Others

By Deployment Mode

- On-Premises

- Cloud

By Farm Size

- Small and Medium Farms

- Large Farms

By End-User

- Farmers

- Agribusinesses

- Research Institutes

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Enhanced Precision Farming through Real-Time Data

One of the main drivers for 5G adoption in agriculture is its ability to provide ultra-fast, reliable, and low-latency connectivity that enables real-time data collection and analysis. This connectivity supports the use of IoT devices, sensors, and drones that monitor crop health, soil conditions, and livestock status instantly.

Farmers can make quicker, more informed decisions about resource use like water, fertilizers, and pesticides, which enhances precision farming practices and boosts efficiency. Such real-time monitoring leads to optimized farm operations by reducing waste and increasing yield with less manual intervention.

For instance, 5G enables networked farm machinery to operate autonomously or semi-autonomously, controlled remotely, which is particularly valuable given current labor shortages. Overall, the increased connectivity and data accuracy fostered by 5G create a more productive and sustainable farming environment.

Restraint Analysis

High Infrastructure Costs and Rural Coverage Gaps

Despite its benefits, a significant restraint on 5G deployment in agriculture is the high cost of infrastructure development, especially in rural and remote farm areas. Establishing reliable 5G networks requires substantial investment in base stations, towers, and related hardware, which may be economically challenging for less populated agricultural regions where the return on investment is slower.

Additionally, many rural areas suffer from poor existing network coverage and face difficulties in upgrading to new 5G technology because of geographical and logistical constraints. Limited network availability limits the reach of 5G-enabled solutions, delaying adoption and benefits. This gap increases the digital divide between large commercial farms in well-connected zones and smallholder farmers in remote locations.

Opportunity Analysis

Government Support and Innovation Funding

The increasing focus of governments and industry stakeholders on modernizing agriculture presents a significant opportunity for the 5G market. Many countries are rolling out supportive initiatives, subsidies, and funding programs specifically aimed at expanding 5G infrastructure in rural areas and encouraging smart farming technology adoption.

This backing reduces financial barriers for farmers and agribusinesses to invest in connected agriculture tools. For example, programs to promote agritech incubators and knowledge partnerships are growing, helping innovators develop new 5G-based farming applications. As global food demand rises and sustainability becomes a priority, 5G-enabled precision agriculture stands poised for accelerated growth, supported by public and private sector collaboration.

Challenge Analysis

Technology Complexity and Farmer Adaptation

A key challenge facing 5G integration in agriculture is the complexity of new technologies and the learning curve for farmers, especially in developing regions. Farmers may lack the technical skills or digital literacy to operate advanced 5G-connected devices and agricultural management platforms effectively.

Moreover, expensive smartphones, sensors, and IoT devices required for 5G applications can deter adoption. This challenges widespread technology diffusion and limits the benefits to digitally savvy and wealthier farms. Overcoming this requires tailored training programs, accessible interfaces, and cost-effective solutions to ensure inclusive adoption across diverse agricultural communities.

Competitive Analysis

Huawei, Ericsson, and Nokia lead the 5G in Agriculture Market by delivering advanced connectivity solutions that enable precision farming, automation, and real-time monitoring. Their strong focus on rural 5G deployment and IoT integration helps farmers manage crops efficiently through data-driven insights. These companies are transforming traditional agriculture by connecting sensors, drones, and equipment for improved productivity and sustainability.

Cisco, Siemens, IBM, and Samsung strengthen the market with digital platforms and edge analytics that connect machinery, sensors, and cloud systems. Their technologies enhance resource efficiency and operational safety while supporting automation and predictive maintenance in farms. These players are focused on secure, scalable, and interoperable 5G systems tailored to agricultural environments.

Vodafone, AT&T, Verizon, and China Mobile are driving large-scale connectivity expansion for smart farming. Trimble and AGCO complement them with precision farming and connected equipment solutions. Their collaboration ensures reliable data exchange and real-time equipment control. Together, these firms create a strong ecosystem that accelerates digital transformation in agriculture through intelligent 5G-enabled operations.

Top Key Players in the Market

- Huawei Technologies Co., Ltd.

- Ericsson AB

- Nokia Corporation

- Cisco Systems, Inc.

- Siemens AG

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Trimble Inc.

- AGCO Corporation

- Telit Communications PLC

- Vodafone Group Plc

- AT&T Inc.

- Verizon Communications Inc.

- China Mobile Communications Corporation

- Others

Recent Developments

- January 2025, Siemens AG expanded its private 5G infrastructure solutions with enhanced coverage to support larger industrial areas, including agriculture. The solution supports up to 24 radio units covering about 5,000 m² each and is now available in multiple countries such as Germany, Sweden, and Brazil, aiming to support connected farming operations and automation.

- In 2025, Samsung Electronics maintained its global market lead in 5G with a notable focus on AI integration in devices that support IoT applications including agriculture. Their smartphone shipments grew, supporting the ecosystem for smart farming technology connectivity

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 53.6 Bn CAGR(2025-2034) 29.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application (Precision Farming, Livestock Monitoring, Smart Greenhouses, Autonomous Tractors, Drones, Others), By Deployment Mode (On-Premises, Cloud), By Farm Size (Small and Medium Farms, Large Farms), By End-User (Farmers, Agribusinesses, Research Institutes, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, Cisco Systems, Inc., Siemens AG, IBM Corporation, Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, Trimble Inc., AGCO Corporation, Telit Communications PLC, Vodafone Group Plc, AT&T Inc., Verizon Communications Inc., China Mobile Communications Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Huawei Technologies Co., Ltd.

- Ericsson AB

- Nokia Corporation

- Cisco Systems, Inc.

- Siemens AG

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Trimble Inc.

- AGCO Corporation

- Telit Communications PLC

- Vodafone Group Plc

- AT&T Inc.

- Verizon Communications Inc.

- China Mobile Communications Corporation

- Others