Global 3D Technical Textile Market Size, Share Analysis Report By Product Type (Woven, Knitted, Non-Woven), By Material (Polyester, Polyamide, Aramid, Composite, Others), By Application (Automotive, Aerospace, Medical, Construction, Sports, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174252

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

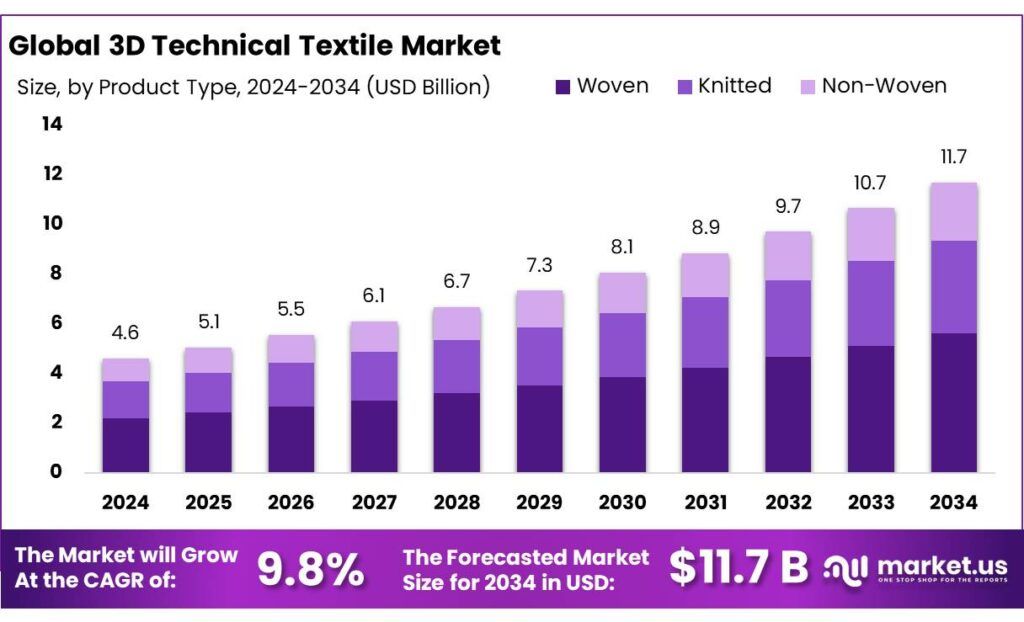

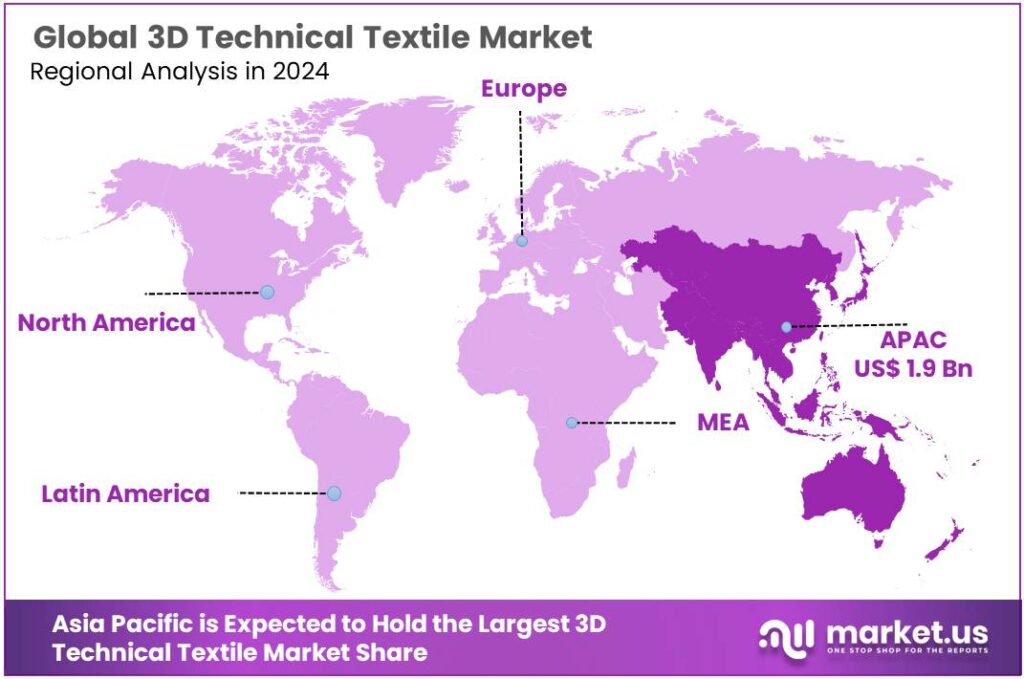

Global 3D Technical Textile Market size is expected to be worth around USD 11.7 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 42.7% share, holding USD 1.9 Billion in revenue.

3D technical textiles refer to engineered textile structures that create a true three-dimensional form (not just layered sheets). In practice, this includes 3D woven and knitted reinforcements, stitched multiaxials, spacer fabrics, and molded preforms designed to deliver strength, impact absorption, thermal control, filtration, and durability in demanding settings.

Key driving factors come from performance economic and risk management. 3D constructions reduce downstream operations by embedding functions directly into the textile, which can lower assembly complexity and improve consistency for automotive, construction, and industrial OEMs. Public innovation infrastructure reinforces this shift: the U.S. Department of Defense announced $75 million in federal funding as part of a broader $317 million public-private effort to accelerate revolutionary fibers and fabrics—signaling continued institutional demand for advanced, functional textiles and domestic manufacturing readiness.

- From a policy and investment standpoint, government initiatives are also pushing the ecosystem forward. In India, the Ministry of Textiles’ National Technical Textiles Mission carries an outlay of ₹1,480 crore through 2025–26, and the government has highlighted support for 168 research projects worth ₹509 crore, strengthening product development, testing capability, and commercialization pathways for technical textiles.

In Europe, Horizon Europe circular-economy calls have earmarked €120 million for circular solutions across material flows and value chains, while specific textile value-chain calls have been published with budgets such as €15 million to accelerate sorting, recycling, and design-for-recycling approaches that ultimately influence technical-textile inputs too.

- Government initiatives and policy environments are increasingly favorable toward technical textile production. For instance, India’s National Technical Textiles Mission (NTTM) was launched to position the country as a global leader by supporting R&D, capacity building, and product diversification in technical textiles. This initiative, along with production-linked incentives (PLI) that have stimulated investments worth ₹7,343 crore in the textile sector, highlights state-level commitments to strengthen domestic textile manufacturing and export competitiveness.

Food and hygiene supply chains are also a quiet but important pull. FAO-cited estimates indicate roughly 14% of food is lost between post-harvest and (excluding) retail stages, and FAO has also framed the value of these losses at around $400 billion—numbers that keep investment focused on better storage, handling, filtration, and protective solutions across agri-food systems.

Key Takeaways

- 3D Technical Textile Market size is expected to be worth around USD 11.7 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 9.8%.

- Woven held a dominant market position, capturing more than a 48.2% share.

- Polyester held a dominant market position, capturing more than a 39.9% share in the 3D Technical Textile Market.

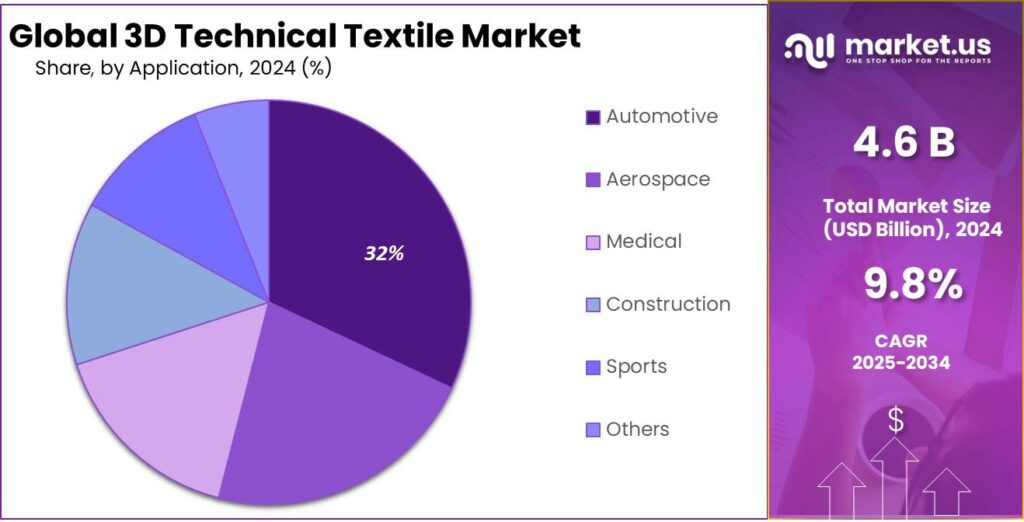

- Automotive held a dominant market position, capturing more than a 32.5% share in the 3D Technical Textile Market.

- Asia Pacific led the 3D Technical Textile Market, holding a dominant 42.7% share and reaching USD 1.9 Bn.

By Product Type Analysis

Woven dominates the 3D Technical Textile Market By Product Type with 48.2% share in 2024 due to reliable strength and process stability.

In 2024, Woven held a dominant market position, capturing more than a 48.2% share in the 3D Technical Textile Market by Product Type. This leadership is strongly linked to how woven structures deliver dependable mechanical performance, especially where load-bearing and long service life matter. Manufacturers also prefer woven formats because they are easier to control during production, giving more consistent thickness, strength, and overall fabric quality.

By Material Analysis

Polyester dominates the 3D Technical Textile Market By Material with 39.9% share in 2024 due to balanced cost and durability.

In 2024, Polyester held a dominant market position, capturing more than a 39.9% share in the 3D Technical Textile Market by Material. This strong position comes from polyester’s ability to deliver consistent strength, flexibility, and long-term performance across demanding applications. Producers favor polyester because it performs reliably under repeated stress while maintaining shape and structural integrity over time.

By Application Analysis

Automotive dominates the 3D Technical Textile Market By Application with 32.5% share in 2024 driven by structural performance needs.

In 2024, Automotive held a dominant market position, capturing more than a 32.5% share in the 3D Technical Textile Market by Application. This leadership reflects the growing use of 3D technical textiles in vehicle components where strength, weight control, and design flexibility are critical. Automotive manufacturers value these textiles for their ability to support complex shapes while maintaining durability under continuous mechanical stress.

Key Market Segments

By Product Type

- Woven

- Knitted

- Non-Woven

By Material

- Polyester

- Polyamide

- Aramid

- Composite

- Others

By Application

- Automotive

- Aerospace

- Medical

- Construction

- Sports

- Others

Emerging Trends

Traceability and circular-material rules are reshaping how 3D technical textiles are designed and sold

One clear “latest trend” in 2024–2025 is that 3D technical textiles are being pushed toward measurable traceability and circular material choices, not just performance. Buyers still want strength, airflow, cushioning, and durability—but they now ask, “What is it made of, where did it come from, and can it be recovered?” This shift is happening because large end users (mobility, building, industrial, and even professional wear) are trying to reduce waste and prove compliance in their supply chains, which forces technical textile suppliers to provide cleaner material data and clearer end-of-life options.

Europe is one of the biggest forces behind this change. The European Commission highlights that around 5 million tonnes of clothing are discarded each year in the EU (about 12 kg per person), and only about 1% of material in clothing is recycled into new clothing. Even though 3D technical textiles often sit “behind the scenes” (inside seats, panels, filters, insulation layers, and industrial components), the same circular pressure is spreading across textile categories because waste and recycling systems are increasingly being planned at the material level.

The fiber mix is also shifting, and the numbers show why traceability is becoming non-negotiable. Textile Exchange reports that polyester remained the most produced fiber globally, accounting for 57% of total fiber production, and virgin fossil-based synthetics increased from 67 million tonnes in 2022 to 75 million tonnes in 2023. In its 2025 report, Textile Exchange adds that recycled fibers were about 7.6% of global fiber production in 2024, and recycled polyester made from plastic bottles accounted for 6.9% of all fiber produced worldwide; it also notes that less than 1% of the global fiber market came from pre- and post-consumer recycled textiles.

Government initiatives are also steering the market toward “validated” technical textile production. In India, the Ministry of Textiles’ National Technical Textiles Mission (NTTM) has a budget of ₹1,480 crore through 2025–26 and has supported 168 research projects worth ₹509 crore. This kind of support matters because it helps build the testing, standards, and innovation pipeline that technical textiles need to meet stricter documentation and performance expectations at the same time.

Drivers

Auto electrification and stricter efficiency rules are pushing lightweight, high-performance 3D technical textiles

One of the biggest drivers for 3D technical textiles is the automotive industry’s steady shift toward lighter, more efficient vehicles. Carmakers are under real pressure to cut energy use and emissions, while still improving safety and comfort. That is exactly where 3D technical textiles fit: they can replace heavier materials in selected parts, add stiffness without adding bulk, and support complex shapes that are hard to achieve with traditional textiles. This is not just a design trend—production engineers like these materials because they help keep performance consistent across large volumes.

The scale of vehicle electrification makes this demand stronger. The International Energy Agency reported that global electric car sales topped 17 million in 2024, rising by more than 25% versus 2023. EVs are heavier due to battery packs, so manufacturers look for weight savings in seats, interior structures, underbody protection layers, acoustic/thermal insulation, and reinforcement zones. 3D textile structures help because they can combine multiple functions—support, cushioning, airflow, vibration damping, and protection—inside a single engineered layer. When OEMs can merge functions into fewer parts, they often reduce assembly steps and improve reliability.

Regulation adds another “push” factor. In the EU, fleet-wide CO₂ targets for cars are set at 93.6 g CO₂/km for 2025–2029 (with tighter targets later). In the United States, the Department of Transportation finalized fuel economy standards that raise fuel economy 2% per year for passenger cars and 2% per year for light trucks for model years 2027–2031. When automakers plan for these targets, they typically work on powertrains and software—but they also chase “hidden” efficiency gains through lightweighting and smart material choices. That’s where advanced textiles, including 3D constructions, get pulled into more component discussions.

Government programs are also supporting this shift by strengthening technical textile ecosystems and encouraging industrial adoption. India’s National Technical Textiles Mission (NTTM) is a clear example: the government has cited a budget outlay of ₹1,480 crore through 2025–26 and support for 168 research projects worth ₹509 crore. In parallel, India’s Production Linked Incentive (PLI) Scheme for Textiles was notified to promote production of MMF apparel/fabrics and products of technical textiles, with an approved outlay of ₹10,683 crore.

Restraints

High material and energy costs make 3D technical textiles harder to scale, especially for price-sensitive buyers

One major restraint for 3D technical textiles is the simple economics of making them. These textiles are not basic fabrics—they are engineered structures that often need specialized looms/knitting, precise layering, controlled bonding, and tighter quality checks. That complexity adds cost at every step: more machine time, more skilled labor, more process control, and more scrap risk when a run does not meet specs. For many buyers, the performance story is clear, but the price jump versus conventional textiles can still delay approvals—especially when procurement teams must justify “why this material” for every component.

Energy cost is a big part of that pressure, because technical textile manufacturing is electricity-heavy (spinning, weaving/knitting, thermal bonding, finishing, and converting). In Europe, Eurostat shows non-household electricity prices were €0.1885/kWh in the first half of 2024, then increased to €0.1941/kWh in the second half of 2024. For producers running large, continuous lines, even small moves in €/kWh can change unit economics quickly—making it harder to lock long-term pricing for OEM contracts. This is one reason some suppliers stay cautious on capacity expansion unless they have strong multi-year offtake commitments.

Raw-material pricing and availability also introduce uncertainty, because many 3D technical textiles rely on synthetic fibers and polymers. When upstream pricing moves, it is difficult to keep finished-goods prices stable—especially for structured 3D products where the value is “built in” through process steps. A useful indicator here is the Producer Price Index for synthetic fibers in the U.S.: the St. Louis Fed’s ALFRED listing shows Sep 2025: 163.694, with noticeable month-to-month movement such as Aug 2025: 157.628 and Jul 2025: 163.557. Even if a buyer understands that indices fluctuate, they still prefer predictable pricing—so volatility can slow adoption or push buyers toward simpler alternatives.

Governments are trying to reduce these barriers by strengthening ecosystems, but the transition takes time. For example, India’s National Technical Textiles Mission has a budget outlay of ₹1,480 crore through 2025–26 and has supported 168 research projects worth ₹509 crore—steps that can improve materials, testing, and commercialization over time. Still, in 2024 and into 2025, cost pressure from energy, inputs, and qualification requirements remains a real restraint—because many end users want the performance benefits, but they also need a clear, stable business case to switch.

Opportunity

AI data centers and clean-energy infrastructure are opening a new demand lane for 3D technical textiles

A major growth opportunity for 3D technical textiles is coming from the fast build-out of data centers, AI computing, and the wider “electrification” ecosystem that supports them. As AI workloads rise, operators are packing more compute power into smaller spaces, which creates heat, vibration, and airflow challenges. 3D spacer fabrics and other engineered textile structures can help here because they are light, breathable, and can be designed to manage air gaps, cushioning, and stable thickness—useful for airflow management panels, protective layers, cable management, and vibration-damping components around sensitive hardware.

The energy numbers show why this is becoming a serious market lane. The IEA notes that global data centres consumed about 460 TWh of electricity in 2022 and could reach more than 1,000 TWh by 2026. Even where exact measurement is still improving, the trend is clear: the EU Commission’s energy site references an IEA estimate that EU data centres used around 70 TWh in 2024, with expectations rising toward 115 TWh by 2030. As operators chase better efficiency and reliability, there is growing interest in materials that can do multiple jobs at once—thermal spacing, acoustic control, abrasion resistance, and safer handling—without adding unnecessary weight or complicated assemblies.

Government policy is also strengthening the supply side for technical textiles, which makes scaling these new opportunities more realistic. In India, the Production Linked Incentive (PLI) Scheme for Textiles was notified with an approved outlay of ₹10,683 crore to promote MMF apparel/fabrics and products of technical textiles—and the government has continued approving applicants under the scheme. Support like this matters because a data-center customer or an electronics OEM typically wants stable supply, consistent quality, and local conversion capability—not just a promising material sample.

In practical terms, the growth opportunity is not limited to one end use. AI infrastructure needs filtration and protection, cable and hose management, cushioning and vibration control, and lightweight structural spacing. The more the world builds power-hungry digital infrastructure, the more demand shifts toward engineered materials that improve performance without adding bulk. For 3D technical textile suppliers, 2024 and 2025 are a window to co-develop application-specific products with data-center equipment makers and integrators—because once a material is qualified into a design, it tends to stay there for many years.

Regional Insights

Asia Pacific dominates the 3D Technical Textile Market with a 42.7% share, valued at USD 1.9 Bn in 2024.

In 2024, Asia Pacific led the 3D Technical Textile Market, holding a dominant 42.7% share and reaching USD 1.9 Bn. This region benefits from a deep manufacturing base where textiles, converting, and downstream component making sit close to each other, helping faster sampling and scale-up. Trade strength supports this advantage: China exported about $271B in textiles in 2023, showing how large and export-ready the regional supply ecosystem is.

Automotive demand also supports technical textile uptake because 3D structures are used where strength, cushioning, and weight control matter. In 2024, Asia-Oceania produced about 54,907,849 motor vehicles, including China at 31,281,592 and India at 6,014,691, keeping a strong pull for advanced textile materials used in interiors, reinforcement layers, and functional components.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DuPont — In 2024, DuPont delivered net sales of $12.4 billion and had approximately 24,000 employees worldwide (as of Dec 31, 2024). In 3D technical textiles, DuPont is closely linked to high-performance fibers and polymers that improve thermal resistance, cut weight, and raise durability—especially where certifications and long service life drive procurement decisions.

Royal Ten Cate — TenCate’s technical-textile heritage is long-running, with key milestones including 1836 (first official document) and the “Royal” designation in 1930. Within its separated businesses, TenCate Protective Fabrics reported > $225M sales, >700 employees, and >1,000 active customers (global key figures for 2020). This footprint supports defense, industrial, and mobility textile specifications.

Freudenberg Performance Materials — In the 2024 financial year, Freudenberg Performance Materials generated sales of >€1.4 billion, supported by about 5,500 employees. Its operating reach spans 15 countries with 36 production sites, which helps it supply consistent nonwovens and technical textiles at scale. These capabilities fit 3D structures used in filtration, mobility, building, and industrial components.

Top Key Players Outlook

- Berry Global

- DuPont

- Royal Ten Cate

- Freudenberg Performance Materials

- Kimberly-Clark Corporation

- Huntsman Corporation

- Asahi Kasei Corporation

- Toray Industries

- Milliken & Company

- Mitsui Chemicals

Recent Industry Developments

In 2024, Berry Global’s reported $12.3B in net sales, $937M in operating income, and $2,045M in operating EBITDA, supported by about 42,000 employees—showing the scale behind its materials supply and converting capability.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Bn Forecast Revenue (2034) USD 11.7 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Woven, Knitted, Non-Woven), By Material (Polyester, Polyamide, Aramid, Composite, Others), By Application (Automotive, Aerospace, Medical, Construction, Sports, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Berry Global, DuPont, Royal Ten Cate, Freudenberg Performance Materials, Kimberly-Clark Corporation, Huntsman Corporation, Asahi Kasei Corporation, Toray Industries, Milliken & Company, Mitsui Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Technical Textile MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

3D Technical Textile MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Berry Global

- DuPont

- Royal Ten Cate

- Freudenberg Performance Materials

- Kimberly-Clark Corporation

- Huntsman Corporation

- Asahi Kasei Corporation

- Toray Industries

- Milliken & Company

- Mitsui Chemicals