Global 3D Secure Payment Authentication Market Size, Share, Industry Analysis Report By Component (Solutions/Software, Services), By End-User (Merchants & E-commerce Platforms, Banks & Financial Institutions (Issuers), Payment Gateways & Acquirers), By Application (E-commerce Merchants, Mobile Commerce (In-App & Mobile Browser), Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162249

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption and Performance

- Analyst Viewpoint

- Investment and Business Benefits

- Role of Generative AI

- U.S. Market Size

- Emerging Trends

- Growth Factors

- Component Analysis

- End-User Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

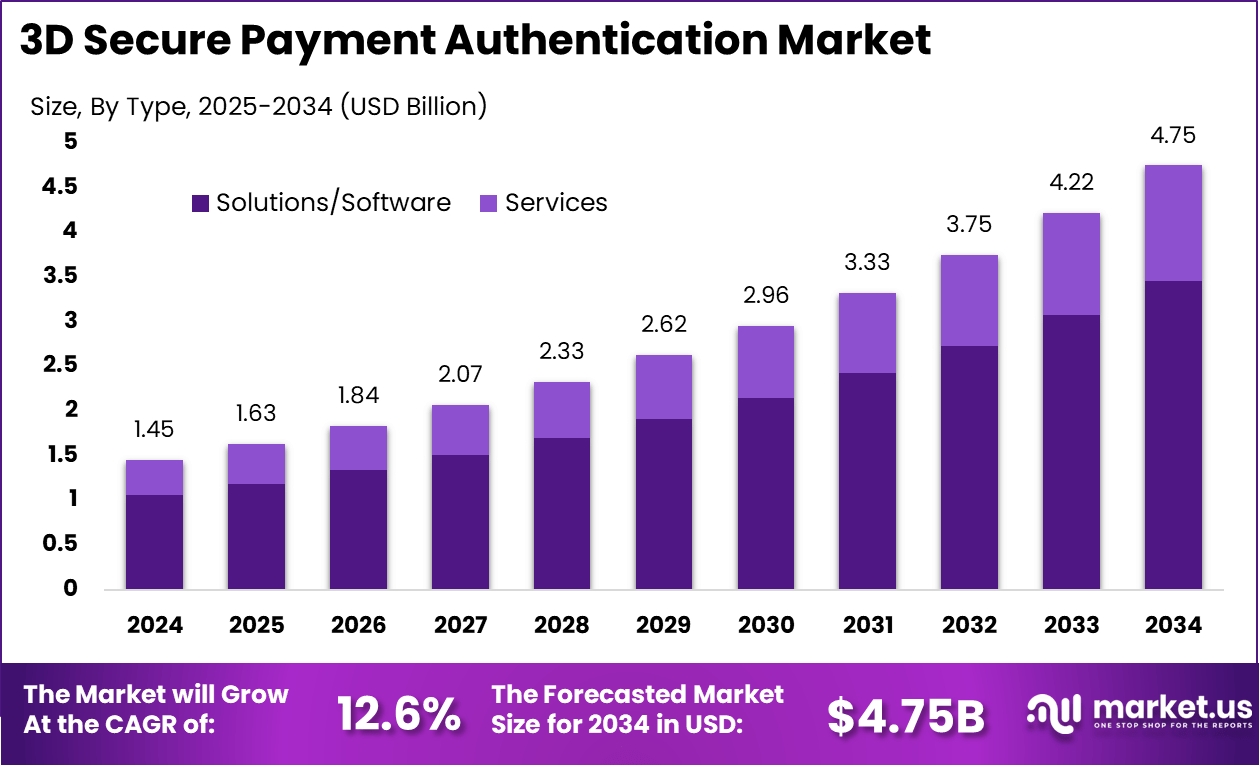

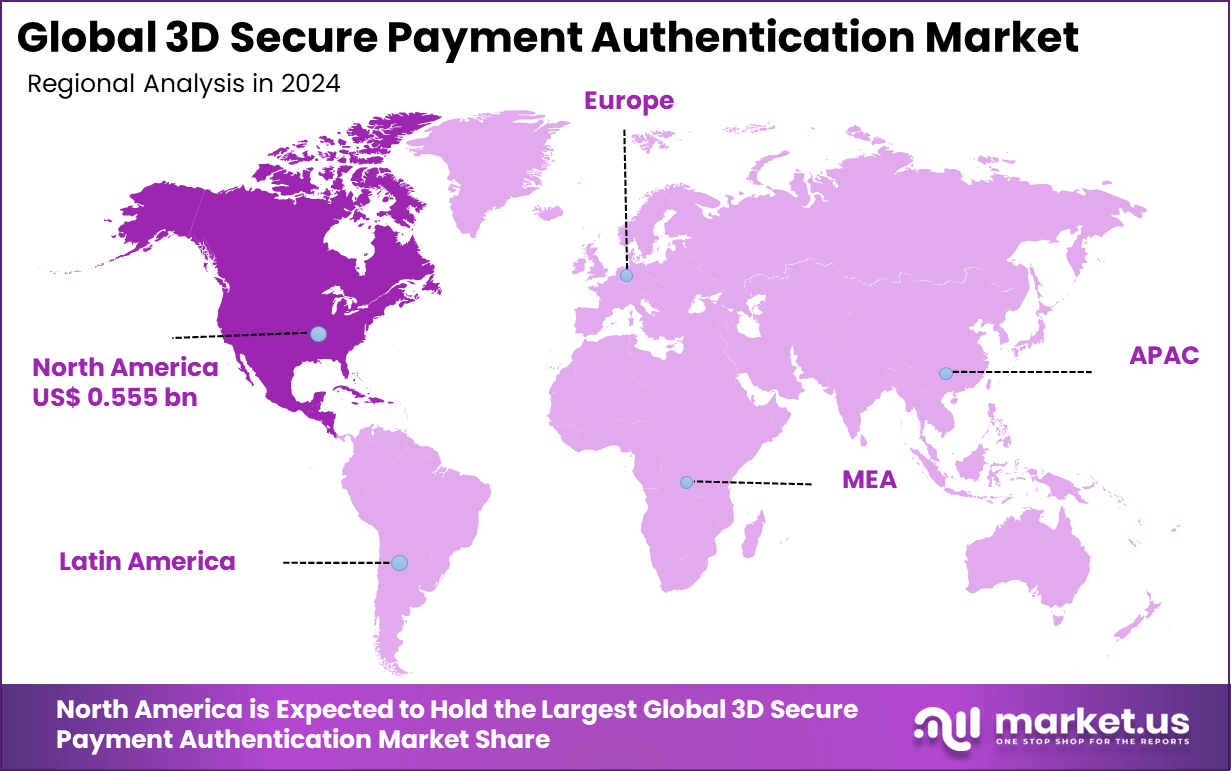

The Global 3D Secure Payment Authentication Market size is expected to be worth around USD 4.75 billion by 2034, from USD 1.45 billion in 2024, growing at a CAGR of 12.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.3% share, holding USD 0.5 billion in revenue.

The 3D Secure Payment Authentication market focuses on securing online transactions through an extra verification layer that confirms a cardholder’s identity before payment approval. This reduces fraud by ensuring that only legitimate users complete online purchases. The system, structured around versions like 3D Secure 1.0 and 2.0, has become an integral part of global e-commerce infrastructure.

The increasing threat of online fraud is a key driver of this market. Over 70% of global merchants reported a rise in attempted fraud during 2024, pushing adoption of advanced authentication systems like 3D Secure. The second major driver is regulatory pressure, particularly from frameworks like the European Union’s PSD2, which enforces strong customer authentication.

The rapid increase in mobile commerce, which grew by 30% year-on-year, also fuels the need for safer mobile payment experiences. These factors collectively strengthen market interest in reliable, consumer-friendly authentication systems. Technological evolution has transformed 3D Secure from a basic password check into a dynamic, intelligence-based verification process.

For instance, in April 2025, RSA Security LLC released adaptive authentication upgrades with cloud-based services to support 3D Secure 2.0 protocols. These enhance risk-based authentication across multiple channels, including mobile, web, and IoT, effectively reducing fraudulent transactions while enabling smoother user experiences.

Key Takeaway

- The Solutions/Software segment led the market with 72.8%, reflecting growing demand for advanced digital authentication and fraud prevention tools.

- Banks and Financial Institutions (Issuers) captured 46.3%, highlighting their central role in implementing secure online transaction frameworks.

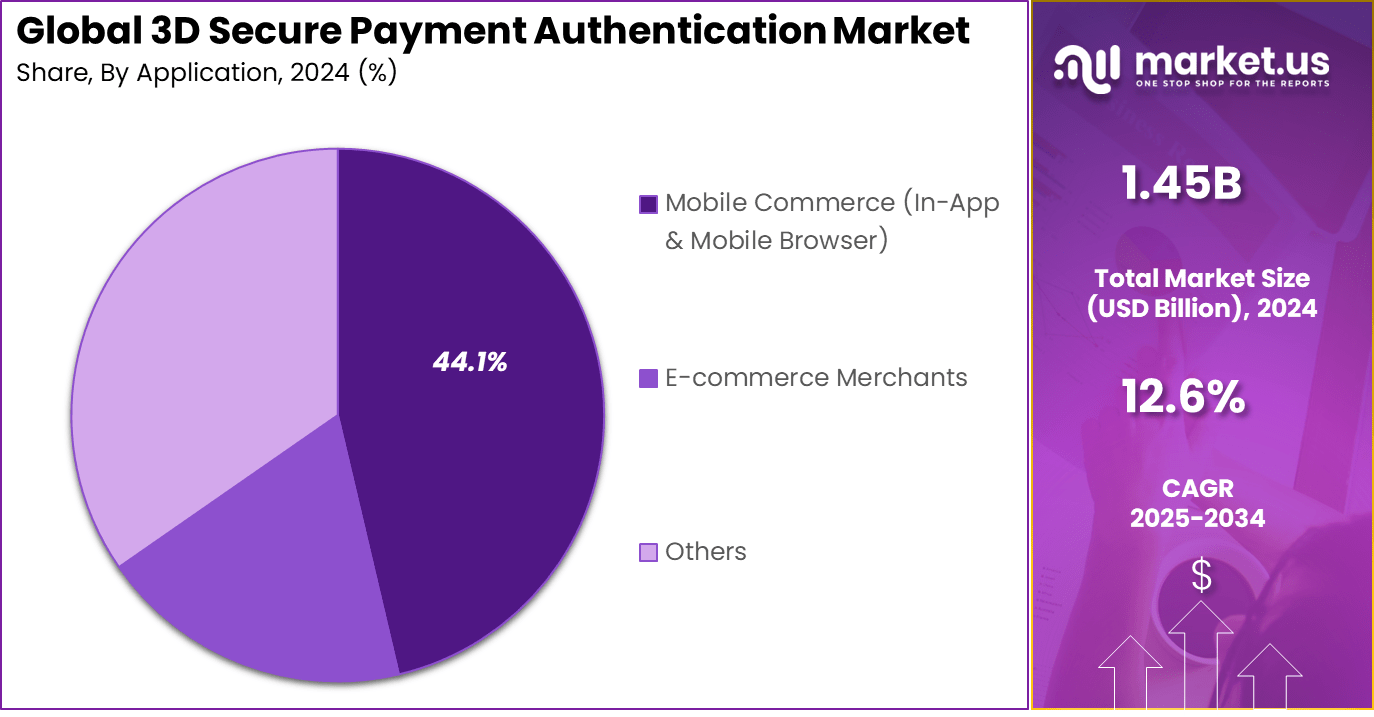

- Mobile Commerce, including in-app and mobile browser transactions, held 44.1%, driven by the rapid growth of mobile payments and digital wallets.

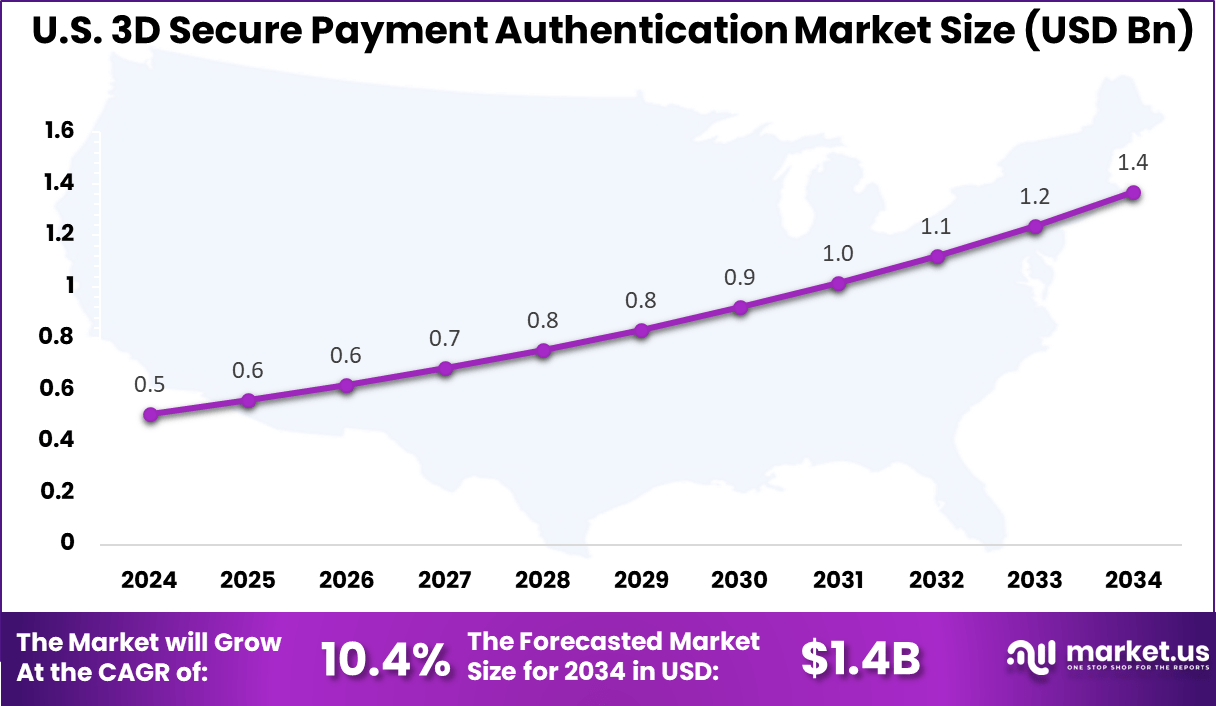

- The US market was valued at USD 0.50 Billion in 2024, recording a steady 10.4% CAGR, supported by stronger cybersecurity regulations and widespread e-commerce activity.

- North America dominated globally with 38.3% share, underpinned by early adoption of secure payment infrastructure and strong financial sector compliance standards.

Adoption and Performance

- Friction and Acceptance: Payment authentication remains a challenge in many regions. Nearly 91% of payments experience friction, often taking more than five seconds to authenticate. Adoption of 3D Secure 2 (3DS2) has helped improve the experience by enabling a “frictionless” flow for low-risk transactions, allowing them to bypass additional authentication steps.

- Success Rates: Performance varies widely by geography. In the United States, the success rate for 3DS challenges is reported at only 41%, while the United Kingdom demonstrates significantly higher efficiency with a 93% success rate. This disparity highlights differences in implementation, consumer readiness, and infrastructure maturity across markets.

- Driver for Adoption: Fraud prevention remains the most important factor driving adoption. About 75% of merchants identify fraud protection as their primary motivation for using authentication systems like 3DS. This focus reflects both regulatory requirements and consumer trust considerations.

- Future Adoption: The outlook for adoption is strong, with 75% of merchants expecting to increase authentication efforts in the future. This indicates that businesses see secure payment flows as a long-term priority, balancing user experience with risk management.

Analyst Viewpoint

The demand for 3D Secure technology has grown significantly with the rapid expansion of e-commerce and digital banking worldwide. As smartphone use and internet access rise, consumers increasingly seek safer payment options. With advances like biometric authentication, device fingerprinting, and AI-driven risk models, payments have become more secure and convenient.

According to the Federal Trade Commission, consumer losses from fraud increased by 14% in 2023, reinforcing the need for robust security layers like 3D Secure in online payments. There is a strong trend toward adopting AI-powered 3D Secure 2.0 technologies.

Merchants prefer these advanced protocols because they reduce friction during checkout, which lowers cart abandonment rates. These systems use biometric verification and machine learning to improve user validation accuracy. Importantly, after successful authentication via 3D Secure, liability for fraudulent transactions shifts from merchants to card issuers, encouraging widespread compliance.

Investment and Business Benefits

Investment opportunities are active in developing enhanced authentication algorithms and cloud-based payment security platforms. Financial institutions are investing in systems that analyze over 100 data points per transaction to dynamically assess risk.

Additionally, startups focusing on behavioral biometrics and machine learning techniques for fraud prevention are attracting considerable venture capital funding. These technologies support safer payment ecosystems, especially in emerging markets.

Businesses adopting 3D Secure authentication report multiple benefits, including fewer fraud losses and reduced chargeback costs. Implementation of 3D Secure 2.0 has been associated with a 20% decrease in fraudulent transaction rates in practical settings. Enhanced security builds consumer trust, increasing conversion rates and encouraging repeat business.

Role of Generative AI

Generative AI is becoming a strong force in modern payment security, especially for 3D Secure authentication systems. It helps detect fraud in real time by simulating synthetic fraud patterns and learning from millions of transactions. Studies show that generative AI models increase fraud detection accuracy by over 35%, while reducing false-positive cases by almost 22%, which enhances customer trust and transaction approval rates.

By analyzing behavioral data, generative AI allows continuous authentication based on user patterns instead of static passwords, leading to smoother experiences and safer digital payments. The use of large-scale data from card networks and merchant platforms helps AI predict new fraud tactics before they appear in real life.

Around 70% of major financial institutions have already deployed AI-based verification frameworks that support the 3D Secure 2.0 environment, showing a steady shift towards AI-native payment ecosystems. Generative AI has also made it possible to simulate cross-border payment threats, improving compliance accuracy by nearly 30% while lowering transaction latency.

U.S. Market Size

The market for 3D Secure Payment Authentication within the U.S. is growing tremendously and is currently valued at USD 0.508 billion, the market has a projected CAGR of 10.4%. The market is growing due to the rising volume of card-not-present transactions, fueled by expanding e-commerce and mobile shopping activities. Consumers increasingly demand secure payment experiences, pushing issuers and merchants to adopt advanced authentication solutions.

Furthermore, the regulatory requirements on payment security and fraud mitigation compel banks and financial service providers to enhance their 3D Secure capabilities. This results in accelerated technology upgrades and the rollout of frictionless authentication methods to balance security with user convenience in the U.S. market.

For instance, in April 2025, RSA Security announced major updates to its adaptive authentication platform, enhancing support for 3D Secure 2.0 protocols with improved fraud detection and risk-based authentication capabilities. These updates bolster transaction security while maintaining seamless user experiences, reinforcing RSA’s position as a leader in 3D Secure solutions in the U.S. market.

In 2024, North America held a dominant market position in the Global 3D Secure Payment Authentication Market, capturing more than a 38.3% share, holding USD 0.55 billion in revenue. This dominance is due to the region’s mature e-commerce landscape, high smartphone penetration, and stringent regulatory environment enforcing secure payment authentication standards.

Banks and financial institutions in the region are early adopters of innovative authentication technologies, facilitating safer digital transactions. The availability of advanced infrastructure and strong consumer awareness of online payment risks also contribute to North America’s leadership in this sector.

For instance, In June 2025, Worldpay expanded its partnership with Visa to strengthen 3D Secure payment authentication in North America, aiming to improve transaction security and reduce checkout friction for consumers.

Emerging Trends

Emerging trends in 3D Secure authentication show how security and convenience are evolving together. The transition to EMV 3DS2 has improved mobile payment compatibility, cutting checkout friction by nearly 40% as more online retailers move toward frictionless flows supported by machine learning-based risk scoring.

In Asia-Pacific, governments are enforcing strong customer authentication, leading to rapid adoption. Japan’s plan for 100% authentication on online payments by 2025 has accelerated the shift towards AI-driven verification.

The push toward biometric and token-based verification is another major trend. Roughly 68% of 3DS transactions are now verified through biometric methods like facial or fingerprint recognition, compared to just 25% five years ago. This helps reduce fraud while improving user convenience, reflecting a clear shift from manual code entry toward seamless authentication based on biometrics and risk data.

Growth Factors

The main growth factors for 3D Secure authentication relate to rising e-commerce volumes and increased cyber fraud. Online fraud cases rose by about 20% in 2024, prompting greater merchant investment in risk-based systems. Systems using 3D Secure protocols have shown to reduce card-not-present fraud by nearly 60%, which is driving faster adoption among banks and merchants that deal with high transaction volumes.

Mobile commerce and digital wallets also act as crucial growth enablers. Transactions from mobile apps now make up nearly 55% of global online payments, and 3D Secure 2.0’s mobile-first architecture helps ensure these are verified securely. Frictionless authentication, cloud deployment, and instant risk analysis together add layers of security that protect both consumers and merchants.

Component Analysis

In 2024, The Solutions/Software segment held a dominant market position, capturing a 72.8% share of the Global 3D Secure Payment Authentication Market. These solutions play a critical role in providing secure transaction verification mechanisms, such as biometric verification, one-time passwords, and risk-based authentication.

The software components help banks and merchants comply with strict regulatory standards while enhancing the security of online payments. Increasing sophistication in the software used for transaction authentication supports smoother customer experiences while effectively reducing fraud occurrences in digital payments. Its ability to adapt to emerging threats and streamline compliance makes it a preferred choice in the 3D Secure Payment Authentication ecosystem.

For Instance, in February 2022, GPayments Pty Ltd. launched its enhanced 3D Secure 2 solutions designed specifically for payment service providers. These solutions focus on improving security and reducing fraud in online payments by enabling robust authentication protocols that integrate smoothly with existing payment gateways.

End-User Analysis

In 2024, the Banks & Financial Institutions (Issuers) segment held a dominant market position, capturing a 46.3% share of the Global 3D Secure Payment Authentication Market. As the frontline defenders of cardholder security, these institutions integrate 3D Secure authentication to verify transactions and prevent fraudulent activities. This is particularly critical as digital payments grow in volume and complexity, requiring stronger authentication to meet regulatory demands and safeguard customer assets.

Their investment in these technologies helps comply with global security mandates and also strengthens consumer confidence in digital banking. As more transactions happen through online channels, banks are increasingly used as gatekeepers safeguarding the payment ecosystem, leading to sustained demand for sophisticated 3D Secure solutions within this user segment.

For instance, in October 2025, Mastercard Incorporated implemented advanced 3D Secure authentication features that leverage risk-based and frictionless authentication to maximize security for banks and financial institutions while maintaining seamless user experiences during transactions.

Application Analysis

In 2024, The Mobile Commerce (In-App & Mobile Browser) segment held a dominant market position, capturing a 44.1% share of the Global 3D Secure Payment Authentication Market. With the rise in smartphone usage and mobile apps for shopping, secure mobile transactions have become essential. The authentication solutions enable secure payment authorization within apps and mobile browsers, giving consumers confidence when making purchases on the go.

This growth is rising due to the increasing preference for mobile payments and the need to safeguard these transactions against fraud. Mobile commerce platforms benefit from these authentication protocols as they enable seamless yet secure payment flows, reducing friction during checkout while ensuring compliance with security standards.

For Instance, in December 2024, Visa Inc.’s Visa Secure program expanded its use of EMV 3-D Secure technology in mobile commerce, especially for in-app and mobile browser purchases. This program focuses on preventing fraud with minimal checkout friction by enabling authentication in the background for low-risk users.

Key Market Segments

By Component

- Solutions/Software

- 3DS Server Software

- Access Control Servers (ACS)

- Others

- Services

- Integration & Deployment Services

- Support & Maintenance

- Managed Services

By End-User

- Merchants & E-commerce Platforms

- Banks & Financial Institutions (Issuers)

- Payment Gateways & Acquirers

By Application

- E-commerce Merchants

- Mobile Commerce (In-App & Mobile Browser)

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Online Transactions Demand Enhanced Security

The rise in e-commerce and online payment volumes drives the demand for 3D Secure payment authentication. As more consumers prefer digital purchases, the risk of fraud in card-not-present transactions increases. Merchants and banks adopt 3DS to ensure that the cardholder’s identity is verified before payment approval, thus reducing fraudulent charges and enhancing trust in online payments. This security layer has become increasingly essential to safeguard both buyers and sellers in the digital marketplace.

Moreover, regulatory requirements like PSD2 enforce strong customer authentication, making 3D Secure a necessity rather than an option. The growing penetration of smartphones and remote shopping accelerates the use of 3DS, which proves to be effective in minimizing fraud and chargeback costs. The continuous shift to digital payments is a fundamental growth engine for the 3D Secure market.

For instance, in June 2025, Mastercard Incorporated enhanced its 3D Secure technology to support an increased volume of online transactions through improved authentication protocols. This update directly responded to rising e-commerce demand and regulatory requirements, helping reduce fraud and build consumer trust in digital payments worldwide.

Restraint

User Friction and Authentication Failures

One significant restraint for widespread adoption of 3D Secure is the added step in the checkout process, which can cause user friction and transaction drop-offs. Customers may find the additional authentication, such as entering an OTP or biometric verification, inconvenient or confusing. This extra step in payment can lead to frustration, resulting in abandoned shopping carts and lost sales for merchants.

Additionally, authentication failures due to incorrect data entry, expired OTPs, or technical issues can block legitimate payments. Older cards or those not enrolled in 3DS also face problems completing transactions. These usability and technical challenges limit seamless customer experience and act as a barrier for merchants who fear losing customers to simpler competing platforms.

For instance, in August 2025, Stripe reported challenges related to payment abandonment due to 3D Secure authentication frictions during checkout on multiple merchant platforms. Users faced inconvenience while completing extra authentication steps, which caused a notable increase in dropped transactions, highlighting the user friction issue inherent in 3DS systems.

Opportunities

Enhanced 3D Secure 2.0 With Risk-Based Authentication

The upgraded 3D Secure 2.0 protocol presents a major growth opportunity by offering frictionless authentication. It allows for risk-based approvals where low-risk transactions bypass additional verification, improving customer experience without compromising security. Features such as biometric authentication, mobile app confirmations, and adaptive security improve acceptance rates and reduce cart abandonment.

Emerging markets and growing digital adoption among small and medium-sized enterprises (SMEs) also open avenues for broader deployment of 3DS solutions. Innovations like AI-driven risk scoring and behavioral biometrics further enhance fraud detection and operational efficiency. With global e-commerce expanding, 3DS 2.0 stands as a key enabler for secure, smooth online payments.

For instance, in March 2025, Entrust Corporation launched support for 3D Secure 2.0 with risk-based authentication capabilities, enabling risk scoring and biometric options that significantly reduced authentication interruptions. This innovation created opportunities for merchants to maintain security while offering smoother checkout flows.

Challenges

Integration and Compatibility Issues

Despite its benefits, integrating 3D Secure across multiple payment platforms and ensuring compatibility with diverse card issuers remains a challenge. Not all cards, issuers, or merchants support the latest 3DS standards, causing inconsistent user experiences. Older devices or browsers might not support 3DS 2.0, resulting in failed authentications and payment declines.

Moreover, frequent updates in regulatory requirements demand continuous compliance adjustments, which increase operational complexity for businesses. Payment solution providers must navigate these technical and regulatory hurdles while maintaining seamless transaction flow, which requires significant investment in infrastructure and expertise.

For instance, in October 2025, Thales Group reported operational burdens related to frequent regulatory changes requiring rapid updates to its authentication infrastructure. These challenges highlight the ongoing difficulty in ensuring smooth integration and compliance for a broad range of merchants and issuers.

Key Players Analysis

The 3D Secure Payment Authentication Market is dominated by global payment networks and financial technology leaders such as Visa Inc., Mastercard Incorporated, American Express Company, and JCB Co., Ltd. These organizations provide the foundational authentication frameworks that secure online transactions through multi-factor verification and fraud prevention. Their 3D Secure 2.0 protocols enhance user experience while maintaining high levels of payment security and regulatory compliance.

Cybersecurity and authentication technology providers including Thales Group, Entrust Corporation, RSA Security LLC, and SISA Information Security play a vital role in strengthening transaction integrity. Their platforms integrate encryption, biometric authentication, and real-time fraud detection capabilities, enabling banks and merchants to mitigate risks associated with card-not-present (CNP) transactions.

Specialized solution providers such as GPayments Pty Ltd., Modirum, Netcetera, Bluefin Payment Systems LLC, DECTA Limited, Stripe, Fiserv, Inc., Marqeta, Inc., and Entersekt, along with other participants, deliver end-to-end authentication services tailored for acquirers, issuers, and payment gateways. Their focus on API-based integration, mobile optimization, and regulatory readiness continues to drive adoption across global e-commerce and digital payment ecosystems.

Top Key Players in the Market

- GPayments Pty Ltd.

- Broadcom Inc.

- Mastercard Incorporated

- RSA Security LLC

- Modirum

- Visa Inc.

- Bluefin Payment Systems LLC

- DECTA Limited

- American Express Company

- JCB Co., Ltd

- American Express

- Thales Group

- Entrust Corporation

- Netcetera

- SISA Information Security

- Stripe

- Fiserv, Inc.

- Marqeta, Inc.

- Entersekt

- Others

Recent Developments

- In March 2025, GPayments unveiled its next-generation Access Control Server (ACS) solution, ActiveAccess 2.0. This new platform redefines 3D Secure authentication by enhancing fraud prevention capabilities while enabling smoother user verification processes, positioning GPayments as a leader in digital payment security.

- In July 2025, Visa continued strengthening its EMV 3D Secure program, focusing on real-time information sharing to prevent fraud while minimizing transaction disruptions. The program supports compliance with Europe’s PSD2 Strong Customer Authentication (SCA) guidelines and enables smoother user experiences globally.

Report Scope

Report Features Description Market Value (2024) USD 1.45 Bn Forecast Revenue (2034) USD 4.75 Bn CAGR(2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions/Software, Services), By End-User (Merchants & E-commerce Platforms, Banks & Financial Institutions (Issuers), Payment Gateways & Acquirers), By Application (E-commerce Merchants, Mobile Commerce (In-App & Mobile Browser), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GPayments Pty Ltd., Broadcom Inc., Mastercard Incorporated, RSA Security LLC, Modirum, Visa Inc., Bluefin Payment Systems LLC, DECTA Limited, American Express Company, JCB Co., Ltd, American Express, Thales Group, Entrust Corporation, Netcetera, SISA Information Security, Stripe, Fiserv, Inc., Marqeta, Inc., Entersekt, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Secure Payment Authentication MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

3D Secure Payment Authentication MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GPayments Pty Ltd.

- Broadcom Inc.

- Mastercard Incorporated

- RSA Security LLC

- Modirum

- Visa Inc.

- Bluefin Payment Systems LLC

- DECTA Limited

- American Express Company

- JCB Co., Ltd

- American Express

- Thales Group

- Entrust Corporation

- Netcetera

- SISA Information Security

- Stripe

- Fiserv, Inc.

- Marqeta, Inc.

- Entersekt

- Others