Global 3D Projector Market By Technology Type (DLP, LCD, and LCoS), By Brightness (Less Than 2,000 Lumens, 2,000 to 3,999 Lumens, 4,000 to 9,999 Lumens, and 10,000 & Above Lumens), By Light Source (Laser, LED, Lamps and Other Light Sources), By Application (Movies & Cinema, Education, Corporate, Events and Large Venues, Home Theater and Gaming,), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec. 2023

- Report ID: 40172

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

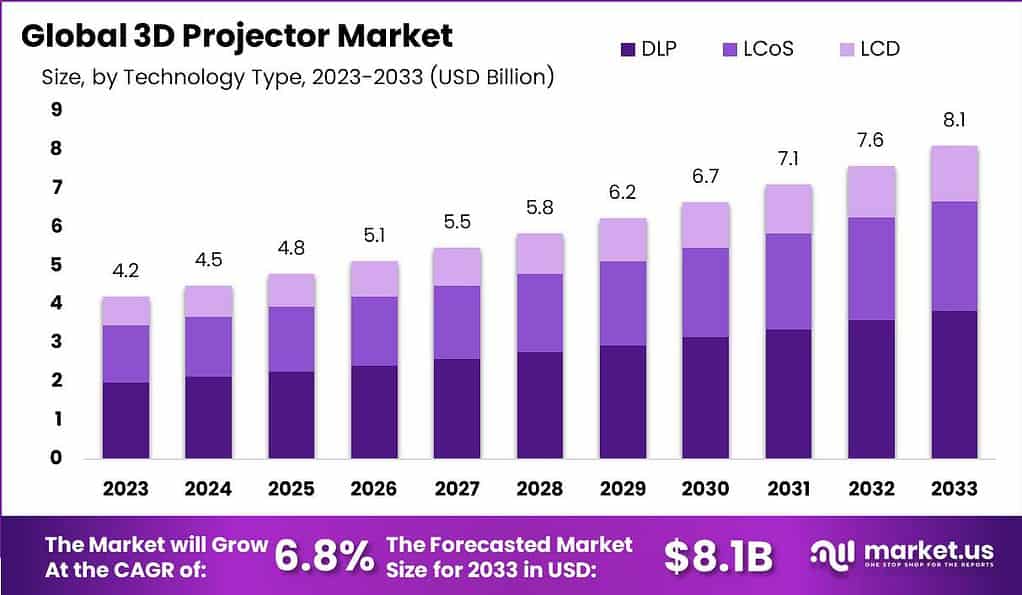

The global 3D Projector market is expected to expand at a 6.8% CAGR during the forecast period. The 3D Projector industry is anticipated to be worth USD 4.2 Billion in 2023 and exceed USD 8.1 Billion by 2033.

A 3D projector is a device used to display three-dimensional stereoscopic images that appear to have depth for more immersive viewing. Unlike standard projectors which project regular flat images, a 3D projector works by rapidly presenting a sequence of left and right images separately to each eye which are then merged by the viewer’s brain to create the illusion of depth and space – hence needing corresponding 3D glasses to use them effectively.

The 3D projector market refers to the industry focused on the research, development, manufacture, marketing and application of these emerging 3D projection systems and related technologies for both personal entertainment as well as professional use cases across sectors like media & entertainment, education, engineering design etc.

Note: Actual Numbers Might Vary In Final Report

As both projection and 3D capture technology steadily advances to reduce visual fatigue along with production of wide range of affordable 3D content, industry analysts expect strong long term growth potential for the global 3D projector market addressing the rising consumer & enterprise demand for enhanced immersive viewing experiences coupled with decreasing costs of solutions.

Key Takeaways

- Market Size and Growth: The anticipated trajectory for the 3D Projector Market predicts a reach of around USD 8.1 billion by 2033, accompanied by a Compound Annual Growth Rate (CAGR) of 6.8% throughout the forecast period.

- What is a 3D Projector?: A 3D projector is a device designed for showcasing three-dimensional stereoscopic images, creating the illusion of depth and space. Effective utilization of such projectors typically necessitates the use of special 3D glasses.

- Technology Types: In 2023, DLP (Digital Light Processing) technology dominated the market with over 47.3% market share due to its sharp image rendering and energy efficiency. LCD and LCoS technologies also played significant roles.

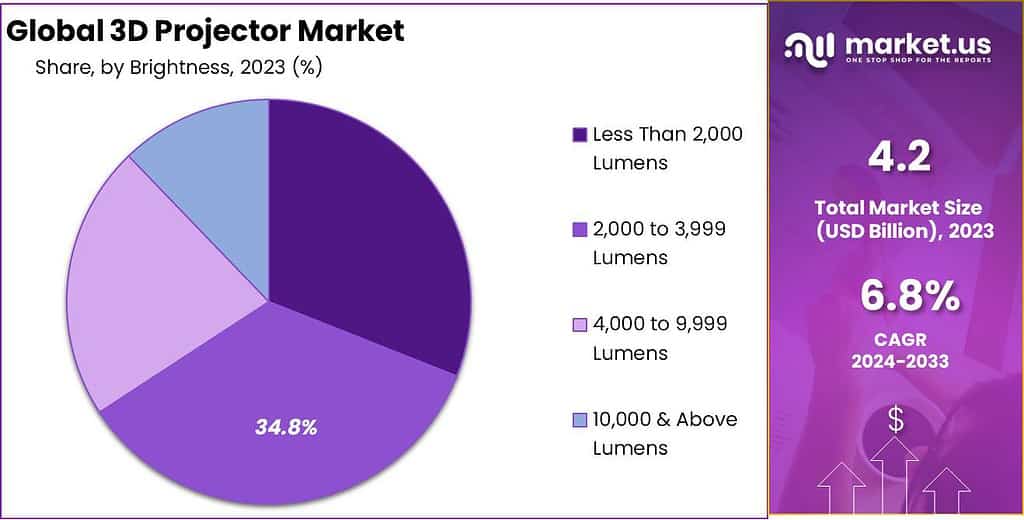

- Brightness Segmentation: Projectors were categorized based on brightness levels, with the 2,000 to 3,999 Lumens category being the most popular (34.8% market share), suitable for educational and small to medium-sized conference rooms.

- Light Sources: Lamps were the dominant light source (36.9% market share) due to their reliability and cost-effectiveness, but laser projectors gained ground for their brightness and extended lifespan.

- Applications: The Movies & Cinema segment led with 27.1% market share, followed by Education, Corporate, and Events and Large Venues. Home Theater and Gaming showed growth potential.

- Driving Factors: Factors driving market growth include the rising demand for immersive entertainment, advancements in projection technologies, expanding educational applications, and corporate adoption for presentations.

- Restraining Factors: High initial costs, maintenance expenses, competition from flat panel displays, and limited 3D content availability are some of the challenges facing the market.

- Growth Opportunities: Rapid technological advancements, emerging markets in developing countries, hybrid projection solutions, and customized solutions for specific industries present growth opportunities.

- Challenges: Challenges include the lack of a comprehensive 3D content ecosystem, environmental concerns related to projector disposal, market competition, and technological adaptation.

- Key Market Trends: Trends include wireless connectivity integration, short-throw projectors for smaller spaces, augmented reality (AR) projection, and smart projectors with built-in operating systems.

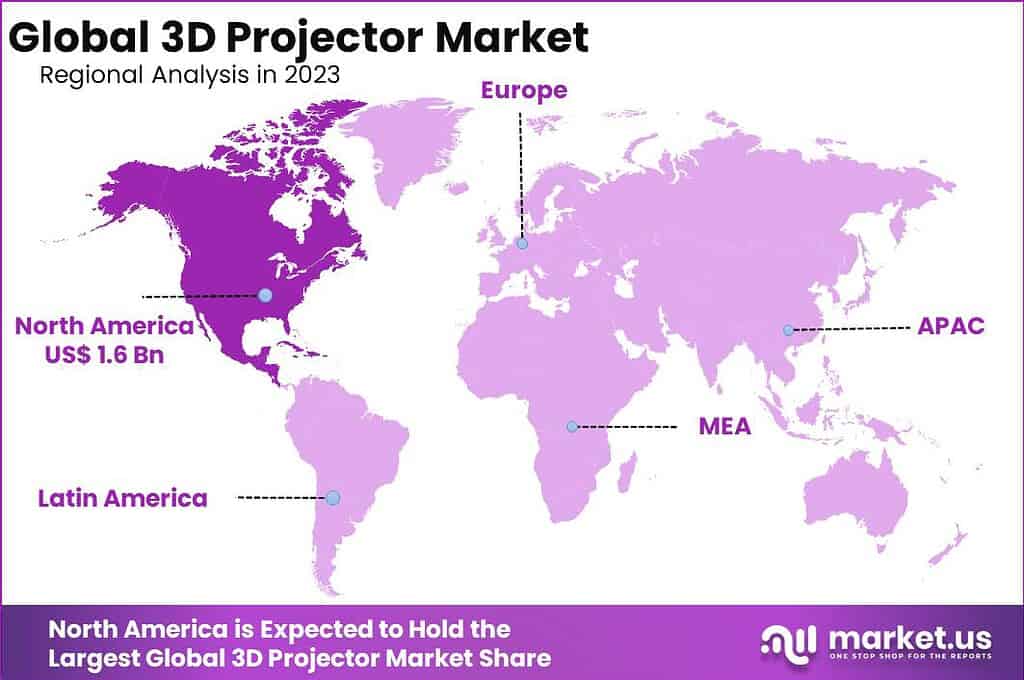

- Regional Analysis: Market growth in the 3D projector sector was driven by contributions from North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America emerged as the leader, commanding a market share exceeding 38.7%.

- Key Players: Prominent companies in the 3D projector market include Sony Corporation, Seiko Epson Corporation, BenQ Corporation, Optoma Corporation, Panasonic Corporation, and several others.

Technology Type Analysis

In 2023, the 3D projector market exhibited a dynamic landscape, with various technology types vying for dominance. Among these, the DLP (Digital Light Processing) segment emerged as the frontrunner, securing a commanding market position by capturing more than a 47.3% share. DLP (Digital Light Processing) technology utilizes tiny mirrors to project light onto a screen, producing sharp and high-quality images.

Its broad acceptance is due to its superior image rendering, energy efficiency, and reasonable pricing, appealing to both individual consumers and businesses. Additionally, DLP projectors have gained significant traction in various sectors, including education, entertainment, and corporate presentations, establishing their prominence in the market.

The LCD (Liquid Crystal Display) technology segment played a significant role in the 3D projector market, holding a substantial market share and contributing significantly to its overall growth. LCD projectors utilize three liquid crystal panels to project images, delivering vibrant colors and high brightness. The versatility and cost-effectiveness of this technology have positioned it as a preferred choice, especially in educational institutions and corporate settings.

Moreover, the LCoS (Liquid Crystal on Silicon) technology segment has made significant advancements in the 3D projector market. LCoS projectors utilize liquid crystals on a silicon surface to generate high-resolution images with remarkable color accuracy. While historically associated with higher costs, limiting its widespread adoption, this technology achieved a notable market share in 2023. The growth is credited to advancements in LCoS technology, rendering it more accessible to a broader range of consumers and industries.

Brightness Analysis

In 2023 the segmentation in the 3D projector market was dependent on the brightness level and resulted into four different categories: Less than 2,000 Lumens, 2,000 – 3,999 lumens, 4,001 – 9,999 Lumens, and finally 10,000 and Above Lumens. Among these segments, the 2,000 to 3,999 Lumens category emerged as the dominant player, capturing more than a substantial 34.8% market share.

This segment’s popularity can be attributed to its versatility, as it strikes a balance between brightness and affordability, making it suitable for a wide range of applications. Projectors falling within this brightness range are commonly found in educational institutions, small to medium-sized conference rooms, and home entertainment setups, driving its strong market position.

Following closely behind, the 4,000 to 9,999 Lumens segment secured a notable share of the market, reflecting its appeal in larger venues and commercial settings. These projectors offer enhanced brightness, making them ideal for auditoriums, theaters, and large conference halls.

In contrast, the Less Than 2,000 Lumens category catered to specific niche requirements where lower brightness suffices, such as small meeting rooms or home use. While this segment may have held a smaller market share, it remained a relevant choice for users seeking compact and energy-efficient projectors.

Meanwhile, the 10,000 & Above Lumens segment, representing the pinnacle of brightness in the market, secured a substantial share, indicative of its importance in demanding applications like large-scale events, outdoor projections, and immersive experiences. Although these projectors are typically more expensive, their unparalleled brightness capabilities are indispensable in scenarios where image clarity and visibility are paramount.

Note: Actual Numbers Might Vary In Final Report

Light Source Analysis

In 2023, the 3D projector market underwent a significant segmentation based on light sources, with key categories including Laser, LED, Lamps, and Other Light Sources. Among these segments, the Lamps category emerged as the dominant player, capturing more than a substantial 36.9% market share. This dominance can be attributed to the established presence of lamp-based projectors in the market, known for their reliability and cost-effectiveness.

Lamps have been a traditional choice for 3D projectors, particularly in educational institutions and corporate environments, owing to their relatively lower initial purchase cost. However, it’s important to note that this segment’s market share is gradually shifting as newer and more advanced light sources gain traction.

On the other hand, the Laser segment has been rapidly gaining ground, securing a significant portion of the market. Laser projectors are preferred for their extended operational lifespan in comparison to traditional lamps. Additionally, they offer superior brightness and color accuracy, making them an appealing option for applications that demand exceptional image quality, including large auditoriums, cinemas, and high-end professional setups.

The LED category also made strides in the 3D projector market, primarily due to its energy efficiency and durability. LED projectors offer a long-lasting light source that consumes less power, making them an environmentally friendly choice. These projectors find favor in applications like portable projectors and outdoor events where power efficiency and reliability are crucial.

Finally, the category of Other Light Sources encompasses emerging technologies and unconventional light sources like hybrid light engines and specialized illumination methods. While this segment holds a relatively smaller market share, it plays a vital role in driving innovation within the industry, with the potential to disrupt traditional projector technologies.

Application Analysis

In 2023, the 3D projector market witnessed a segmentation based on various applications, with key categories including Movies & Cinema, Education, Corporate, Events and Large Venues, Home Theater, and Gaming. Among these segments, the Movies & Cinema category emerged as the dominant player, capturing more than a substantial 27.1% market share.

This dominance can be attributed to the enduring appeal of 3D projection in delivering immersive cinematic experiences. 3D projectors in the Movies & Cinema segment are favored for their ability to bring films to life with depth and realism, making them a cornerstone of the entertainment industry. The adoption of cutting-edge technologies like laser projection has further enhanced the visual quality and appeal of 3D cinema, solidifying its market leadership.

Following closely behind, the Education segment secured a significant share of the market, emphasizing the pivotal role of 3D projectors in modern teaching methods. Educational institutions across the globe have increasingly embraced 3D projection technology to engage students and facilitate interactive learning experiences.

In the Corporate sector, 3D projectors are utilized for presentations, meetings, and conferences, driving the demand for high-quality visual aids. This segment held a noteworthy share of the market, showcasing the relevance of 3D projection in professional settings.

Events and Large Venues, such as concerts, sports events, and conferences, also saw significant adoption of 3D projection technology. The ability to create visually stunning and immersive experiences for large audiences contributed to this segment’s share in the market.

Home Theater and Gaming, while a smaller segment, displayed growth potential, as consumers increasingly seek to replicate cinematic and gaming experiences in the comfort of their homes.

Driving Factors

- Rising Demand for Immersive Entertainment: The increasing consumer appetite for immersive and high-quality entertainment experiences, particularly in movies, gaming, and home theaters, is a significant driving factor for the 3D projector market. Consumers seek to replicate the cinema experience in their homes, driving the demand for advanced 3D projectors.

- Advancements in Projection Technologies: Continuous advancements in projector technologies, such as laser projection, high-resolution displays, and improved color accuracy, are propelling market growth. These innovations lead to better image quality, longer lifespan, and reduced maintenance costs, making 3D projectors more appealing to a broader audience.

- Expanding Educational Applications: The integration of 3D projectors in educational institutions for interactive learning and enhanced visual aids is driving market growth in the education sector. As educators recognize the benefits of 3D projection in engaging students, the demand for projectors in this segment continues to rise.

- Corporate Adoption for Presentations: Corporations are increasingly adopting 3D projectors for presentations, training sessions, and meetings, boosting market growth in the corporate sector. The ability to deliver impactful and dynamic presentations is a key driver as businesses seek to enhance communication and collaboration.

Restraining Factors

- High Initial Costs: The initial cost of 3D projectors, particularly those equipped with advanced technologies like laser projection, can be a significant barrier to adoption. Many potential buyers are deterred by the upfront expenses, impacting market growth.

- Maintenance Expenses: While newer technologies like laser projectors offer longer lifespans, the maintenance costs can still be substantial. Replacing components like laser modules or lamps can add to the total cost of ownership, deterring some buyers.

- Competition from Flat Panel Displays: Flat panel displays, such as LED TVs and OLED screens, are becoming increasingly affordable and offer impressive picture quality. This competition poses a challenge to the 3D projector market, especially in smaller home theater setups.

- Limited 3D Content: The availability of 3D content, especially in the consumer entertainment sector, remains somewhat limited. A lack of compelling 3D content can hinder the adoption of 3D projectors, as consumers may not find sufficient content to justify the investment.

Growth Opportunities

- Rapid Technological Advancements: Continued advancements in projection technology, including miniaturization, increased portability, and augmented reality (AR) capabilities, present growth opportunities. These innovations can open new markets and applications.

- Emerging Markets: Untapped markets in developing countries present substantial growth opportunities for 3D projectors. As these regions undergo economic expansion and witness increased access to technology, the demand for 3D projectors is anticipated to surge.

- Hybrid Projection Solutions: The emergence of hybrid projectors, amalgamating the advantages of various technologies such as DLP and laser, provides an opportunity to address a broader spectrum of customer needs with versatile and cost-effective solutions.

- Customized Solutions: Providing customizable solutions for specific industries and applications, such as healthcare, simulation, and digital signage, can lead to niche market growth for 3D projectors.

Challenges

- Content Ecosystem: The lack of a comprehensive 3D content ecosystem remains a challenge. To sustain market growth, efforts are needed to encourage content creators to produce more 3D content for various applications.

- Environmental Concerns: Environmental concerns related to the disposal of projector lamps and electronic waste pose challenges. Market players need to address sustainability concerns and develop eco-friendly solutions.

- Market Competition: The 3D projector market is highly competitive, with numerous manufacturers vying for market share. Maintaining a competitive edge and differentiating products can be challenging.

- Technological Adaptation: Some consumers and businesses may be slow to adapt to new technologies or may face difficulties in integrating 3D projectors into their existing setups, leading to potential implementation challenges.

Key Market Trends

- Wireless Connectivity: One prominent trend is the integration of wireless connectivity options in 3D projectors. This allows for easier setup and content streaming, catering to the demand for hassle-free experiences.

- Short-Throw Projectors: Short-throw projectors, which can project large images from a short distance, are gaining popularity. These projectors are ideal for smaller spaces and interactive applications.

- Augmented Reality (AR) Projection: The convergence of AR and 3D projection is a notable trend. Projectors with AR capabilities are being used in various sectors, including education, gaming, and industrial training.

- Smart Projectors: Smart projectors with built-in operating systems and app support are becoming more common. This trend aligns with the growing demand for integrated and user-friendly solutions.

Key Market Segmentation

Technology Type

- DLP

- LCD

- LCoS

Brightness

- Less Than 2,000 Lumens

- 2,000 to 3,999 Lumens

- 4,000 to 9,999 Lumens

- 10,000 & Above Lumens

Light Source

- Laser

- LED

- Lamps

- Other Light Sources

Application

- Cinema

- Education

- Corporate

- Home Theater and Gaming

- Events and Large Venues

- Other Applications

Regional Analysis

In the year 2023, North America strengthened its leading position in the 3D projector market, capturing a substantial market share exceeding 38.7%. This dominant standing is influenced by various factors, such as the early embrace of advanced projection technology, a resilient economic landscape, and a dedicated pursuit of state-of-the-art audiovisual solutions. Notably, both the United States and Canada have attracted noteworthy investments, particularly in the entertainment, education, and corporate sectors, thereby fostering an increased demand for 3D projectors.

In Europe, the 3D projector market also experienced noteworthy growth in 2023, contributing substantially to the global market. European countries, including Germany, France, the United Kingdom, and Spain, witnessed increased adoption of 3D projectors across sectors such as education, cinema, and gaming. The emphasis on immersive viewing experiences and the integration of advanced projection technology into cultural and entertainment events played significant roles in the market’s expansion.

Moving to the Asia-Pacific (APAC) region, 2023 witnessed an exceptional growth rate in the 3D projector market. APAC nations like China, Japan, South Korea, and India emerged as leaders in adopting 3D projection technology. Factors such as rapid urbanization, a burgeoning entertainment industry, and a growing interest in digital content consumption contributed to the heightened demand for 3D projectors. The region’s dynamic consumer market, coupled with the increasing number of educational institutions and corporate entities, created fertile ground for 3D projector manufacturers to thrive.

In Latin America, the 3D projector market experienced growing demand in 2023, albeit with a comparatively smaller market share. The region demonstrated a readiness to adopt immersive projection solutions across sectors, including cinema, gaming, and education. The market’s growth potential became evident as telecoms, government services, and entertainment venues increasingly incorporated 3D projectors to enhance customer experiences.

Finally, the Middle East and Africa (MEA) region also witnessed rapid growth in the 3D projector market. Focused on enhancing cultural events, customer engagement, and education, MEA countries, particularly in the Gulf Cooperation Council (GCC) region, embraced 3D projectors in sectors such as hospitality, entertainment, and education. Although MEA’s market share is relatively small compared to other regions, its dedication to leveraging 3D projection for various applications suggests promising growth in the near future.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The analysis of key players in the 3D projector market reveals a dynamic landscape shaped by industry leaders’ strategic initiatives and market dynamics. These key players contribute significantly to the market’s competitiveness and innovation, often driving advancements in 3D projection technology. Their roles encompass areas such as product development, technological innovation, market expansion, and strategic collaborations.

Understanding the strategies and market presence of these key players provides valuable insights into the overall trajectory of the 3D projector market, influencing factors such as market share, product offerings, and global reach.

Top Player’s Company Profiles

- Sony Corporation

- Seiko Epson Corporation

- BenQ Corporation

- Optoma Corporation

- Panasonic Corporation

- Sharp NEC Display Solutions

- LG Corporation

- ViewSonic Corporation

- Acer Inc.

- Christie Digital Systems

- Hitachi, Ltd.

- The Ricoh Company, Ltd.

- Other Key Players

Recent Development

- December 2022: INOX Leisure Ltd (INOX), India’s premier multiplex chain, strengthened its collaboration with leading 3D solutions provider Volfoni. INOX acquired additional SmartCrystal Diamond technology solutions from Volfoni to enhance its 3D cinema screens nationwide. The agreement for new installations was formalized during CineAsia 2022 in Bangkok, aligning with INOX’s commitment to implementing cutting-edge cinema technology for an unparalleled movie-watching experience.

- August 2022: SPRODE INDIA introduced the highly sought-after JMGO 4K 3D Tri-Color Laser TV Projector U2 and JMGO O series in India, marking the celebration of 75 years of Indian independence. With a patriotic vision, SPRODE aimed to provide every Indian household with the privilege of an authentic theatre experience at home. As the national distributor of JMGO GLOBAL in India, SPRODE played a pioneering role in introducing smart theatre and laser TV technologies to the Indian market.

Report Scope

Report Features Description Market Value (2023) US$ 4.2 Bn Forecast Revenue (2033) US$ 8.1 Bn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology Type Analysis (DLP, LCD, and LCoS), By Brightness (Less Than 2,000 Lumens, 2,000 to 3,999 Lumens, 4,000 to 9,999 Lumens, and 10,000 & Above Lumens), By Light Source (Laser, LED, Lamps and Other Light Sources), By Application (Movies & Cinema, Education, Corporate, Events and Large Venues, Home Theater and Gaming) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Sony Corporation, Seiko Epson Corporation, BenQ Corporation, Optoma Corporation, Panasonic Corporation, Sharp NEC Display Solutions, LG Corporation, ViewSonic Corporation, Acer Inc., Christie Digital Systems, Hitachi, Ltd., The Ricoh Company, Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a 3D projector?3D projector is a specialized projection device that displays images or videos with a sense of depth, creating a three-dimensional visual experience. It uses advanced technologies to enhance the viewing quality and immersion.

How does a 3D projector work?3D projectors typically employ technologies such as DLP (Digital Light Processing), LCD (Liquid Crystal Display), or LCoS (Liquid Crystal on Silicon) to project separate images for each eye, creating the illusion of depth and three-dimensionality.

How big is 3D Projector market?The global 3D Projector market is expected to expand at a 6.8% CAGR during the forecast period. The 3D Projector industry is anticipated to be worth USD 4.2 Billion in 2023 and exceed USD 8.1 Billion by 2033.

What are the key factors driving the growth of the 3D projector market?The growth of the 3D projector market is propelled by factors such as increased demand for immersive viewing experiences, advancements in projection technology, and expanding applications in sectors like entertainment, education, and business presentations.

What are the emerging trends in the 3D projector market?Emerging trends include the adoption of laser technology for improved brightness and color accuracy, the development of hybrid projectors combining multiple technologies, and the exploration of untapped markets in developing countries.

-

-

- Sony Corporation

- Seiko Epson Corporation

- BenQ Corporation

- Optoma Corporation

- Panasonic Corporation

- Sharp NEC Display Solutions

- LG Corporation

- ViewSonic Corporation

- Acer Inc.

- Christie Digital Systems

- Hitachi, Ltd.

- The Ricoh Company, Ltd.

- Other Key Players