Global 3d Printed Electronics Market By Printing Technology (Inkjet Printing, Screen Printing, Others), By Material Ink(Conductive Inks, Dielectric Inks,others ), By Resolution (Less than 100 lines/CM, 100 to 200 lines/CM, More than 200 lines/CM), By Application(Displays, E paper displays, Others), By End Use Industry(Retail and Packaging, Construction and Architecture, Others), By Transport Techniques (Roll to Roll, Sheet to Sheet, Sheet to Shuttle), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166203

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Adoption

- By Printing Technology

- By Material

- By Resolution

- By Application

- By Transport Techniques

- By End-User Industry

- Key Benefits

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

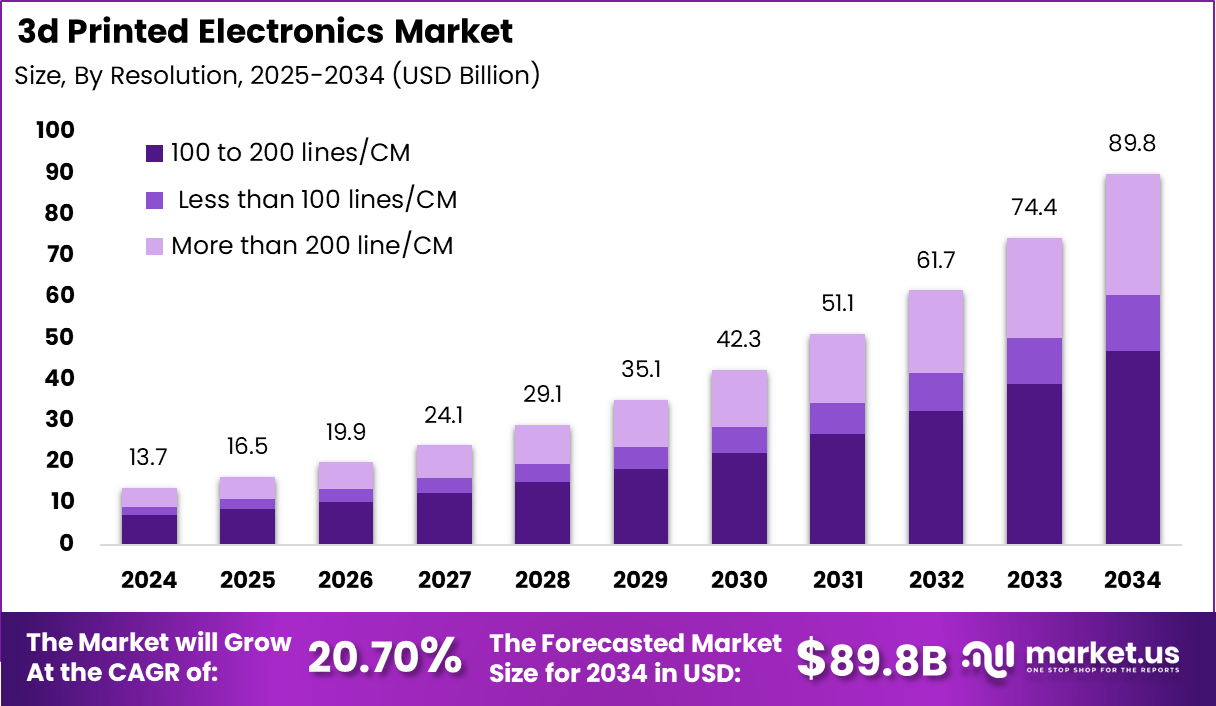

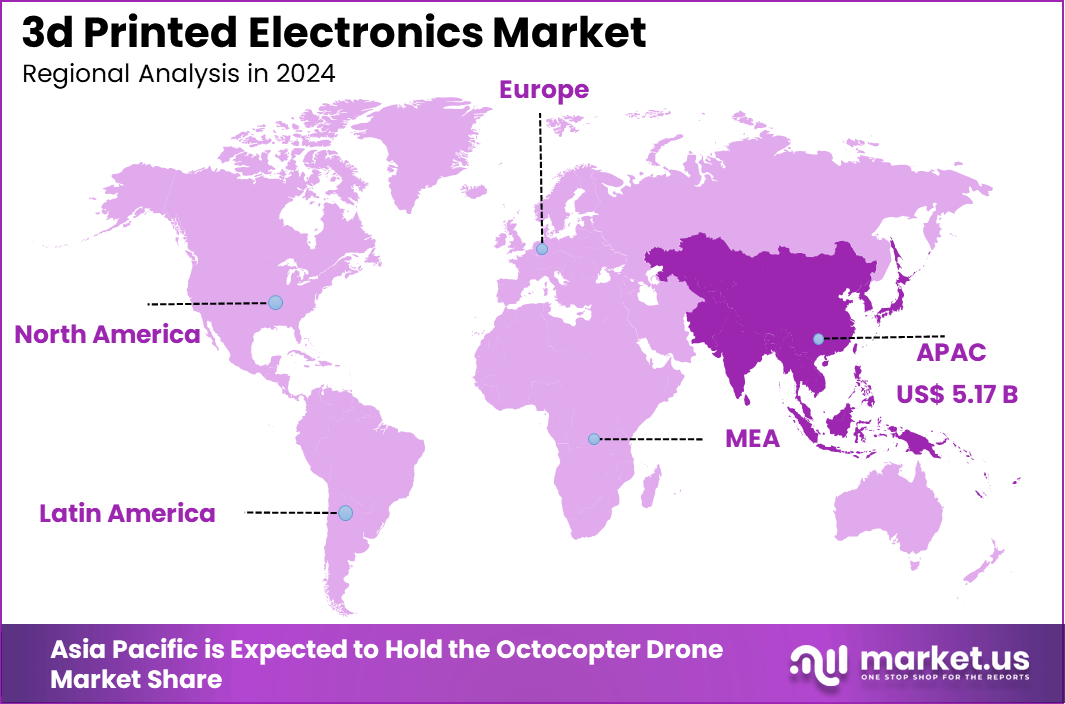

The Global 3d Printed Electronics Market generated USD 13.7 billion in 2024 and is predicted to register growth from USD 16.5 billion in 2025 to about USD 89.8 billion by 2034, recording a CAGR of 20.70% throughout the forecast span. In 2024, Asia-Pacific held a dominan market position, capturing more than a 37.8% share, holding USD 5.17 Billion revenue.

The 3D printed electronics market has expanded as manufacturers adopt additive processes to produce lightweight, flexible and highly customised electronic components. Growth reflects rising demand for rapid prototyping, lower material waste and more compact circuit designs. The market now supports production of antennas, sensors, circuit boards and wearable components using conductive inks and layered materials.

The growth of the market can be attributed to increasing need for miniaturised electronics, faster development cycles and broader industrial interest in additive manufacturing. Traditional manufacturing methods face cost and design limitations that 3D printing can overcome. The push toward flexible, stretchable and shape conforming electronics further supports adoption across multiple sectors.

Key driving factors include the push for smaller, more flexible electronic devices that offer enhanced performance and customizability. Innovative printing materials such as conductive inks and hybrid materials improve electrical performance and design precision.

Increasing integration of IoT and smart devices is raising demand for electronics that are functionally integrated and can be rapidly produced. The surge in low-volume, high-complexity products and the need to reduce inventory costs further widen the appeal of 3D printed electronics.

Demand analysis highlights consumer electronics as a major user, accounting for about 30% of market share, focusing on wearables, smart devices, and compact circuit boards. The medical sector, with roughly 15% of demand, benefits from personalized implants, sensors, and diagnostic devices produced with precise customization.

Automotive and aerospace industries increasingly adopt 3D printed electronics for lightweight components and complex designs that improve fuel efficiency and system integration. Growing R&D efforts and collaborations between electronics and 3D printing companies drive continuous innovation and broaden applications.

Top Market Takeaways

- By printing technology, inkjet printing leads with 42.9% of the market share. Inkjet’s flexibility, precision, and cost-efficiency make it the preferred method for producing complex electronic patterns and circuits.

- By material, inks dominate with 65.1%, including conductive inks (silver, copper, carbon), dielectric inks, and semiconductor inks that enable functional electronic layers on various substrates.

- By resolution, the 100 to 200 lines/CM segment holds 52.4% share, balancing production speed with fine line precision for applications like RFID tags and flexible electronics.

- By application, RFID tags account for 25.6% of the market, driven by demand in inventory tracking, supply chain management, and smart packaging.

- By end-user industry, the consumer segment leads with 28.5%, benefiting from the miniaturization and customization enabled by 3D printed electronics in wearables, smart devices, and consumer gadgets.

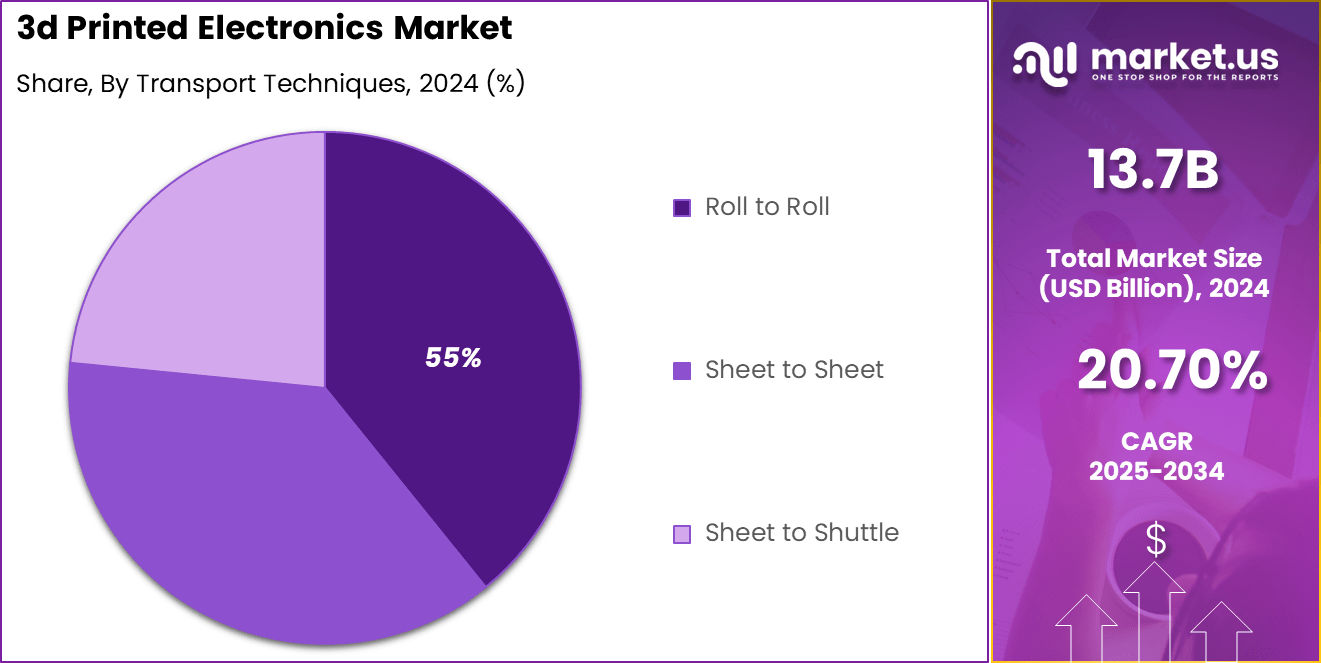

- By transport technique, roll-to-roll (R2R) technology controls 55.2% of the market, valued for its high-throughput, continuous production capability, and cost efficiency in manufacturing flexible electronic components.

Key Adoption

Usage Statistics

- Prototyping leads overall use, with more than 60% of production workflows in custom electronics and up to 72% in aerospace and defense focused on prototyping and R&D for faster and more cost-effective design testing.

- End-use production is increasing, with 21% of businesses using 3D printing for final parts in 2023. In custom electronics, more than 60% of production workflows use 3D printing for design, assembly, and functional components.

- Adoption varies by industry, with high-value sectors driving market expansion.

Industry-Specific Adoption

- Consumer Electronics holds about 30% of the market and uses 3D printing for rapid prototyping, specialized components, and custom accessories. Major brands such as HP and Apple have integrated 3D-printed internal parts into selected products.

- Aerospace and Defense accounts for nearly 25% of the market, using 3D printing for lightweight antennas, structural components, and advanced circuit designs that require high performance.

- Medical and Healthcare adoption is rising quickly, supported by strong professional confidence. Usage includes custom sensors, implants, prosthetics, and patient-specific devices where precise tailoring is essential.

- Automotive companies use the technology for integrated sensors, lightweight structures, smart surfaces, and parts that support energy efficiency and advanced engineering needs.

By Printing Technology

Inkjet printing leads the 3D printed electronics market with a share of 42.9%. This technology offers precise, digital control over material deposition without physical contact, allowing fast prototyping and customization. Its non-contact nature reduces substrate damage and supports printing on flexible or delicate materials, making it ideal for diverse applications such as flexible sensors, RFID tags, and organic photovoltaics.

The ability to print intricate, fine patterns efficiently has made inkjet printing a preferred method in advanced electronics manufacturing.Ongoing enhancements in ink formulations and printer resolution continue to expand inkjet printing’s role in producing high-performance, lightweight, and low-cost electronic devices.

By Material

Inks dominate the material segment, accounting for 65.1% of the market. Conductive inks composed of silver, copper, carbon, and carbon-based materials are essential in printing electronic circuits, sensors, antennas, and displays on various substrates. The versatility of these inks allows for integration with flexible electronics and wearable devices, supporting the market’s rapid growth.

Innovations in ink chemistry are improving electrical performance and environmental sustainability, attracting broad industrial use. Inks not only enable functionality but also contribute significantly to reducing manufacturing costs and enabling scalable, roll-to-roll production of printed electronics.

By Resolution

The resolution range of 100 to 200 lines per centimeter captures 52.4% of the market share. This level offers a balanced trade-off between printing precision and production speed, suitable for mass manufacturing of RFID tags, flexible displays, and sensors that do not require ultra-high precision.

Printing at this resolution enables rapid scaling of printed electronics, meeting industrial demand without escalating costs.This mid-resolution category has widespread adoption across consumer electronics and industrial applications where quality and throughput need to align closely with economic viability.

By Application

RFID tag printing accounts for 25.6% of the 3D printed electronics market. Printed RFID tags provide cost-effective and flexible solutions for inventory management, asset tracking, and smart packaging. These tags benefit from being lightweight, thin, and easily integrated into various surfaces and products without adding significant costs or complexity.

Their proliferation is propelled by expanding retail and logistics sectors demanding real-time tracking and authentication. The increasing use of printed RFID technology enhances supply chain efficiency and product security, driving strong market demand.

By Transport Techniques

Roll-to-roll processing claims 55.2%, ideal for continuous high-speed production of flexible electronics. It feeds substrates through printers like a web press, printing circuits uniformly over large areas. This suits volume runs of films, sensors, and displays, slashing per-unit costs. Consistency across rolls ensures quality in scale.

R2R excels in handling thin, bendable materials for foldables and photovoltaics. Automation reduces labor while enabling complex multilayer builds. Its efficiency drives flexible tech in consumer and energy sectors. This technique anchors the path to commercial viability.

By End-User Industry

Consumer industries take 28.5%, fueled by demand for miniaturized gadgets like wearables and smart homes. 3D printed circuits embed into housings for seamless sensors and displays, enhancing user features without bulk. Customization speeds product cycles, meeting trends in connected devices. Lightweight builds align with portability priorities.

The sector benefits from on-demand printing that cuts prototyping time sharply. It supports IoT growth by integrating modules into everyday items affordably. Rapid market shifts favor this flexibility, keeping consumer electronics innovative and competitive. Adoption here sets patterns for broader industry use.

Key Benefits

- Integrated design and functional consolidation enable circuits, antennas, and sensors to be embedded directly into complex shapes, reducing assembly steps and part count.

- Rapid prototyping improves development speed by moving from design to working electronic parts in hours or days, supporting faster product launches.

- Customization and low-volume production become viable because no tooling or masks are required, allowing economically feasible small-batch or one-off builds.

- Weight and size reduction is achieved by embedding conductive pathways inside structures, supporting aerospace, EV, and medical applications.

- Supply chain resilience improves since additive workflows reduce reliance on multi-tier PCB manufacturing and allow local production.

- Material efficiency increases with additive deposition reducing waste and enabling lighter, more sustainable electronic components.

Emerging Trends

Key Trends Description Technological Advancements Continuous innovation in 3D printing tech enhancing precision, speed, and material diversity. Customization Demand Rising need for tailored electronic components in healthcare, aerospace, consumer electronics, etc. Cost Efficiency Reduced manufacturing costs due to less material waste and lower labor requirements. Rapid Prototyping Faster production of prototypes enabling quicker design validation and product iterations. Design Flexibility Ability to create complex geometries and integrate multiple functions in single parts. Growth Factors

Key Factors Description Industry 4.0 Adoption Increasing Industry 4.0 implementation driving demand for automated, high-speed, and flexible electronics manufacturing. Expansion in Emerging Applications Growth in IoT, wearable tech, medical devices fueling 3D printed electronics adoption. Environmental Sustainability Growing focus on eco-friendly materials and processes in 3D printing. Investment and Government Support Increased funding and initiatives supporting R&D and commercialization of 3D printed electronics. Regional Market Growth Asia-Pacific region leading growth due to electronics manufacturing scale and government initiatives. Key Market Segments

By Printing Technology

- Inkjet Printing

- Screen Printing

- Gravure Printing

- Flexographic Printing

- Others

By Material

- Ink

- Conductive Inks

- Dielectric Inks

- Other Inks

- Polymers

- Paper

- Glass

- Others

By Resolution

- Less than 100 lines/CM

- 100 to 200 lines/CM

- More than 200 lines/CM

By Application

- Displays

- E paper displays

- Electroluminescent (EL) Displays

- Battery

- RFID Tags

- Lighting

- Photovoltaic Cells

- Others

By End Use Industry

- Retail and Packaging

- Construction and Architecture

- Aerospace and Defense

- Consumer Electronics

- Healthcare

- Automotive and Transportation

- Others

By Transport Techniques

- Roll to Roll

- Sheet to Sheet

- Sheet to Shuttle

Regional Analysis

Asia Pacific led the 3D printed electronics market with a commanding share of 37.8%, driven by rapid technological advancements and a robust electronics manufacturing ecosystem in countries like China, Japan, South Korea, and Taiwan.

The region benefits from strong government initiatives supporting advanced manufacturing technologies and significant investments in R&D, fostering innovation and rapid commercialization of 3D printed electronic components.

Increasing demand from sectors such as automotive, consumer electronics, healthcare, and industrial manufacturing propels growth, especially as manufacturers seek lightweight, flexible, and cost-effective electronic solutions.

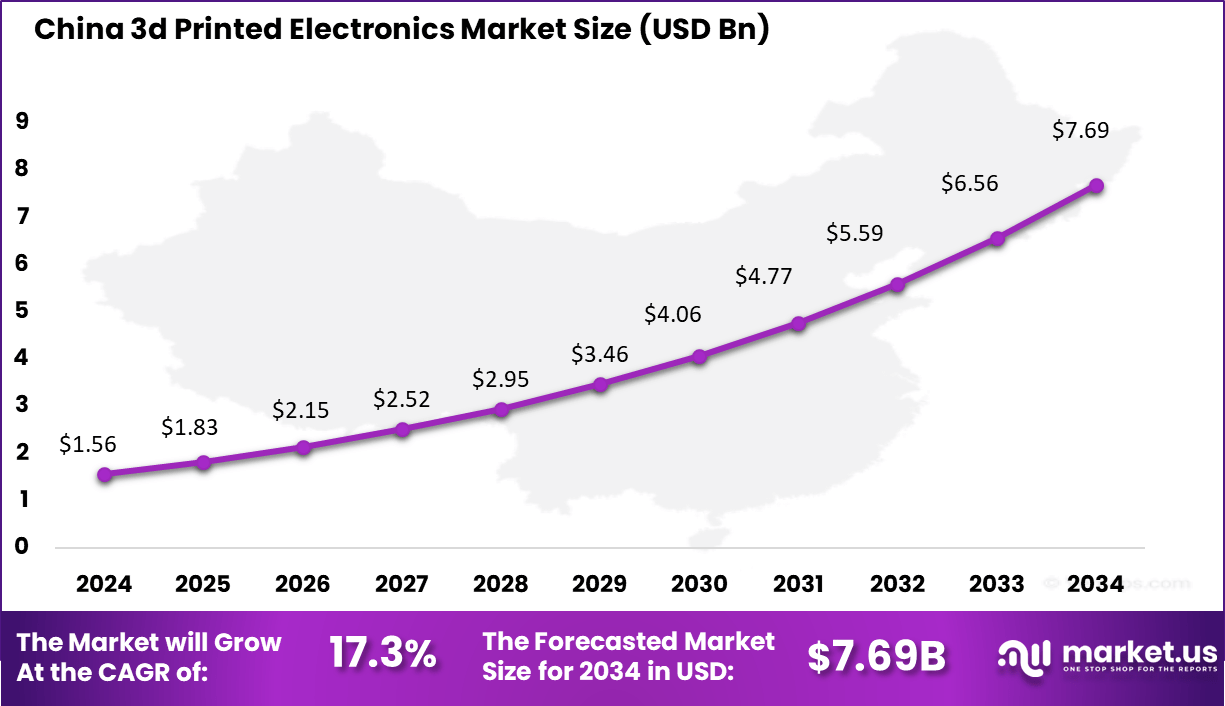

China stands out within the Asia Pacific region as a dominant market, valued at an estimated USD 1.56 billion in 2024. The country leads due to its large-scale electronics production, expanding consumer electronics market, and aggressive government support for additive manufacturing technologies. Chinese companies are at the forefront of developing innovative materials and printing methods to enhance the performance and scalability of 3D printed electronics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Design Flexibility and Rapid Prototyping

The 3D printed electronics market is driven by the exceptional design freedom and rapid prototyping capability it offers. Unlike traditional electronics manufacturing, 3D printing allows embedding conductive materials directly into complex three-dimensional structures. This flexibility empowers manufacturers to create customized, compact, and multi-functional devices that are difficult to achieve with conventional 2D circuit boards.

Rapid prototyping accelerates the product development cycle, enabling immediate testing and iteration. This efficiency gives companies a competitive edge, especially in consumer electronics, aerospace, and healthcare sectors that require faster innovation turns and highly tailored electronic solutions.

Restraint

High Costs and Production Speed Limitations

Despite its benefits, high production costs and slower fabrication speeds restrict the mass adoption of 3D printed electronics. Advanced printing systems and materials, such as conductive inks and hybrid polymers, demand significant investment. Furthermore, the printing process for multi-layer, complex circuits remains time-consuming compared to traditional manufacturing, impacting scalability for large volume production.

These limitations mostly affect industries aiming at high-volume outputs where cost-efficiency and speed are critical. Overcoming these barriers requires ongoing technological advancements and cost reduction strategies to compete with established electronics production lines.

Opportunity

Growing Demand in Wearables and Medical Devices

Expanding applications in wearables, medical implants, and IoT devices present significant growth opportunities for the 3D printed electronics market. The ability to print conformal electronics directly onto curved and flexible surfaces suits the miniaturization and personalization trends in these sectors.

Custom medical implants with embedded sensors and smart wearables with enhanced functionality are prime examples of market expansion. Additionally, industry collaborations and government support for research in additive manufacturing bolster innovation and adoption. Continued material advancements and integration of AI-driven design software also open new frontiers for complex, high-performance 3D electronic components.

Challenge

Regulatory Compliance and Material Limitations

A major challenge is navigating evolving regulatory standards for safety, performance, and environmental impact in emerging 3D printed electronics applications. Sectors like healthcare and aerospace require rigorous certification processes, which slow product commercialization and add costs.

Material limitations, such as availability of specialized conductive and dielectric inks compatible with 3D printing, also pose challenges. Achieving consistent quality, reliability, and durability in printed electronics demands continuous R&D efforts. Addressing these barriers is key to unlocking the full commercial potential of this innovative technology.

Competitive Analysis

LG Display, Samsung Electronics, Molex, Agfa-Gevaert, and E Ink lead the 3D printed electronics market with advanced printing technologies used for flexible circuits, smart displays, and lightweight electronic components. Their solutions focus on high-resolution printing, improved conductivity, and scalable production processes. These companies support growing demand for wearable devices, flexible screens, and next-generation sensors.

NovaCentrix, BASF, Nissha, DuPont, PARC, ISORG, and Sumitomo strengthen the market with specialized materials, conductive inks, and innovative printing platforms. Their technologies enable printed antennas, organic sensors, and transparent electronics. These providers focus on material stability, fast curing, and compatibility with diverse substrates. Expanding use of printed components in IoT devices, medical patches, and automotive interiors supports steady adoption of their solutions.

Nano Dimension, Hensoldt, GSI Technologies, Enfucell, Draper, Eastprint, Cubbison, KWJ Engineering, and other participants broaden the landscape with additive manufacturing systems for multilayer PCBs, RFID labels, and printed batteries. Their offerings emphasize rapid prototyping, design flexibility, and cost-efficient low-volume production. These companies support customized electronics for aerospace, defense, and industrial applications.

Top Key Players in the Market

- LG Display Co Ltd

- Samsung Electronics Co. Ltd

- Molex, LLC

- Agfa- Gevaert Group

- E Ink Holdings

- Nova Centrix

- BASF

- Nissha Co, Ltd

- DuPont de Nemours, Inc

- Palo Alto Research Center Incorporated

- ISORG SA

- Sumitomo

- Nano Dimension

- Hensodt

- GSI Technologies LLC

- Enfucell

- Draper

- Eastprint Incorporated

- The Cubbison Company

- KWJ Engineering Incorporated

- Others

Recent Developments

- August, 2025, LG Display showcased advancements in large OLED panels, including 4th-generation OLED with META technology for AI TVs and gaming OLEDs, delivering improved brightness, color reproduction, and energy efficiency.

- January, 2025, Samsung unveiled “The Premiere 5,” the industry’s first interactive triple-laser ultra-short-throw projector with advanced LightWARP technology, enabling interactive touch experiences and high-quality image projection

Report Scope

Report Features Description Market Value (2024) USD 13.7 Bn Forecast Revenue (2034) USD 89.8 Bn CAGR(2025-2034) 20.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Printing Technology (Inkjet Printing, Screen Printing, Others), By Material Ink (Conductive Inks, Dielectric Inks,others), By Resolution (Less than 100 lines/CM, 100 to 200 lines/CM, More than 200 lines/CM), By Application(Displays, E paper displays, Others), By End Use Industry(Retail and Packaging, Construction and Architecture, Others), By Transport Techniques (Roll to Roll, Sheet to Sheet, Sheet to Shuttle) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LG Display Co Ltd, Samsung Electronics Co. Ltd, Molex, LLC, Agfa-Gevaert Group, E Ink Holdings, Nova Centrix, BASF, Nissha Co, Ltd, DuPont de Nemours, Inc, Palo Alto Research Center Incorporated, ISORG SA, Sumitomo, Nano Dimension, Hensodt, GSI Technologies LLC, Enfucell, Draper, Eastprint Incorporated, The Cubbison Company, KWJ Engineering Incorporated, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3d Printed Electronics MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

3d Printed Electronics MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LG Display Co Ltd

- Samsung Electronics Co. Ltd

- Molex, LLC

- Agfa- Gevaert Group

- E Ink Holdings

- Nova Centrix

- BASF

- Nissha Co, Ltd

- DuPont de Nemours, Inc

- Palo Alto Research Center Incorporated

- ISORG SA

- Sumitomo

- Nano Dimension

- Hensodt

- GSI Technologies LLC

- Enfucell

- Draper

- Eastprint Incorporated

- The Cubbison Company

- KWJ Engineering Incorporated

- Others