Global 1-Decene Market By Derivative Type(Oxo Alcohols, Chlorinated Olefins, Linear Alkyne Benzenes, Polyalphaolefins, Alkyl Dimethylamine, Di-alkyl Diethylamine, Linear Mercaptans), By Form(Liquid, Solid), By Application(Poly Alpha Olefin, Polyethylene, Detergent Alcohols), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 60525

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

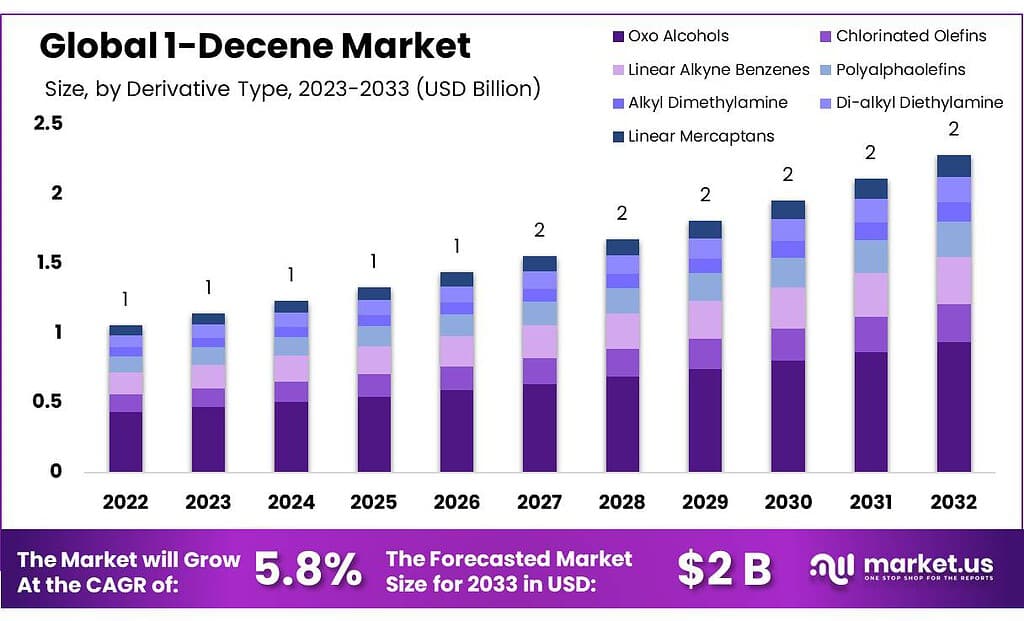

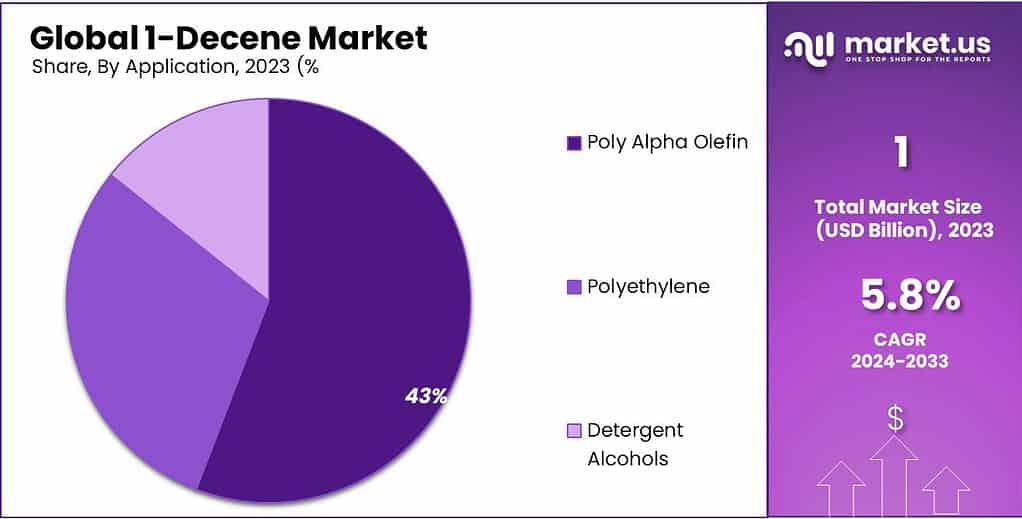

The 1-Decene Market size is expected to be worth around USD 2 billion by 2033, from USD 1 Bn in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

The industry will see a rise in Insistence for synthetic lubricants due to increased volume growth by major industry participants and a focus on alpha olefins made of bio-based materials. Poly alpha olefins have seen a rise in demand due to their superior lubrication and slighter engine wear.

The oligomerization and synthesis of linear alpha-olefins produce polyalphaolefin. C-10 is the preferred alpha oil for PAO production. The key driver of the 1-decene market is assumed to be the rise of PAO’s insistence on engine & gear oils, greases & other lubricants

Key Takeaways

- Market Growth: The 1-Decene market is projected to grow from USD 1 billion in 2023 to around USD 2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.8%.

- Dominance of PolyAlphaOlefin (PAO): In 2024, PAO captured over 39% of the market share. Its extensive use in high-performance lubricants, especially in the automotive and industrial sectors, is a primary growth driver.

- Rising Demand for Oxo Alcohols: Utilized in plasticizers, solvents, and acrylates, Oxo Alcohols are experiencing growing demand in construction and consumer goods, marking their significance in the 1-Decene market.

- Application in Safety Standards: Chlorinated Olefins, used in flame retardants and plastic additives, are in demand due to increased safety standards across industries.

- Liquid Form’s Market Leadership: In 2024, the liquid form of 1-Decene held a dominant position with over 35.6% market share, favored for its ease of handling and versatility in various industrial processes.

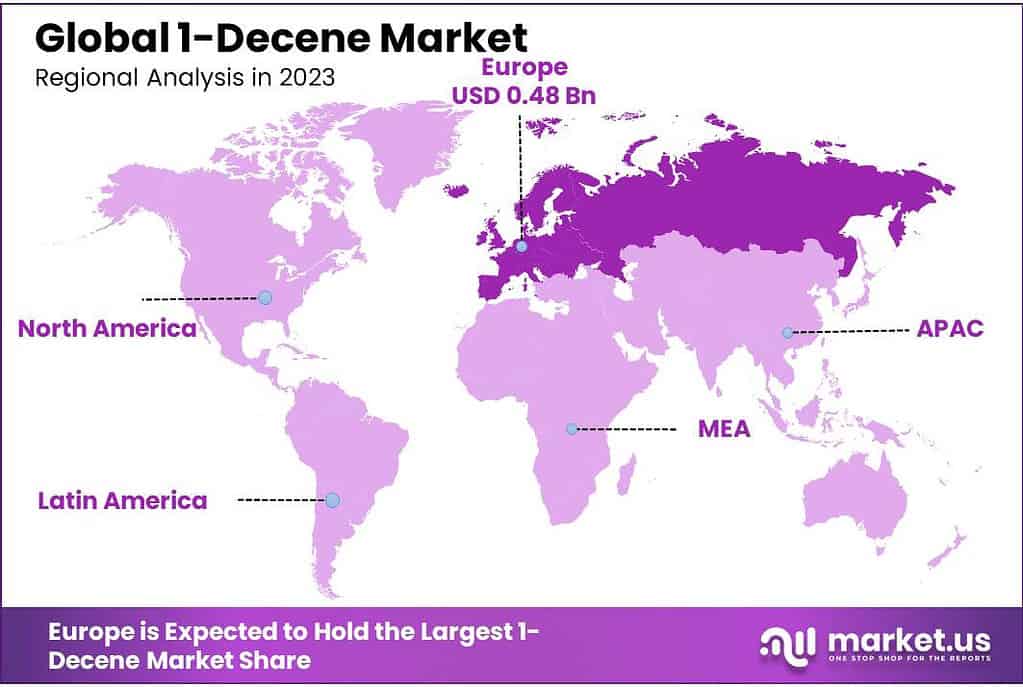

- Regional Market Insights: Europe led the market in 2023 with over 46% revenue share, attributed to its extensive industrial base of PAOs and oxo alcohols. North America’s growth is propelled by its expanding oil and gas infrastructure and natural resources.

By Derivative Type Analysis

PolyAlphaOlefin (PAO) held a dominant market position in the 1-Decene market, capturing more than a 39% share. This dominance can be attributed to PAO’s extensive use in high-performance lubricants, driven by its superior properties such as thermal stability and high viscosity index. The demand for these lubricants is increasing, particularly in the automotive and industrial sectors, fueling PAO’s market growth.

Oxo Alcohols, another significant derivative of 1-Decene, are widely utilized in the production of plasticizers, solvents, and acrylates. The segment’s growth is propelled by the escalating demand in sectors like construction and consumer goods. The versatility of Oxo Alcohols in various applications positions them as a key component in the 1-Decene market.

Chlorinated Olefins, derived from 1-Decene, find their primary application in the manufacture of flame retardants and plastic additives. The increasing emphasis on safety standards across various industries is driving the demand for Chlorinated Olefins, thus contributing to their market share.

Linear Alkyl Benzene (LAB) is another notable segment within the 1-Decene market. LAB is primarily used in the production of biodegradable detergents. The growing consumer preference for eco-friendly cleaning products is boosting the demand for LAB, indicating a positive trend in its market growth.

Polyalphaolefins, a premium segment of 1-Decene derivatives, are extensively used in synthetic lubricants. Their superior performance in extreme conditions makes them ideal for aerospace and automotive applications, leading to a steady growth in their market demand.

Alkyl Dimethylamine and Di-alkyl Diethylamine segments, though smaller in comparison, are gaining traction in niche applications like water treatment and pharmaceuticals. Their unique chemical properties drive their demand in these specialized sectors.

By Form

In 2024, the liquid form of 1-Decene held a dominant market position, capturing more than a 35.6% share. This dominance is primarily due to the ease of handling and versatility that liquid 1-Decene offers. Its application in the production of high-quality lubricants, plastics, and detergents is a key driver for its significant market share. The liquid form’s adaptability in various industrial processes, including chemical synthesis and polymer production, further bolsters its standing in the market.

Conversely, the solid form of 1-Decene, while holding a smaller market share, presents unique advantages in certain applications. Solid 1-Decene is often preferred for its stability and long shelf-life, making it suitable for applications that require precise formulations and controlled release of properties. Its use in specialized chemical processes and niche industrial applications contributes to its steady demand in the market.

Application analysis

In 2024, PolyAlphaOlefin (PAO) held a dominant market position in the 1-Decene market, capturing more than a 39% share. This dominance can be attributed to PAO’s extensive use in high-performance lubricants, driven by its superior properties such as thermal stability and high viscosity index. The demand for these lubricants is increasing, particularly in the automotive and industrial sectors, fueling PAO’s market growth.

Oxo Alcohols, another significant derivative of 1-Decene, are widely utilized in the production of plasticizers, solvents, and acrylates. The segment’s growth is propelled by the escalating demand in sectors like construction and consumer goods. The versatility of Oxo Alcohols in various applications positions them as a key component in the 1-Decene market.

Chlorinated Olefins, derived from 1-Decene, find their primary application in the manufacture of flame retardants and plastic additives. The increasing emphasis on safety standards across various industries is driving the demand for Chlorinated Olefins, thus contributing to their market share.

Linear Alkyl Benzene (LAB) is another notable segment within the 1-Decene market. LAB is primarily used in the production of biodegradable detergents. The growing consumer preference for eco-friendly cleaning products is boosting the demand for LAB, indicating a positive trend in its market growth.

Polyalphaolefins, a premium segment of 1-Decene derivatives, are extensively used in synthetic lubricants. Their superior performance in extreme conditions makes them ideal for aerospace and automotive applications, leading to a steady growth in their market demand.

Alkyl Dimethylamine and Di-alkyl Diethylamine segments, though smaller in comparison, are gaining traction in niche applications like water treatment and pharmaceuticals. Their unique chemical properties drive their demand in these specialized sectors.

Lastly, Linear Mercaptans, derived from 1-Decene, are key in producing surfactants and pesticides. The agricultural sector’s growing need for efficient pesticides supports the steady demand for Linear Mercaptans.

Overall, the 1-Decene market is characterized by diverse applications across various industries, with each derivative playing a crucial role in its respective domain. The market’s growth trajectory is influenced by technological advancements, environmental regulations, and evolving consumer preferences.

Кеу Маrkеt Ѕеgmеntѕ

By Derivative Type

- Oxo Alcohols

- Chlorinated Olefins

- Linear Alkyne Benzenes

- Polyalphaolefins

- Alkyl Dimethylamine

- Di-alkyl Diethylamine

- Linear Mercaptans

By Form

- Liquid

- Solid

By Application

- Poly Alpha Olefin

- Polyethylene

- Detergent Alcohols

Drivers

The 1-Decene market is experiencing a surge driven by the rising demand for PAOs-based synthetic lubricants, largely propelled by the automobile industry. The consumption trends of PAOs directly influence the demand for 1-Decene, as it serves as a fundamental component in these lubricants.

As developing countries witness improvements in living standards, there’s a notable increase in the number of vehicles. This rise, driven by the middle-class population’s increased spending on automobiles, fuels the demand for lubricants—a significant application area for 1-Decene derivatives.

The appeal of 1-Decene lies in its diverse technical performance advantages, making it exceptionally suitable for use in lubricants. These advantages contribute to its effectiveness and reliability in lubrication applications, further bolstering its demand in the market.

The growth trajectory of the automotive industry, spurred by factors such as increasing populations in developing nations like China, India, and Brazil, acts as a driving force behind the escalating demand for lubricants—ultimately propelling the need for 1-Decene derivatives in this sector.

Restraints

The growth of Group III base oils presents a significant restraint on the 1-Decene market. Traditionally, synthetic oils like PAOs were favored for their exceptional characteristics in viscosity index, pour point, volatility, and oxidation stability. However, advancements in base oil manufacturing, particularly in Group III oils using modern hydroisomerization technology, have narrowed the performance gap.

These modern Group III oils now offer comparable performance to traditional PAO-based synthetic oils across various applications. They provide similar advantages, addressing the demands of industries reliant on high-performance lubricants. The automotive sector, in particular, is driving the demand for these advanced Group III base oils.

Stricter regulations on emissions and overall carbon footprint have propelled automotive manufacturers to seek higher-performing oils. This need for improved performance, coupled with regulatory pressures, has led to a surge in demand for Group III base oils within the automotive industry, posing a restraint on the 1-Decene market as the preferred choice for synthetic lubricants.

Opportunities

An exciting opportunity in the 1-Decene market emerges from the increased research and development investments directed toward producing alpha olefins from diverse sources. Researchers and institutions are exploring innovative methods to derive alpha olefins from biomass, marking a significant shift in production practices.

Pioneering studies, such as the work conducted at The Center for Biorenewable Chemicals (CBiRC), an NSF-funded Engineering Research Center in the US, have showcased novel approaches. Their research demonstrates the production of medium-chain length free fatty acids utilizing E. coli bacteria, utilizing sugars as a carbon source. This groundbreaking methodology employs codon-optimized enzyme sources from both eukaryotic and prokaryotic origins expressed within microbial systems.

The outcomes of such projects have been remarkable, reporting yields of 35% to 40% of theoretical expectations, with an attainment of 2.7 g/L. These results demonstrate a highly promising direction in the production of alpha olefins, showcasing comparable efficiency to recent literature reports.

This research paves the way for more sustainable and alternative sources for alpha olefins, opening new avenues for their production beyond conventional methods.

Challenges

One of the significant challenges facing the 1-Decene market is the noticeable gap between supply and demand. The market landscape is dominated by a limited number of key players with substantial manufacturing capacities.

Companies such as Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Royal Dutch Shell, and INEOS stand out for their comparatively larger production capabilities in the realm of linear alpha olefins, including 1-Decene.

However, the presence of only a few major players with significant production capacities poses a challenge. Smaller players in the market have limited manufacturing capabilities for linear alpha olefins, particularly 1-Decene.

This scarcity of production capacity becomes a hurdle for manufacturers of derivative products like PAOs and oxo alcohols, leading to increased difficulty in meeting the soaring demand for 1-Decene across these derivative types.

The surging demand for 1-Decene exceeds the manufacturing capacities of these players, creating a situation where manufacturers struggle to meet market demands. The disparity between demand and production capacity presents a significant challenge within the 1-Decene market, impacting downstream industries reliant on these derivatives and hampering their production capabilities.

Regional Analysis

Europe had the largest revenue share at over 46% in 2023. This is due to its vast industrial base of PAOs as well as oxo alcohols. North America’s growth is mainly due to the expansion of oil and gas infrastructure in the US, Canada, and Mexico.

Because of its large natural resources, North America is considered a potential investment center for 1-Decene production. The oil & gas industry has enjoyed cost advantages due to its abundance of natural resources such as crude oil and shale gas and access to oil & gas exploration and production technology.

The region’s shale gas exploration is another reason for increased demand. Some of the most prominent 1-Decene producers are in the region, including Exxon Mobil Corporation (US), and Chevron Phillips Chemical Company LLC (US). This market will be driven by the increasing demand from the automobile industry and the growing awareness of eco-friendly products.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Shell Chemicals and INEOS are major players in alpha-olefin production. ExxonMobi, SASOL,Qatar Chemicals, Ottokemi, World of Chemicals, chemnet are some of the other companies. The 1-decene market is dominated by a few multinational companies that have their patented technology. Shell Chemicals accounted significant growth market, with the other three largest players being Shell Chemicals and ExxonMobi.

Major industry players have demonstrated a high degree of integration in the market. Notably, key players such as Shell Chemicals and INEOS, Chevron Phillips (SASOL), ExxonMobil, Qatar Chemicals, Ottokemi, World of Chemicals, chimney, and other key players have integrated their operations throughout the value chain, including supply and production of raw materials to end-users.

Кеу Маrkеt Рlауеrѕ

- Shell Chemicals

- INEOS

- Chevron Phillips

- ExxonMobil

- SASOL

- Qatar Chemicals

- Ottokemi

- World of chemicals

- Chemnet

- Other Key Players

Recent Development

In January 2023, For its cosmetic ingredients production facility in Cologne, Germany, INEOS Oligomers received the EFfCI GMP certification. The independent certification agency, DQS CFS, has issued the certification. The GMP (Good Manufacturing Practices) certification from the EFfCI (European Federation for Cosmetic Ingredients) guarantees the consistency of the quality monitoring and assurance methods used in the manufacture of cosmetic ingredients.

Report Scope

Report Features Description Market Value (2023) USD 1 Bn Forecast Revenue (2033) USD 2 Bn CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Derivative Type(Oxo Alcohols, Chlorinated Olefins, Linear Alkyne Benzenes, Polyalphaolefins, Alkyl Dimethylamine, Di-alkyl Diethylamine, Linear Mercaptans), By Form(Liquid, Solid), By Application(Poly Alpha Olefin, Polyethylene, Detergent Alcohols) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Samancor Chrome, Jindal Steel & Power Limited, Eurasian Resources Group, Hernic, Vargön Alloys AB, Ferbasa, Yilmaden, Glencore, ALBCHROME, Outokumpu, IMFA, Balasore Alloys Limited, Ferro Alloys Corporation Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samancor Chrome

- Jindal Steel & Power Limited

- Eurasian Resources Group

- Hernic

- Vargön Alloys AB

- Ferbasa

- Yilmaden

- Glencore

- ALBCHROME

- Outokumpu

- IMFA

- Balasore Alloys Limited

- Ferro Alloys Corporation Ltd.