Quick Navigation

Overview

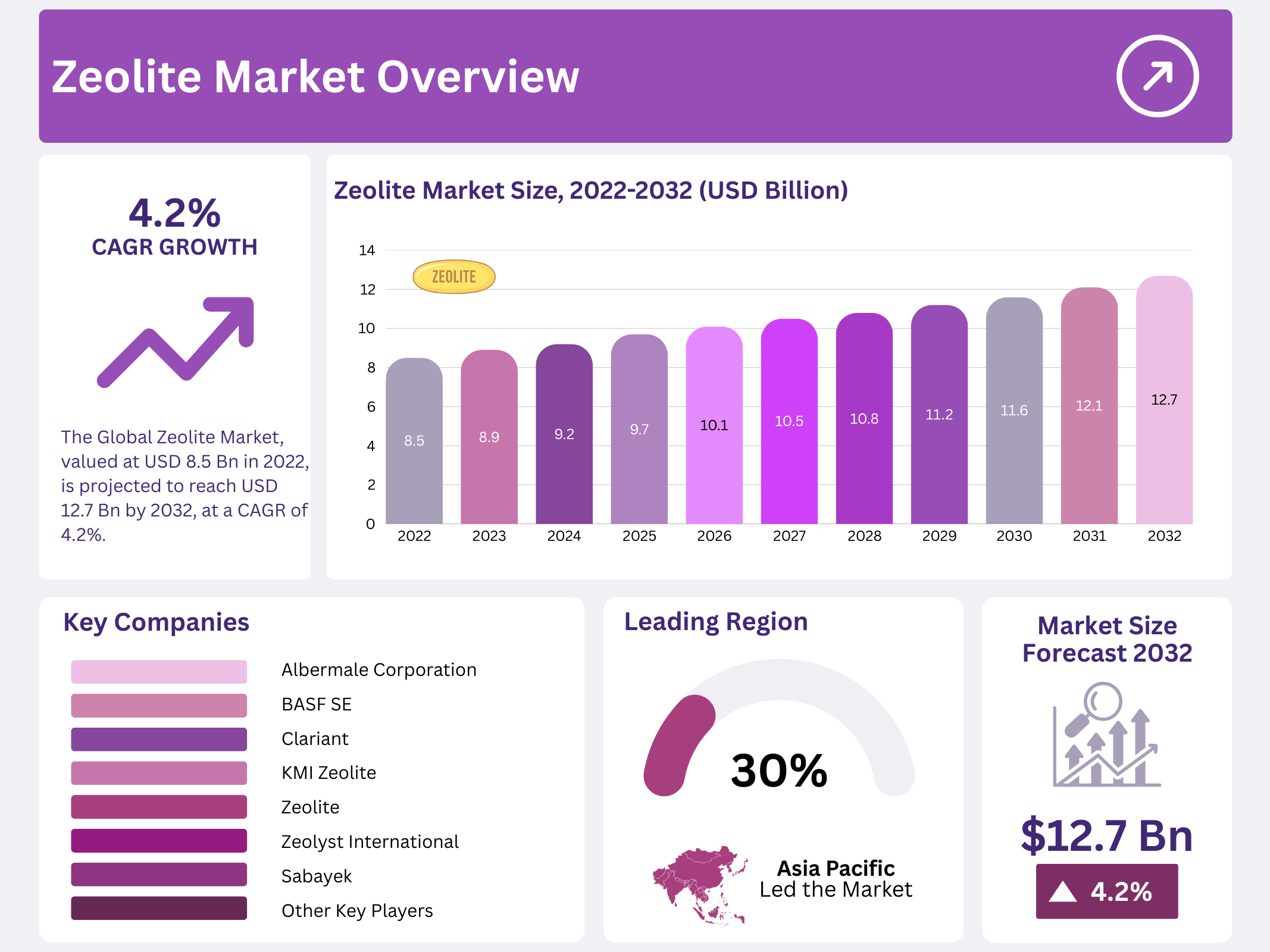

New York, NY – September 19, 2025 – The Global Zeolite Market is growing steadily and is expected to reach USD 12.7 Billion by 2032, up from USD 8.5 Billion in 2022, with a compound annual growth rate (CAGR) of 4.2% between 2023 and 2032.

Demand for zeolite is rising because it is useful in many industries, especially detergents, water treatment, agriculture, and catalysts, where it helps clean water, improve soil, support chemical reactions, or replace more harmful materials. Key growth factors include increasing environmental awareness, stricter regulations on pollutants and phosphates, and the push towards sustainable and eco-friendly industrial practices. Zeolite’s popularity stems from its natural and synthetic forms, its ability to act as an adsorbent or molecular sieve, and its relatively low toxicity.

Zeolite Market opportunities lie in emerging applications such as advanced catalysts, soil conditioners, slow-release fertilizers, odor control, and wastewater purification. Expansion is being driven especially in regions undergoing rapid industrialization and urbanization, where infrastructure growth, rising disposable incomes, and stronger government policies create more demand. With these forces at work, the zeolite market looks set to broaden in both application scope and geographic reach over the coming decade.

Key Takeaways

- The Global Zeolite Market is expected to grow from USD 8.5 billion in 2022 to USD 12.7 billion by 2032, with a 4.2% CAGR.

- Synthetic zeolites dominate, holding 87% of the market share in 2022.

- Catalysts lead applications with a 47% share in 2022, vital for petrochemical refining.

- Detergent builders generate the highest revenue, enhancing cleaning and water treatment.

- Catalyst function holds a 57% market share in 2022.

- Asia Pacific accounts for 30% of the market value in 2022, fueled by industrialization in China, India, and Japan.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 8.5 Billion |

| Forecast Revenue (2032) | USD 12.7 Billion |

| CAGR (2023-2032) | 4.2% |

| Segments Covered | By Type (Natural and Synthetic), By Application (Catalysts, Adsorbents, Detergent Builders, Cement, Animal Feed, and Other Applications), By Function (Ion-Exchange, Molecular Sieve, and Catalyst) |

| Competitive Landscape | Albemarle Corporation, BASF SE, Clariant, KMI Zeolite, Zeolite, Zeolyst International, Other Key Players |

Key Market Segments

By Type Analysis

The global zeolite market is segmented into natural and synthetic types. Among these, the synthetic segment dominates in terms of revenue, holding 87% of the total share in 2022. Synthetic zeolites are engineered with precise crystalline structures, making them highly effective in critical applications.

Their widespread use in the oil and gas industry for catalytic cracking, as well as in detergents and water treatment, has been a key growth driver. On the other hand, the natural zeolite segment is larger in terms of volume due to its affordability and availability. Natural zeolites are particularly in demand within the construction industry, where they are used in cement, lightweight aggregates, and dimension stones.

By Application Analysis

Based on application, the zeolite market is divided into catalysts, adsorbents, detergent builders, cement, animal feed, and others. Catalysts represent the leading segment, with a 47% share in 2022. Their effectiveness stems from properties such as high surface area, ion exchange capability, and tailored pore size, making them essential in petrochemical refining and fluid catalytic cracking (FCC) for fuel production. While catalysts dominate in growth, the detergent builders segment generates the highest revenue, as synthetic zeolites play a key role in improving cleaning efficiency and water treatment processes.

By Function Analysis

From a functional perspective, zeolites are segmented into ion exchange, molecular sieve, and catalyst functions. The catalyst function is the most significant, capturing 57% of the market share in 2022 with a projected CAGR of 4.6%. Their unique porous structure enables selective adsorption and efficient conversion of hydrocarbons, making them indispensable in FCC and hydrocarbon cracking (HC) processes.

Regional Analysis

Asia Pacific leads the global zeolite market, accounting for 30% of the market value in 2022. Rapid industrialization and urbanization in China, India, and Japan have fueled demand, especially in petroleum refining and automotive industries, where FCC catalysts are crucial. North America follows closely, driven by strong demand from the oil and gas sector and rising adoption of zeolites in detergents, catalysts, and construction materials.

Top Use Cases

- Detergents: Zeolite acts as a gentle water softener in everyday laundry soaps, grabbing onto minerals like calcium that make water hard and reduce cleaning power. This eco-friendly swap for harsh chemicals helps clothes stay brighter and cleaner while being kinder to rivers and lakes, making it a go-to choice for green household brands aiming to meet consumer demands for sustainable living.

- Agriculture: In farming, zeolite enriches soil by slowly releasing nutrients like potassium and nitrogen to plants, while soaking up extra water during dry spells to prevent wilting. It cuts down on fertilizer waste and boosts crop yields naturally, appealing to growers seeking cost-effective ways to build healthier fields amid rising eco-regulations and unpredictable weather patterns.

- Water Purification: Zeolite shines in cleaning dirty water by trapping heavy metals and extra nutrients that cloud streams and harm fish. Used in simple filters for homes or big plants, it swaps out bad ions for harmless ones, supporting communities in need of affordable, reliable access to fresh water as pollution concerns grow worldwide.

- Petroleum Refining: As a smart catalyst, zeolite breaks down heavy oils into useful fuels like gasoline in refineries, speeding up reactions without wasting energy. Its precise pores ensure cleaner outputs with fewer byproducts, helping oil companies refine operations to align with tougher emission rules and push for more efficient, planet-friendly fuel production.

- Animal Feed: Zeolite in livestock feed locks away toxins and balances minerals in animal diets, leading to healthier herds and less manure odor on farms. It promotes better digestion and growth without synthetic additives, fitting the trend toward natural supplements that enhance farm productivity while easing environmental strain from large-scale animal raising.

Recent Developments

1. Albemarle Corporation

Albemarle is advancing zeolite applications in lithium refining to support the EV battery supply chain. They are developing specialized molecular sieves for purification processes, critical for producing battery-grade lithium compounds. This innovation aims to increase efficiency and sustainability in lithium extraction, aligning with the global push for electrification and higher-purity material requirements.

2. BASF SE

BASF is focused on developing innovative zeolite-based catalysts for sustainable chemical processes. A key area is their novel catalyst for propane dehydrogenation (PDH), enhancing propylene yield and energy efficiency. They are also creating solutions for renewable fuels and emissions control, leveraging zeolites to help the industry reduce its carbon footprint and transition toward a circular economy.

3. Clariant

Clariant has launched its groundbreaking Enercyn catalyst, a zeolite-based solution for propane dehydrogenation. This innovation significantly boosts propylene production efficiency and reduces energy consumption compared to previous technologies. It represents a major step in meeting the growing global demand for propylene while improving the environmental footprint of production plants through superior stability and lower coke formation.

4. KMI Zeolite

KMI Zeolite specializes in natural zeolite applications for agriculture and environmental remediation. Their recent developments focus on creating advanced soil amendment products that enhance water retention and nutrient efficiency, reducing the need for fertilizers. They are also expanding solutions for heavy metal capture in water and odor control in waste management, promoting sustainable and natural purification methods.

5. Zeolite

Operating under the name Zeolite, this company is a major supplier of natural clinoptilolite. Their recent work emphasizes supplying high-grade material for animal feed additives to improve gut health and reduce ammonia emissions. They are also expanding into water filtration markets, providing natural zeolite products for removing contaminants like ammonia and heavy metals from industrial and agricultural wastewater streams.

Conclusion

Zeolite stands out as a versatile, earth-friendly mineral powerhouse in today’s evolving market landscape. Its natural ability to trap impurities, swap ions, and speed chemical processes makes it indispensable across cleaning products, farming aids, water systems, fuel making, and feed enhancers. With global pushes for greener practices amid climate worries and stricter rules, zeolite’s low-impact profile and adaptability fuel its steady rise, offering businesses smart paths to innovation and sustainability without heavy trade-offs.