Quick Navigation

Overview

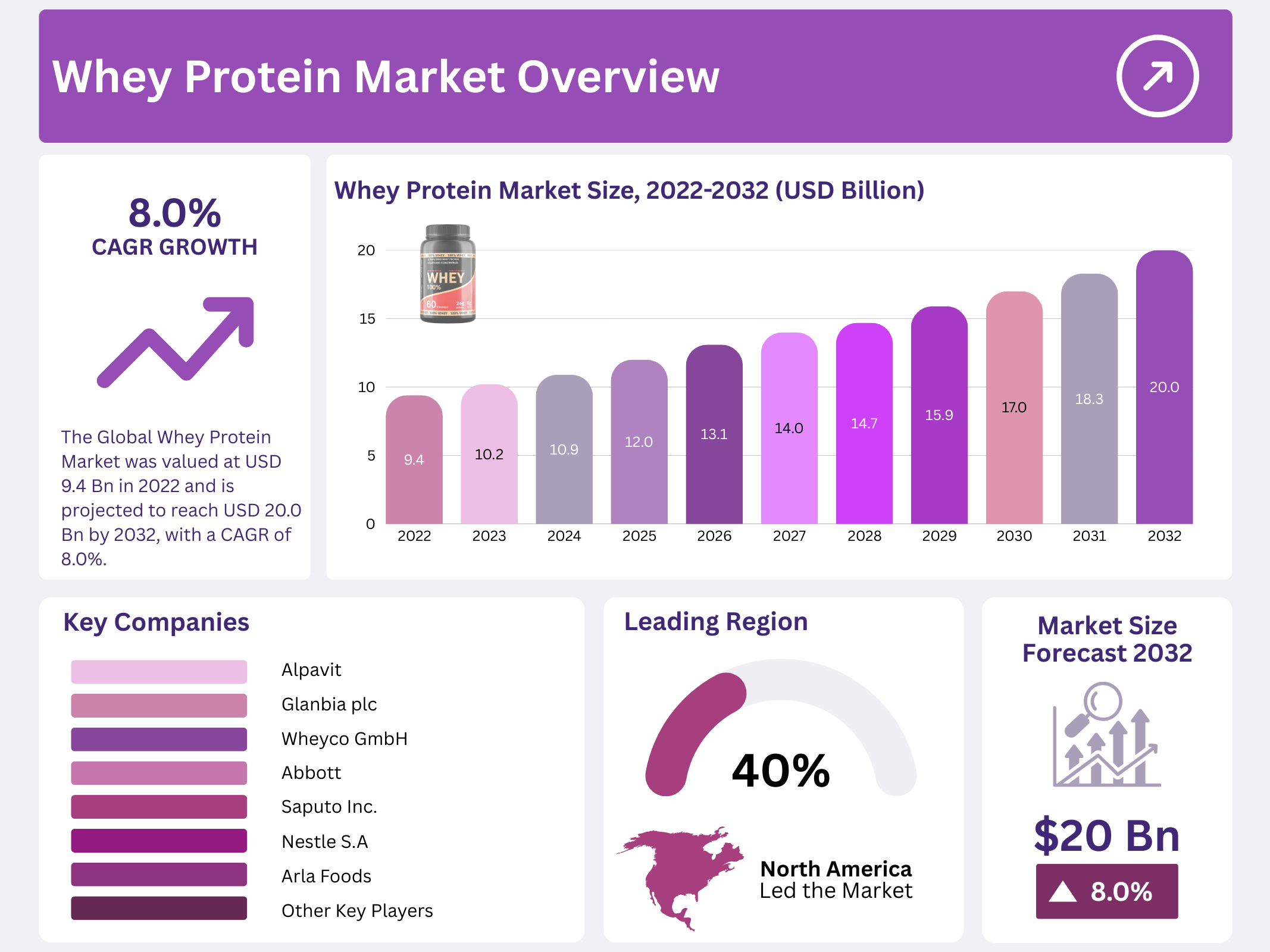

New York, NY – December 15, 2025 – In 2022, the global Whey Protein Market was valued at USD 9.4 billion and is expected to reach USD 20.0 billion by 2032, growing at a CAGR of 8.0% from 2023 to 2032. Whey protein is derived from whey, the liquid remaining after milk curdles during cheese production. It is a high-quality protein known for enhancing dietary nutrition, supporting immune health, and promoting muscle protein synthesis when combined with exercise, making it widely used in sports and fitness nutrition.

Whey protein also offers additional health benefits such as weight management and cholesterol reduction, with ongoing research highlighting new nutritional and functional advantages. Growing awareness of healthy lifestyles and preventive nutrition has increased its global demand, particularly as fitness centers and sports professionals frequently recommend protein supplementation. Consumers are increasingly drawn to whey protein as part of a balanced, protein-rich diet aimed at improving overall wellness.

Beyond supplements, whey protein is widely used in the food and beverage industry due to its antihypertensive and antibacterial properties, finding applications in baked goods, dairy products, beverages, cereals, chocolates, and infant nutrition. Its expanding use in cosmetics and personal care products further strengthens its premium positioning. Rising obesity rates, growing demand for natural and organic foods, continuous product innovation, and government initiatives promoting healthy living are collectively driving sustained growth in the whey protein market.

Key Takeaways

- The Global whey protein market was valued at USD 9.4 billion in 2022 and is projected to reach USD 20.0 billion by 2032, with a CAGR of 8.0% (2023-2032).

- Whey protein concentrates led the market in 2022 with the largest revenue share of 38.5%.

- Organic whey protein dominated the source segment in 2022, holding 61% revenue share due to rising clean-eating trends.

- Supermarkets and hypermarkets were the top distribution channels in 202,2 with 28% revenue share and are expected to maintain leadership.

- Sports nutrition remained the leading application segment in 2022, capturing 25% of total market revenue.

- North America is expected to dominate the global whey protein market, capturing the largest share of approximately 40% throughout the forecast period.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 9.4 Billion |

| Forecast Revenue (2032) | USD 20.0 Billion |

| CAGR (2023-2032) | 8.0% |

| Segments Covered | By Type- Isolates, Concentrates, Hydrolysates, By Source- Organic, Conventional, By Distribution Channel- Supermarkets/ Hypermarkets, Specialty Stores, Online Stores, Other Distribution Channels and by Application – Sports Nutrition, Dietary Supplements, Infant Formula, Food Processing, Beverages, and Other Applications |

| Competitive Landscape | Alpavit, Hilmar Cheese Company, Inc., Glanbia plc, Wheyco GmbH, Davisco Foods International, Inc., Nestle S.A., Arla Foods, Saputo Inc., Olam International, Abbott, Leprino Foods Company, and Other Key Players |

Key Market Segments

By Type Analysis

Isolates Emerging as the Fastest-Growing Segment

The concentrates segment dominated the whey protein market in 2022, accounting for the largest revenue share of 38.5%. Whey protein concentrates (WPC) are widely used in muscle-building formulations as well as in processed cheese, bakery products, cereals, and nutrition bars. These concentrates contain a mix of proteins along with lactose, lipids, and minerals, making them suitable for a broad range of food applications.

WPC also serves as a cost-effective alternative for caramel blending, offering better flavor and processing flexibility. Its easy availability, affordability, and versatility across food and nutrition products continue to support steady demand and segment growth. The isolates segment is expected to register strong growth during the forecast period.

Whey protein isolate is a complete protein source rich in all nine essential amino acids, which are vital for muscle growth and recovery. Its high purity, low-fat content, and superior amino acid profile help reduce muscle loss, improve athletic performance, and support lean muscle development. Rising consumer focus on high-protein diets, weight management, and everyday protein-fortified foods is driving demand for isolates.

By Source Analysis

Organic Whey Protein Leads Market Demand

The organic segment led the source category in 2022, holding a revenue share of 61%. Growing consumer awareness around clean eating and health-focused lifestyles has increased demand for fresh, organic, and minimally processed food products. Organic whey protein is widely perceived as a healthier option, free from synthetic additives, which continues to support its market leadership.

The conventional segment is expected to witness steady growth over the forecast period. Its wide availability and cost advantages make conventional whey protein suitable for large-scale food, beverage, and nutrition applications. Manufacturers are increasingly focused on offering affordable products to cater to multiple industries, which is expected to sustain demand in this segment.

By Distribution Channel

Supermarkets and Hypermarkets Drive the Highest Sales

Supermarkets and hypermarkets accounted for a revenue share of 28% in 2022 and are expected to remain the leading distribution channel. These outlets have a strong presence across both developed and emerging regions, offering consumers easy access to a wide variety of whey protein products under one roof.

The convenience of in-store purchasing and product availability has supported channel dominance. Meanwhile, online retail is growing rapidly and is projected to expand at a high rate in the coming years. Consumers increasingly prefer online platforms due to convenience, competitive pricing, and home delivery options, which is expected to further support market growth.

By Application

Sports Nutrition Holds the Largest Application Share

The sports nutrition segment dominated the application landscape, accounting for a revenue share of 25%. Whey protein is highly valued in sports nutrition due to its fast absorption, high biological value, and rich content of branched-chain and essential amino acids. These properties make it a preferred ingredient in protein powders, bars, and performance-focused food products.

Whey protein also plays a key role in maintaining muscle mass during aging and supporting recovery during injury or illness. Growing participation in fitness activities, increasing awareness of muscle health, and recommendations from gyms and fitness centers are expected to continue driving demand across sports nutrition and weight-management applications.

Regional Analysis

North America is expected to dominate the global whey protein market, capturing the largest share of approximately 40% throughout the forecast period. This leadership position is driven by several key factors, including the increasing prevalence of lifestyle-related diseases and growing consumer awareness of health and wellness. A significant portion of the population is actively participating in gyms and fitness centers, where whey protein supplements are widely promoted as an essential component of fitness and muscle-building regimens.

Additionally, whey protein’s functional benefits, such as its antihypertensive and antibacterial properties, are boosting its incorporation into a wide range of food and beverage products, including dairy items, cereals, beverages, chocolate, and bakery goods. This expanding application in the food industry is further accelerating overall demand in the region. Strategic initiatives by leading market players, including frequent new product launches, are also playing a crucial role in sustaining North America’s market growth.

The Asia-Pacific region is projected to experience the fastest growth during the forecast period. This rapid expansion is fueled by rising domestic consumption and strong export demand for dairy-based protein ingredients, particularly whey and casein. China, benefiting from abundant raw material availability, has emerged as one of the world’s leading producers of dairy-derived proteins. Concurrently, India is witnessing a surge in fitness centers and gyms, coupled with heightened health and wellness awareness among consumers, which is significantly driving regional demand and contributing to the robust growth outlook for Asia-Pacific.

Top Use Cases

- Sports Nutrition Supplements Whey protein stands out as a go-to option for athletes and fitness lovers, aiding in muscle growth and quick recovery after intense workouts. Its fast-digesting nature allows the body to absorb essential amino acids rapidly, making it perfect for shakes or bars consumed right after exercise. This keeps users energized and supports long-term performance goals in active lifestyles.

- Functional Foods in Baking and Dairy In everyday foods like breads, yogurts, and cheeses, whey protein acts as a natural thickener and texture enhancer, improving mouthfeel without adding extra fats. It boosts nutritional value by adding high-quality protein, appealing to health-conscious families seeking tastier, nutrient-packed snacks that fit busy routines and promote balanced eating habits.

- Health Support for Metabolic Wellness Whey protein helps manage everyday health challenges like blood pressure and inflammation through its gentle, bioactive properties. Added to daily smoothies or cereals, it supports heart health and steady energy levels, making it a simple addition for those aiming to ease lifestyle-related concerns while enjoying familiar meals with a wellness twist.

- Recovery Aid During Illness or Aging For people facing recovery from injuries or the natural slowdown of aging, whey protein provides gentle muscle support in easy-to-digest forms like soft drinks or puddings. It helps maintain strength and vitality without overwhelming the system, offering a comforting way to rebuild resilience and stay independent in daily activities.

- Innovative Biotech and Non-Food Uses Beyond the kitchen, whey protein finds roles in eco-friendly biotech, such as creating natural adhesives or fueling sustainable energy processes like biogas production. This versatile side turns dairy leftovers into useful materials, supporting green industries that value resource efficiency and reduce waste in creative, planet-friendly ways.

Recent Developments

1. Alpavit

Alpavit has expanded its whey protein concentrate offerings, emphasizing non-GMO and sustainably sourced ingredients from European dairy. Recent focus is on clean-label, easily soluble whey proteins for sports nutrition and functional foods. The company invests in energy-efficient processing to meet growing demand for high-quality dairy proteins while reducing environmental impact.

2. Hilmar Cheese Company, Inc.

Hilmar Cheese launched Hilmar WP 9250, a high-purity whey protein isolate (>90% protein) with exceptional clarity and neutral taste for ready-to-mix beverages. They also opened a new state-of-the-art Customer Innovation Centre in California to help customers develop protein-fortified products, demonstrating a strong commitment to R&D and market-specific solutions.

3. Glanbia plc

Through its Glanbia Performance Nutrition division, the company launched a new sustainable whey protein initiative, tracing Irish grass-fed dairy. Their brand Optimum Nutrition (ON) expanded with 100% Whey Protein Gold Standard, featuring new flavors and packaging. Glanbia also invested in its US cheese and whey facility to increase high-value protein production capacity significantly.

4. Wheyco GmbH

Wheyco has focused on developing specialized whey protein hydrolysates for clinical nutrition and medical food applications, emphasizing high bioavailability and hypoallergenic properties. They also enhanced their instantized whey protein concentrates for improved mixing in protein bars and powders. Recent efforts highlight customizable protein solutions for specific customer processing needs.

5. Davisco Foods International, Inc.

Following its acquisition by Agropur, Davisco’s whey protein operations are now part of Agropur Dairy Ingredients. The integration has led to new investments in the Eden Prairie, MN facility, increasing production of specialty whey protein isolates and concentrates. The focus is on leveraging combined expertise to offer a broader portfolio of native and functional whey proteins.

Conclusion

Whey protein emerges as a powerhouse ingredient in today’s wellness-focused world, blending natural goodness with endless possibilities across fitness, food, and beyond. As consumers prioritize simple, effective ways to nurture their health amid busy lives, its adaptability fuels steady market appeal and innovation. Whey protein promises to remain a trusted ally, bridging tradition and tomorrow’s sustainable needs with effortless integration into daily routines.